Market Overview

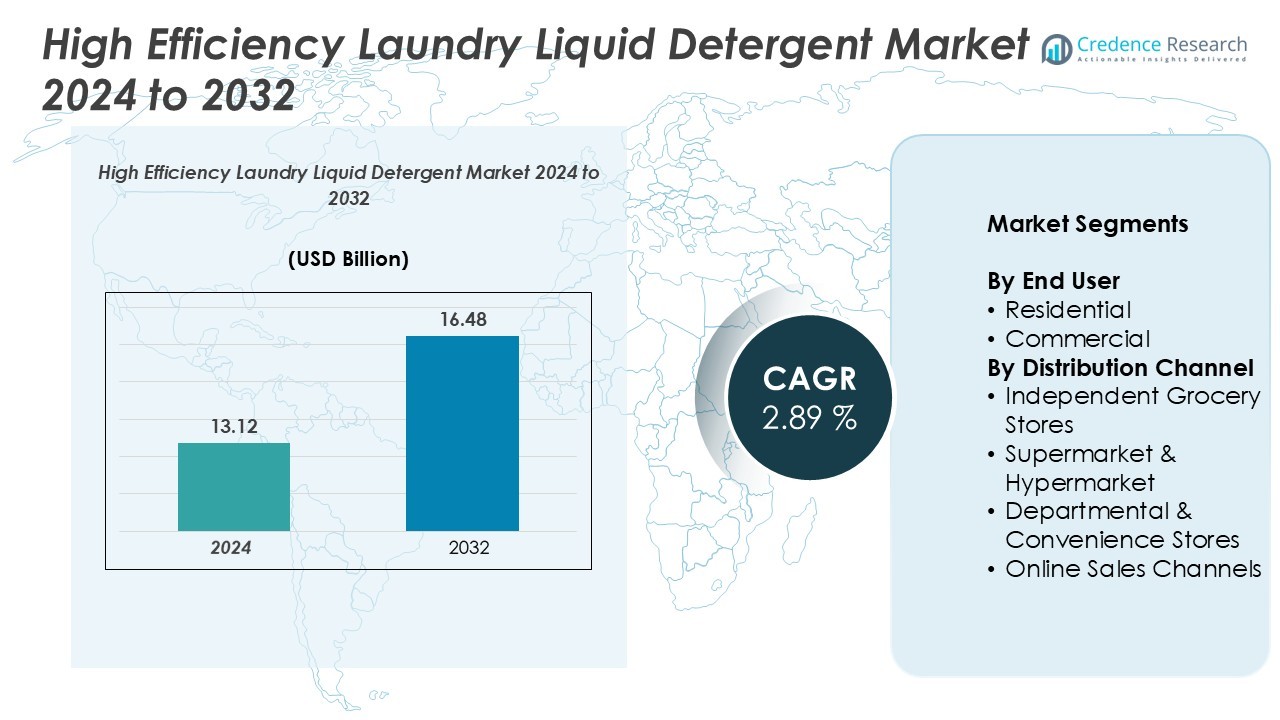

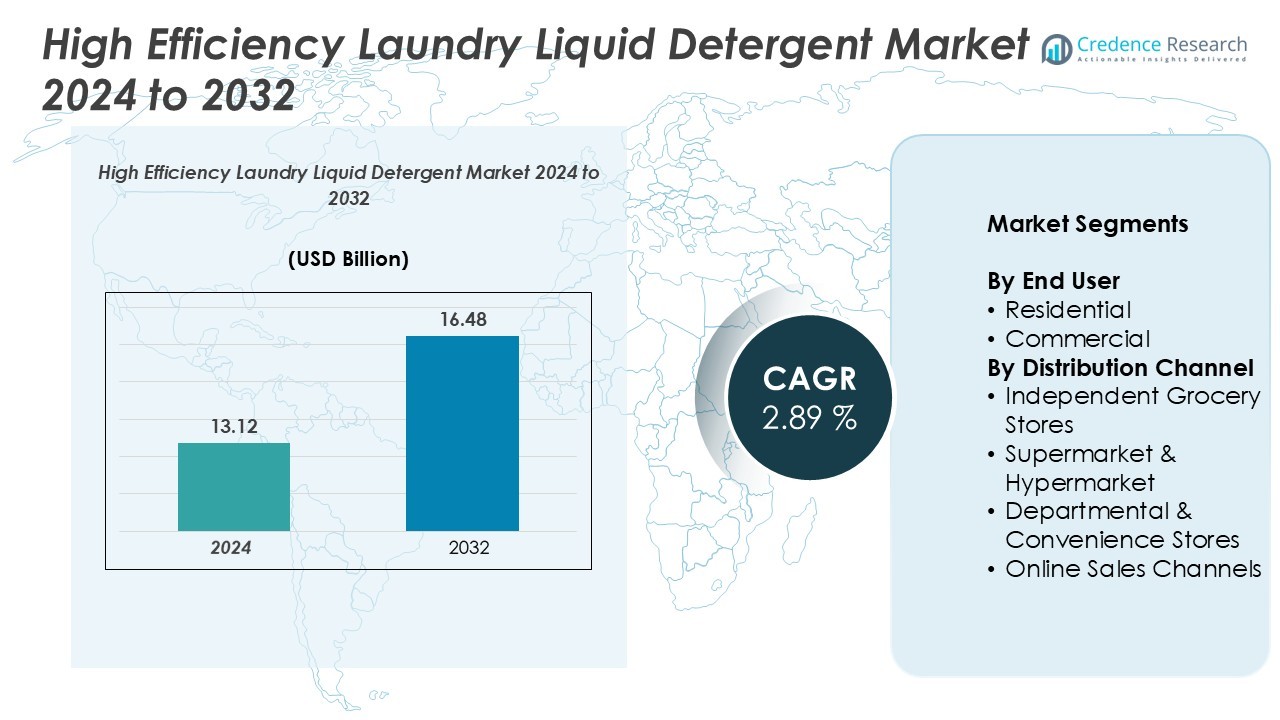

The High Efficiency Laundry Liquid Detergent Market size was valued at USD 13.12 billion in 2024 and is anticipated to reach USD 16.48 billion by 2032, at a CAGR of 2.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Efficiency Laundry Liquid Detergent Market Size 2024 |

USD 13.12 Billion |

| High Efficiency Laundry Liquid Detergent Market, CAGR |

2.89% |

| High Efficiency Laundry Liquid Detergent Market Size 2032 |

USD 16.48 Billion |

The high efficiency laundry liquid detergent market is led by major players such as Unilever, Procter & Gamble, Henkel AG & Co. KGaA, Reckitt Benckiser Group PLC, The Clorox Company, Church & Dwight, Inc., Colgate-Palmolive Company, Ecolab Inc., Biokleen, and Venus Laboratories dba Earth Friendly Products. These companies dominate through strong brand portfolios, extensive R&D, and sustainable formulation advancements. North America leads the global market with a 34% share, driven by high adoption of energy-efficient appliances and premium detergents, followed by Europe with 28%, emphasizing eco-friendly and concentrated products. Asia Pacific, holding 25%, shows the fastest growth due to rapid urbanization, rising disposable incomes, and expanding e-commerce retail networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The High Efficiency Laundry Liquid Detergent Market was valued at USD 13.12 billion in 2024 and is projected to reach USD 16.48 billion by 2032, growing at a CAGR of 2.89% during the forecast period.

- Market growth is driven by the rising use of energy-efficient washing machines and increasing consumer preference for concentrated, eco-friendly detergents that reduce water and energy consumption.

- Trends such as sustainable packaging, bio-based surfactants, and digital retail expansion are shaping product innovation and customer engagement across global markets.

- The market is moderately competitive, with leading players including Unilever, Procter & Gamble, Henkel, and Reckitt Benckiser focusing on R&D and brand differentiation, while smaller eco-friendly brands gain traction in niche segments.

- Regionally, North America holds 34%, followed by Europe with 28% and Asia Pacific with 25%, while the residential end-user segment dominates with over 70% market share due to growing household detergent consumption.

Market Segmentation Analysis:

By End User

The residential segment holds the dominant share of the high efficiency laundry liquid detergent market, accounting for over 70% of total consumption. This dominance is driven by the growing adoption of energy-efficient washing machines and rising awareness of sustainable home care solutions. Consumers increasingly prefer concentrated liquid detergents that offer higher cleaning power at lower dosages. Urbanization, smaller household sizes, and higher disposable incomes further accelerate residential demand. Manufacturers focus on launching eco-friendly and low-foam formulations to cater to environmentally conscious households, strengthening product penetration in the residential sector.

- For instance, Unilever’s Wonder Wash formula was indeed designed for 15-minute cycles, and the innovation was supported by 35 pending patents.

By Distribution Channel

Supermarkets and hypermarkets represent the leading distribution channel, capturing around 45% of the market share. Their dominance stems from strong product visibility, attractive discounts, and wide brand assortments. Consumers prefer these outlets for bulk purchases and promotional offers. The growing presence of organized retail networks in urban and semi-urban areas continues to support segment growth. However, online sales channels are expanding rapidly, fueled by digital promotions and subscription-based delivery models, allowing customers to access premium detergent brands conveniently and cost-effectively.

- For instance, Wonder Wash drove volume and competitive momentum in Europe and contributed to the company’s “share-winning growth across multiple markets.

Key Growth Drivers

Rising Adoption of Energy-Efficient Appliances

The growing penetration of high-efficiency (HE) washing machines is a major driver for the high efficiency laundry liquid detergent market. These appliances require low-sudsing, quick-dissolving detergents to ensure optimal performance and prevent residue buildup. Consumers increasingly prefer HE detergents that deliver superior cleaning results with reduced water and energy usage. Manufacturers such as Procter & Gamble and Henkel are developing advanced HE formulations compatible with smart washing technologies. Government incentives promoting energy-efficient appliances further support demand growth. This trend aligns with global sustainability goals, positioning HE detergents as essential household cleaning products across both developed and emerging economies.

- For instance, Procter & Gamble’s Tide HE Liquid Laundry Detergent is specifically designed for high-efficiency (HE) washing machines. The product is sold in various sizes, with corresponding load counts.

Growing Focus on Eco-Friendly and Concentrated Formulations

Rising environmental awareness and stricter regulations on chemical usage are driving the shift toward eco-friendly detergents. Consumers seek biodegradable, phosphate-free, and plant-based formulations that minimize environmental impact without compromising cleaning performance. Concentrated detergents also appeal to users due to reduced packaging waste and lower transportation emissions. Companies like Unilever and Church & Dwight are expanding their green product portfolios with biodegradable surfactants and recyclable packaging. This sustainable innovation not only strengthens brand loyalty but also allows manufacturers to capture environmentally conscious consumers, fueling steady market expansion across global retail channels.

- For instance, Unilever purchased the world’s first linear alkylbenzene (LAB) surfactant made from renewable carbon for its cleaning products.

Increasing Urbanization and Evolving Consumer Lifestyles

Rapid urbanization, coupled with busier lifestyles, has led to higher reliance on convenient and high-performing cleaning solutions. Dual-income households prefer liquid detergents that dissolve quickly and clean effectively in shorter wash cycles. The growing working-class population and rising disposable incomes further contribute to increased detergent consumption. Moreover, premiumization trends are encouraging consumers to shift toward specialized HE detergents with added fragrances and fabric care properties. The expansion of e-commerce platforms and brand visibility through digital marketing campaigns enhance accessibility, reinforcing the market’s growth trajectory among tech-savvy and time-conscious consumers worldwide.

Key Trends & Opportunities

Expansion of E-Commerce and Direct-to-Consumer Channels

The digital transformation of retail has opened new growth avenues for detergent manufacturers. Online platforms such as Amazon, Walmart, and brand-owned websites allow customers to compare products, read reviews, and subscribe for recurring deliveries. This shift provides companies with valuable consumer insights and direct engagement opportunities. Subscription models and online-exclusive eco-packs are gaining traction, offering convenience and sustainability. Smaller players are also leveraging social media marketing and influencer partnerships to build niche HE detergent brands. The continued rise of online shopping is expected to reshape distribution dynamics, enhancing market penetration and consumer retention.

- For instance, Unilever’s CEO confirmed in late 2023 that digital commerce represented 17% of the company’s total revenue. It also correctly reports strong e-commerce growth within India, including that the quick commerce business more than doubled in 2023.

Technological Innovation in Detergent Formulations

Advances in surfactant technology and enzyme engineering are enabling the creation of highly efficient, multi-functional detergents. Formulations that deliver effective stain removal at low temperatures appeal to energy-conscious consumers. Innovations such as micro-encapsulated fragrance beads and smart dosing systems are enhancing user experience. Companies are investing in R&D to improve solubility, reduce residues, and increase compatibility with automated washing systems. For instance, advanced cold-wash enzyme blends now allow energy savings of up to 40%. These innovations not only improve product performance but also position manufacturers competitively in an increasingly sustainability-driven market.

- For instance, P&G uses enzymes, including Savinase from Novozymes, to ensure Ariel detergents perform effectively at low wash temperatures (15°C or lower) and reduce energy consumption. The collaboration is well-documented in the context of their shared focus on advancing cold water cleaning technology. The specific use of the “16L” formulation is highly plausible, though the exact composition of specific detergent products can vary and evolve over time.

Key Challenges

High Product Costs and Intense Price Competition

The development of premium, high-efficiency formulations often involve costly raw materials, including biodegradable surfactants and enzyme complexes. These factors increase production expenses, limiting affordability in price-sensitive markets. Additionally, established global brands face competition from low-cost regional manufacturers offering similar cleaning performance at reduced prices. Frequent promotional discounts and retailer markups further strain profit margins. Maintaining a balance between product quality, sustainability, and affordability remains a persistent challenge for manufacturers aiming to expand their footprint in both emerging and mature economies.

Limited Consumer Awareness in Developing Markets

Despite global growth, awareness regarding high-efficiency detergents remains limited in several developing regions. Many consumers still rely on traditional powder detergents due to lower costs and habit persistence. The lack of widespread availability of HE washing machines further restricts adoption. Educational campaigns and product demonstrations are essential to communicate the long-term cost and performance benefits of HE detergents. Without effective consumer education and retail engagement, manufacturers may struggle to achieve desired penetration levels in emerging markets, slowing the pace of market expansion.

Regional Analysis

North America

North America holds a 34% market share in the high efficiency laundry liquid detergent market. Strong adoption of energy-efficient appliances, high consumer spending, and demand for eco-friendly formulations drive market growth. The U.S. dominates regional consumption, supported by leading brands like Procter & Gamble and Church & Dwight introducing concentrated, low-sudsing detergents. Growing environmental regulations and the popularity of sustainable packaging further accelerate innovation. Expanding e-commerce channels also enhance product accessibility, while consumers increasingly prefer premium detergents with fragrance retention and hypoallergenic properties, reinforcing North America’s leadership in the global market.

Europe

Europe accounts for 28% of the global market share, driven by stringent sustainability standards and widespread use of high-efficiency washing machines. The U.K., Germany, and France lead demand, with consumers prioritizing biodegradable and phosphate-free formulations. Manufacturers such as Henkel and Unilever emphasize eco-certified ingredients and recyclable packaging. Government-led awareness programs promoting energy conservation continue to fuel regional adoption. Additionally, private-label detergents are gaining ground through supermarkets and online platforms, offering cost-effective yet sustainable alternatives. Technological innovations and rising interest in fragrance-boosted detergents further strengthen the European market’s position.

Asia Pacific

Asia Pacific captures 25% of the market share, showing the fastest growth due to rapid urbanization and increasing household incomes. Expanding middle-class populations in China, India, and Japan are fueling detergent consumption. Manufacturers are focusing on affordable HE liquid formulations tailored for compact washing machines common in urban households. Local brands and multinational players are investing heavily in marketing to educate consumers about water-efficient products. Rising awareness of environmental concerns and the growth of e-commerce platforms further enhance product availability. This region is expected to become a key growth hub over the forecast period.

Latin America

Latin America holds a 7% market share, with Brazil and Mexico leading detergent consumption. Increasing penetration of energy-efficient washing machines and the growing preference for liquid detergents over powders support market expansion. Consumers are shifting toward concentrated formulas that offer higher performance and longer-lasting fragrance. Manufacturers are strengthening distribution networks through supermarkets and digital retail channels to reach a broader audience. Promotional pricing and rising awareness of hygiene and fabric care contribute to steady growth, although economic fluctuations and import costs may slightly impact pricing strategies in the region.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the global market share, driven by increasing urbanization and rising awareness of hygiene standards. Countries like the UAE, Saudi Arabia, and South Africa show growing adoption of premium liquid detergents, supported by expanding retail infrastructure. International brands dominate, offering advanced formulations suitable for varying water conditions. The trend toward sustainability and fragrance-rich products is gaining momentum among middle-income consumers. Although limited appliance penetration in rural areas remains a challenge, ongoing infrastructure development and e-commerce expansion are expected to improve market accessibility.

Market Segmentations:

By End User

By Distribution Channel

- Independent Grocery Stores

- Supermarket & Hypermarket

- Departmental & Convenience Stores

- Online Sales Channels

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The high efficiency laundry liquid detergent market is highly competitive, with global players focusing on product innovation, sustainability, and brand differentiation. Key companies such as Unilever, Procter & Gamble, Henkel AG & Co. KGaA, Reckitt Benckiser Group PLC, and The Clorox Company dominate the market through extensive distribution networks and diversified product portfolios. These companies invest heavily in R&D to develop concentrated, biodegradable, and enzyme-rich formulations that enhance cleaning performance while reducing environmental impact. Emerging players like Biokleen and Venus Laboratories dba Earth Friendly Products are gaining traction by promoting eco-friendly and plant-based detergents. Strategic collaborations, digital marketing, and e-commerce expansion are driving competitiveness across regions. Moreover, private-label brands are intensifying price competition in retail markets, while multinational manufacturers continue to prioritize premium product segments, sustainable packaging, and consumer convenience features to strengthen their market positioning and brand loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Unilever

- Reckitt Benckiser Group PLC

- The Clorox Company

- Procter and Gamble

- Henkel AG and Co. KGaA

- Church and Dwight, Inc.

- Colgate-Palmolive Company

- Ecolab Inc.

- Biokleen

- Venus Laboratories dba Earth Friendly Products

Recent Developments

- In 2024, Henkel launched Persil® Activewear Clean, a first-of-its-kind detergent specifically designed for athletic wear. This product addresses the growing demand for products that effectively remove body oil, sweat, and odors while maintaining the shape and stretch of performance fabrics. This product was recognized as a 2025 Product of the Year USA Award winner, reflecting its popularity and innovation in meeting the needs of consumers with active lifestyles.

- In 2023, ARM & HAMMER™ Power Sheets Laundry Detergent was launched, an eco-friendly sheet format, and all® free clear ultra-concentrated liquid detergent with 100% recycled plastic bottles, as well as a broader trend toward hypoallergenic, dermatologist-tested, and smart detergents compatible with advanced washing machines

Report Coverage

The research report offers an in-depth analysis based on End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with rising adoption of energy-efficient washing machines worldwide.

- Eco-friendly and biodegradable detergent formulations will gain higher consumer preference.

- Concentrated liquid detergents will dominate as consumers seek cost-efficient and sustainable options.

- Manufacturers will focus more on recyclable and refillable packaging solutions.

- Online sales and subscription-based delivery models will drive long-term customer retention.

- Technological innovations will improve enzyme performance and cold-water washing efficiency.

- Premium detergent brands will strengthen presence through fragrance and fabric care enhancements.

- Regional growth will accelerate in Asia Pacific due to urbanization and digital retail expansion.

- Strategic partnerships and mergers will increase to expand market reach and product portfolios.

- Consumer education campaigns will rise to promote awareness of HE detergents’ performance and sustainability benefits.