Market Overview

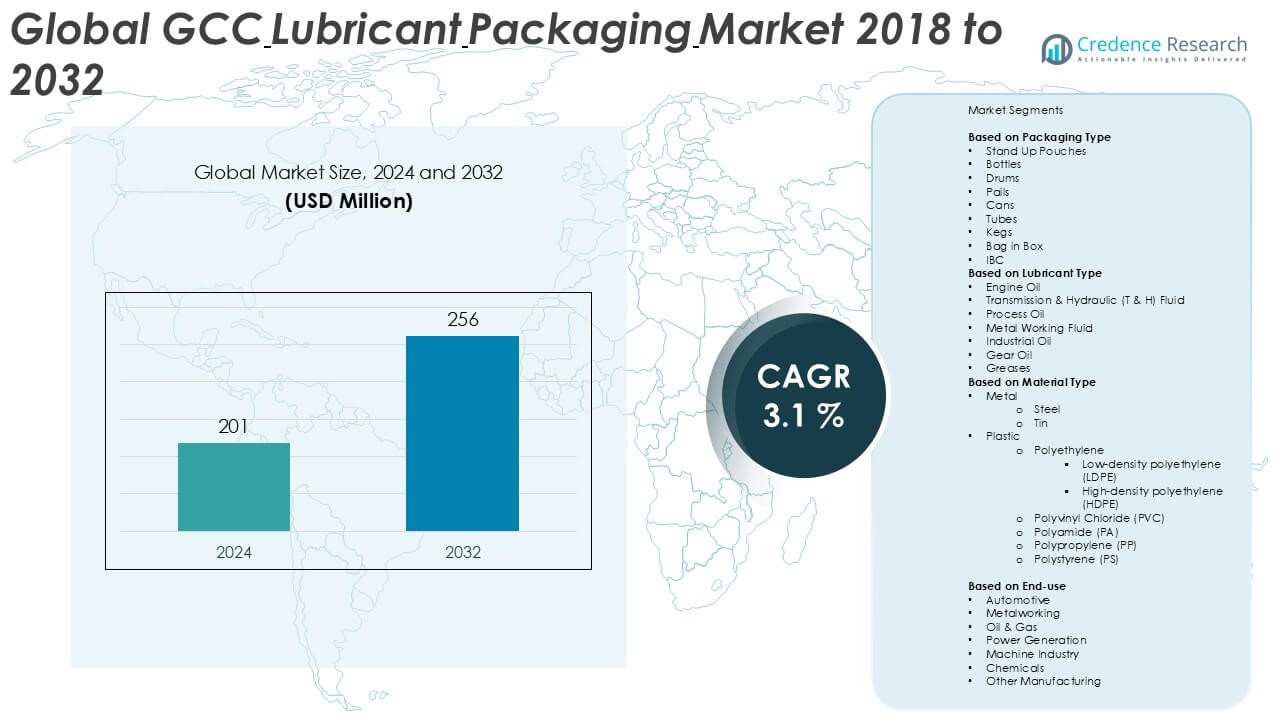

The GCC Lubricant Packaging market size was valued at USD 201 million in 2024 and is anticipated to reach USD 256 million by 2032, at a CAGR of 3.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Lubricant Packaging Market Size 2024 |

USD 201 Million |

| GCC Lubricant Packaging Market, CAGR |

3.1% |

| GCC Lubricant Packaging Market Size 2032 |

USD 256 Million |

The GCC lubricant packaging market features several prominent players, including Mold-Tek Packaging Ltd, DUPLAS AL SHARQ L.L.C, Saudi Can Manufacturing Company Ltd, Neelkamal Plastics Factory LLC, and Al Watania Plastics. These companies lead the market through robust production capabilities, a diverse product portfolio, and strong regional distribution networks. Mold-Tek and DUPLAS AL SHARQ have gained traction through innovation in plastic packaging, while Saudi-based firms like Zamil Plastics Industries Ltd and Saudi Plastic Factory benefit from proximity to large-scale lubricant producers. The Kingdom of Saudi Arabia dominates the regional market with a commanding 41.5% share in 2024, driven by its expansive automotive, industrial, and oil & gas sectors. The United Arab Emirates follows, supported by strong export infrastructure and industrial development. Together, these companies and regions shape the competitive and geographical core of the GCC lubricant packaging industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The GCC lubricant packaging market was valued at USD 201 million in 2024 and is projected to reach USD 256 million by 2032, growing at a CAGR of 3.1% during the forecast period.

- Market growth is primarily driven by the expanding automotive and industrial sectors, coupled with national diversification initiatives that increase lubricant demand across construction, manufacturing, and power generation.

- A key trend is the shift toward recyclable and sustainable packaging materials, with increasing adoption of HDPE and flexible formats like stand-up pouches and bag-in-box solutions for cost and environmental efficiency.

- The market is moderately fragmented, with players like Mold-Tek Packaging Ltd, Saudi Can Manufacturing Company Ltd, and DUPLAS AL SHARQ L.L.C competing through product innovation, regional partnerships, and capacity expansion.

- Saudi Arabia leads the market with a 41.5% share, followed by the UAE at 25%; segment-wise, bottles dominate the packaging type, and engine oil accounts for the largest share by lubricant type.

Market Segmentation Analysis:

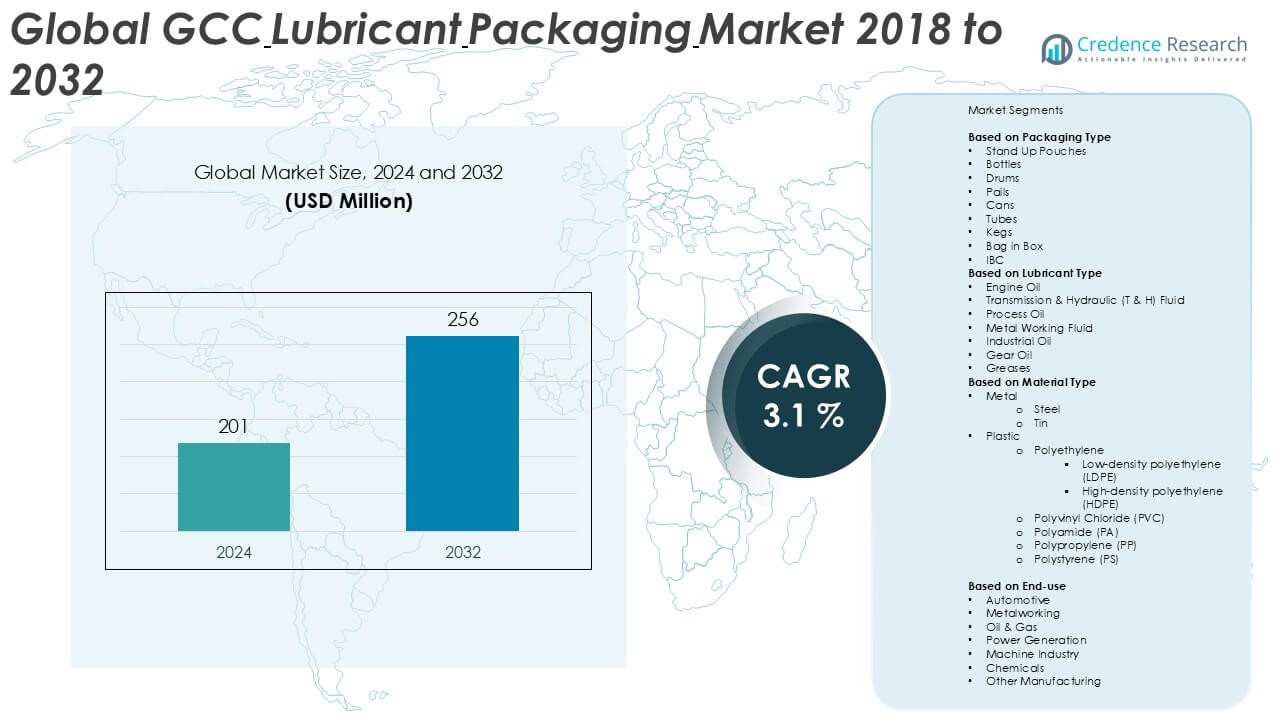

By Packaging Type

In the GCC lubricant packaging market, bottles dominate the packaging type segment, accounting for the largest market share in 2024. Their popularity stems from their convenience, leak-proof design, and compatibility with both consumer and industrial applications. Bottles offer ease of storage, transport, and controlled dispensing, making them the preferred choice for automotive and industrial lubricant products. While stand-up pouches and bag-in-box formats are gaining traction due to their lightweight nature and lower environmental footprint, the rigid structure and familiarity of bottles continue to drive their dominance, especially in retail and automotive servicing sectors across the region.

- For instance, Mold-Tek Packaging Ltd operates over 11 manufacturing plants and has an in-house tool room with 80+ injection molding machines that produce over 25 million lubricant packaging containers annually, ensuring wide availability and quality consistency.

By Lubricant Type

Engine oil represents the dominant sub-segment in the lubricant type category, contributing the highest market share in 2024. This leadership is attributed to the expanding automotive sector in GCC countries, particularly in Saudi Arabia and the UAE, where vehicle ownership and maintenance services are increasing. The demand for efficient engine performance and longer vehicle life cycles sustains the high usage of engine oil. Moreover, growing industrial activities have boosted the consumption of gear oils and industrial oils, though their market share remains secondary to engine oil. The segment’s growth is supported by rising economic diversification efforts and infrastructure development.

- For instance, Saudi Aramco’s Luberef refinery produces over 600,000 metric tons of base oils annually, a critical input for engine oil, demonstrating the segment’s scale and integration within the region’s industrial framework.

By Material Type

Plastic remains the dominant material in the GCC lubricant packaging market, with high-density polyethylene (HDPE) leading the sub-segment with the largest market share. HDPE is favored for its durability, chemical resistance, and suitability for various lubricant viscosities. It is widely used in the manufacturing of bottles, pails, and drums. Its lightweight nature and lower production costs further enhance its appeal for both manufacturers and end-users. Although metal containers like steel and tin are still used in industrial applications, the cost-efficiency and design flexibility of plastic materials, particularly HDPE and polypropylene, are driving the segment’s dominance and growth.

Key Growth Drivers

Expanding Automotive and Industrial Sectors

The GCC lubricant packaging market benefits significantly from the steady expansion of the region’s automotive and industrial sectors. Rapid urbanization, increased vehicle ownership, and robust investments in infrastructure and manufacturing are driving the demand for lubricants and, consequently, their packaging. Saudi Arabia and the UAE, in particular, are witnessing a surge in automotive servicing and heavy machinery use, both of which require efficient lubricant solutions. This growth directly fuels the need for durable, convenient, and cost-effective packaging solutions to support rising consumption across key sectors.

- For instance, Zamil Plastics Industries Ltd has a production capacity exceeding 4,500 tons of plastic components annually, much of which supports automotive and industrial lubricant packaging needs in the KSA.

Government-Led Economic Diversification Initiatives

National development strategies like Saudi Vision 2030 and the UAE’s industrial expansion plans are encouraging economic diversification beyond oil. These initiatives boost non-oil industries, including power generation, chemicals, and manufacturing, which heavily depend on industrial lubricants. As these sectors grow, the demand for high-performance packaging capable of preserving lubricant quality and extending product shelf life also increases. This macroeconomic push provides consistent support for lubricant consumption, thereby creating new opportunities for packaging manufacturers across the GCC to expand and innovate.

- For instance, Al Watania Plastics has invested in over 150 extrusion and molding machines, with operations supporting lubricant packaging used in Saudi Arabia’s growing manufacturing and chemical industries.

Technological Advancements in Packaging Materials

Innovations in packaging materials, particularly lightweight, durable plastics such as HDPE and PP, have played a pivotal role in market growth. These materials offer better barrier properties, cost-efficiency, and environmental compliance. Enhanced design technologies also enable manufacturers to produce tamper-evident, ergonomic, and recyclable packaging. Such advancements meet the rising demand for safety, sustainability, and functionality in lubricant packaging. The ongoing development of flexible packaging and smart labeling further strengthens the value proposition, enabling brands to improve product handling, traceability, and appeal in competitive markets.

Key Trends & Opportunities

Shift Toward Sustainable and Recyclable Packaging

Sustainability has emerged as a critical trend in the GCC lubricant packaging market. Environmental regulations and increasing corporate responsibility are driving the shift toward recyclable and eco-friendly materials. Manufacturers are investing in biodegradable polymers, reusable container systems, and post-consumer recycled plastics. This trend is not only aligned with global climate goals but also responds to growing consumer and industrial demand for greener solutions. The focus on circular economy practices presents opportunities for packaging companies to differentiate through innovation and sustainable product offerings.

- For instance, Duplas Al Sharq L.L.C incorporates over 30% post-consumer recycled content in select lubricant containers, with a production output surpassing 50 million plastic units annually.

Rising Adoption of Flexible Packaging Formats

Flexible packaging solutions like stand-up pouches and bag-in-box formats are gaining popularity due to their cost-effectiveness, reduced material usage, and easier logistics. These formats are especially attractive for small and medium-sized lubricant suppliers targeting B2B distribution. Their lightweight structure reduces transportation costs, while their adaptability suits various lubricant types. Although rigid packaging remains dominant, the gradual transition toward flexible options opens new market segments and appeals to customers seeking space-saving, eco-conscious alternatives, particularly in sectors prioritizing convenience and efficient supply chains.

- For instance, First Press Plastic Moulders has deployed over 20 pouch-forming machines with an annual output of 18 million flexible units, supporting regional lubricant producers shifting toward compact and efficient packaging formats.

Key Challenges

Fluctuating Raw Material Prices

The GCC lubricant packaging market is sensitive to volatility in raw material prices, particularly plastics and metals. These fluctuations, driven by global supply chain disruptions, crude oil price shifts, and geopolitical tensions, affect production costs and profit margins for packaging manufacturers. High dependency on imported raw materials adds further strain, making it difficult to maintain pricing consistency. Manufacturers are often forced to pass on the costs to end-users, potentially reducing demand and competitiveness in a price-sensitive market environment.

Regulatory Compliance and Environmental Constraints

Growing environmental awareness and the introduction of stringent packaging waste regulations across the GCC pose a compliance challenge. Governments are implementing policies to reduce plastic usage, limit landfill waste, and encourage recycling. While these regulations promote sustainability, they also demand significant investment in research, innovation, and process upgrades for packaging firms. Smaller players may struggle to meet these evolving standards, creating a barrier to entry or expansion and increasing pressure on existing businesses to adapt quickly and efficiently.

Competition from Local and International Players

The lubricant packaging market in the GCC is highly competitive, with both regional manufacturers and global packaging giants vying for market share. International companies often have advanced technology, broader product portfolios, and stronger supply chain networks. Local players, meanwhile, compete through pricing and regional customization. This intense competition puts pressure on margins and limits growth for smaller or new entrants. To remain viable, companies must focus on innovation, quality, and strategic partnerships to maintain differentiation in a crowded and maturing market.

Regional Analysis

Kingdom of Saudi Arabia (K.S.A)

Saudi Arabia held the largest market share in the GCC lubricant packaging market in 2024, accounting for over 40% of the regional demand. This dominance is driven by the country’s extensive automotive sector, expanding industrial base, and growing infrastructure projects under Vision 2030. The high consumption of lubricants across manufacturing, construction, and transportation sectors sustains demand for durable packaging formats such as bottles, drums, and pails. Additionally, government-backed industrial development and foreign investment in downstream industries continue to boost lubricant usage, reinforcing the country’s leadership position in the regional packaging market.

United Arab Emirates (U.A.E)

The United Arab Emirates captured around 25% of the GCC lubricant packaging market in 2024, positioning it as the second-largest market in the region. The country’s advanced logistics infrastructure, growing automotive aftermarket, and robust industrial base contribute significantly to the demand for lubricant packaging. Dubai and Abu Dhabi, in particular, serve as commercial hubs, fostering lubricant trade and distribution. The U.A.E. also emphasizes sustainability, encouraging the use of recyclable plastic packaging and eco-friendly solutions. These factors collectively enhance the country’s role as a critical contributor to the growth and innovation of the regional lubricant packaging industry.

Kuwait

Kuwait accounted for approximately 10% of the GCC lubricant packaging market share in 2024. The country’s oil and gas sector, coupled with a recovering automotive industry, supports the stable demand for lubricants and their packaging. Industrial lubricants are commonly used in refinery and petrochemical operations, driving the need for durable packaging solutions like steel drums and IBCs. While the market size is relatively smaller than Saudi Arabia and the U.A.E., Kuwait’s efforts to diversify its economy and invest in infrastructure development are expected to create moderate growth opportunities in the lubricant packaging sector over the forecast period.

Qatar

Qatar represented close to 9% of the GCC lubricant packaging market share in 2024. The country’s focus on industrial growth, along with its active oil and gas operations, underpins consistent demand for lubricant packaging, particularly in formats like pails, drums, and cans. The construction boom driven by national development initiatives post-FIFA World Cup 2022 has further accelerated lubricant consumption. Additionally, the government’s emphasis on sustainability has led to increased interest in recyclable plastic packaging. While smaller in size, Qatar remains an important contributor to the regional market, especially in industrial and heavy machinery lubricant applications.

Bahrain

Bahrain held nearly 8% of the GCC lubricant packaging market in 2024. Though the smallest among the major Gulf economies, Bahrain’s active automotive servicing sector and expanding industrial activities create a stable demand for lubricant products. Bottles and tubes are widely used in consumer-facing automotive lubricants, while drums and cans support small-scale industrial requirements. The government’s efforts to strengthen the manufacturing and logistics sectors under its Economic Vision 2030 provide a foundation for future growth. However, limited scale and higher reliance on imports constrain Bahrain’s ability to compete with larger regional players in packaging innovation and volume.

Oman

Oman accounted for about 8% of the GCC lubricant packaging market share in 2024. The country’s demand is primarily driven by its logistics sector, industrial expansion, and automotive maintenance market. Lubricant consumption in seaport operations, mining, and manufacturing supports the steady need for various packaging types, including kegs, pails, and HDPE bottles. Oman’s efforts to diversify its economy and reduce dependency on oil revenue have led to increased investments in downstream sectors. While the market is moderate in size, Oman’s strategic location and ongoing infrastructure projects position it as a key emerging player within the regional packaging landscape.

Market Segmentations:

By Packaging Type

- Stand Up Pouches

- Bottles

- Drums

- Pails

- Cans

- Tubes

- Kegs

- Bag in Box

- IBC

By Lubricant Type

- Engine Oil

- Transmission & Hydraulic (T & H) Fluid

- Process Oil

- Metal Working Fluid

- Industrial Oil

- Gear Oil

- Greases

By Material Type

- Metal

- Plastic

- Polyethylene

- Low-density polyethylene (LDPE)

- High-density polyethylene (HDPE)

- Polyvinyl Chloride (PVC)

- Polyamide (PA)

- Polypropylene (PP)

- Polystyrene (PS)

By End-use

- Automotive

- Metalworking

- Oil & Gas

- Power Generation

- Machine Industry

- Chemicals

- Other Manufacturing

By Region

- Kingdom of Saudi Arabia (K.S.A)

- United Arab Emirates (U.A.E)

- Kuwait

- Qatar

- Bahrain

- Oman

Competitive Landscape

The competitive landscape of the GCC lubricant packaging market is characterized by a mix of regional and international players competing on product quality, material innovation, and cost efficiency. Companies such as Mold-Tek Packaging Ltd, DUPLAS AL SHARQ L.L.C, and Neelkamal Plastics Factory LLC play a significant role in delivering high-volume, durable plastic packaging solutions across the region. Local manufacturers like Saudi Can Manufacturing Company Ltd, Zamil Plastics Industries Ltd, and Al Watania Plastics hold strong market positions in the Kingdom of Saudi Arabia due to their established distribution networks and tailored offerings for the domestic industrial sector. Firms are increasingly focusing on sustainability, investing in recyclable and lightweight packaging formats to align with regulatory trends and consumer preferences. Strategic partnerships, product customization, and expansion of manufacturing capabilities are key strategies being employed to gain competitive advantage. The market remains moderately fragmented, with innovation, cost leadership, and customer service acting as key differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Al Watania Plastics

- Mold-Tek Packaging Ltd

- DUPLAS AL SHARQ L.L.C

- Zamil Plastics Industries Ltd

- First Press Plastic Moulders

- Saudi Can Manufacturing Company Ltd

- National Plastic Factory

- Neelkamal Plastics Factory LLC

- Arabian Gulf Manufacturers Ltd

- Rising Plastics Industry LLC

- Saudi Plastic Factory

- Siddco Plastics Industries Ltd

- Eterna Plastics

- Pampa Industries International (Corp)

Recent Developments

- In March 2023, Al Ain Water, a major water provider in the United Arab Emirates, created a new water container made of recycled polyethylene terephthalate (rPET). Because it requires 75% less energy to produce than virgin PET and emits 75% less carbon dioxide during manufacture, recycled PET has a better ecological balance than glass and single-use aluminum cans.

- In September 2022, KeryasPaper Industry LLC announced to set up of their upcoming Kraft liner project in the United Arab Emirates with a capacity of 200,000 Metric Ton Per Annum (MTPA) at an investment of USD 40 million for the pulp and paper manufacturing unit.

- In August 2022, Symphony Environmental Solutions Plc, a company that makes plastic products smarter, safer, and more sustainable, announced a production agreement between the firm and EcobatchPlastic Factory in the United Arab Emirates. The production of Ecobatchplastic factory’s biodegradable d2w masterbatch is covered under this Agreement, primarily for supplying masterbatches to manufacturers of rigid plastic packaging products in the GCC.

Market Concentration & Characteristics

The GCC Lubricant Packaging Market demonstrates moderate market concentration, with a mix of regional and international players competing for share. It includes key participants such as Saudi Can Manufacturing Company, DUPLAS AL SHARQ L.L.C, Mold-Tek Packaging Ltd, and Al Watania Plastics, each offering a broad range of packaging solutions tailored to industrial and automotive lubricant needs. It features a strong preference for rigid plastic formats, particularly HDPE bottles and drums, due to their durability, cost-efficiency, and compatibility with high-volume applications. Flexible packaging formats such as stand-up pouches are gaining attention for their lightweight nature and lower environmental impact. It operates in a price-sensitive environment where manufacturers prioritize volume efficiency, material quality, and compliance with emerging sustainability regulations. It remains heavily influenced by regional economic diversification and industrial expansion, especially in Saudi Arabia and the UAE, which together account for over 65% of the market share. It presents stable long-term prospects supported by consistent lubricant demand and evolving packaging standards.

Report Coverage

The research report offers an in-depth analysis based on Packaging Type, Lubricant Type, Material Type, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising lubricant consumption across automotive and industrial sectors.

- Demand for sustainable and recyclable packaging solutions will increase due to tightening environmental regulations.

- HDPE bottles will continue to dominate, but flexible packaging formats will gain higher adoption.

- Technological advancements in barrier materials and lightweight designs will enhance packaging performance.

- Saudi Arabia and the UAE will remain the leading regional markets due to strong industrial activity.

- Local manufacturers will expand capacity to meet growing domestic and export demand.

- Strategic partnerships between packaging firms and lubricant producers will strengthen supply chain efficiency.

- Regulatory shifts toward circular economy practices will influence packaging design and material selection.

- Digital printing and smart packaging solutions may emerge to support branding and traceability.

- Competitive pressure will encourage cost optimization and innovation among regional players.