Market Overview

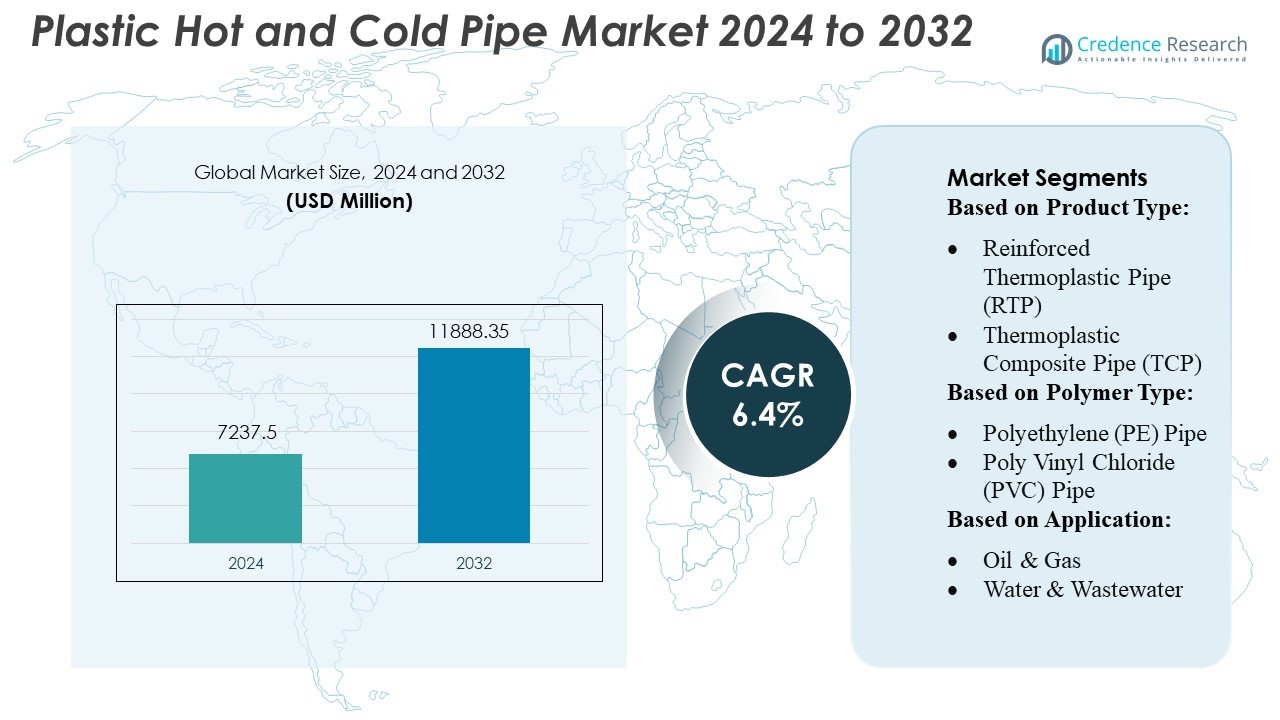

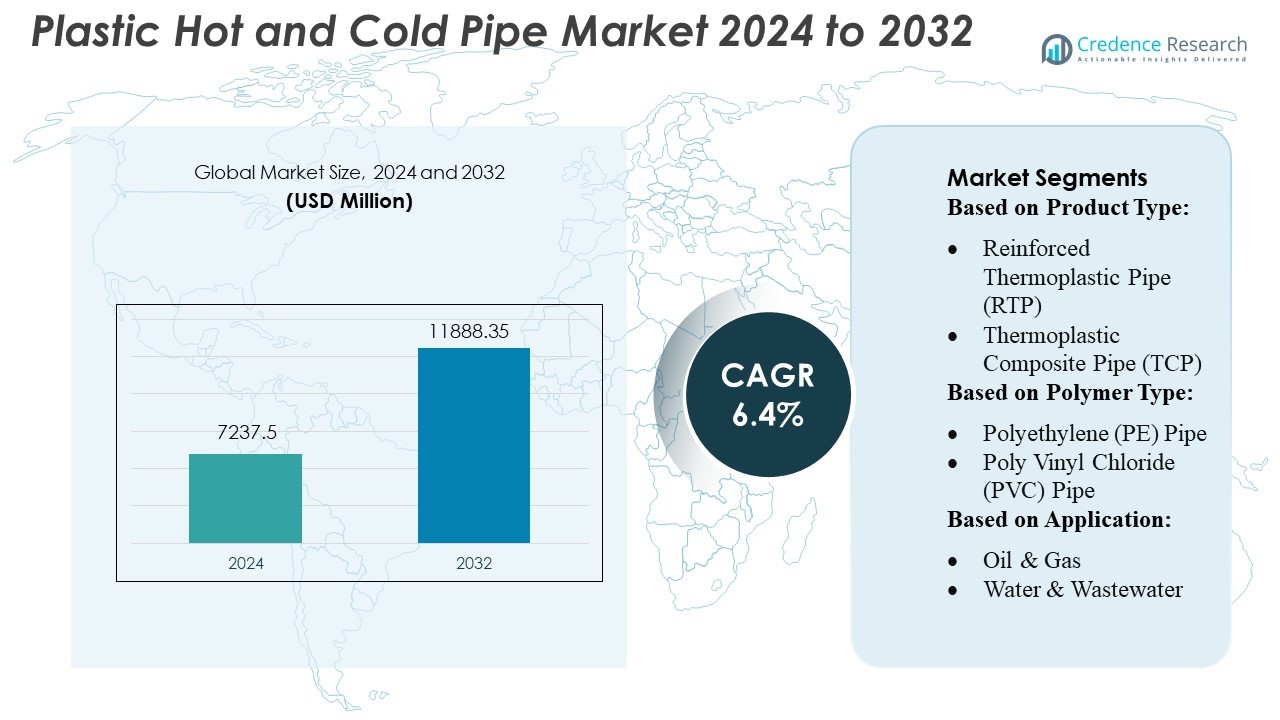

Plastic Hot and Cold Pipe Market size was valued USD 7237.5 million in 2024 and is anticipated to reach USD 11888.35 million by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Hot & Cold Pipe Market Size 2024 |

USD 7237.5 Million |

| Plastic Hot & Cold Pipe Market, CAGR |

6.4% |

| Plastic Hot & Cold Pipe Market Size 2032 |

USD 11888.35 Million |

The Plastic Hot and Cold Pipe Market features a competitive landscape shaped by global manufacturers focused on enhancing product durability, thermal efficiency, and installation performance. Companies continue to invest in advanced polymer formulations, automated extrusion systems, and multilayer composite technologies to strengthen their market position. Strategic expansion into emerging economies and the development of climate-specific piping solutions further support competitiveness. Asia-Pacific leads the global market with a dominant 38% share, driven by rapid urbanization, extensive residential construction, and strong government investment in water infrastructure. This region’s large-scale adoption of PPR, CPVC, and multilayer pipes continues to reinforce its leadership in the industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Plastic Hot and Cold Pipe Market reached USD 7,237.5 million in 2024 and is projected to attain USD 11,888.35 million by 2032, expanding at a CAGR of 6.4%, supported by rising construction activity and increasing replacement demand.

- Growing use of PPR, CPVC, and multilayer composite pipes in residential and commercial plumbing systems drives market expansion, as consumers prioritize thermal stability, corrosion resistance, and long-term installation efficiency.

- Manufacturers strengthen competitiveness by investing in automated extrusion lines, advanced polymer blends, and region-specific product innovations, while expanding distribution networks across high-growth economies.

- Limited availability of skilled installers and fluctuating raw material prices restrain market adoption, particularly in developing regions where cost sensitivity remains high.

- Asia-Pacific leads with a 38% regional share, followed by North America and Europe, while the residential segment holds the largest share due to extensive urbanization and rising demand for energy-efficient piping solutions.

Market Segmentation Analysis:

By Product Type:

Reinforced Thermoplastic Pipe (RTP) dominated the market with an estimated 60–65% share, driven by its superior pressure resistance, rapid installation, and longer lifecycle in demanding environments. RTP adoption accelerated as operators prioritized corrosion-free and flexible pipe systems for high-temperature and high-pressure flows, particularly in oil and gas infrastructure upgrades. Thermoplastic Composite Pipe (TCP) continued to expand due to its reduced weight and suitability for deepwater applications, but RTP maintained leadership because of its wider field qualification, mature supply chain, and proven cost savings in onshore and offshore pipeline replacement projects.

- For instance, ASTRAL POLYTECHNIK LIMITED designs its PEX-a PRO piping system to operate safely at temperatures up to 95 °C and supports accidental spikes up to 110 °C, according to its official specifications.

By Polymer Type:

Polyethylene (PE) Pipe led the polymer segment with an approximate 45–50% market share, supported by its high flexibility, chemical resistance, and suitability for both hot and cold fluid transport. Its dominance stems from extensive use in water distribution, district heating, and industrial networks. Polypropylene (PP) and Polyvinylidene Fluoride (PVDF) followed, benefitting from higher temperature tolerance and improved abrasion performance. However, PE remained the preferred option due to lower cost, ease of fusion welding, and wider compliance with global pressure-rating standards, which supported its adoption in new fluid-handling installations.

- For instance, Chevron Phillips Chemical Company offers its Marlex® TRB-432 resin, a bimodal high-density PE rated PE 4710/PE 100, which exhibits a density of 0.949 g/cm³, a melt flow rate of 8.0 g/10 min, and over 700% elongation at break, making it ideal for high-pressure piping applications.

By Application:

Oil & Gas remained the dominant application, accounting for over 50% of the market, driven by rising replacement of corroded steel pipelines and increased demand for lightweight, flexible pipe systems in shale, offshore, and midstream operations. Operators favored RTP and TCP solutions for their reduced installation time, minimal maintenance, and strong performance in aggressive environments. Water & Wastewater and Utilities & Renewables experienced steady growth as municipalities shifted toward corrosion-free polymer pipelines. Mining & Dredging contributed moderately, leveraging plastic pipes for slurry handling and improved wear resistance in abrasive operations.

Key Growth Drivers

Rising Construction and Infrastructure Development

Rapid expansion in residential, commercial, and industrial construction continues to drive demand for plastic hot and cold piping systems. Urban housing projects, smart city developments, and large infrastructure upgrades are increasing installations of durable, corrosion-resistant, and cost-efficient plastic pipes. Governments in emerging economies are prioritizing water supply modernization and energy-efficient building standards, boosting market penetration. Additionally, replacement of aging metal pipelines with long-lasting plastic variants accelerates adoption, particularly in high-growth regions such as Asia-Pacific and the Middle East.

- For instance, Tommur Industry (Shanghai) Co., Ltd operates two factories on a combined 10,000 m² footprint with 8 extrusion lines and 24 injection-molding machines, enabling them to produce a wide variety of PPR, PP, PVC, CPVC, and PE pipes and fittings.

Shift Toward Energy-Efficient and Sustainable Piping Solutions

Growing emphasis on energy conservation and sustainability is expanding the use of PEX, PP-R, and CPVC pipes in temperature-regulated water distribution. These materials offer superior insulation, reduced heat loss, and higher lifecycle efficiency, aligning with green building certifications and eco-friendly construction practices. Manufacturers are investing in recyclable polymers, low-emission production processes, and improved pipe formulations to meet environmental regulations. This shift toward sustainable piping materials is strengthening market demand across residential and commercial applications, especially in developed markets adopting strict energy codes.

- For instance, FRIALEN NXT safety fittings reduce CO₂ emissions by approximately 25% compared to standard fittings, thanks to their compact design.

Advancements in Polymer Technology and Installation Techniques

Continuous advancements in polymer engineering, multilayer pipe designs, and fusion/jointing technologies strengthen the market by enhancing pipe durability, flexibility, and thermal performance. Innovations such as oxygen-barrier PEX pipes, antimicrobial inner layers, and enhanced pressure-resistant compounds improve reliability in hot and cold water systems. Faster and easier installation methods, such as push-fit connectors and heat-fusion welding, reduce labor time and cost, further supporting adoption among contractors. These technology improvements broaden usage across challenging applications, including district heating, radiant flooring, and industrial fluid handling.

Key Trends & Opportunities

Growing Adoption of Smart Plumbing and Remote Monitoring

Digitalization in building systems is creating opportunities for smart plumbing networks that integrate sensors, leak-detection systems, and temperature monitoring. Plastic piping materials, especially PEX and PP-based variants, support these installations due to their flexibility and compatibility with embedded monitoring components. Commercial buildings, hospitals, and high-end residential complexes increasingly adopt intelligent water management to reduce leakage costs and ensure operational safety. This trend enhances the future scope of technologically advanced piping solutions with improved interoperability and predictive maintenance capabilities.

- For instance, Wienerberger acquired Wideco Sweden AB, which already monitors over 40,000 km of district-heating pipe networks via IoT sensors and a web-based platform.

Expansion of Multilayer Composite Pipe Systems

Multilayer composite pipes—combining plastic polymers with aluminum or glass fiber reinforcement—are gaining traction due to their superior thermal stability, shape memory, and reduced thermal expansion compared to single-layer plastic pipes. These pipes offer high pressure resistance and longer service life in hot and cold water applications, creating new opportunities in large-scale heating and cooling systems. Their lightweight structure and flexible installation profile also attract installers seeking efficiency and reduced tooling requirements. This trend accelerates their adoption in both residential retrofits and new building projects.

- For instance, Finolex CPVC pipes are manufactured conforming to the IS 15778 standard in SDR 11 and SDR 13.5 classes. These pipes have certified working pressures of up to 28.14 kg/cm² at 27 °C and are suitable for continuous use at temperatures up to 82 °C (with reduced pressure).

Increasing Penetration in Industrial and Process Applications

Plastic hot and cold pipes are rapidly moving beyond residential and commercial use into industrial sectors requiring corrosion resistance and chemical stability. Industries such as food processing, pharmaceuticals, and light manufacturing are replacing metal pipes with high-performance plastic variants to improve hygiene, prevent scale build-up, and reduce maintenance frequency. Rising viability of high-temperature engineered polymers opens new avenues in process water management and auxiliary fluid handling. This shift presents manufacturers with significant opportunities to tailor advanced PVC, PP-R, and CPVC systems for industrial-grade demands.

- For instance, Orbia’s R&D team introduced its Sentio® heating-and-cooling controls, which enable modulation of floor-heating systems with a 0.5 °C resolution via Bluetooth-connected thermostats.

Key Challenges

Fluctuating Raw Material Prices and Supply Chain Disruptions

Volatility in the prices of petrochemical feedstocks, including PVC and polyethylene resins, directly affects production costs and profit margins for pipe manufacturers. Global supply chain disruptions—driven by geopolitical uncertainty, shipping bottlenecks, and energy price fluctuations—create inconsistency in raw material availability. These uncertainties hinder price stability, discourage long-term procurement planning, and intensify competition among manufacturers. As a result, the market faces challenges in maintaining consistent production volumes and meeting delivery commitments, particularly in cost-sensitive regional markets.

Competition from Alternative Piping Materials

Despite strong growth, plastic pipes face competition from metal and composite piping materials, especially in high-temperature or heavy-duty applications where metal systems offer proven reliability. Concerns about plastic degradation under prolonged exposure to UV, extreme temperatures, or aggressive chemicals also limit adoption in certain environments. Regulatory restrictions on plastic usage in some regions due to environmental concerns further intensify the challenge. These factors compel manufacturers to continually innovate material formulations to match performance benchmarks and mitigate resistance from end users accustomed to traditional materials.

Regional Analysis

North America

North America commands a significant market share of around 27%, driven by rapid adoption of plastic hot and cold pipes across residential, commercial, and industrial plumbing systems. Strong construction activity in the United States, combined with demand for PEX and CPVC pipes due to leakage resistance, thermal stability, and ease of installation, supports expansion. Stringent building codes encouraging energy-efficient piping further bolster market penetration. Infrastructure modernization programs, including water distribution upgrades, fuel long-term adoption. The presence of leading manufacturers and increased use of multilayer composite pipes in HVAC, district heating, and renovation projects sustains consistent regional growth.

Europe

Europe accounts for approximately 25% market share, driven by advanced plumbing standards, widespread retrofitting of aging water networks, and stringent regulations promoting corrosion-resistant and thermally efficient piping materials. High demand for PERT, PP-R, and multilayer composite pipes in hydronic heating, radiator connections, and underfloor heating accelerates adoption. Germany, Italy, and France lead usage due to strong residential energy-efficient construction trends. The region’s shift toward sustainable building materials, supported by EU directives such as EPBD and Green Deal targets, further strengthens market expansion. Ongoing renovation of heritage and multi-unit dwellings also enhances the demand outlook.

Asia-Pacific

Asia-Pacific dominates the market with an estimated 38% share, driven by massive urbanization, rising residential construction, and increasing adoption of cost-effective plastic pipes in China, India, and Southeast Asia. Expanding smart city projects and government-backed infrastructure programs accelerate installation of PPR, PVC, and multilayer pipes for hot and cold water distribution. Rapid industrial growth in manufacturing and commercial real estate boosts demand for durable, lightweight, and corrosion-free piping. Increased awareness of energy-efficient plumbing systems and shifting preference toward PEX and CPVC technologies contribute to strong regional penetration. The region remains the fastest-growing global market.

Latin America

Latin America holds around 6% market share, supported by increasing investments in residential housing, water supply modernization, and cost-efficient plumbing materials. Brazil and Mexico drive regional demand as builders shift from metal to PPR and PVC pipes due to lower installation and maintenance costs. Growing middle-income housing development, coupled with gradual industrial expansion, sustains adoption of hot and cold pipe systems. Government-led initiatives for improving water infrastructure and reducing pipeline leakage support broader use of plastic pipes. Despite economic fluctuations, replacement demand and urban development projects continue to provide stable growth opportunities across the region.

Middle East & Africa

The Middle East & Africa region accounts for nearly 4% market share, driven by rising urban development, large-scale commercial construction, and rapid adoption of CPVC and PPR piping systems suited to high-temperature environments. GCC countries, particularly the UAE and Saudi Arabia, lead consumption due to extensive residential and hospitality expansion. Investments in water recycling plants and district cooling networks further support usage of thermally stable plastic pipes. In Africa, infrastructure gaps and growing housing demand encourage steady uptake of cost-efficient piping alternatives. Continued government spending on utilities, desalination, and public infrastructure will support long-term market expansion.

Market Segmentations:

By Product Type:

- Reinforced Thermoplastic Pipe (RTP)

- Thermoplastic Composite Pipe (TCP)

By Polymer Type:

- Polyethylene (PE) Pipe

- Poly Vinyl Chloride (PVC) Pipe

By Application:

- Oil & Gas

- Water & Wastewater

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Plastic Hot and Cold Pipe players such as Kubota ChemiX Co., Ltd, ASTRAL POLYTECHNIK LIMITED, Chevron Phillips Chemical Company, Tommur Industry (Shanghai) CO., LTD, Aliaxis Group S.A., Wienerberger AG, Pipe Corporation, Finolex Industries Ltd, Kotec Corporation, and Mexichem SAB de CV. The Plastic Hot and Cold Pipe Market is characterized by continuous innovation, strong regional expansion, and a growing emphasis on high-performance polymer technologies. Manufacturers increasingly invest in advanced extrusion systems, multilayer composite designs, and high-temperature–resistant materials to meet evolving construction and plumbing standards. Sustainability plays a central role, with companies adopting recyclable polymers, energy-efficient production lines, and lower-emission manufacturing practices. Market participants also focus on improving distribution networks, offering customized piping solutions tailored to residential, commercial, and industrial applications. As infrastructure modernization accelerates globally, competition intensifies around product reliability, certification compliance, thermal efficiency, and long-term lifecycle performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Prysmian completed the acquisition of Channell Commercial Corporation for a base purchase price of plus customary adjustments. Channell, a US-based company, manufactures thermoplastic enclosures and fiber management solutions, which marks a significant move for Prysmian to transition from a cable manufacturer to a full solutions provider, as reported in this press release and this Cabling Installation & Maintenance article.

- In June 2024, Rollepaal, the world’s leading supplier of pipe extrusion technology, is pleased to announce it has developed an exclusive relationship in India with accepted and acknowledged Sintex, part of the Welspun Group.

- In May 2023, SABIC unveiled that it has opened a new European Tube Innovation Center in the Netherlands. The new European Tube Innovation Center is located close to SABIC’s production facility in Geleen and will assist in developing, evaluating, sampling, and testing custom pipe materials.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Polymer Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily as global construction and renovation activities accelerate.

- Manufacturers will increasingly adopt energy-efficient and automated production technologies to improve output and quality.

- Demand for high-temperature-resistant pipes such as CPVC, PPR, and multilayer composites will continue to rise.

- Sustainability requirements will drive wider adoption of recyclable and low-emission polymer materials.

- Smart building trends will promote greater integration of pipes compatible with advanced heating and cooling systems.

- Urbanization in developing regions will expand installation of cost-efficient plastic piping in residential and commercial projects.

- Companies will focus on expanding distribution networks to strengthen regional market penetration.

- Greater enforcement of plumbing safety and performance standards will encourage adoption of certified high-reliability pipe systems.

- Product customization for climate-specific applications will gain prominence across global markets.

- Strategic collaborations and technology partnerships will accelerate innovation and enhance competitive differentiation.