Market Overview:

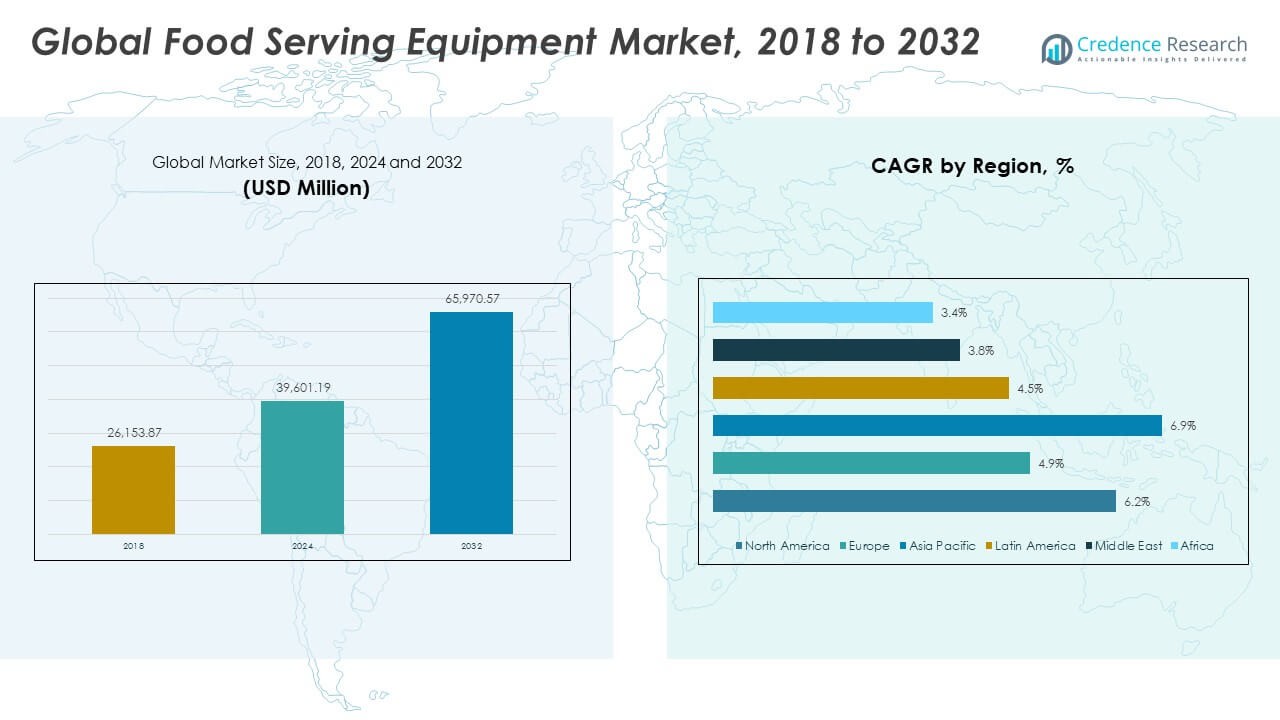

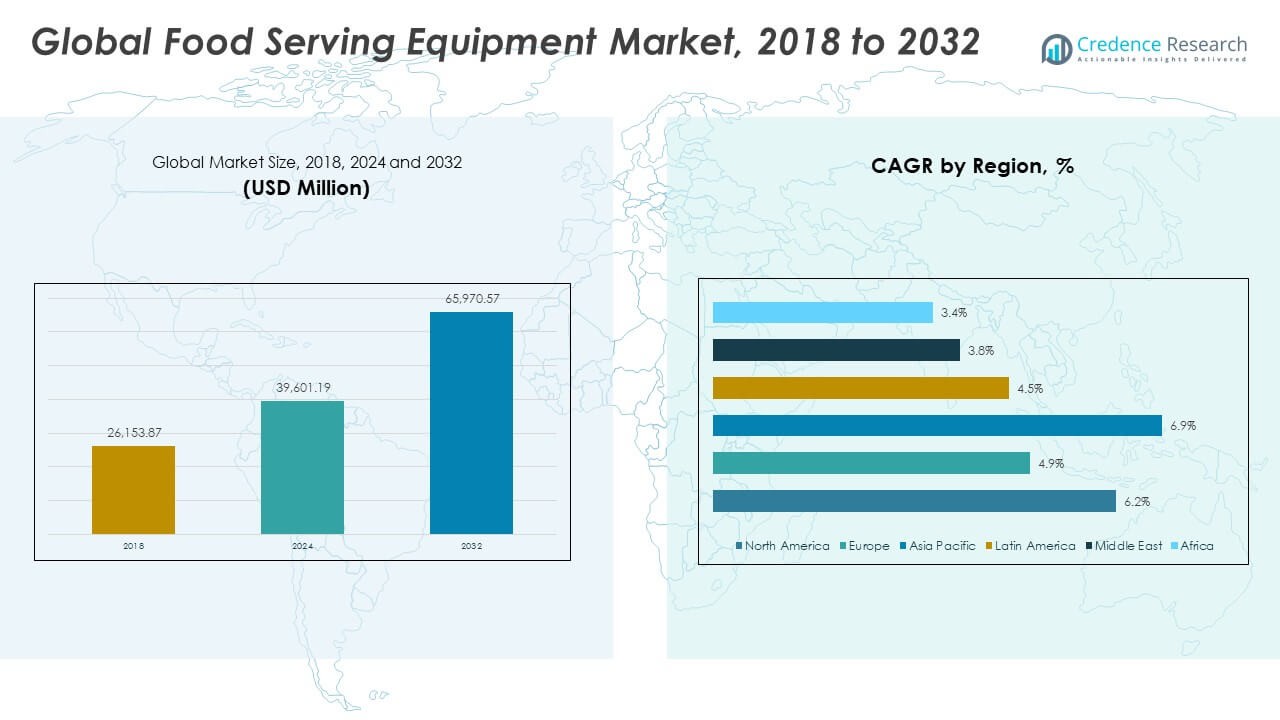

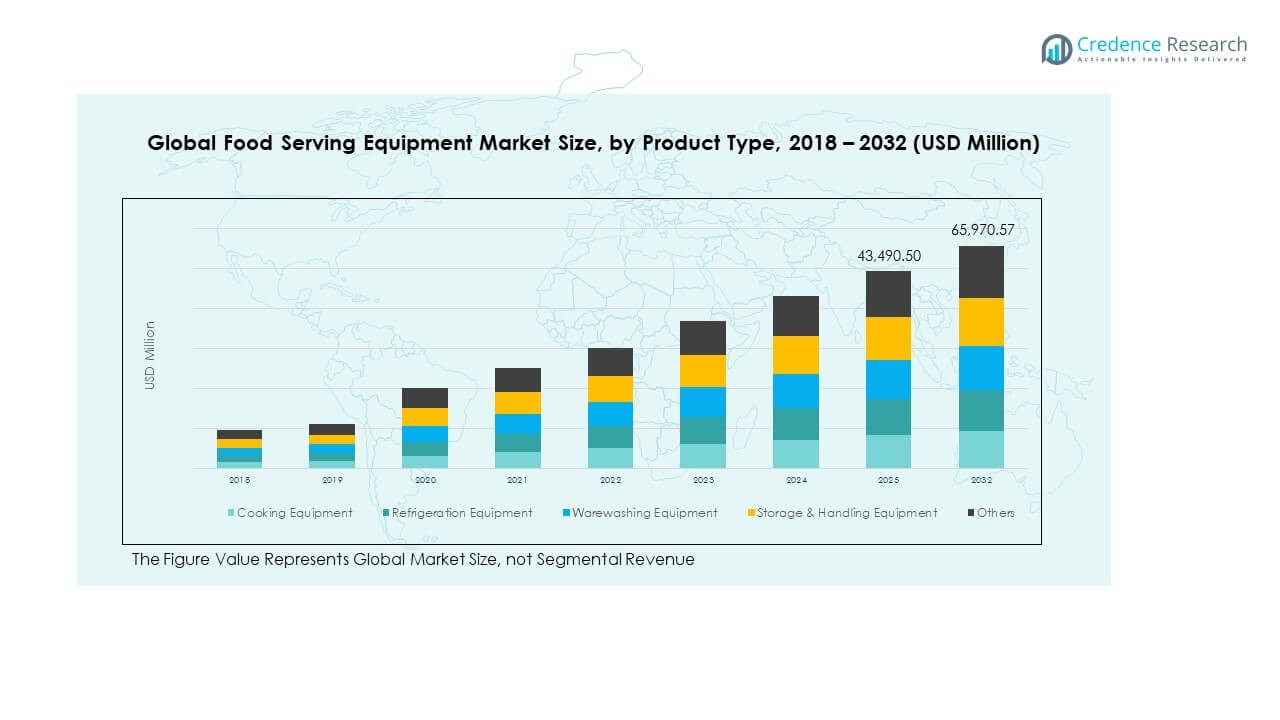

The Global Food Serving Equipment Market size was valued at USD 26,153.87 million in 2018 to USD 39,601.19 million in 2024 and is anticipated to reach USD 65,970.57 million by 2032, at a CAGR of 6.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Serving Equipment Market Size 2024 |

USD 39,601.19 Million |

| Food Serving Equipment Market, CAGR |

6.13% |

| Food Serving Equipment Market Size 2032 |

USD 65,970.57 Million |

Growing urban populations, higher disposable incomes, and changing dining habits are driving the Global Food Serving Equipment Market. Restaurants, quick-service outlets, and institutional cafeterias are upgrading equipment to improve operational efficiency, food presentation, and customer satisfaction. Manufacturers focus on smart, ergonomic, and durable solutions that reduce energy consumption and maintenance requirements. Expansion of catering services, hotel chains, and cloud kitchens further fuels demand. Technological advancements and sustainability initiatives encourage businesses to invest in modern serving systems. It continues to benefit from these structural and operational trends, strengthening market momentum.

Regionally, North America and Europe lead the Global Food Serving Equipment Market due to established foodservice infrastructure and high adoption of advanced technology. Asia Pacific is emerging rapidly, driven by urbanization, tourism, and expanding restaurant networks in countries like China, India, and Japan. Latin America shows moderate growth with increasing hospitality investments, while the Middle East benefits from luxury dining and hotel developments. Africa presents early-stage opportunities as foodservice infrastructure develops. Market expansion in emerging regions is supported by growing awareness of hygiene, automation, and operational efficiency, making them key growth areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Food Serving Equipment Market size was valued at USD 26,153.87 million in 2018, USD 39,601.19 million in 2024, and is projected to reach USD 65,970.57 million by 2032, expanding at a CAGR of 6.13% during the forecast period.

- North America leads with 27% share due to advanced foodservice infrastructure, Europe holds 19% supported by established hospitality chains, and Asia Pacific has 41% driven by rapid urbanization and expanding restaurant networks.

- Asia Pacific is the fastest-growing region with a 41% share, fueled by increasing urban population, tourism growth, and modernization of commercial kitchens.

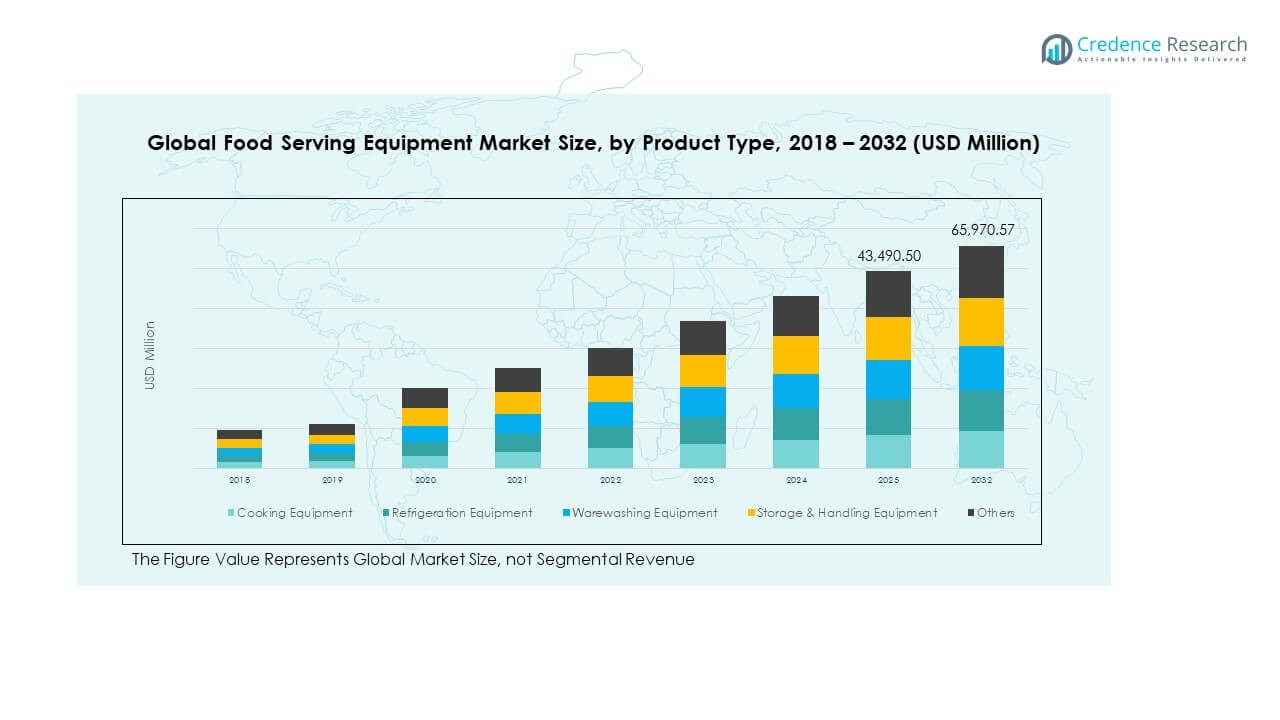

- By product type, cooking equipment dominates the market with roughly 30% share, followed by refrigeration and warewashing equipment, reflecting high demand for essential kitchen functionality.

- Storage & handling equipment and other product types collectively account for about 25% of the market, supporting efficiency and operational workflow in commercial and institutional foodservice operations.

Market Drivers

Rising Demand from the Expanding Hospitality and Foodservice Industry

The Global Food Serving Equipment Market experiences strong growth due to expansion in the hospitality and foodservice sectors. Increasing numbers of hotels, quick-service restaurants, and catering firms are fueling the adoption of advanced serving solutions. Growing urban populations and changing consumer dining habits support this trend. Many establishments focus on modern presentation, hygiene, and convenience. The rise in commercial kitchens in corporate offices and institutional canteens is further driving equipment needs. Energy-efficient and ergonomic designs are now preferred by end users. Growing tourism in key economies enhances the demand for serving solutions. It continues to evolve with the increasing sophistication of global dining experiences.

- For instance, Yum! Brands has invested in digital kitchen technologies and automation across its restaurants in the U.S. and Asia-Pacific to improve operational efficiency and support faster order processing. These initiatives focus on enhancing throughput, reducing manual effort, and integrating smart cooking equipment to optimize service delivery.

Technological Advancements Enhancing Operational Efficiency and Hygiene

Technology adoption is transforming food serving equipment with smart sensors, automation, and IoT integration. Modern systems now monitor temperature, reduce waste, and ensure food safety. Many manufacturers focus on connected systems for real-time maintenance and control. This enhances reliability, minimizes downtime, and extends product lifespan. Automation also reduces manual handling, ensuring hygiene and efficiency in commercial kitchens. Intelligent dispensers and automated serving stations are gaining traction in large-scale food operations. The integration of touchless systems supports post-pandemic safety standards. It reinforces consumer confidence and improves workflow efficiency across hospitality spaces.

Shift Toward Sustainable and Energy-Efficient Equipment Solutions

Sustainability is a major driver influencing purchasing decisions in this market. Manufacturers are developing eco-friendly materials and designs that cut energy use. Government regulations on energy consumption encourage the shift toward greener solutions. Businesses prefer low-emission equipment to meet their corporate sustainability goals. Recyclable components and longer product lifecycles attract environmentally conscious buyers. The foodservice industry is increasingly aware of its carbon footprint. Green certifications and compliance standards strengthen brand reputation in global markets. It highlights the growing link between sustainability and market competitiveness.

- For instance, Irinox launched its MultiFresh Next blast chiller/freezers using R290 natural refrigerant, focusing on eco-friendly operation and reduced environmental impact. These units are designed to improve energy efficiency in commercial kitchens while maintaining high performance and food quality standards.

Growth of Organized Retail and Institutional Food Services

The organized retail and institutional catering sectors contribute significantly to market expansion. Large chains and foodservice companies invest heavily in modern equipment to handle high volumes. Organized food retailing supports uniform quality and presentation standards. Schools, hospitals, and corporate cafeterias are upgrading facilities with advanced serving systems. Equipment reliability and hygiene are critical in these environments. The growth of cloud kitchens and online meal delivery adds demand for durable, efficient serving tools. Government nutrition programs in developing countries create further opportunities. It continues to benefit from investments in public foodservice infrastructure worldwide.

Market Trends

Adoption of Smart and Connected Food Serving Technologies

serving technologies are reshaping how the foodservice industry operates. Equipment with IoT-enabled monitoring, automated temperature control, and predictive maintenance is becoming common. These systems help operators improve service quality while reducing energy use. Connectivity also supports centralized management of multiple locations. Data-driven insights allow better decision-making in inventory and maintenance planning. Remote control functions simplify operations for large restaurant networks. Integration with digital ordering platforms enhances service speed and consistency. The Global Food Serving Equipment Market benefits from the convergence of technology and foodservice efficiency.

- For instance, GTI Designs deployed its IoT-enabled Futuro Multideck and United display cases for a U.S. supermarket chain, enhancing temperature monitoring and improving operational efficiency across multiple stores.

Focus on Modular and Space-Saving Design Innovations

Modern kitchens prefer modular and compact serving equipment to optimize limited space. The trend supports faster installation, easier maintenance, and flexible layout changes. Modular systems suit quick-service outlets and mobile catering setups. Lightweight, foldable, or stackable products offer convenience for small operations. Urban foodservice spaces demand adaptable solutions to handle high customer turnover. Multi-functional designs reduce clutter and improve operational flow. Manufacturers are investing in user-friendly, ergonomic configurations to match this demand. It ensures higher efficiency without compromising on performance or presentation quality.

- For instance, Riddhi Display launched a modular restaurant kitchen equipment line for a Mumbai-based quick-service chain, designed to improve workflow efficiency and optimize operational workspace in commercial kitchens.

Rising Popularity of Customization and Aesthetic Appeal in Equipment Design

A growing emphasis on customer experience drives demand for visually appealing serving equipment. Restaurants and hotels seek customized colors, finishes, and themes to reflect brand identity. Manufacturers now collaborate with designers to develop tailored solutions. Aesthetic integration with interiors enhances dining ambience and customer satisfaction. High-end establishments prefer premium materials like stainless steel and tempered glass. Custom design also improves functionality and brand differentiation in competitive markets. Consumer expectations are pushing innovation beyond standard designs. It strengthens the emotional connection between food presentation and overall dining experience.

Expansion of Cloud Kitchens and Self-Service Models in Food Distribution

The increasing number of cloud kitchens and self-service food stations is shaping market evolution. These models rely on reliable and compact serving systems to streamline workflows. Self-serve buffet stations and automated dispensers are becoming common in commercial spaces. Touchless technology ensures hygiene and customer safety in high-traffic zones. Cloud kitchens prefer standardized equipment for easy scalability across multiple outlets. Equipment designed for fast assembly and minimal maintenance suits these models. The market is evolving toward automation and contactless delivery environments. It aligns with digital transformation in food distribution and restaurant operations.

Market Challenges Analysis

High Initial Investment and Maintenance Costs for Advanced Systems

The Global Food Serving Equipment Market faces significant barriers due to high setup costs. Advanced systems require substantial capital for procurement and installation. Small and medium-sized businesses find it difficult to adopt premium solutions. Maintenance expenses for automated and connected devices remain high. Replacement parts and skilled technicians are often limited in developing regions. Equipment downtime affects productivity and customer service quality. Economic fluctuations also delay upgrades in commercial establishments. It continues to struggle with cost-sensitive buyers despite technological progress.

Stringent Health and Safety Regulations Across Multiple Regions

Regulatory compliance adds complexity to global equipment manufacturing. Each region enforces unique safety and food-handling standards. Manufacturers must adapt designs to meet local certification requirements. Non-compliance risks penalties, delays, and loss of market trust. Frequent policy updates increase operational uncertainty for producers. Testing, documentation, and certification raise production timelines and costs. Smaller players face challenges keeping pace with regulatory changes. It creates competitive pressure that favors large companies with global compliance systems.

Market Opportunity

Emergence of Automation and Digital Integration as Growth Catalysts

Automation and digital control systems are opening new opportunities for the industry. Smart serving systems reduce waste, optimize energy use, and improve food safety. Digital dashboards provide real-time performance data to kitchen operators. Restaurants and hotels are adopting automated serving robots for efficiency and hygiene. The demand for AI-powered scheduling and predictive maintenance tools is rising. Connectivity enhances communication between appliances and staff for smoother service. The Global Food Serving Equipment Market is leveraging automation for greater reliability. It creates an edge for manufacturers offering integrated smart solutions.

Expanding Demand Across Emerging Economies and Institutional Sectors

Developing nations offer vast potential through growing foodservice infrastructure. Rapid urbanization and rising income levels encourage dining-out trends. Institutional catering in hospitals, schools, and offices creates a steady equipment demand. Governments in Asia-Pacific and Africa are investing in hospitality and tourism facilities. Affordable, durable, and energy-efficient solutions attract new buyers in these markets. Partnerships between global brands and local distributors improve accessibility. It continues to expand as businesses modernize service systems in emerging regions. The trend strengthens long-term market sustainability and geographic diversification.

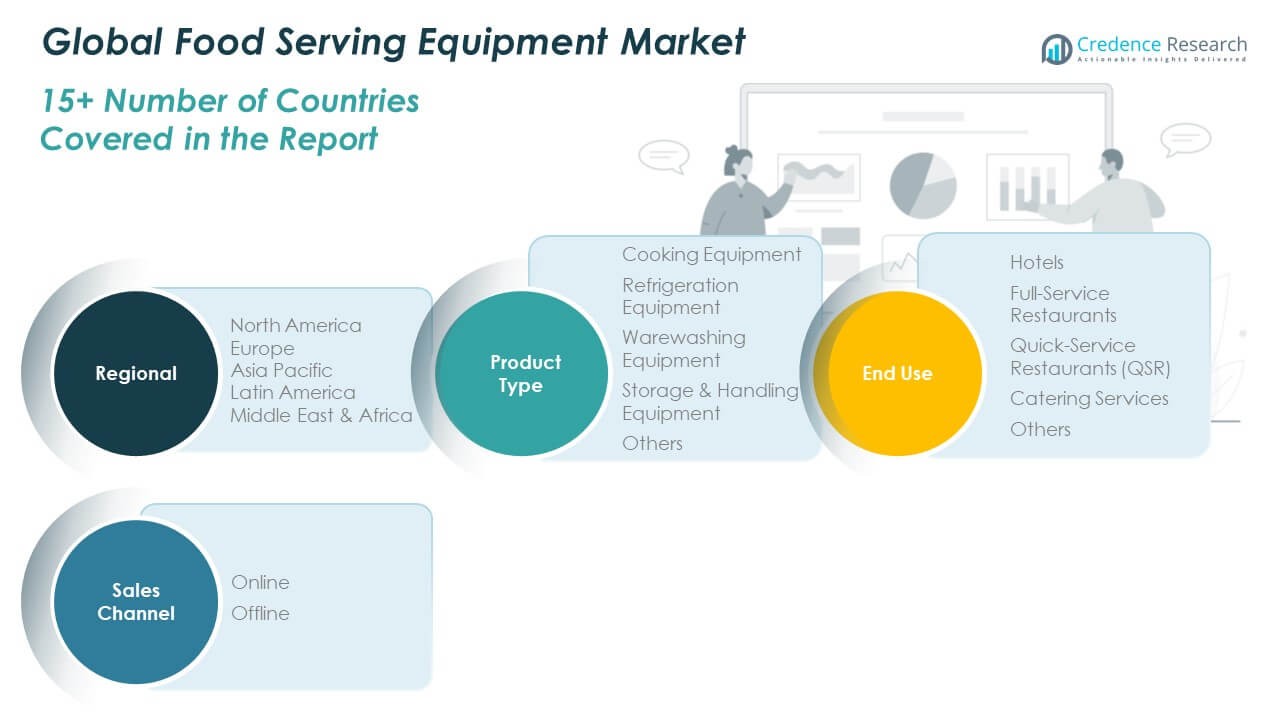

Market Segmentation Analysis:

By Product Type, the Global Food Serving Equipment Market is divided into cooking equipment, refrigeration equipment, warewashing equipment, storage and handling equipment, and others. Cooking equipment holds the largest share, supported by strong demand from commercial kitchens and foodservice chains. Refrigeration systems follow due to their role in maintaining food safety and quality. Warewashing and storage equipment are gaining popularity for enhancing workflow efficiency and hygiene compliance. The growing focus on energy efficiency and automation across these categories drives continuous product innovation and upgrades.

- For instance, Hobart’s AMTL Two Level Door Type Dishwasher delivers the highest throughput available for door-type machines, achieving up to 80 racks per hour and NSF-compliant sanitization in every cycle, as confirmed in the product’s launch data.

By End Use, the market includes hotels, full-service restaurants, quick-service restaurants (QSR), catering services, and others. Quick-service restaurants dominate due to fast-paced operations and high equipment turnover. Hotels and full-service restaurants maintain steady demand for premium and customized serving solutions. Catering services are expanding with event-based dining and outdoor service requirements. The shift toward ready-to-serve and buffet-style operations supports equipment modernization across all end users.

- For instance, McDonald’s implemented AI-enabled kitchen equipment and sensor-connected fryers across its global restaurants to enhance predictive maintenance, streamline operations, and improve efficiency in food preparation and service.

By Sales Channel, the market is segmented into online and offline distribution. The offline channel leads due to established dealer networks and on-site product demonstrations preferred by large buyers. The online segment is growing rapidly with the rise of e-commerce platforms offering wide product selection and transparent pricing. It benefits from digital marketing, direct brand sales, and increasing acceptance of online procurement among small foodservice operators.

Segmentation:

By Product Type

- Cooking Equipment

- Refrigeration Equipment

- Warewashing Equipment

- Storage & Handling Equipment

- Others

By End Use

- Hotels

- Full-Service Restaurants

- Quick-Service Restaurants (QSR)

- Catering Services

- Others

By Sales Channel

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Global Food Serving Equipment Market size was valued at USD 7,253.66 million in 2018 to USD 10,803.62 million in 2024 and is anticipated to reach USD 18,076.63 million by 2032, at a CAGR of 6.2% during the forecast period. North America holds a 27% market share, driven by the presence of established foodservice chains and advanced hospitality infrastructure. The region’s demand is supported by continuous investments in restaurant modernization and automation. Rising preference for energy-efficient and smart equipment enhances replacement rates. The United States leads the market with strong consumer spending on dining-out activities. Canada and Mexico follow, expanding through quick-service and institutional catering outlets. Sustainability regulations and hygiene standards influence purchasing decisions. It benefits from high product innovation and strong manufacturer presence.

Europe

The Europe Global Food Serving Equipment Market size was valued at USD 4,870.75 million in 2018 to USD 6,970.09 million in 2024 and is anticipated to reach USD 10,555.76 million by 2032, at a CAGR of 4.9% during the forecast period. Europe accounts for a 19% share, supported by growing adoption of energy-efficient and design-focused serving systems. The region’s foodservice industry emphasizes aesthetics and sustainability in equipment procurement. Germany, the UK, and France dominate with well-established catering and hospitality sectors. Manufacturers prioritize ergonomic designs and eco-friendly materials to meet strict EU standards. Technological advancements in warewashing and refrigeration enhance operational performance. The presence of leading brands and R&D centers strengthens regional competitiveness. It continues to benefit from the integration of digital and modular serving solutions.

Asia Pacific

The Asia Pacific Global Food Serving Equipment Market size was valued at USD 11,615.54 million in 2018 to USD 18,226.78 million in 2024 and is anticipated to reach USD 32,186.93 million by 2032, at a CAGR of 6.9% during the forecast period. Asia Pacific dominates the market with a 41% share, led by strong economic growth and rising foodservice investments. China, Japan, and India are the primary contributors, supported by rapid urbanization and changing eating habits. Expanding restaurant chains and catering services stimulate regional equipment demand. Government incentives for tourism infrastructure further encourage modernization. Local manufacturers focus on affordable, durable, and compact product designs. The region shows strong adoption of automated and smart equipment in urban centers. It continues to lead in production scale and market expansion potential.

Latin America

The Latin America Global Food Serving Equipment Market size was valued at USD 1,258.61 million in 2018 to USD 1,882.49 million in 2024 and is anticipated to reach USD 2,782.39 million by 2032, at a CAGR of 4.5% during the forecast period. Latin America captures a 6% market share, with Brazil and Mexico serving as key growth hubs. Rising food retail chains and institutional kitchens support equipment demand across major cities. Expanding tourism and event catering sectors contribute to regional sales. The need for affordable, durable, and easy-to-maintain equipment remains strong. International brands are increasing partnerships with local distributors to enhance availability. Economic stability and hospitality growth influence long-term adoption. It continues to gain traction through modernization of local foodservice infrastructure.

Middle East

The Middle East Global Food Serving Equipment Market size was valued at USD 712.29 million in 2018 to USD 983.22 million in 2024 and is anticipated to reach USD 1,374.03 million by 2032, at a CAGR of 3.8% during the forecast period. The Middle East holds a 4% market share, supported by expanding hotel, resort, and catering operations. GCC countries, led by the UAE and Saudi Arabia, are driving demand through hospitality investments. Growth in tourism and food festivals enhances product adoption. The focus on luxury dining and high-end kitchen equipment fuels premium product sales. Regional distributors offer tailored solutions to meet local climate and service requirements. Government-led diversification into non-oil sectors boosts the foodservice ecosystem. It maintains steady growth supported by large-scale event catering and quick-service outlets.

Africa

The Africa Global Food Serving Equipment Market size was valued at USD 443.01 million in 2018 to USD 734.98 million in 2024 and is anticipated to reach USD 994.81 million by 2032, at a CAGR of 3.4% during the forecast period. Africa represents a 3% share, showing gradual adoption driven by urbanization and economic reforms. South Africa leads the regional market with strong hotel and restaurant development. Growing middle-class population and food delivery trends encourage equipment upgrades. Local catering services and institutional food programs are expanding steadily. Limited infrastructure challenges continue to affect distribution and servicing capacity. International players are entering through partnerships and franchise support. The region’s future growth depends on investments in foodservice infrastructure and training. It shows early-stage potential for long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Electrolux

- Welbilt

- Duke Manufacturing

- MEIKO Maschinenbau GmbH & Co. KG

- The Middleby Corporation

- HOSHIZAKI CORPORATION

- Hobart

- RATIONAL AG

- BUNN

- Cambro Manufacturing Co. Inc.

Competitive Analysis:

The Global Food Serving Equipment Market features strong competition among international and regional manufacturers focusing on innovation, quality, and sustainability. Leading companies such as Electrolux, Welbilt, The Middleby Corporation, and HOSHIZAKI CORPORATION emphasize product advancement, modular design, and digital integration. Many brands invest in smart technologies that enhance energy efficiency and operational control in commercial kitchens. It remains highly consolidated, with established players holding significant revenue shares across North America and Europe. Smaller firms compete through niche offerings, customized solutions, and cost-effective designs. Strategic mergers, regional expansions, and product launches define current competition trends. The market also witnesses growing partnerships with hospitality chains and foodservice distributors. It continues to evolve through digitalization and the adoption of connected food equipment to improve performance and user experience.

Recent Developments:

- In October 2025, RATIONAL USA expanded its partnership with Schmid Dewland, increasing the manufacturer’s representative coverage to include additional sales territories in the United States (MAFSI Region 5). RATIONAL also broadened its partnership with PMR Foodservice Equipment Reps and Alliance Foodservice Equipment, further strengthening sales and customer support across multiple regions in 2025.

- In August 2025, The Middleby Corporation expanded its portfolio through the acquisition of Oka-Spezialmaschinenfabrik GmbH & Co. KG, a German manufacturer specializing in extrusion, molding, and cutting equipment for bakery and confectionery sectors. This strategic move grows Middleby’s food processing equipment offerings while boosting support for the bakery business globally.

- In August 2025, Hoshizaki Alliance finalized the acquisition of Structural Concepts Corporation, a leading U.S. manufacturer of advanced food display cases. This deal strengthens Hoshizaki’s equipment lineup and expands its reach into foodservice, supermarket, and convenience store markets in the Americas.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, End Use and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of smart, connected, and automated serving equipment will redefine foodservice operations.

- Increasing focus on sustainability and energy efficiency will influence product design and materials.

- Rapid growth of quick-service and cloud kitchen models will accelerate equipment demand.

- Expansion of hospitality and tourism industries will enhance investments in advanced serving systems.

- Integration of AI and IoT-based maintenance tools will improve operational reliability and lifecycle management.

- Growing preference for modular, compact, and customizable systems will support space-efficient installations.

- Manufacturers will expand production facilities across Asia Pacific to meet rising regional demand.

- Strategic collaborations between equipment producers and foodservice brands will strengthen distribution networks.

- Digital sales channels and e-commerce growth will enhance accessibility for small and mid-sized buyers.

- Ongoing product innovations focused on hygiene, automation, and design will sustain market competitiveness.