Market Overview:

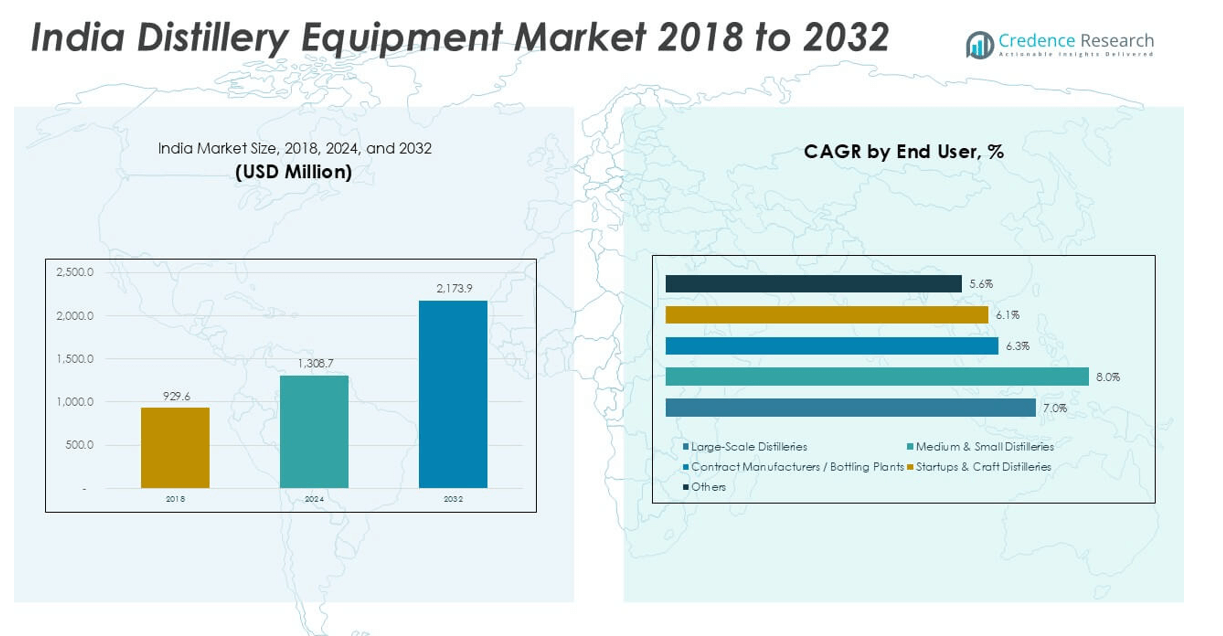

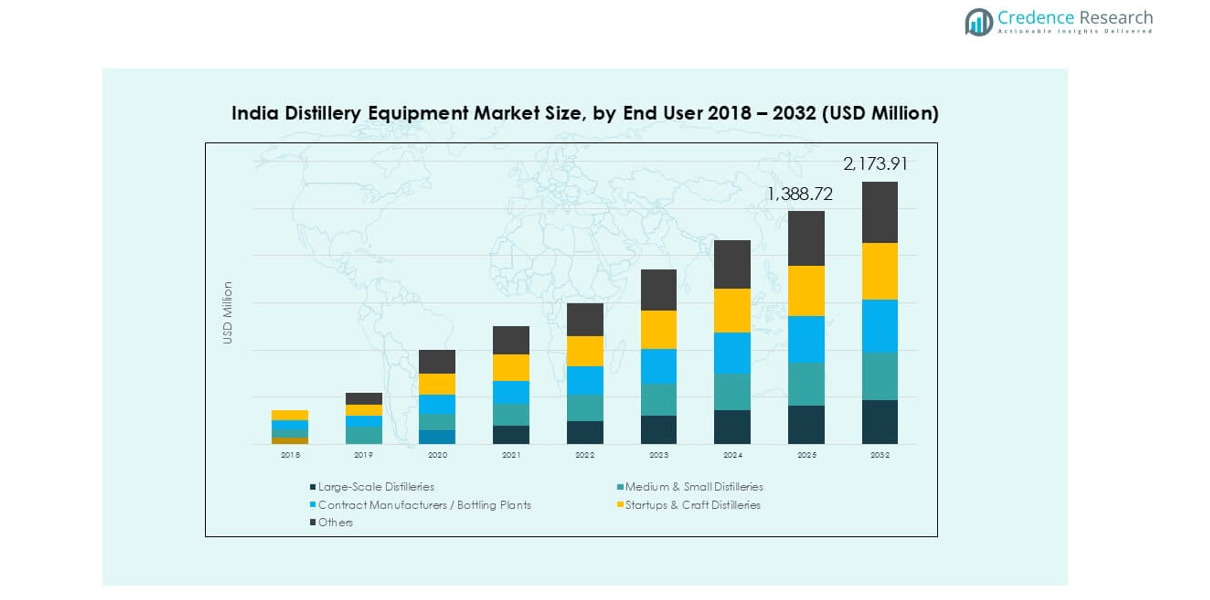

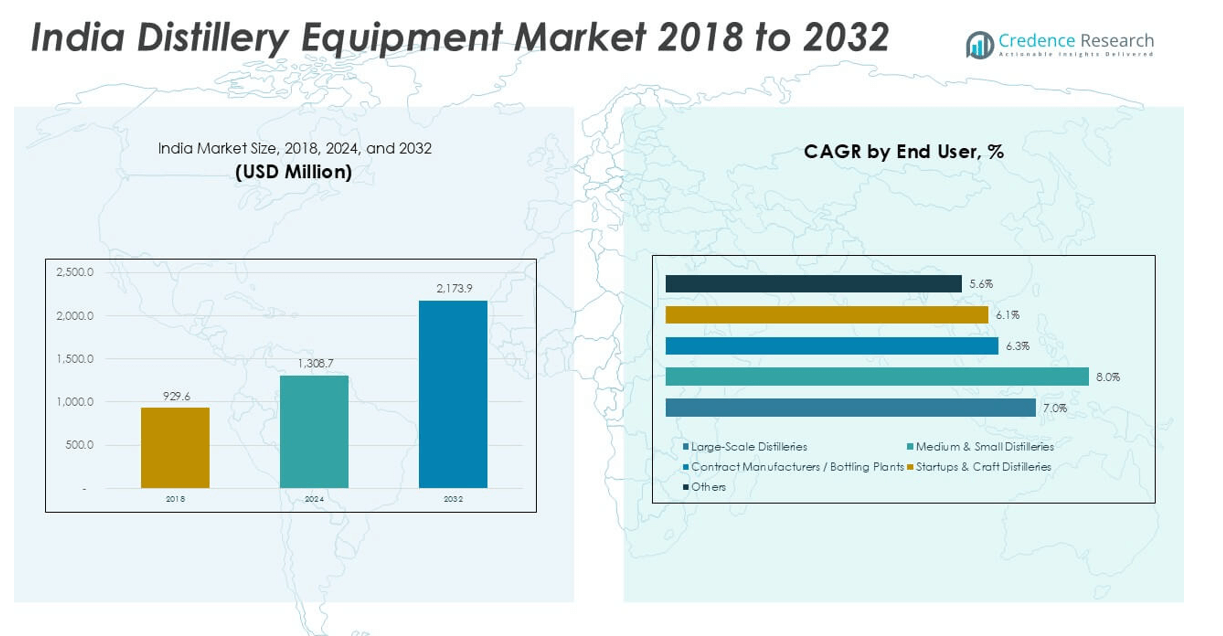

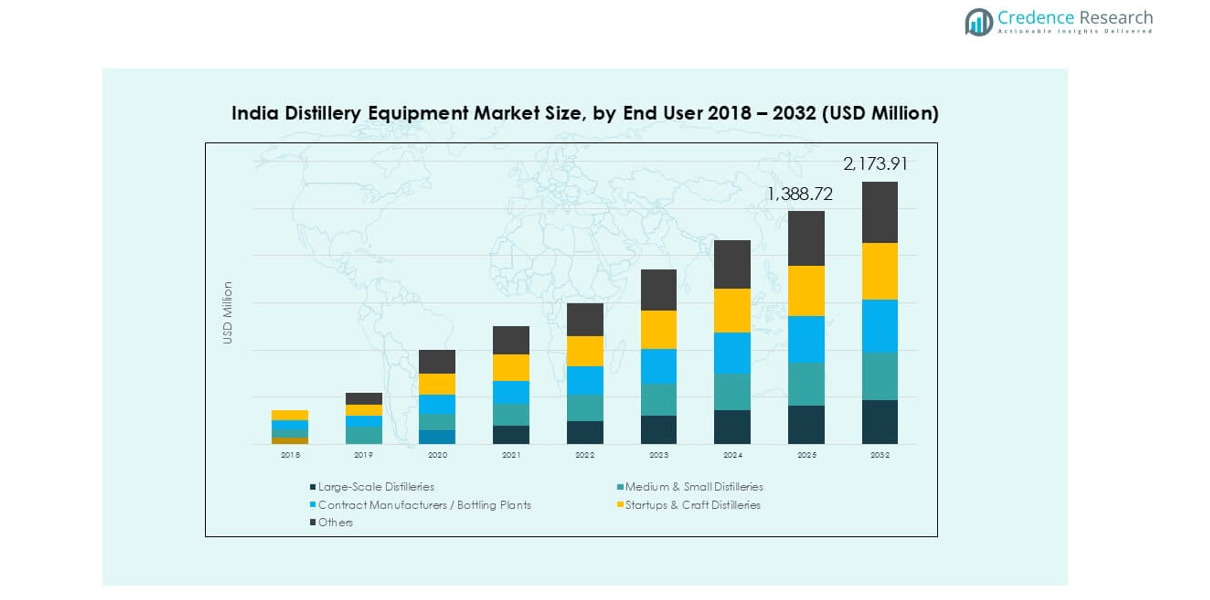

The India distillery equipment market was valued at USD 929.6 million in 2018 and reached USD 1308.7 million in 2024. It is projected to attain USD 2173.9 million by 2032, growing at a CAGR of 7.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Distillery Equipment Market Size 2024 |

USD 1308.7 million |

| India Distillery Equipment Market, CAGR |

7.0% |

| India Distillery Equipment Market Size 2032 |

USD 2173.9 million |

The India distillery equipment market is led by key players such as Praj Industries Ltd., Uttamenergy Ltd., Excel Engineers & Consultants, and SS Engineers, known for their advanced engineering solutions and turnkey project capabilities. Praj Industries Ltd. maintains a dominant position due to its strong presence in ethanol plant installations and process innovation. These companies cater to a wide spectrum of clients, from large-scale distilleries to craft units, offering a diverse range of fermentation, distillation, and automation equipment. Regionally, North India holds the largest share, accounting for 28% of the market in 2024, driven by dense distillery concentration in Uttar Pradesh, Haryana, and Punjab. The region benefits from government biofuel policies and abundant raw material supply, which continue to attract substantial investment in distillery infrastructure and equipment modernization.

Market Insights

- The India distillery equipment market was valued at USD 929.6 million in 2018 and reached USD 1308.7 million in 2024. It is projected to attain USD 2173.9 million by 2032, growing at a CAGR of 7.0% during the forecast period.

- Market growth is driven by expanding ethanol blending programs, rising demand for IMFL and craft spirits, and government incentives encouraging distillery capacity enhancement.

- A key trend is the increasing adoption of automation and turnkey solutions, particularly in mid- to large-scale distilleries, along with rising demand for modular equipment from microbreweries and craft units.

- The market is led by companies like Praj Industries Ltd., Uttamenergy Ltd., and Excel Engineers & Consultants, offering turnkey solutions and efficient process systems; however, high capital costs and regulatory compliance remain major constraints for smaller distillers.

- Regionally, North India holds the largest market share at 28%, followed by South India (25%) and West India (22%); the 5–50 KLPD capacity segment dominates with nearly 40% market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment Type

In the India distillery equipment market, fermentation equipment holds the largest market share, accounting for over 25% in 2024. This dominance is attributed to its critical role in alcohol production, where precise fermentation is essential for quality and yield. Growing demand for high-efficiency fermenters, particularly in large-scale and craft distilleries, has driven technological advancements and higher adoption. Distillation columns and condensers also witness steady demand due to their indispensable function in refining and separation. Additionally, automation and control systems are gaining traction as manufacturers seek to enhance operational efficiency and reduce manual errors.

- For instance, Praj Industries Ltd. installed over 1,000 fermentation systems across Indian ethanol and spirit plants, including a 60 million liters per annum (MLPA) capacity setup at Godavari Biorefineries, incorporating their patented PrajCaneBenz™ fermentation technology.

By Capacity

The 5–50 KLPD (kilo litres per day) segment dominates the Indian market, capturing nearly 40% of the total share in 2024. This capacity range is ideal for small to medium-scale distilleries, which form a significant portion of the industry landscape. These units cater to both regional demand and diversified product lines like craft spirits and ethanol blending. Government initiatives supporting ethanol production and favorable licensing norms for mid-sized plants have further encouraged investment in this category. The “Above 100 KLPD” segment is also growing, backed by large distillery expansions and increased demand for biofuels.

- For instance, Uttamenergy Ltd. executed a 200 KLPD grain-based distillery project for Triveni Engineering & Industries in Uttar Pradesh, with energy-efficient evaporators and zero liquid discharge systems, while also delivering over 40 installations in the 5–50 KLPD category between 2020 and 2023.

By Application

Malt spirit and IMFL (Indian Made Foreign Liquor) blending lead the application segment with over 30% market share in 2024, driven by the high consumption of spirits across India. The segment benefits from consistent consumer demand, brand-led expansions, and modernization of production units. Breweries and craft breweries follow closely, supported by the rising popularity of premium and artisanal beverages among urban consumers. Microbreweries and extraction units are also emerging applications, reflecting a shift toward niche products and value-added production processes in food, pharma, and biotech industries.

Market Overview

Expansion of Ethanol Blending Programs

The Indian government’s aggressive push toward ethanol blending in automotive fuels has significantly boosted distillery capacity expansion. The National Policy on Biofuels and targets like 20% ethanol blending by 2025 have incentivized both public and private sector investments in distillery infrastructure. This surge in demand for fuel-grade ethanol is directly propelling the need for advanced distillery equipment, particularly fermentation systems, distillation columns, and automated control systems, creating robust growth opportunities across equipment manufacturers and turnkey solution providers.

- For instance, Excel Engineers & Consultants commissioned a 150 KLPD ethanol plant for Shree Renuka Sugars Ltd., incorporating high-efficiency distillation and fermentation units along with SCADA-controlled automation, enabling continuous operation and quality monitoring.

Rising Consumption of IMFL and Craft Spirits

India’s evolving alcohol consumption patterns, especially among urban and millennial consumers, are driving the growth of premium Indian Made Foreign Liquor (IMFL) and craft spirits. This demand is prompting the establishment of new distilleries and the modernization of existing units with high-efficiency equipment. Craft distilleries, in particular, are adopting compact, automated, and multi-functional distillation setups to cater to niche markets, thereby expanding the market base for specialized and modular distillery equipment solutions.

- For instance, Spectec Techno Projects commissioned a 25 KLPD craft distillery in Goa for Adinath Spirits, featuring modular skid-mounted distillation columns with energy recovery systems and compact automation panels to enable high-yield production in limited space.

Increasing Focus on Automation and Efficiency

Manufacturers are increasingly adopting automation and smart control systems to streamline production, minimize operational errors, and ensure regulatory compliance. Automation enables consistent product quality, reduces manpower dependency, and improves energy efficiency, all of which are critical in a highly regulated industry like distilling. The rising demand for scalable, Industry 4.0-enabled distillery setups is encouraging equipment suppliers to integrate advanced technologies such as IoT, PLCs, and SCADA systems, contributing to sustained market growth.

Key Trends & Opportunities

Growth of Microbreweries and Craft Distilleries

The surge in microbreweries and boutique distilleries, especially in metropolitan areas, is opening new avenues for compact and modular distillery equipment. These small-scale units demand flexible and scalable systems to produce a variety of alcoholic beverages. This trend is fostering innovation in equipment design, including portable distillation columns, hybrid fermenters, and integrated automation for batch production, offering significant opportunities for local and international equipment manufacturers to tap into the premium and artisanal alcohol segment.

- For instance, Steamax Energy India Pvt. Ltd. developed compact distillation units with capacities ranging from 1 KLPD to 10 KLPD, and installed over 85 microbrewery systems in cities like Bengaluru, Pune, and Hyderabad, many integrated with PLC-based process automation and mobile-friendly control interfaces.

Turnkey Project Demand and EPC Integration

There is an increasing preference for end-to-end project execution via EPC contractors and turnkey solution providers. Distillery clients seek comprehensive services—design, supply, installation, commissioning, and automation—from a single source to reduce complexity and ensure faster go-to-market. This trend is reshaping the competitive landscape and creating collaborative opportunities for equipment vendors to partner with EPC firms. It also boosts demand for integrated equipment packages and after-sales services, contributing to long-term business scalability.

- For instance, Admech Equipment (India) Pvt. Ltd. successfully completed 12 turnkey distillery projects across India between 2021 and 2023, including a 70 KLPD facility in Maharashtra featuring full-cycle design, civil work, equipment fabrication, and SCADA-enabled commissioning, reducing average setup time by over 30 days compared to traditional models.

Key Challenges

High Capital Investment and Cost Sensitivity

Setting up or upgrading a distillery involves significant capital expenditure on specialized equipment, utilities, and compliance measures. Small and medium enterprises often struggle with financial constraints, limiting their ability to adopt modern technologies. Cost sensitivity among buyers pushes manufacturers to offer competitively priced solutions, sometimes at the expense of quality or innovation. This price pressure, combined with rising raw material and input costs, can hinder long-term profitability and market penetration for premium equipment providers.

Regulatory and Environmental Compliance Burdens

Distillery operations in India face stringent environmental regulations related to effluent treatment, waste management, and emissions control. Meeting compliance standards necessitates investment in ancillary systems such as Clean-in-Place (CIP) units and Zero Liquid Discharge (ZLD) technologies, adding to the overall cost and complexity. Delays in obtaining environmental clearances and regional policy inconsistencies can further slow down project timelines, posing challenges for equipment vendors and project developers alike.

Skilled Labor Shortage for Equipment Operation

The operation of sophisticated distillery equipment—especially automated control systems—requires trained and skilled personnel. However, a lack of technical expertise in many regions hampers the optimal utilization of advanced machinery, leading to operational inefficiencies and underperformance. This skills gap is particularly prominent in rural or semi-urban setups, where most ethanol and alcohol distilleries are located. Equipment suppliers often need to provide extended training and support services, which adds to project costs and delivery timeframes.

Regional Analysis

North India

North India accounted for approximately 28% of the India distillery equipment market share in 2024, driven by strong IMFL production and the presence of large-scale distilleries in states like Uttar Pradesh, Haryana, and Punjab. The region benefits from government-supported ethanol blending programs and a high concentration of sugar mills that serve as feedstock sources. Increasing investment in modernizing distillery infrastructure and expanding production capacity has boosted demand for advanced fermentation, distillation, and automation equipment. Additionally, EPC contractors and OEMs are actively participating in project execution across the region, further enhancing market development opportunities.

South India

South India captured around 25% of the market share in 2024, supported by the presence of established alcohol manufacturers and growing demand for craft spirits in urban centers like Bengaluru, Chennai, and Hyderabad. The region leads in microbrewery and craft distillery installations, driving demand for compact, modular, and automated distillery equipment. States like Tamil Nadu and Karnataka have seen increased ethanol production capacities, aided by policy support and investment incentives. The adoption of energy-efficient and sustainable distillation technologies is also gaining momentum in this region, as companies strive to meet environmental compliance and operational efficiency goals.

West India

West India held a market share of approximately 22% in 2024, anchored by Maharashtra and Gujarat, which are among the leading states in ethanol and liquor production. Maharashtra, with its robust sugar industry, is a hub for ethanol distilleries and large-scale IMFL production, generating steady demand for high-capacity distillation columns, condensers, and automation systems. Additionally, Gujarat’s industrial policies and investment-friendly environment have attracted equipment suppliers and turnkey service providers. Increasing awareness of sustainable distilling processes and zero liquid discharge requirements is further driving the replacement and upgrading of older distillery equipment in this region.

East India

East India accounted for nearly 15% of the distillery equipment market in 2024, with Bihar, Odisha, and West Bengal leading growth due to government licensing reforms and investment in ethanol production. Though traditionally underpenetrated, this region is witnessing a gradual increase in distillery establishments, especially focused on ethanol for fuel blending. Equipment demand is primarily centered on mid-sized fermentation systems and basic automation setups suitable for new and expanding distilleries. Challenges such as infrastructure limitations are gradually being addressed through government schemes, positioning East India as an emerging opportunity zone for distillery equipment suppliers.

Central India

Central India contributed approximately 10% of the market share in 2024, with Madhya Pradesh and Chhattisgarh being the primary growth centers. These states benefit from agricultural raw material availability and supportive ethanol production policies, leading to the emergence of several new distillery projects. The market is mainly driven by demand for mid-range equipment like pumps, valves, and heat exchangers, along with storage tanks. While large-scale adoption of automation remains limited, government-backed capacity expansion plans and rising ethanol blending targets are expected to stimulate further investment in distillery infrastructure and equipment upgrades in the coming years.

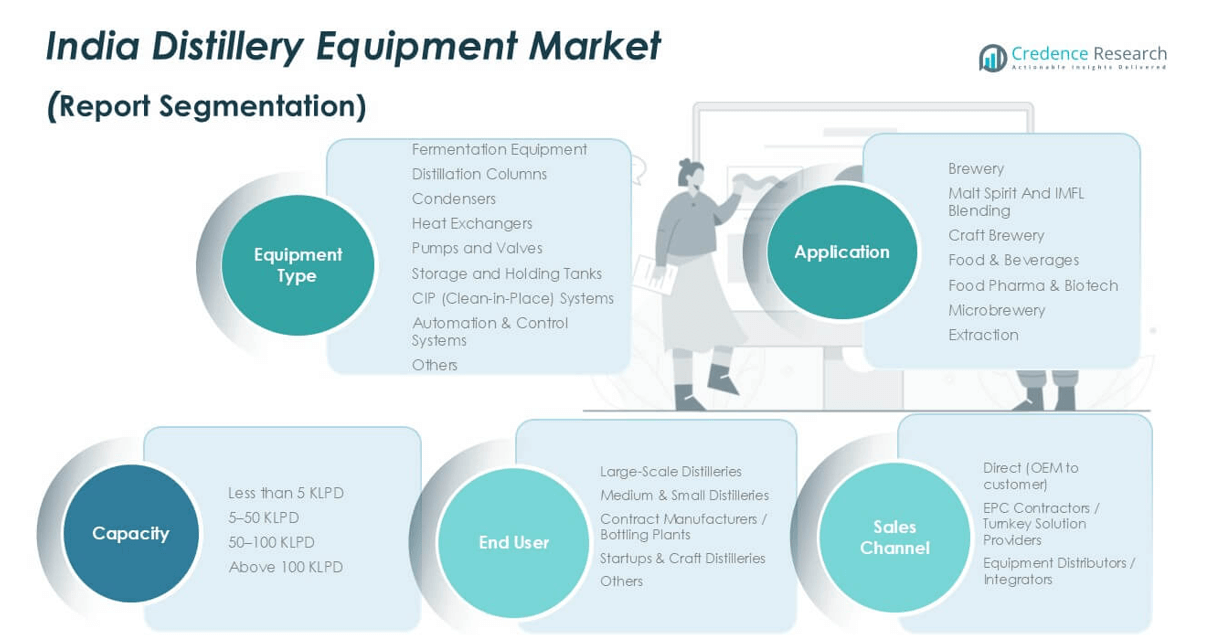

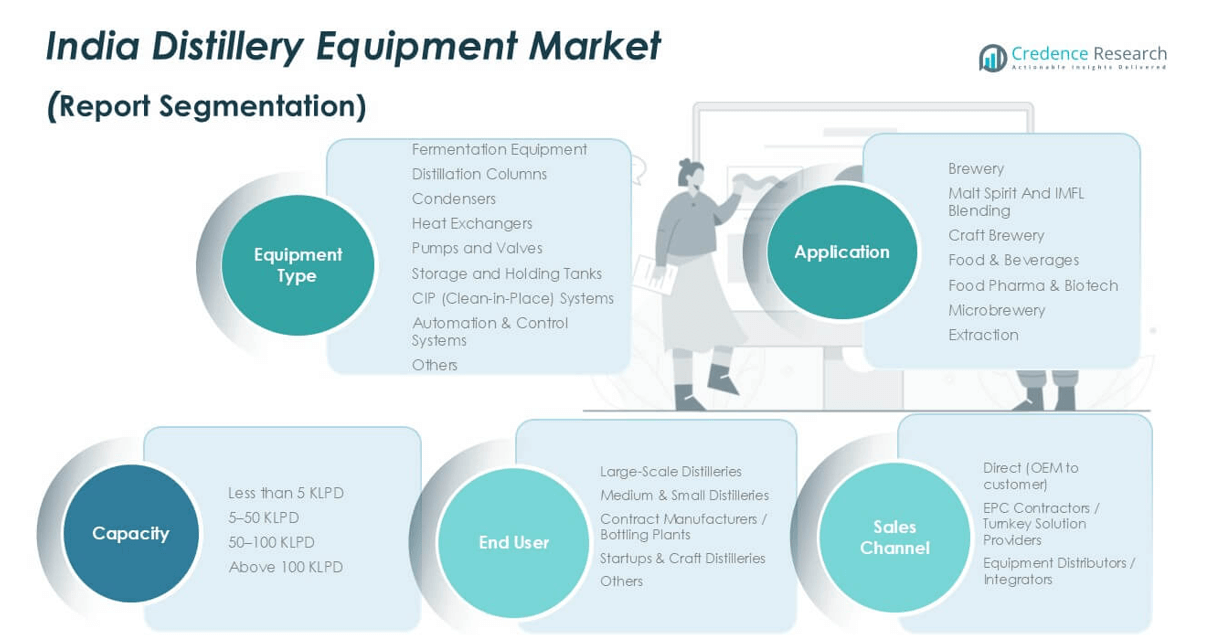

Market Segmentations:

By Equipment Type

- Fermentation Equipment

- Distillation Columns

- Condensers

- Heat Exchangers

- Pumps and Valves

- Storage and Holding Tanks

- CIP (Clean-in-Place) Systems

- Automation & Control Systems

- Others

By Capacity

- Less than 5 KLPD

- 5–50 KLPD

- 50–100 KLPD

- Above 100 KLPD

By Application

- Brewery

- Malt Spirit and IMFL Blending

- Craft Brewery

- Food & Beverages

- Food, Pharma & Biotech

- Microbrewery

- Extraction

By End User Type

- Large-Scale Distilleries

- Medium & Small Distilleries

- Contract Manufacturers / Bottling Plants

- Startups & Craft Distilleries

- Others

By Sales Channel

- Direct (OEM to Customer)

- EPC Contractors / Turnkey Solution Providers

- Equipment Distributors / Integrators

By Geography

- North India

- South India

- West India

- East India

- Central India

Competitive Landscape

The India distillery equipment market is moderately fragmented, with a mix of established players and emerging domestic manufacturers competing to capture market share. Leading companies such as Praj Industries Ltd., Uttamenergy Ltd., and Excel Engineers & Consultants dominate the market due to their strong engineering capabilities, turnkey project execution, and broad product portfolios. These players benefit from longstanding industry relationships and technological expertise, especially in ethanol and IMFL production segments. Smaller firms like SS Engineers, Steamax Energy India Pvt. Ltd., and Spectec Techno Projects are gaining ground by offering cost-effective, modular, and customized equipment solutions, particularly for craft and micro-distilleries. Strategic collaborations with EPC contractors and investments in automation and energy-efficient systems are common competitive tactics. Additionally, the growing focus on sustainability and regulatory compliance is encouraging innovation in process design and clean-in-place systems. Overall, the market is witnessing healthy competition with an emphasis on quality, service support, and technological integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Praj Industries Ltd.

- Uttamenergy Ltd.

- Excel Engineers & Consultants

- SS Engineers

- Steamax Energy India Pvt. Ltd.

- Shreeji Technology

- Admech Equipment (India) Pvt. Ltd.

- Spectec Techno Projects

- Advance Biofuel

- KMW

Recent Developments

- In 2025, Advance Biofuel expanded its ethanol and biofuel plant manufacturing capacity in Gujarat, India. They offer comprehensive solutions for ethanol and compressed biogas (CBG) plants, including turnkey engineering, commissioning, and waste-to-energy technologies. Their focus is on developing efficient, scalable, and sustainable ethanol production projects.

- In March 2025, Praj Industries held a technical workshop in Pune focused on expanding ethanol production in India. The workshop highlighted the use of grain-based add-on modules, allowing sugar mills to diversify and operate year-round. Praj showcased technologies like air-cooled condensers to improve water and steam efficiency, leading to increased distillery productivity and higher profit margins.

Market Concentration & Characteristics

The India Distillery Equipment Market demonstrates a moderate level of market concentration, with a few dominant players such as Praj Industries Ltd., Uttamenergy Ltd., and Excel Engineers & Consultants holding significant influence due to their strong project execution capabilities and broad product portfolios. It features a mix of established firms and emerging domestic manufacturers catering to various scales of operation, from large ethanol plants to small craft distilleries. The market reflects strong regional variation, with North India accounting for the highest share due to policy support and abundant feedstock availability. Demand centers are aligned with sugarcane-producing states and regions prioritizing ethanol blending targets. Buyers in this market show a clear preference for turnkey solutions, energy efficiency, and automation, which has shifted competition toward integrated systems and advanced technologies. It remains price-sensitive, particularly in the SME segment, where cost constraints limit high-tech adoption. The market shows consistent demand from expanding ethanol production and evolving consumer preferences in alcohol consumption.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Capacity, Application, End User Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India distillery equipment market will continue to grow due to rising demand for ethanol production under the national biofuel policy.

- Increasing consumption of IMFL and premium craft spirits will drive equipment upgrades and new installations.

- More distilleries will adopt automation and control systems to improve efficiency and reduce operational errors.

- Modular and compact equipment solutions will gain popularity among microbreweries and small-scale distillers.

- Turnkey solutions from EPC contractors will become the preferred approach for new project execution.

- Investments in clean-in-place (CIP) systems and zero liquid discharge setups will rise due to strict environmental regulations.

- Demand for mid-capacity equipment (5–50 KLPD) will remain strong, especially in emerging Tier 2 and Tier 3 cities.

- Local manufacturers will expand their offerings to compete with established players in automation and integration.

- The industry will witness increased collaboration between equipment suppliers and biofuel companies.

- Training and after-sales services will become key differentiators as technology adoption increases.