Market Overview:

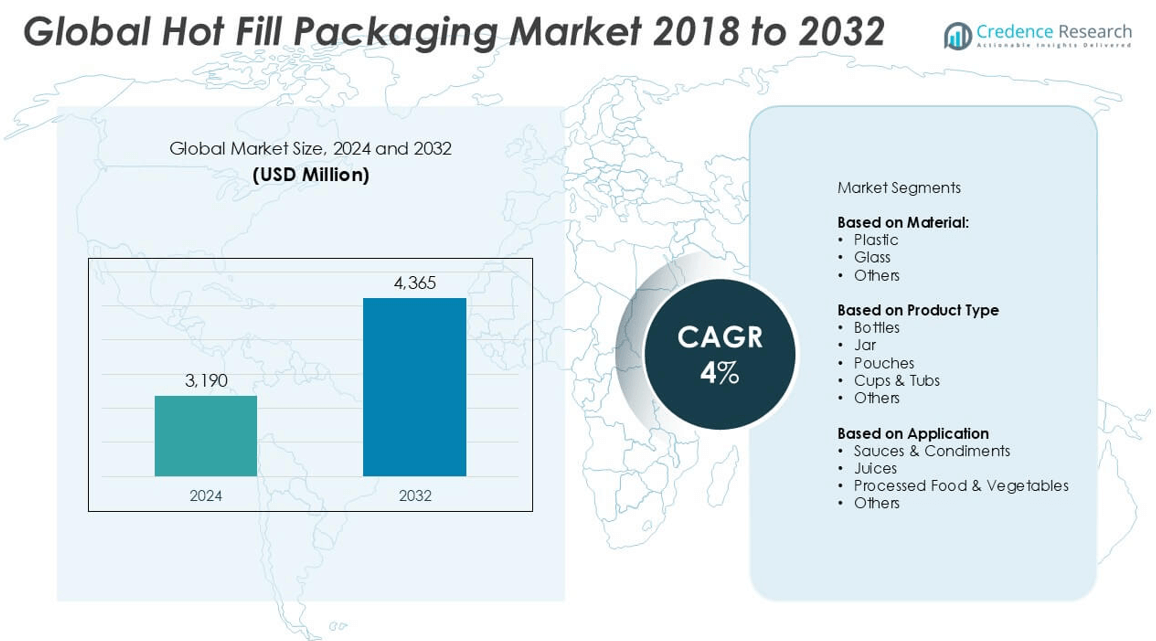

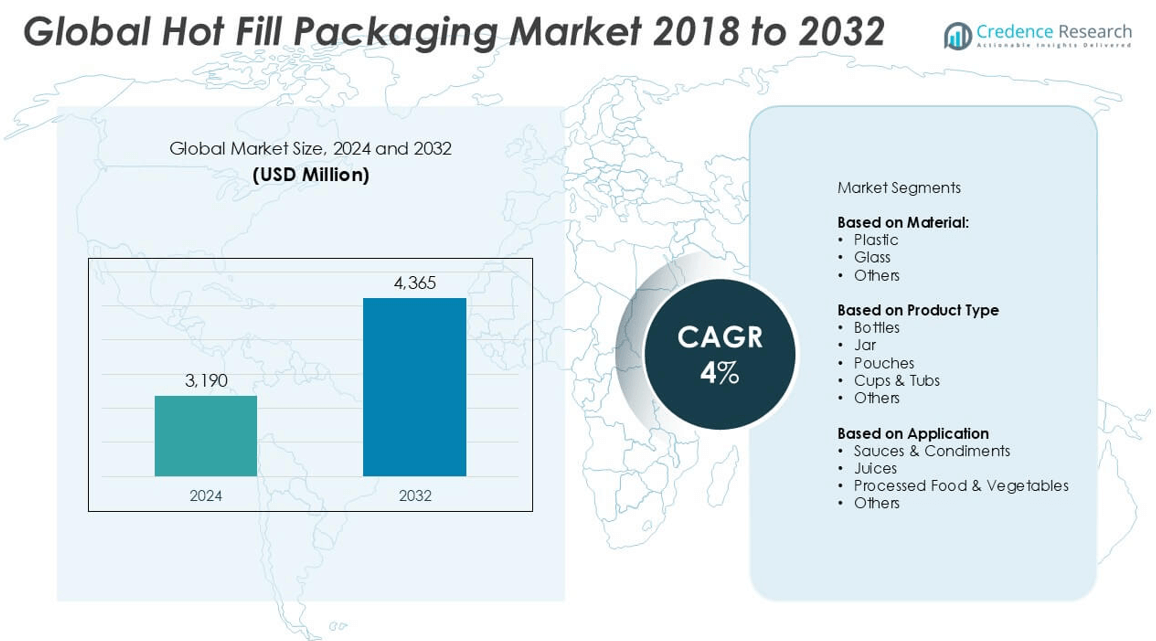

The Hot Fill Food Packaging Market size was valued at USD 29746 million in 2024 and is anticipated to reach USD 40521 million by 2032, at a CAGR of 3.94% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hot Fill Food Packaging Market Size 2024 |

USD 29746 million |

| Hot Fill Food Packaging Market, CAGR |

3.94% |

| Hot Fill Food Packaging Market Size 2032 |

USD 40521 million |

The primary drivers of the Hot Fill Food Packaging Market include the rising consumer preference for ready-to-eat meals, beverages, and other packaged foods, coupled with the growing emphasis on maintaining nutritional value and taste. Additionally, the demand for eco-friendly packaging solutions is pushing manufacturers to adopt sustainable materials such as recyclable plastics and biodegradable options. The growing adoption of hot filling in packaging applications like juices, sauces, soups, and ready-to-drink beverages is also boosting market growth. Furthermore, innovations in packaging technology are enhancing product shelf life and consumer convenience, further stimulating demand.

Regionally, North America dominates the Hot Fill Food Packaging Market, owing to the strong food and beverage manufacturing sector and the high demand for convenience foods. Europe follows closely, driven by stringent food safety regulations and increasing consumer awareness about product quality. The Asia-Pacific region is expected to witness the highest growth rate, fueled by rapid urbanization, rising disposable incomes, and expanding food processing industries.

Market Insights:

- The Hot Fill Food Packaging Market was valued at USD 29,746 million in 2024 and is projected to reach USD 40,521 million by 2032, growing at a CAGR of 3.94%.

- Rising consumer demand for sustainable packaging solutions is driving the adoption of recyclable plastics and biodegradable materials.

- Technological advancements in hot filling machines and packaging materials are enhancing product shelf life and reducing operational costs.

- The increasing preference for ready-to-eat meals and beverages is fueling the demand for hot fill packaging to preserve nutritional value and taste.

- Rapid urbanization and growing disposable incomes in the Asia-Pacific region are contributing to significant market growth.

- North America holds the largest market share at 35%, driven by a robust food and beverage manufacturing sector and strong consumer demand.

- High operational costs and the complexity of meeting strict sustainability regulations are key challenges for market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Convenience Foods

The Hot Fill Food Packaging Market benefits from the growing preference for ready-to-eat meals, beverages, and other packaged foods. Consumers lead increasingly busy lifestyles, prioritizing convenience, which drives demand for products that are easy to store and consume. Hot filling extends shelf life while maintaining the nutritional content and flavor of food and beverages, offering a significant advantage in the fast-moving consumer goods (FMCG) sector. This trend is particularly prominent in sectors like juices, soups, and sauces, which have witnessed higher adoption of hot fill packaging solutions.

Growing Focus on Sustainability

Sustainability has become a critical driver in the Hot Fill Food Packaging Market. Consumers are more aware of environmental issues, pushing manufacturers to explore eco-friendly packaging solutions. The market sees a shift toward recyclable plastics, biodegradable materials, and other sustainable packaging options. This shift reflects the increasing demand for brands to adopt practices that align with consumers’ environmental values, influencing packaging decisions across the food and beverage industry.

- For instance, Suntory’s redesign of Lucozade Energy bottles resulted in an annual reduction of 956 metric tons of new plastic used for packaging.

Technological Advancements in Packaging

Advancements in packaging technologies have contributed significantly to the growth of the Hot Fill Food Packaging Market. Innovations such as improved hot filling machines and the development of advanced packaging materials ensure that products retain their flavor, texture, and nutritional value for longer periods. These technologies also enhance production efficiency, reducing operational costs and ensuring consistency in product quality. The ability to incorporate new features like tamper-evident seals and convenient packaging designs further drives market growth.

- For instance, Thermo Fisher Scientific’s patented Tamper Evident Carton is engineered to remain fully tamperproof at temperatures as low as –80°C, effectively protecting clinical supplies and pharmaceuticals in extreme cold storage environments.

Expanding Food Processing Industries in Developing Regions

The expansion of food processing industries in emerging economies, especially in the Asia-Pacific region, acts as a key driver for the Hot Fill Food Packaging Market. Increased urbanization, rising disposable incomes, and changing consumer preferences are fueling the demand for packaged foods. These regions are experiencing a surge in food and beverage production, necessitating efficient packaging solutions to meet growing demand. Hot fill packaging enables manufacturers to process and distribute products rapidly, benefiting both producers and consumers.

Market Trends:

Shift Toward Eco-friendly and Sustainable Packaging Solutions

A prominent trend in the Hot Fill Food Packaging Market is the increasing demand for sustainable and eco-friendly packaging solutions. Consumers and businesses alike are prioritizing environmental impact, prompting manufacturers to invest in packaging materials that are recyclable, biodegradable, and reduce plastic usage. The market has seen a shift toward biodegradable films, plant-based materials, and recyclable plastics to address growing concerns over waste and environmental degradation. As regulations around packaging sustainability become stricter, food and beverage producers are seeking packaging solutions that align with these mandates, ensuring compliance while meeting consumer demand for eco-conscious products. This trend is expected to continue as both consumer preferences and regulatory pressures push the market toward greener alternatives.

- For instance, DS Smith reached its ambitious milestone in 2025 by removing 1.2billion pieces of plastic from its packaging lines, a goal achieved 16 months ahead of schedule, demonstrating the broad adoption of fiber-based alternatives across 27 countries in Europe and North America.

Innovation in Packaging Design and Technology

Technological advancements in packaging design and filling processes are reshaping the Hot Fill Food Packaging Market. Manufacturers are focusing on innovations that improve product shelf life, packaging efficiency, and consumer convenience. Packaging solutions are becoming more versatile, with features such as tamper-evident seals, easy-to-open designs, and enhanced barrier properties to protect against external contaminants. The development of high-barrier materials that maintain the integrity of food products over longer periods is gaining traction, particularly in beverages and ready-to-eat meals. These innovations improve the overall performance of packaging and ensure that products remain fresh and safe for consumption during transport and storage, contributing to the growing adoption of hot fill packaging across diverse food and beverage applications.

- For instance, Enercon Industries’ induction sealing technology is used by Mendes Gonçalves to hermetically seal 120,000 bottles daily, efficiently protecting against leaks and tampering for their entire range of sauces and condiments.

Market Challenges Analysis:

High Operational Costs and Equipment Investment

A key challenge facing the Hot Fill Food Packaging Market is the high operational costs associated with hot fill processing. The need for specialized equipment and packaging materials that can withstand high temperatures increases capital expenditure for manufacturers. The continuous demand for advancements in packaging technology, while beneficial, also leads to higher maintenance and replacement costs for existing machinery. Smaller manufacturers may struggle to compete with larger players who have the financial capacity to invest in the latest technologies and sustain these higher operational costs. This creates a competitive disparity, limiting growth potential for smaller businesses within the market.

Regulatory Compliance and Sustainability Pressures

The Hot Fill Food Packaging Market faces ongoing pressure to comply with stringent food safety regulations and sustainability initiatives. As governments around the world impose more stringent packaging requirements, manufacturers must adapt their operations to meet these regulations while balancing cost efficiency. The demand for eco-friendly packaging further complicates matters, as businesses must find cost-effective ways to implement sustainable solutions. The transition to recyclable and biodegradable materials can increase production complexity and costs, creating a significant challenge for companies striving to maintain profitability while meeting both regulatory and consumer expectations.

Market Opportunities:

Expansion in Emerging Markets and Growing Urbanization

The Hot Fill Food Packaging Market has significant growth potential in emerging markets, particularly in Asia-Pacific, where rapid urbanization and increasing disposable incomes are driving demand for packaged foods and beverages. As these regions experience shifts in consumer preferences toward convenience foods, there is an opportunity for manufacturers to cater to a larger, more diverse customer base. Local food and beverage producers in these markets are increasingly adopting hot fill packaging to extend product shelf life and meet growing demand for ready-to-eat meals and beverages. This trend presents a unique opportunity for market expansion and the introduction of cost-effective packaging solutions tailored to local needs.

Innovation in Sustainable and Smart Packaging Solutions

There is a growing opportunity within the Hot Fill Food Packaging Market to innovate with sustainable and smart packaging solutions. As consumers become more eco-conscious, the demand for biodegradable, recyclable, and environmentally friendly packaging continues to rise. Smart packaging technologies, such as QR codes for traceability and integrated freshness indicators, offer manufacturers the chance to enhance consumer engagement while improving product safety. Companies investing in sustainable materials and innovative packaging designs can differentiate themselves in a competitive market, attracting environmentally aware consumers and adhering to stricter global sustainability regulations. This trend aligns with industry efforts to meet both regulatory and consumer demands for greener, smarter packaging options.

Market Segmentation Analysis:

By Material

The Hot Fill Food Packaging Market is predominantly driven by plastic materials, with polyethylene terephthalate (PET) and polypropylene (PP) leading the way. These materials offer excellent heat resistance, lightweight properties, and durability, making them ideal for food packaging. PET is especially popular for beverages as it maintains product quality and extends shelf life. In response to growing sustainability concerns, the demand for biodegradable and recyclable plastics is also rising, as manufacturers aim to meet eco-friendly packaging standards.

- For instance, TIPA Corp Ltd has commercialized fully compostable films for food packaging that meet international certifications for home and industrial compostability, ensuring the packaging fully biodegrades in less than 6 months under composting conditions.

By Packaging Format

The market sees significant adoption of both pouches and bottles. Pouches are favored for beverages and ready-to-eat meals due to their convenience, portability, and reduced environmental footprint compared to rigid containers. Bottles, mainly made from PET, continue to dominate the beverage sector, offering superior protection against contamination while ensuring product safety. These formats cater to consumer preferences for easy-to-use, on-the-go packaging solutions, driving growth in the Hot Fill Food Packaging Market.

- For instance, Amcor developed the first-ever spouted pouch made entirely from polyethylene (PE) in partnership with Stonyfield Organic, which reduced over five tons of plastic per 10mm cap used in packaging their YoBaby yogurt line.

By Capacity

In the Hot Fill Food Packaging Market, the small-to-medium capacity range, particularly up to 500ml, leads in popularity. This is driven by the demand for single-serve beverages and ready-to-eat meals, which cater to on-the-go consumers. Larger pack sizes, ranging from 500ml to 2L, are more common in family-sized or bulk packaging for products like sauces and soups. The growing preference for convenience and portion-controlled packaging continues to fuel the demand across different capacity ranges.

Segmentations:

By Material

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Biodegradable Plastics

- Recyclable Plastics

- Aluminum

- Paper-based Materials

By Packaging Format

- Pouches

- Bottles

- Cartons

- Jars

- Tubes

- Sachets

By Capacity

- Up to 250 ml

- 250 ml to 500 ml

- 500 ml to 1L

- 1L to 2L

- Above 2L

By Application

- Beverages

- Sauces and Condiments

- Soups

- Ready-to-Eat Meals

- Dairy Products

- Processed Foods

- Other Packaged Foods

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading the Market with Strong Demand for Convenience Foods

North America holds the largest share in the Hot Fill Food Packaging Market, accounting for 35% of the global market. The region’s strong demand for convenience foods and beverages, combined with an established food processing industry, drives the adoption of hot fill packaging solutions. The U.S. plays a pivotal role, benefiting from high consumer spending power and a preference for ready-to-eat products. Manufacturers in North America focus on innovation, ensuring continued market growth. Regulatory support for sustainable packaging solutions further enhances the region’s dominance, encouraging further investment and development in hot fill technologies.

Europe: Focus on Sustainability and Regulatory Compliance

Europe holds 27% of the global Hot Fill Food Packaging Market share, driven by strict food safety regulations and increasing consumer demand for sustainable packaging solutions. Countries such as Germany, France, and the UK are adopting eco-friendly materials in response to regulatory pressures and consumer preferences for environmentally responsible packaging. The region’s food and beverage industry is increasingly aligning with sustainability initiatives, influencing packaging innovations. Manufacturers in Europe are prioritizing biodegradable, recyclable materials, ensuring compliance with the European Union’s regulations and meeting market demands for sustainable and efficient packaging solutions.

Asia-Pacific: Rapid Growth Due to Urbanization and Changing Lifestyles

Asia-Pacific accounts for 24% of the Hot Fill Food Packaging Market, with rapid urbanization and rising disposable incomes driving significant growth. The demand for packaged food and beverages, especially ready-to-eat meals and drinks, is increasing as consumer behavior shifts toward convenience and quality products. Major markets in China, India, and Japan are adopting hot fill packaging solutions to meet the evolving needs of consumers. The food processing industry in the region is expanding, supporting further growth in hot fill packaging applications and contributing to the increasing market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Resilux NV

- Nirmal Pet

- Amcor Plc

- Graham Packaging Company

- E-proPLAST GmbH

- Acti Pack

- Imperial Packaging

- MJS Packaging

- Plastipak Holdings, Inc.

- Mpact

- AL AMANA PLASTICS

- West Coast Container

- P. Wilkinson Containers Ltd.

- Indorama Ventures Public Company Limited

- Crown Holdings, Inc

Competitive Analysis:

The Hot Fill Food Packaging Market is highly competitive, with major players like Amcor Plc, Berry Global Inc., and Mondi Plc leading the way. These companies focus on innovation in packaging materials, developing high-performance, sustainable solutions such as recyclable plastics and biodegradable options to meet the growing demand for eco-friendly packaging. Regional players also play a vital role by offering cost-effective solutions tailored to local needs. Competitive strategies include forming strategic partnerships with food and beverage manufacturers, enhancing production efficiency, and adopting automation and smart packaging technologies to reduce costs and improve speed. As the market evolves, these players continue to innovate, ensuring they meet consumer preferences and comply with stringent regulatory standards. Additionally, key players are investing heavily in research and development to create packaging that extends shelf life while preserving product quality. The market’s focus on sustainability is reshaping the competitive landscape, driving companies to develop environmentally responsible packaging alternatives.

Recent Developments:

- In May 2025, Graham Packaging Company announced a financial results review for Q1 2025 but did not disclose any new product launches, acquisitions, or partnerships in public news sources.

- In November 2024, Amcor Plc launched two new open-call initiatives—Amcor Lift-Off Sprints and Amcor Lift-Off Connect—to spur technical collaborations with start-ups focused on R&D challenges and innovation in sustainable packaging, with the first Sprints session scheduled for early 2025.

- In November 2024, Indorama Ventures announced the acquisition of Kemelix and FlowSolve brands in the energy extraction sector, aiming to strengthen their Indovinya specialty surfactants portfolio and boost presence in high-growth markets.

Market Concentration & Characteristics:

The Hot Fill Food Packaging Market exhibits a moderate concentration, with a few large players such as Amcor Plc, Berry Global Inc., and Mondi Plc holding significant market share. These key players dominate by offering a wide range of packaging solutions, focusing on technological innovation and sustainability. The market is characterized by increasing demand for eco-friendly and recyclable materials, driving companies to develop sustainable packaging alternatives. Competitive rivalry is intense, with firms competing on factors such as product quality, cost-efficiency, and sustainability. Regional players also contribute by catering to local needs and offering cost-effective solutions. As sustainability becomes a top priority, market dynamics are shifting towards innovation in materials and packaging technologies, allowing businesses to differentiate themselves while adhering to regulatory standards. The market is evolving, with companies continuously exploring new opportunities for growth and adapting to changing consumer demands.

Report Coverage:

The research report offers an in-depth analysis based on Material, Packaging Format, Capacity, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Hot Fill Food Packaging Market is expected to experience steady growth, driven by increasing consumer demand for convenient, shelf-stable food and beverage products.

- Advancements in packaging technologies are enhancing product safety and shelf life, contributing to the market’s expansion.

- The adoption of sustainable packaging materials is gaining momentum, aligning with consumer preferences for eco-friendly solutions.

- Regulatory frameworks emphasizing food safety and quality control are encouraging manufacturers to adopt hot fill packaging methods.

- The Asia-Pacific region is anticipated to lead the market, driven by rapid urbanization and a growing food and beverage industry.

- North America is projected to witness significant growth, attributed to increasing consumer demand for convenience foods and technological advancements in packaging.

- The beverage sector is expected to dominate the market, with hot fill packaging being widely used for fruit juices and other beverages.

- The development of new materials is enabling producers to create packages that meet both marketing and environmental needs.

- E-commerce is playing a significant role in food distribution channels, especially with the rise of online grocery shopping.

- Opportunities for growth exist in emerging markets, where increasing disposable incomes and changing lifestyles are driving demand for packaged foods.