Market Overview

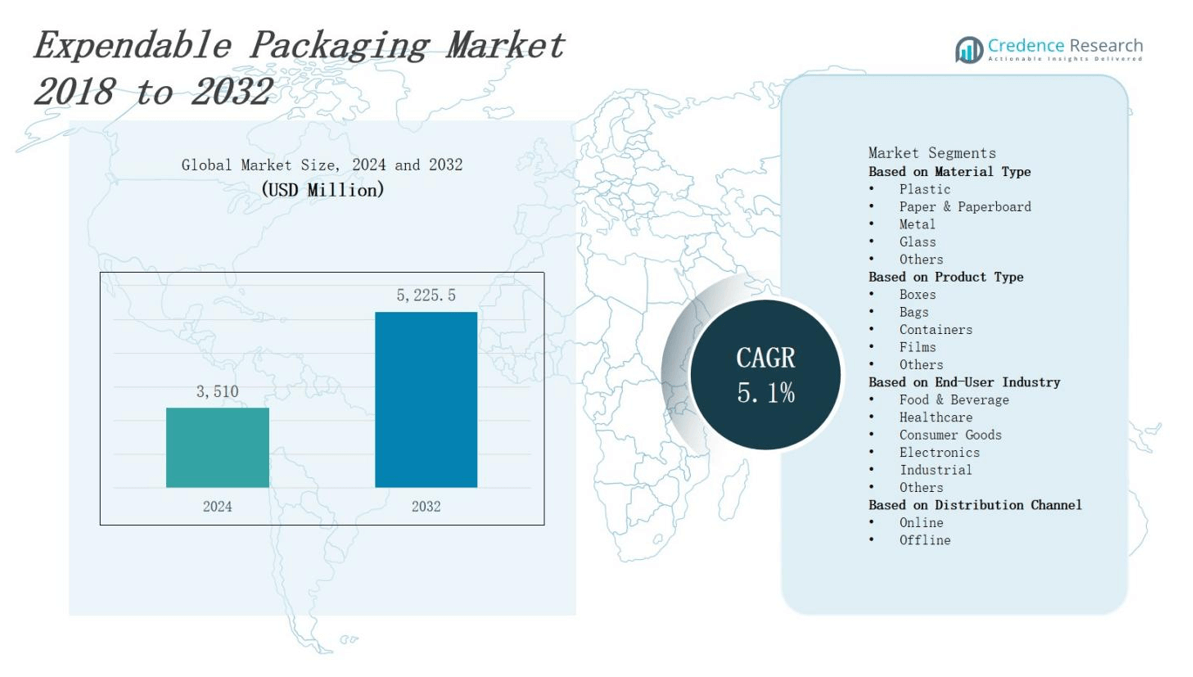

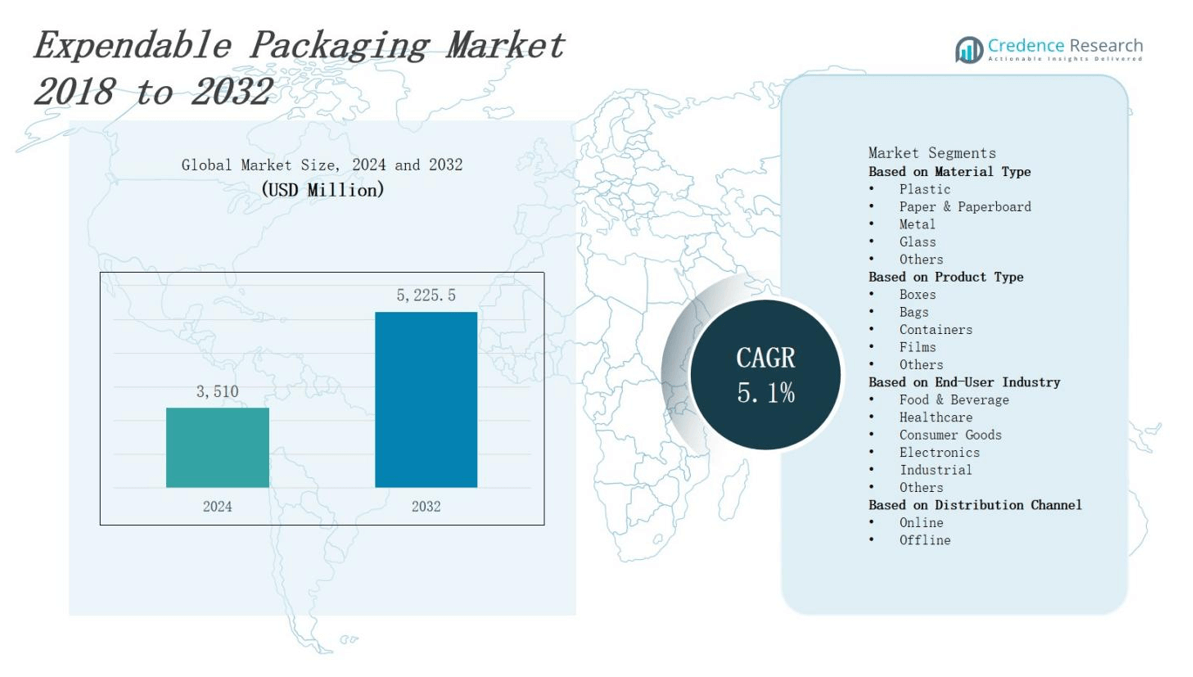

The expendable packaging market is projected to grow from USD 3,510 million in 2024 to USD 5,225.5 million by 2032, reflecting a compound annual growth rate of 5.1%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Expendable Packaging Market Size 2024 |

USD 3,510 million |

| Expendable Packaging Market, CAGR |

5.1% |

| Expendable Packaging Market Size 2032 |

USD 5,225.5 million |

Manufacturers in the expendable packaging market accelerate innovations to meet rising demand for lightweight, cost‑effective solutions across food, pharmaceutical, and consumer goods sectors. Stricter environmental regulations drive adoption of recyclable materials and biodegradable polymers. Growth in e‑commerce platforms compels companies to develop durable, tamper‑evident designs that optimize shipping efficiency. Advances in digital printing and labeling enable personalized branding and supply chain traceability. Automation and robotics streamline production, reduce labor costs, and enhance scalability. Strategic collaborations between material scientists and firms foster sustainable formulations. Rising raw material prices prompt investments in alternative feedstocks to maintain pricing and ensure supply chain resilience.

North America leads with 36% share, backed by International Paper, WestRock and Amcor. Europe holds 29%, driven by Mondi, DS Smith and Smurfit Kappa. Asia Pacific secures 24%, supported by Berry Global, Sealed Air and Huhtamaki. Latin America captures 6% and relies on local partnerships from Graphic Packaging. Middle East & Africa records 5% and benefits from Crown Holdings expansions. The expendable packaging market spans diverse regions, each with unique demand patterns and regulatory environments. Key players tailor offerings to regional needs, invest in capacity and drive sustainable packaging solutions.

Market Insights

- The expendable packaging market will rise from USD 3,510 million in 2024 to USD 5,225.5 million by 2032, growing at 5.1% CAGR.

- Manufacturers innovate lightweight, cost‑effective designs for food, pharmaceutical, and consumer goods.

- Stricter environmental rules drive adoption of recyclable materials and biodegradable polymers.

- E‑commerce expansion demands durable, tamper‑evident packaging that optimizes shipping efficiency.

- Digital printing and labeling deliver personalized branding and enhance supply‑chain traceability.

- Automation and robotics boost production throughput, cut labor costs, and support scalability.

- Collaborations with material scientists and feedstock diversification strategies bolster supply‑chain resilience.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Regulatory Compliance Drives Material Innovation

Manufacturers respond to stricter environmental regulations by developing recyclable and biodegradable materials. The expendable packaging market meets EU and US directives that mandate waste reduction. It adopts advanced polymer blends that balance cost and sustainability. Compliance pressures push producers to benchmark materials against lifecycle assessments. Industry leaders invest in research partnerships with institutions to drive material breakthroughs. Consumers reward brands that publish environmental metrics. Regulators enforce audits maintain compliance standards.

- For instance, US-based TerraSafe Materials develops biopolymer compounds and biodegradable coatings that replace traditional petroleum-based packaging, suitable for diverse industries including food packaging.

E‑Commerce Growth Spurs Packaging Demand

E‑commerce expansion compels retailers to secure products. The expendable packaging market supports fulfillment by offering lightweight, designs. It integrates cushioning systems that optimize shipment volume and lower transport costs. Brands adopt customizable boxes mailers to reinforce brand identity. Consumer expectations for prompt delivery drive firms to standardize packaging formats across distribution centers. Logistics providers collaborate with suppliers to refine packaging that resists rough handling. Efficient packaging reduces returns and downtime.

- For instance, Mondi Group reports that 80% of European e-commerce shoppers view sustainable packaging as a non-negotiable, leading to widespread adoption of recyclable mailer bags and clear consumer guidance on reuse or disposal, strengthening brand loyalty through eco-conscious packaging.

Raw Material Price Volatility Impacts Costs

Fluctuations in resin and paperboard pricing influence production costs sectors. The expendable packaging market adjusts procurement strategies to secure supply. It negotiates long‑term contracts with chemical suppliers to mitigate price swings. Firms invest in alternative feedstocks, including recycled content, to diversify input sources. Procurement teams monitor commodity exchanges and apply hedging instruments. Cost pressures prompt margin optimization through operations. Stakeholders track macroeconomic trends and currency shifts to anticipate cost impacts.

Sustainability Trends Shape Product Design

Consumer demand for eco‑friendly packaging steers design innovations. The expendable packaging market embraces reusable and compostable innovative formats. It integrates minimalistic layouts that reduce material volumes and waste. Brands trial plant‑based inks to lower ecological footprint. Designers collaborate with sustainability experts to validate end‑of‑life scenarios. Certification programs like FSC and Cradle to Cradle inform material choices. Market leaders promote robust circular economy models by launching take‑back schemes and refill stations.

Market Trends

Expansion of Biodegradable and Recyclable Material Adoption

The expendable packaging market has witnessed a surge in adoption of biodegradable polymers and recycled content. Manufacturers pursue eco‑friendly formulations to comply with stricter waste directives. R&D teams test novel blends that maintain strength while reducing environmental impact. It benefits from government incentives that promote circular economy models. Consumers reward packaging that carries sustainability labels. Suppliers partner with certification bodies to validate material claims. This drive reduces landfill contributions and enhances brand reputation.

- For instance, UK-based Notpla specializes in seaweed-derived bioplastics that fully compost and prevent leakage in food packaging, offering a sustainable substitute to conventional plastics.

Integration of Digital Technologies to Enhance Supply Chain Visibility

Technology vendors introduce RFID tags and QR code integration for expendable packaging market solutions. Companies deploy IoT sensors that monitor shipment conditions in real‑time. It improves traceability across manufacturing and logistics networks. Data analytics dashboards alert stakeholders to handling issues and route deviations. This visibility drives faster decision making and reduces product losses. Teams refine packaging parameters based on performance data. Collaboration with software providers streamlines process automation and reporting.

- For instance, Fineline Technology integrates RFID into retail packaging to provide wireless bulk scanning, facilitating instant product tracking and inventory management without line-of-sight scanning, thus enhancing operational efficiency and security.

Design Optimization to Support E‑Commerce and Retail Logistics

Brands tailor packaging dimensions to minimize void space and lower transportation costs. The expendable packaging market uses modular box systems that fit multiple product sizes. It employs advanced folding techniques that speed manual assembly on packing lines. Suppliers offer pre‑formed mailers that reduce tape usage and waste. Production teams adjust wall thickness to balance strength and material savings. Continuous testing validates impact resistance during transit. This approach drives operational efficiency and cost savings.

Collaborative Strategies to Mitigate Raw Material Price Fluctuations

Stakeholders secure supply by forging long‑term contracts with resin and paperboard suppliers. The expendable packaging market forms consortiums that pool demand and negotiate volume discounts. It invests in alternative materials research to lower reliance on oil‑based feedstocks. Procurement teams implement dynamic sourcing strategies that pivot between vendors. This collaboration reduces exposure to commodity swings. Joint forecasting improves inventory planning across the value chain. Firms maintain margin stability while supporting innovation efforts.

Market Challenges Analysis

Balancing Rising Material Costs and Sustainability Requirements

The expendable packaging market confronts a convergence of material price volatility and sustainability mandates. It struggles to maintain margin targets while meeting biodegradable content requirements under new waste directives. Producers face wide swings in resin and pulp costs that challenge budget forecasts. It negotiates long‑term supply agreements and invests in feedstock diversification to shield margins. Contract terms demand adherence to evolving environmental standards that vary by region. It must align production processes with third‑party certification audits and lifecycle assessments. This challenge drives firms to refine cost models and streamline operations.

Overcoming Regulatory Complexity and Infrastructure Constraints

Supply chain disruptions and inconsistent recycling infrastructure hinder the expendable packaging market’s growth. It encounters delays when critical components transit through congested ports. Regulations around waste collection vary widely between countries and states. It collaborates with logistics partners to develop contingency plans and buffer inventories. This segment navigates shifting customs requirements that impose added paperwork. It adapts packaging designs to match local processing capabilities and sorting systems. These hurdles compel teams to coordinate cross‑functional initiatives and improve resilience.

Market Opportunities

Digital Print and Customization Expansion

Brand owners demand unique designs that tie marketing messages to packaging. The expendable packaging market can adopt high‑resolution print technologies to support differentiation. It helps brands test limited editions and regional variants. Suppliers offer short‑run production that lowers inventory risk. This flexibility strengthens relationships between manufacturers and retailers. It drives adoption of inkjet and digital label solutions. Stakeholders record faster turnarounds and lower setup costs. Enhanced variable data printing also enables personalized promotions that boost consumer engagement and loyalty.

Bio‑Based Material Production Growth and Collaboration

Governments grant incentives for plant‑derived polymers and recycled content. The expendable packaging market can partner with biopolymer producers to scale capacity. It taps into renewable feedstocks that reduce carbon footprint. Manufacturers test compostable trays and mailers for food and healthcare uses. This approach delivers performance that matches traditional plastics. Suppliers share research costs and accelerate time to market. It unlocks new revenue streams in eco‑sensitive segments. Joint pilot programs with universities foster material innovation and certification readiness.

Market Segmentation Analysis:

By Material Type

Companies prioritize plastic and paper & paperboard to balance cost and sustainability. The expendable packaging market embraces plastic for durability and moisture resistance while increasing recycled paperboard use. It deploys metal for premium applications that ensure strength and barrier performance. Glass maintains niche demand in sectors that value reusability and inert properties. Other materials such as biopolymers and composites receive growing interest. These material based strategies align investments with regulatory and consumer demands.

- For instance, Nestlé has increased the use of recycled paperboard in its packaging to improve recyclability while maintaining product protection, aligning with sustainability goals. This shift is part of broader efforts to reduce reliance on virgin materials in packaging.

By Product Type

Manufacturers expand box and bag offerings to meet diverse shipping and retail needs. The expendable packaging market designs containers that protect sensitive goods and simplify handling. It engineers films that combine flexibility and puncture resistance for wrap applications. Other product types such as sleeves and blister packs gain traction in pharma and electronics. Producers optimize dimensions and wall thickness to reduce waste and improve load stability. These product level initiatives drive operational efficiency.

- For instance, Packman Industries produces a wide range of flexible plastic pouches, including stand-up and zipper pouches, widely used for snacks and beverages, offering lightweight protection and convenience.

By End-User Industry

Food & beverage segment leads volume demand due to high turnover and strict hygiene requirements. The expendable packaging market provides tailored solutions for healthcare that meet sterilization and compliance standards. It serves consumer goods brands with custom finishes and branding options. Electronics packaging emphasizes anti‑static films and shock‑absorbent inserts. Industrial applications require heavy‑duty containers with robust performance. Other sectors such as agriculture and pet care leverage versatile formats to support market growth.

Segments:

Based on Material Type

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

Based on Product Type

- Boxes

- Bags

- Containers

- Films

- Others

Based on End-User Industry

- Food & Beverage

- Healthcare

- Consumer Goods

- Electronics

- Industrial

- Others

Based on Distribution Channel

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America commands 36% share, Europe holds 29%, Asia Pacific secures 24%, Latin America captures 6%, Middle East & Africa records 5%. The expendable packaging market benefits from mature recycling infrastructure and high consumer awareness. It leverages advanced manufacturing to deliver lightweight, durable solutions for food and healthcare sectors. Producers implement automated lines to boost throughput and cut labor expenses. Brands adopt digital print to reinforce identity on e‑commerce shipments. Logistics firms partner with packagers to reduce damage rates. Regulatory support for sustainable materials sustains innovation.

Europe

Europe commands 29% share, North America holds 36%, Asia Pacific secures 24%, Latin America captures 6%, Middle East & Africa records 5%. The expendable packaging market aligns with stringent EU waste directives that mandate eco‑friendly content. It develops recyclable paperboard and compostable polymers to meet compliance. Packaging suppliers certify materials under recognized schemes to bolster trust. Manufacturers adjust wall thickness and carton dimensions to improve transport efficiency. Retailers coordinate with producers to trial reusable mailer programs. Investment in closed‑loop systems reduces dependency on virgin feedstocks.

Asia Pacific

Asia Pacific commands 24% share, North America holds 36%, Europe records 29%, Latin America captures 6%, Middle East & Africa records 5%. The expendable packaging market expands rapidly on rising disposable incomes and booming e‑commerce. It serves diverse industries from electronics to consumer goods with custom box and film solutions. Local governments incentivize bio‑based materials production to cut carbon output. Suppliers scale capacity in China and India to meet regional demand. Packaging designers test anti‑counterfeit features for healthcare shipments. This growth underscores the region’s strategic importance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crown Holdings, Inc.

- Amcor plc

- Sonoco Products Company

- Mondi Group

- Graphic Packaging International, LLC

- International Paper Company

- DS Smith Plc

- Berry Global Group, Inc.

- Sealed Air Corporation

- Huhtamaki Oyj

- WestRock Company

- Smurfit Kappa Group

Competitive Analysis

In the expendable packaging market, leading participants pursue differentiation through sustainable material portfolios and digital‑print capabilities. International Paper, WestRock, and Amcor compete on global footprint, leveraging production networks to meet regional demand and minimize lead times. It invests in R&D collaborations with research institutions to develop compostable polymers and recycled‑content fiber blends. Mid‑sized firms like Mondi and DS Smith focus on niche sectors, offering custom box designs and lightweight film solutions that reduce transit damage. Berry Global and Sealed Air emphasize advanced barrier technologies for food safety and medical packaging. Smurfit Kappa and Huhtamaki leverage circular economy initiatives, launching take‑back programs and closed‑loop systems. Graphic Packaging and Sonoco differentiate through services, including packaging consultancy and digital mockup tools. Intense competitive pressure drives price optimization and operational efficiency. Firms monitor raw material indices to adjust procurement strategies. This landscape fosters innovation and compels firms to align with tightening regulatory demands.

Recent Developments

- In April 2025, Mondi completed the acquisition of Schumacher Packaging’s Western Europe operations.

- In May 2025, Metsä Group and Amcor partnered to develop recyclable three‑dimensional moulded fibre food packaging.

- In April 2024, Sealed Air introduced a lightweight, certified compostable tray designed to replace traditional polystyrene foam trays used in protein packaging. This product resulted from a collaboration with Eastman’s Aventa Renew material and CRYOVAC’s compostable overwrap.

- In December 2024, Sonoco acquired Eviosys in a $3.9 billion USD deal, strengthening Sonoco’s position as a global leader in metal food can and aerosol packaging solutions, particularly expanding its footprint in Europe.

Market Concentration & Characteristics

Market concentration in the expendable packaging market remains high, with the top five producers controlling over 60% of global output. Major players leverage extensive production networks and manufacturing processes to maintain scale advantages and optimize unit costs. It secures raw material supply channels through vertical integration and enforces strict quality controls. Mid‑tier companies serve niche applications by offering specialized materials and tailored packaging formats. High entry barriers arise from significant capital requirements for production equipment and rigorous environmental regulations. Price competition stays moderate thanks to product differentiation based on barrier performance and digital print solutions. Client consolidation among retailers and e‑commerce platforms strengthens buyer influence and prompts suppliers to offer value‑added services such as on‑demand printing and rapid prototype development. Research partnerships with academic institutions accelerate new material validation, while strategic acquisitions redefine market dynamics and unlock adjacent segment opportunities. This structure supports sustained growth underpinned by innovation and compliance.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Companies will expand use of plant‑based polymers to meet sustainability mandates.

- Manufacturers will integrate IoT‑enabled tracking into packaging solutions.

- Suppliers will deploy automated assembly lines to boost production efficiency.

- Brands will leverage digital printing for on‑demand personalization and rapid prototyping.

- Producers will adopt closed‑loop recycling systems to recover and reuse materials.

- R&D teams will explore composite blends to enhance package durability and barrier performance.

- Firms will partner with logistics providers to standardize formats and reduce transit damage.

- Packaging designers will incorporate anti‑counterfeit features to secure high‑value shipments.

- Stakeholders will apply AI‑driven data analysis to optimize package dimensions and material use.

- Market participants will collaborate on cross‑industry initiatives to accelerate sustainable innovation.