Market Overview:

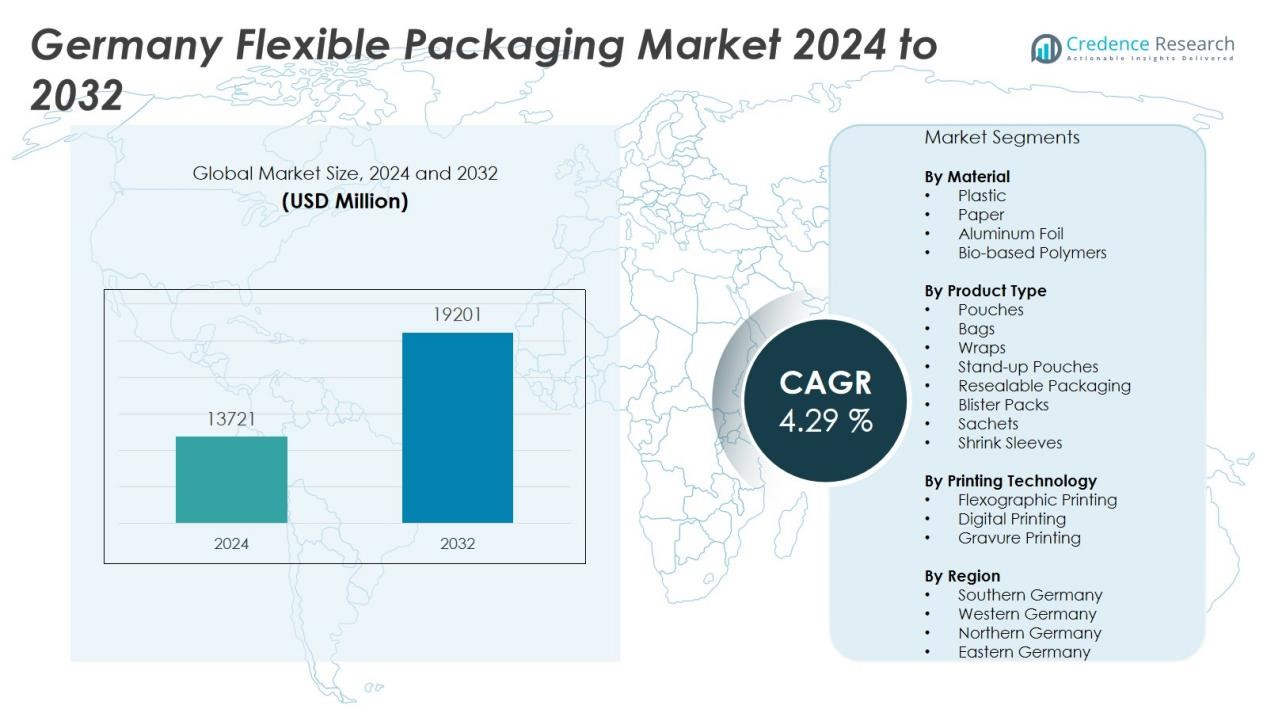

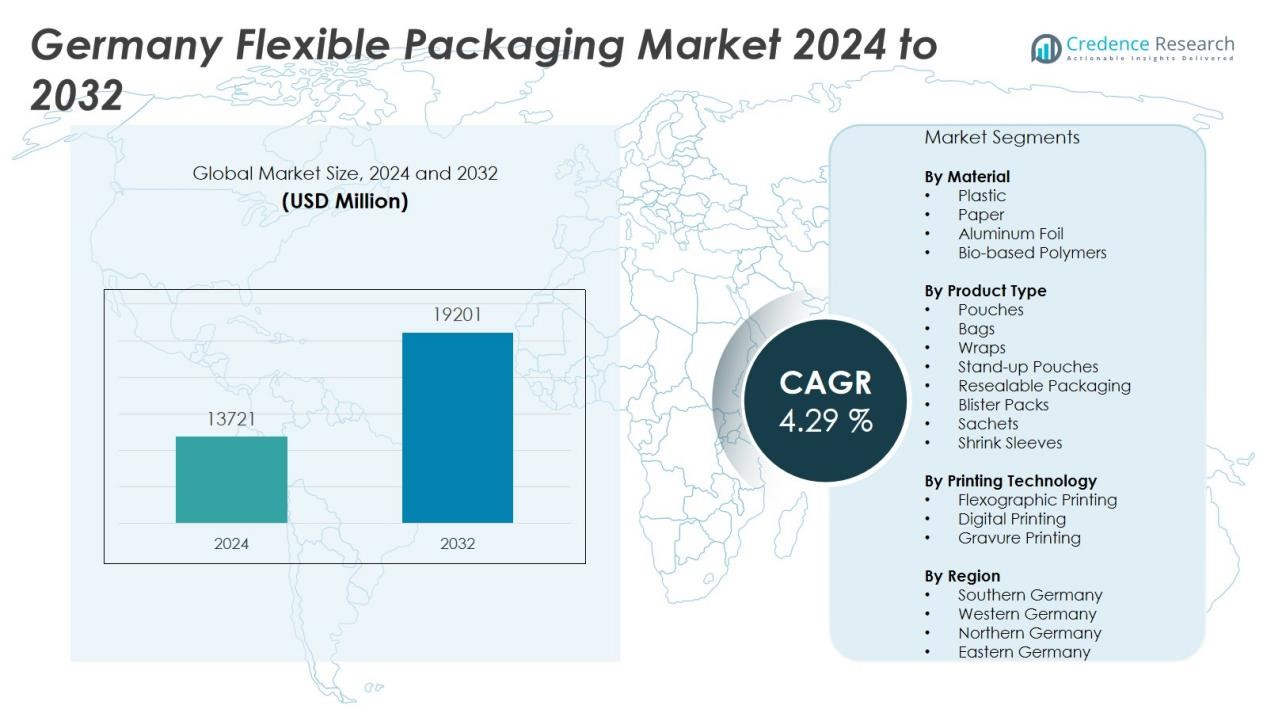

The Germany flexible packaging market size was valued at USD 13721 million in 2024 and is anticipated to reach USD 19201 million by 2032, at a CAGR of 4.29 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Flexible Packaging Market Size 2024 |

USD 13721 Million |

| Germany Flexible Packaging Market, CAGR |

4.29 % |

| Germany Flexible Packaging Market Size 2032 |

USD 19201 Million |

Growth in Germany’s flexible packaging market is fueled by rising consumer demand for convenient, portable, and resealable packaging options. Heightened focus on reducing food waste, regulatory emphasis on recyclability, and increased e-commerce activity further accelerate adoption of flexible packaging solutions. Manufacturers develop advanced barrier films and digital printing technologies, enabling superior product protection and brand customization.

Regionally, Germany leads the flexible packaging market in Europe due to its advanced manufacturing infrastructure, strong presence of global and domestic packaging firms such as Constantia Flexibles, Printpack, Sealed Air, ProAmpac, Avery Dennison, RPC Group, Mondi, and Berry Global, and high standards for product quality and safety. The country’s strategic location and well-established logistics network support exports across the European Union. Germany’s ongoing sustainability initiatives and commitment to circular economy principles position it as a benchmark for innovation and regulatory compliance in the flexible packaging sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany flexible packaging market reached USD 13,721 million in 2024 and is projected to hit USD 19,201 million by 2032.

- Rising demand for convenient, portable, and resealable packaging options accelerates market growth across food, beverage, and personal care sectors.

- Strict sustainability regulations and strong R&D investments drive the shift to recyclable, compostable, and bio-based materials.

- Advanced barrier films and digital printing technologies enable longer shelf life, enhanced product protection, and brand differentiation.

- Germany holds 26% market share in the European flexible packaging sector, with leadership from firms like Constantia Flexibles, Mondi, and Berry Global.

- Southern and western regions account for 54% of domestic market share, while northern and eastern regions contribute 20%, fueled by e-commerce and emerging industries.

- Challenges include complex regulatory frameworks, high compliance costs, and limited recycling infrastructure for multi-layer materials.

Market Drivers:

Growing Demand for Convenient and Sustainable Packaging Solutions Fuels Market Expansion:

The Germany flexible packaging market experiences robust growth due to rising consumer preference for convenience-oriented products. Urbanization and busy lifestyles drive demand for easy-to-use, lightweight, and resealable packaging formats. It caters to on-the-go consumption trends across food, beverage, and personal care segments. Brands prioritize user-friendly designs that enhance product portability and minimize waste.

- For instance, Bischof+Klein launched its new CC-Bag TS flexible packaging for liquids with a filling capacity from 3L up to 10L, addressing bulk food and industrial applications with material-saving design.

Stringent Sustainability Regulations Drive Adoption of Eco-Friendly Materials:

Germany enforces strict environmental regulations that encourage adoption of recyclable, compostable, and bio-based flexible packaging materials. Companies invest in R&D to create packaging that meets high sustainability standards while maintaining product integrity. It aligns with Germany’s national circular economy strategies, reducing landfill waste and supporting resource efficiency. Regulatory pressure accelerates industry-wide transition to greener solutions.

- For instance, BASF’s ecovio® compostable organic waste bags were distributed to over 21,000 households in Berlin during a three-month pilot project. The initiative led to at least a 10% increase in organic waste collection while cutting non-biodegradable plastic contamination in the organic waste stream.

Technological Advancements Enable Enhanced Product Protection and Shelf Appeal:

Advances in material science and digital printing technology support the development of high-barrier, flexible packaging solutions. The Germany flexible packaging market benefits from improved shelf life, superior product protection, and attractive branding. Smart packaging features and personalized graphics increase consumer engagement and help brands differentiate in a competitive marketplace. Innovation in barrier films enables packaging to maintain freshness and quality over extended periods.

Commerce Growth and Changing Retail Dynamics Support Flexible Packaging Uptake:

Rapid expansion of e-commerce channels increases the demand for flexible packaging that ensures product integrity during storage and shipping. It offers durability, tamper-evident features, and adaptability for diverse product categories. The shift towards online grocery and direct-to-consumer models strengthens adoption in both food and non-food sectors. Flexible packaging’s versatility meets evolving logistics requirements and supports efficient supply chain management.

Market Trends:

Sustainable Materials and Circular Economy Initiatives Shape Packaging Innovation:

The Germany flexible packaging market witnesses rapid adoption of sustainable materials and eco-friendly design practices. Manufacturers prioritize recyclable, compostable, and bio-based polymers to meet consumer expectations and comply with environmental mandates. It supports industry-wide efforts to reduce plastic waste, achieve higher recycling rates, and promote circular economy models. Brands introduce mono-material packaging and minimize unnecessary layers to enhance recyclability and resource efficiency. Regulatory frameworks and consumer awareness drive investment in closed-loop systems, where materials are reused or repurposed within the supply chain. Collaboration between packaging firms, resin producers, and retailers accelerates commercialization of green solutions, positioning Germany as a leader in sustainable packaging trends.

- For instance, SÜDPACK’s Multi SV Skin packaging combines a 150µm top film and a 250µm Ecoterm base film, both certified as recyclable, and this novel solution received a recyclability score of 74 out of 100 in testing by Institute cyclos-HTP.

Smart Packaging Technologies and Personalization Enhance Consumer Experience:

Technological advancements propel the integration of smart packaging features in the Germany flexible packaging market, enhancing both functionality and user engagement. Companies adopt digital printing, RFID tags, and QR codes to enable product traceability, real-time information, and anti-counterfeit measures. It empowers brands to deliver interactive experiences, personalized graphics, and limited-edition designs tailored to specific consumer segments. Demand for on-pack communication and authentication grows in food, pharmaceuticals, and premium segments. The shift towards digital transformation supports greater supply chain transparency and supports omnichannel retail strategies. These innovations create new opportunities for brand differentiation and customer loyalty across the German marketplace.

- For instance, Nestlé transformed its Smarties brand packaging by switching 90% of the global product range to recyclable paper packaging, eliminating approximately 250 million plastic packs sold each year, with its Hamburg, Germany plant playing a leading role in this upgrade.

Market Challenges Analysis:

Complex Regulatory Environment Increases Compliance Costs and Market Uncertainty:

The Germany flexible packaging market faces significant challenges due to the country’s evolving and stringent regulatory environment. Frequent changes in packaging waste directives and recycling standards demand continuous adaptation by manufacturers. It increases operational complexity and compliance costs, especially for small and medium-sized enterprises. Companies must regularly update production processes and documentation to align with government mandates. Market participants face uncertainty around upcoming regulations related to single-use plastics and extended producer responsibility schemes. Navigating these complexities requires proactive investment in regulatory expertise and robust quality management systems.

Limited Recycling Infrastructure and Technical Barriers to Sustainable Packaging Adoption:

Limited recycling infrastructure and technological barriers hinder the widespread adoption of advanced sustainable packaging solutions. The Germany flexible packaging market struggles with the compatibility of multi-layered and composite materials in current recycling systems. It poses technical challenges for achieving high recycling rates and meeting ambitious sustainability targets. High costs of developing recyclable alternatives and scaling production further restrict market growth. Manufacturers must address supply chain bottlenecks and invest in new recycling technologies. Overcoming these hurdles is critical for meeting regulatory expectations and consumer demand for environmentally responsible packaging.

Market Opportunities:

Rising Demand for Sustainable Packaging Solutions Creates Growth Opportunities:

The Germany flexible packaging market presents significant opportunities for manufacturers to capitalize on the shift toward sustainable and circular packaging. Increased consumer awareness and government mandates for recyclability encourage brands to adopt bio-based, compostable, and mono-material solutions. It benefits from investments in green technologies and materials innovation, enabling companies to meet strict regulatory standards. Partnerships between packaging suppliers and FMCG brands support rapid commercialization of next-generation sustainable products. Growing demand for plastic-free alternatives opens new avenues in food, beverage, and personal care segments. Companies that proactively embrace eco-friendly practices can strengthen their market position and capture emerging customer segments.

Digitalization and Smart Packaging Technologies Drive Value Creation:

Advances in digitalization, automation, and smart packaging present new growth prospects for the Germany flexible packaging market. The integration of digital printing, RFID, and IoT-enabled features enhances product traceability, authentication, and consumer engagement. It supports the trend toward personalized and interactive packaging experiences, creating differentiation in competitive retail environments. E-commerce expansion increases demand for tamper-evident, durable, and adaptable packaging formats that ensure product safety during transit. Collaborations across the value chain foster the development of intelligent packaging solutions tailored to evolving consumer needs. The market is well positioned to benefit from investments in digital transformation and supply chain optimization.

Market Segmentation Analysis:

By Material:

The Germany flexible packaging market features a strong preference for plastic materials, including polyethylene, polypropylene, and polyethylene terephthalate, due to their versatility and cost efficiency. It also sees growing use of paper, aluminum foil, and bio-based polymers in response to sustainability initiatives and regulatory pressures. Market participants invest in developing recyclable and compostable materials to align with circular economy goals and consumer demand for eco-friendly options.

- For instance, SoBiCo GmbH, a subsidiary of Polymer Group, opened a plant in Pferdsfeld producing 2,000metric tons annually of Plactid® flexible PLA copolymers, made with 75–95% bio-based content, and plans to scale production up to 10,000tons per year—broadening applications of flexible bioplastics beyond packaging to sectors like automotive and textiles.

By Product Type:

Pouches, bags, and wraps dominate the product landscape in the Germany flexible packaging market, offering convenience and extended shelf life across food, beverage, and personal care sectors. Stand-up pouches and resealable packaging formats gain traction due to rising demand for portability and portion control. Specialty products such as blister packs, sachets, and shrink sleeves support innovation in pharmaceutical and industrial applications.

By Printing Technology:

Flexographic printing leads in the Germany flexible packaging market, valued for its high-speed production and ability to accommodate diverse substrates. Digital printing gains popularity for shorter runs and personalized packaging solutions, enabling rapid response to market trends. Gravure printing remains relevant for high-volume, premium packaging with intricate graphics and finishes. The market’s focus on high-quality visual appeal and customization drives ongoing investment in advanced printing technologies.

- For instance, modern gravure presses can print up to 14 meters of film per second, making this technology ideal for large-scale flexible packaging applications requiring consistent, high-quality output.

Segmentations:

By Material:

- Plastic

- Paper

- Aluminum Foil

- Bio-based Polymers

By Product Type:

- Pouches

- Bags

- Wraps

- Stand-up Pouches

- Resealable Packaging

- Blister Packs

- Sachets

- Shrink Sleeves

By Printing Technology:

- Flexographic Printing

- Digital Printing

- Gravure Printing

By Region:

- Southern Germany

- Western Germany

- Northern Germany

- Eastern Germany

Regional Analysis:

Germany :

Germany accounts for 26% market share in the European flexible packaging sector, making it the largest national market in the region. The Germany flexible packaging market benefits from its advanced manufacturing infrastructure, strong supply chain integration, and significant investments in research and development. It serves as a production and export hub for food, pharmaceutical, and personal care packaging, supplying key European and global brands. Strict regulatory frameworks and early adoption of sustainable packaging practices set industry benchmarks across the continent. Local manufacturers lead in innovation, offering cutting-edge barrier films and recyclable materials. The country’s robust distribution network and logistics capabilities support efficient movement of finished products within Europe and abroad.

Southern and Western Regions :

Southern and western regions together represent 54% market share in the Germany flexible packaging market, driven by dense industrial clusters and strong consumer goods production. Major packaging manufacturers, resin suppliers, and FMCG companies operate in cities such as Munich, Stuttgart, and Düsseldorf. These regions benefit from high technology adoption and proximity to automotive, pharmaceutical, and food industry clients. Collaborative networks between research institutes and packaging firms foster advanced materials innovation. High urbanization and purchasing power in these regions boost demand for convenient, premium, and eco-friendly packaging solutions. Logistics hubs in southern and western Germany enable fast distribution across the country and the European Union.

Northern and Eastern Regions:

Northern and eastern Germany contribute 20% market share, supported by the growth of e-commerce, logistics, and emerging manufacturing sectors. Cities such as Hamburg and Leipzig act as strategic entry points for international trade and facilitate efficient movement of packaged goods. The regions focus on developing smart packaging technologies and digitalization in response to changing retail trends. Investment in modern infrastructure and government support attract new entrants to the packaging industry. The market benefits from evolving consumer preferences and a growing presence of small and medium-sized enterprises. Northern and eastern Germany offer expansion opportunities for companies seeking to tap into less saturated and fast-developing markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Constantia Flexibles

- Printpack

- Sealed Air

- ProAmpac

- Avery Dennison

- RPC Group

- Mondi

- Berry Global

- Amcor

- Crown Holdings

- Scholle IPN

Competitive Analysis:

The Germany flexible packaging market features intense competition among global and regional players, with key companies such as Constantia Flexibles, Printpack, Sealed Air, ProAmpac, Avery Dennison, RPC Group, Mondi, and Berry Global leading industry innovation. It benefits from the presence of these established firms, which invest in advanced manufacturing processes, sustainable materials, and product customization to strengthen their market positions. Strategic partnerships, mergers, and acquisitions remain common, enabling companies to expand their product portfolios and access new customer segments. The market rewards firms that demonstrate agility in responding to regulatory shifts and consumer preferences for eco-friendly solutions. Continuous investment in R&D and digital printing technologies allows these companies to set benchmarks for quality and operational efficiency. Strong competition drives a relentless focus on cost optimization, service reliability, and sustainable value creation across all major flexible packaging segments in Germany.

Recent Developments:

- In May 2025, Constantia Flexibles launched EcoVerHighPlus, a recyclable-ready mono PP laminate for coffee packaging, developed in partnership with Delica, part of Migros Industrie.

- In April 2025, Constantia Flexibles announced a strategic partnership with T-Systems to modernize their IT infrastructure, an important step in their digital transformation journey

- In May 2025, ProAmpac showcased new fiber-based, sustainable packaging for hot and cold food-to-go applications at the International Dairy Deli Bakery Association (IDDBA) Show

Market Concentration & Characteristics:

The Germany flexible packaging market demonstrates high market concentration, with leading multinational and domestic firms dominating production, distribution, and innovation. Major players include Huhtamaki, Amcor, Mondi, and Constantia Flexibles, supported by a network of specialized SMEs and technology providers. It features a mature value chain, advanced manufacturing infrastructure, and a strong emphasis on sustainability, regulatory compliance, and product quality. Companies in this market prioritize research and development, investing in recyclable materials, high-barrier films, and digital printing technologies. Strategic partnerships between manufacturers, brand owners, and research institutions drive continuous improvement and foster rapid adoption of new solutions. The market’s customer base spans food, pharmaceuticals, personal care, and industrial segments, supporting long-term growth and resilience.

Report Coverage:

The research report offers an in-depth analysis based on Material, Product Type, Printing Technology and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for mono‑material and bio‑based packaging will rise sharply, driven by stricter recyclability standards and brand commitment to sustainability.

- Brands will adopt advanced digital printing and customization options to enhance consumer engagement and premium positioning.

- Collaboration between resin producers, converters, and recycling firms will improve closed‑loop recycling systems and material traceability.

- Smart packaging that integrates QR codes, RFID, and sensor technologies will gain traction in high‑value segments such as pharmaceuticals and fresh foods.

- Investment in automation and Industry 4.0 manufacturing will enhance production efficiency and quality control across the sector.

- E‑commerce growth will accelerate uptake of lightweight, tamper‑evident packaging designed for last‑mile delivery resilience.

- Research into compostable barrier films and renewable feedstock polymers will expand commercial options beyond traditional plastics.

- Packaging firms will partner with retail and FMCG companies to pilot circular‑economy initiatives, boosting brand trust and regulatory compliance.

- SMEs will benefit from digital tools to improve traceability, design flexibility, and supply chain integration.

- Germany will lead Europe in flexible packaging innovation and sustainability practices, with domestic and international firms adopting its standards to maintain competitiveness.