Market Overview:

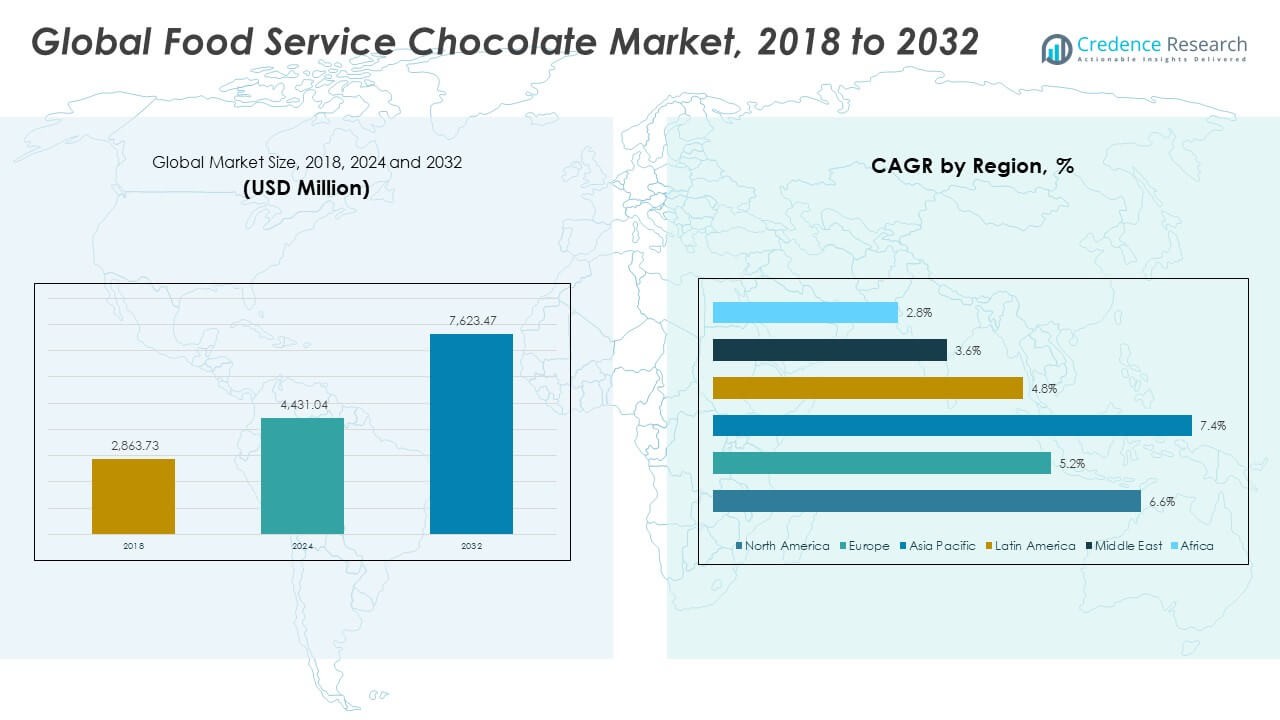

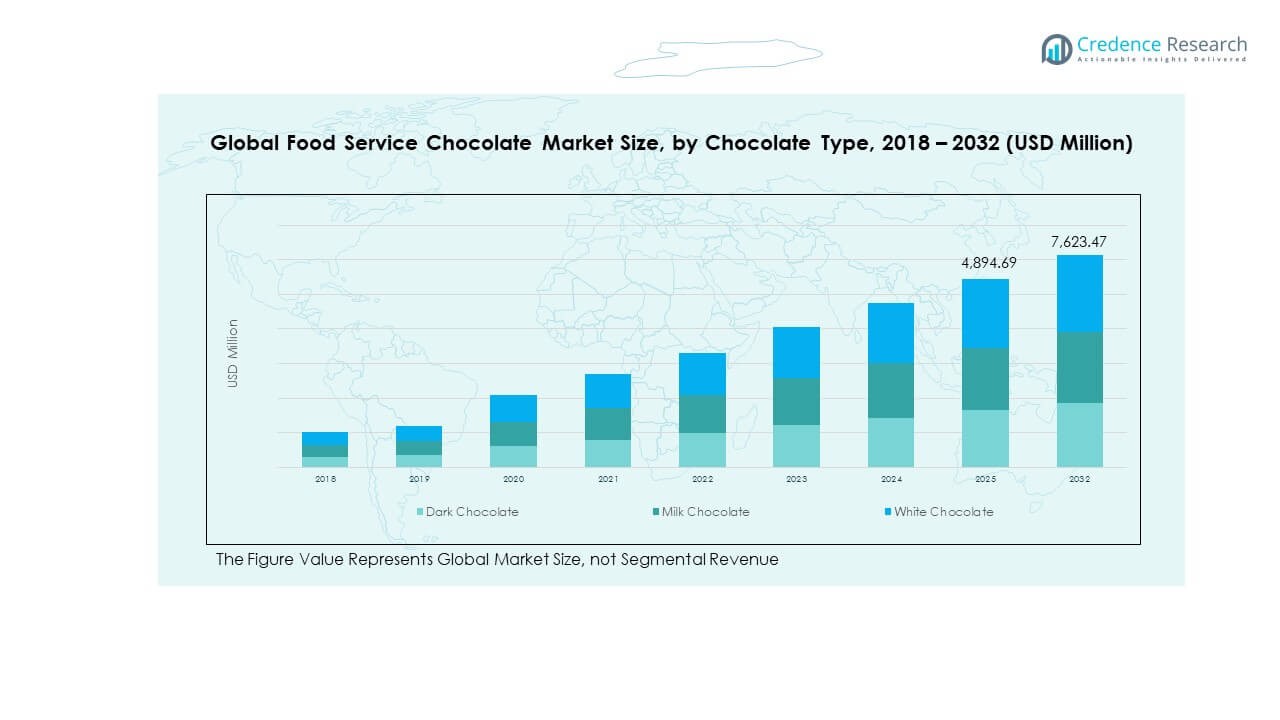

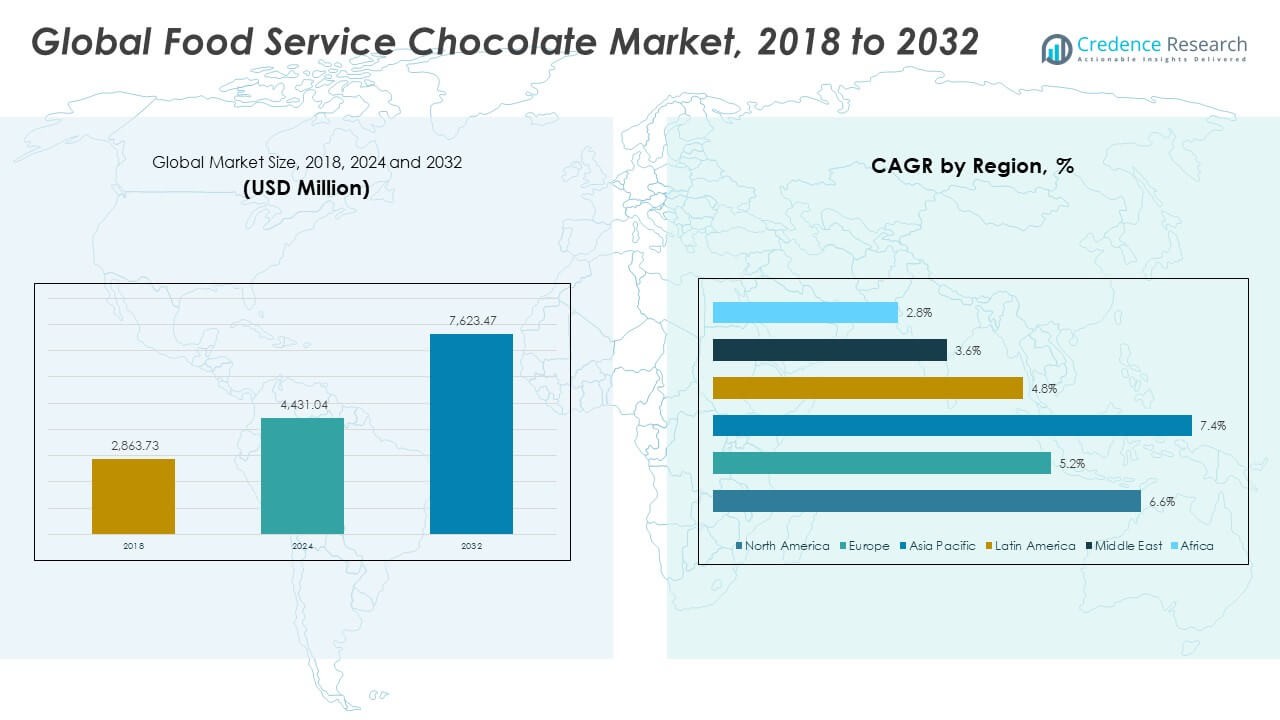

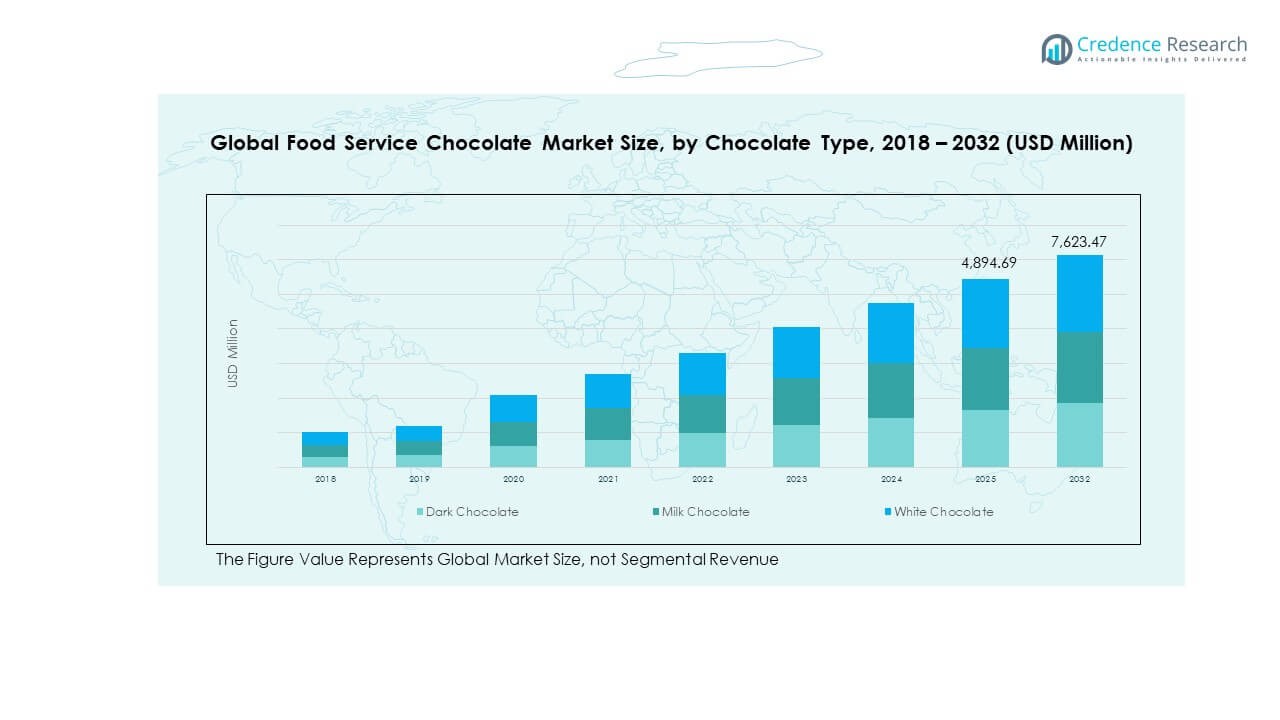

The Global Food Service Chocolate Market size was valued at USD 2,863.73 million in 2018 to USD 4,431.04 million in 2024 and is anticipated to reach USD 7,623.47 million by 2032, at a CAGR of 6.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Service Chocolate Market Size 2024 |

USD 4,431.04 Million |

| Food Service Chocolate Market, CAGR |

6.53% |

| Food Service Chocolate Market Size 2032 |

USD 7,623.47 Million |

Rising demand for premium chocolate products drives growth in the Global Food Service Chocolate Market. Food service operators integrate high-quality chocolate into desserts, beverages, and specialty menu items to enhance customer experience. It encourages manufacturers to innovate with flavors, textures, and formats tailored for hotels, cafés, and bakeries. Chains and independent operators purchase bulk chocolate products to ensure consistent supply. It also promotes sustainable and ethically sourced ingredients. Seasonal offerings and limited-edition products further stimulate consumption. It strengthens brand loyalty and supports competitive differentiation in the market.

North America and Western Europe lead the Global Food Service Chocolate Market with mature café, hotel, and bakery sectors. Asia Pacific shows rapid growth due to rising disposable income, expanding urban café culture, and increased hotel chains. Latin America and the Middle East display moderate adoption driven by urbanization and emerging café formats. Africa remains smaller but gradually develops with increasing awareness of premium chocolate offerings. It encourages tailored product offerings and efficient supply chain strategies. Market expansion in emerging regions relies on cultural adaptation and premium product introduction.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Food Service Chocolate Market was valued at USD 2,863.73 million in 2018, USD 4,431.04 million in 2024, and is projected to reach USD 7,623.47 million by 2032, growing at a CAGR of 6.53% during the forecast period.

- North America, Europe, and Asia Pacific hold the largest market shares at 32%, 22%, and 26% respectively, driven by mature café and hotel sectors, high disposable income, and established food service infrastructure.

- Asia Pacific is the fastest-growing region with a 26% share, propelled by urbanization, expanding café culture, and rising consumer demand for premium chocolate offerings.

- By chocolate type, dark chocolate leads with an estimated 40% share, followed by milk chocolate at 35%, reflecting consumer preference for premium and balanced flavor profiles.

- White chocolate holds approximately 25% of the market, used mainly in desserts, beverages, and decorative applications, supporting product innovation and menu diversification.

Market Drivers

Rising Consumer Preference For Premium And Indulgent Chocolate Offerings

The Global Food Service Chocolate Market experiences strong growth due to rising consumer preference for premium chocolate products. It drives food service operators to incorporate high-quality cocoa and unique flavors into menus. Consumers increasingly choose artisanal, gourmet, and customized chocolate desserts and beverages. Retail and café chains respond with bulk procurement to maintain consistent supply. It encourages innovation in chocolate formulations and ingredient blends. Health-conscious formulations, like reduced sugar or organic chocolate, attract niche consumer segments. Restaurants and bakeries leverage chocolate trends to differentiate menus. It strengthens brand loyalty and enhances overall customer satisfaction.

Expansion Of Quick Service Restaurants And Café Chains Globally

Rapid expansion of quick service restaurants (QSRs) and café chains fuels the Global Food Service Chocolate Market. It increases demand for ready-to-use chocolate ingredients for beverages, pastries, and desserts. Chains require consistent quality and efficient supply chain management. It motivates manufacturers to provide diversified product formats and pre-tempered chocolate solutions. Menu innovation often integrates chocolate-based seasonal and promotional offerings. It supports higher purchase volumes by food service operators. Operators adopt premium chocolate to meet evolving consumer expectations. It creates long-term contracts between suppliers and QSR chains.

- For instance, Barry Callebaut Group’s annual report for fiscal year 2023–24 shows the company delivered over 554,190 metric tons of chocolate products to North America including significant volumes to quick service chains demonstrating its capacity for uninterrupted, large-scale supply and successful fulfillment of long-term contracts with international café and restaurant operators.

Technological Innovations In Chocolate Production And Customization

Technological advancements in chocolate processing support the growth of the Global Food Service Chocolate Market. It allows manufacturers to produce consistent flavors, textures, and shapes efficiently. Innovations include functional chocolate, flavor infusions, and temperature-stable formulations. Food service providers adopt these technologies to enhance product quality and presentation. It enables precise portioning and easy integration into recipes. Manufacturers also optimize packaging for bulk distribution. It reduces wastage and increases operational efficiency. Technological adoption drives profitability for both producers and operators.

Increasing Demand For Sustainable And Ethical Chocolate Sources

Sustainability trends significantly influence the Global Food Service Chocolate Market. It encourages sourcing cocoa from certified ethical and fair-trade farms. Operators and consumers prioritize traceable supply chains and eco-friendly packaging. It motivates chocolate manufacturers to implement sustainable practices in cultivation and processing. Companies adopt energy-efficient production techniques to reduce carbon footprint. It improves brand image among environmentally conscious consumers. Restaurants and cafés highlight sustainability in marketing and menu offerings. It supports premium pricing for responsibly sourced chocolate products.

- For example, in April 2025, Mondelēz International reported a 9% year-on-year reduction in its Scope 3 greenhouse gas emissions between 2023 and 2024. The company confirmed that about 91% of the cocoa used in its chocolate products was sourced through its Cocoa Life sustainability program, as stated in its official ESG disclosures.

Market Trends

Integration Of Chocolate Into Innovative Beverage Formats Across Cafés And QSRs

The Global Food Service Chocolate Market sees growing adoption in beverage innovations. It expands usage in hot and cold chocolate drinks, milkshakes, and specialty coffee beverages. Cafés leverage chocolate blends to create signature drinks. It enables pairing with seasonal flavors like caramel, nuts, or spices. Operators introduce visually appealing chocolate toppings and decorations. It enhances customer engagement through unique beverage experiences. Market players focus on convenient ready-to-use chocolate syrups and powders. It supports increased sales and repeat visits.

Customization And Personalization Of Chocolate-Based Menu Items

Personalization trends drive the Global Food Service Chocolate Market, emphasizing unique consumer experiences. It encourages operators to offer customized chocolate desserts, toppings, and fillings. Consumers select flavor combinations, shapes, and portion sizes. It promotes interactive menu experiences, enhancing engagement. Chains adopt modular product designs for rapid customization. It increases average transaction values and customer satisfaction. Chocolate producers respond by offering tailored bulk ingredients. It positions operators as trend-conscious and innovative. It strengthens competitive advantage in saturated food service markets.

- For instance, Barry Callebaut, a leading supplier of chocolate to QSRs and cafés, highlighted in its 2025 Chocolate Trends Report the rise of multi-flavor chocolate offerings and digital customization tools, validated through an 11-country consumer survey and implemented with QSR chains like Krispy Kreme.

Incorporation Of Health-Oriented Ingredients In Chocolate Offerings

Health-conscious formulations emerge as a key trend in the Global Food Service Chocolate Market. It promotes reduced-sugar, high-cocoa, and functional chocolate products. Operators integrate ingredients like superfoods, nuts, or protein powders. It addresses growing demand for indulgence without compromising health. Consumers seek transparency regarding nutritional content and sourcing. It encourages brands to develop innovative labeling and educational campaigns. Food service operators align offerings with wellness-oriented menu strategies. It drives higher adoption in cafés, restaurants, and hotels.

- For instance, Lindt & Sprüngli introduced its EXCELLENCE Fusion tablets in August 2025, blending 70% and 85% cocoa content with optional layers of milk or white chocolate, catering to consumers seeking high-cocoa, less-sweet chocolate with unique flavor fusions.

Adoption Of Automation And Efficient Supply Chain Solutions For Chocolate Ingredients

Automation trends influence the Global Food Service Chocolate Market in production and delivery. It enables consistent quality, faster processing, and reduced human error. Manufacturers adopt automated tempering, molding, and packaging systems. It facilitates large-scale distribution for cafés, bakeries, and hotels. Operators benefit from efficient inventory management and real-time supply tracking. It ensures timely replenishment and prevents stockouts. Chocolate suppliers invest in cold chain and storage technologies. It enhances overall operational efficiency and reduces losses. It strengthens reliability and customer trust.

Market Challenges Analysis

Volatility In Cocoa Prices And Raw Material Supply Constraints

The Global Food Service Chocolate Market faces challenges from fluctuating cocoa prices and limited raw material availability. It increases production costs and impacts profit margins for manufacturers. Supply disruptions in key cocoa-producing countries affect consistent deliveries. It forces food service operators to adjust pricing or menu offerings. Import-dependent regions experience additional logistical and regulatory complexities. It discourages small operators from maintaining premium chocolate items. Manufacturers respond with long-term contracts or alternative ingredient blends. It requires careful planning to stabilize supply and cost structures.

Stringent Regulatory Standards And Sustainability Compliance Pressure

Regulatory compliance poses significant hurdles in the Global Food Service Chocolate Market. It must meet food safety, labeling, and quality standards in multiple regions. Operators face pressure to source ethically and demonstrate sustainability practices. It increases operational complexity and documentation requirements. Non-compliance risks fines, product recalls, and reputational damage. Manufacturers invest in certifications and monitoring systems to align with regulations. It affects small and medium-sized enterprises disproportionately. Operators must balance innovation with compliance demands. It emphasizes strategic planning to ensure regulatory alignment.

Market Opportunities

Expansion Into Emerging Markets With Rising Disposable Income And Café Culture

The Global Food Service Chocolate Market offers opportunities in emerging regions, driven by growing disposable income. It supports expansion of cafés, bakeries, and dessert chains. Operators can introduce premium and artisanal chocolate offerings. It enables penetration into urban and semi-urban centers. Local adaptation of flavors and product sizes enhances consumer acceptance. It allows partnerships with local suppliers for sustainable sourcing. Manufacturers can scale production to meet growing demand. It encourages strategic marketing and brand positioning in emerging markets.

Innovation In Functional And Specialty Chocolate Offerings To Capture Niche Segments

Functional and specialty chocolate presents growth potential in the Global Food Service Chocolate Market. It enables development of products with added nutrients, protein, or wellness benefits. Operators can target health-conscious consumers and premium segments. It supports seasonal, limited-edition, and personalized chocolate products. Manufacturers respond with unique formulations and bulk-ready solutions. It fosters collaboration between chocolate producers and food service operators. Innovation increases customer engagement and repeat business. It enhances differentiation in competitive food service markets.

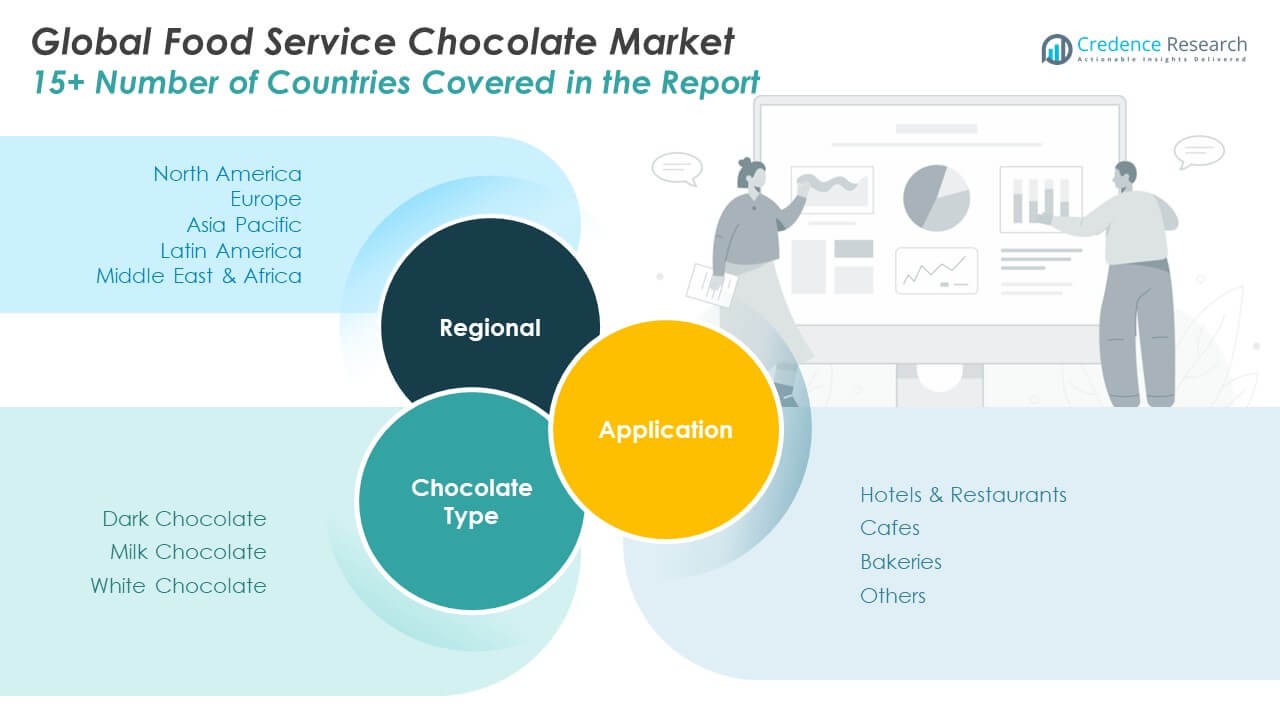

Market Segmentation Analysis:

By Chocolate Type

The Global Food Service Chocolate Market demonstrates varied demand across chocolate types. Dark chocolate dominates premium offerings due to its rich flavor and high cocoa content, appealing to both gourmet and health-conscious consumers. Milk chocolate attracts a broad consumer base with its balanced sweetness, supporting high-volume usage in cafés and bakeries. White chocolate maintains a niche presence, primarily for decorative applications and specialty desserts. It encourages innovation in flavor pairings and visual presentation. Manufacturers optimize production to meet distinct requirements for tempering, melting points, and texture for each type. It drives product diversification and enhances menu versatility for food service operators.

- For instance, Barry Callebaut’s 2nd Generation includes milk chocolate variations introduced in 2023, maintaining high throughput for bakery and café chains through efficient production that reduces ingredient complexity to only 2–3 raw components, as confirmed by their product trends report.

By Application

Hotels and restaurants lead chocolate usage in the Global Food Service Chocolate Market, leveraging it in desserts, beverages, and specialty dishes. Cafés drive consistent demand through chocolate-based drinks and pastries, promoting frequent purchases of syrups, powders, and couverture. Bakeries rely on chocolate for confections, decorative applications, and baked goods, creating bulk procurement opportunities for suppliers. Other applications include institutional catering and event-specific orders, supporting market penetration across various segments. It encourages customized product formats and flexible supply options to meet operational needs. These application segments collectively shape consumption patterns and influence strategic production decisions for manufacturers.

- For example, in 2024, Valrhona continued offering its professional-grade Ivoire 35% white chocolate and Dulcey 35% blond chocolate in large-bag and block formats for bakery and pastry professionals. These couvertures are designed for consistent melting and flavor balance in commercial kitchens, as stated on Valrhona’s official product listings.

Segmentation:

By Chocolate Type:

- Dark Chocolate

- Milk Chocolate

- White Chocolate

By Application:

- Hotels & Restaurants

- Cafes

- Bakeries

- Others

By Region / Country Analysis:

- North America: U.S., Canada, Mexico

- Europe: UK, France, Germany, Italy, Spain, Russia, Rest of Europe

- Asia Pacific: China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific

- Latin America: Brazil, Argentina, Rest of Latin America

- Middle East: GCC Countries, Israel, Turkey, Rest of Middle East

- Africa: South Africa, Egypt, Rest of Africa

Regional Analysis:

North America

The North America Global Food Service Chocolate Market size was valued at USD 937.43 million in 2018 to USD 1,430.39 million in 2024 and is anticipated to reach USD 2,470.08 million by 2032, at a CAGR of 6.6% during the forecast period. North America holds a significant market share due to mature café culture, extensive quick-service restaurant networks, and strong consumer preference for premium chocolate products. It drives consistent demand in hotels, restaurants, and bakeries. Manufacturers supply bulk chocolate, syrups, and couverture to meet operational needs. It encourages innovation in flavor profiles, portioning, and packaging formats. Operators adopt sustainable and ethically sourced chocolate to attract conscious consumers. It benefits from advanced distribution channels and efficient logistics. Market growth also stems from increasing disposable income and urbanization trends.

Europe

The Europe Global Food Service Chocolate Market size was valued at USD 507.87 million in 2018 to USD 740.50 million in 2024 and is anticipated to reach USD 1,152.04 million by 2032, at a CAGR of 5.2% during the forecast period. Europe holds a strong market share driven by high consumption in cafés, patisseries, and hotels. It encourages premium and artisanal chocolate adoption for desserts and beverages. Countries like Germany, France, and the UK dominate demand with established chocolate traditions. It supports innovation in specialty chocolates, functional ingredients, and decorative applications. Operators emphasize quality, traceability, and sustainability. It benefits from organized retail and supply chain efficiency. Market growth is also supported by tourism and seasonal promotions.

Asia Pacific

The Asia Pacific Global Food Service Chocolate Market size was valued at USD 1,192.62 million in 2018 to USD 1,916.83 million in 2024 and is anticipated to reach USD 3,508.56 million by 2032, at a CAGR of 7.4% during the forecast period. Asia Pacific leads market growth with rapid urbanization, rising disposable income, and expanding café and hotel networks. It drives demand for premium and flavored chocolate products. Countries such as China, India, Japan, and South Korea show increasing adoption in beverages, desserts, and bakery items. It encourages product innovation tailored to local tastes. Operators prefer bulk procurement for efficiency and cost management. It benefits from strategic partnerships between local suppliers and global chocolate manufacturers. Market expansion is reinforced by rising awareness of quality and sustainable sourcing.

Latin America

The Latin America Global Food Service Chocolate Market size was valued at USD 124.76 million in 2018 to USD 190.45 million in 2024 and is anticipated to reach USD 286.79 million by 2032, at a CAGR of 4.8% during the forecast period. Latin America holds a moderate market share, driven by café chains, bakeries, and hotel consumption. It experiences demand for both mass-market and premium chocolate products. Countries like Brazil and Argentina dominate usage with growing urban centers. It encourages innovation in traditional and specialty chocolate offerings. Operators invest in bulk sourcing and cost-effective supply chains. It benefits from a rising middle-class population and tourism growth. Market expansion is gradually increasing with evolving consumer tastes.

Middle East

The Middle East Global Food Service Chocolate Market size was valued at USD 64.61 million in 2018 to USD 89.30 million in 2024 and is anticipated to reach USD 123.15 million by 2032, at a CAGR of 3.6% during the forecast period. The region holds a modest market share, supported by luxury hotels, cafés, and high-end restaurants. It drives demand for premium, artisanal, and seasonal chocolate products. Countries like the UAE, Saudi Arabia, and Israel lead consumption. It encourages innovation in packaging, presentation, and flavor infusions. Operators emphasize quality, imported chocolate, and ethical sourcing. It benefits from growing tourism and hospitality sectors. Market growth is steady with gradual adoption of global chocolate trends.

Africa

The Africa Global Food Service Chocolate Market size was valued at USD 36.44 million in 2018 to USD 63.57 million in 2024 and is anticipated to reach USD 82.85 million by 2032, at a CAGR of 2.8% during the forecast period. Africa holds a smaller market share due to limited premium chocolate adoption and fragmented food service infrastructure. It sees demand concentrated in hotels, urban cafés, and bakeries. Countries like South Africa and Egypt lead usage. It encourages niche premium and imported chocolate products. Operators manage supply chains carefully to reduce losses. It benefits from increasing urbanization and disposable income. Market growth remains moderate with gradual awareness of premium chocolate offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Mondelez International

- Mars Inc.

- Ferrero Group

- Nestlé S.A.

- The Hershey Company

- Barry Callebaut

- Guittard Chocolate Company

- Valrhona

- Blommer Chocolate Company

- Cargill

Competitive Analysis:

The Competitive Analysis of the Global Food Service Chocolate Market shows a highly concentrated landscape where major global players hold significant influence. Firms with extensive product portfolios and integrated supply chains dominate channel access and cost efficiencies. It drives competition through premium and value offerings tailored for hotels, cafés, and bakeries. Suppliers invest in sustainable sourcing, innovations in flavour and texture, and bulk-ready solutions to meet food‑service needs. It leads to strategic partnerships, acquisitions, and regional expansions to secure growth. Key companies such as Barry Callebaut, Nestlé S.A., Cargill, and Mondelēz International drive these dynamics. It places pressure on smaller or regional players to specialize in niche markets or adopt differentiated value propositions.

Recent Developments:

- In May 2025, Ghirardelli Chocolate Company launched a new line of food‑service chocolate products designed specifically for cafés and dessert operators, featuring pre‑portioned bars, sauces and toppings optimized for quick‑service and full‑service restaurants.

- In January 2024, Mars Incorporated completed the acquisition of Hotel Chocolat Group PLC, bringing the premium UK chocolate brand and its more than 130 stores under Mars’ portfolio and reinforcing its presence in food‑service chocolate segments.

- In April 2024, Duas Rodas S.A. introduced 26 new SKUs under its “Mix” brand targeting the food‑service channel, including ganaches, bake‑in fillings, flavour infusions and coatings, thereby expanding its portfolio for professional kitchens and dessert operations.

Report Coverage:

The research report offers an in-depth analysis based on Chocolate Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Premium and artisanal chocolate offerings will continue to gain traction in hotels, cafés, and bakeries.

- Expansion of quick service restaurants and café chains will drive consistent demand for bulk chocolate ingredients.

- Technological advancements in chocolate production will improve consistency, shelf life, and operational efficiency.

- Sustainability initiatives and ethical sourcing will influence purchasing decisions of food service operators.

- Health-conscious and functional chocolate formulations will attract niche consumer segments.

- Emerging markets in Asia Pacific and Latin America will show faster adoption due to rising disposable income.

- Customization of chocolate-based desserts and beverages will enhance consumer engagement and repeat business.

- Automation in production, packaging, and supply chain will reduce operational costs and wastage.

- Strategic collaborations between manufacturers and food service operators will strengthen market presence.

- Seasonal, limited-edition, and flavor innovation will sustain consumer interest and market differentiation.