Market Overview:

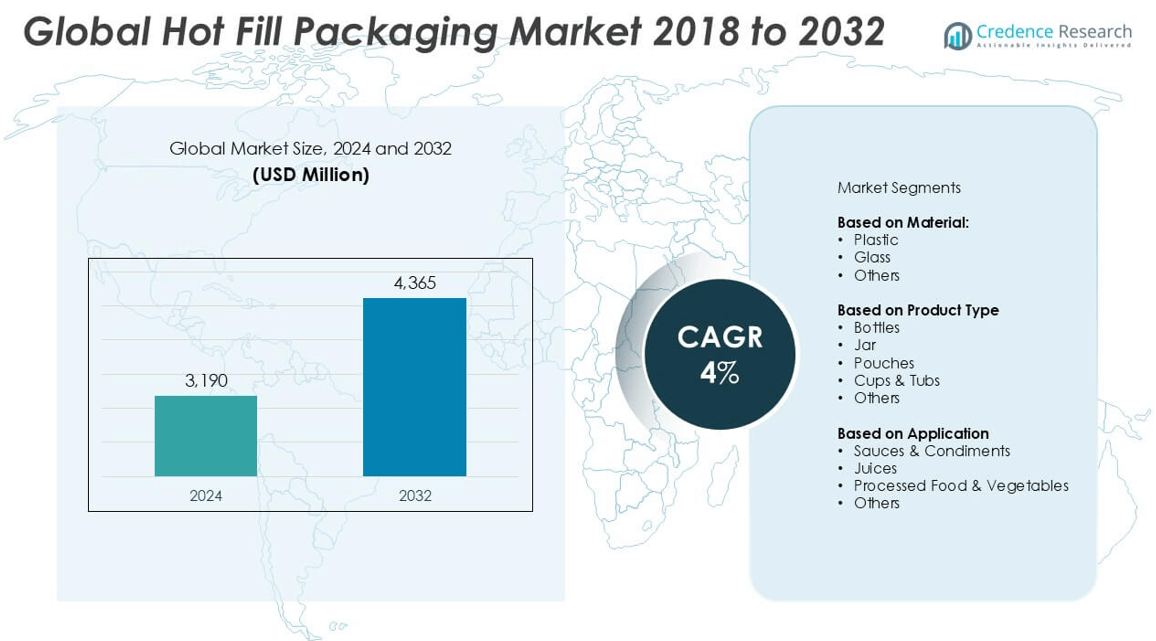

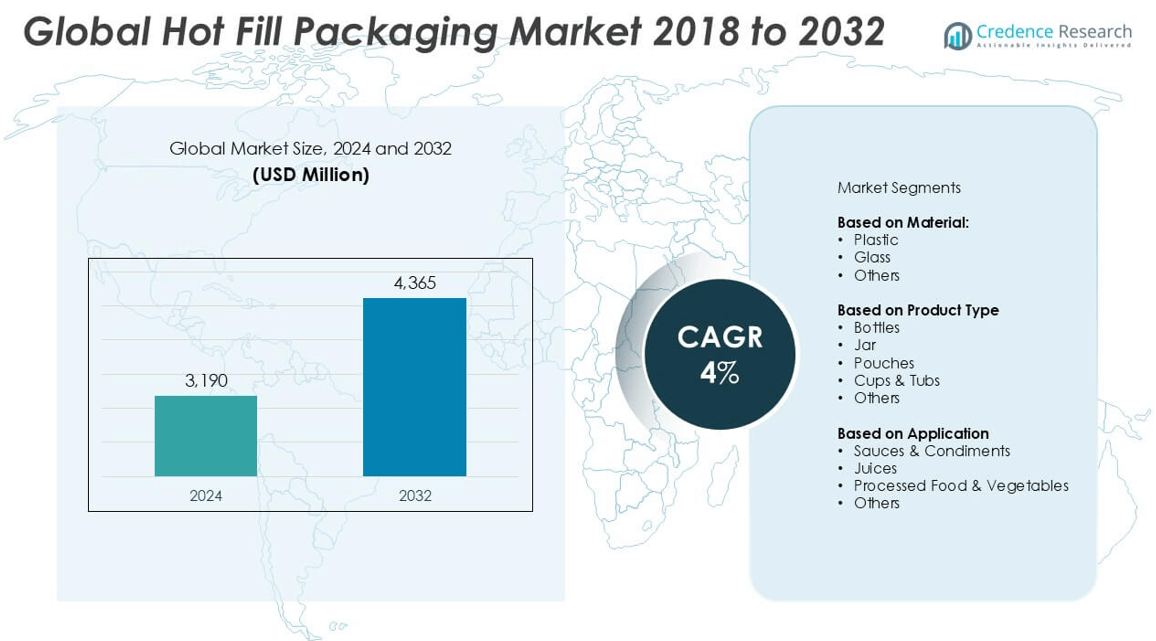

Hot Fill Packaging market size was valued at USD 3,190 million in 2024 and is anticipated to reach USD 4,365 million by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hot Fill Packaging Market Size 2024 |

USD 3,190 million |

| Hot Fill Packaging Market, CAGR |

4% |

| Hot Fill Packaging Market Size 2032 |

USD 4,365 million |

The Hot Fill Packaging market is characterized by the presence of several prominent players that drive innovation and market expansion. Key companies include Amcor Plc, Graham Packaging Company, Plastipak Holdings, Inc., Indorama Ventures Public Company Limited, Crown Holdings, Inc., and Resilux NV. These players focus on enhancing material performance, sustainability, and production efficiency to meet the rising demand for heat-resistant and recyclable packaging. North America leads the global market, accounting for approximately 28% of the total market share in 2024, driven by high consumption of ready-to-drink beverages and advanced packaging infrastructure. Europe follows closely, supported by strong regulatory frameworks and growing preference for eco-friendly materials.

Market Insights

- The Hot Fill Packaging market was valued at USD 3,190 million in 2024 and is projected to reach USD 4,365 million by 2032, growing at a CAGR of 4% during the forecast period.

- Market growth is primarily driven by rising demand for preservative-free beverages, expansion of the ready-to-drink segment, and advancements in heat-resistant packaging materials.

- Increasing focus on sustainable and recyclable packaging, along with innovations in PET bottle design and lightweight formats, are key trends influencing the market landscape.

- Major players such as Amcor Plc, Plastipak Holdings, and Indorama Ventures are intensifying competition through product development and strategic collaborations; plastic material and bottle segments hold dominant shares.

- North America leads the market with a 28% share, followed by Europe at 25% and Asia Pacific at 30%; however, high initial investment in filling technology and limited availability of sustainable heat-resistant materials act as key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

The plastic segment dominates the Hot Fill Packaging market, accounting for the largest market share in 2024. This is attributed to its cost-effectiveness, lightweight properties, and superior flexibility compared to glass and other materials. Plastic packaging also offers high heat resistance and durability, making it ideal for hot fill applications. PET and PP plastics are commonly used due to their barrier properties and ease of customization. Although glass remains relevant for premium packaging, the growing demand for convenience and sustainability in consumer goods continues to drive the adoption of plastic materials.

- For instance, Plastipak Holdings, Inc. developed its ThermoShape™ PET bottle technology, which can withstand fill temperatures up to 95°C and is used across more than 250 production lines globally.

By Product Type:

Among product types, bottles emerged as the dominant segment, capturing the highest market share in 2024. Their widespread use in beverages, particularly juices and sauces, supports this trend. Bottles are favored for their ease of handling, sealing capabilities, and compatibility with high-temperature filling processes. Additionally, innovations in lightweight bottle designs and the availability of recyclable materials contribute to their market leadership. Pouches and jars are gaining traction, but bottles remain the preferred choice due to their familiarity among consumers and compatibility with automated filling lines.

- For instance, Amcor Plc introduced its PowerPost™ hot fill bottle design, reducing bottle weight by 10 grams while maintaining integrity at 85°C fill temperatures across over 400 million units annually.

By Application:

Juices hold the leading position in the application segment of the Hot Fill Packaging market, securing the largest market share in 2024. The growth is driven by rising health awareness and increasing consumption of ready-to-drink fruit and vegetable beverages. Hot fill technology ensures extended shelf life without preservatives, which aligns well with consumer demand for natural products. Furthermore, expanding juice offerings by global and regional beverage manufacturers continue to boost the demand for hot fill-compatible packaging formats. Sauces and condiments follow closely, benefiting from the need for hygienic and heat-stable packaging solutions.

Market Overview

Rising Demand for Preservative-Free and Natural Beverages

The increasing consumer preference for preservative-free and natural beverages is a major growth driver for the hot fill packaging market. Hot fill technology allows products like juices and sauces to be sterilized without the need for chemical preservatives, aligning with growing health-conscious consumption trends. Manufacturers are responding by launching more clean-label drinks that require heat-resistant packaging. As consumers demand more transparency and healthier product formulations, hot fill packaging provides a practical and cost-effective solution, significantly boosting its adoption across beverage and processed food industries.

- For instance, The Coca-Cola Company expanded its Simply® juice line using hot fill PET bottles developed by Graham Packaging, processing over 800 million preservative-free units annually.

Growth of the Ready-to-Drink (RTD) Segment

The surge in demand for ready-to-drink (RTD) products, especially functional beverages, energy drinks, and fruit juices, is fueling the growth of the hot fill packaging market. Urbanization, busy lifestyles, and convenience-based consumption patterns are driving this trend. Hot fill packaging offers longer shelf life and ensures product safety, making it ideal for RTD items. Additionally, innovations in packaging materials and formats such as lightweight bottles and pouches enhance portability and appeal, further encouraging manufacturers to choose hot fill packaging for a wide range of RTD product lines.

- For instance, PepsiCo launched over 600 million RTD beverage units in Asia-Pacific using Indorama Ventures’ hot-fill-compatible EcoSmart PET resin technology.

Technological Advancements in Packaging Materials

Continuous advancements in packaging materials, especially in heat-resistant plastics such as PET and PP, are enhancing the efficiency and performance of hot fill packaging. These innovations enable lighter, more sustainable packaging without compromising structural integrity during the high-temperature filling process. The development of recyclable and multilayer barrier materials also supports shelf stability and environmental compliance. As manufacturers seek sustainable yet functional packaging solutions, these advancements not only reduce operational costs but also open new opportunities for expanding into more demanding application areas such as organic sauces and premium beverages.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Packaging

The global shift toward sustainable packaging is creating new opportunities for growth in the hot fill packaging market. Brands are increasingly adopting recyclable plastics and biodegradable materials to meet environmental regulations and consumer expectations. PET bottles, which are both recyclable and compatible with hot fill processes, are gaining popularity. Additionally, innovations in lightweight design and material reduction are helping manufacturers lower carbon footprints. This trend not only enhances brand image but also meets growing demand from eco-conscious consumers, offering a competitive edge in the evolving packaging landscape.

- For instance, Resilux NV achieved a 12% reduction in PET resin usage per unit across 150 million hot fill bottles produced annually by integrating advanced lightweighting techniques.

Expansion into Emerging Economies

Rapid urbanization and rising disposable incomes in emerging economies such as India, China, Brazil, and Southeast Asian countries present significant opportunities for market expansion. These regions are experiencing increased consumption of packaged foods and beverages, creating demand for reliable and safe packaging solutions. Hot fill packaging is especially attractive due to its cost-efficiency and ability to ensure product safety without refrigeration. Multinational companies are investing in local production and distribution networks to cater to this demand, driving regional market growth and encouraging localized innovation in packaging formats and materials.

- For instance, AL AMANA PLASTICS ramped up PET hot fill bottle production in the UAE to 120 million units annually to support regional growth across the Middle East and North Africa.

Key Challenges

Material Limitations for Heat Resistance and Sustainability

One of the major challenges in the hot fill packaging market is the limited availability of materials that can simultaneously offer high heat resistance and meet sustainability standards. While PET and PP are widely used, they often face scrutiny due to environmental concerns. Finding alternatives that are both biodegradable and capable of withstanding high-temperature filling processes remains a technological hurdle. Manufacturers are under pressure to balance performance with environmental compliance, making R&D investment critical to overcoming this material limitation.

High Initial Investment in Machinery and Infrastructure

Implementing hot fill packaging processes requires significant capital investment in specialized filling equipment and heat-resistant packaging lines. For small and medium-sized enterprises (SMEs), this presents a major barrier to entry. Additionally, retrofitting existing production lines to accommodate hot fill technology can be costly and time-consuming. These high initial costs can deter manufacturers from adopting the technology, particularly in price-sensitive markets, thereby slowing overall market penetration despite its long-term cost and efficiency benefits.

Competition from Alternative Sterilization Methods

The hot fill packaging market faces growing competition from alternative sterilization technologies such as aseptic and retort packaging. These methods offer greater flexibility in packaging materials and formats, and often come with longer shelf life benefits. Aseptic processing, in particular, is gaining traction for its ability to handle dairy and protein-based beverages, which are not suitable for traditional hot fill. As these technologies become more accessible and cost-effective, they pose a threat to the growth of hot fill packaging, especially in niche beverage and food segments.

Regional Analysis

North America

North America held a substantial share of the global hot fill packaging market in 2024, accounting for approximately 28% of the overall market. The region’s strong position stems from the well-established food and beverage industry, high consumption of ready-to-drink juices and sauces, and demand for extended shelf-life packaging solutions. Consumers’ inclination toward natural, preservative-free products further boosts adoption. Technological advancements in PET packaging and strong retail infrastructure support growth. The U.S. leads the regional market, driven by innovation in sustainable materials and increasing investment in advanced filling technologies by major beverage producers.

Europe

Europe captured nearly 25% of the global hot fill packaging market in 2024, supported by stringent food safety regulations and rising consumer demand for organic and clean-label beverages. Countries such as Germany, France, and the U.K. contribute significantly due to high per capita consumption of processed food and juices. The market also benefits from the strong presence of eco-conscious consumers driving demand for recyclable and sustainable packaging. Additionally, European manufacturers are investing in bio-based plastics and heat-tolerant packaging formats, reinforcing the region’s leadership in adopting advanced, environmentally friendly packaging technologies.

Asia Pacific

Asia Pacific emerged as the fastest-growing region, commanding around 30% market share in the hot fill packaging market in 2024. Rapid urbanization, increasing disposable incomes, and expanding retail networks are major growth drivers across China, India, Japan, and Southeast Asia. The growing consumption of packaged beverages and convenience foods boosts demand for heat-stable and safe packaging formats. Additionally, regional governments are supporting packaging innovation and safety compliance, encouraging investments in modern filling technologies. The dominance of local manufacturers and evolving consumer preferences toward health-centric and shelf-stable products further accelerates regional growth.

Latin America

Latin America accounted for nearly 9% of the global hot fill packaging market in 2024. Brazil and Mexico lead the region due to increasing consumption of juices, sauces, and other shelf-stable food products. The region is witnessing steady growth driven by expanding urban populations and rising demand for cost-effective, convenient packaging formats. While infrastructure and technological limitations pose challenges, growing investment in food processing and packaging innovation is helping address these gaps. Moreover, regional brands are adopting recyclable plastic materials to align with sustainability goals, contributing to incremental market expansion.

Middle East & Africa

The Middle East & Africa (MEA) region represented approximately 8% of the hot fill packaging market in 2024. The market is gradually expanding due to increasing demand for packaged beverages and processed foods, particularly in urban centers of the UAE, Saudi Arabia, and South Africa. The growth is supported by improving retail distribution and rising health awareness, which is driving the preference for preservative-free food products. However, infrastructure constraints and limited access to advanced filling technology hinder large-scale adoption. Despite these challenges, the region holds long-term potential due to favorable demographics and emerging investment in food packaging facilities.

Market Segmentations:

By Material

By Product Type

- Bottles

- Jar

- Pouches

- Cups & Tubs

- Others

By Application

- Sauces & Condiments

- Juices

- Processed Food & Vegetables

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Hot Fill Packaging market is defined by the strong presence of global packaging giants and specialized regional players. Leading companies such as Amcor Plc, Plastipak Holdings, Indorama Ventures Public Company Limited, and Graham Packaging Company dominate the market through their expansive product portfolios, technological expertise, and global distribution networks. These players consistently invest in R&D to develop lightweight, recyclable, and heat-resistant materials, catering to the growing demand for sustainable packaging solutions. Strategic partnerships, capacity expansions, and acquisitions are common tactics used to strengthen market positions and enhance production capabilities. Competition is particularly intense in the plastic bottle segment, where innovation in design, barrier properties, and cost efficiency plays a crucial role. While multinational corporations lead in large-volume applications, regional manufacturers focus on custom packaging formats and serve niche markets. This dynamic competitive environment encourages continuous innovation and adaptation to evolving regulatory, environmental, and consumer expectations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mpact

- Nirmal Pet

- Plastipak Holdings, Inc.

- MJS Packaging

- AL AMANA PLASTICS

- Wilkinson Containers Ltd.

- Amcor Plc

- Indorama Ventures Public Company Limited

- Acti Pack

- Crown Holdings, Inc

- Alpha Group

- Imperial Packaging

- Graham Packaging Company

- West Coast Container

- Resilux NV

- E-proPLAST GmbH

Recent Developments

- In December 2024, Tetra Pak partnered with The Coca-Cola Company to develop a new range of plant-based, fully renewable cartons suitable for hot fill beverages. This initiative aims to reduce the carbon footprint of beverage packaging and promote environmental sustainability.

- In August 2024, Berry Global completed the acquisition of RPC Group, a leading plastic packaging supplier. This strategic move aims to expand Berry Global’s product offerings in the hot fill packaging sector and strengthen its position in the global market.

- In June 2024, Graham Packaging launched a series of fully recyclable hot fill containers aimed at the beverage industry. These containers are designed to withstand high-temperature filling processes without compromising on recyclability, aligning with the growing demand for sustainable packaging solutions.

- In March 2024, Amcor introduced a new line of ultra-lightweight, high-barrier PET bottles designed specifically for hot fill applications. These bottles offer enhanced sustainability by reducing material usage while maintaining the structural integrity required for hot fill processes.

Market Concentration & Characteristics

The Hot Fill Packaging Market shows moderate to high market concentration, with a few major players accounting for a significant share of global revenue. Companies such as Amcor Plc, Plastipak Holdings, and Indorama Ventures maintain strong competitive positions through their extensive production capabilities, global distribution networks, and continuous product innovation. It features a mix of multinational corporations and regional manufacturers, where leading firms dominate premium and large-scale applications while smaller companies cater to localized needs. The market operates under strict regulatory standards, especially concerning food safety and material sustainability. Product characteristics must meet high-temperature resistance and extended shelf-life requirements without compromising material integrity. PET remains the preferred material due to its thermal stability, recyclability, and cost efficiency. Bottles dominate among product types, favored for their compatibility with beverage applications and automated filling systems. The market responds swiftly to shifts in consumer demand for healthier, preservative-free products, driving continuous innovation in packaging formats and technologies.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The hot fill packaging market is expected to witness consistent growth driven by increasing demand for ready-to-drink beverages and convenience food products.

- Rising health consciousness among consumers is encouraging the use of preservative-free, hot-filled natural juices and teas.

- The growing adoption of PET bottles for hot fill applications is enhancing product visibility and shelf appeal, boosting market demand.

- Technological advancements in heat-resistant packaging materials are enabling manufacturers to offer more sustainable and efficient solutions.

- Expansion of food and beverage industries in emerging economies is creating new growth opportunities for hot fill packaging providers.

- Increasing preference for eco-friendly and recyclable materials is pushing companies to innovate in biodegradable hot fill packaging options.

- Improved shelf-life and product safety features are strengthening the use of hot fill methods across various liquid food categories.

- Brand differentiation and customization in packaging designs are becoming critical for attracting consumer attention in competitive markets.

- Automation in hot fill production lines is streamlining operations and reducing production costs for packaging companies.

- Strategic collaborations between material suppliers and food manufacturers are accelerating product development in the hot fill packaging segment.