Market Overview

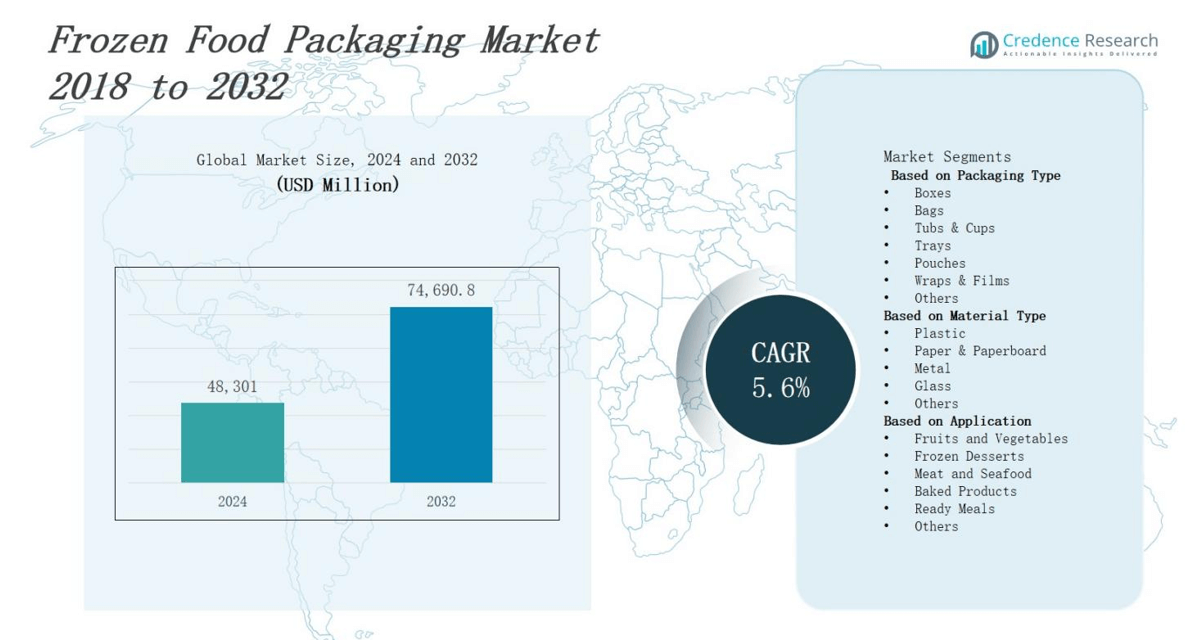

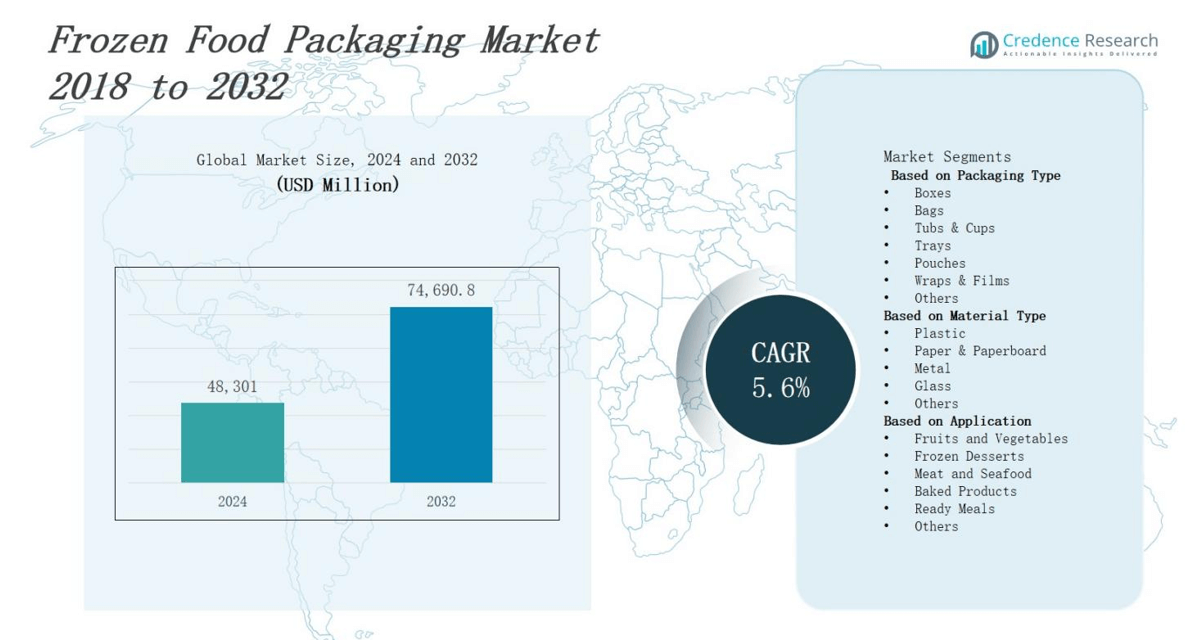

The frozen food packaging market is projected to expand from USD 48,301 million in 2024 to USD 74,690.8 million by 2032, representing a 5.6% CAGR.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Frozen Food Packaging Market Size 2024 |

USD 48,301 million |

| Frozen Food Packaging Market, CAGR |

5.6% |

| Frozen Food Packaging Market Size 2032 |

USD 74,690.8 million |

Growth in consumer demand for convenient meal solutions drives the frozen food packaging market, and manufacturers deploy advanced barrier films and vacuum-sealing technologies to extend shelf life. Rising e‑commerce adoption prompts innovations in protective and lightweight materials that reduce transit damage and lower logistics costs. Sustainability regulations and consumer preference stimulate the development of recyclable and compostable packaging formats. Companies integrate active and intelligent packaging systems with oxygen scavengers and time–temperature indicators to preserve quality and boost transparency. Digital printing capabilities also allow high‑resolution graphics and variable data, enhancing brand differentiation in crowded retail environments and expanding market reach globally.

The frozen food packaging market covers North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America benefits from robust cold chain infrastructure and barrier films, while Europe leads in recyclable formats under stringent regulations. Asia Pacific sees rapid urbanization and rising convenience food demand. Latin America grows through organized retail expansion. Middle East & Africa sees emerging demand and cold chain investments. Leading companies such as Uflex Limited, Sealed Air Corporation, American Packaging Corporation, MOD‑PAC Corporation, Berry Plastics Group Inc. and WestRock Company maintain strong regional presence.

Market Insights

- The frozen food packaging market will grow from USD 48,301 million in 2024 to USD 74,690.8 million by 2032 at a 5.6% CAGR.

- Rising demand for convenient meals drives deployment of advanced barrier films and vacuum‑sealing technologies that extend shelf life.

- E‑commerce expansion fuels innovation in protective, lightweight materials that minimize transit damage and reduce logistics costs.

- Sustainability mandates and consumer preference accelerate development of recyclable and compostable packaging formats.

- Adoption of active and intelligent systems—oxygen scavengers and time–temperature indicators—preserves quality and enhances transparency.

- Digital printing capabilities enable high‑resolution graphics and variable data to strengthen brand differentiation.

- North America (26%), Europe (38%), Asia Pacific (22%), Latin America (8%) and Middle East & Africa (6%) drive global growth, led by Uflex, Sealed Air, American Packaging and WestRock.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Advanced Barrier and Sealant Solutions

The frozen food packaging market benefits from improved barrier films that prevent moisture migration. It leverages multilayer laminates and modified atmosphere packaging to maintain product integrity. Manufacturers implement vacuum sealing and high-pressure processing techniques to inhibit microbial growth. Research on nanocomposite coatings enhances mechanical strength while reducing material thickness. Stakeholders collaborate on tailored barrier formulations that optimize cost and performance. Market participant confidence increases when packaging ensures product quality and freshness.

- For instance, Stora Enso’s Cupforma Dairy utilizes a multilayer virgin fiber-based board, ensuring excellent protection and extended shelf life for frozen dairy products like ice cream and desserts.

Sustainable Material Adoption and Regulatory Compliance

The frozen food packaging market responds to stringent environmental regulations and consumer demand for eco-friendly solutions. It integrates recyclable polyethylene terephthalate trays and compostable films in product designs. Brands invest in bio-based polymers and paperboard alternatives to reduce carbon footprint. Government mandates on plastic reduction drive research into innovative circular packaging models. Packaging producers certify materials under sustainability standards to ensure compliance. Stakeholder collaboration accelerates adoption of green packaging methods.

- For instance, Parkside partnered with Iceland in 2022 to develop recyclable paper packaging specifically designed for frozen fish products, marking a breakthrough in paper flexible packaging for frozen foods.

E‑Commerce Growth and Supply Chain Optimization

The frozen food packaging market capitalizes on rising online grocery sales and last-mile delivery demands. It utilizes lightweight, puncture-resistant materials to mitigate transit-related damage. Cold chain logistics integrate insulated containers and phase-change materials to preserve temperature integrity. Packaging suppliers deploy modular designs that streamline packing operations reduce storage space. Industry stakeholders adopt automated palletization and track-and-trace technologies to enhance traceability. Investment in supply chain efficiency bolsters market resilience and cost-effectiveness.

Active, Intelligent and Brand Differentiation Solutions

The frozen food packaging market leverages active packaging that incorporates oxygen scavengers and moisture absorbers to extend freshness. It employs time–temperature indicators that offer clear spoilage signals to consumers. Brands integrate intelligent QR codes and NFC tags to provide traceability and promote engagement. Digital printing enables high-quality graphics and data to reinforce brand identity. Packaging producers develop formats cater to global retail channels. Investment in these innovations bolsters competitiveness and trust.

Market Trends

Increasing Demand for Eco‑Friendly and Recyclable Designs

The frozen food packaging market faces mounting pressure to adopt sustainable materials and design solutions. It shifts away from single‑use plastics toward recyclable and compostable films. Brands collaborate with material scientists to develop bio‑based polymers that meet performance requirements. Industry leaders pursue certifications and transparency to build consumer trust. Regulatory bodies enforce stricter waste reduction targets that drive innovation. Investment in circular economy initiatives promotes reuse and resource efficiency.

- For instance, CoolBox, a UK-based startup, produces plant-based insulated packaging for frozen foods that is fully kerbside recyclable and plastic-free by utilizing starch-based glue, ensuring eco-friendliness without compromising thermal protection[previous conversation

Integration of Smart and Active Packaging Technologies

The frozen food packaging market embraces smart packaging systems that enhance product safety and traceability. It incorporates QR codes and NFC tags to deliver real‑time supply chain data. Brands integrate time–temperature indicators and oxygen scavengers to preserve freshness. Technology providers supply sensors that monitor package integrity throughout distribution. Companies analyze collected data to optimize logistics and reduce spoilage. Investment in digital platforms strengthens transparency and fosters consumer engagement.

- For instance, Nestlé uses time-temperature indicators that change color if the product experiences unsafe temperature fluctuations, ensuring freshness through the cold chain.

Customization through Digital Printing and Personalization

The frozen food packaging market customizes designs to align with regional preferences and brand identity. It leverages digital printing capabilities to produce variable graphics and small‑batch runs. Brands offer portion‑controlled packaging that caters to on‑the‑go consumers. Industry players invest in modular packaging formats that streamline manufacturing and reduce changeover times. Companies collaborate with retailers to develop co‑branded packaging that enhances shelf impact. Innovation in tamper‑evident features boosts product security and builds consumer confidence.

Expansion of E‑Commerce Channels and Cold Chain Logistics

The frozen food packaging market expands its e‑commerce footprint to serve growing online grocery demand. It implements insulated mailers and phase‑change materials to maintain cold chain integrity. Packaging providers optimize material weight to lower shipping costs and carbon emissions. Companies adopt standardized package dimensions that improve warehouse utilization. Technology integrations automate sorting and temperature monitoring. Collaboration among distributors, retailers and logistics partners enhances delivery speed and reliability. Industry analysts predict continuous growth in direct‑to‑consumer packaging solutions.

Market Challenges Analysis

High Implementation Costs and Material Availability Constraints

The frozen food packaging market faces increased material costs that pressure profit margins. It struggles to balance performance requirements with sustainable material expenses. Manufacturers encounter supply constraints for advanced bio‑based resins and specialty films. Equipment upgrades for new packaging formats demand significant capital investment. Smaller processors find limited access to high‑end technologies that ensure barrier protection. Price fluctuations in oil‑driven polymers create budget unpredictability for stakeholders. Collaboration remains critical to secure reliable supply chains and cost efficiencies.

Stringent Regulations and Cold Chain Management Challenges

The frozen food packaging market must comply with evolving environmental and food safety standards. It navigates complex regulations on material composition and waste disposal across regions. Differences in national guidelines create compliance burdens for multinational brands. It sustains robust packaging performance to preserve cold chain integrity across last‑mile delivery. Temperature deviations during transit can compromise product quality and trigger recalls. Coordination among packaging suppliers, logistics providers and retailers remains vital. Failure to align standards and operations can lead to regulatory fines and brand damage.

Market Opportunities

Adoption of Innovative Cold Chain Solutions Fuels Growth

Strict quality requirements and consumer demand for convenience open avenues for advanced cold chain materials. The frozen food packaging market presents opportunities for specialized insulation films and phase-change materials that extend shelf life. It supports collaborations between packaging suppliers and logistics providers to develop integrated solutions. Companies can invest in smart sensors that provide real-time temperature tracking. Transparent supply chain data builds consumer trust and reduces waste. Brands that deploy modular, stackable container designs benefit from optimized warehouse efficiency. Growth in regional cold chain infrastructure expands addressable markets in emerging economies.

Leveraging Sustainable Materials to Capture Consumer Preference

Consumer emphasis on sustainability drives demand for eco-friendly packaging formats. The frozen food packaging market incentivizes use of recyclable trays and compostable films that minimize environmental impact. It allows material developers to introduce bio-based polymers with competitive cost and performance benchmarks. Companies that secure certifications from recognized bodies enhance brand reputation. Partnerships with recycling facilities enable closed-loop programs that return materials for reuse. Premium product lines can command higher margins when paired with credible green credentials. Industry stakeholders that adapt to circular economy principles attract environmentally conscious demographics.

Market Segmentation Analysis:

By Packaging Type

The frozen food packaging market segments into boxes, bags, tubs & cups, trays, pouches, wraps & films, and others. Boxes deliver structural stability and stackability. Bags support flexibility for bulk storage. Tubs & cups offer portion control and reuse potential. Trays accommodate meat and prepared items with rigidity. Pouches provide lightweight, space‑efficient options. Wraps & films deliver thermal barrier and moisture resistance. Other formats address niche needs, covering multipacks and specialized containers.

- For instance, Conagra Brands packages frozen vegetables in flexible plastic pouches made from polyethylene, providing lightweight and space-efficient storage solutions.

By Material Type

The frozen food packaging market categorizes materials into plastic, paper & paperboard, metal, glass, and others. Plastic dominates thanks to barrier performance and cost efficiency. Paper & paperboard suit recyclable and lightweight requirements. Metal offers exceptional durability and cold retention. Glass delivers chemical inertness and premium presentation. Other materials include hybrid composites and biodegradable polymers. Producers tailor material selection to balance sustainability demands with functional performance across storage and distribution channels.

- For instance, Coldwater Prawns of Norway packages its frozen prawns in pouches made from multilayer film containing 60% ocean-bound plastic, developed with SABIC and Estiko Packaging Solutions, exemplifying cutting-edge sustainable plastic us.

By Application

The frozen food packaging market divides into fruits and vegetables, frozen desserts, meat and seafood, baked products, ready meals, and others. Packaging for fruits and vegetables emphasizes breathability and puncture resistance. Frozen desserts require moisture barrier and aesthetic appeal. Meat and seafood demand leak‑proof seals and pathogen control. Baked products need crispness preservation through modified atmosphere. Ready meals benefit from compartmentalized trays for reheating. Other applications cover pet food and specialty diets.

Segments:

Based on Packaging Type

- Boxes

- Bags

- Tubs & Cups

- Trays

- Pouches

- Wraps & Films

- Others

Based on Material Type

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

Based on Application

- Fruits and Vegetables

- Frozen Desserts

- Meat and Seafood

- Baked Products

- Ready Meals

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America and Europe

The frozen food packaging market assigns 26% share to North America and 38% to Europe. It leverages mature retail networks and robust cold chain infrastructure to serve large consumer bases. Market participants invest in high‑barrier films and automated packaging lines to maintain product quality. Stakeholders pursue eco‑certifications to meet regulatory requirements. Intensified e‑commerce adoption drives innovation in lightweight, protective solutions. Collaboration between packaging suppliers and distributors enhances supply chain resilience and cost efficiency.

Asia Pacific

The frozen food packaging market allocates 22% share to Asia Pacific. It benefits from rapid urbanization, rising disposable incomes, and shifting diets toward convenience foods. Regional producers adopt flexible pouches and microwave‑safe trays to serve evolving preferences. Government incentives support local production of sustainable materials. Technology providers deliver tailored barrier solutions that extend shelf life under challenging climatic conditions. Strategic alliances between global brands and regional converters accelerate market expansion and local expertise retention.

Latin America and Middle East & Africa

The frozen food packaging market designates 8% share to Latin America and 6% to Middle East & Africa. It experiences moderate growth driven by expanding organized retail and increased frozen food consumption. Manufacturers introduce portion‑controlled tubs and resealable pouches to match local demand patterns. Government focus on food safety standards prompts adoption of tamper‑evident seals. Packaging firms partner with logistics providers to optimize last‑mile cold chain performance. Urban migration and changing lifestyles create opportunities for value‑added frozen offerings in both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Uflex Limited

- Sealed Air Corporation

- American Packaging Corporation

- MOD‑PAC Corporation

- Berry Plastics Group Inc.

- Ampac Holdings LLC

- Sealstrip Corporation

- WestRock Company

- Sonoco Products Company

- Alto Packaging

- International Paper Company

- Amcor PLC

- Amerplast Ltd

Competitive Analysis

The frozen food packaging market sees intense rivalry among key players. Uflex Limited focuses on lightweight films that meet sustainability targets. Sealed Air Corporation deploys automated sealing systems and barrier technologies for extended shelf life. American Packaging Corporation expands capacity in North America to capture rising demand. MOD‑PAC Corporation leverages digital printing to deliver customized designs for retail brands. Berry Plastics Group Inc. invests in recyclable resin development to align with regulatory guidelines. Ampac Holdings LLC forms partnerships to widen its global distribution network. WestRock Company offers fiber‑based alternatives that reduce plastic use in trays and cartons. Sonoco Products Company integrates active packaging with oxygen scavengers to preserve product quality. International Paper Company and Amcor PLC pursue acquisitions and joint ventures to strengthen their market positions. Amerplast Ltd. specializes in niche sealing solutions for meat and seafood applications. It drives innovation, consolidation and efficiency across the sector.

Recent Developments

- In June 24, 2025, Amcor and Cofigeo partnered to create a multi‑compartment tray designed for convenience and sustainability in frozen food packaging.

- In June 30, 2025, Sealed Air showcased Next‑Gen sustainable packaging solutions for frozen products at ProPak Asia 2025, highlighting shelf‑life extension and waste‑reduction features.

- In February 2025, Indian conglomerate ITC acquired Prasuma, a leading chilled meat and frozen food brand, to expand its presence in the frozen foods market.

- On May 12, 2025, Metsä Group and Amcor PLC partnered on moulded fibre food packaging solutions tailored for frozen food applications.

Market Concentration & Characteristics

The Based on Packaging Type exhibits moderate concentration. It features a mix of global conglomerates and regional specialists. Leading firms like Uflex Limited, Sealed Air Corporation, WestRock Company and Berry Plastics Group Inc. control major revenue share through extensive production capacity and technology portfolios. It allows smaller converters to compete in niche segments such as sustainable films and custom digital runs. High entry barriers—capital-intensive equipment and regulatory compliance—limit new entrants. It demands continuous innovation in barrier performance and cold chain compatibility. Global players leverage integrated supply chains to optimize cost structures and secure raw material access. Regional players focus on local preferences and faster service. It benefits buyers through competitive pricing and diverse product offerings. Stable demand for frozen foods ensures predictable volume requirements, promoting long-term partnerships between manufacturers and brand owners. Industry consolidation rapidly intensifies through mergers and joint ventures that expand geographic coverage and drive economies of scale.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Material Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will integrate smart sensors and IoT technologies to monitor cold chain conditions, ensuring quality.

- Brands will expand use of sustainable materials to meet consumer demand and reduce environmental impact.

- Packaging designers will adopt modular formats that simplify logistics, reduce waste, and optimize space utilization.

- Investment in recyclable polymers will accelerate circular economy initiatives, driving material reuse and resource efficiency.

- Digital printing will enable rapid customization for regional markets and support fully compelling brand storytelling.

- Companies will develop active packaging systems incorporating oxygen scavengers to extend freshness and reduce spoilage.

- Supply chains will leverage data analytics to optimize temperature control and minimize significant product losses.

- E‑commerce‑focused packaging solutions will enhance last‑mile delivery reliability and improve overall customer satisfaction metrics effectively.

- Collaborative partnerships will drive material innovation and significant cost efficiencies across global packaging supply networks.

- Regulatory compliance efforts will spur development of eco‑friendly solutions that meet evolving global market standards.