Market overview

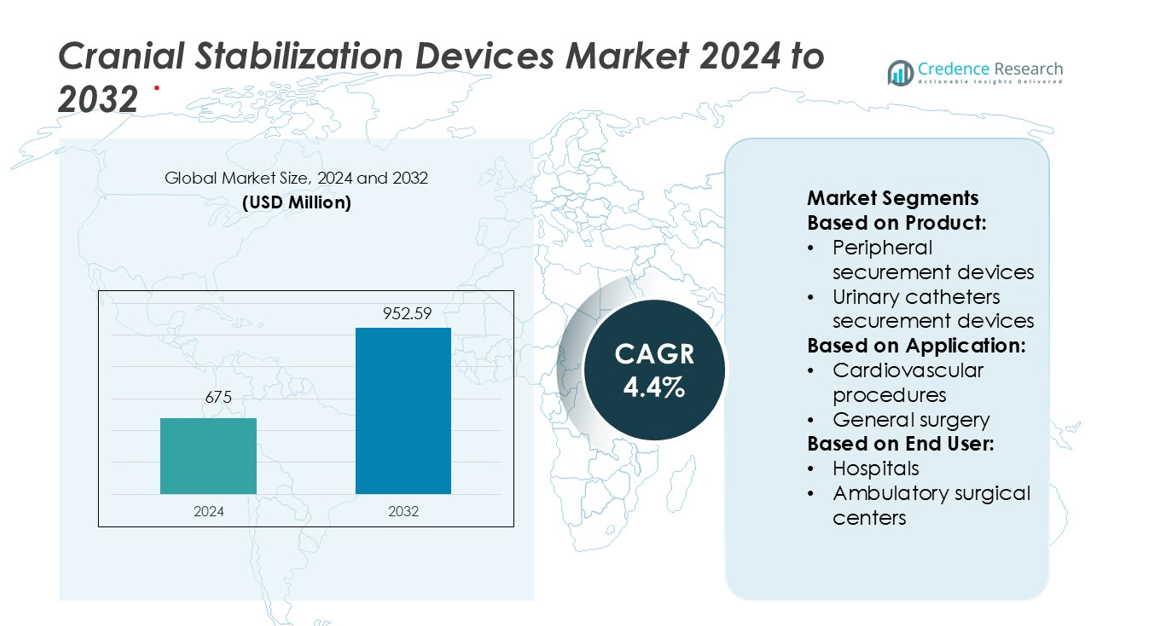

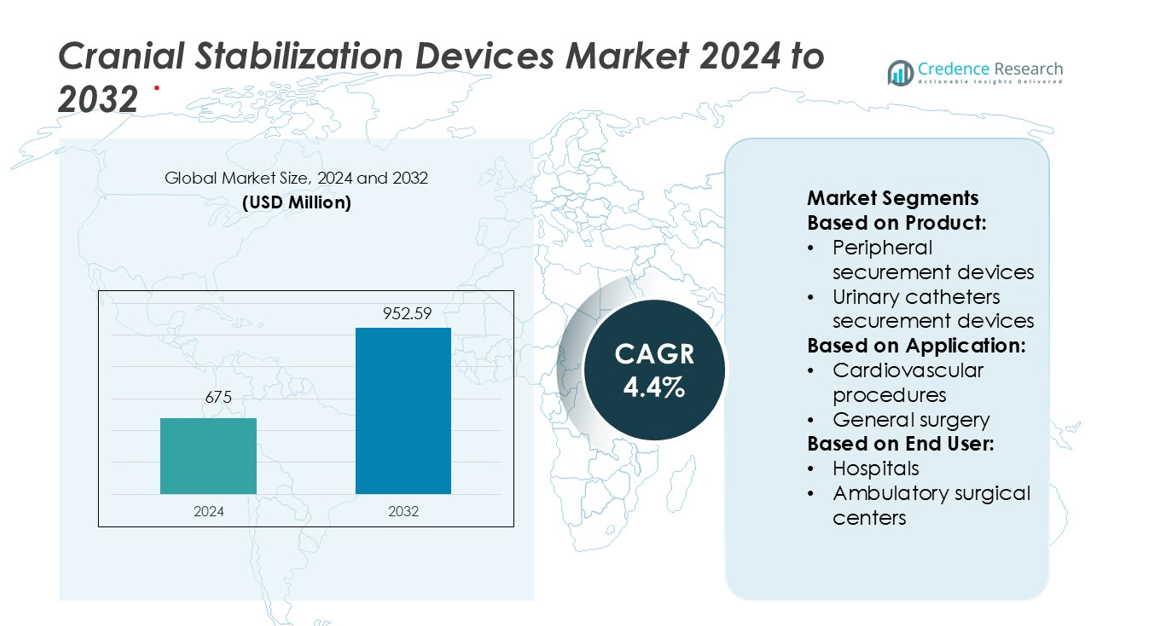

Cranial Stabilization Devices Market size was valued USD 675 million in 2024 and is anticipated to reach USD 952.59 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cranial Stabilization Devices Market Size 2024 |

USD 675 million |

| Cranial Stabilization Devices Market, CAGR |

4.4% |

| Cranial Stabilization Devices Market Size 2032 |

USD 952.59 million |

The Cranial Stabilization Devices Market is driven by strong competition among top players such as Medicon eG, Johnson & Johnson, evonos GmbH & Co. KG, Stryker Corporation, Acumed LLC, Zimmer Biomet Holdings, Inc., KLS Martin Group, Integra Lifesciences, B. Braun Melsungen AG, and Medtronic plc. These companies focus on product innovation, strategic partnerships, and expanding global distribution to strengthen their positions. North America leads the market with a 35% share, supported by advanced healthcare infrastructure, a high volume of neurosurgical procedures, and early adoption of image-guided systems. Strong R&D capabilities, regulatory approvals, and training initiatives in this region further enhance market leadership and accelerate the adoption of advanced stabilization technologies.

Market Insights

- The Cranial Stabilization Devices Market was valued at USD 675 million in 2024 and is expected to reach USD 952.59 million by 2032, growing at a CAGR of 4.4%.

- Increasing neurosurgical procedures and rapid adoption of minimally invasive techniques are driving steady market expansion.

- North America holds the largest regional share at 35%, supported by advanced infrastructure and strong regulatory frameworks.

- Intense competition among key players is accelerating product innovation, strategic partnerships, and global distribution expansion.

- High device costs and limited access in low-resource settings remain key restraints, while rising demand for radiolucent and ergonomic devices is shaping future trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Arterial securement devices hold the largest share in the cranial stabilization devices market, accounting for 32%. These devices reduce catheter dislodgement and infection risk, supporting their strong use in critical care. Growing adoption in neurosurgical and intensive care procedures boosts demand. Their secure fit and improved patient safety drive hospital preference. Peripheral securement devices follow closely, supported by increased use in routine and post-operative care. Innovation in adhesive materials and stabilization techniques continues to enhance their performance in clinical settings.

- For instance, Medicon eG lists over 30 000 distinct surgical instrument items produced across its 11 manufacturing facilities in the Tuttlingen region.

By Application

Cardiovascular procedures dominate the market with a 38% share. These procedures require stable catheter placement to prevent complications during interventions. Rising cardiac surgeries and minimally invasive procedures increase the need for securement solutions. Advanced product designs reduce movement and contamination risks, improving patient outcomes. Urological procedures and oncology applications also show steady growth, supported by rising disease prevalence. Technological advancements in catheter anchoring systems further expand their usage across multiple surgical applications.

- For instance, Johnson & Johnson’s ● THERMOCOOL SMARTTOUCH SF catheter features a 56-hole porous tip and direct contact-force sensing; in one study the device achieved lesions with a tip-temperature profile equivalent to its predecessor while using half the irrigation flow rate (8 mL/min instead of 17 mL/min for <30 W power).

By End User

Hospitals lead the market with a 64% share, driven by the high volume of critical and surgical procedures. Large hospitals adopt securement devices to minimize catheter-related infections and complications. Their structured care protocols and demand for reliable stabilization tools support steady product uptake. Ambulatory surgical centers represent a growing segment, supported by the rise in outpatient surgeries. Home care settings also contribute to demand due to the increasing use of long-term catheters for chronic care patients.

Key Growth Drivers

Rising Neurosurgical Procedure Volumes

The growing prevalence of traumatic brain injuries, tumors, and degenerative conditions is increasing the need for neurosurgeries. Surgeons rely on cranial stabilization devices to ensure precision and minimize movement during delicate procedures. Advancements in imaging technologies and the expansion of specialized neurosurgical centers further support higher procedural volumes. For instance, the growing adoption of minimally invasive cranial procedures has boosted demand for advanced stabilization systems. This rising surgical caseload is expected to strengthen the market growth trajectory over the coming years.

- For instance, evonos’s evoDrill Cranial Perforator single-use device offers versions that automatically stop perforation when skull bone thickness reaches at least 1 mm or at least 3 mm, with available diameters of 9/6 mm, 11/7 mm, 13/9 mm and 14/11 mm.

Technological Advancements in Stabilization Systems

Manufacturers are integrating improved materials, modular designs, and ergonomic features in cranial stabilization devices. These innovations enhance procedural accuracy, reduce surgical time, and improve patient outcomes. Technologies like 3D-printed head frames and radiolucent materials allow for better imaging compatibility and surgical access. Additionally, real-time monitoring and fixation systems offer more secure stabilization during complex neurosurgeries. Continuous product upgrades by leading manufacturers support market expansion and increased adoption across healthcare facilities worldwide.

- For instance, Stryker’s “Universal Neuro III” System plates have a low-profile height of 0.4 mm, and some skull-base plates as thin as 0.3 mm, offering a slimmer implant for reduced palpability.

Growing Investments in Healthcare Infrastructure

Developing economies are expanding investments in healthcare infrastructure to improve access to advanced surgical procedures. Governments and private institutions are increasing funding for neurosurgical units, specialized trauma centers, and critical care facilities. This infrastructure growth enhances the availability of cranial stabilization systems in both urban and rural areas. Partnerships with global medical device firms and the rising number of trained neurosurgeons further boost product adoption. These investments are strengthening the foundation for sustainable market growth.

Key Trends & Opportunities

Adoption of Minimally Invasive Techniques

The shift toward minimally invasive neurosurgeries is creating strong demand for advanced cranial stabilization systems. These procedures require highly stable fixation devices to ensure precise surgical navigation and minimal tissue disruption. Manufacturers are introducing lightweight, adjustable, and radiolucent stabilization systems to meet these needs. Hospitals are also prioritizing devices compatible with image-guided surgery platforms. This trend supports shorter recovery times, reduced infection risks, and improved surgical outcomes, driving higher adoption rates across healthcare settings.

- For instance, Acumed’s OsteoMed Profile Zero™ Neuro Fixation System offers a plate-to-screw construct of 0.25 mm profile made from Grade 5 titanium, enabling ultra-low-profile implants for minimal disruption.

Integration with Navigation and Imaging Technologies

The integration of cranial stabilization systems with advanced imaging and navigation platforms is gaining momentum. Modern devices allow seamless compatibility with CT, MRI, and intraoperative navigation systems, improving surgical accuracy. This integration enables surgeons to position patients more precisely and monitor changes in real time. It also supports advanced procedures like tumor resection and deep brain stimulation. The trend is opening new growth opportunities for manufacturers focusing on smart and hybrid stabilization solutions.

- For instance, Zimmer Biomet’s ‘1.5 mm Neuro Plating System’ introduces titanium plates with a lower overall plate-screw profile, not a 1.5 mm plate height. The system, which features a 1.5 mm high-torque self-drilling screw, is designed for neurosurgical fixation in imaging-sensitive procedures while reducing implant palpability.

Rising Focus on Customization and Patient Comfort

Healthcare facilities are emphasizing patient comfort and individualized care during neurosurgical procedures. This trend is driving the demand for customizable head fixation devices designed to reduce pressure points and improve fit. Manufacturers are investing in ergonomic designs, soft interface materials, and quick-lock mechanisms. These innovations help minimize skin injuries, optimize patient positioning, and reduce procedure times. Hospitals adopting patient-centric stabilization systems can enhance surgical outcomes and improve overall patient experience.

Key Challenges

High Device Costs and Budget Constraints

Cranial stabilization systems are capital-intensive and require significant investment in compatible surgical equipment. Many hospitals, especially in low-income regions, face budget constraints that limit product adoption. High procurement and maintenance costs also increase the financial burden on healthcare facilities. Limited reimbursement policies further slow the adoption of advanced stabilization systems. This cost barrier remains a key challenge for market expansion, especially in resource-limited settings.

Shortage of Skilled Neurosurgeons

The effective use of cranial stabilization devices requires highly skilled neurosurgeons and trained operating room teams. Many developing regions face shortages of specialized professionals, which restricts the adoption of advanced surgical technologies. Inadequate training programs and uneven distribution of skilled personnel also impact procedural outcomes. This workforce gap slows technology penetration and limits market growth potential. Expanding specialized training programs remains essential to address this challenge.

Regional Analysis

North America

North America leads the Cranial Stabilization Devices Market with a 35% share. Strong healthcare infrastructure, high procedure volumes, and rapid technology adoption support this dominance. The region benefits from advanced neurosurgical facilities and skilled professionals. U.S. hospitals prioritize precision-driven head fixation systems for trauma and tumor surgeries. Increased investments in image-guided and minimally invasive surgeries further drive demand. Collaborations between hospitals and device manufacturers accelerate product innovation and market penetration. Favorable reimbursement policies and continuous R&D also strengthen North America’s leading market position.

Europe

Europe holds a 28% market share, driven by strong adoption of advanced neurosurgical technologies and supportive regulatory frameworks. Countries such as Germany, France, and the U.K. play a major role in technological deployment. High healthcare spending and specialized neurosurgical centers support the use of innovative stabilization devices. Strategic collaborations with academic hospitals encourage clinical trials and early product adoption. Growing emphasis on minimally invasive surgeries further boosts demand. Europe’s mature healthcare system and high patient safety standards drive steady market expansion.

Asia Pacific

Asia Pacific accounts for a 22% market share and is witnessing the fastest growth. Rising investments in healthcare infrastructure and expanding access to advanced surgical care fuel this expansion. Countries such as China, India, and Japan are seeing higher neurosurgery volumes due to increased trauma cases and aging populations. Government healthcare initiatives and hospital modernization programs improve device availability. Growing training programs for neurosurgeons also support broader adoption. Rapid market growth in this region reflects improving surgical capabilities and increasing awareness of advanced stabilization technologies.

Latin America

Latin America holds an 8% share of the market, supported by steady improvements in healthcare infrastructure. Countries such as Brazil, Mexico, and Argentina are expanding neurosurgical units in major hospitals. Growing awareness of head fixation devices and rising trauma cases are increasing demand. Public-private healthcare partnerships help enhance access to advanced surgical tools. However, budget constraints and uneven infrastructure development slow penetration in smaller cities. Targeted investments in specialized surgical facilities are expected to support moderate but stable growth in this region.

Middle East & Africa

The Middle East & Africa account for a 7% market share. The market is driven by growing investments in healthcare modernization, particularly in the Gulf Cooperation Council (GCC) countries. Countries such as the UAE and Saudi Arabia are focusing on upgrading neurosurgical capabilities through public and private partnerships. Rising incidence of road accidents and traumatic brain injuries supports demand. However, limited access in rural regions and a shortage of skilled professionals constrain market growth. Expanding specialized hospital networks is expected to enhance future adoption rates.

Market Segmentations:

By Product:

- Peripheral securement devices

- Urinary catheters securement devices

By Application:

- Cardiovascular procedures

- General surgery

By End User:

- Hospitals

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cranial Stabilization Devices Market is highly competitive, with key players including Medicon eG, Johnson & Johnson, evonos GmbH & Co. KG, Stryker Corporation, Acumed LLC, Zimmer Biomet Holdings, Inc., KLS Martin Group, Integra Lifesciences, B. Braun Melsungen AG, and Medtronic plc. The Cranial Stabilization Devices Market is characterized by strong competition, continuous innovation, and a focus on advanced surgical technologies. Manufacturers are prioritizing product development through the integration of radiolucent materials, 3D-printed components, and ergonomic fixation systems to improve surgical accuracy and patient safety. Strategic collaborations with hospitals and research institutes are enabling faster clinical validation and market entry of new devices. Companies are also expanding their presence in emerging regions by enhancing distribution networks and training neurosurgeons on advanced systems. High R&D investments, regulatory clearances, and acquisitions are shaping competitive strategies. This dynamic landscape fosters rapid innovation and product differentiation, driving steady market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medicon eG

- Johnson & Johnson

- evonos GmbH & Co. KG

- Stryker Corporation

- Acumed LLC

- Zimmer Biomet Holdings, Inc.

- KLS Martin Group

- Integra Lifesciences

- Braun Melsungen AG

- Medtronic plc

Recent Developments

- In January 2025, B. Braun Medical Inc. launched the Clik-FIX Epidural/Peripheral Nerve Block Catheter Securement Device. The low-profile, soft, secure device minimizes catheter displacement and dislodgement during regional anesthesia, enhancing patient safety and pain control.

- In April 2024, Kelyniam Global and Fin-ceramica, Faenza S.p.a., manufacturers of custom cranial implants, have announced that the NEOS Surgery Cranial LOOP fixation system has received FDA 510(k) clearance. This system is approved for use with Finceramica’s CustomizedBone hydroxyapatite cranial implant.

- In April 2024, 3D Systems announced that the Food and Drug Administration (FDA) has granted 510(k) clearance for its VSP PEEK Cranial Implant, a patient-specific cranial implant solution that is 3D-printed.

- In February 2023, Stryker announced that its Q Guidance System with Cranial Guidance Software received 510(k) clearance from the U.S. Food and Drug Administration. The Q Guidance System is an image-based planning and intraoperative guidance system designed to support cranial surgeries. This approval helped the company solidify its neurotechnology portfolio in the U.S

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see increased adoption of minimally invasive neurosurgical procedures.

- Advanced imaging integration will drive the development of smarter stabilization systems.

- Demand will rise in emerging economies with improving healthcare infrastructure.

- Manufacturers will focus on lightweight, radiolucent, and patient-friendly device designs.

- AI and navigation technologies will enhance surgical precision and efficiency.

- Strategic collaborations will expand product availability across more hospitals.

- Training programs will grow to address the shortage of skilled neurosurgeons.

- Regulatory support will accelerate the approval of innovative stabilization solutions.

- Customization and ergonomic features will gain higher clinical preference.

- Competitive pressure will lead to faster product innovation cycles.