Market Overview

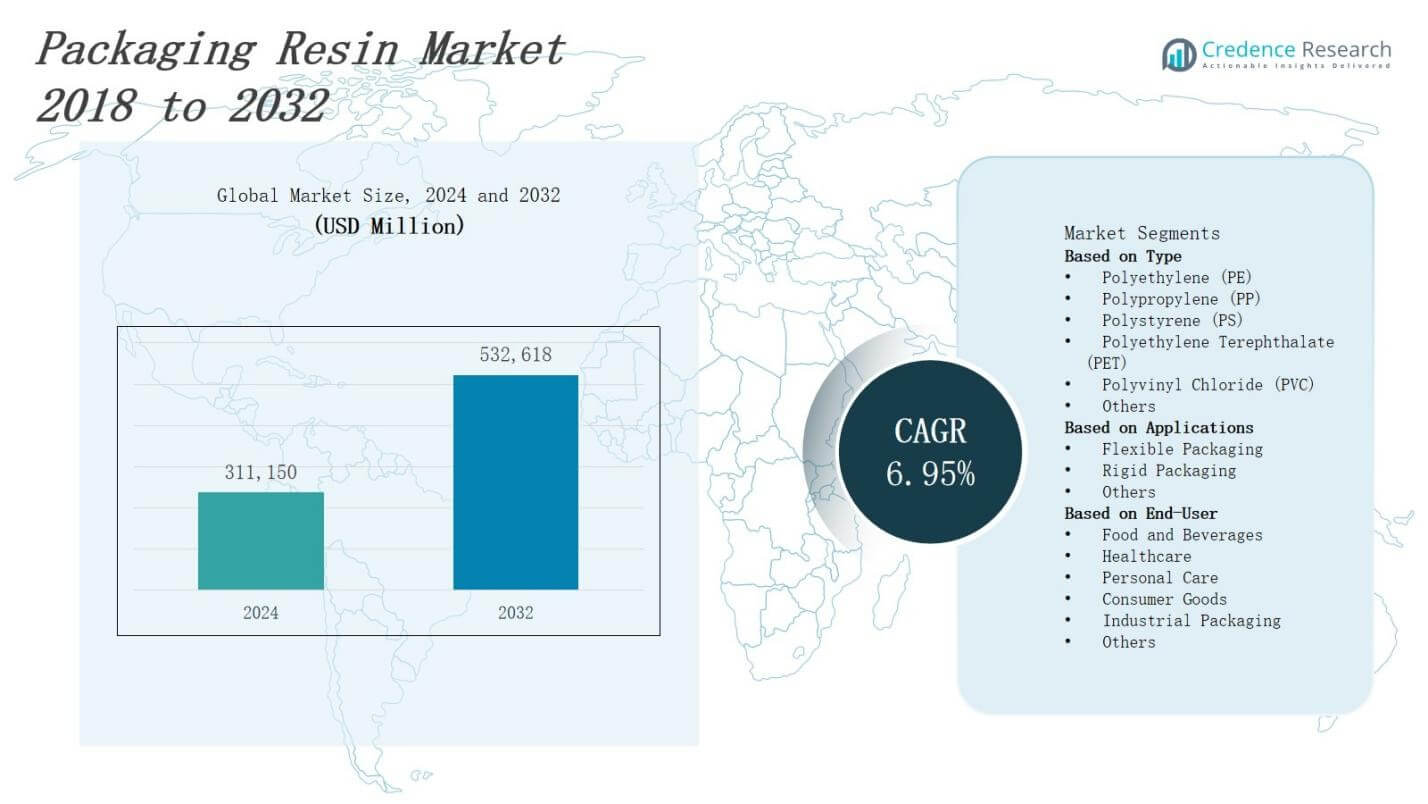

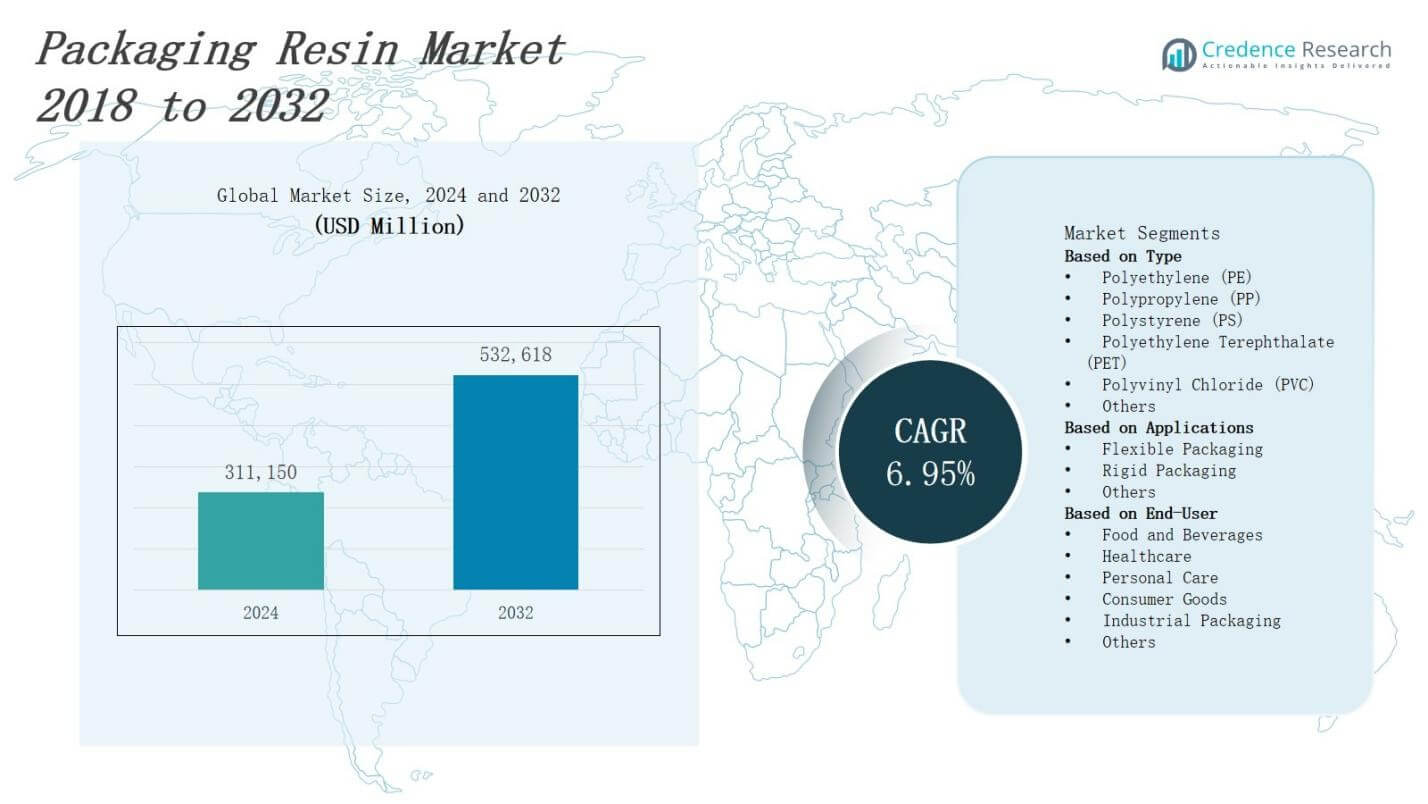

The Packaging Resin Market is projected to expand from USD 311,150 million in 2024 to USD 532,618 million by 2032 at a CAGR of 6.95%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Resin Market Size 2024 |

USD 311,150 Million |

| Packaging Resin Market, CAGR |

6.95% |

| Packaging Resin Market Size 2032 |

USD 532,618 Million |

Rising demand for lightweight, durable packaging solutions drives the Packaging Resin Market, as brands seek cost-effective materials that enhance product protection and extend shelf life. Stringent regulations on food safety and sustainability encourage manufacturers to adopt recyclable and bio-based resins, boosting R&D investment in innovative materials. Advances in polymer blending and compounding technologies improve barrier properties and processing efficiency. Increased e‑commerce volumes and shifting consumer preferences for eco‑friendly packaging accelerate adoption of advanced resins. Collaborations between resin producers and packaging converters optimize supply chains and facilitate scalable production. Growing emphasis on circular economy practices further strengthens market growth and innovation.

The Packaging Resin Market demonstrates varied regional dynamics. North America leads through advanced processing infrastructure, robust logistics networks and major players such as Dow Inc. and LyondellBasell. Europe drives sustainability and circularity initiatives under BASF SE and INEOS stewardship. Asia Pacific records rapid expansion as PetroChina, Sinopec and Reliance Industries supply booming FMCG, e‑commerce and pharmaceutical sectors. Latin America meets rising food and consumer goods demand via Braskem and SABIC’s local compounding hubs. Middle East & Africa leverages ExxonMobil and regional petrochemical integration to support agrochemical and bottled water packaging. It adapts to diverse regulations and consumer preferences across all regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Packaging Resin Market will expand from USD 311,150 million in 2024 to USD 532,618 million by 2032 at a 6.95% CAGR.

- Demand for lightweight, durable materials drives adoption of advanced resins that enhance protection and extend shelf life.

- Stringent food‑safety and sustainability mandates force producers to develop recyclable, bio‑based resin grades.

- E‑commerce growth compels supply of flexible pouches and rigid containers with reliable barrier and easy‑open features.

- Advances in polymer blending and nano‑composite additives boost oxygen and moisture resistance in packaging films.

- Collaborations between resin manufacturers and converters streamline supply chains and support closed‑loop recycling.

- Key players tailor regional strategies in North America, Europe and Asia Pacific to capture high‑growth end‑use segments.

Market Drivers

Stringent Regulatory Frameworks and Sustainability Mandates

The Packaging Resin Market faces rigorous food safety and environmental standards that compel resin producers to develop recyclable and bio-based solutions. It meets strict migration limits and labeling requirements enforced by global agencies. Consumers demand transparency and safe materials. Governments incentivize circular economy practices. Industry players allocate resources to certify resins under recognized sustainability schemes. Regulatory compliance enhances brand reputation and drives material innovation in the sector.

- For instance, Dow has advanced proprietary recyclable polyethylene resins that comply with strict global migration limits and enable circular packaging designs.

Rising E‑Commerce and Consumer Convenience Trends

The Packaging Resin Market supports booming online retail by offering lightweight, protective materials that reduce shipping costs and damage rates. It accommodates high throughput and rapid packaging cycles required by distribution centers. Shoppers expect durable containers and easy-to-open formats. Brands invest in resins that balance strength and flexibility. Producers refine extrusion and injection processes to boost output. Supply chains adapt to fulfill diverse packaging specifications under tight deadlines.

- For instance, Amcor developed a polyethylene resin that enhances packaging durability while reducing weight by up to 20%, cutting freight expenses for e-commerce shipments.

Advancements in Polymer Technologies and Material Performance

Demand for high-barrier and specialty resins drives research in polymer blending and nano-composites for improved gas and moisture resistance. The Packaging Resin Market leverages optimized catalysts and compounding techniques to enhance clarity and tensile strength. It integrates anti-fog and anti-static properties directly into resins. Manufacturers trial reactive extrusion to reduce processing steps. Industry collaborations accelerate scale-up of novel formulations. These technological strides raise performance standards across packaging applications.

Collaboration and Circular Economy Adoption

Producers and converters in the Packaging Resin Market partner to optimize resin grades for closed-loop recycling initiatives. It supports recovery systems that collect post-consumer packaging and reprocess materials into feedstock. Stakeholders pilot chemical recycling to complement mechanical methods and expand material reuse. Joint ventures fund infrastructure for sorting and purification. Brands commit to targets for recycled content in packaging. These alliances strengthen supply chain resilience and reduce environmental footprint.

Market Trends

Integration of Digital and Smart Technologies

Digital printing systems embed variable data and QR codes directly on flexible pouches. These tools reduce setup time and material waste. Active packaging features such as freshness indicators and RFID tags gain traction. The Packaging Resin Market adopts resins compatible with conductive inks and sensor integration. It supports on‑package authentication to combat counterfeits. Brand owners value real‑time consumer engagement. This trend accelerates adoption of multifunctional packaging formats.

- For instance, Epac Flexible Packaging uses Variable Data Printing (VDP) to print unique QR codes on each package, allowing consumers to access specific web content instantly.

Shift toward Bio‑based and Biodegradable Resins

Resin producers develop plant‑derived materials such as PLA and PHA to reduce reliance on fossil feedstocks. Demand for compostable films and bottles increases among eco‑conscious brands. The Packaging Resin Market integrates certified recycled content into many grades. It expands chemical recycling pilots to reclaim monomers and support closed loops. Regulatory incentives reward bio‑based content in food and beverage applications. Consumers reward brands that use certified compostable packaging alternatives. This pattern drives new joint ventures.

- For instance, companies like BASF have launched certified compostable packaging solutions integrating bio-based content to meet regulatory incentives and consumer demands for sustainable alternatives.

Development of High‑Barrier and Specialty Resin Formulations

Researchers refine EVOH blends and nano‑composite additives to boost oxygen and moisture resistance. Packaging engineered with antimicrobial and UV‑blocking properties enters premium segments. The Packaging Resin Market deploys tailored copolymers to meet stringent shelf‑life requirements. It institutes rigorous testing protocols for barrier performance under diverse conditions. Packaging makers benefit from streamlined processing and reduced layer counts. Industry alliances fund pilot lines for reactive extrusion and in‑line compounding. This shift improves product protection across sensitive goods.

Growth of Custom and On‑Demand Resin Production

Brands request small‑batch runs and rapid formula tweaks to support limited editions and seasonal campaigns. Flexible extrusion lines enable just‑in‑time resin delivery based on dynamic order data. The Packaging Resin Market invests in digital tracking systems that monitor resin quality and batch genealogy. It reduces lead times through modular reactor setups and automated adjustments. Co‑development programs link resin producers with brand R&D teams. Producers scale localized compounding facilities near major demand centers. This model enhances agility in volatile markets.

Market Challenges Analysis

Volatile Feedstock Prices and Supply Chain Disruptions

Feedstock cost fluctuations create margin pressure across the Packaging Resin Market. It relies on petrochemical derivatives subject to crude oil and natural gas price swings. Sudden raw material shortages force producers to seek alternative suppliers under tight timelines. Transportation bottlenecks and port congestions raise logistics expenses. Regulatory inspections and customs delays further complicate inbound resin shipments. Producers must maintain buffer inventories, which ties up working capital and reduces flexibility. Industry players face constant risk of production stoppages due to supply chain instability.

Balancing Performance Demands with Environmental Regulations

Stricter waste management rules challenge the Packaging Resin Market to deliver high-barrier properties alongside recyclability. It must reformulate grades to meet both shelf‑life requirements and end‑of‑life recovery targets. Testing protocols for recycled content and compostability extend development cycles. Conflicting regional standards force multiple certification efforts for a single resin grade. Brands apply pressure to adopt certified bio‑based content without compromising mechanical strength. R&D teams navigate complex trade‑offs between functional additives and regulatory thresholds. Supply chains adjust to integrate reclaimed monomers while preserving consistent quality.

Market Opportunities

Expansion of Sustainable and Recycled Resin Portfolios

The Packaging Resin Market can capitalize on rising consumer demand for eco‑friendly materials by offering certified recycled and bio‑based resins. It can forge partnerships with waste management firms to secure feedstock for chemical recycling initiatives. Regulatory incentives in Europe and North America reward recycled content in packaging. Producers can introduce mono‑material solutions that simplify recovery and reuse. Investment in pilot lines for advanced recycling helps lower production costs. These moves support brand sustainability goals and enhance market differentiation.

Emerging Market Penetration and Custom Formulation Strategies

Rapid urbanization in Asia Pacific and Latin America presents growth corridors for the Packaging Resin Market. It deploys localized compounding facilities to reduce lead times and logistics expenses. Brands require specialty grades for e‑commerce and smart packaging formats. It offers small‑batch runs and on‑demand formula tweaks to capture niche segments. Collaborative R&D programs with converters accelerate product validation. This approach broadens customer base and increases resilience against regional volatility. Strong local support networks further boost adoption in high‑growth economies.

Market Segmentation Analysis:

By Type

The Packaging Resin Market segments by type into Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), and other specialty resins. It assigns leading share to PE and PP due to cost efficiency and versatility. PS and PET occupy niche roles in disposable and beverage packaging. PVC serves rigid applications requiring chemical resistance. Other resins like EVOH support barrier performance. Producers tailor grades to support diverse processing methods.

- For instance, PE is widely used for packaging applications such as frozen food bags and containers, with over 100 million tonnes produced annually worldwide, reflecting its dominance and broad utility.

By Application

The Packaging Resin Market divides applications into flexible packaging, rigid packaging, and other formats. It drives growth in flexible films for pouches, shrink wraps, and bags, offering lightweight handling and drop resistance. Rigid packaging includes bottles, containers, and trays that demand structural strength. Other formats such as caps and closures require specialized resin blends. Brands work with converters to select optimal resins for each format. This segmentation enables efficient resource allocation.

- For instance, ExxonMobil and SABIC supply polyethylene (PE) and polypropylene (PP) resins widely used in flexible and rigid packaging, known for their high mechanical strength and moisture resistance, critical for food and beverage packaging applications.

By End-User

The Packaging Resin Market classifies end-user sectors into food and beverages, healthcare, personal care, consumer goods, industrial packaging, and others. It allocates major resin volumes to food and beverage producers for safety and barrier needs. Healthcare demands high-purity grades for sterile packaging. Personal care relies on aesthetic and functional attributes. Consumer goods favor durable and decorative solutions. Industrial applications focus on chemical resistance. Other sectors include electronics and automotive where resins require tailored performance.

Segments:

Based on Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Others

Based on Applications

- Flexible Packaging

- Rigid Packaging

- Others

Based on End-User

- Food and Beverages

- Healthcare

- Personal Care

- Consumer Goods

- Industrial Packaging

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The Packaging Resin Market benefits from robust manufacturing in the United States and Canada. It supplies high‑performance resins to the food and beverage sector. It complies with stringent FDA and CFIA standards for safety. It leverages well‑developed logistics networks for efficient distribution. It fosters innovation through R&D investments in barrier and specialty grades. It held 17% of global market share in 2024.

Europe

The Packaging Resin Market in Europe prioritizes circular economy goals. It integrates recycled content to meet EU mandates. It refines resin grades to adhere to ECHA regulations on chemicals. It supports pharmaceutical and automotive packaging applications. It partners with converters to expand chemical recycling capacity. It held 15% of global market share in 2024.

Asia Pacific

The Packaging Resin Market sees rapid growth in Asia Pacific. It draws on low‑cost production hubs in China, India, and Southeast Asia. It serves booming FMCG and e‑commerce industries. It invests in bioplastic development to address environmental concerns. It expands compounding facilities near major consumer centers. It held 48% of global market share in 2024.

Latin America

The Packaging Resin Market in Latin America focuses on Brazil and Mexico. It optimizes local compounding to reduce lead times. It supplies flexible films for food packaging. It collaborates with converters to develop cost‑effective blends. It responds to rising demand for retail and consumer goods. It held 11% of global market share in 2024.

Middle East & Africa

The Packaging Resin Market in this region leverages petrochemical integration in Saudi Arabia and UAE. It delivers resins for bottled water and agrochemical packaging. It expands via joint ventures in chemical recycling. It addresses infrastructure gaps through strategic alliances. It supports regional growth by localizing resin production. It held 9% of global market share in 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Reliance Industries

- BASF SE

- PetroChina Companies Ltd.

- Braskem

- Dow Inc.

- SABIC

- INEOS

- LyondellBasell Industries N.V.

- Sinopec

- ExxonMobil Corporation

Competitive Analysis

Major resin producers compete on price, product performance and sustainability credentials. Companies such as Dow Inc., BASF SE and LyondellBasell maintain global footprint through integrated operations and efficient feedstock access. It challenges smaller suppliers by leveraging scale and diversified portfolios that include bio‑based and high‑barrier grades. ExxonMobil and Sinopec invest in joint ventures to expand regional compounding capacity and secure supply chains. Reliance Industries and Braskem target emerging markets with localized production hubs. Innovation in barrier and specialty resins differentiates players, driven by partnerships with brand owners. Compliance with regulatory standards on recycled content influences market positioning. Strategic alliances support chemical recycling initiatives. Price volatility and feedstock availability drive tactical adjustments in product mix. Competitive dynamics in the Packaging Resin Market hinge on operational efficiency, portfolio diversity and alignment with sustainability targets. Market players quickly monitor feedstock trends to adjust contract terms and inventory levels for global risk mitigation.

Recent Developments

- On June 30, 2025, Dow announced the launch of INNATE™ TF 220 Precision Packaging Resin, designed for high‑performance, mono‑material BOPE films and introduced a collaboration with Liby to integrate 10% PCR content.

- On March 7, 2025, LyondellBasell launched Pro‑fax EP649U, a high‑flow polypropylene impact copolymer for thin‑walled rigid food packaging, available in CirculenRenew and CirculenRevive portfolios.

- In February 2025, Repsol completed the acquisition of a Dutch polypropylene recycling startup to strengthen its post‑consumer resin capabilities

- On March 5, 2025, ExxonMobil Signature Polymers confirmed its participation at Plastico Brasil 2025 to showcase innovative packaging resin solutions and sensor‑compatible formulations.

Market Concentration & Characteristics

Major producers dominate the Packaging Resin Market, with the top ten companies capturing over 60% of global sales. It features high entry barriers due to capital‑intensive production facilities and complex feedstock integration. Leading firms leverage scale to negotiate favorable raw material contracts and optimize logistics across regions. It balances standard commodity grades with specialty resins that command premium pricing in food, healthcare and industrial applications. Integration of upstream petrochemical assets secures stable feedstock streams and enhances margin resilience. It adapts quickly to regulatory shifts on recyclability and bio‑based content through dedicated R&D investments. Collaborative ventures and joint‑development agreements streamline technology transfer between resin producers and brand owners. This concentrated structure fosters efficiency but demands continual portfolio diversification to meet evolving performance and sustainability standards.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Producers will expand bio‑based resin offerings to meet rising sustainability demands.

- Brands will increase use of chemically recycled resins to support circular economy goals.

- Packaging converters will adopt smart resin formulations compatible with sensor integration.

- Regional compounding facilities will grow to reduce lead times in high‑demand markets.

- R&D teams will refine high‑barrier resin blends for sensitive food and pharmaceutical goods.

- Collaborative ventures with waste management firms will secure feedstock for recycling initiatives.

- Automation enhancements will optimize extrusion and injection processes for custom resin grades.

- Market players will launch small‑batch resin services to support limited‑edition packaging runs.

- Resin producers will integrate antimicrobial and UV‑blocking additives into standard grades.

- Strategic alliances with brand owners will accelerate scale‑up of innovative resin technologies.