Market Overview

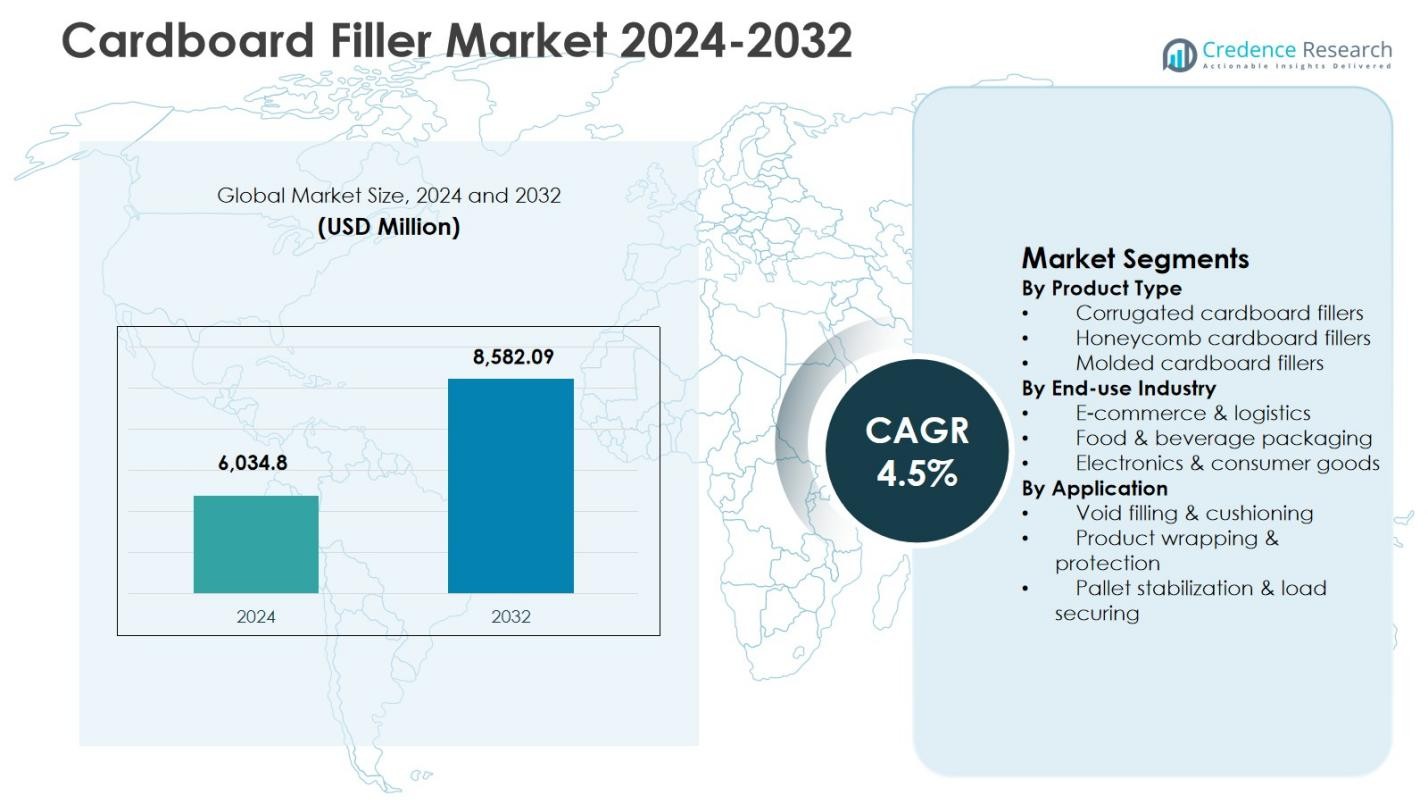

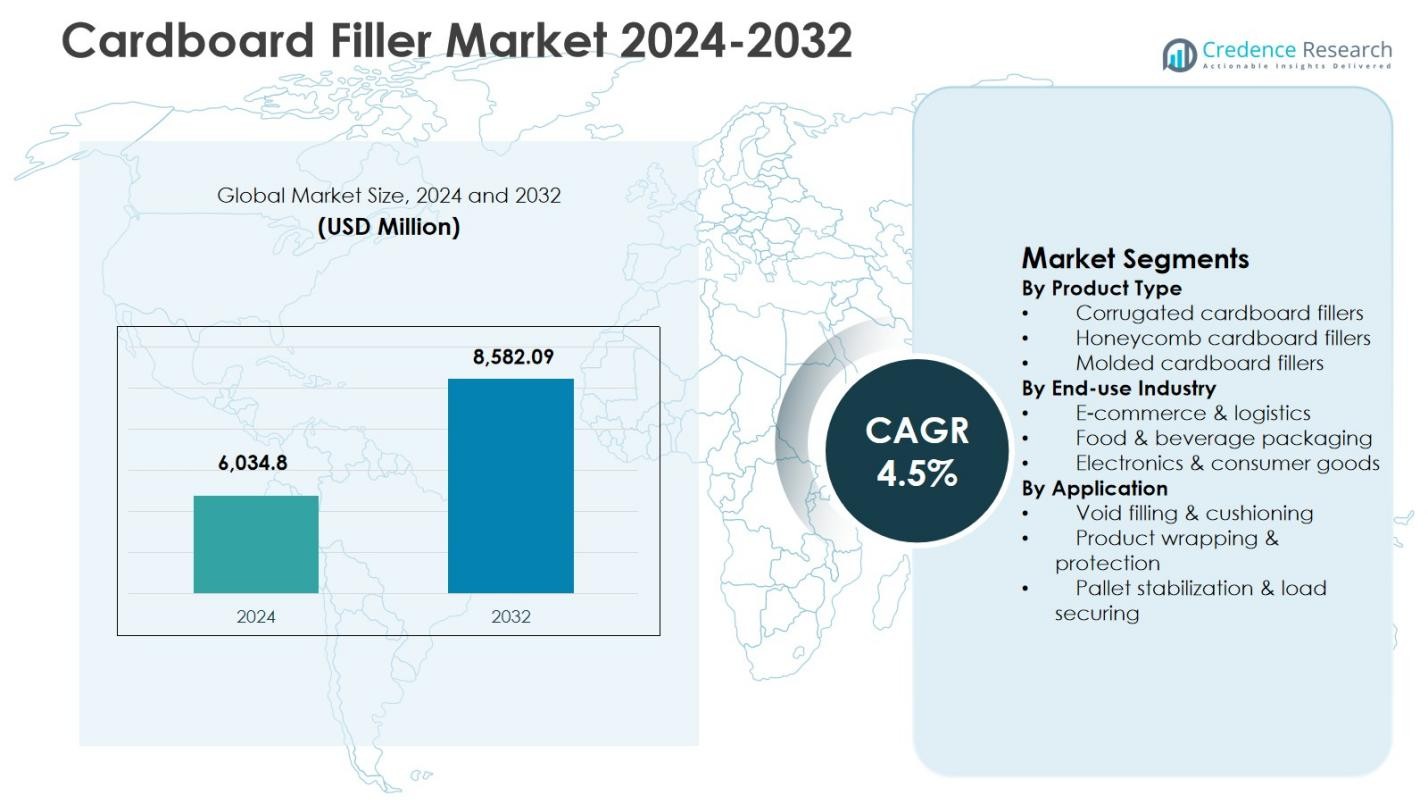

The Cardboard Filler Market size was valued at USD 6,034.8 million in 2024 and is anticipated to reach USD 8,582.09 million by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cardboard Filler Market Size 2024 |

USD 6,034.8 Million |

| Cardboard Filler Market, CAGR |

4.5% |

| Cardboard Filler Market Size 2032 |

USD 8,582.09 Million |

Cardboard Filler Market is supported by the presence of established packaging manufacturers such as DS Smith plc, Smurfit Kappa Group, Sonoco Products Company, Sealed Air Corporation, Cascades Inc., Axxor Group, Packaging Corporation of America (Hexacomb), Huhtamaki PPL Limited, Grigeo AB, and LSquare Eco Products Pvt. Ltd. These players focus on expanding sustainable, recyclable, and high-strength cardboard filler solutions to meet growing demand from e-commerce, logistics, and industrial packaging applications. Continuous investments in automation, material innovation, and capacity expansion strengthen their market presence. Regionally, North America led the Cardboard Filler Market with a 32.6% market share in 2024, driven by advanced logistics infrastructure, high e-commerce penetration, and strong regulatory support for paper-based packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Cardboard Filler Market was valued at USD 6,034.8 million in 2024 and is projected to reach USD 8,582.09 million by 2032, growing at a CAGR of 4.5% during the forecast period.

- Cardboard Filler Market growth is driven by rising demand for sustainable packaging, rapid expansion of e-commerce logistics, and increasing replacement of plastic fillers with recyclable cardboard alternatives across industries.

- Cardboard Filler Market trends highlight strong demand for corrugated cardboard fillers, which held 46.8% segment share in 2024, supported by lightweight structure, cost efficiency, and suitability for automated packaging systems.

- Cardboard Filler Market analysis shows leading players focusing on product innovation, capacity expansion, and automation to strengthen fiber-based protective packaging portfolios and meet high-volume logistics requirements.

- Cardboard Filler Market regional analysis indicates North America led with 32.6% share in 2024, followed by Europe at 28.4% and Asia Pacific at 24.9%, driven by e-commerce growth and sustainability regulations.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type:

The Cardboard Filler Market by product type is led by corrugated cardboard fillers, which accounted for 46.8% of the market share in 2024. Corrugated fillers dominate due to their high strength-to-weight ratio, flexibility in design, and cost efficiency for bulk packaging applications. These fillers are widely used across e-commerce and industrial shipping because they provide reliable cushioning while remaining lightweight and recyclable. Strong demand for sustainable and fiber-based protective packaging solutions, along with increasing regulatory pressure to reduce plastic usage, continues to drive the adoption of corrugated cardboard fillers globally.

- For instance, Acme Corrugated Box developed AcmeGUARD®, a proprietary moisture-resistant coated corrugated material introduced in 2018, enabling Norman Smith Enterprises to ship floral products with plants, soil, and water domestically after overseas costs rose in 2019.

By End-use Industry:

By end-use industry, e-commerce & logistics emerged as the dominant sub-segment, holding a 52.4% share of the Cardboard Filler Market in 2024. The segment benefits from the rapid growth of online retail, rising parcel shipments, and the need for effective void-fill solutions to prevent product damage during transit. Cardboard fillers are preferred for e-commerce packaging due to their recyclability, ease of disposal, and compatibility with automated packing lines. The expansion of cross-border trade and same-day delivery services further accelerates demand from logistics and fulfillment centers.

- For instance, Amazon announced in June 2024 that it had replaced 95% of plastic air pillows in its North American delivery packaging with paper-based filler made from 100% recycled content, eliminating nearly 15 billion plastic air pillows from about 2 billion packages annually and improving curbside recyclability.

By Application:

In terms of application, void filling & cushioning accounted for the largest share at 48.9% in 2024, making it the dominant sub-segment in the Cardboard Filler Market. This dominance is driven by the essential role of cardboard fillers in minimizing movement inside packages and protecting goods from shock and vibration. Industries handling fragile, high-value, or irregularly shaped products increasingly rely on cardboard-based void fillers to ensure shipment integrity. Growing emphasis on damage reduction, cost savings from fewer returns, and the shift toward paper-based protective materials continue to support strong demand in this application segment.

Key Growth Drivers

Rising Demand for Sustainable Packaging Solutions

The Cardboard Filler Market is strongly driven by the global shift toward sustainable and eco-friendly packaging materials. Businesses across e-commerce, logistics, and manufacturing increasingly replace plastic fillers with recyclable and biodegradable cardboard alternatives to meet environmental regulations and corporate sustainability goals. Cardboard fillers offer high recyclability, reduced carbon footprint, and compatibility with circular economy models. Growing consumer awareness regarding sustainable packaging further accelerates adoption, encouraging brands to integrate fiber-based void-fill and cushioning solutions into their packaging strategies to enhance environmental credibility.

- For instance, WestRock’s KD-Fold™ provides a tube-shaped, single-face corrugated fanfold substrate for e-commerce mailers via its Pak On Demand™ system, creating tight-fit packaging that eliminates the need for void fill and uses 50% less paper than standard corrugated boxes.

Expansion of E-commerce and Logistics Activities

Rapid growth in e-commerce and logistics operations significantly fuels demand in the Cardboard Filler Market. Increasing online purchases generate higher parcel volumes, requiring effective protective packaging to reduce product damage during transportation. Cardboard fillers provide reliable cushioning, lightweight performance, and cost efficiency, making them ideal for high-throughput fulfillment centers. The rise of same-day and next-day delivery services further intensifies the need for fast, automated, and sustainable packaging solutions, reinforcing consistent demand for cardboard fillers across global supply chains.

- For instance, DHL introduced GoGreen recyclable cardboard boxes under its sustainability initiative, featuring FSC-certified materials from responsibly managed forests to cushion parcels in high-volume logistics without added fillers.

Regulatory Pressure to Reduce Plastic Packaging

Stringent regulations targeting single-use plastics act as a key growth driver for the Cardboard Filler Market. Governments across Europe, North America, and parts of Asia enforce policies that limit plastic packaging and promote recyclable materials. Cardboard fillers comply with these regulatory frameworks while maintaining strong protective performance. Manufacturers and retailers increasingly adopt cardboard-based fillers to ensure compliance, avoid penalties, and align with environmental standards, thereby accelerating market penetration and long-term growth across multiple end-use industries.

Key Trends & Opportunities

Increasing Adoption of Automated Paper-Based Packaging Systems

Automation in packaging operations represents a significant trend and opportunity within the Cardboard Filler Market. Companies increasingly deploy automated cardboard filler dispensing systems to improve packing efficiency and reduce labor costs. These systems integrate seamlessly with high-speed production and fulfillment lines, enabling consistent void filling and optimized material usage. The trend supports scalability for large e-commerce and logistics operators while creating opportunities for equipment manufacturers and material suppliers to offer integrated, high-performance cardboard filler solutions.

- For instance, Medpets adopted Ranpak’s Cut’it!™ EVO machines alongside Form’it!™ case erectors, reducing packing stations from 20 to four while processing over 1200 orders per hour and eliminating filling material entirely.

Growth Opportunities in Emerging Markets

Emerging economies present strong growth opportunities for the Cardboard Filler Market due to expanding retail, manufacturing, and logistics infrastructure. Rising disposable incomes, increasing online shopping penetration, and improving supply chain networks drive demand for protective packaging solutions. Local manufacturers increasingly adopt cardboard fillers to meet sustainability standards and cost requirements. Investments in warehousing and cross-border trade across Asia-Pacific, Latin America, and the Middle East further strengthen long-term market potential in these regions.

- For instance, Oji Holdings Corporation in Japan manufactures corrugated containers using E-flute and micro-flute paper for protective packaging, combining aesthetic qualities with strength to support e-commerce and export needs.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material prices, particularly recycled paper and kraft paper, poses a significant challenge for the Cardboard Filler Market. Price fluctuations directly impact production costs and profit margins for manufacturers. Supply chain disruptions, changes in recycling rates, and energy cost variations further intensify pricing uncertainty. Manufacturers must balance cost efficiency with quality and sustainability requirements, which can limit pricing flexibility and create challenges in maintaining stable long-term contracts with end-use customers. Additionally, dependence on regional paper recovery systems and inconsistent availability of recycled inputs can affect production planning, inventory management, and timely fulfillment of customer orders, increasing operational risk.

Performance Limitations Compared to Plastic Alternatives

Despite strong sustainability advantages, cardboard fillers face performance challenges when compared to certain plastic-based alternatives. Cardboard fillers may offer lower moisture resistance and reduced durability in high-humidity or heavy-load applications. These limitations can restrict adoption in specific industries requiring enhanced protection. Manufacturers must invest in product innovation, material treatments, and design optimization to overcome performance gaps, which increases development costs and may slow adoption in specialized packaging applications. In addition, the need for protective coatings or hybrid solutions can raise overall packaging costs and complicate recycling processes, further influencing purchasing decisions among performance-driven end users.

Regional Analysis

North America

North America held 32.6% of the Cardboard Filler Market share in 2024, driven by strong adoption of sustainable packaging across e-commerce, retail, and logistics sectors. The region benefits from advanced fulfillment infrastructure, high online shopping penetration, and strict environmental regulations encouraging paper-based protective packaging. Major retailers and logistics providers actively replace plastic void fillers with recyclable cardboard alternatives to meet sustainability targets. The presence of leading packaging manufacturers and widespread use of automated packaging systems further supports consistent demand growth across the United States and Canada.

Europe

Europe accounted for 28.4% of the Cardboard Filler Market share in 2024, supported by stringent regulations on plastic usage and strong emphasis on circular economy practices. Countries such as Germany, the United Kingdom, and France drive adoption through regulatory compliance and corporate sustainability commitments. High recycling rates and well-established paper recovery systems strengthen the use of cardboard fillers across industrial, food, and consumer goods packaging. Continuous innovation in fiber-based protective solutions and growing cross-border e-commerce activity further reinforce market expansion across the region.

Asia Pacific

Asia Pacific captured 24.9% of the Cardboard Filler Market share in 2024, reflecting rapid growth in e-commerce, manufacturing, and logistics activities. Expanding consumer markets in China, India, and Southeast Asia generate high demand for cost-effective and sustainable protective packaging. Rising environmental awareness and government initiatives promoting recyclable materials support the shift toward cardboard fillers. The region also benefits from increasing investments in warehousing, fulfillment centers, and export-oriented manufacturing, driving sustained demand across both domestic and international supply chains.

Latin America

Latin America represented 8.1% of the Cardboard Filler Market share in 2024, driven by expanding retail, food packaging, and logistics sectors. Growing e-commerce adoption in countries such as Brazil and Mexico increases the need for protective packaging solutions that balance performance and sustainability. Cardboard fillers gain preference due to their recyclability and cost efficiency compared to plastic alternatives. Improvements in recycling infrastructure and rising environmental regulations further support gradual market expansion across the region.

Middle East & Africa

The Middle East & Africa accounted for 6.0% of the Cardboard Filler Market share in 2024, supported by growing logistics hubs, retail expansion, and increasing demand for sustainable packaging. Gulf countries drive adoption through investments in e-commerce and supply chain infrastructure, while Africa shows emerging demand from food and consumer goods packaging. Rising awareness of environmental impact and gradual regulatory developments encourage the use of cardboard fillers. Ongoing investments in distribution networks and trade activities support steady market growth across the region.

Market Segmentations:

By Product Type

- Corrugated cardboard fillers

- Honeycomb cardboard fillers

- Molded cardboard fillers

By End-use Industry

- E-commerce & logistics

- Food & beverage packaging

- Electronics & consumer goods

By Application

- Void filling & cushioning

- Product wrapping & protection

- Pallet stabilization & load securing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

DS Smith plc, Smurfit Kappa Group, Sonoco Products Company, Sealed Air Corporation, Cascades Inc., Axxor Group, Packaging Corporation of America (Hexacomb), Huhtamaki PPL Limited, Grigeo AB, and LSquare Eco Products Pvt. Ltd. are the prominent participants shaping the Cardboard Filler Market. The market is characterized by strong emphasis on sustainable material innovation, product performance enhancement, and expansion of paper-based protective packaging portfolios. Leading companies focus on developing recyclable, lightweight, and high-strength cardboard fillers to meet evolving e-commerce and industrial packaging needs. Strategic investments in automated packaging solutions and production capacity expansions strengthen operational efficiency and customer reach. Regional players leverage cost-effective manufacturing and local supply chains to compete with multinational firms. Partnerships with logistics providers, retail brands, and industrial customers support long-term contracts and recurring demand. Continuous innovation, sustainability alignment, and geographic expansion remain central to maintaining market positioning.

Key Player Analysis

- DS Smith plc

- Smurfit Kappa Group

- Packaging Corporation of America (Hexacomb)

- Sonoco Products Company

- Sealed Air Corporation

- Huhtamaki PPL Limited

- Axxor Group

- Cascades Inc.

- Grigeo AB

- LSquare Eco Products Pvt. Ltd.

Recent Developments

- In July 2025, Packaging Corporation of America (PCA) acquired Greif’s US containerboard business for $1.8 billion, expanding capacity in corrugated sheet plants relevant to cardboard filler production.

- In March 2024, Stahl signed an exclusive licensing agreement with Barriertec to sell Barriertec’s sustainable barrier solutions under the Stahl brand, enhancing its offerings in recyclable paper and cardboard packaging, including applications relevant to the Cardboard Filler Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End Use Industry, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Cardboard Filler Market will continue expanding as sustainability becomes a core packaging requirement across industries.

- Increasing replacement of plastic void fillers with recyclable cardboard solutions will support long-term demand growth.

- E-commerce and logistics operations will remain the primary consumption channels due to rising parcel volumes.

- Automated cardboard filler dispensing systems will gain wider adoption in high-throughput packaging facilities.

- Manufacturers will focus on improving strength, flexibility, and moisture resistance of cardboard fillers.

- Demand from food, electronics, and consumer goods packaging will steadily increase.

- Emerging markets will contribute significantly as retail and logistics infrastructure expands.

- Recycling and circular economy initiatives will strengthen the use of fiber-based protective packaging.

- Strategic partnerships between packaging suppliers and logistics providers will increase.

- Ongoing regulatory pressure on plastic packaging will reinforce the shift toward cardboard fillers.

Market Segmentation Analysis:

Market Segmentation Analysis: