Market Overview

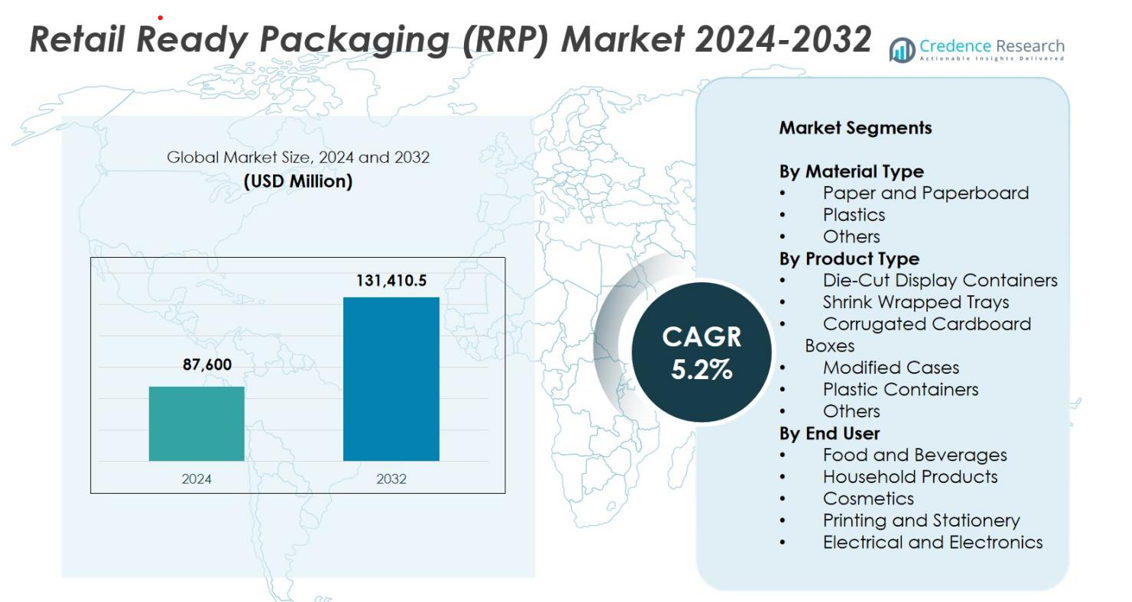

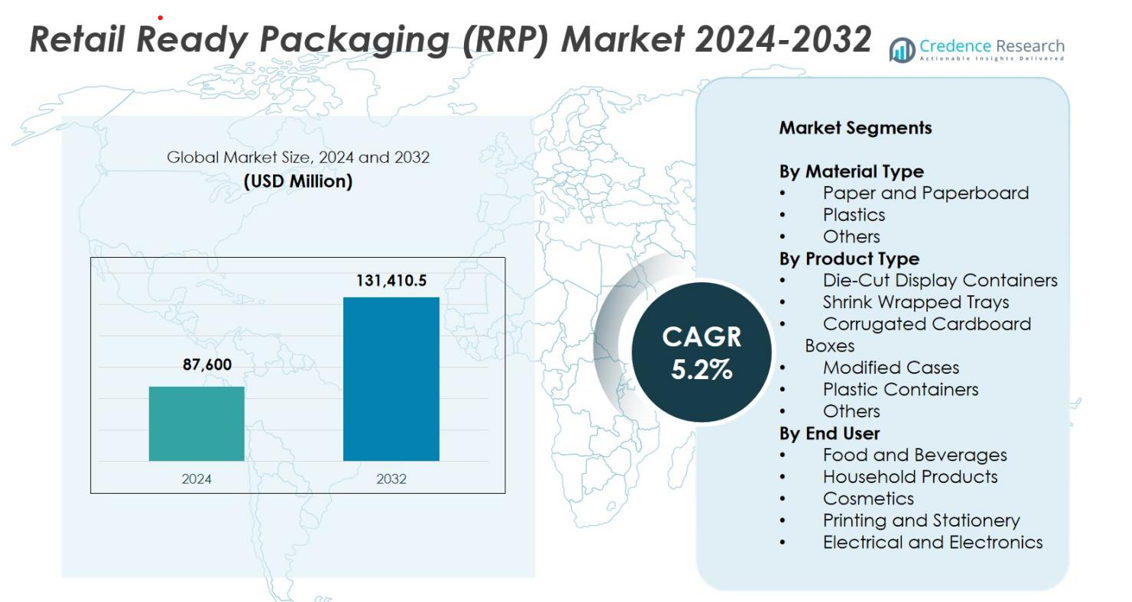

Retail Ready Packaging (RRP) Market size was valued at USD 87,600 Million in 2024 and is anticipated to reach USD 131,410.5 Million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Retail Ready Packaging (RRP) Market Size 2024 |

USD 87,600 Million |

| Retail Ready Packaging (RRP) Market, CAGR |

5.2% |

| Retail Ready Packaging (RRP) Market Size 2032 |

USD 131,410.5 Million |

Retail Ready Packaging (RRP) market is shaped by the strong presence of leading players such as Mondi, Smurfit Kappa, DS Smith, International Paper, Georgia-Pacific, Packaging Corporation of America, Huhtamaki Oyj, SIG, Caps Cases Ltd, Billerud, and Weedon Group Ltd, all of which focus on delivering sustainable, shelf-ready, and customizable packaging solutions. These companies invest in recyclable fiber-based materials, advanced printing technologies, and efficient supply chain designs to meet evolving retail requirements. Regionally, Europe leads the market with a 34.6% share in 2024, driven by stringent sustainability regulations and mature retail infrastructure, followed by North America and Asia Pacific with notable growth potential.

Market Insights

- Retail Ready Packaging (RRP) market was valued at USD 87,600 million in 2024 and is projected to reach USD 131,410.5 million by 2032, expanding at a CAGR of 5.2%.

- Market growth is driven by rising demand for shelf-ready solutions, sustainability-focused packaging, and increased FMCG product turnover, with paper and paperboard leading the material segment with a 62.4% share.

- Trends include wider adoption of digital printing, recyclable materials, and automation-friendly designs that enhance visibility, reduce handling time, and improve in-store efficiency.

- Key players such as Mondi, Smurfit Kappa, DS Smith, International Paper, Georgia-Pacific, and Billerud strengthen the market through innovations in lightweight fiber packaging and retailer-specific formats.

- Europe leads with a 34.6% regional share, followed by North America at 31.2% and Asia Pacific at 24.8%, while corrugated cardboard boxes dominate the product segment with a 47.8% share, supported by strong demand in food and beverage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Material Type

The Retail Ready Packaging (RRP) market by material type is dominated by paper and paperboard, accounting for 62.4% of the total share in 2024, driven by rising demand for sustainable, recyclable, and cost-efficient packaging formats across FMCG and retail channels. Paper-based RRP solutions support high printability, easy shelf placement, and alignment with retailers’ sustainability goals, making them preferred for large-volume applications such as food, beverages, and household goods. Plastics follow due to their durability and moisture resistance, while other hybrid materials gain traction through innovative, functional designs.

- For Instance, DS Smith and Coca-Cola HBC Austria implemented a cardboard-based outer packaging to replace plastic handles on 1.5-liter PET soft-drink multipacks supplied to Austrian supermarkets, illustrating fibre-based RRP displacing plastic in beverage retail

By Product Type

Among product types, corrugated cardboard boxes led the Retail Ready Packaging (RRP) market with 47.8% share in 2024, supported by their strength, versatility, low cost, and suitability for high-speed retail supply chains. These boxes offer excellent stacking efficiency and are widely used in food, beverages, and electronics categories. Die-cut display containers and shrink-wrapped trays are also expanding as retailers focus on shelf visibility and operational efficiency. Modified cases and plastic containers serve niche applications requiring enhanced product protection and moisture control.

- For Instance, Walmart expanded the use of corrugated shelf-ready boxes across its packaged food aisles, implementing standardized box dimensions to improve pallet efficiency and speed up restocking in high-turnover categories.

By End User

The food and beverages segment dominated the Retail Ready Packaging (RRP) market in 2024, capturing 54.1% share, primarily driven by supermarket expansion, faster replenishment needs, and rising demand for convenience-oriented packaging formats. RRP supports quick restocking, better product presentation, and reduced labor hours, making it ideal for high-turnover categories such as snacks, dairy, bakery, and beverages. Household products and cosmetics are increasingly adopting RRP for enhanced shelf appeal, while printing, stationery, and electronics sectors use it to improve protection and retail display efficiency.

Key Growth Drivers

Rising Demand for Shelf-Ready and Convenience Packaging

The growing preference for shelf-ready and convenience-driven packaging formats is a major driver for the Retail Ready Packaging (RRP) market. Modern retail formats such as supermarkets, hypermarkets, and discount stores require packaging that supports faster replenishment, easy product identification, and minimal manual handling. RRP enables products to be placed directly on shelves without unpacking, reducing labor time and improving store efficiency. This is especially valuable for high-turnover categories like snacks, beverages, household goods, and personal care. The expansion of promotional activities and frequent SKU rotations further increases the need for display-ready designs that enhance visibility and merchandising speed. As retailers prioritize operational consistency and efficiency across large store networks, demand for RRP continues to rise globally.

- For Instance, Tesco continued its rollout of standardized shelf-ready packaging across fresh produce and grocery lines, reporting improved replenishment efficiency through pre-cut, easy-open RRP formats.

Expanding Focus on Sustainability and Recyclable Packaging Materials

Sustainability has become a powerful growth catalyst for the RRP market, driven by regulatory mandates, retailer commitments, and shifting consumer expectations. Brands are transitioning from plastic-based packaging to recyclable, biodegradable, and fiber-based alternatives such as corrugated cardboard and paperboard. This shift supports circular economy principles while helping companies reduce waste and meet environmental compliance standards. Restrictions on single-use plastics strengthen the adoption of sustainable RRP solutions, prompting innovations like water-based inks, lightweight paper grades, and eco-friendly adhesives. Retailers increasingly evaluate packaging sustainability as part of supplier selection, accelerating demand for greener formats. As environmental responsibility becomes core to brand identity, sustainable RRP options continue to gain significant traction.

- For instance, PepsiCo under its “pep+” agenda has committed to reduce virgin plastic use, increase recycled content, and scale non-plastic or compostable materials across key markets, explicitly exploring paper-based and recyclable alternatives for its secondary and primary packaging.

Growth of Modern Retail Infrastructure and FMCG Expansion

The expansion of organized retail networks and the rapid growth of FMCG categories are key drivers boosting the RRP market. Emerging economies are transitioning from traditional retail formats to modern chains that require standardized, automated, and shelf-efficient packaging systems. RRP supports these needs by enabling streamlined distribution, faster shelf placement, and improved product turnover. FMCG manufacturers also seek packaging that enhances brand visibility while reducing logistics complexity and labor dependence. As global retail giants expand into developing regions and omnichannel models gain strength, RRP adoption accelerates. Advancements in digital printing further support rapid customization, seasonal launches, and promotional labeling, making RRP a strategic asset in modern retail environments.

Key Trends & Opportunities

Increased Adoption of Digital Printing and Smart Packaging Features

Digital printing is reshaping the RRP landscape by offering faster production, high-resolution branding, and cost-efficient customization. Retailers leverage digital printing for regional promotions, limited-edition packs, and personalized messaging that enhances shopper engagement. RRP manufacturers benefit from shorter run lengths, rapid prototyping, and flexible design changes without the constraints of traditional plate-based printing. Smart packaging features such as QR codes, NFC, and AR-enabled content further elevate product interaction and traceability. These technologies enable real-time engagement, improved supply chain visibility, and enhanced consumer trust. As experiential retail grows, digitally enhanced RRP solutions represent significant opportunities for innovation and differentiation.

- For instance, in 2023 Nestlé deployed digitally printed QR codes on select confectionery packs in Europe, enabling consumers to access product stories, ingredient transparency, and promotional content through mobile scanning.

Growing Opportunities in E-commerce-Integrated Retail Formats

Omnichannel and e-commerce-integrated retail models are unlocking new opportunities for RRP manufacturers. While RRP traditionally served physical shelves, packaging is now evolving to support click-and-collect operations, dark stores, and hybrid fulfillment centers. Retailers require packaging that improves handling efficiency, protects products during transport, and remains shelf-ready for in-store display. This dual-function requirement encourages development of stronger, modular, and automation-friendly RRP designs. As online grocery, quick-commerce platforms, and cross-channel retailing expand, demand for durable and versatile RRP formats increases. The convergence of e-commerce and brick-and-mortar operations positions RRP as a critical enabler of streamlined supply chains.

- For instance, Mondi Group’s corrugated RRP tray solutions developed for Aldi Süd’s click‑and‑collect model in Germany integrate reinforced board and easy‑open tear strips, ensuring easy replenishment in stores and damage protection during home delivery.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating prices of raw materials such as pulp, paperboard, plastics, and printing components create significant challenges for the RRP market. Manufacturers must manage cost pressures while meeting retailer expectations for price stability and sustainability. Global disruptions including freight delays, energy cost fluctuations, and supply shortages further strain production cycles. These issues lead to increased operational expenses and reduced profitability, particularly for mid-sized suppliers. Retailers often resist price increases, forcing manufacturers to absorb costs or optimize through lightweighting and material alternatives. Persistent volatility limits strategic planning and may slow adoption of advanced RRP innovations.

Design and Standardization Constraints Across Retail Chains

Variations in retailer requirements such as shelf dimensions, display configurations, and handling specifications pose a major challenge for RRP standardization. Manufacturers must adapt designs to suit each retailer’s operational setup, increasing complexity, development time, and production costs. Poorly optimized designs can reduce stacking stability, cause transit damage, or fail to deliver intended shelf impact. Balancing strength, sustainability goals, and cost efficiency adds further constraints. As retailers implement stricter packaging compliance criteria, suppliers face rising pressure to deliver precise, adaptable, and structurally sound RRP solutions. These design challenges require continuous innovation and engineering expertise to achieve consistency across diverse retail environments.

Regional Analysis

North America

North America held a significant share of 31.2% in the Retail Ready Packaging (RRP) market in 2024, driven by strong penetration of organized retail, high reliance on shelf-ready formats, and rising adoption of sustainable packaging solutions. Major retail chains such as Walmart, Costco, and Target accelerate demand for standardized RRP formats that improve replenishment efficiency and product visibility. Growing consumer preference for packaged food, beverages, and household goods further supports market expansion. The region also benefits from advanced printing technologies and strict sustainability mandates encouraging recyclable, fiber-based RRP solutions.

Europe

Europe dominated the Retail Ready Packaging (RRP) market with 34.6% share in 2024, supported by mature retail networks, stringent sustainability regulations, and high adoption of fiber-based packaging. Retailers including Tesco, Carrefour, and Aldi enforce strict RRP compliance standards, pushing manufacturers toward precision-engineered, easy-to-handle formats. The region’s strong commitment to circular economy initiatives accelerates demand for recyclable and biodegradable RRP materials. Expansion of private-label FMCG products and increased automation across logistics and merchandising further strengthen market growth, making Europe one of the most advanced regions for RRP adoption.

Asia Pacific

Asia Pacific accounted for 24.8% of the Retail Ready Packaging (RRP) market in 2024 and remains the fastest-growing region. The rapid expansion of supermarkets, hypermarkets, and convenience stores, combined with rising urbanization and disposable incomes, fuels demand for shelf-ready packaging. China, India, and Southeast Asian countries contribute significantly due to strong FMCG consumption and increasing focus on merchandising efficiency. Sustainability concerns are prompting a shift toward recyclable and cost-effective packaging formats. Additionally, the region’s booming e-commerce sector drives demand for durable, stackable, and visually appealing RRP suitable for omnichannel supply chains.

Latin America

Latin America held a 5.4% share of the Retail Ready Packaging (RRP) market in 2024, supported by growing retail consolidation, rising packaged food demand, and a focus on operational cost optimization. Countries such as Brazil, Mexico, and Chile are increasing adoption of shelf-ready formats to streamline restocking and improve product visibility. The region is gradually transitioning from traditional packaging to corrugated and printable RRP solutions that enhance merchandising efficiency. Sustainability awareness is rising, encouraging manufacturers to incorporate recyclable materials. However, economic fluctuations and uneven retail development present moderate constraints to faster market penetration.

Middle East & Africa

The Middle East & Africa region accounted for 4% share of the Retail Ready Packaging (RRP) market in 2024, driven by expanding supermarket chains, increasing consumption of packaged FMCG goods, and investments in modern retail infrastructure. Markets such as the UAE, Saudi Arabia, and South Africa demonstrate growing adoption of RRP to improve shelf presentation and reduce stocking time. Efforts toward sustainability and the shift toward organized retail formats further support market development. Despite these advancements, varying regulatory standards and slower uptake in emerging African economies continue to limit broader regional expansion.

Market Segmentations

By Material Type

- Paper and Paperboard

- Plastics

- Others

By Product Type

- Die-Cut Display Containers

- Shrink Wrapped Trays

- Corrugated Cardboard Boxes

- Modified Cases

- Plastic Containers

- Others

By End User

- Food and Beverages

- Household Products

- Cosmetics

- Printing and Stationery

- Electrical and Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Retail Ready Packaging (RRP) market features a diverse and expanding competitive landscape, with global and regional players focusing on sustainability, innovation, and supply chain efficiency. Leading companies such as Mondi, Smurfit Kappa, DS Smith, International Paper, Georgia-Pacific, Billerud, Packaging Corporation of America, Huhtamaki Oyj, SIG, Caps Cases Ltd, and Weedon Group Ltd actively strengthen their portfolios through recyclable materials, lightweight designs, and advanced digital printing capabilities. These players emphasize customized RRP solutions that enhance shelf visibility, reduce handling time, and align with retailer-specific requirements. Strategic initiatives including acquisitions, capacity expansions, and product innovations support market positioning amid rising demand for fiber-based and eco-friendly packaging formats. Additionally, manufacturers increasingly integrate automation-ready designs and smart printing features to address evolving retail expectations. The competitive environment is shaped by continuous pressure to meet sustainability targets, deliver cost-efficient packaging, and support rapid merchandising cycles across global retail chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Mondi launched an extended corrugated and solid-board packaging portfolio for the food-packaging industry strengthening its readiness for Retail Ready Packaging (RRP) demands.

- In October 2025, Georgia‑Pacific completed the acquisition of Anchor Packaging, a manufacturer of food containers and film packaging a move that expands Georgia-Pacific’s footprint in packaging including segments relevant to retail-ready packaging.

- In September 2025, Closed Loop Partners extended a US$10 million loan to TemperPack Technologies supporting the latter’s growth in sustainable packaging technologies that can feed into RRP supply chains.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Product Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as retailers prioritize shelf-ready and labor-efficient packaging formats.

- Sustainability requirements will accelerate the shift toward recyclable, fiber-based RRP solutions.

- Digital printing adoption will expand, enabling faster customization and enhanced shelf appeal.

- Automation-friendly RRP designs will grow to support high-speed retail and logistics operations.

- E-commerce integration will increase demand for durable, dual-purpose packaging for fulfillment and in-store display.

- Retailers will push for standardized packaging specifications, increasing demand for precise and adaptable designs.

- Innovative lightweight materials will emerge to reduce costs while maintaining performance.

- FMCG and private-label expansion will drive demand for high-volume, visually compelling RRP formats.

- Smart packaging features such as QR codes and tracking elements will gain wider adoption.

- Emerging markets will see rising RRP adoption due to the rapid development of modern retail infrastructure.