Market Overview:

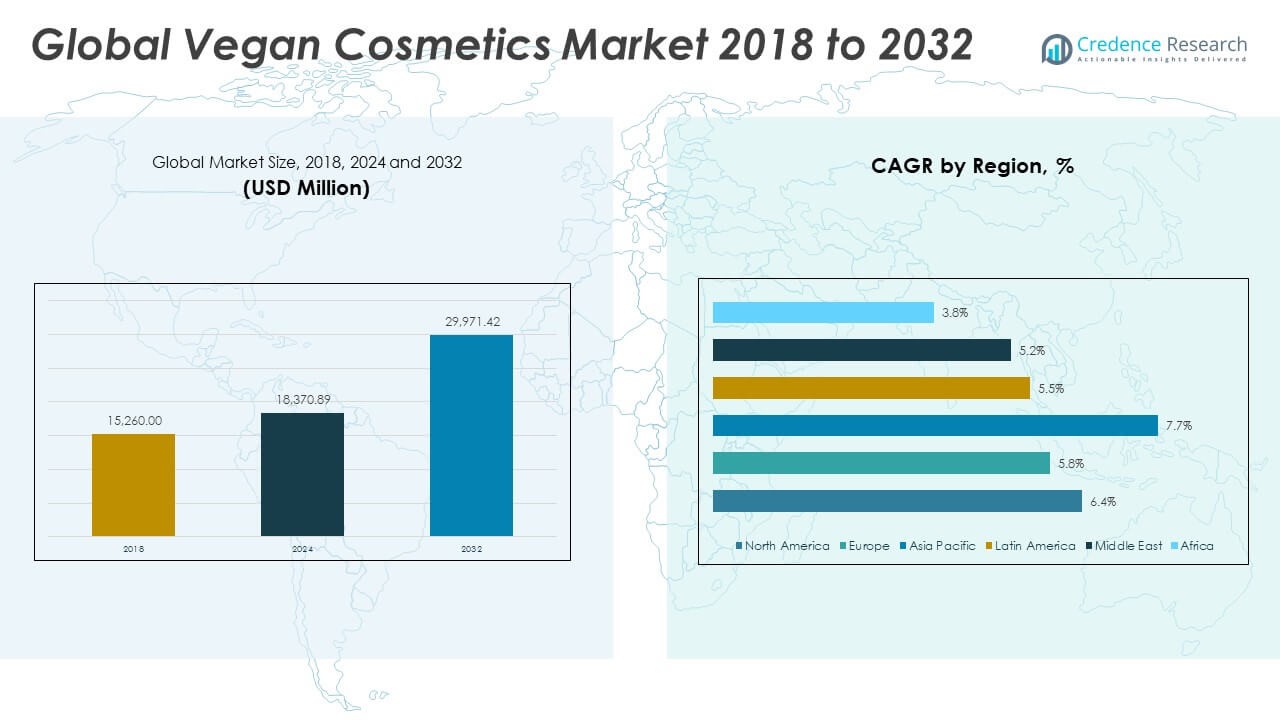

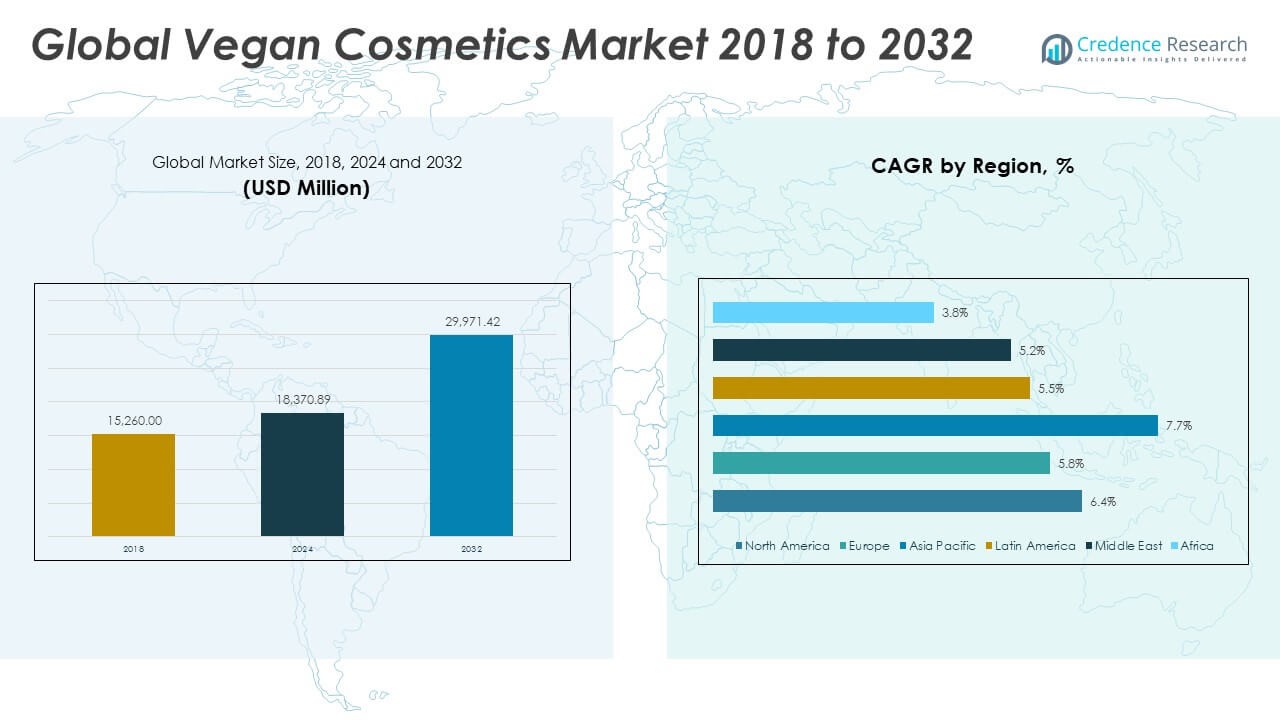

The Vegan Cosmetics Market size was valued at USD 15,260.00 million in 2018 to USD 18,370.89 million in 2024 and is anticipated to reach USD 29,971.42 million by 2032, at a CAGR of 6.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegan Cosmetics Market Size 2024 |

USD 18,370.89 Million |

| Vegan Cosmetics Market, CAGR |

6.38% |

| Vegan Cosmetics Market Size 2032 |

USD 29,971.42 Million |

The market is witnessing strong growth due to rising consumer awareness regarding cruelty-free and environmentally sustainable products. Consumers are increasingly scrutinizing ingredients and sourcing practices, driving brands to formulate cosmetics without animal-derived components. Growth is further supported by clean beauty trends, the influence of social media advocacy, and endorsements from celebrities promoting vegan lifestyles. Major brands are expanding their product lines to meet the rising demand for ethical, transparent, and plant-based formulations.

North America leads the Vegan Cosmetics Market due to high consumer awareness, strong regulatory support, and rapid adoption of vegan lifestyles. Europe closely follows, driven by stringent animal welfare regulations and growing preferences for clean-label products. Emerging regions such as Asia Pacific, especially India and South Korea, are seeing rising traction owing to increasing urbanization, ethical consumerism, and evolving beauty standards. The Middle East and Latin America are also gradually embracing vegan cosmetic offerings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Vegan Cosmetics Market was valued at USD 18,370.89 million in 2024 and is expected to reach USD 29,971.42 million by 2032, growing at a CAGR of 6.38%.

- Rising ethical consumerism and demand for cruelty-free, plant-based formulations are major drivers of market growth.

- Clean beauty trends and increased awareness of harmful synthetic ingredients are boosting vegan product adoption.

- Inconsistent labeling standards and limited ingredient sourcing present ongoing challenges for manufacturers.

- High product costs and shorter shelf lives restrict adoption, especially in price-sensitive regions.

- Europe leads the market with the largest regional share, driven by strict animal testing bans and eco-conscious consumers.

- Asia Pacific shows the fastest growth, supported by increasing urbanization, influencer-driven marketing, and rising ethical awareness.

Market Drivers:

Surging Ethical Consumerism and Preference for Cruelty-Free Products Are Catalyzing Vegan Cosmetic Demand

The rise of ethical consumerism has significantly boosted the demand for cruelty-free and vegan products. Consumers are aligning their purchase behaviors with personal values, especially concerning animal welfare. Brands are now responding to this shift by removing animal-derived ingredients and avoiding animal testing. Certification bodies such as Vegan Society and PETA are helping consumers identify genuine vegan offerings. Ethical concerns have pushed companies to adopt transparent labeling practices. Retailers have also started creating separate sections for vegan cosmetics to streamline the shopping experience. The Vegan Cosmetics Market benefits from this change, which has increased brand loyalty and product experimentation. Ethical transparency has become a crucial purchasing factor across age groups.

- For example, The Body Shop officially announced in January 2024 that 100% of its product formulations have been certified vegan by The Vegan Society, making it the first global beauty brand to achieve this milestone. The certification covers over 4,000 ingredients across its entire product line, including skincare, haircare, body care, makeup, and fragrances.

Growing Popularity of Clean Beauty and Plant-Based Ingredients Is Reinforcing Market Expansion

The clean beauty movement is shifting consumer interest toward products free of harmful chemicals and synthetic additives. Vegan cosmetics often align with these clean beauty principles by using plant-based, non-toxic ingredients. This has driven innovation in botanical extracts, natural oils, and plant-based pigments. Consumers now prefer ingredient lists that are short, recognizable, and safe for sensitive skin. Brands are capitalizing on this trend by investing in natural formulation R&D. Marketing efforts have shifted toward promoting product safety, purity, and sustainability. The Vegan Cosmetics Market aligns with this demand, creating differentiation in a competitive cosmetics industry. Influencers and beauty bloggers amplify this shift by advocating for safer, nature-derived skincare and makeup.

Heightened Social Media Influence and Celebrity Endorsements Are Shaping Purchase Behavior

Social media platforms play a major role in shaping beauty trends and influencing consumer preferences. Influencers and celebrities who support veganism frequently promote vegan cosmetics, expanding product visibility. Viral content and product reviews have a strong impact on younger demographics seeking ethical choices. Hashtags like #veganbeauty and #crueltyfree build engagement and raise awareness. Startups leverage social platforms to connect directly with niche audiences. User-generated content also boosts trust and authenticity around vegan products. The Vegan Cosmetics Market gains momentum as social engagement increases, especially during product launches or collaborations. Brands that invest in strategic influencer partnerships have experienced faster growth and higher online traction.

- For instance, Too Faced tapped into the viral “Latte Makeup” trend by collaborating with top beauty influencers and showcasing bronzer-focused looks on social media. The campaign generated significant buzz, contributing to increased engagement and product visibility across platforms.

Retail Expansion and Strategic Branding Are Supporting Global Vegan Cosmetics Accessibility

Wider retail availability across physical and online channels is strengthening consumer access to vegan cosmetics. Supermarkets, pharmacies, and specialty beauty stores now stock dedicated vegan sections. E-commerce platforms offer advanced filters and vegan certifications to aid consumer navigation. Subscription boxes featuring ethical and sustainable products also help in brand discovery. Strategic branding efforts highlight cruelty-free values, eco-friendly packaging, and ingredient sourcing. Consumers trust brands that communicate ethical production processes and sustainability milestones. Global players are entering new markets with tailored messaging to reflect local values. The Vegan Cosmetics Market is scaling up as branding and accessibility align with consumer convenience and values.

Market Trends:

Luxury and Premium Cosmetic Brands Are Introducing Vegan Product Lines to Capture Ethical Consumers

Luxury cosmetic brands are responding to shifting preferences by launching dedicated vegan lines. This transition reflects growing pressure on high-end companies to align with ethical consumption. Premium consumers expect products to match performance standards while adhering to cruelty-free values. Luxury houses now integrate sustainable sourcing, ethical certifications, and clean formulations into their brand narratives. High-end retailers promote vegan products alongside mainstream items, signaling a change in market positioning. Innovative packaging, upscale ingredients, and refined branding help differentiate luxury vegan offerings. The Vegan Cosmetics Market benefits as these premium additions elevate category perception. This shift is making vegan products aspirational, not just accessible.

Rapid Innovation in Biotech and Lab-Grown Ingredients Is Reshaping Formulation Standards

Biotechnological advancements are enabling the development of lab-grown alternatives to traditional animal-derived ingredients. Companies are investing in fermentation-based collagen, synthetic squalene, and plant-derived peptides. These innovations maintain product efficacy while adhering to vegan standards. R&D investments focus on matching or exceeding the performance of non-vegan ingredients. Formulators are adopting greener chemistry principles to maintain product integrity and shelf life. Sustainable alternatives are entering the supply chain at competitive costs. The Vegan Cosmetics Market is being reshaped by scientific breakthroughs that expand formulation possibilities. These innovations appeal to both performance-driven and ethically motivated consumers.

- For example, Amyris has commercialized Neossance® Squalane a sustainable, sugarcane‑derived, plant‑based substitute for shark‑sourced squalene through fermentation. Since its introduction in 2011, it has been adopted by thousands of global cosmetics brands across skincare, color cosmetics, and sun care.

Increasing Demand for Inclusive Beauty Is Promoting Vegan Cosmetics for All Skin Types

Beauty consumers increasingly demand inclusive products that cater to diverse skin tones, types, and concerns. Vegan brands are responding by offering a broader shade range, hypoallergenic options, and multi-functional products. Inclusive formulations support sensitive and acne-prone skin using gentle, plant-based ingredients. The expansion into inclusive beauty aligns with social values around representation and fairness. Marketing campaigns feature models across ethnicities, gender identities, and age groups. Packaging and messaging reflect diversity, reinforcing emotional connection with the brand. The Vegan Cosmetics Market is growing stronger in markets where inclusive product offerings gain customer trust. Representation remains a powerful driver in shaping long-term brand loyalty.

- For instance, Fenty Beauty’s Pro Filt’r Soft Matte Longwear Foundation is a vegan, cruelty‑free foundation offered in 50 shades, originally launched with 40. It has been widely praised for inclusive shade range and longwear performance, helping the brand to set a standard in the beauty industry for coverage across diverse skin tones while aligning with ethical consumer expectations.

Rising Focus on Sustainable Packaging and Carbon-Neutral Supply Chains Is Reshaping Brand Strategy

Consumers now expect cosmetic brands to address packaging waste and carbon emissions. Vegan cosmetics companies are shifting to recyclable, biodegradable, and refillable packaging formats. Carbon-neutral shipping and production are becoming brand differentiators. Supply chain traceability tools help brands communicate environmental impact transparently. Investments in circular design and eco-certifications enhance brand credibility. Regulations around packaging waste in regions like Europe are reinforcing this shift. The Vegan Cosmetics Market is adapting to this demand by embedding sustainability into core operations. Companies that prioritize low-impact manufacturing build stronger brand equity among eco-conscious buyers.

Market Challenges Analysis:

Ingredient Sourcing Limitations and Labeling Ambiguities Are Hindering Product Transparency

Securing reliable, scalable sources for plant-based and non-animal alternatives remains a significant challenge. Some vegan substitutes may face supply shortages or require high processing costs. Ingredient validation is often complex, especially for micro-ingredients like colorants or preservatives. Certification standards vary across regions, creating confusion for global brands. Misleading labels and greenwashing dilute consumer trust and undermine genuine brands. Regulatory gaps allow non-vegan ingredients to pass under vague definitions. The Vegan Cosmetics Market struggles with inconsistent definitions, which can hinder mass adoption. Consumers demand transparency, but brands often face difficulty in sourcing and verifying every component.

High Product Cost and Limited Shelf Life Impact Consumer Adoption and Retailer Acceptance

Vegan cosmetics often carry a premium price tag due to small-batch production, specialized ingredients, and sustainable packaging. This cost barrier limits access, especially in price-sensitive regions. Products using natural and organic components tend to have shorter shelf life, complicating logistics and inventory management. Retailers hesitate to stock such products in high volumes due to spoilage risk. Consumer expectations for performance and longevity must align with ethical sourcing and clean formulations. The Vegan Cosmetics Market faces the dual challenge of affordability and performance consistency. Overcoming these concerns is vital to expanding into mainstream retail channels and emerging economies.

Market Opportunities:

Untapped Potential in Emerging Markets with Growing Middle-Class Consciousness of Ethical Beauty

Emerging markets such as Southeast Asia, Latin America, and parts of Africa present untapped opportunities for vegan cosmetics. Rising disposable income and awareness of ethical consumption are driving early demand. Urban millennials and Gen Z are becoming more vocal about sustainability and animal rights. Brands can build awareness through regional influencer partnerships and digital outreach. Local product adaptation and pricing strategies can unlock significant growth. The Vegan Cosmetics Market can scale in these regions with tailored branding and accessible retail distribution. These areas offer room for new entrants and partnerships with ethical beauty startups.

Product Line Diversification into Men’s Grooming and Baby Care Segments Can Widen Market Reach

The market holds strong potential in expanding product portfolios beyond traditional makeup and skincare. Men’s grooming, haircare, and baby care are segments with rising vegan adoption. Consumers seek safe, gentle, and plant-based alternatives across all family categories. Brands can gain competitive edge by targeting underserved niches. Strategic diversification helps reduce dependency on crowded beauty segments. The Vegan Cosmetics Market can enhance its footprint by innovating across new demographic needs. Awareness campaigns, educational content, and trial-based marketing can support product adoption in these extensions.

Market Segmentation Analysis:

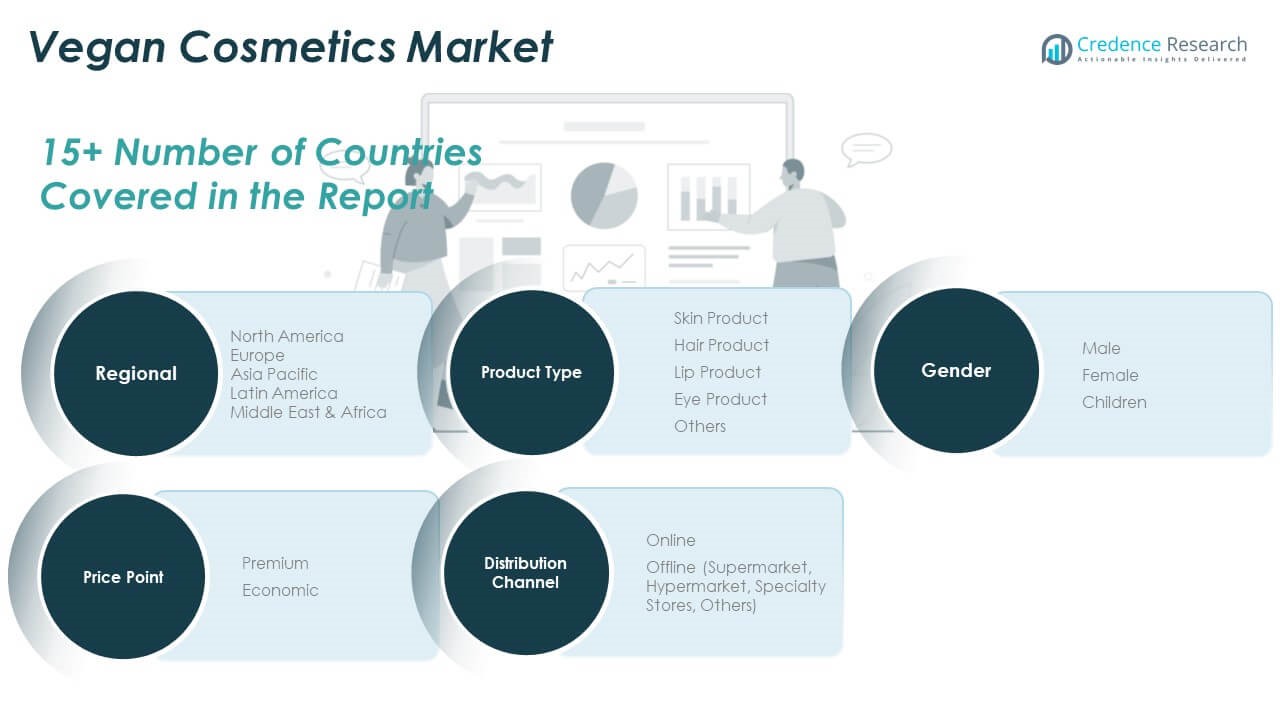

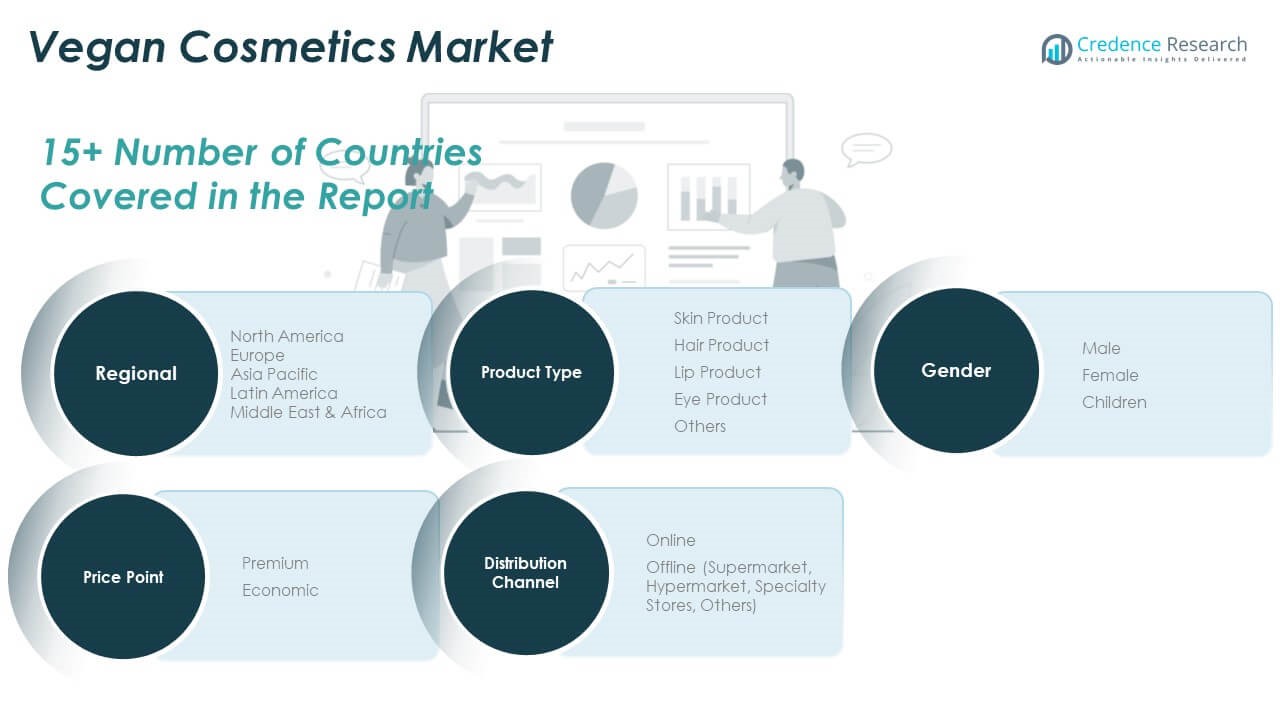

The Vegan Cosmetics Market is segmented

By product type

into skin, hair, lip, eye, and other products, with skin products contributing the largest share due to growing demand for plant-based skincare. Hair and lip products are gaining traction, supported by innovation in vegan formulations and color-safe, toxin-free solutions. Eye products show steady growth, especially in cruelty-free mascaras and eyeliners.

By gender,

the female segment leads the market, driven by strong awareness of ethical beauty and clean-label ingredients. The male segment is expanding steadily, supported by rising interest in grooming and personal care. Children’s vegan cosmetics, though niche, are gaining attention from parents seeking non-toxic and gentle products.

- For example, leading brands like The Body Shop and Milk Makeup are especially popular among female consumers seeking cruelty-free options.

By price point,

the premium segment dominates with high-performing and certified offerings. The economic segment is growing in emerging markets due to accessible pricing strategies.

By distribution channel,

online platforms account for a significant share due to product variety and convenience. Offline sales remain strong through supermarkets, hypermarkets, specialty stores, and other physical outlets. The Vegan Cosmetics Market benefits from both digital engagement and retail visibility.

- For example, DM (Drogerie Markt) in Germany and large retailers like Sephora and Ulta have expanded vegan cosmetic shelf space and in-store signage to anchor visibility for mainstream shoppers.

Segmentation:

By Product Type

- Skin Product

- Hair Product

- Lip Product

- Eye Product

- Others

By Gender

By Price Point

By Distribution Channel

- Online

- Offline

- Supermarket

- Hypermarket

- Specialty Stores

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Vegan Cosmetics Market size was valued at USD 4,333.84 million in 2018 to USD 5,136.39 million in 2024 and is anticipated to reach USD 8,365.08 million by 2032, at a CAGR of 6.4% during the forecast period. North America holds the highest market share at 27.91% in 2024. It leads the global market due to a well-established beauty industry, high consumer awareness, and strong retail presence. Regulatory support for cruelty-free and sustainable products continues to strengthen consumer trust. Major brands in the region emphasize transparency, clean labeling, and inclusive product development. The U.S. and Canada have seen rapid expansion in vegan skincare and makeup across e-commerce and brick-and-mortar stores. Millennials and Gen Z consumers drive market momentum through ethical purchasing habits. Influencer-led product endorsements play a key role in accelerating adoption. The region also attracts innovation in packaging and biotechnology-driven vegan ingredients.

Europe

The Europe Vegan Cosmetics Market size was valued at USD 5,273.86 million in 2018 to USD 6,161.09 million in 2024 and is anticipated to reach USD 9,631.40 million by 2032, at a CAGR of 5.8% during the forecast period. Europe commands a 33.54% market share in 2024, making it the largest regional contributor. It maintains this lead due to stringent EU regulations against animal testing and growing environmental consciousness. Germany, the UK, and France dominate the regional landscape with a strong presence of certified organic and vegan beauty brands. Consumers are highly informed and place importance on ethical, traceable sourcing. Regional campaigns emphasize sustainable beauty and zero-waste packaging. Local startups and heritage brands alike are launching dedicated vegan lines. Specialty retailers and online platforms cater specifically to vegan consumers. The market remains competitive with innovation driven by plant-derived actives and minimalistic formulations.

Asia Pacific

The Asia Pacific Vegan Cosmetics Market size was valued at USD 3,680.71 million in 2018 to USD 4,630.31 million in 2024 and is anticipated to reach USD 8,347.06 million by 2032, at a CAGR of 7.7% during the forecast period. It accounts for 25.21% of the global market share in 2024, with the fastest growth rate among all regions. Rising urbanization, internet penetration, and adoption of Western beauty standards are fueling demand. South Korea, Japan, China, and India are key markets driving the surge in ethical beauty consumption. K-beauty trends promote clean, transparent, and skin-friendly formulations, many of which align with vegan standards. Regional brands are expanding their portfolios with cruelty-free certifications to attract conscious consumers. Social media platforms and influencer-driven marketing rapidly increase product awareness. Younger consumers lead this shift by demanding transparency and environmentally responsible practices. Investment in R&D and cross-border e-commerce boosts regional competitiveness.

Latin America

The Latin America Vegan Cosmetics Market size was valued at USD 1,037.68 million in 2018 to USD 1,238.01 million in 2024 and is anticipated to reach USD 1,884.30 million by 2032, at a CAGR of 5.5% during the forecast period. It holds a 6.75% share of the global market in 2024. The region is gradually shifting toward ethical consumption due to changing lifestyles and increasing environmental awareness. Brazil and Mexico lead regional adoption, supported by strong natural ingredient availability and evolving consumer preferences. Local brands are entering the vegan space to address rising demand. Certification programs and awareness campaigns are helping demystify vegan claims. Affordability remains a key consideration, prompting brands to create value-based vegan offerings. E-commerce platforms are expanding access to niche brands and products. Partnerships with dermatologists and influencers are shaping market education. Growth is steady but constrained by limited regulatory enforcement and consumer skepticism.

Middle East

The Middle East Vegan Cosmetics Market size was valued at USD 628.71 million in 2018 to USD 712.67 million in 2024 and is anticipated to reach USD 1,058.16 million by 2032, at a CAGR of 5.2% during the forecast period. It represents 3.87% of the global market share in 2024. The market is gaining traction through urban centers like Dubai, Riyadh, and Abu Dhabi, where consumers are adopting global beauty trends. Demand is driven by affluent millennials and expatriates seeking halal, ethical, and vegan products. Retailers are stocking certified vegan brands to meet shifting preferences. The region emphasizes clean beauty aligned with religious and cultural values. Social media influences consumer awareness and shapes product perceptions. Growth is moderated by price sensitivity and limited vegan-specific product ranges. International brands are entering the market with localized campaigns. The segment has potential but requires broader education and regulatory clarity.

Africa

The Africa Vegan Cosmetics Market size was valued at USD 305.20 million in 2018 to USD 492.41 million in 2024 and is anticipated to reach USD 685.42 million by 2032, at a CAGR of 3.8% during the forecast period. It holds the smallest share at 2.68% of the global market in 2024. The market is in its early development stage, with limited access to certified vegan brands. Demand is slowly emerging in urban centers like Johannesburg, Nairobi, and Lagos. Rising awareness of skin health, ethical consumption, and clean ingredients is influencing younger demographics. Local entrepreneurs are launching natural beauty products with vegan positioning. Barriers include affordability, low brand penetration, and limited distribution networks. Online retail offers potential to bridge accessibility gaps. The Vegan Cosmetics Market in Africa can grow with targeted education and inclusion of culturally relevant ingredients. Regional initiatives and partnerships could support market awareness and trust.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amway Corporation

- Estée Lauder Companies Inc.

- Groupe Rocher

- L’Occitane Group

- L’Oréal S.A.

- LVMH Group

- MuLondon

- Pacifica Beauty

- l.f. Cosmetics Company

- Urban Decay

- Nature’s Gate

- TJS India

- Seraphine Botanicals

- Hera Beauty Ltd.

- Herrco Cosmetics

Competitive Analysis:

Leading companies in the Vegan Cosmetics Market include industry giants and specialized vegan beauty brands. They compete through product innovation, cruelty‑free certification, sustainable packaging, and transparent sourcing. It faces strong rivalry from both established global players and niche brands that differentiate by unique formulations or ethical branding. Companies invest heavily in marketing campaigns that leverage influencer partnerships, social media presence, and consumer reviews. Retail channels span premium beauty retailers, online marketplaces, and specialty eco-beauty stores. Competitive pressure drives continuous product upgrades, broader shade ranges, and inclusive skincare offerings. It maintains competitiveness by targeting eco-conscious consumers and flexibility in regional adaptation. Brands that deliver consistent quality while maintaining ethical credentials enjoy higher loyalty. Fast followers often capitalize on viral trends to capture share from market leaders. Consumer trust hinges on visible certifications and verified ingredient claims.

Recent Developments:

- In June 2025, Amway Corporation announced a significant expansion of its partnership with South Korea-based HEM Pharma to drive innovation in microbiome health. This collaboration leverages one of the world’s largest gut microbiome databases, aiming to advance probiotic development and deliver personalized solutions globally. The deal signals Amway’s commitment to innovation in health, skincare, and personalized wellness offerings.

- In March 2025, Estée Lauder Companies Inc. entered into a partnership with India’s Ministry of Commerce and Industry (Startup India) to support innovation and entrepreneurship in India’s beauty sector.

- In January 2025, Groupe Rocher began the process of divesting from its children’s fashion and home products divisions, including Petit Bateau, to further invest in and focus on its core skincare, beauty, and wellness brands such as Yves Rocher and Arbonne.

- In Jan 2024, The Body Shop launched a new fully vegan makeup line, marking a significant expansion of its vegan-certified offerings. This launch positions The Body Shop as the world’s first global beauty brand to offer 100% vegan product formulations across its entire portfolio, reflecting the rising consumer demand for ethical, cruelty-free options in the cosmetics industry.

Market Concentration & Characteristics

The Vegan Cosmetics Market exhibits moderate concentration with a mix of well-established global brands and agile niche players. It features several dominant competitors with strong brand identity, wide distribution networks, and significant R&D budgets. Niche firms capture attention through specialized clean formulations, localized ingredients, and tight-knit ethical communities. It operates on diverse business models—premium, direct-to-consumer, subscription-based, and mass-retail. Brand loyalty remains high among ethical consumers when transparency and certification match claims. It demands consistency in ongoing ingredient sourcing and traceability across supply chains. Distribution spans brick-and-mortar retail, digital platforms, and omnichannel strategies, enabling wide accessibility. Investment in technology and sustainable practices gives firms competitive edge while maintaining credibility.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Gender, Price Point and Distribution Channel, It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Consumer preference for cruelty-free and ethically sourced products will drive steady demand across skincare, makeup, and personal care segments.

- Innovation in plant-based and lab-grown alternatives will expand formulation capabilities and improve product performance.

- Brands will increasingly integrate sustainable packaging and carbon-neutral operations to strengthen market positioning.

- Social media influence and celebrity endorsements will continue to shape consumer behavior and promote niche vegan offerings.

- Expansion into men’s grooming, baby care, and haircare will diversify product portfolios and attract new demographics.

- Certification and labeling transparency will play a critical role in building consumer trust and brand loyalty.

- Emerging markets will witness rising adoption driven by urbanization, digital outreach, and growing ethical awareness.

- E-commerce and direct-to-consumer models will remain dominant channels for product visibility and personalized marketing.

- Collaborative efforts between startups and established brands will accelerate innovation and global market penetration.

- Regulatory alignment and clearer definitions of vegan labeling will support market integrity and long-term growth.