Market Overview

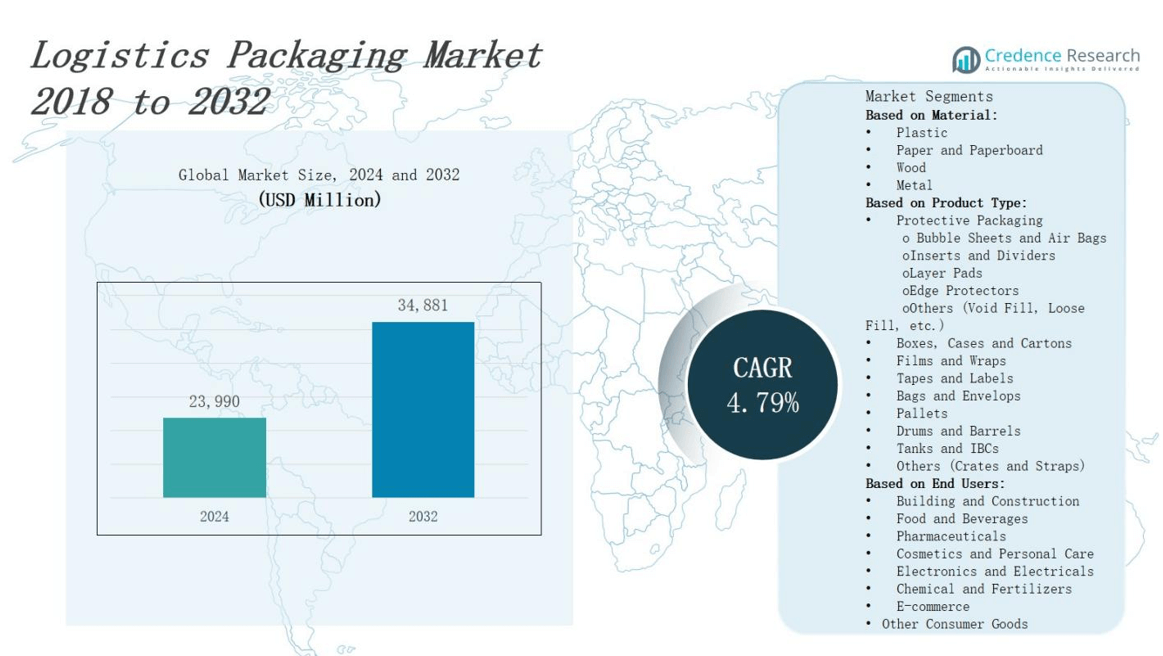

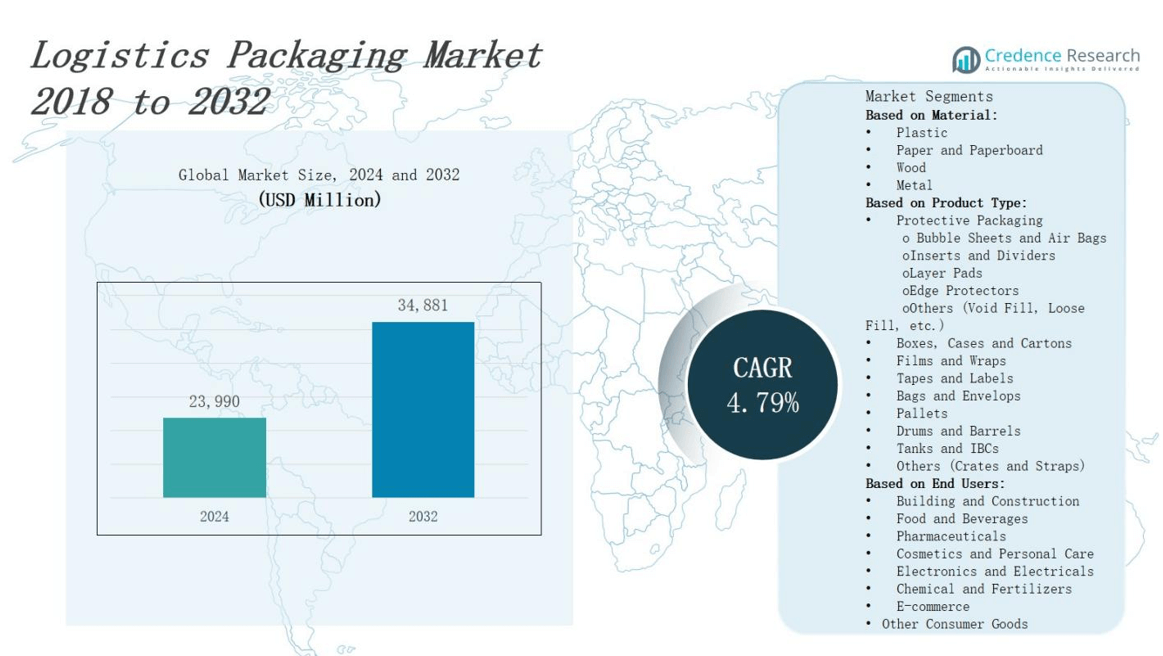

The logistics packaging market is projected to grow from USD 23,990 million in 2024 to USD 34,881 million by 2032 at a CAGR of 4.79%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Logistics Packaging Market Size 2024 |

USD 23,990 million |

| Logistics Packaging Market, CAGR |

4.79% |

| Logistics Packaging Market Size 2032 |

USD 34,881 million |

Rising e‑commerce volumes and supply chain complexity drive the logistics packaging market as companies invest in lightweight solutions that optimize transportation costs and reduce damage. Sustainability regulations and growing consumer demand for eco‑friendly materials motivate packaging providers to adopt recyclable and bio‑based substrates. Technological advancements in smart packaging, including RFID tracking, IoT sensors, and real‑time temperature monitoring, enhance visibility and control across distribution networks. Automation and robotics streamline packing processes, increase throughput, and lower labor expenses. Strategic collaborations between packaging manufacturers and logistics service providers foster innovation in modular designs and multi‑use systems, supporting just‑in‑time delivery and circular economy initiatives.

Regional demand patterns shape the logistics packaging market: North America leads with automated packing solutions, pallets, Europe drives circularity and compostable substrates, Asia Pacific expands through e‑commerce and growth, Latin America relies on food packaging, and Middle East & Africa invest in bulk containers. Key players such as Braid Logistics and Trans Ocean Bulk Logistics dominate crate and pallet services. Specialized firms including BLT Flexitank Industrial Co. Ltd. and BAG Corp. address liquid packaging needs, while Jumbo Bag Corporation and Boxon USA deliver bulk and protective packaging worldwide.

Market Insights

- The market will expand from USD 23,990 million in 2024 to USD 34,881 million by 2032 at a CAGR of 4.79%, driven by rising e‑commerce volumes and supply chain complexity.

- Companies invest in lightweight, modular packaging to optimize transportation costs, increase truckload capacity, and reduce product damage.

- Regulatory mandates and consumer demand push providers to adopt recyclable, bio‑based substrates and develop compostable designs.

- RFID tracking, IoT sensors, and real‑time temperature monitoring enhance end‑to‑end visibility and risk management across distribution networks.

- Automation and robotics boost throughput, lower labor expenses, and streamline packing processes through advanced data analytics and modular robotic cells.

- Strategic collaborations between packaging manufacturers and logistics service providers foster co‑designed crates, shared recycling loops, and circular‑economy programs.

- North America leads adoption of automated solutions, Europe drives circularity initiatives, and Asia Pacific, Latin America, and MEA adapt packaging to local e‑commerce, food export, and cold‑chain requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Sustainability and Regulatory Compliance

Growing environmental regulations and corporate sustainability goals drive demand for recycled and bio-based materials. Regulatory bodies enforce packaging waste targets and penalize non‑compliance. It pushes manufacturers to innovate with compostable substrates and designs. Brands seek to reduce carbon footprint and report measurable waste reductions. Consumer preferences for eco‑friendly solutions influence procurement decisions. The logistics packaging market responds by developing lightweight, recyclable, and reusable systems. It drives global widespread adoption quickly.

- For instance, Ball Corporation’s aluminum aerosol cans contain 50% recycled material and have half the carbon footprint of standard cans.

Cost Optimization and Efficiency

Companies pursue modular lightweight structures to directly lower transportation costs and significantly boost truckload capacity. Bulk packaging consolidation cuts handling steps and reduces labor expenses. It streamlines warehouse operations and minimizes material usage. Investment in automated packing lines increases throughput and reduces error rates. Advanced data analytics guide packaging size selection to match product dimensions precisely. The logistics packaging market improves margins by standardizing pallet patterns and optimizing load planning.

- For instance, Zipline Logistics introduced an on-site consolidation program for Evans Food Group, which cut landed costs per pallet by 20%, demonstrating significant savings via freight consolidation.

Technological Integration and Visibility

IoT-enabled sensors provide real‑time tracking of package location and condition. RFID tags automate inventory audits and reduce manual scanning errors. It enhances supply chain transparency and lowers risk of misrouting. Blockchain‑based platforms secure transaction records and verify provenance. Cloud‑enabled dashboards consolidate data from multiple touchpoints to support quick decision making. The logistics packaging market adopts digital twins to simulate packaging performance under varied conditions. It improves end‑to‑end operational responsiveness significantly.

Strategic Collaboration and Innovation

Packaging manufacturers partner with logistics providers to create end‑to‑end service offerings. Shared development programs lead to co‑designed modular crates and load carriers. It reduces lead times and aligns packaging design with transportation modes. Joint ventures accelerate testing of novel materials and sustainable processes. Industry consortia define performance standards and promote reuse through take‑back schemes. The logistics packaging market benefits from cross‑sector collaboration and pooled investment. It supports agile packaging solutions.

Market Trends

Rise of Modular Packaging Solutions

Container design trends shift toward modular systems that adapt to varied cargo dimensions. Manufacturers develop stackable racks and reusable pallets for multiple shipment cycles. It reduces protective material requirements while preserving load integrity. RFID-enabled tracking ensures each module returns to origin for reuse. Companies report lower per-unit costs on average. The logistics packaging market benefits from this shift by scaling modular formats globally. Collaboration between shippers and packagers accelerates standardization across supply chains.

- For instance, Maersk introduced stackable, reusable steel containers that reduce packing waste while maintaining load stability across multiple shipments.

Growth of Smart Sensor Integration

Sensors embed into packaging and relay temperature, shock, and humidity data directly to cloud platforms. Real-time alerts prevent spoilage and damage during transport. It improves risk management by enabling immediate corrective action. Companies leverage machine learning models to predict potential failures. Partnerships between technology providers and packaging firms accelerate sensor miniaturization. The logistics packaging market embraces these advances to enhance transparency. Regulators consider mandating sensor use for high-value shipments.

- For instance, SICK integrates sensors into packaging machinery to monitor conditions for cereals and snacks, ensuring freshness by sending immediate alerts on any deviations.

Shift Toward Sustainable Materials

Designers select bio-based polymers and recycled fibers to meet stricter waste regulations. Certified compostable substrates undergo third-party validation for end-of-life safety. It reduces landfill burden and aligns with corporate sustainability targets. Major carriers implement take-back programs to reclaim packaging for reuse. Academic institutes test novel plant-derived foams and coatings for durability. The logistics packaging market moves toward widespread circularity. Governments offer incentives to promote use of renewable materials in packaging.

Expansion of Automation in Packaging Lines

Industrial robots handle palletizing, wrapping, and strapping tasks with high precision. Vision systems detect product orientation and adjust equipment automatically. It reduces manual labor requirements and error rates significantly. Conveyor systems incorporate dynamic weight sensors to optimize load distribution. Integration with warehouse management software synchronizes packaging pace with order volume. The logistics packaging market sees increased investment in modular robotic cells. System integrators collaborate to retrofit existing lines for minimal downtime.

Market Challenges Analysis

Escalating Material and Compliance Costs

Volatility in raw material prices drives manufacturers to pass higher costs through the supply chain. Strict environmental regulations require continuous adaptation of packaging compositions and certification efforts. It forces suppliers to invest in expensive testing and auditing procedures. Meeting diverse regional compliance standards increases administrative overhead. Custom orders raise unit costs and complicate production scheduling. Stakeholders struggle to balance sustainability goals with budget constraints. The logistics packaging market faces pressure to deliver cost‑effective and compliant solutions under tight margins.

Complexity of Standardization and Technology Integration

Disparate technical standards impede interoperability of packaging systems across global networks. It complicates collaboration between carriers, shippers, and packagers. Integrating IoT and automation platforms demands significant capital outlay. Small and mid‑sized enterprises lack resources to upgrade existing lines rapidly. Workforce training requirements extend project timelines. Cybersecurity threats target connected devices and risk data breaches. The logistics packaging market must navigate these obstacles to achieve seamless operations.

Market Opportunities

Leveraging E‑commerce Growth through Digital Packaging Solutions

Surge in online shopping volumes creates demand for packaging that preserves product integrity and optimizes space. It encourages providers to integrate digital printing for personalized branding and variable data. Robotic pick‑and‑pack systems enable faster order processing and expand service capacity. Partnerships with e‑commerce platforms allow real‑time packaging configuration based on order profile. Blockchain platforms verify shipment authenticity and build consumer trust. Data‑driven insights guide precise package dimensioning to minimize waste. The logistics packaging market stands to benefit from these digital advances.

Driving Circularity through Innovative Material Partnerships

Emerging focus on circular economy models opens collaboration between manufacturers and recyclers. It drives investment in plant‑based polymers and advanced coatings that meet durability standards. Shared recycling networks return used packaging to origin for renewed use. Certification schemes validate sustainable claims and deliver market differentiation. Government grant programs fund pilot projects for reusable container loops. Joint research initiatives test novel fiber blends for strength and moisture resistance. The logistics packaging market capitalizes on these partnerships to expand eco‑friendly product portfolios.

Market Segmentation Analysis:

By Material

Plastic leads volume share thanks to low cost and strength. Paper and paperboard gain traction through recycling mandates and lightweight profile. Wood appeals in construction and heavy industry for load support. Metal meets durability and reuse requirements in high‑value sectors. It forces innovation in composite blends and coating solutions. The logistics packaging market adapts to varied material demands across industries.

- For instance, STIHL Inc., a leading power equipment manufacturer, reduced 760 tons of corrugated packaging waste annually by standardizing reusable paperboard packaging, improving delivery reliability and cutting operational costs.

By Product Type

Protective packaging dominates through bubble sheets, air bags, inserts and edge protectors that prevent damage during transit. Boxes, cases and cartons handle structured transport of goods. Films and wraps offer moisture control and pallet stability. Tapes and labels support traceability and brand messaging. Rigid items like drums, barrels and IBCs serve liquid transport. It drives modular design and custom‑fit solutions. The logistics packaging market optimizes choice by type to meet application needs.

- For instance, Phoenix Packers offers three-layer sandwich air bubble bags featuring a polyethylene film with air bubbles that provide excellent cushioning for fragile items like electronics and glassware.

By End Users

Building and construction segment relies on sturdy crates, pallets and drums for heavy loads and site logistics. Food and beverage sector requires hygienic cartons, crates and films to protect perishables. Pharmaceuticals demand tamper‑evident containers with traceable labels. E‑commerce drives high volume of bags, envelopes and cases with brand customization. It encourages rapid redesign cycles to match order profiles. The logistics packaging market refines offerings by user vertical to align with sector specifications.

Segments:

Based on Material:

- Plastic

- Paper and Paperboard

- Wood

- Metal

Based on Product Type:

-

- Bubble Sheets and Air Bags

- Inserts and Dividers

- Layer Pads

- Edge Protectors

- Others (Void Fill, Loose Fill, etc.)

- Boxes, Cases and Cartons

- Films and Wraps

- Tapes and Labels

- Bags and Envelops

- Pallets

- Drums and Barrels

- Tanks and IBCs

- Others (Crates and Straps)

Based on End Users:

- Building and Construction

- Food and Beverages

- Pharmaceuticals

- Cosmetics and Personal Care

- Electronics and Electricals

- Chemical and Fertilizers

- E-commerce

- Other Consumer Goods

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 36 % share of the logistics packaging market. Strong e‑commerce growth drives demand for customized cartons, pallets and protective packaging. Major shippers adopt automated packing lines and reusable modules to cut costs. It leverages advanced tracking systems for real‑time visibility and damage prevention. Regulatory emphasis on material recovery supports uptake of recyclable substrates. Leading manufacturers partner with carriers to co‑develop modular solutions that fit diverse shipment profiles.

Europe

Europe commands 30 % share of the logistics packaging market. Stringent waste directives prompt adoption of bio‑based papers and compostable films. It standardizes pallet dimensions and crate formats to optimize cross‑border transport. Pharmaceutical and automotive sectors demand tamper‑evident containers with traceable labels. Major suppliers invest in circular‑economy programs and take‑back schemes. Collaborative R&D accelerates development of coated fibers and reusable packaging loops for sustainable distribution networks.

Asia Pacific, Latin America & Middle East & Africa

Asia Pacific accounts for 24 % share of the logistics packaging market, driven by rapid industrial expansion and rising online retail volumes. Latin America secures 6 % share through growth in food exports and FMCG distribution. Middle East & Africa holds 4 % share, supported by investments in port infrastructure and cold‑chain systems. It adapts packaging formats to local climate and regulatory requirements. Regional players develop modular containers and temperature‑controlled solutions to meet diverse end‑user needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BLT Flexitank Industrial Co. Ltd.

- Jumbo Bag Corporation

- BAG Corp.

- Trans Ocean Bulk Logistics

- Boxon USA

- Braid Logistics

Competitive Analysis

Leading providers, including Braid Logistics and Trans Ocean Bulk Logistics, emphasize modular packaging solutions that reduce transit damage and optimize space. They invest in digital printing for brand differentiation and sensor integration for real‑time visibility. Specialist manufacturers such as BLT Flexitank Industrial Co. Ltd. target bulk liquid shipments with high‑strength flexitanks. They partner with carriers to launch circular reuse programs. New entrants leverage e‑commerce growth by offering lightweight envelopes and automated packing lines that boost throughput. They compete on cost efficiency and turnaround time. Major players expand through strategic acquisitions and joint ventures to gain geographic reach and broaden service portfolios. They deploy data analytics to forecast demand and streamline inventory. Smaller firms face pressure to adopt reusable materials and automation or seek alliances. They tailor solutions to sector requirements, such as temperature control for pharmaceuticals and robust drums for construction materials. Regulatory compliance drives adoption of recycled substrates.

Recent Developments

- On May 12, 2025, Packsize announced global partnerships with Sitma and Paccurate to expand its sustainable, right‑sized, on‑demand packaging solutions.

- On June 11, 2025, Hy‑Tek Intralogistics and Packsize partnered to introduce SMART packaging systems for automated warehouses, optimizing the packaging process and reducing waste.

- On March 31, 2025, DHL completed its acquisition of U.S. pharma logistics firm Cryopdp, strengthening its packaging and cold‑chain services in the life sciences sector.

- On March 16, 2025, DS Smith introduced DryPack, a 100% recyclable, water‑resistant seafood packaging box approved for air freight, enhancing cold‑chain performance and sustainability.

Market Concentration & Characteristics

The logistics packaging market exhibits moderate concentration with leading providers such as Braid Logistics, Trans Ocean Bulk Logistics, BLT Flexitank Industrial Co. Ltd., BAG Corp., Jumbo Bag Corporation and Boxon USA commanding significant share. It ranks among top global suppliers that deliver modular systems, protective solutions and smart packaging technologies. Mid‑tier firms compete on specialization in end‑user segments and regional niches. New entrants face high capital requirements and certification barriers. It demands broad product portfolios covering protective packaging, drums, pallets and IBCs. Suppliers differentiate through sustainability credentials and digital integration of RFID and IoT sensors. It shifts toward circular‑economy models with take‑back schemes and reusable containers. Consolidation through acquisitions and alliances accelerates scale advantage. Price competition remains intense, requiring lean production practices and optimized logistics networks. It fosters development of regionally tailored offerings and multi‑tier service models.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Leading brands will adopt AI-driven packaging design tools to optimize dimensions, materials, and cost efficiency.

- Logistics companies will invest in reusable container systems and infrastructure to reduce packaging waste volumes.

- Sensor-equipped packaging will gain broad market traction for enhanced real-time supply chain visibility and monitoring.

- E-commerce platforms will demand smaller batch, on-demand packaging runs to match variable order volumes precisely.

- Logistics providers will integrate blockchain technology to secure shipment tracking, ensure authenticity, build consumer trust.

- Packaging firms will expand automation, integrating modular robotic cells in packing lines to optimize throughput.

- Packaging suppliers will partner with recyclers to establish closed-loop collection systems and support circular economy.

- Manufacturers will deploy digital twins to simulate packaging performance under varied transport conditions, reducing cycles.

- Packaging players will tailor offerings to meet local requirements and adapt designs to climatic challenges.

- Companies will leverage data analytics to forecast material demand, optimize inventory levels, and minimize stockouts.