Market Overview

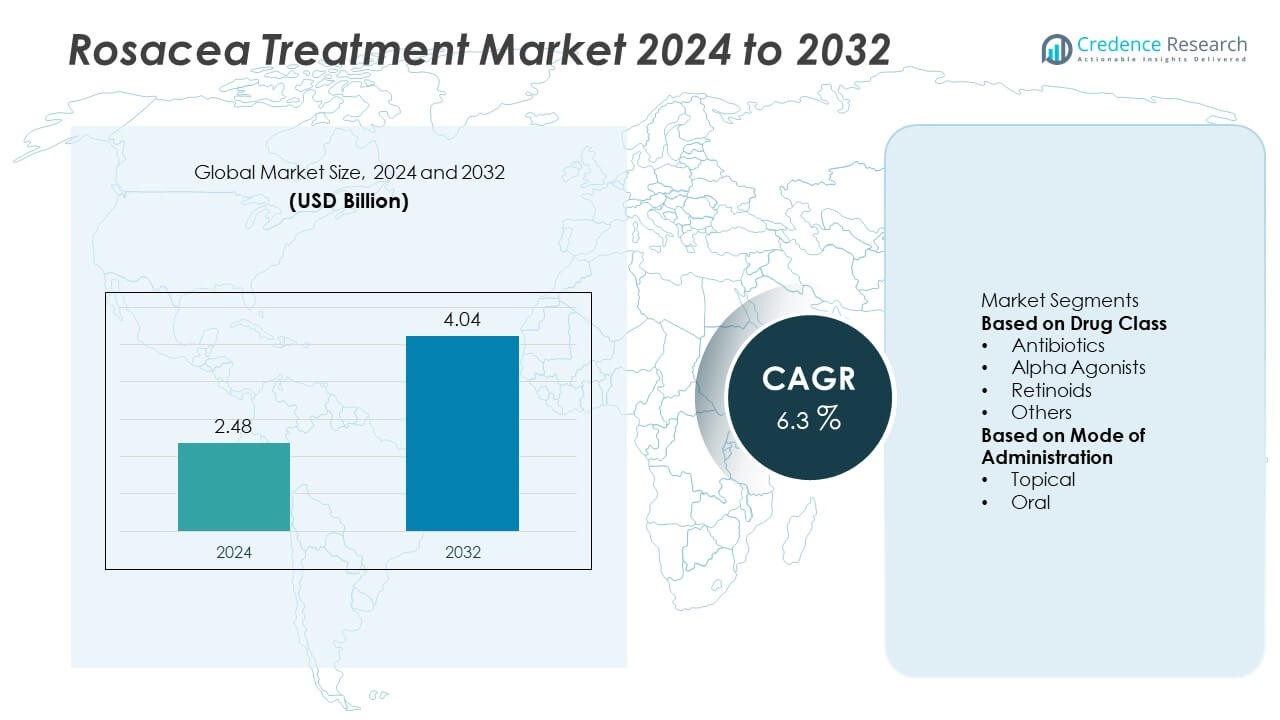

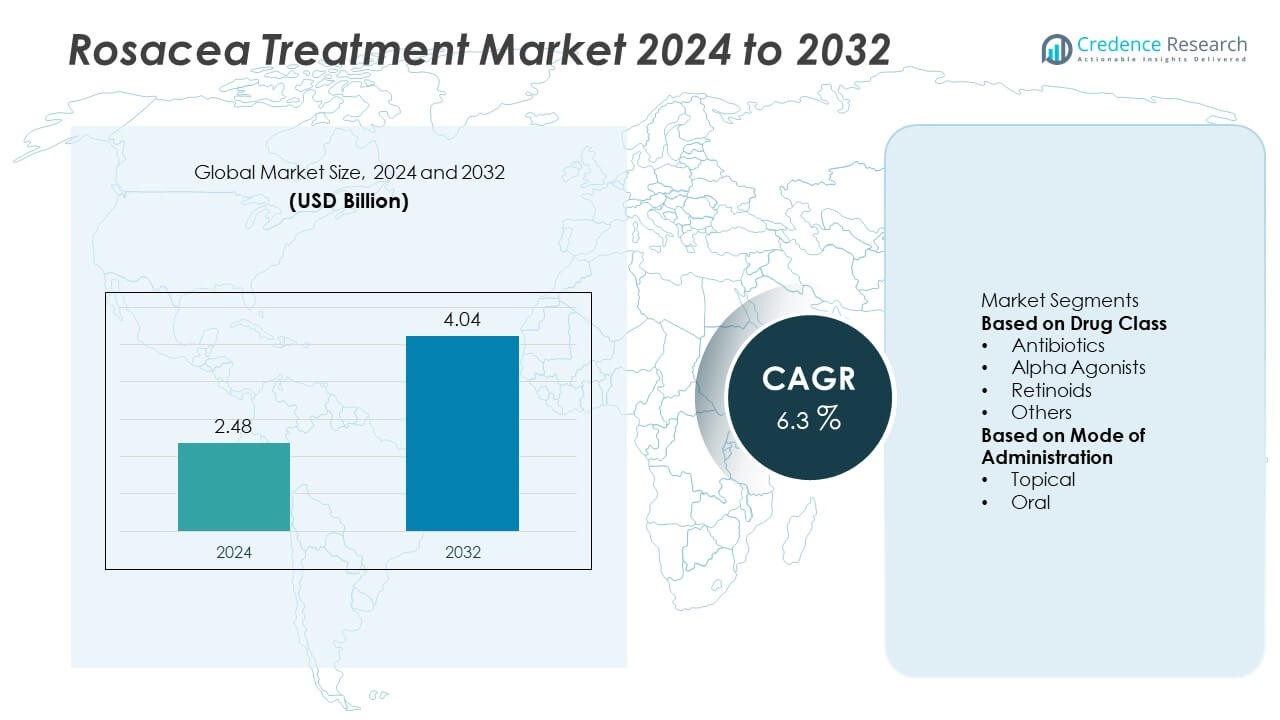

The Rosacea Treatment Market was valued at USD 2.48 billion in 2024 and is projected to reach USD 4.04 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rosacea Treatment Market Size 2024 |

USD 2.48 Billion |

| Rosacea Treatment Market, CAGR |

6.3 % |

| Rosacea Treatment Market Size 2032 |

USD 4.04 Billion |

The rosacea treatment market is driven by major players such as Sol-Gel Technologies Ltd., Pfizer Inc., Mayne Pharma Group Limited, Bausch Health Companies Inc., AbbVie Inc., Aclaris Therapeutics, Inc., LEO Pharma A/S, Nestlé Skin Health, Bayer AG, and Galderma. These companies focus on developing advanced topical and oral formulations with enhanced efficacy and tolerability. Strategic collaborations, clinical trials, and expansion in emerging markets strengthen their global footprint. North America led the market with a 39% share in 2024, supported by advanced dermatological care and strong product availability. Europe followed with a 31% share, driven by innovation in skincare therapeutics and growing demand for prescription-based rosacea treatments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The rosacea treatment market was valued at USD 2.48 billion in 2024 and is projected to reach USD 4.04 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Market growth is driven by rising disease prevalence, increasing dermatology consultations, and growing consumer awareness of skin health and aesthetics.

- Key trends include the emergence of combination therapies, biologics, and personalized skincare approaches targeting long-term symptom control.

- Leading companies such as Galderma, Pfizer Inc., AbbVie Inc., and Bausch Health Companies Inc. focus on innovative formulations, mergers, and expanding product portfolios to maintain competitiveness.

- North America held the largest 39% share, followed by Europe at 31%, while the antibiotics segment led the market with a 46% share in 2024, supported by effective symptom management and strong clinical adoption across both prescription and over-the-counter formulations.

Market Segmentation Analysis:

By Drug Class

The antibiotics segment dominated the rosacea treatment market with a 46% share in 2024. This dominance is driven by their broad clinical use in reducing inflammation, erythema, and papulopustular lesions. Oral and topical antibiotics such as doxycycline and metronidazole remain first-line therapies due to proven efficacy and minimal side effects. Rising prescriptions for sub-antimicrobial dose doxycycline to minimize bacterial resistance further support adoption. Continuous product innovation and combination formulations are enhancing therapeutic outcomes, reinforcing antibiotics as the leading segment in rosacea management.

- For instance, Galderma reported that its ORACEA® 40 mg modified-release doxycycline capsules provided anti-inflammatory benefits in clinical trials for rosacea. In two Phase 3 trials, patients treated with ORACEA® experienced mean reductions of 61% and 46% in inflammatory lesions within 16 weeks.

By Mode of Administration

The topical segment held the largest market share of 58% in 2024, supported by growing demand for convenient, non-invasive treatment options. Topical formulations deliver targeted action with fewer systemic effects, improving patient compliance and long-term skin health. Common agents such as ivermectin, azelaic acid, and brimonidine gels offer effective symptom control for erythematotelangiectatic and papulopustular rosacea. Increased availability of over-the-counter and prescription-based topical products strengthens this segment’s position. Expanding R&D efforts toward advanced delivery systems and combination topicals are expected to sustain the segment’s dominance throughout the forecast period.

- For instance, Sol-Gel Technologies developed EPSOLAY®, a 5% benzoyl peroxide topical cream using microencapsulation technology, approved by the U.S. FDA for inflammatory lesions of rosacea. The product’s controlled-release system reduces irritation and achieved a 43% median reduction in lesion count after 12 weeks in Phase 3 trials involving 733 patients.

Key Growth Drivers

Rising Prevalence of Rosacea Worldwide

Increasing cases of rosacea, particularly among adults aged 30–50, are fueling market growth. Environmental factors, stress, and lifestyle changes contribute to a higher incidence across North America and Europe. Growing awareness of chronic skin conditions and early diagnosis have expanded patient access to dermatological care. The rising number of dermatology clinics and tele-dermatology services further support consistent treatment adoption, driving sustained demand for topical and oral therapies globally.

- For instance, Pfizer has expanded its use of digital health solutions, including wearable devices and mobile apps, in clinical trials to improve patient adherence and outcomes. Examples include studies using wearable devices for chronic skin conditions like atopic dermatitis to objectively measure sleep disruption from scratching and studies for other diseases that utilize mobile apps with medication reminders to track adherence.

Advancements in Formulation and Drug Delivery

Continuous R&D in advanced topical and combination therapies is enhancing treatment outcomes. Companies are focusing on developing improved formulations, such as microencapsulated and controlled-release gels, to reduce irritation and enhance absorption. The introduction of selective alpha agonists and low-dose antibiotics has improved safety and tolerability profiles. These innovations provide longer-lasting relief with fewer side effects, increasing patient adherence. The trend toward precision skincare and targeted treatment delivery continues to boost the overall market expansion.

- For instance, Galderma introduced its 1% ivermectin cream under the Soolantra® brand, which demonstrated up to a 75% reduction in inflammatory lesions after 12 weeks in Phase III trials with nearly 1,400 participants. Soolantra® was found to be effective and well-tolerated in clinical studies, with long-term benefits extending to 52 weeks.

Growing Demand for Aesthetic and Dermatological Treatments

Expanding consumer preference for aesthetic skincare is strengthening rosacea treatment adoption. Patients seek visible improvement in redness, inflammation, and skin tone uniformity, driving demand for dermatology-based therapies. The availability of prescription-strength products through dermatologists and medical spas is improving access. The influence of beauty awareness and social media is encouraging individuals to seek early treatment. This rising consumer inclination toward skin health and appearance enhancement supports higher sales of both prescription and over-the-counter rosacea therapies.

Key Trends & Opportunities

Increasing Adoption of Combination and Personalized Therapies

The growing use of combination treatments—integrating antibiotics, alpha agonists, and anti-inflammatory agents—offers comprehensive symptom management. Personalized treatment protocols based on subtype and severity are gaining traction among dermatologists. Advances in diagnostic tools and digital skin analysis platforms support precise treatment planning. This trend enhances patient satisfaction and clinical outcomes, creating new opportunities for pharmaceutical companies to develop customized and synergistic drug combinations tailored to individual needs.

- For instance, in a randomized vehicle-controlled study of 190 patients with both persistent erythema and inflammatory lesions, the combination of 1% Ivermectin Cream 1% and 0.33% Brimonidine Gel 0.33% achieved a “clear” or “almost clear” investigator global assessment in 55.8 % of patients, compared with 36.8 % in the vehicle group, at week 12.

Emergence of Biologics and Novel Therapeutic Agents

Pharmaceutical innovation is shifting toward biologics and peptide-based therapies targeting inflammatory pathways. These next-generation drugs aim to control flare-ups and address resistant forms of rosacea more effectively. Clinical trials evaluating IL-17 and antimicrobial peptide inhibitors show promising results. Companies are investing in research partnerships to introduce biologic formulations with improved safety and durability. The emergence of these targeted therapies presents significant opportunities for expanding advanced treatment portfolios in the global market.

- For instance, an open-label investigator-initiated trial of 300 mg weekly for 5 weeks then monthly Secukinumab (an IL-17A monoclonal antibody) was conducted in 24 adults with moderate-to-severe papulopustular rosacea, with 17 patients completing the study.

Key Challenges

High Treatment Costs and Limited Reimbursement

Rosacea therapies, particularly advanced formulations and biologics, often involve high costs. Limited insurance coverage for cosmetic-related treatments restricts access, especially in developing regions. Many patients opt for self-medication or over-the-counter products due to affordability concerns. These financial barriers reduce long-term adherence and delay treatment initiation. Expanding reimbursement frameworks and introducing cost-effective generic versions remain crucial to addressing this market restraint.

Side Effects and Patient Compliance Issues

Prolonged use of antibiotics and retinoids can cause irritation, dryness, and microbial resistance. Patients often discontinue therapy due to these adverse reactions or delayed visible results. Lack of consistent follow-up care further worsens compliance rates. Addressing tolerability concerns through improved formulations and patient education is essential. Companies are focusing on developing mild, long-acting, and non-irritating formulations to improve user comfort and ensure continued treatment adherence.

Regional Analysis

North America

North America held the leading 39% share of the rosacea treatment market in 2024, driven by high disease prevalence and strong dermatological infrastructure. The U.S. dominates due to advanced healthcare systems, early diagnosis, and widespread use of prescription-based topical and oral therapies. Growing consumer awareness about aesthetic skincare and rising adoption of tele-dermatology platforms further boost market expansion. Key players such as Galderma, Bausch Health, and AbbVie focus on innovative formulations and strategic partnerships, reinforcing regional dominance through continuous product launches and clinical research investments in advanced topical and systemic therapies.

Europe

Europe accounted for a 31% market share in 2024, supported by increasing dermatology consultations and strong pharmaceutical innovation. Countries like Germany, France, and the U.K. lead due to higher healthcare spending and well-established cosmetic dermatology sectors. Growing demand for prescription creams, gels, and combination therapies enhances treatment adoption. Supportive reimbursement policies and awareness campaigns about chronic skin disorders further strengthen regional growth. Pharmaceutical companies are focusing on introducing novel drug formulations and expanding distribution networks, while consumer inclination toward anti-inflammatory and natural ingredient-based products continues to shape the market landscape.

Asia Pacific

Asia Pacific captured a 21% share of the global rosacea treatment market in 2024, fueled by rapid urbanization, increasing pollution exposure, and growing cosmetic awareness. Rising middle-class income levels and expanding dermatology clinics in China, Japan, and South Korea are boosting demand for advanced skincare treatments. Increasing recognition of rosacea symptoms and online dermatological consultations support early treatment adoption. Regional players are investing in R&D and launching cost-effective generics to cater to wider populations. The rising influence of beauty trends and digital health platforms further enhances the region’s potential for accelerated market growth.

Latin America

Latin America accounted for a 6% share of the rosacea treatment market in 2024, driven by growing healthcare awareness and expanding access to dermatological services. Brazil and Mexico are leading contributors, supported by rising disposable incomes and increasing aesthetic treatment adoption. The expanding presence of global skincare brands and affordable topical therapies fosters higher patient uptake. However, limited specialist availability and lower insurance coverage remain key restraints. Ongoing public health initiatives and increasing imports of dermatological products are gradually improving treatment accessibility across the region, encouraging long-term market development.

Middle East & Africa

The Middle East & Africa region held a 3% market share in 2024, supported by improving healthcare infrastructure and growing dermatology service availability. The UAE and Saudi Arabia are major contributors due to rising cosmetic awareness and increasing investments in advanced skin clinics. Expanding urban populations and higher income levels are driving the demand for topical treatments and professional skincare solutions. However, limited product availability and lower disease awareness challenge widespread adoption. International pharmaceutical partnerships and product launches focused on skin health management are expected to stimulate moderate growth over the forecast period.

Market Segmentations:

By Drug Class

- Antibiotics

- Alpha Agonists

- Retinoids

- Others

By Mode of Administration

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rosacea treatment market is characterized by strong participation from major players such as Sol-Gel Technologies Ltd., Pfizer Inc., Mayne Pharma Group Limited, Bausch Health Companies Inc., AbbVie Inc., Aclaris Therapeutics, Inc., LEO Pharma A/S, Nestlé Skin Health, Bayer AG, and Galderma. These companies focus on expanding their dermatology portfolios through advanced formulations, clinical research, and partnerships. Continuous innovation in topical and oral therapies, including combination products and controlled-release gels, strengthens their market presence. Firms like Galderma and Sol-Gel Technologies lead in product development for long-lasting and tolerable treatments. Strategic acquisitions, new product launches, and expanding distribution channels across developed and emerging markets enhance competitiveness. Growing investments in biologics, peptide-based agents, and personalized skincare solutions are intensifying rivalry, while companies also focus on regulatory approvals and digital marketing initiatives to strengthen brand visibility and capture a larger global patient base.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sol-Gel Technologies Ltd.

- Pfizer Inc.

- Mayne Pharma Group Limited

- Bausch Health Companies Inc.

- AbbVie Inc.

- Aclaris Therapeutics, Inc.

- LEO Pharma A/S

- Nestlé Skin Health

- Bayer AG

- Galderma

Recent Developments

- In September 2025, Sol‑Gel Technologies Ltd. announced that Canada’s regulator issued a Notice of Compliance for its product EPSOLAY® (topical benzoyl peroxide 5%) for the treatment of inflammatory lesions of rosacea in adults.

- In November 2024, Journey Medical Corporation received approval from the U.S. Food & Drug Administration for EMROSI™ (minocycline hydrochloride extended-release capsules 40 mg) to treat inflammatory lesions of rosacea in adults.

- In February 2023, Mayne Pharma Group Limited announced a licensing agreement with Galderma S.A. for the launch of an authorised generic version of ORACEA® (doxycycline) for inflammatory lesions of rosacea in adult patients.

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Mode of Administration and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by improved diagnosis and awareness of rosacea.

- Pharmaceutical innovation will focus on safer and more effective topical and oral formulations.

- Combination and personalized therapy approaches will gain wider clinical adoption.

- Digital dermatology platforms will improve treatment accessibility and patient compliance.

- Key players will expand their presence through acquisitions and dermatology partnerships.

- Asia Pacific will show strong growth supported by rising healthcare expenditure and cosmetic awareness.

- Biologic and peptide-based drugs will create new therapeutic opportunities.

- Over-the-counter formulations will gain popularity due to affordability and ease of use.

- Market competition will intensify with increasing focus on product differentiation and brand positioning.

- Sustainability and clean-label skincare trends will influence product innovation and marketing strategies.