Market Overview:

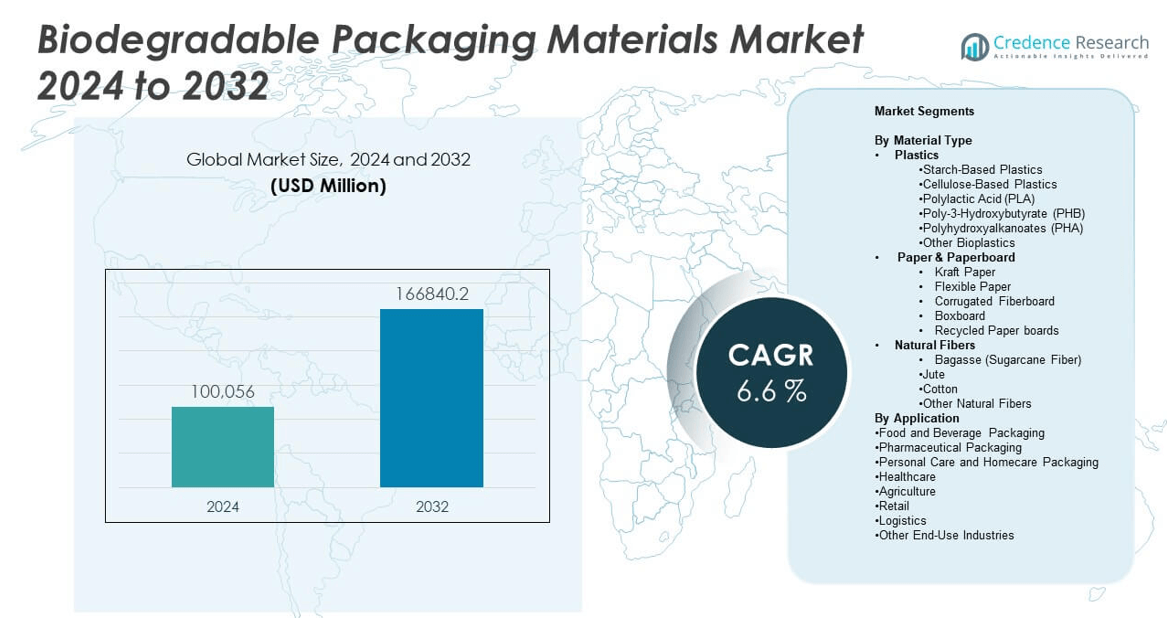

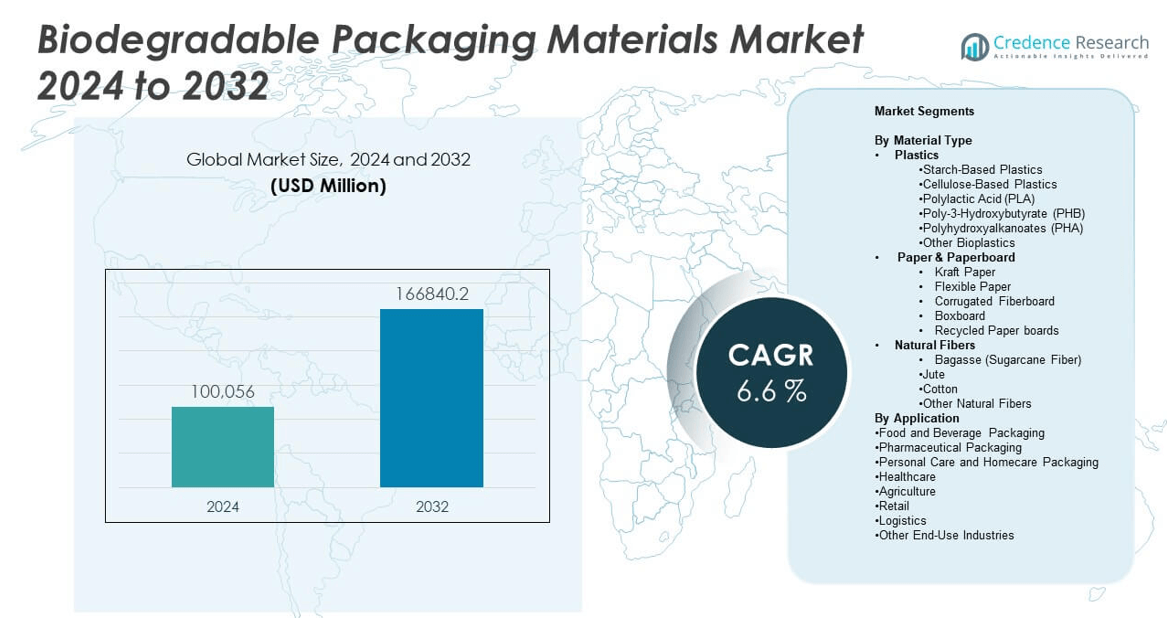

The Biodegradable Packaging Materials Market is projected to grow from USD 100,056 million in 2024 to an estimated USD 166,840.2 million by 2032, with a compound annual growth rate (CAGR) of 6.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biodegradable Packaging Materials Market Size 2024 |

USD 100,056 million |

| Biodegradable Packaging Materials Market, CAGR |

6.6% |

| Biodegradable Packaging Materials Market Size 2032 |

USD 166,840.2 million |

This market is experiencing strong momentum as consumer awareness about environmental sustainability intensifies and governments impose stricter regulations on single-use plastics. Manufacturers are adopting biodegradable alternatives made from materials such as starch, polylactic acid (PLA), and cellulose, which break down naturally without leaving harmful residues. The increasing demand for eco-friendly packaging in the food and beverage, personal care, and healthcare sectors is further propelling market growth. Technological advancements in compostable and water-soluble films are also opening new opportunities for application across multiple industries.

Geographically, Europe leads the market due to stringent environmental policies and widespread adoption of green packaging solutions. North America follows closely, driven by corporate sustainability goals and consumer preference for environmentally responsible products. The Asia Pacific region is emerging rapidly, supported by rising environmental awareness, expanding e-commerce, and proactive government initiatives in countries like China, India, and South Korea. Latin America and the Middle East are witnessing gradual adoption, primarily led by multinational brands and evolving packaging standards.

Market Insights:

- The Biodegradable Packaging Materials Market was valued at USD 100,056 million in 2024 and is projected to reach USD 166,840.2 million by 2032, growing at a CAGR of 6.6%.

- Growing bans on single-use plastics and strict global regulations are accelerating the shift toward biodegradable alternatives.

- Rising consumer demand for eco-friendly packaging is driving innovation in compostable films and bio-based polymers.

- High production costs and limited industrial composting infrastructure continue to restrain market scalability.

- Europe holds the largest market share at 34%, driven by regulatory enforcement and mature recycling systems.

- Asia Pacific is witnessing the fastest growth due to expanding urbanization and national plastic reduction policies.

- North America maintains strong momentum, supported by ESG-driven corporate initiatives and sustainable packaging mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Regulatory Pressures on Conventional Plastic Waste Management

Governments across key regions are implementing strict regulations against conventional plastic usage. These policies include bans on single-use plastics and mandates for compostable packaging in consumer products. The shift has created high demand for biodegradable alternatives. The Biodegradable Packaging Materials Market benefits from regulatory alignment with environmental goals. Brands are adapting packaging formats to comply with evolving legislation. Regulatory bodies in Europe and North America are enforcing eco-compliance certifications. These legal frameworks are accelerating transitions to bio-based packaging. Companies face significant penalties for non-compliance, prompting proactive material sourcing. Regulations continue to reshape packaging development and procurement strategies.

- For example, in the United States, California’s SB 54 bill requires packaging producers to achieve a 25% reduction in single-use plastics and 100% compostability or recyclability in all packaging by 2032.

Growing Consumer Awareness of Environmental Sustainability and Waste Reduction

Eco-conscious consumer behavior is driving demand for biodegradable packaging across retail sectors. Buyers are prioritizing brands that demonstrate commitment to environmental responsibility. The Biodegradable Packaging Materials Market is gaining traction from consumers seeking alternatives to plastic waste. Lifestyle changes and ethical purchasing are reinforcing the shift to compostable materials. Packaging has become a key factor in consumer decision-making. Industries are responding by rebranding and relabeling packaging with sustainability credentials. Public discourse on plastic pollution strengthens support for green materials. Social media campaigns and advocacy groups are influencing consumer expectations. Packaging that communicates biodegradability now holds commercial advantage.

Increased Adoption in the Food and Beverage Sector Due to Compostable Compliance

Food and beverage manufacturers are under pressure to meet both safety and environmental standards. Biodegradable packaging offers a balance between shelf life, hygiene, and sustainability. The Biodegradable Packaging Materials Market has seen significant demand from this segment. Compostable containers, films, and wraps are replacing traditional plastic counterparts. Regulatory guidance encourages compostable solutions for single-serve and ready-to-eat packaging. Brands are aligning with zero-waste movements to enhance market positioning. Certified compostable materials attract eco-conscious consumers in the food sector. Supply chains are adjusting to incorporate plant-based polymers for mass production. Food service providers are investing in compostable packaging to meet green targets.

- For instance, Magical Mushroom Company’s mycelium-based packaging is made from 100% mushroom root (mycelium) combined with agricultural waste such as hemp or sawdust. The packaging is custom-molded and produced in about seven days. It fully decomposes in home compost conditions within approximately 40 to 45 days and is certified for industrial compostability under recognized standards, including EN 13432.

Technological Advancements Enhancing Material Performance and Application Range

Innovation in material science is enabling the development of high-performance biodegradable solutions. New blends offer strength, flexibility, and durability equivalent to conventional plastic. The Biodegradable Packaging Materials Market is evolving with enhanced mechanical and barrier properties. Manufacturers are integrating additives that accelerate decomposition without compromising function. Advancements allow broader applications across industrial, healthcare, and electronics packaging. High-speed production compatibility has improved market feasibility for large-scale deployment. Research institutions and startups are collaborating to enhance material properties. Funding for R&D in biopolymers is expanding the innovation pipeline. Technology is making biodegradable options more competitive with petroleum-based packaging.

Market Trends:

Shift Toward Bio-Based Multilayer Films and Coatings for Functional Packaging

The market is observing growing adoption of bio-based multilayer films in flexible packaging. These films combine compostability with high-performance barriers against moisture and oxygen. The Biodegradable Packaging Materials Market is seeing a shift toward coated paper and PLA blends. Bio-based coatings are replacing petroleum-based laminates in foodservice and pharmaceutical packaging. Manufacturers are creating hybrid structures that support recyclability and biodegradability. These innovations address both functional and environmental demands. Brand owners seek sustainable films that maintain printability and sealing strength. Regulatory incentives for mono-material solutions further promote multilayer biodegradable films. Product launches emphasize recyclability, compostability, and renewable content.

- For example, Earthfirst Films launched its Earthfirst Compostable Laminations in November 2024 engineered to deliver moisture and oxygen barrier properties matching those of conventional plastics, now available as regenerative, high-performance pre-laminations suitable for digital printing.

Expansion of E-Commerce Accelerating Demand for Sustainable Secondary Packaging

The e-commerce sector is pushing demand for biodegradable cushioning, mailers, and shipping bags. Retailers are seeking sustainable solutions for secondary packaging amid consumer pressure. The Biodegradable Packaging Materials Market is adapting to online retail’s high-volume, protective packaging needs. Corrugated boxes, molded pulp inserts, and starch-based peanuts are gaining traction. Brands aim to improve the sustainability of their unboxing experience. Environmentally-friendly void fills and outer wrappings enhance corporate ESG compliance. Product returns and reshipments require resilient yet biodegradable options. Logistics partners are optimizing packaging for sustainability in transit. Consumer satisfaction increasingly depends on the ecological profile of delivery packaging.

Brand Differentiation Through Visual Communication of Compostability Claims

Design and labeling of biodegradable packaging now emphasize compostability credentials. Brands use icons, certifications, and printed messages to highlight environmental compliance. The Biodegradable Packaging Materials Market is seeing increased demand for clearly marked eco-packaging. Packaging serves not just a protective function but also a branding and messaging tool. Transparent claims are key to building trust among sustainability-focused buyers. On-pack information about disposal methods is becoming standard practice. Third-party certifications like OK Compost and ASTM D6400 are used prominently. Retailers prefer SKUs that visually communicate sustainable attributes. This trend influences packaging procurement and shelf placement decisions.

Growing Use of Agricultural and Marine Waste Feedstocks for Packaging Material

Manufacturers are exploring non-food biomass sources such as seaweed, bagasse, and corn husks. These feedstocks reduce competition with food supply and offer local sourcing benefits. The Biodegradable Packaging Materials Market is seeing innovation in waste-derived polymer development. Startups are commercializing cellulose-based materials from agro-industrial byproducts. Algae-based films are gaining traction for their fast biodegradation and low footprint. Regional governments support waste valorization initiatives through grants and subsidies. These feedstocks align with circular economy goals and carbon neutrality targets. Low-waste input materials improve lifecycle assessments and reduce environmental burden. Industry partnerships are scaling pilot programs into commercial packaging lines.

- For example, Sway’s seaweed-based bags, commercialized in October 2024, are notable for composting fully in 12 weeks and offering a 40% lower cradle-to-gate carbon footprint compared to fossil-based LDPE.

Market Challenges Analysis:

Limited Commercial Infrastructure for Biodegradable Waste Processing and Collection

One of the main challenges is the absence of robust composting and collection infrastructure. Biodegradable packaging often ends up in landfills, where degradation slows significantly. The Biodegradable Packaging Materials Market faces limitations in post-use material recovery. Municipal waste systems in many regions lack segregation for compostable materials. This infrastructure gap undermines the effectiveness of biodegradable solutions. Consumer confusion about disposal methods leads to contamination of recycling streams. Without widespread industrial composting facilities, end-of-life benefits remain underutilized. Brands face reputational risks if biodegradability claims do not translate into real-world impact. Solving the waste processing bottleneck requires cross-sector collaboration and public investment.

High Costs and Supply Chain Complexity Compared to Conventional Plastic

The cost of biodegradable packaging remains a barrier for widespread adoption. Raw materials like PLA and PHA are more expensive than fossil-based polymers. The Biodegradable Packaging Materials Market must navigate pricing challenges across supply chains. Specialized machinery, certifications, and production processes increase operational expenses. Smaller manufacturers face entry barriers due to high capital requirements. Procurement teams often prioritize affordability over sustainability. Scaling production to reduce unit costs requires significant investment. Price-sensitive sectors hesitate to switch due to marginal cost differences. Aligning cost competitiveness with performance remains a critical hurdle for market expansion.

Market Opportunities:

Rising Corporate Sustainability Targets Driving Investment in Eco-Packaging

Global corporations are prioritizing carbon-neutral goals and ESG reporting. These mandates are creating demand for certified biodegradable packaging at scale. The Biodegradable Packaging Materials Market is positioned to support these sustainability roadmaps. Procurement strategies are shifting toward verified compostable and renewable solutions. Companies view packaging transformation as a key pillar of climate responsibility. Long-term vendor contracts are opening for certified biodegradable suppliers. Industry awards and certifications offer competitive differentiation. Internal product development teams are collaborating with packaging innovators.

Untapped Potential in Emerging Economies with Regulatory Tailwinds

Developing nations are beginning to implement plastic bans and packaging reforms. These shifts open new markets for biodegradable formats in retail and food sectors. The Biodegradable Packaging Materials Market can grow by localizing production in these economies. Low-cost raw materials and growing middle-class awareness fuel potential. Governments offer tax incentives and pilot zones for sustainable packaging ventures. Regional packaging converters seek partnerships with bio-based resin suppliers. Adoption is accelerating in Asia, Latin America, and Africa, supported by urbanization trends.

Market Segmentation Analysis:

The Biodegradable Packaging Materials Market is segmented

By material type into plastics, paper & paperboard, and natural fibers. Plastics hold a dominant share due to the wide use of starch-based plastics, cellulose-based plastics, PLA, PHB, and PHA in flexible packaging applications. PLA and starch-based variants are widely adopted in foodservice and retail due to their compostability and printability. Paper & paperboard, including kraft paper, flexible paper, corrugated fiberboard, boxboard, and recycled paperboards, continue to grow steadily in both primary and secondary packaging due to recyclability and consumer preference for plastic-free formats. Natural fibers such as bagasse, jute, and cotton are gaining traction in niche applications where biodegradability and strength are essential, particularly in rigid and molded formats.

- For instance, NatureWorks LLCis a global leader in PLA (polylactic acid) bioplastics, marketed under the Ingeo™ brand. In 2024, Ingeo™ grades 2003D and 4043D were adopted widely in flexible film and thermoformed packaging for foodservice brands.

By application, food and beverage packaging remains the largest segment due to regulatory mandates and demand for sustainable foodservice materials. Pharmaceutical and healthcare packaging are adopting biodegradable materials to meet clean-label and disposal requirements. Personal care and homecare brands are turning to bioplastics and fiber-based formats for sustainable branding. Agriculture and logistics segments are integrating biodegradable films and molded packaging for crop protection and shipping stability. Retail packaging continues to evolve with eco-friendly alternatives to attract environmentally conscious consumers. It enables a wide variety of industries to meet sustainability goals through certified compostable and recyclable solutions.

- For example, Amcor has launched AmSky™, a recyclable blister pack for pharmaceuticals, replacing PVC with a polyolefin-based structure compatible with current recycling streams.

Segmentation:

By Material Type

- Plastics

- Starch-Based Plastics

- Cellulose-Based Plastics

- Polylactic Acid (PLA)

- Poly-3-Hydroxybutyrate (PHB)

- Polyhydroxyalkanoates (PHA)

- Other Bioplastics

- Paper & Paperboard

- Kraft Paper

- Flexible Paper

- Corrugated Fiberboard

- Boxboard

- Recycled Paper boards

- Natural Fibers

- Bagasse (Sugarcane Fiber)

- Jute

- Cotton

- Other Natural Fibers

By Application

- Food and Beverage Packaging

- Pharmaceutical Packaging

- Personal Care and Homecare Packaging

- Healthcare

- Agriculture

- Retail

- Logistics

- Other End-Use Industries

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe holds the largest share of the Biodegradable Packaging Materials Market at 34% in 2024. Strong regulatory enforcement of single-use plastic bans and widespread adoption of compostable solutions drive regional growth. Countries such as Germany, France, and the Netherlands have set ambitious waste reduction targets, encouraging industries to shift toward bio-based packaging. Leading packaging manufacturers in Europe continue to invest in R&D for certified compostable materials. Consumer preference for eco-labeled products strengthens demand across sectors, particularly in food and personal care. Government incentives and well-established waste management infrastructure support sustained market expansion.

North America accounts for 28% of the Biodegradable Packaging Materials Market, led by the U.S. and Canada. Rising awareness of environmental sustainability and increasing adoption of corporate ESG goals fuel packaging transformation. Brands are integrating biodegradable options into e-commerce, retail, and food distribution. The region benefits from rapid material innovation and growing startup activity in bioplastics. Public pressure on brands to eliminate plastic waste accelerates investment in alternative packaging. Municipalities and states have introduced local bans and composting mandates that further reinforce adoption.

Asia Pacific represents 24% of the market share and is the fastest-growing region. It offers significant potential due to rising population, expanding urbanization, and evolving regulatory landscapes. China, India, and South Korea are advancing national plastic reduction policies, creating space for biodegradable packaging adoption. Local manufacturers are scaling production of PLA, starch-based, and cellulose materials to meet demand. E-commerce and food delivery services in the region are integrating sustainable packaging into operations. The Biodegradable Packaging Materials Market in Asia Pacific is benefiting from strong domestic demand and increased export opportunities for compostable goods.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mondi Group

- Smurfit Kappa Group

- Tetra Pak International S.A.

- Sealed Air Corporation

- International Paper Company

- BASF SE

- Stora Enso

- WestRock Company

- DS Smith

- Huhtamaki Oyj

- NatureWorks LLC

- Novamont S.p.A.

- Be Green Packaging LLC

- Eco-Products, Inc.

- Kruger Inc.

- Reynolds Group Holding Limited

- Clearwater Paper Corporation

- Sonoco Products Company

- Berry Global Group

- Ball Corporation

- Vegware Ltd.

Competitive Analysis:

The Biodegradable Packaging Materials Market features strong competition among multinational corporations and regional specialists. Companies compete on material innovation, regulatory compliance, and end-user customization. It continues to see high R&D investment aimed at enhancing performance, shelf life, and printability of biodegradable formats. Strategic mergers and partnerships with biotech startups are expanding market reach. Players focus on product certifications such as EN 13432 and ASTM D6400 to gain credibility. Rising private-label packaging demand pushes firms to offer cost-effective solutions. Market leaders benefit from economies of scale and established supply chains. Competitive advantage lies in the ability to deliver certified, scalable, and sustainable packaging alternatives across industries.

Recent Developments:

- In June 2025, Mondi Group made headlines in the biodegradable packaging materials market by launching the re/cycle PaperPlus Bag Advanced. This innovative high-barrier paper bag significantly reduces plastic content, provides robust moisture protection for humidity-sensitive products, and supports recyclability, making it an ideal choice for the construction sector and powdery goods.

- In May 2024, Sealed Air Corporation released the Liquibox® Universal Self-Sealing Cap, a hygienic, recycle-ready fitment for professional dairy dispensing systems. The product is designed to reduce food waste, enhance hygiene, and extend freshness in commercial milk dispensing applications, underlining Sealed Air’s progress in advancing recyclable packaging innovations.

- In June 2024, Tetra Pak International S.A. entered a new strategic partnership with China’s Yili Group to advance innovation in dairy packaging. The collaboration focuses on R&D in equipment, new materials, quality control, and the sustainable development of dairy packaging, addressing growing consumer demands for greener solutions.

Market Concentration & Characteristics:

The Biodegradable Packaging Materials Market shows moderate concentration with a mix of global leaders and emerging regional players. It is characterized by rapid innovation in materials science and strong alignment with regulatory shifts toward sustainability. The market favors companies with integrated supply chains, advanced R&D capabilities, and proven compliance with compostability standards. Product differentiation relies on functional performance, material sourcing transparency, and environmental certifications. It continues to evolve toward application-specific designs for food, beverage, and personal care packaging. The market encourages cross-sector collaboration between packaging firms, biopolymer producers, and waste management operators.

Report Coverage:

The research report offers an in-depth analysis based on material type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for biodegradable packaging will continue to rise due to global regulatory pressure on plastic reduction.

- Consumer preference for sustainable products will drive brand investment in compostable packaging solutions.

- Technological advancements in bio-based materials will expand application across diverse industries.

- Increased availability of composting infrastructure will enhance end-of-life effectiveness for biodegradable products.

- E-commerce growth will boost the need for sustainable secondary and protective packaging formats.

- Emerging markets in Asia and Latin America will become key growth areas due to policy reforms and urbanization.

- Food and beverage companies will lead adoption through eco-certified, functional packaging innovations.

- Strategic partnerships between packaging producers and biopolymer suppliers will support scalability.

- Retailers will prioritize biodegradable alternatives to meet internal sustainability goals and reduce waste footprint.

- Continued R&D investments will improve cost-efficiency, barrier properties, and shelf stability of biodegradable packaging.