Market Overview:

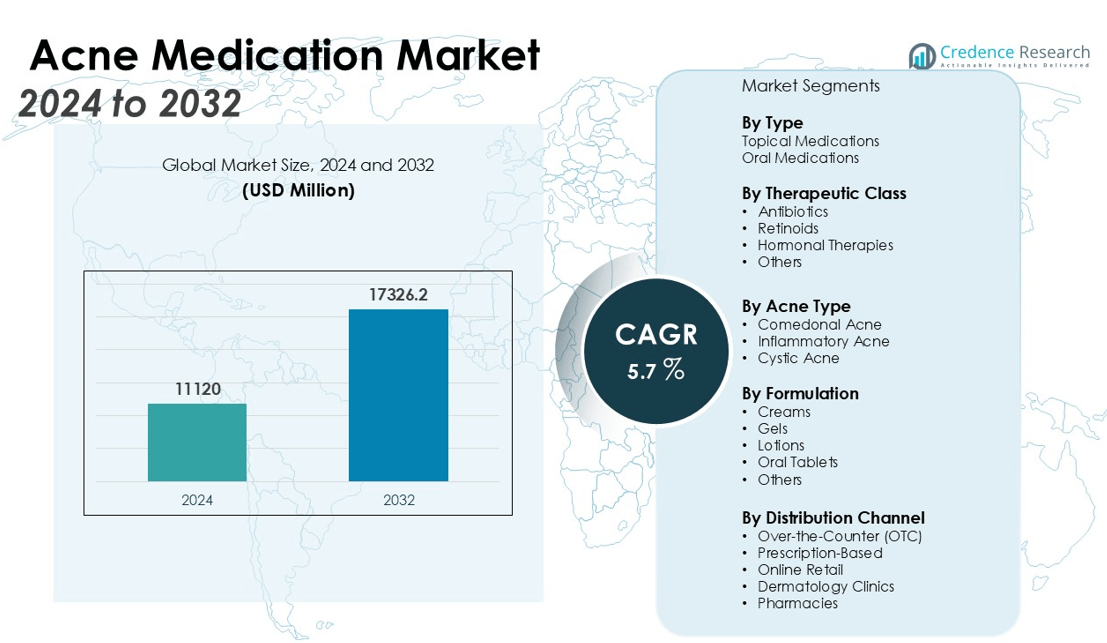

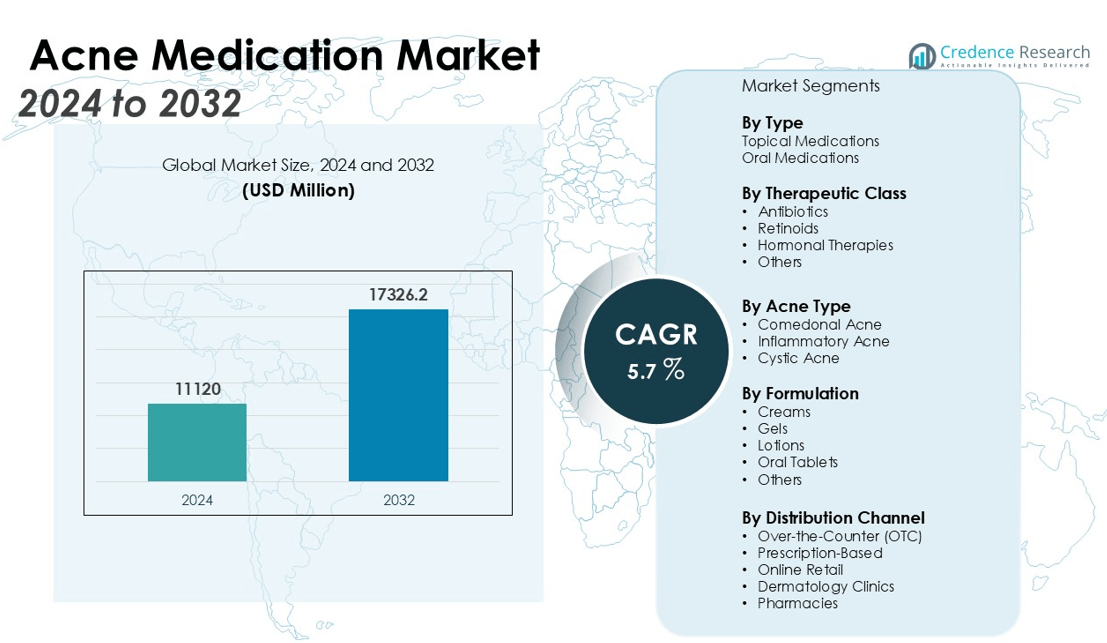

The Acne Medication Market size was valued at USD 11120 million in 2024 and is anticipated to reach USD 17326.2 million by 2032, at a CAGR of 5.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acne Medication Market Size 2024 |

USD 11120 million |

| Acne Medication Market, CAGR |

5.7% |

| Acne Medication Market Size 2032 |

USD 17326.2 million |

Key drivers of market growth include the growing demand for over-the-counter and prescription acne medications, fueled by rising skin health concerns and an expanding consumer base seeking aesthetic treatments. Advances in biotechnology and the introduction of innovative topical and oral medications have significantly improved treatment efficacy and patient compliance. Additionally, the surge in dermatological consultations and greater access to healthcare services globally further boosts the demand for acne medications. The availability of personalized acne treatments is also contributing to market expansion, catering to diverse skin types and severity levels.

Regionally, North America dominates the acne medication market, accounting for a significant share of the global market, attributed to high disposable incomes, advanced healthcare infrastructure, and widespread awareness about acne treatments. However, the Asia-Pacific region is anticipated to witness the highest growth rate during the forecast period, driven by increasing urbanization, rising disposable incomes, and growing awareness about dermatological care in emerging economies like India and China. Furthermore, the rise in acne awareness campaigns and product innovations in the region are expected to fuel demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Acne Medication Market was valued at USD 11,120 million in 2024 and is projected to reach USD 17,326.2 million by 2032.

- Advances in biotechnology have improved the efficacy of both topical and oral acne treatments, increasing patient compliance.

- The growing focus on personalized skincare and aesthetic treatments is driving demand for tailored acne medications.

- Rising healthcare access, including more dermatological consultations, is contributing to increased demand for both OTC and prescription acne medications.

- North America dominates the market, holding 40% of the global share due to high disposable incomes and advanced healthcare systems.

- Asia-Pacific is expected to experience the highest growth rate, accounting for 30% of the market, driven by urbanization and rising disposable incomes.

- Europe’s demand for organic and natural acne treatments is growing, offering opportunities for product innovation in the established market.

Market Drivers:

Growing Prevalence of Acne and Rising Skin Health Concerns

The increasing prevalence of acne, especially among teenagers and young adults, is one of the primary drivers of the Acne Medication Market. Acne affects a large portion of the global population, contributing to heightened awareness and demand for effective treatments. As more individuals seek solutions for their skin concerns, both over-the-counter and prescription medications experience greater uptake. This shift towards managing acne as a health and aesthetic concern drives the growth of the market.

- For instance, The American Academy of Dermatology reports that acne is the most common skin condition in the U.S., affecting up to 50 million Americans annually.

Advancements in Medication and Treatment Efficacy

The Acne Medication Market has experienced significant growth due to advancements in medication formulations, such as the development of more effective topical and oral treatments. Biotechnology innovations have enhanced the efficacy of acne medications, leading to better patient outcomes. The introduction of new drug classes, including those focused on hormonal acne and tailored treatments for different skin types, has expanded the range of available solutions, increasing market accessibility and boosting consumer confidence.

- For instance, in its pivotal Phase 3 STAR-1 trial, Dermata Therapeutics’ novel treatment Xyngari demonstrated that patients experienced an average reduction of 16.8 inflammatory lesions.

Increasing Focus on Aesthetic Treatments and Personalized Care

A growing focus on aesthetic and dermatological care contributes to the market’s expansion. Acne is not only seen as a medical condition but also as an aesthetic issue that can impact an individual’s self-esteem and quality of life. This shift in perspective has prompted a higher demand for personalized acne treatments that cater to individual skin types, promoting more targeted solutions. The availability of personalized skincare has driven consumer interest, further accelerating the adoption of acne medications.

Rising Healthcare Access and Dermatological Consultations

The increased availability of dermatological consultations and improved healthcare infrastructure globally has also bolstered the demand for acne medications. As healthcare systems expand and patient access to specialists improves, more individuals are seeking professional advice on managing acne. This surge in dermatological consultations encourages prescription-based treatments, which significantly contribute to the overall growth of the Acne Medication Market.

Market Trends:

Shift Toward Over-the-Counter and Non-Prescription Medications

The Acne Medication Market is experiencing a notable trend toward the increased use of over-the-counter (OTC) and non-prescription medications. Consumers are seeking more convenient and accessible solutions, driving the growth of OTC products such as cleansers, gels, and creams. These products are often formulated with active ingredients like salicylic acid and benzoyl peroxide, offering consumers effective treatments without the need for a prescription. The rise of e-commerce platforms has further facilitated the availability and convenience of OTC medications, allowing individuals to access a wide range of acne treatments from the comfort of their homes. This shift reflects growing self-management of acne, contributing to the market’s overall expansion.

- For instance, the popular OTC brand Proactiv became one of its parent company Guthy-Renker’s most successful products, generating a reported $1 billion in sales in a single year.

Increased Focus on Natural and Organic Ingredients

Another significant trend in the Acne Medication Market is the rising consumer preference for natural and organic ingredients in acne treatments. With growing concerns about the potential side effects of synthetic chemicals, consumers are turning toward more natural alternatives, such as tea tree oil, aloe vera, and green tea extract. These ingredients are seen as safer and gentler on the skin, appealing to individuals with sensitive skin or those looking for holistic solutions. The trend toward organic and cruelty-free products has led to an increase in the number of brands offering plant-based and eco-friendly acne medications. This shift aligns with the broader demand for sustainable and ethical skincare products, positioning the market for further growth in this segment.

- For instance, a clinical trial involving 41 patients tested an anti-acne herbal cream containing extracts from the medicinal plants Saponaria officinalis, Inula helenium, and Solanum nigrum, which showed significant antimicrobial and anti-inflammatory activities.

Market Challenges Analysis:

Side Effects and Risk of Irritation

One of the primary challenges in the Acne Medication Market is the potential for side effects and skin irritation associated with certain treatments. Many acne medications, particularly those containing active ingredients like benzoyl peroxide and salicylic acid, can cause dryness, redness, and peeling. These side effects can lead to decreased patient compliance, particularly among individuals with sensitive skin. As a result, some users may discontinue treatment, hindering market growth. While newer treatments have minimized these concerns, the risk of irritation remains a challenge for both consumers and manufacturers.

Regulatory Hurdles and Market Fragmentation

The Acne Medication Market also faces challenges related to regulatory hurdles and market fragmentation. Different regions have varying regulations for the approval of acne medications, which can delay product launches and limit market access. Furthermore, the market is highly fragmented with numerous local and international players, making it difficult for companies to achieve widespread market penetration. The competition in the market, coupled with the complexities of regulatory approval, presents barriers to growth for both new and established brands in the acne medication sector.

Market Opportunities:

Growing Demand for Personalized and Tailored Treatments

One significant opportunity in the Acne Medication Market is the growing demand for personalized treatments. Consumers are increasingly seeking solutions that cater to their specific skin types and acne severity. Advances in dermatology and biotechnology have enabled the development of more customized medications, enhancing treatment efficacy and patient satisfaction. This trend opens avenues for brands to introduce targeted solutions that address individual needs, such as personalized skincare regimens or medications designed for sensitive skin. By focusing on personalized care, companies can build stronger customer loyalty and tap into a more specific and lucrative segment of the market.

Expanding Presence in Emerging Markets

Emerging markets present substantial growth opportunities for the Acne Medication Market. With rising disposable incomes, increasing urbanization, and improving healthcare access in regions like Asia-Pacific and Latin America, there is a growing demand for effective acne treatments. As awareness about acne and skin care increases in these regions, the need for both over-the-counter and prescription medications is expected to rise. Companies can capitalize on this by expanding their distribution networks and tailoring products to meet local preferences. This expansion could significantly boost market growth, particularly in countries such as India, China, and Brazil, where a large percentage of the population faces acne-related concerns.

Market Segmentation Analysis:

By Type

The Acne Medication Market is segmented by type into topical medications and oral medications. Topical medications dominate the market, accounting for a significant share due to their direct application and effectiveness in treating localized acne. These include creams, gels, and lotions containing active ingredients like benzoyl peroxide, salicylic acid, and retinoids. Oral medications, including antibiotics and hormonal treatments, are gaining traction, especially for moderate to severe cases of acne. The demand for oral treatments is rising due to their ability to address more widespread acne and hormonal imbalances.

- For instance, in two 12-week clinical trials of a microencapsulated benzoyl peroxide and tretinoin cream (E-BPO/T), subjects with moderate to severe acne experienced an average reduction of 21.6 inflammatory lesions.

By Therapeutic Class

The Acne Medication Market is further segmented by therapeutic class into antibiotics, retinoids, and others. Antibiotics hold the largest share, primarily because they are effective in controlling bacterial growth and reducing inflammation. Retinoids, including both topical and oral forms, are also popular for their ability to prevent clogged pores and promote skin cell turnover. The “others” category includes treatments such as hormonal therapies, which are gaining popularity, particularly for women with hormonal acne.

- For instance, in pre-clinical studies, trifarotene (Aklief) produced a comedolytic (pore-clearing) effect comparable to other retinoids but at a dose that was 10 times lower.

By Acne Type

The market is segmented by acne type into comedonal acne, inflammatory acne, and cystic acne. Inflammatory acne holds the largest share due to its widespread prevalence and severity. This type of acne often leads to scarring, driving higher demand for effective treatment options. Comedonal acne, though less severe, is common among younger populations, contributing to steady demand for topical treatments. Cystic acne, the most severe form, requires intensive treatment, often including oral medications and dermatological interventions, leading to significant market opportunities for more specialized therapies.

Segmentations:

By Type

- Topical Medications

- Oral Medications

By Therapeutic Class

- Antibiotics

- Retinoids

- Hormonal Therapies

- Others

By Acne Type

- Comedonal Acne

- Inflammatory Acne

- Cystic Acne

By Formulation

- Creams

- Gels

- Lotions

- Oral Tablets

- Others

By Distribution Channel

- Over-the-Counter (OTC)

- Prescription-Based

- Online Retail

- Dermatology Clinics

- Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America: Leading Market Share

North America accounts for 40% of the global Acne Medication Market, making it the largest regional market. This dominance is driven by a high incidence of acne, advanced healthcare infrastructure, and widespread consumer awareness. The United States leads the region, benefiting from its well-established dermatology sector and access to advanced treatment options. High disposable incomes and an increasing inclination toward aesthetic treatments further boost the demand for both prescription and over-the-counter acne medications. The region’s robust healthcare system ensures consumers have easy access to medications, fueling market expansion.

Asia-Pacific: Rapid Growth and Expanding Demand

Asia-Pacific holds a 30% share of the Acne Medication Market and is expected to experience the highest growth rate during the forecast period. Rapid urbanization, rising disposable incomes, and an expanding middle class in countries like China, India, and Japan are significant drivers of this growth. Increasing awareness of skincare and acne treatments, particularly among younger populations, has led to a surge in demand for acne medications. Improved healthcare access and dermatological services in the region further contribute to the adoption of both prescription and OTC treatments.

Europe: Established Market with Emerging Trends

Europe holds a 25% share of the global Acne Medication Market. The region’s growth is driven by a strong focus on skin health and increasing consumer awareness of acne treatments. Major markets such as Germany, France, and the United Kingdom benefit from well-developed healthcare systems, ensuring easy access to a wide range of medications. While the market in Europe is mature, there is a growing trend toward organic and natural acne treatments, providing opportunities for product innovation. The increasing interest in aesthetic treatments among young adults further supports the demand for acne medications in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Pfizer Inc.

- AbbVie Inc.

- Mayne Pharma Group Limited.

- Botanix Pharmaceuticals

- Teva Pharmaceutical Industries Ltd.

- Kenvue Inc

- Bayer AG

- GlaxoSmithKline Plc.

- Bausch Health Companies Inc

- Galderma S.A.

Competitive Analysis:

The Acne Medication Market is highly competitive, with key players focusing on product innovation, brand differentiation, and expanding distribution networks. Leading companies such as Johnson & Johnson, Galderma, and Roche dominate the market, offering a broad range of acne treatments across topical and oral formulations. These companies leverage strong research and development capabilities to introduce advanced formulations that enhance efficacy and reduce side effects. Smaller, emerging players are focusing on natural and organic ingredients to cater to the growing demand for sustainable and gentle skincare solutions. Retailers are increasingly adopting online platforms, enabling direct-to-consumer sales and expanding reach in global markets. The competitive landscape also includes the rise of generic products, challenging branded medications and offering cost-effective alternatives to consumers. Companies are actively pursuing strategic partnerships and acquisitions to strengthen their market position and increase product offerings across diverse acne types and therapeutic classes.

Recent Developments:

- In July 2025, Pfizer Inc. announced that the combination of XTANDI® plus leuprolide demonstrated a significant improvement in survival outcomes for men with non-metastatic hormone-sensitive prostate cancer with high-risk biochemical recurrence.

- In July 2025, Teva Pharmaceutical Industries Ltd. launched Fidaxomicin Tablets, the generic equivalent of Dificid® tablets.

- In July 2025, Pfizer Inc. launched Piperacillin and Tazobactam for Injection, USP, 4.5 g, which included a change to the product’s Unit of Sale National Drug Code (NDC).

Market Concentration & Characteristics:

The Acne Medication Market is moderately concentrated, with a few dominant players holding a significant share. Major companies, including Johnson & Johnson, Galderma, and Roche, control a large portion of the market, driven by strong brand recognition and established distribution networks. These companies focus on innovation, offering a range of effective topical and oral treatments. The market also features several smaller players offering natural and organic alternatives, catering to the rising demand for sustainable skincare solutions. The market is characterized by a diverse product portfolio that targets various acne types, from mild to severe, and incorporates both prescription and over-the-counter options. Online retail channels are gaining traction, allowing companies to reach broader consumer bases. The competitive environment is further shaped by the emergence of generics, which challenge branded products by offering affordable treatment alternatives.

Report Coverage:

The research report offers an in-depth analysis based on Type, Therapeutic Class, Acne Type, Formulation, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The integration of digital health technologies, including teledermatology and mobile health apps, is expected to improve patient access to acne treatments.

- There will be a continued focus on personalized medicine, with treatments tailored to genetic and environmental factors to improve treatment outcomes.

- Rising consumer demand for natural and organic skincare products is driving the growth of acne medications based on sustainable and gentle ingredients.

- Advancements in drug delivery systems, such as targeted delivery and sustained-release formulations, will enhance the effectiveness and convenience of acne treatments.

- Increased public awareness and education regarding acne and its treatments are expected to boost adoption rates of various therapies.

- The growing middle-class populations in emerging markets like Asia-Pacific and Latin America will contribute significantly to the demand for acne medications.

- Favorable regulatory environments in many regions will encourage the development and approval of new and innovative acne treatments.

- Partnerships between pharmaceutical companies and technology firms will accelerate the development of innovative solutions for acne care.

- Preventive skincare will gain traction, leading to the development of acne medications focused on early intervention and maintaining skin health.

- The adoption of combination therapies, which offer more comprehensive treatment options, will become more prevalent as patients seek more effective solutions.