Market Overview:

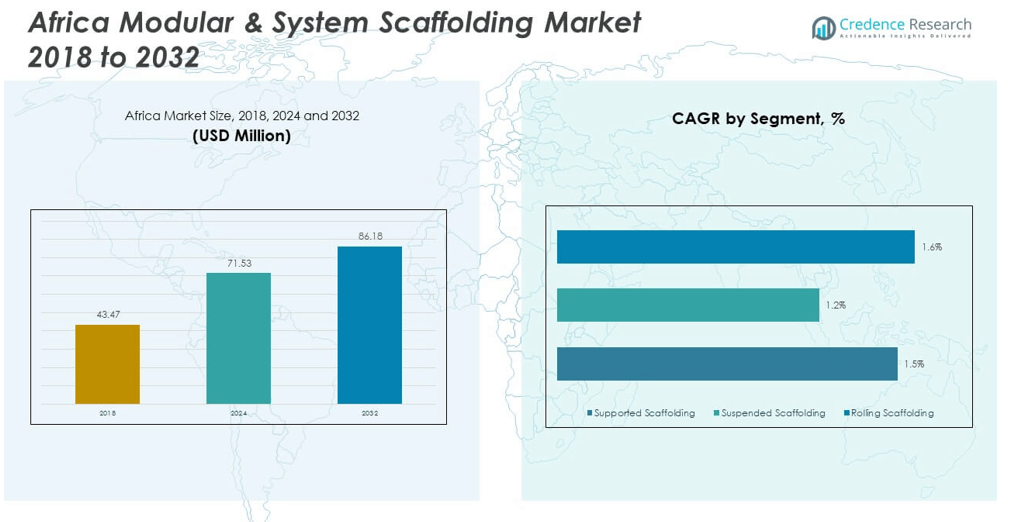

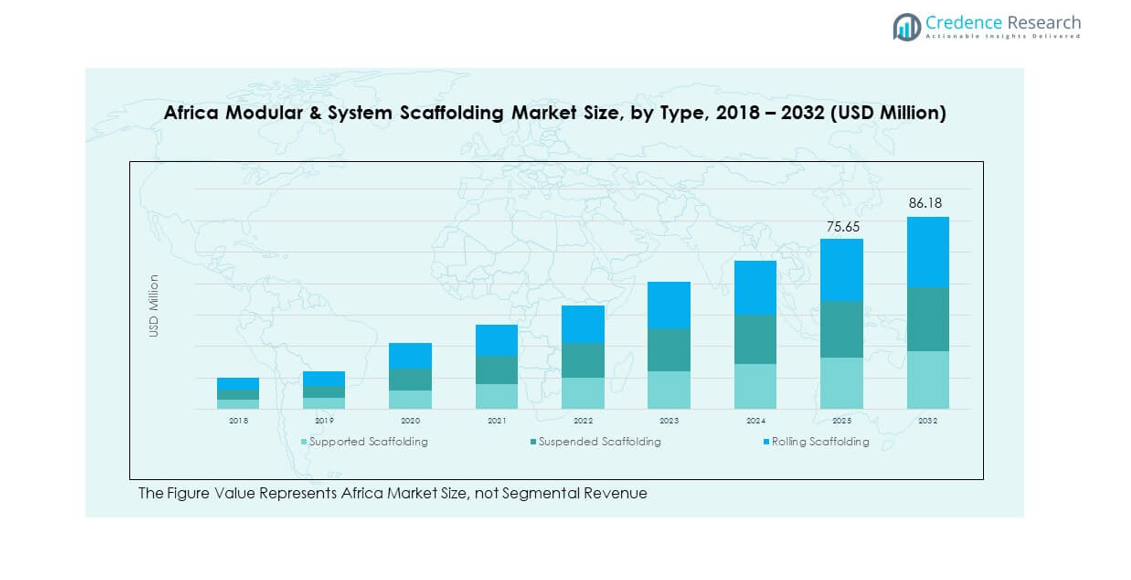

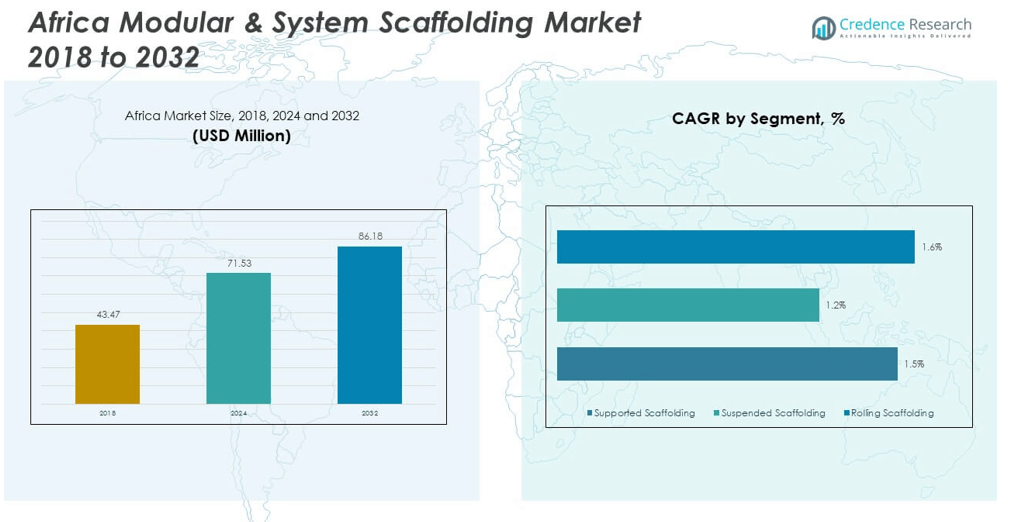

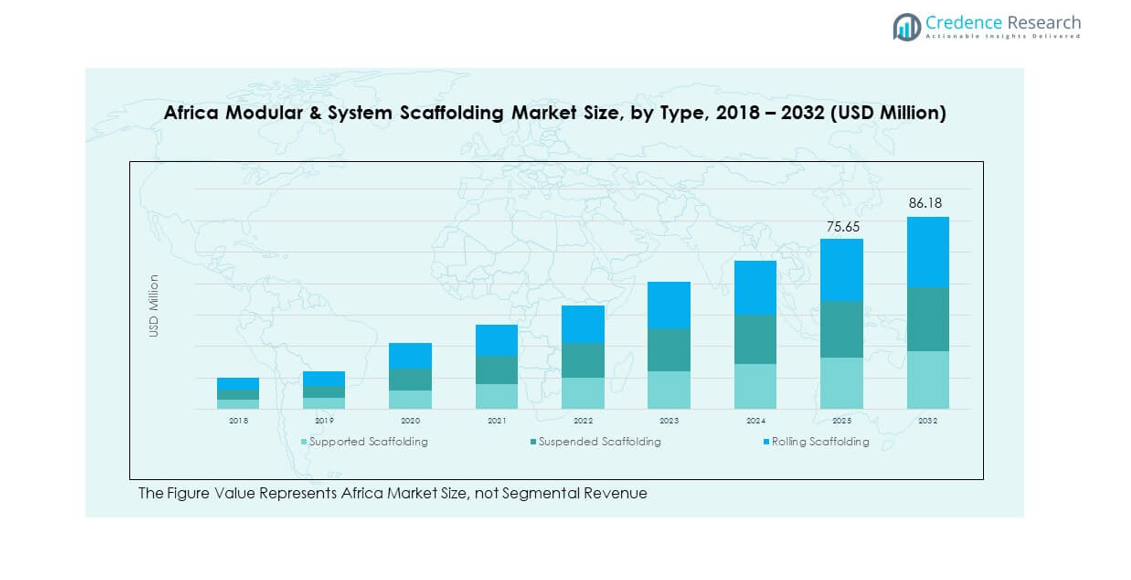

The Africa Modular & System Scaffolding Market size was valued at USD 43.47 million in 2018 to USD 71.53 million in 2024 and is anticipated to reach USD 86.18 million by 2032, at a CAGR of 1.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Africa Modular & System Scaffolding Market Size 2024 |

USD 71.53 million |

| Africa Modular & System Scaffolding Market, CAGR |

1.90% |

| Africa Modular & System Scaffolding Market Size 2032 |

USD 86.18 million |

The Africa Modular & System Scaffolding Market is experiencing steady growth due to increasing investments in infrastructure and urban development projects across the continent. Rapid urbanization, population growth, and expansion of commercial and residential construction activities are driving demand for efficient, safe, and reusable scaffolding systems. Governments and private developers continue to focus on modernizing infrastructure, including transport networks, healthcare, and education facilities, fueling the need for modular scaffolding solutions. Contractors prefer these systems due to their adaptability, time-saving assembly, and reduced labor costs.

Regionally, countries such as South Africa and Egypt lead the market due to their well-established construction sectors and high demand for commercial and industrial infrastructure. Nigeria is emerging as a key market, supported by population growth and urban expansion. East African nations, including Kenya and Tanzania, are gaining traction due to increased foreign investment in large-scale infrastructure projects. These markets benefit from government initiatives and public-private partnerships aimed at modernizing cities and improving regional connectivity. This geographic spread reflects both established and emerging opportunities across the continent

Market Insights:

- The Africa Modular & System Scaffolding Market size was valued at USD 47 million in 2018 to USD 71.53 million in 2024 and is anticipated to reach USD 86.18 million by 2032, at a CAGR of 1.90% during the forecast period.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Infrastructure expansion, particularly in transportation and energy sectors, continues to drive demand for modular scaffolding systems across the continent.

- Urbanization and increased residential construction are accelerating the adoption of supported scaffolding due to its strength and versatility.

- Market growth faces constraints from fluctuating raw material prices and reliance on imported scaffolding components.

- South Africa leads the market with a 31.2% share, supported by mature construction practices and established scaffold rental networks.

- Egypt follows with 24.6%, driven by national megaprojects and alignment with Vision 2030 construction goals.

- Nigeria and East African countries like Kenya are emerging as growth hubs, backed by foreign investments and industrial project pipelines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Infrastructure expansion across major African economies drives scaffolding system demand

The Africa Modular & System Scaffolding Market is benefitting from sustained infrastructure development in countries such as South Africa, Egypt, and Nigeria. Governments are prioritizing large-scale projects across transportation, energy, and urban housing. These initiatives demand reliable, modular scaffolding systems for faster project execution and enhanced worker safety. Contractors are opting for system scaffolds due to their quick assembly, durability, and design flexibility. The ease of dismantling and reusability also reduces operational costs. Economic diversification strategies across Africa are accelerating industrialization, contributing further to scaffolding demand. It supports ongoing construction across oil refineries, airports, and commercial spaces.

Rapid urbanization and rising residential construction strengthen scaffold market demand

Urban migration continues to grow, prompting a surge in housing development across major African cities. The Africa Modular & System Scaffolding Market is expanding due to this shift, especially with mid-rise and high-rise housing projects becoming more common. Builders prefer system scaffolding due to its superior load-bearing capacity and safety standards. Urban infrastructure, including hospitals, schools, and government buildings, also drives product adoption. Real estate developers are streamlining operations and reducing delays through modular solutions. Standardized scaffolding solutions help address labor shortages by enabling faster setup with fewer skilled workers. This trend significantly boosts market growth.

- For example, ULMA Construction delivers advanced high-load, ringlock-based scaffolding and formwork systems such as the BRIO and MK series used internationally for high-rise and infrastructure projects.

Growth in public-private partnerships encourages system scaffolding adoption

Collaborations between governments and private entities are increasing investment inflow into the construction sector. The Africa Modular & System Scaffolding Market benefits from these public-private infrastructure deals, especially in transportation and renewable energy sectors. These projects require compliance with global safety and quality benchmarks, making modular scaffolding the preferred choice. Large contractors choose these systems to meet project timelines and ensure regulatory adherence. The trend supports expansion across both greenfield and brownfield developments. Construction firms are aligning with international safety norms, further promoting modular system usage. Demand is steady across both urban and semi-urban zones.

Cost-efficiency and productivity gains from modular systems boost adoption rates

Contractors are increasingly favoring modular scaffolding systems for their cost-effectiveness and operational efficiency. The Africa Modular & System Scaffolding Market gains from their reusability, ease of transport, and minimal downtime. These systems improve productivity on-site while ensuring consistent safety compliance. Their lightweight yet durable components lower logistical burdens. The ability to configure structures for different site conditions adds strategic value. Time-bound government tenders and competitive bidding processes encourage faster, safer construction methods. It supports industry transformation toward safer, standardized scaffolding techniques.

- For instance, BrandSafway offers modular scaffolding and access solutions for industrial and infrastructure maintenance, emphasizing procedural efficiency and turnaround readiness.

Market Trends:

Adoption of aluminum-based scaffolding systems accelerates across African projects

Demand for lightweight and corrosion-resistant scaffolding is shifting attention toward aluminum-based systems. The Africa Modular & System Scaffolding Market is embracing these alternatives over traditional steel frameworks. Contractors value aluminum’s ease of handling, long-term durability, and lower maintenance costs. It supports faster assembly and reduces worker fatigue on-site. The shift improves construction timelines while enhancing safety and adaptability. These systems are also suitable for renovation or restoration projects in urban settings. Their growing use in mid-size and large-scale infrastructure projects signals a broader materials transition.

Rental-based scaffolding business models gain traction among contractors

The preference for renting scaffolding equipment is growing, especially among small and medium construction firms. The Africa Modular & System Scaffolding Market is witnessing increased demand for flexible, short-term usage models. Renting lowers upfront capital costs and allows access to advanced systems without ownership risks. It supports contractors working on multiple sites with varying scaffolding needs. Equipment rental companies are expanding their fleets to offer modular and system scaffolds in scalable quantities. Contractors also benefit from technical support and maintenance included in rental agreements. This model aligns well with project-based construction dynamics across the continent.

- For instance, Avontus Quantify software enables real‑time utilization reporting on scaffolding assets to support efficient rental fleet management. Industry benchmarks and Avontus users commonly target around a 75–80% utilization rate as optimal—ensuring assets are productive while maintaining adequate inventory for future jobs.

Integration of digital project management tools streamlines scaffold operations

Digitalization is emerging in the construction industry, improving scaffold planning and safety compliance. The Africa Modular & System Scaffolding Market is responding to this shift with integration of software for scaffold design, scheduling, and site inspections. These tools help reduce human error, ensure structural safety, and track real-time usage. QR code-based inventory systems and GPS tracking further optimize equipment management. Data-driven scaffolding operations reduce delays and enhance accountability. Contractors can manage labor and materials more effectively using mobile platforms. This trend supports efficiency in fast-paced urban construction environments.

Sustainability and green building certification influence scaffold selection

Eco-conscious construction practices are influencing scaffolding procurement decisions. The Africa Modular & System Scaffolding Market is aligning with green building regulations and certifications. Developers aim to reduce environmental footprints by choosing recyclable and low-emission materials. Modular scaffolds made from lightweight metals or sustainable composites are gaining favor. Certification systems are pushing for materials that meet energy-efficiency and lifecycle sustainability benchmarks. Scaffolding solutions that support waste reduction and efficient logistics are being prioritized. This shift reflects broader alignment with global sustainable development goals.

- For instance, Layher Allround Lightweight components engineered with high‑tensile steel enable around 10% faster assembly and up to 12% improved transport capacity, while maintaining certified load-bearing performance.

Market Challenges Analysis:

Fluctuating raw material prices and import dependency increase cost pressures

The Africa Modular & System Scaffolding Market faces challenges from unstable pricing of raw materials such as steel and aluminum. Many African countries rely on imports for these materials, exposing the market to global price volatility and currency fluctuations. Limited domestic manufacturing capacity exacerbates procurement delays and increases lead times. These disruptions affect contractor budgeting, project schedules, and vendor negotiations. Unforeseen spikes in raw material costs force smaller construction firms to seek cheaper, less durable alternatives. The cost burden also impacts scaffold rental companies trying to expand inventory. It hampers scalability and limits the adoption of advanced systems.

Lack of skilled labor and inconsistent safety enforcement hinder market penetration

Shortage of trained scaffold installers and weak regulatory oversight create barriers to growth. The Africa Modular & System Scaffolding Market struggles with inconsistent implementation of international safety standards. Inadequate training programs result in misuse or unsafe installation practices. This leads to workplace accidents, undermining contractor confidence and increasing liability risks. Smaller construction firms often lack the expertise to fully utilize modular systems, opting for traditional methods. Fragmented safety enforcement across regions also reduces demand for compliant scaffolding. It limits market development, especially in semi-urban and rural construction zones.

Market Opportunities:

Expansion of transportation and renewable energy sectors creates scaffold demand

Africa is witnessing increased investment in transport corridors, railway lines, and renewable energy facilities. The Africa Modular & System Scaffolding Market stands to benefit from this momentum, with large-scale projects requiring extensive temporary structures. Modular scaffolds support construction of bridges, wind turbines, and solar farms, especially in remote locations. Governments are also encouraging energy transition projects, opening up new applications. It creates consistent demand for reliable, easily deployed scaffolding solutions across evolving industrial zones.

Growth of tier-2 cities and special economic zones drives future deployment

Development of emerging urban centers and special economic zones (SEZs) presents a long-term opportunity. The Africa Modular & System Scaffolding Market can expand its footprint by serving construction firms operating outside major metropolitan hubs. These zones require efficient infrastructure delivery under tight timelines. Demand for flexible scaffolding that adapts to varied terrain and structural needs is rising. It allows manufacturers and rental providers to scale operations strategically.

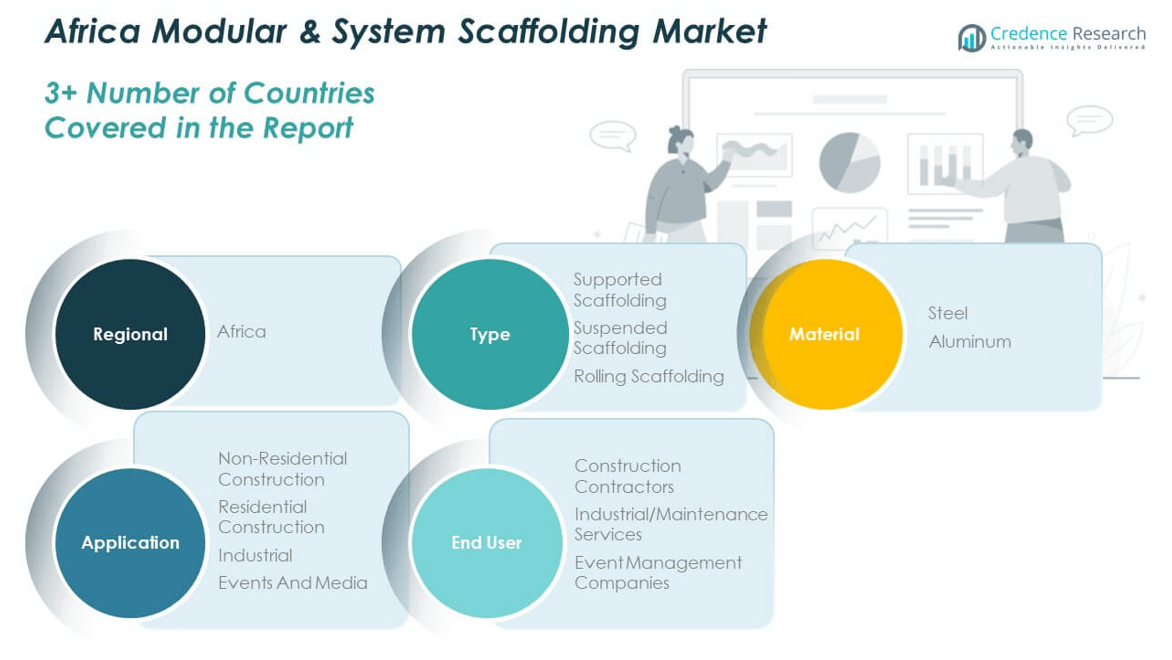

Market Segmentation Analysis:

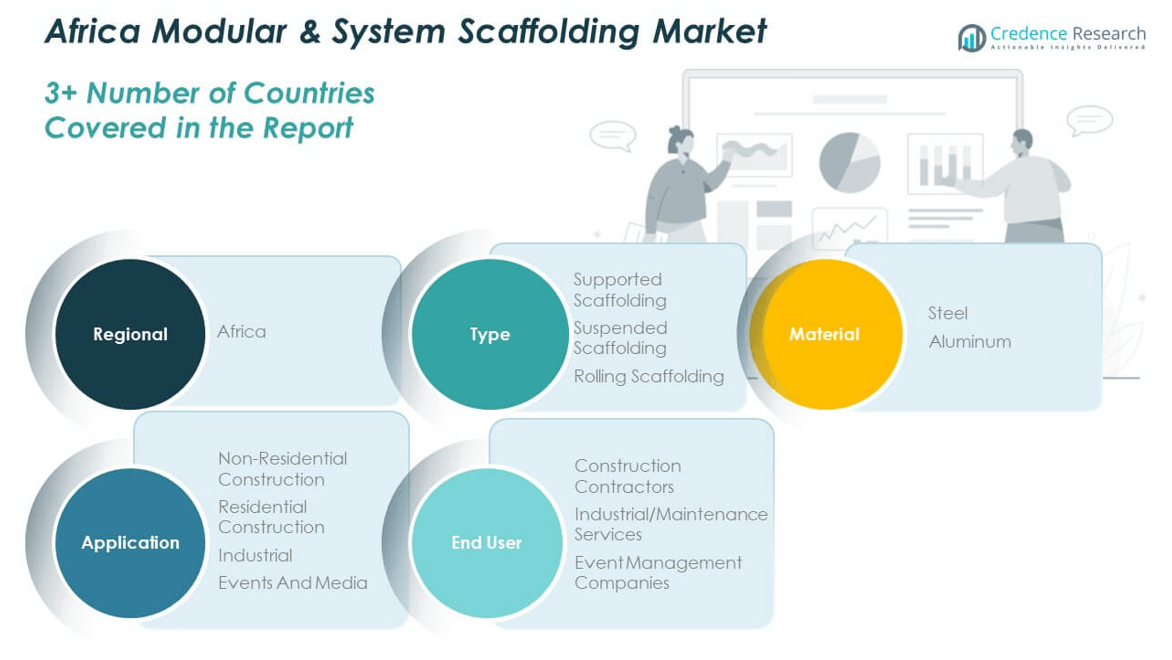

By type, The Africa Modular & System Scaffolding Market is segmented by type into supported, suspended, and rolling scaffolding. Supported scaffolding dominates the market due to its stability and widespread use in large construction projects. Suspended scaffolding is preferred for high-rise structures and maintenance applications, while rolling scaffolding is gaining adoption in indoor and flexible-use scenarios.

- For example, Layher Morocco supplied its prefabricated multidirectional Allround scaffolding system for the restoration of Hassan Tower in Rabat—a UNESCO‑listed heritage monument exceeding 50 m in height. The system used 8‑way rosette nodes at 50 cm intervals to fit the tower’s cylindrical form, and the scaffolding was fully erected in under a month by a 10‑person crew.

By material, steel scaffolding holds the largest share, driven by its strength, durability, and load-bearing capacity. Aluminum scaffolding is expanding due to its lightweight nature and ease of transport, especially for short-term and mobile applications.

- For instance, Spar Steel’s SPARDECK® galvanized steel scaffold boards comply with BS EN 12811-1 and Load Class 6, offering fire-resistant platform solutions that are up to 20% lighter than LVL timber boards.

By application, non-residential construction leads the market, supported by ongoing infrastructure and commercial development across Africa. The industrial segment follows, benefiting from maintenance and expansion projects in energy, mining, and manufacturing. Residential construction is steadily growing due to urban housing demand. Events and media represent a niche but rising application area, particularly in South Africa and Egypt.

By end user, construction contractors form the largest consumer base, driven by high-volume procurement and recurring projects. Industrial and maintenance services use modular systems for ongoing facility operations and upgrades. Event management companies are adopting modular scaffolds for temporary structures at exhibitions, concerts, and sports venues.

For example, Stefanutti Stocks is a major South African engineering and construction group active across sectors such as transport infrastructure, industrial plants, and civil engineering and also provides access scaffolding services

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

By Region:

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

South Africa leads the Africa Modular & System Scaffolding Market with a market share of 31.2%. The country’s well-developed construction industry, supported by government investments in infrastructure renewal and commercial property development, drives consistent demand for modular scaffolding systems. Urban centers such as Johannesburg, Cape Town, and Durban continue to expand, requiring advanced scaffolding technologies for vertical construction. The private sector’s participation in real estate and industrial zones further boosts product adoption. Contractors in South Africa prioritize high safety standards and efficient build cycles, making system scaffolding the preferred solution. It maintains a dominant position due to strong local manufacturing and import capacity.

Egypt holds the second-largest share in the market, accounting for 24.6%. Major urban development initiatives such as the New Administrative Capital and other infrastructure megaprojects are driving strong demand. The government’s Vision 2030 plan emphasizes modern construction standards, which support the transition to system-based scaffolding for large-scale works. Egypt also benefits from a growing industrial base and transport development along the Suez Canal corridor. It supports consistent scaffold usage in both private and public sector projects. Increased collaboration with foreign engineering firms also brings international scaffolding practices into the domestic market. These factors sustain its position as a key regional growth hub.

Nigeria accounts for 21.3% of the Africa Modular & System Scaffolding Market, driven by rising urbanization and infrastructure projects across Lagos, Abuja, and Port Harcourt. Oil and gas infrastructure and commercial construction demand reliable, reusable scaffolding systems. While the country faces challenges in safety regulation enforcement and skilled labor availability, demand is growing due to ongoing real estate expansion. East Africa collectively contributes 14.5% to the market, with Kenya and Tanzania emerging as strong contenders. Their development in transport, energy, and housing infrastructure creates steady demand for modular scaffolding. It sees future growth potential across both western and eastern corridors of the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SGB-Cape

- HUGO Scaffolds Limited

- Wapo Scaffolding (T) Limited

- Southey Contracting

- Liberty Events and Contracts Scaffolding Ltd.

- Form-Scaff

- SA Scaffold Group

- Kasthew Construction Uganda

- Neetoo Industries & Co. Ltd.

- Afix Scaff (Mauritius) Ltd

Competitive Analysis:

The Africa Modular & System Scaffolding Market features a moderately competitive landscape with both global and regional players actively expanding their footprint. Leading companies such as PERI, Layher, and Doka dominate due to their strong product portfolios, engineering support, and rental services. Local players focus on cost-effective solutions and customization, serving small to mid-sized construction projects. The market encourages competition based on product durability, ease of assembly, and compliance with safety standards. Key firms invest in training services and digital project management to enhance customer value. Partnerships with infrastructure developers and government bodies strengthen brand presence. It continues to attract new entrants as demand grows across urban and industrial zones.

Recent Developments:

- In Feb 2025, Southey Contracting made headlines by being appointed as the authorized distributor of Belzona in Angola. This partnership enhances Southey Contracting’s offering in industrial protective coatings and polymeric repair technologies, increasing Belzona’s product availability and broadening Southey’s service scope for industrial clients in multiple sectors, including oil, gas, and mining.

- In February 2024, SGB-Cape announced a strategic partnership with ICR Group. This collaboration 6 SGB-Cape’s commitment to delivering comprehensive industrial services solutions in Africa by collaborating with global industry players, further strengthening their market position.

Market Concentration & Characteristics:

The Africa Modular & System Scaffolding Market demonstrates moderate concentration, with a few large companies controlling significant share while regional players meet localized demand. It is characterized by increasing adoption of rental-based models, strong preference for standardized systems, and demand driven by infrastructure and residential growth. Market players compete on safety, innovation, and cost-efficiency. The market also reflects gradual technological integration with digital planning tools improving scaffold management. Suppliers offering training, maintenance, and tailored solutions see better client retention. It continues to evolve with growing emphasis on environmental compliance and modular design flexibility.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased government spending on infrastructure will create sustained demand for modular scaffolding systems.

- Urban expansion and smart city initiatives will drive the need for efficient, safe construction solutions.

- Growth of public-private partnerships will support large-scale deployment of system scaffolds.

- Adoption of aluminum and lightweight materials will enhance mobility and reduce installation time.

- Rental services are expected to expand, catering to SMEs and short-term construction needs.

- Integration of digital project management tools will streamline scaffold planning and tracking.

- Safety compliance and regulatory alignment will become key differentiators for suppliers.

- Rising construction activity in emerging economies like Kenya and Ghana will open new market opportunities.

- Investments in renewable energy and transport infrastructure will accelerate product usage.

- Local manufacturing and training initiatives will reduce import dependency and enhance operational capacity.