Market Overview

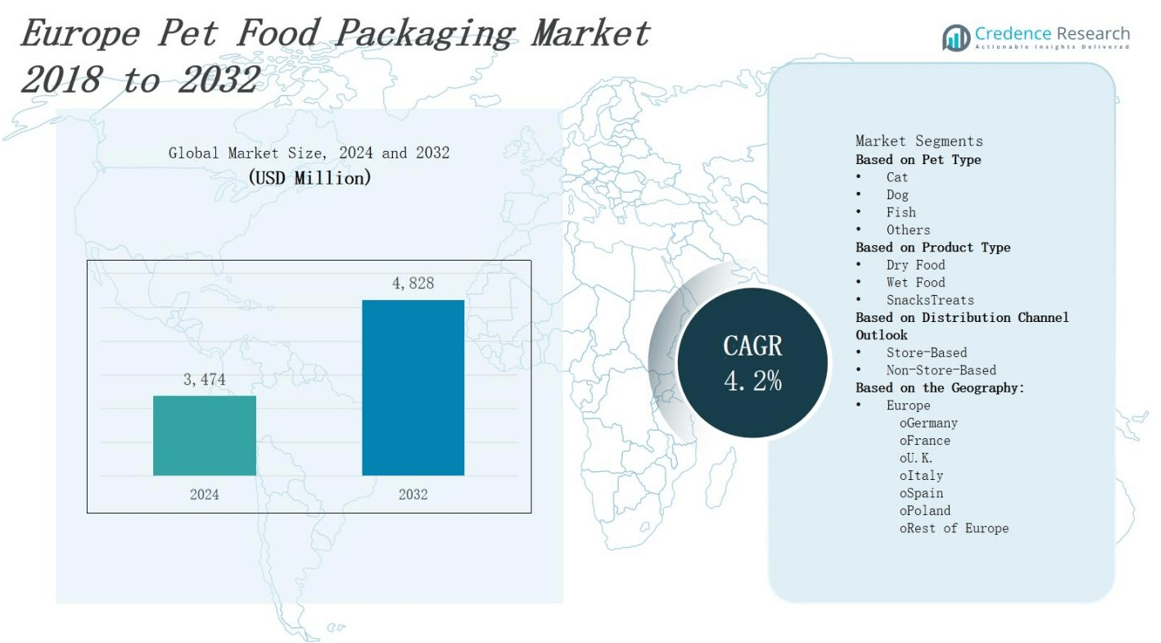

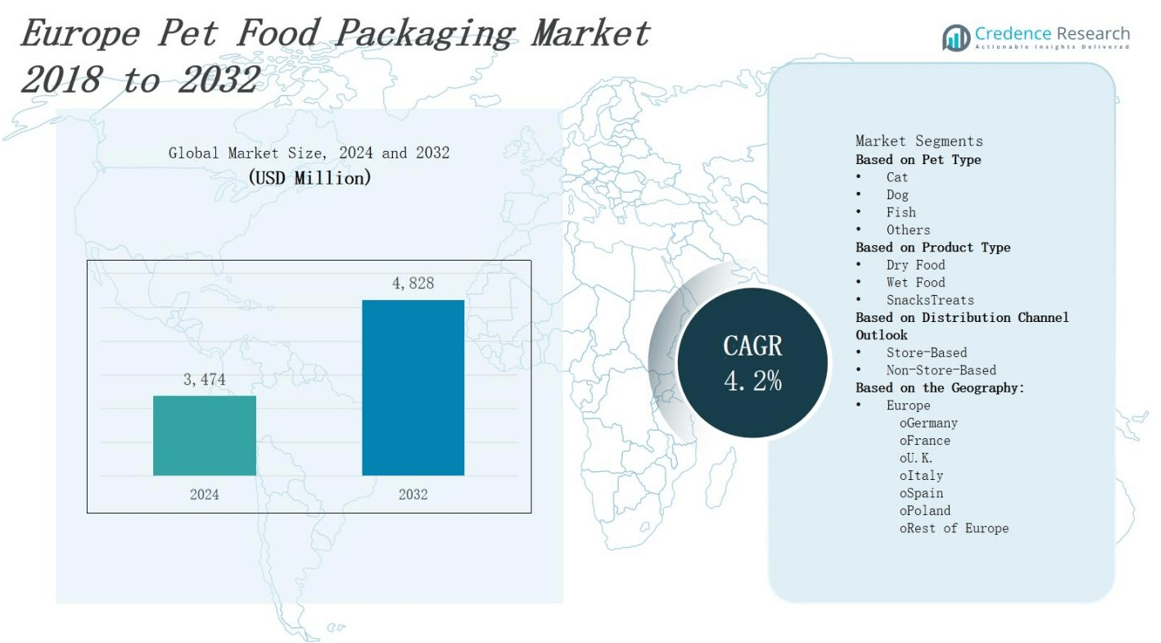

The Europe pet food packaging market is projected to expand from USD 3,474 million in 2024 to USD 4,828 million by 2032, reflecting a CAGR of 4.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Pet Food Packaging MarketSize 2024 |

USD 3,474 million |

| Europe Pet Food Packaging Market, CAGR |

4.2% |

| Europe Pet Food Packaging MarketSize 2032 |

USD 4,828 million |

Growing pet ownership and premiumization in Europe drive demand for innovative pet food packaging solutions that ensure product freshness. Manufacturers adopt sustainable materials such as biodegradable plastics and recycled fibers to comply with environmental regulations and satisfy eco-conscious consumers. They integrate smart packaging features—including QR codes for traceability and freshness indicators—to enhance consumer engagement. The surge in e-commerce channels compels brands to use lightweight, resealable stand‑up pouches that optimize shipping efficiency. Players focus on moisture‑resistant barrier coatings and clear windows to highlight product quality. They invest in automation and flexible packaging lines to increase throughput and reduce operational costs.

Western Europe leads with 50% share, driven by Germany, France and UK demand. It benefits from high‑performance barrier films and resealable pouches that preserve premium formulations. Southern Europe holds 20%, supported by Italy and Spain’s flexible pouch preferences and region‑specific graphics. Northern Europe secures 15%, led by low‑emission materials in Scandinavia. Eastern Europe accounts for 15%, driven by Poland’s and Romania’s uptake of low‑cost stand‑up pouches. The europe pet food packaging market features major players including Coveris Holding S.A., Goglio S.p.A., Smurfit Kappa, AptarGroup, Berry Global, Ardagh Group, Huhtamaki, Mondi, Sonoco, and Constantia Flexibles. These firms invest in sustainable substrates, digital printing, efficient automated lines, smart features to meet regional preferences, compliance mandates.

Market Insights

- Western Europe commands 50% share, followed by Southern Europe (20%), Northern Europe (15%) and Eastern Europe (15%), with regional preferences shaping package formats.

- Premium demand drives use of high‑barrier films and multilayer laminates to protect nutrient integrity and extend shelf life.

- Adoption of biodegradable polymers and post‑consumer recycled content meets strict EU sustainability mandates and resonates with eco‑conscious buyers.

- Smart packaging features—QR codes, NFC tags and freshness indicators—enhance traceability and foster consumer trust.

- E‑commerce growth compels lightweight, resealable stand‑up pouches and automated fill‑seal lines to boost shipping efficiency and throughput.

- Stringent EU regulations on material migration and labeling demand full traceability, extensive certification and rigorous testing.

- Volatile resin and film prices drive procurement diversification, local sourcing partnerships and agile production planning to safeguard margins.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Premiumization and Health-Focused Demand

The europe pet food packaging market responds to growing consumer demand for premium and functional products. It features high-barrier films and multilayer laminates that safeguard nutrients and extend shelf life. Brands emphasize resealable closures to preserve freshness after opening. Manufacture shifts toward advanced prints and embossed labels that enhance brand appeal. Retailers report higher sales for premium-segment packaging units. Companies invest in research to refine barrier performance and aesthetic design.

- For instance, Nestlé Purina PetCare introduced a new jelly-based wet cat food under its Gourmet Revelations brand across 15 European countries in 2025, using advanced packaging that preserves freshness and encourages natural eating behaviors.

Emphasis on Sustainable Materials

The europe pet food packaging market witnesses strong adoption of sustainable substrates. It integrates biodegradable polymers and post-consumer recycled content. Manufacturers collaborate with material suppliers to validate compostability certifications. Retail chains enforce minimal plastic usage and encourage paper-based pouches. Suppliers optimize substrate thickness to reduce material consumption without compromising barrier integrity. Brands apply water-based inks and solvent-free adhesives to lower environmental impact. Industry alliances drive standardization of ecofriendly packaging guidelines.

- For instance, Mondi Group has invested in mono-material structures and flexible pouches that reduce plastic use while maintaining barrier integrity, responding to regulatory demands and consumer preferences for sustainability and convenience.

Integration of Smart Packaging Technologies

The europe pet food packaging market embraces smart features that inform consumers. It houses QR codes linking to ingredient traceability. Brands embed freshness indicators that change color when spoilage risk arises. Manufacturers install NFC tags to facilitate digital engagement and loyalty programs. Retailers leverage data from package scans to forecast demand patterns. Developers innovate oxygen scavengers and microperforation systems to maintain ideal internal atmosphere. Smart packaging boosts transparency and trust.

Growth of E‑commerce and Operational Efficiency

The europe pet food packaging market experiences pressure from expanding online sales. It demands lightweight packaging suited for shipping. Brands prefer flexible stand-up pouches that reduce shipping costs and save shelf space. Manufacturers automate fill-and-seal lines to increase throughput. Suppliers offer customizable package formats that support subscription models. They reduce labor through automation. Retailers integrate packaging design with warehouse flow to optimize space. Industry invests in robotics to improve efficiency.

Market Trends

Expansion of Recyclable Mono‑Material Solutions

The europe pet food packaging market transitions toward mono‑material film solutions that streamline recycling processes. Brands adopt polyethylene‑based pouches that eliminate multilayer complexity. It maintains barrier performance through advanced coatings. Suppliers certify packaging with widely recognized recycling labels. Retailers educate consumers on proper disposal methods. Manufacturers optimize film thickness to conserve material and preserve strength. Industry partnerships invest heavily in circular economy initiatives to recover post‑consumer PET and PE packaging.

- For instance, Coveris collaborated with French pet food maker Demavic to launch mono-material, recyclable bags using MonoFlexE polyethylene film, designed for easy recycling and production line compatibility.

Adoption of Digital Printing for Brand Differentiation

Manufacturers in the europe pet food packaging market deploy digital printing technology to enhance brand flexibility. It allows low‑volume runs and rapid design changes. Brands personalize packaging with pet names and nutritional information. Digital presses eliminate plate costs and shorten lead times. Suppliers integrate high‑resolution inkjet systems into existing production lines. Retailers leverage seasonal artwork and promotional codes to engage customers. Investment in automation reduces labor and improves color consistency.

- For instance, Polysack has validated fully recyclable mono-polyethylene films printed on HP Indigo digital presses, enabling brands to create custom, sustainable packaging with rapid design changes and no added costs.

Rise of Customizable Subscription Packaging Models

The europe pet food packaging market shows rising demand for customizable subscription packaging models. It provides measured portions for weekly delivery schedules. Brands design refillable pouches that users return for reuse. Companies adopt modular package formats that adapt to a variety of recipes. Suppliers provide printing‑on‑demand capabilities to reflect subscriber preferences. Automation in fulfillment centers packs subscription kits with minimal handling. Subscription packaging fosters direct‑to‑consumer loyalty and reduces inventory waste.

Implementation of Modular E‑commerce Packaging Systems

Growth of online sales influences the europe pet food packaging market toward modular packaging systems. It prioritizes stackable cartons and mail‑ready pouches that withstand transit. Brands use dimension‑optimized crates to minimize void space. Manufacturers integrate tamper‑evident seals and cushioning inserts to secure products. Suppliers adapt packaging lines with robotic pick‑and‑place cells. Warehouses deploy automated sortation to accelerate order fulfillment. Efficient modular systems lower damage rates and boost customer satisfaction.

Market Challenges Analysis

Strict Regulatory and Labeling Requirements

The [europe pet food packaging market ] faces strict regulations on material migration and labeling across EU member states. It must comply with EU Regulation 1935/2004 and corresponding national laws. Companies navigate complex certification procedures and provide full traceability of raw materials. Failure to meet migration limits triggers costly recalls and damages brand reputation. Regulators conduct frequent audits and sample tests. Brands dedicate considerable resources to maintain compliance documentation. Manufacturers adapt packaging artwork and technical dossiers while incurring higher testing costs for novel materials and label approvals.

Volatility in Raw Material Costs and Supply Chain Disruptions

The [europe pet food packaging market ] encounters unpredictable fluctuations in resin and film prices. It struggles to forecast costs due to volatility in crude oil and polymer markets. Suppliers endure strain from energy price spikes and shipping delays. Brands transfer higher costs to customers, which undermines competitive positioning. Companies optimize procurement strategies and diversify their supplier base to secure materials. Production teams adjust plans quickly to avoid stockouts and reduce waste. Manufacturers monitor geopolitical tensions and raw material shortages while investing in local sourcing collaborations to strengthen resilience and maintain consistent supply levels.

Market Opportunities

Growth in Ecofriendly and Recyclable Innovations

The europe pet food packaging market presents strong potential for sustainable format development. It offers biodegradable pouches that meet stricter environmental mandates. Brands can trial mono‑material designs that streamline recycling collection. Suppliers supply certified compostable films to address consumer concerns. Companies introduce water‑based inks to reduce chemical residues. Retailers promote refill stations that reduce single‑use packaging. Collaborations between packagers and waste management firms unlock circular economy pilots.

Expansion via Direct‑to‑Consumer and Digital Engagement

The europe pet food packaging market can leverage DTC models to strengthen brand loyalty. It enables tailored portion packs for subscription services. Marketers integrate QR codes to deliver pet wellness content and reorder prompts. Fulfillment centers adopt modular kits that simplify logistics. Brands launch limited‑edition designs to boost online sales and social media buzz. Packaging lines that support short‑run customization will capture niche audiences. Partnerships with pet influencers amplify product launch visibility.

Market Segmentation Analysis:

By Pet Type

The europe pet food packaging market splits into cat, dog, fish and other segments based on pet type. It shows the highest demand for dog food packaging, driven by premium kibble formats. Cat food packaging follows, supported by growing interest in wet meals. Fish food packaging maintains stable growth, driven by aquarium hobby trends. Packaging for other pets—including small mammals and birds—offers niche growth opportunities. Brands tailor barrier properties and portion sizes to each pet category’s requirements.

By Product Type

The europe pet food packaging market divides into dry food, wet food and snacks & treats segments. It leads with dry food packaging, leveraging resealable stand‑up pouches that extend shelf life. Wet food packaging secures second position, supported by premium trays and pouches with easy‑peel lids. Snack & treat packaging grows rapidly, driven by single‑serve sachets and ecofriendly pouches. Suppliers innovate barrier coatings to preserve flavors across all types. Brands optimize package formats to match consumption patterns and portion control needs.

- For instance, KM Packaging supplies premium lidding film solutions for wet pet food trays. Their peelable and resealable films allow for easy-peel lids and are compatible with common tray materials like CPET and APET, ensuring premium sealing, freshness, and convenient opening.

By Distribution Channel Outlook

The europe pet food packaging market categorizes distribution into store‑based and non‑store‑based channels. It records strong performance in retail outlets—supermarkets, pet specialty stores and hypermarkets—through shelf‑ready cartons and display packs. Non‑store‑based channels—including e‑commerce platforms and subscription services—gain momentum with lightweight mail‑ready pouches. Brands integrate tamper‑evident features and convenience closures for direct‑to‑consumer deliveries. Packaging designs adapt to logistics requirements for both channels to ensure product integrity and customer satisfaction.

- For instance, supermarkets and hypermarkets such as Tesco and Carrefour effectively utilize shelf-ready cartons and display packs to enhance product visibility and consumer convenience.

Segments:

Based on Pet Type

Based on Product Type

- Dry Food

- Wet Food

- SnacksTreats

Based on Distribution Channel Outlook

- Store-Based

- Non-Store-Based

Based on the Geography:

-

- Germany

- France

- U.K.

- Italy

- Spain

- Poland

- Rest of Europe

Regional Analysis

Western Europe

The europe pet food packaging market commands a leading share in Western Europe at 50%. It benefits from strong demand in Germany, France and the United Kingdom. Manufacturers deploy high‑performance barrier films to protect premium formulations. Brands feature resealable pouches and rigid plastic trays that appeal to consumers’ convenience preferences. Retailers prioritize shelf‑ready display packs that enhance in‑store visibility. Suppliers invest in localized production to reduce lead times. Investment in automated lines ensures consistent quality across high‑volume runs.

Southern Europe

Southern Europe holds 20% of the europe pet food packaging market, while Northern Europe secures 15%. It records growth in Italy and Spain through flexible pouch formats. Brands tailor graphics to regional preferences and emphasize recyclable substrates. Manufacturers introduce easy‑tear notches and portion‑control sachets to match on‑the‑go lifestyles. Retailers integrate loyalty codes via on‑pack QR functionality. Suppliers collaborate with waste management firms to improve collection rates. Companies refine supply chains to mitigate seasonal demand fluctuations.

Eastern Europe

Eastern Europe accounts for 15% of the europe pet food packaging market. It shows rising demand in Poland, Romania and the Czech Republic. Brands adopt low‑cost stand‑up pouches and laminated cartons that fit local budgets. Manufacturers adjust barrier properties to suit varied climate conditions. Retailers expand private‑label offerings that drive volume growth. Suppliers offer short‑run digital printing services to support emerging brands. Companies develop distributor partnerships to extend reach into rural markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sonoco Products Company

- Huhtamaki OYJ

- Goglio S.p.A

- Berry Global Group, Inc.

- AptarGroup, Inc.

- Smurfit Kappa

- Mondi plc

- Coveris Holding S.A.

- Ardagh Group S.A.

- Constantia Flexibles

Competitive Analysis

Major players such as Coveris Holding S.A., Goglio S.p.A, Smurfit Kappa, AptarGroup, Inc., Berry Global Group, Inc., Ardagh Group S.A., Huhtamaki OYJ, Mondi plc, Sonoco Products Company and Constantia Flexibles compete vigorously in the europe pet food packaging market landscape. Companies differentiate through sustainable substrates that meet strict EU regulations. It focuses on mono‑material pouches and advanced barrier coatings. Firms invest in digital printing to shorten lead times and support low‑volume customization. Price competition drives efficiency improvements in supply chains. Strategic alliances with resin suppliers secure raw material at favorable rates. Firms expand production capacity by automating fill‑seal lines. Innovation in smart packaging features such as QR‑code traceability enhances brand loyalty. Market consolidation through mergers and acquisitions strengthens regional presence. Continuous process optimization helps companies maintain margins and respond swiftly to shifting consumer preferences.

Recent Developments

- In May 2023, Nestlé Purina unveiled its Friskies Playfuls cat treats, offering chicken & liver and salmon & shrimp flavor varieties in a convenient round form.

- In December 2024, Berry Global Group, Inc. teamed up with VOID Technologies to introduce a sustainable, high‑performance polyethylene film designed for pet food packaging.

- In July 2023, Hill’s Pet Nutrition released MSC‑certified pollock and insect‑protein formulas enriched with vitamins, omega‑3 fatty acids, and antioxidants for pets with sensitive systems.

- In May 2023, Virbac completed the acquisition of GS Partners in the Czech Republic and Slovakia, establishing its 35th subsidiary to strengthen regional distribution.

Market Concentration & Characteristics

The europe pet food packaging market features moderate concentration, with the top ten suppliers accounting for more than sixty percent of industry revenue. It rewards firms that maintain integrated production, advanced barrier technologies and regional distribution networks. Leading players invest in automated fill‑seal lines and digital printing to lower unit costs and support rapid design changes. Mid‑tier companies compete on niche formats such as compostable pouches and subscription‑ready kits. High capital requirements for equipment and compliance create a barrier to new entrants. Brand owners select partners based on throughput capacity, quality certification and sustainability credentials. Intense rivalry drives continuous process improvement and strategic alliances with resin suppliers to secure raw material at stable rates.

Report Coverage

The research report offers an in-depth analysis based on Pet Type, Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Companies will adopt mono‑material films to streamline recycling processes and enhance circular packaging efficiency.

- Brands will integrate QR codes to provide consumers with real‑time product information and enhanced traceability.

- Manufacturers will install advanced barrier coatings to extend shelf life and maintain pet food quality.

- Suppliers will validate compostable film materials to meet evolving environmental regulations across European markets stringently.

- Businesses will develop subscription‑ready pouch formats that facilitate recurring deliveries and improve consumer convenience overall.

- Packaging lines will incorporate robotics to boost throughput, reduce labor costs and ensure consistent quality.

- Stakeholders will partner with waste management firms to pilot circular recycling for post‑consumer packaging recovery.

- Producers will launch low‑emission substrate variants that appeal to eco‑conscious consumers and reduce environmental footprint.

- Retailers will leverage digital design platforms for limited‑edition prints to drive seasonal promotions and engagement.

- Companies will establish production hubs across Europe to shorten lead times and optimize chain resilience.