Market Overview

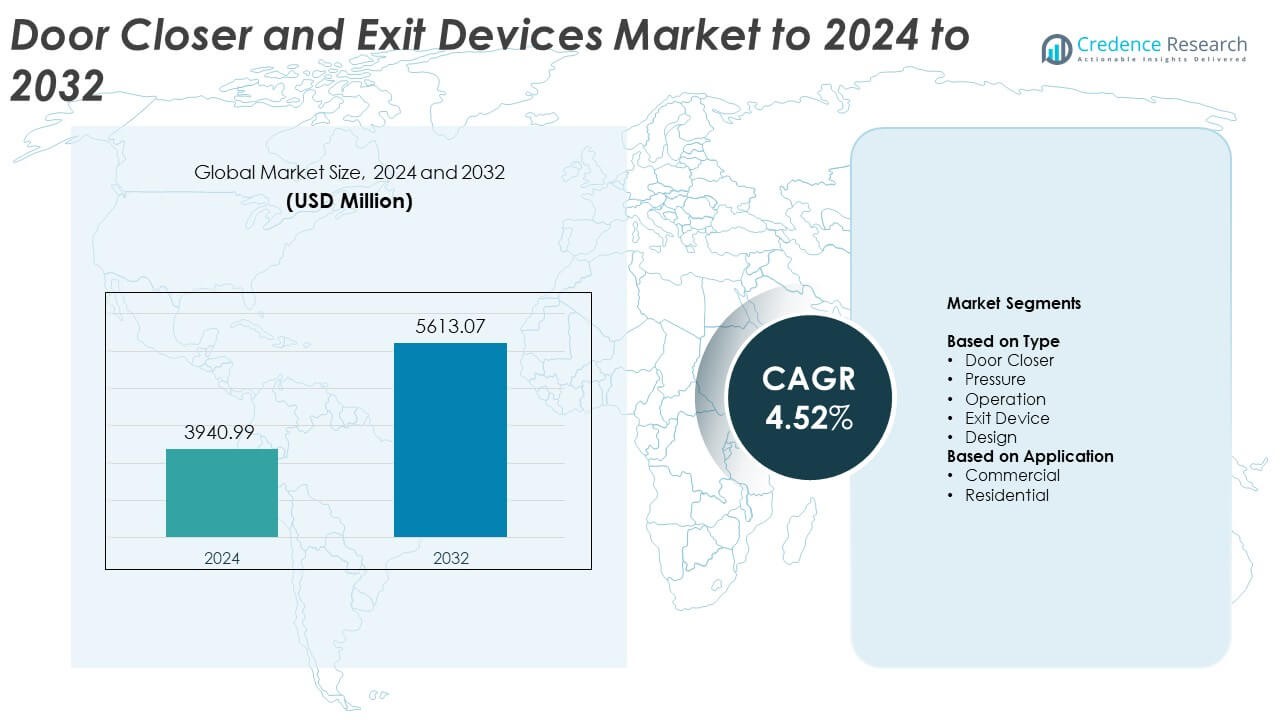

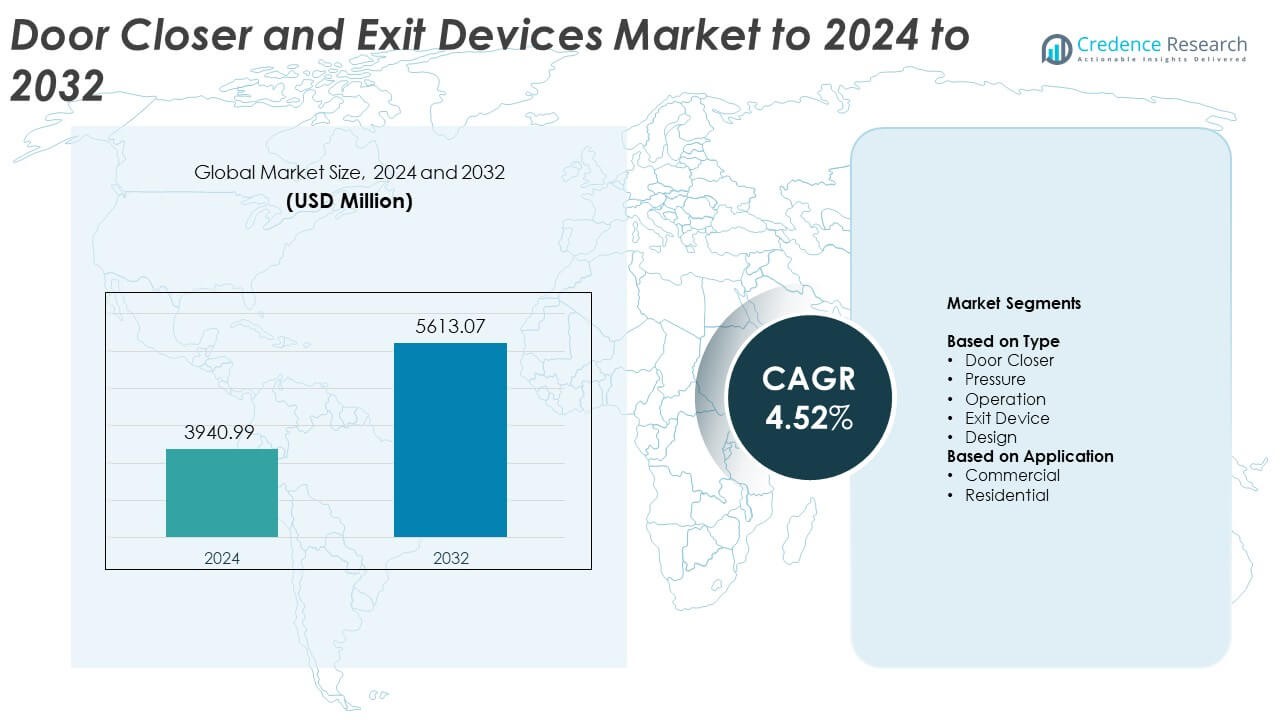

Door Closer and Exit Devices Market size was valued at USD 3940.99 million in 2024 and is anticipated to reach USD 5613.07 million by 2032, at a CAGR of 4.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Door Closer and Exit Devices Market Size 2024 |

USD 3940.99 Million |

| Door Closer and Exit Devices Market, CAGR |

4.52% |

| Door Closer and Exit Devices Market Size 2032 |

USD 5613.07 Million |

The Door Closer and Exit Devices Market is shaped by major players such as Dorence Industries, Assa Abloy, Dynasty Hardware, GEZE GmbH, Dormakaba, Tell Manufacturing, Allegion, Hager Group, ISEO, and DOM, each competing through advanced safety designs, durable mechanisms, and integration with modern access control systems. North America leads the global market with about 34% share in 2024 due to strict fire safety codes and high commercial construction activity. Europe follows with nearly 29% share supported by strong regulatory compliance and widespread institutional adoption. Asia Pacific holds around 25% share and remains the fastest-growing region driven by rapid urban development and rising safety awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Door Closer and Exit Devices Market reached USD 3940.99 million in 2024 and is projected to hit USD 5613.07 million by 2032, growing at a CAGR of 4.52%.

- Growth is driven by stricter global fire-safety regulations and rising installation of certified door closers and exit devices across commercial facilities, where the commercial segment holds about 62% share.

- Key trends include rapid adoption of smart-integrated door systems, energy-efficient closers, and upgraded panic hardware, supporting higher demand for advanced models in high-traffic buildings.

- Competition strengthens as leading manufacturers invest in durable mechanisms, smooth-action closers, automated exit devices, and broader product portfolios tailored for heavy-duty and retrofit applications.

- North America leads with around 34% share, followed by Europe at 29% and Asia Pacific at 25%, while the door closer category remains dominant with nearly 46% share in 2024.

Market Segmentation Analysis:

By Type

Door closer leads this segment with about 46% share in 2024 due to rising adoption across commercial buildings, hospitals, and institutional facilities that require controlled door movement and improved fire safety compliance. Demand grows as builders prefer adjustable and hydraulic models that support smooth closing, durability, and energy-efficient HVAC performance. Exit devices also gain traction as safety rules tighten in public spaces, while pressure, operation, and design-based variants expand with upgrades in modern infrastructure and retrofitting of older structures.

- For instance, Dormakaba’s TS 98 XEA door closer is officially certified for 500,000 test cycles under EN 1154 endurance testing (Dormakaba Product Certification, 2024).

By Application

Commercial buildings dominate this segment with nearly 62% share in 2024, driven by strict safety codes, growing construction of retail outlets, hotels, offices, and public institutions. These facilities require panic bars, heavy-duty exit devices, and automatic door closers to support emergency egress and high-traffic operations. Residential demand grows at a steady pace as homeowners adopt compact closers for privacy and security upgrades. Rising renovation rates and smart home adoption further support product installations across multi-family and single-family housing.

- For instance, Allegion’s Von Duprin 99 Series exit devices are factory-tested to meet and often exceed the ANSI/BHMA A156.3 Grade 1 standard, which requires all certified devices to pass 500,000 mechanical cycles under a 20-pound preload condition.

Key Growth Drivers

Stricter Safety Regulations

Global building rules now demand reliable door control and safe exit systems. Many countries update fire and emergency codes, pushing builders to install certified closers and panic devices. This shift raises adoption in offices, malls, and public buildings. Strong compliance pressure encourages upgrades in older structures. The steady flow of new construction also expands demand. This driver is the most important growth factor because it affects every major region and end user.

- For instance, ASSA ABLOY’s DC700G-FT model is certified in compliance with EN 1154 and is suitable for use on fire and smoke protection doors. The product is approved for installation on fire-resistance doors rated for up to 120 minutes.

Rise in Commercial Infrastructure Projects

New commercial projects increase demand for door closers and exit devices. Offices, hospitals, hotels, and retail sites need durable hardware to manage heavy foot traffic. Builders prefer models with strong closing force and long service life, which increases product uptake. Growing investment in airports and smart buildings also strengthens demand. Retrofit work in aging buildings adds further volume. This factor continues to guide market growth across urban regions.

- For instance, GEZE’s TS 5000 door closer is certified to meet the highest durability grade of the EN 1154 standard, which requires withstanding 500,000 opening and closing cycles.

Focus on Enhanced Security and Access Control

Users want safer entry points and controlled movement in busy buildings. Modern door closers support better access control, noise reduction, and energy savings. Facility managers prefer hardware that integrates with electric locks and monitoring systems. Adoption rises in schools, healthcare sites, banks, and industrial units. The push for secure environments boosts premium product demand. This growth driver supports long-term upgrades across both public and private facilities.

Key Trends and Opportunities

Adoption of Smart and Connected Door Systems

Smart closers and exit devices gain traction as buildings shift toward connected security. Manufacturers introduce systems with sensors, remote access, and automation features. These tools improve monitoring and reduce failure risks in high-traffic sites. Growth in smart cities helps push adoption further. The trend opens strong opportunities for digital access control and integrated safety platforms. It continues to reshape product development across global markets.

- For instance, Honeywell Building Technologies provides a wide range of access control and building automation systems that utilize BACnet for integration. The company offers a BACnet Control Module and various door control modules (DCMs) and intelligent controllers, these typically support a maximum of 2 doors per module or are part of larger

Rising Demand for Energy-Efficient Building Hardware

More builders now focus on energy-saving hardware to support green construction goals. Door closers help maintain indoor temperature by reducing uncontrolled airflow. This lowers HVAC load and supports sustainability targets. Governments promote energy-efficient upgrades in public facilities, creating wide opportunities. Manufacturers respond with adjustable, low-leakage designs that improve building performance. This trend expands strongly in commercial and institutional spaces.

- For instance, HOPPE manufactures high-quality door and window handles and fittings that contribute to the overall performance of a complete door or window assembly. The EN 12207 standard relates to the air permeability of the entire window or door set

Expansion of Retrofit and Renovation Activities

Old buildings require upgraded exit devices and reliable door control systems. Renovation activity rises across North America, Europe, and Asia Pacific. Many facilities replace outdated hardware to meet new safety rules and improve security. This creates stable demand for durable and easy-install products. Growing awareness of compliance gaps increases the need for certified hardware. The trend provides strong opportunities for aftermarket suppliers.

Key Challenges

High Installation and Maintenance Costs

Many users delay upgrades because installation costs remain high for advanced models. Large commercial sites require skilled labor, which raises total project spending. Regular maintenance adds extra cost for facility owners. Smaller businesses often choose basic hardware instead of premium systems. This slows adoption of advanced door control technology. The challenge remains strong in price-sensitive regions.

Limited Standardization Across Global Markets

Safety and hardware standards vary widely between countries. Manufacturers must adapt product designs to meet different codes, increasing cost and complexity. Import rules also differ, slowing cross-border sales. Builders often face confusion when choosing compliant hardware. This slows adoption, especially in developing regions. The challenge limits smooth global expansion for many suppliers.

Regional Analysis

North America

North America holds about 34% share in 2024, driven by strict fire safety rules, steady commercial construction, and frequent renovation cycles across offices, hospitals, and educational buildings. Demand remains strong for certified panic devices and heavy-duty door closers in high-traffic facilities. Builders adopt advanced hydraulic and smart-integrated models to meet performance and security requirements. Retrofit programs across the United States continue to replace outdated exit hardware, supporting consistent growth. Canada also shows rising adoption as new building codes push for enhanced emergency egress solutions.

Europe

Europe accounts for nearly 29% share in 2024, supported by mature construction standards and strong enforcement of EN safety certifications. High adoption in institutional buildings, transport hubs, and hospitality facilities drives steady demand. Countries such as Germany, France, and the U.K. focus on energy-efficient door systems that reduce drafts and maintain indoor climate control. Upgrades in public infrastructure and heritage building restorations create additional opportunities. Manufacturers benefit from the region’s preference for durable, low-maintenance closers and advanced exit devices that comply with stringent regulatory norms.

Asia Pacific

Asia Pacific captures around 25% share in 2024 and remains the fastest-growing region due to rapid urban expansion, rising commercial real estate investment, and increasing adoption of modern building safety systems. China, India, Japan, and South Korea show strong demand for high-traffic exit devices and cost-efficient closers in malls, airports, and corporate facilities. Growing awareness of emergency safety compliance boosts installations in new developments. The region’s expanding smart building ecosystem also drives uptake of automated and connected door control hardware, supporting long-term growth.

Middle East and Africa

Middle East and Africa hold roughly 7% share in 2024, driven by growing commercial projects, hospitality expansion, and large-scale public infrastructure development. Gulf countries prioritize fire-safe construction practices, increasing demand for panic bars and heavy-duty closers in premium facilities. Africa shows rising adoption in urban centers where building safety enforcement improves. The region’s warm climate encourages the use of closers that help maintain indoor cooling efficiency. Increasing investment in airports, schools, and healthcare facilities further supports market expansion.

South America

South America represents about 5% share in 2024, supported by gradual improvements in safety compliance across commercial and residential buildings. Brazil, Argentina, and Chile experience steady installation of exit devices in public spaces as fire protection rules strengthen. Modernization of office buildings and retail centers stimulates demand for reliable closers and panic hardware. Cost-effective models gain preference in price-sensitive markets, while premium devices grow in high-value construction projects. The region benefits from increasing urban development and refurbishment activities in major cities.

Market Segmentations:

By Type

- Door Closer

- Pressure

- Operation

- Exit Device

- Design

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Door Closer and Exit Devices Market is shaped by leading companies such as Dorence Industries, Assa Abloy, Dynasty Hardware, GEZE GmbH, Dormakaba, Tell Manufacturing, Allegion, Hager Group, ISEO, and DOM. The market features strong competition driven by product innovation, durability standards, and compliance with global fire and safety regulations. Manufacturers focus on enhancing performance through smoother mechanisms, corrosion-resistant materials, and integration with access control systems. Many players invest in smart technologies that support remote monitoring and automated control for modern commercial buildings. Companies also expand their product portfolios to serve diverse applications including high-traffic public spaces, residential complexes, and industrial facilities. Strategic partnerships with distributors and construction firms help strengthen global presence, while continuous upgrades to meet regional building codes create differentiation. The rise of retrofit and renovation projects further intensifies competition as brands compete to offer efficient, easy-install solutions tailored to aging infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Assa Abloy launched its ecoLOGIC solution, an AI-driven algorithm that optimizes automatic door behavior to dynamically reduce energy waste

- In 2024, Allegion introduced the Von Duprin 70 Series, a value-focused family of Grade 1 exit devices.

- In 2023, ISEO continued to offer and support its existing lines of sliding arm door closers, including the established IS315 and IS115 models, which are suitable for various door types such as wood, metal, and aluminum, including fire-resistant doors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as governments tighten fire and emergency safety rules.

- Demand will rise for smart-enabled door closers with integrated sensors and remote access.

- Commercial renovation projects will drive higher adoption of upgraded exit devices.

- Builders will prefer energy-efficient models that support green building goals.

- Manufacturers will expand product lines with quieter, smoother, and adjustable mechanisms.

- Integration with access control and security platforms will gain wider acceptance.

- Asia Pacific will emerge as the strongest growth region due to rapid construction activity.

- Retrofit demand will increase across older buildings needing code-compliant hardware.

- Global suppliers will focus on simplified installation to reduce labor costs.

- Hybrid mechanical-electronic exit devices will gain traction in high-traffic facilities.