Market Overview:

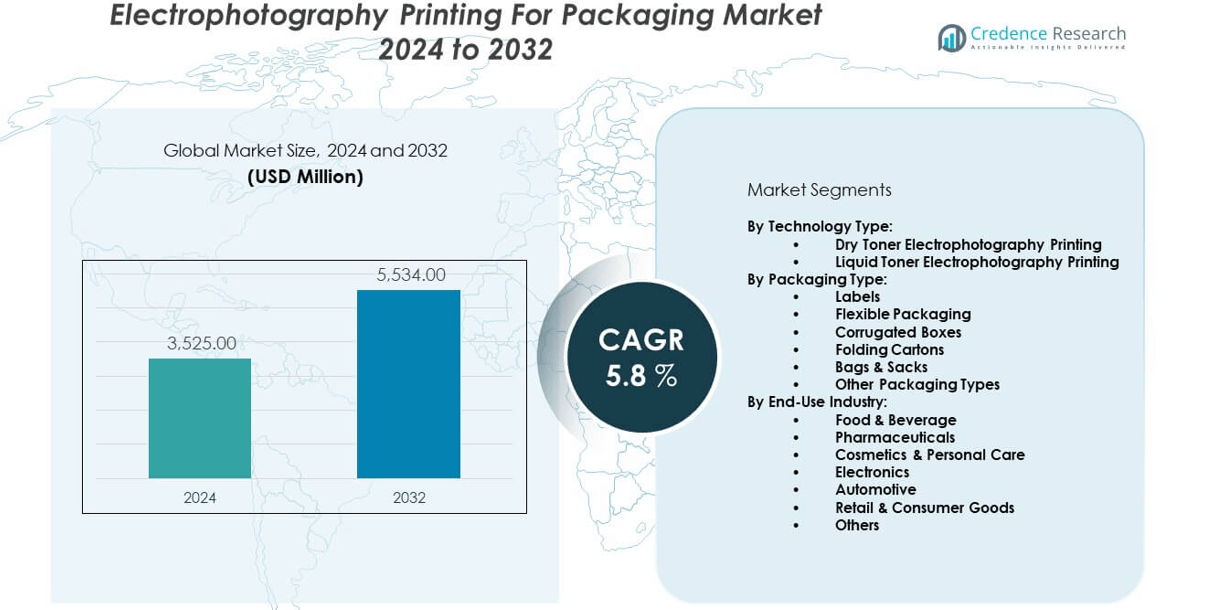

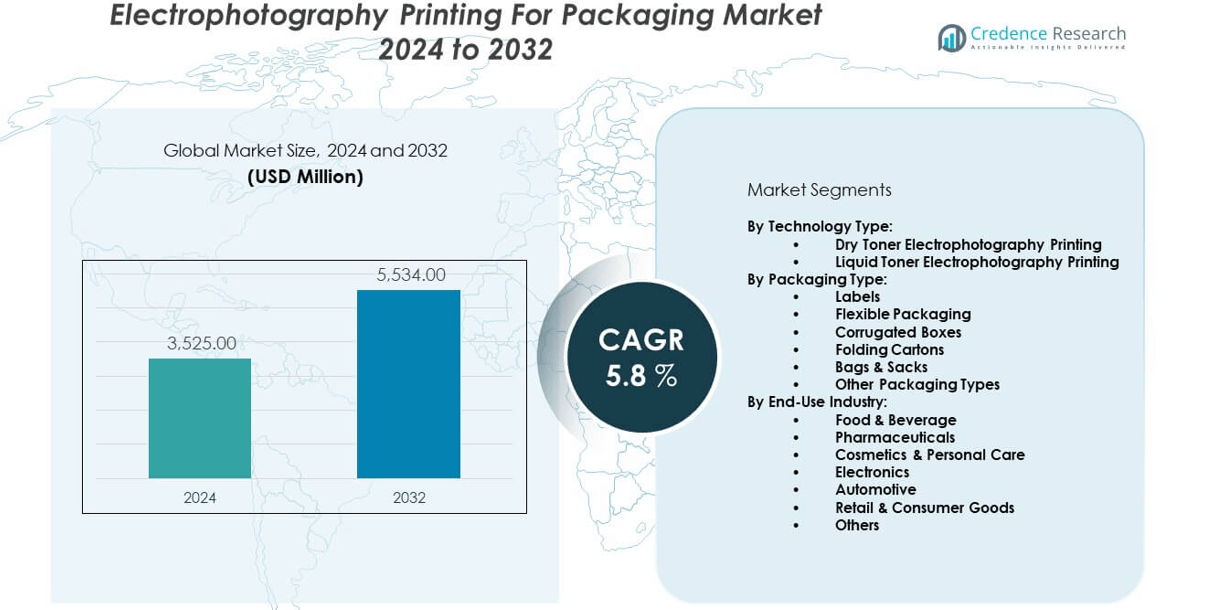

The Electrophotography printing for packaging market is projected to grow from USD 3,525 million in 2024 to an estimated USD 5,534 million by 2032, with a compound annual growth rate (CAGR) of 5.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electrophotography Printing for Packaging Market Size 2024 |

USD 3,525 million |

| Electrophotography Printing for Packaging Market, CAGR |

5.8% |

| Electrophotography Printing for Packaging Market Size 2032 |

USD 5,534 million |

Growth in the electrophotography printing for packaging market is driven by increasing demand for short-run, high-quality, and customized packaging solutions. Brand owners and manufacturers seek faster turnaround times and efficient inventory management, which digital printing delivers. Advancements in electrophotographic technology enhance image resolution, substrate compatibility, and color consistency, making it suitable for folding cartons, labels, and flexible packaging. The growing preference for sustainable printing processes and the shift toward on-demand production further accelerate adoption across various end-use sectors such as food, beverage, cosmetics, and pharmaceuticals.

Regionally, North America leads the electrophotography printing for packaging market due to strong adoption of digital technologies and a well-developed consumer packaging sector. Europe follows, supported by stringent sustainability regulations and widespread use of premium packaging in retail and cosmetics. Asia Pacific emerges as the fastest-growing region, driven by booming e-commerce, rising consumer demand, and increasing investments in digital printing infrastructure across countries like China, India, and Japan. Latin America and the Middle East & Africa show gradual adoption, with opportunities expanding as packaging converters upgrade their printing capabilities.

Market Insights:

- The Electrophotography printing for packaging market is projected to grow from USD 3,525 million in 2024 to USD 5,534 million by 2032, at a CAGR of 5.8% during the forecast period.

- Increasing demand for personalized, short-run, and high-quality packaging drives adoption of electrophotographic printing technologies.

- Rapid turnaround time, reduced waste, and efficient inventory management enhance its relevance for consumer-driven sectors.

- High equipment costs and less cost-effectiveness for large-volume runs remain key challenges for small and mid-size converters.

- Material compatibility issues and print durability limitations restrict use in certain high-barrier or moisture-sensitive packaging applications.

- North America leads due to digital infrastructure and packaging innovation, followed by Europe with strong regulatory support for sustainability.

- Asia Pacific emerges as the fastest-growing region, driven by e-commerce expansion, flexible packaging demand, and rising investment in digital print technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Customization and Personalization in Packaging Solutions:

The Electrophotography printing for packaging market benefits from increasing demand for customized and personalized packaging formats. Brands aim to stand out on crowded retail shelves, and this technology enables high-resolution, variable data printing for niche campaigns. Companies in the food, beverage, and cosmetics sectors deploy this method to address seasonal and regional preferences. It allows brand owners to execute fast-changing designs without incurring plate-making costs. The flexibility to print short runs supports market testing and targeted promotions. Digital workflows also reduce waste, aligning with sustainability goals. It improves speed-to-market, allowing packaging changes on demand. These capabilities collectively fuel the growth of digital electrophotographic packaging applications.

- For instance, ePac Flexible Packaging operates over 60 HP Indigo presses worldwide, each capable of producing hundreds of unique SKUs daily, demonstrating industrial-scale personalized packaging.

Growth of On-Demand and Short-Run Packaging Production Requirements:

Brands shifting toward agile supply chains accelerate the use of digital printing, supporting the Electrophotography printing for packaging market. The technology supports low-volume orders and quick design updates, ideal for limited editions or frequent SKU changes. It eliminates minimum order constraints and reduces warehouse costs by enabling just-in-time production. Manufacturers optimize production workflows and respond faster to market feedback. It helps reduce inventory waste and obsolescence, particularly for fast-moving consumer goods. Consumer preferences drive frequent changes in packaging formats, labels, and branding. The system handles diverse substrates, including paperboard, films, and synthetics, widening application scope. This demand for agility reinforces the relevance of electrophotographic solutions.

- For instance, HP Indigo’s Enhanced Productivity Mode, launched in 2024, enables up to 4,600 full-color sheets per hour (A3), according to HP’s official release.

Enhanced Image Quality, Print Consistency, and Material Versatility:

Technical advancements in digital toner and imaging units continue to strengthen the capabilities of electrophotographic presses. The Electrophotography printing for packaging market gains traction because of its ability to maintain consistent color output across multiple jobs. High-resolution imaging and precise registration meet the quality expectations of premium product brands. It delivers smooth gradients, fine text, and detailed graphics across various substrates. Compatibility with coated and uncoated materials improves its usability across folding cartons and flexible formats. Brand owners expect minimal variation between batches, which this method supports effectively. Operators benefit from reduced setup time and simplified workflows. This reliability makes it a preferred solution for high-value product packaging.

Sustainability Goals and Demand for Eco-Friendly Packaging Practices:

Sustainability initiatives create strong momentum for digital printing technologies that minimize waste and energy consumption. The Electrophotography printing for packaging market aligns with global environmental targets by reducing chemical use and material overproduction. Digital systems produce only what is needed, significantly limiting overruns. Ink waste and cleaning solvents are minimized compared to traditional analog methods. This printing method supports recyclable and biodegradable substrates, which are in growing demand. Brands use it to communicate sustainability messages directly on the packaging. Reducing carbon footprint without compromising design flexibility helps companies meet regulatory and consumer expectations. It positions electrophotography as a future-proof technology for responsible packaging innovation.

Market Trends:

Integration of Workflow Automation and Digital Press Enhancements:

Packaging printers increasingly integrate end-to-end workflow automation with digital electrophotographic systems. The Electrophotography printing for packaging market sees rapid digitization of prepress, color management, and finishing processes. Automation enables consistent quality with minimal operator intervention. Press manufacturers embed real-time diagnostics and predictive maintenance tools. Advanced RIP software and AI-based calibration improve uptime and throughput. Integrated systems reduce turnaround time while supporting complex variable designs. Market participants adopt automated inspection systems to ensure output accuracy. This shift improves overall operational efficiency and cost predictability. These enhancements reshape the competitive dynamics of packaging production facilities.

- For instance, Domino Printing Sciences’ newly updated Sunrise DFE combines AI-driven ripping technology and automated variable data handling, ensuring jobs with complex, variable designs run smoothly at speeds up to 120 meters per minute for label and packaging applications.

Rise of Smart Packaging and Interactive Print Applications:

Smart packaging features such as QR codes, NFC tags, and augmented reality markers are increasingly implemented in digital print jobs. The Electrophotography printing for packaging market leverages this trend by enabling high-resolution, data-driven image printing on variable surfaces. Smart print elements help brands engage customers post-purchase, linking physical packaging to digital experiences. Authentication and anti-counterfeiting functions are also embedded using variable coding. Personalized interactions, loyalty campaigns, and traceability tools align with digital transformation strategies. The ability to dynamically change each unit in a batch supports advanced smart packaging applications. Packaging becomes a marketing asset beyond functional containment. These innovations extend the value chain of printed packaging.

- For instance, Unilever, partnering with Be My Eyes, has implemented AQR codes scannable from up to 1.1 meters away on product packaging since 2024, as verified by Zappar technical briefing.

Expansion of Digital Printing in Non-Traditional Packaging Segments:

Electrophotography expands beyond typical label and carton formats into newer applications such as flexible films and metallized substrates. The Electrophotography printing for packaging market benefits as converters adopt new press configurations that handle unconventional materials. Brands in nutraceuticals, home care, and electronics seek smaller production batches with visual appeal. Hybrid presses combine digital and analog units to expand design possibilities. The shift from rigid to flexible packaging also supports digital adaptability. Converters explore options that support tactile finishes, variable coatings, and specialty toners. These trends increase adoption of digital platforms across diverse packaging verticals. The broadened application base elevates growth potential.

Evolution of Brand Strategies and Design Agility:

Faster product development cycles force brands to revise packaging more frequently. The Electrophotography printing for packaging market responds to this shift by offering agility in design iterations. On-demand packaging supports marketing launches and seasonal promotions without committing to high inventory. Creative teams experiment with micro-campaigns and hyperlocal targeting through dynamic design changes. Short-run jobs become feasible for start-ups and niche players due to lower capital requirements. Larger players use digital print to localize messaging without slowing global supply chains. The turnaround advantage complements omnichannel retail models. Packaging becomes a dynamic tool for storytelling and consumer engagement.

Market Challenges Analysis:

High Equipment Costs and Limited Economies of Scale for Large Runs:

Cost barriers remain a major concern for converters evaluating digital electrophotographic systems. The Electrophotography printing for packaging market faces limitations when competing with flexographic or gravure presses on long runs. Capital investment for commercial-scale digital presses and compatible finishing units is significant. Total cost per unit often rises on high-volume jobs, discouraging use for core SKUs. Operating costs for toner, fuser units, and maintenance also add up over time. Smaller converters hesitate to adopt without assured return on investment. Hybrid workflows sometimes require integration challenges between digital and analog lines. These cost-related hurdles slow broader market penetration, especially in cost-sensitive segments.

Material Compatibility and Durability Concerns for Specific Applications:

Material limitations and durability concerns affect the versatility of electrophotographic output. The Electrophotography printing for packaging market struggles to match the substrate range and durability of other technologies in certain use cases. Heat-sensitive materials or heavily laminated films may not perform well in digital toner systems. Packaging requiring high moisture or abrasion resistance, such as frozen or greasy food, may face print integrity issues. Barrier coatings and overprint varnishes are often necessary but can add complexity. Ink adhesion, rub resistance, and shelf-life performance must meet industry compliance. These technical concerns limit usage in demanding environments without added treatment.

Market Opportunities:

Adoption by Emerging Brands, Start-ups, and Regional Producers:

Smaller brands and regional manufacturers represent a strong growth avenue for digital presses. The Electrophotography printing for packaging market benefits from demand for low-volume, premium-quality packaging solutions. Start-ups aim to enter markets with limited capital and prefer short-run packaging that matches brand aesthetics. It allows regional producers to experiment with design innovation and personalization. Entry barriers remain lower than traditional presses. Customization creates perceived value, enhancing shelf impact. This segment enables digital adoption beyond major CPGs. Growing local production further supports digital scalability.

Sustainable Packaging Solutions Supporting Regulatory Compliance:

Evolving environmental regulations and brand commitments open opportunities for sustainable packaging formats. The Electrophotography printing for packaging market offers efficient, low-waste production methods that align with circular economy principles. It enables printing on recycled and biodegradable materials without harmful chemicals. Brands aiming to showcase eco-credentials use digital labels and cartons to communicate transparency. Regulatory shifts toward EPR and carbon reduction favor digital over analog methods. This green advantage enhances adoption across environmentally conscious sectors.

Market Segmentation Analysis:

By Technology Type

The Electrophotography printing for packaging market segments into dry toner and liquid toner technologies. Dry toner leads due to its operational simplicity, fast setup, and compatibility with a broad range of substrates. It suits short-run, high-resolution jobs that require quick turnaround. Liquid toner, while offering superior ink coverage and smoother gradients, sees slower adoption due to higher operational costs and maintenance requirements. Both technologies support variable data printing, but dry toner remains preferred for general packaging needs.

- For instance, Xeikon’s dry toner label printers handle a broad array of substrates without pretreatment, saving both time and operational cost.

By Packaging Type

Labels represent the largest segment, driven by demand for brand visibility, regulatory compliance, and SKU-level customization. Folding cartons and flexible packaging follow, benefiting from short-run promotional campaigns and retail-ready applications. Corrugated boxes gain traction with e-commerce growth and small-batch distribution needs. Bags & sacks along with other packaging types—such as wraps, bands, and sleeves—cater to niche products and specialized branding formats. The market favors formats that offer visual appeal, product protection, and quick adaptation to design changes.

- For instance, Advancements in substrates and high-speed inspection systems meet demand for rapid, information-rich, and visually appealing labels. In folding cartons and flexible packaging, HP Indigo presses are widespread.

By End-Use Industry

Food and beverage leads end-use demand, fueled by frequent packaging updates, localization, and freshness indicators. Pharmaceuticals adopt electrophotographic printing for serialized labels, traceability, and regulatory compliance. Cosmetics and personal care brands require premium, customizable packaging with high-resolution graphics and tactile effects. Electronics and automotive sectors rely on precision labelling and packaging for technical components. Retail and consumer goods use it for seasonal campaigns, limited editions, and private label branding. It continues to serve a wide range of industries requiring flexible, high-quality, and sustainable print solutions.

Segmentation:

By Technology Type:

- Dry Toner Electrophotography Printing

- Liquid Toner Electrophotography Printing

By Packaging Type:

- Labels

- Flexible Packaging

- Corrugated Boxes

- Folding Cartons

- Bags & Sacks

- Other Packaging Types

By End-Use Industry:

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Electronics

- Automotive

- Retail & Consumer Goods

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Strong Adoption of Digital Print Technologies

North America dominates the Electrophotography printing for packaging market, accounting for approximately 36% of the global share. The region benefits from widespread use of digital presses across packaging converters and established brands. Demand for short-run, premium packaging in the food, beverage, and cosmetics sectors continues to grow. Companies prioritize sustainable practices and agile supply chains, which align with the capabilities of electrophotography. The U.S. leads regional growth, supported by investments in digital printing infrastructure and consumer-driven packaging trends. It remains a hub for technological innovation and early adoption of workflow automation in packaging production. Strong presence of major digital press manufacturers reinforces market momentum.

Europe Drives Growth through Sustainability and Regulatory Alignment

Europe holds a 28% share in the Electrophotography printing for packaging market, driven by strict environmental regulations and demand for sustainable packaging. Countries such as Germany, the UK, and France prioritize recyclable and low-waste print solutions, encouraging the shift from analog to digital processes. Brands seek flexibility and compliance with evolving packaging laws, pushing adoption across various sectors. Electrophotographic solutions support material-efficient runs and enable high-quality output on recyclable substrates. The market benefits from a well-developed packaging ecosystem and government support for sustainable industrial practices. It continues to grow due to brand localization strategies and increasing private label production.

Asia Pacific Emerges as the Fastest-Growing Region in the Market

Asia Pacific represents 24% of the Electrophotography printing for packaging market and exhibits the fastest growth rate among all regions. Strong e-commerce expansion, urbanization, and increasing demand for consumer goods drive packaging diversification. China, Japan, South Korea, and India lead adoption due to rising investments in digital print infrastructure and growing emphasis on packaging differentiation. Local manufacturers turn to electrophotographic solutions for low-volume and short-lead-time jobs. It enables regional brands to respond faster to shifting consumer preferences and reduce inventory waste. The market in Asia Pacific gains further support from government initiatives promoting smart manufacturing and sustainable production.

Rest of the World Shows Gradual Adoption and Emerging Potential

The Rest of the World, including Latin America and the Middle East & Africa, accounts for the remaining 12% share of the Electrophotography printing for packaging market. These regions show gradual adoption, with packaging converters exploring digital printing to support local production and flexible manufacturing. Market activity remains strongest in Brazil, Mexico, and the UAE, where retail modernization and brand expansion fuel packaging demand. Digital solutions appeal to small businesses seeking cost-efficient customization. Limited infrastructure and high equipment costs restrain faster adoption, but growth potential exists. Investment in digital transformation and regional packaging capabilities will shape future momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HP Inc.

- Xeikon N.V.

- Eastman Kodak Company

- Canon Inc.

- Xerox Corporation

- Konica Minolta Business Solutions

- Ricoh Company, Ltd.

- Domino Printing Sciences plc

- Fuji Xerox Co., Ltd.

- EFI, Inc.

Competitive Analysis:

The Electrophotography printing for packaging market features intense competition among global players focused on digital innovation, speed, and image quality. Key companies such as HP Inc., Canon Inc., Xeikon N.V., and Eastman Kodak Company lead the market with broad portfolios and scalable digital press solutions. These players invest heavily in R&D to improve toner performance, expand substrate compatibility, and enable end-to-end automation. Strategic partnerships with packaging converters and FMCG brands strengthen their presence across multiple regions. Companies differentiate by offering workflow integration, variable data printing, and eco-friendly print solutions. It remains a dynamic and innovation-driven market with competition centered on efficiency, customization, and sustainability.

Recent Developments:

- In July 2025, Domino Printing Sciences plc introduced the new compact Domino N410 LED label press at Labelexpo Europe 2025 in Barcelona. This device, alongside their established N730i and N610i presses, targets converters seeking flexible, efficient digital electrophotographic printing for labels and packaging. Domino also released a new version of its Sunrise Digital Front End (DFE), enhancing productivity and press efficiency through advanced AI-driven ripping technology.

- In February 2025, Konica Minolta Business Solutions launched the AccurioPress 14010S at PrintPack 2025. This flagship digital press delivers speeds up to 140 A4 pages per minute and introduces white-toner capability, enabling premium specialty packaging production with colored and transparent media. The exhibition, running February 1–5, 2025, also featured the MGI AccurioShine 3600 embellishment system and other commercial and label-oriented presses.

- In February 2025, HP Inc. unveiled major advancements in its HP Indigo and PageWide digital printing portfolio at Hunkeler Innovationdays, highlighting their Liquid Electrophotography (LEP) solutions. The company showcased its new HP Indigo 120K HD digital press, capable of printing up to 6,000 sheets per hour and over two million sheets per month, aimed at high-volume digital packaging and commercial print applications.

Market Concentration & Characteristics:

The Electrophotography printing for packaging market is moderately concentrated, with a few dominant players holding substantial global share. It exhibits strong barriers to entry due to high capital costs, technical expertise, and established brand relationships. Global manufacturers drive innovation, while regional players focus on niche applications. It features continuous product upgrades, strategic collaborations, and ecosystem integration. Market dynamics reflect high technology intensity and growing customer demand for short-run, premium packaging formats with faster turnaround and sustainability compliance.

Report Coverage:

The research report offers an in-depth analysis based on technology type, packaging type, end-use industry, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for personalized packaging will continue to grow, driving adoption of short-run digital printing.

- Electrophotographic presses will gain wider usage in folding cartons and flexible formats due to design flexibility.

- Advancements in toner chemistry and automation will improve cost-efficiency and substrate compatibility.

- Sustainability initiatives will strengthen demand for low-waste, chemical-free printing solutions.

- Workflow integration and AI-based press management will enhance print quality and reduce downtime.

- Adoption will rise among regional brands and startups seeking low-volume premium packaging.

- North America and Europe will maintain leadership through innovation and regulatory compliance.

- Asia Pacific will record the highest growth, fueled by e-commerce, FMCG expansion, and digital infrastructure.

- Partnerships between equipment manufacturers and packaging converters will accelerate product innovation.

- Increasing digital transformation in packaging will reshape production cycles and go-to-market strategies.