Market Overview:

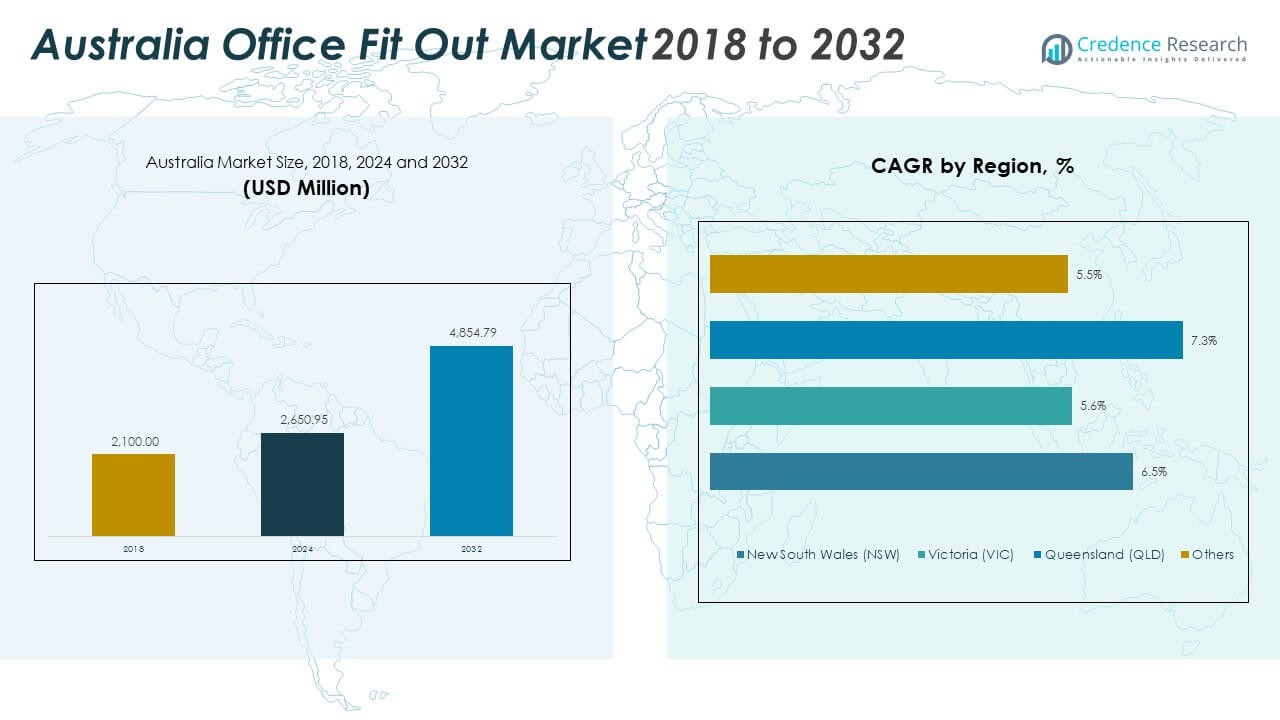

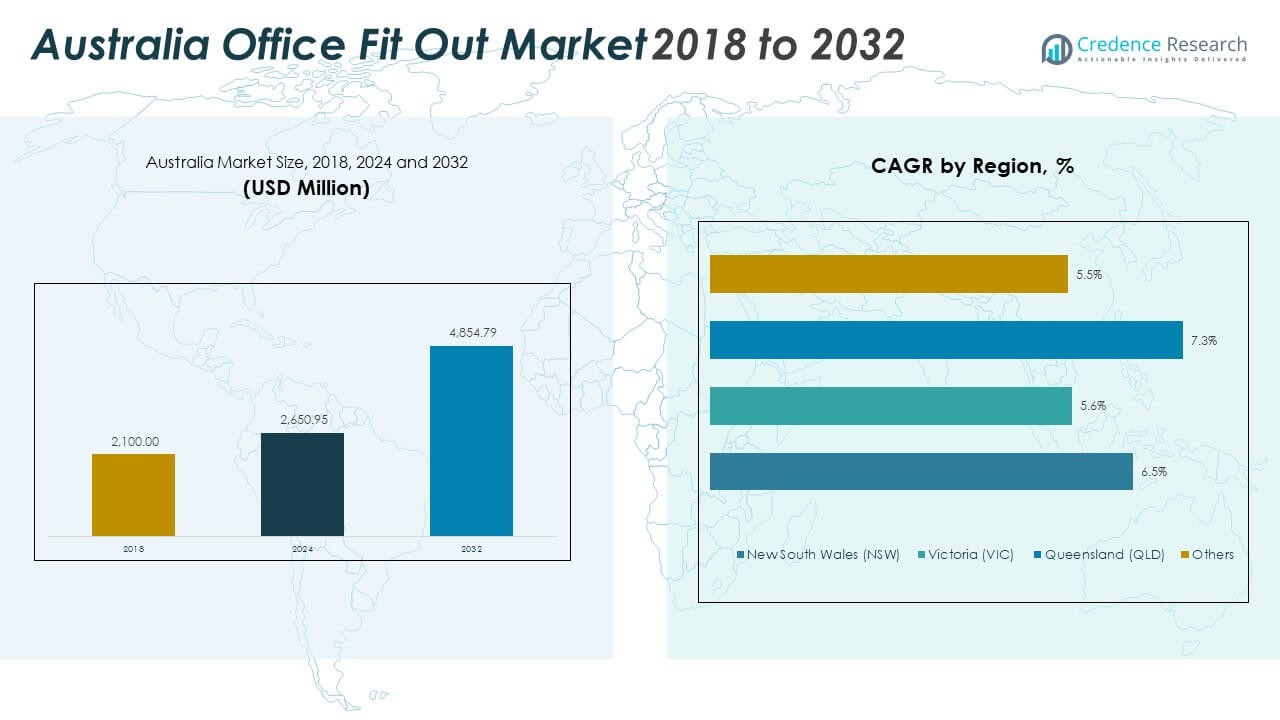

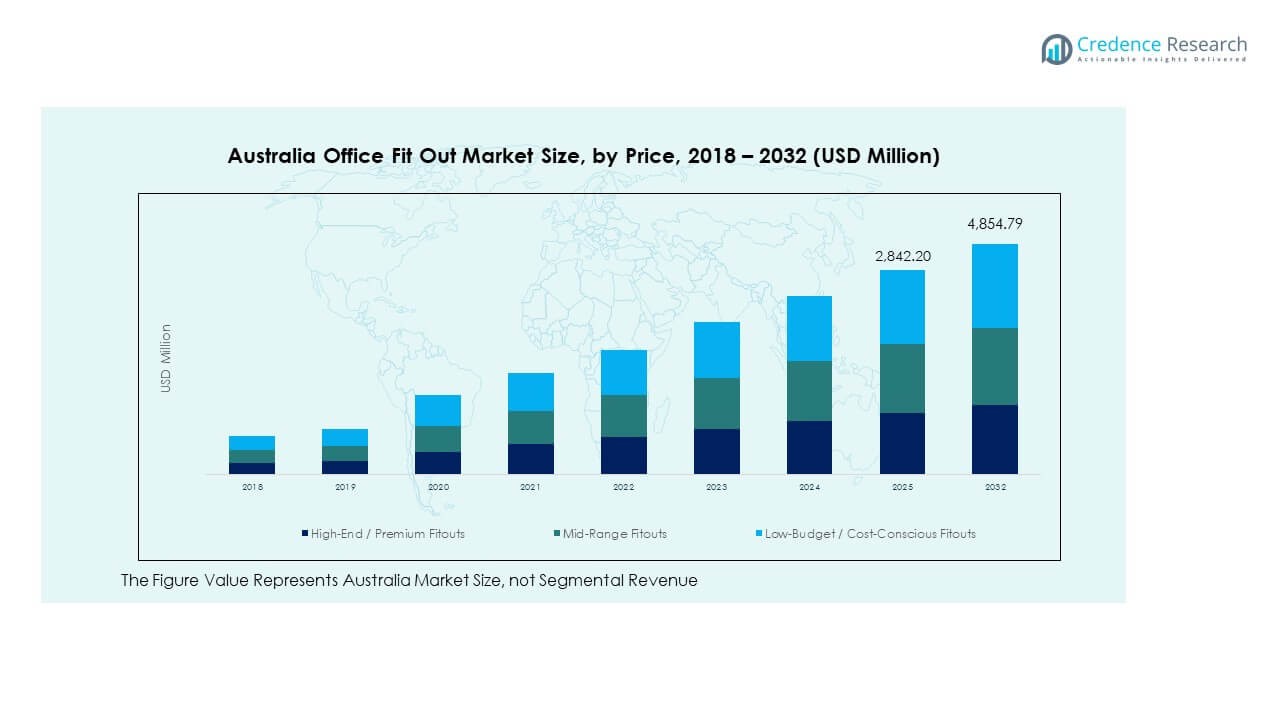

The Australia Office Fit Out Market size was valued at USD 2,100.00 million in 2018, grew to USD 2,650.95 million in 2024, and is anticipated to reach USD 4,854.79 million by 2032, at a CAGR of 7.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Office Fit Out Market Size 2024 |

USD 2,650.95 Million |

| Australia Office Fit Out Market, CAGR |

7.95% |

| Australia Office Fit Out Market Size 2032 |

USD 4,854.79 Million |

The market is being driven by several factors, including the rising demand for flexible, modern office spaces to accommodate hybrid work models. Companies are prioritizing workplace environments that foster collaboration, employee well-being, and productivity. Technological integration in office designs, coupled with sustainability goals, is also a key contributor. As businesses adapt to evolving trends, the need for office refurbishments and innovative fit-out solutions continue to rise.

The major regions leading the Australia Office Fit Out Market are New South Wales, Victoria, and Queensland. New South Wales, particularly Sydney, remains the dominant market due to a high concentration of corporate offices and growing demand for premium fit-outs. Victoria follows, with Melbourne experiencing an increase in refurbishment projects and demand for flexible workspaces. Emerging markets in regional areas are expected to contribute to growth, driven by lower real estate costs and expanding businesses seeking cost-effective fit-out solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Office Fit Out Market was valued at USD 2,100 million in 2018, growing to USD 2,650.95 million in 2024, and is projected to reach USD 4,854.79 million by 2032, with a CAGR of 7.95% during the forecast period.

- The market is led by New South Wales (NSW) with a 35% share, followed by Victoria (27%) and Queensland (24%). NSW’s dominance is driven by Sydney’s concentration of corporate offices, while Victoria and Queensland are experiencing growth due to regional office expansions.

- Queensland is the fastest-growing region, driven by affordable real estate options and businesses expanding to lower-cost areas. It holds a 24% share of the market.

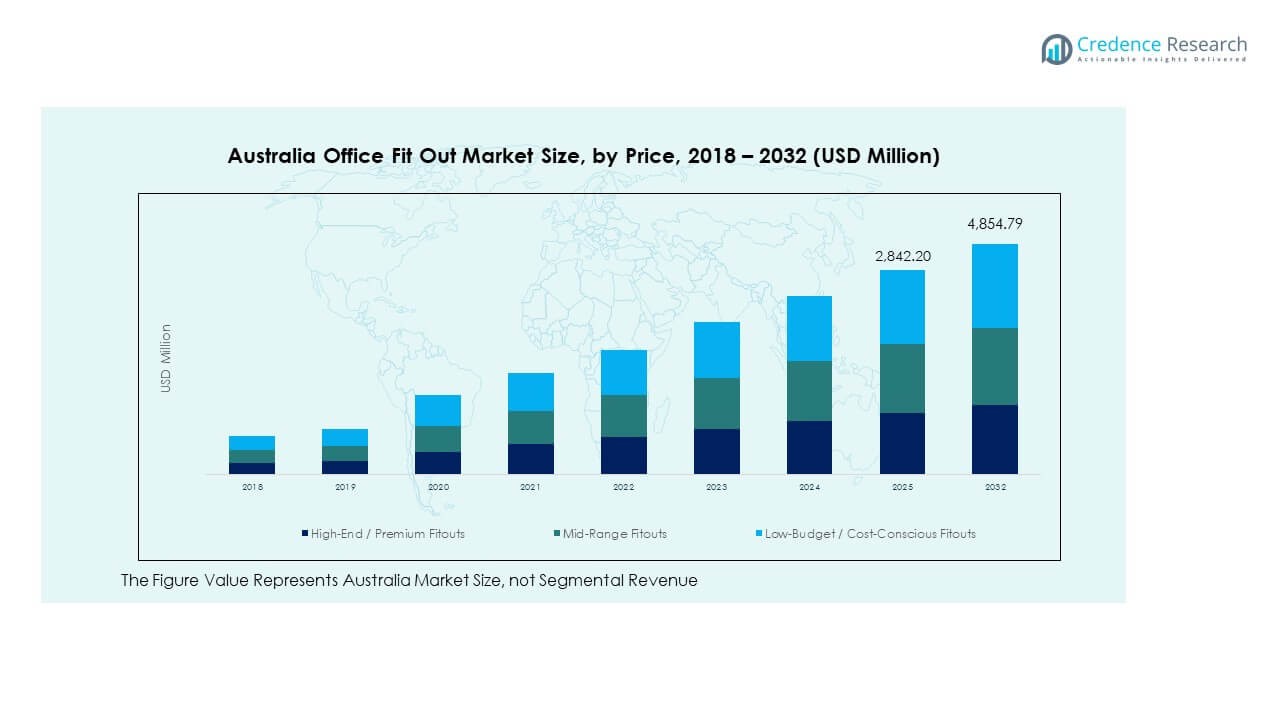

- The High-End / Premium Fitouts segment dominates with the largest share of the market, while the Mid-Range Fitouts and Low-Budget / Cost-Conscious Fitouts segments show balanced growth, reflecting demand across various price points.

- The market distribution by price shows that High-End / Premium Fitouts account for the largest market share, with Mid-Range Fitouts and Low-Budget / Cost-Conscious Fitouts growing at a steady pace, catering to different business needs.

Market Drivers:

Increased Focus on Employee Well-Being

The Australia Office Fit Out Market has seen a significant rise in demand driven by the focus on employee well-being. Companies are increasingly prioritizing healthy, ergonomic office designs that improve productivity and job satisfaction. Open layouts, natural lighting, and wellness areas such as gyms or relaxation zones are becoming standard in office spaces. Firms understand that enhancing the work environment positively impacts employee retention, morale, and performance.

Technological Advancements in Office Design

With rapid advancements in technology, the Australia Office Fit Out Market is experiencing increased investment in smart office solutions. Companies are integrating automation and digital tools into office spaces, such as smart lighting, temperature control systems, and meeting room management systems. These innovations help businesses reduce operational costs and increase efficiency, aligning with growing environmental and sustainability goals. The integration of advanced technology is essential for modern offices to meet the demands of the digital age.

- For instance, Schiavello Group developed and launched the Nura Space platform in Melbourne to monitor and manage workspaces using advanced IoT technologies, providing real-time space usage data and workspace communications for both the company and its clients.

Demand for Flexible Workspaces

The rising demand for flexible workspaces has also been a key driver in the Australia Office Fit Out Market. As companies adapt to remote working trends, they require office spaces that can easily be reconfigured for varying team sizes and business needs. The trend towards activity-based workspaces (ABW) allows employees to choose their work environment based on the task at hand. This flexibility supports collaboration and innovation while ensuring that office spaces remain cost-efficient.

Sustainability and Green Building Initiatives

The push for sustainability is reshaping the Australia Office Fit Out Market. Green building certifications such as LEED (Leadership in Energy and Environmental Design) and NABERS (National Australian Built Environment Rating System) are becoming standard requirements for office renovations. Companies are investing in energy-efficient materials, water conservation systems, and sustainable construction practices to reduce their carbon footprints. This shift towards eco-friendly office fit-outs is driven by both corporate responsibility and government regulations aimed at reducing environmental impact.

- For instance, Charter Hall’s Office portfolio more than doubled the number of buildings rated at least 5 stars in Green Star and managed to reduce its energy intensity by 20% despite a 47% increase in floor area since 2019, marking a nation-leading green building achievement as announced in 2023.

Market Trends:

Rise of Co-Working Spaces

The increasing popularity of co-working spaces is a notable trend in the Australia Office Fit Out Market. These spaces provide flexible work options for startups, freelancers, and established businesses seeking cost-effective office solutions. The rise of the gig economy and changing work dynamics have driven the growth of shared office environments. Companies in urban centers are opting for flexible spaces that encourage collaboration while allowing for scalability as their workforce grows.

- For example, Hub Australia’s Collins Street Melbourne location offers flexible office space with premium amenities such as AV-equipped meeting rooms, high-speed internet, and carbon-neutral certified facilities. The site also provides ergonomic workstations and end-of-trip facilities, verified through company listings.

Integration of Hybrid Work Models

Hybrid work models are driving significant change in office fit-outs across Australia. Companies are redesigning their spaces to accommodate a mix of in-office and remote work. This requires creating versatile workstations, collaborative zones, and technology solutions that support virtual meetings and seamless communication. The need for more adaptable and technology-friendly office designs has accelerated the demand for specialized fit-outs that cater to this new work model.

Focus on Smart and Automated Office Solutions

Another important trend in the Australia Office Fit Out Market is the integration of smart technologies within office spaces. This includes the use of IoT devices for enhanced security, automated climate control systems, and sensors that track office space utilization. Smart offices help businesses save on energy costs, enhance the user experience, and improve efficiency. The growing demand for these solutions reflects a shift towards more data-driven and responsive office environments.

- For example, in July 2022, JLL acquired Envio Systems to enhance its smart building capabilities. The acquisition enables large-scale deployment of IoT technology to optimize HVAC, lighting, and energy management systems in commercial buildings, supporting real-time data analysis for predictive decision-making.

Customization of Office Design for Branding

The demand for customized office fit-outs that align with corporate branding is also increasing. Companies are investing in bespoke office designs that reflect their brand identity, culture, and values. This trend is particularly prominent in creative industries where the office environment is considered an extension of the brand itself. Customization not only enhances brand presence but also boosts employee engagement and pride in their workspace.

Market Challenges Analysis:

Rising Costs of Construction and Materials

One of the primary challenges faced by the Australia Office Fit Out Market is the increasing costs of construction and raw materials. Prices for essential materials such as timber, steel, and glass have risen in recent years, impacting overall project budgets. These rising costs force businesses to reconsider their design choices and can lead to delays in project timelines. With many companies striving for high-quality, sustainable office spaces, the challenge of maintaining cost-effectiveness while meeting design expectations continues to be significant.

Shortage of Skilled Labor

Another challenge impacting the Australia Office Fit Out Market is the shortage of skilled labor in the construction and design industries. The demand for specialized workers such as project managers, designers, and craftsmen who can deliver high-end office fit-outs is high, but the supply remains limited. This shortage increases labor costs and contributes to delays in project completion. As the market continues to grow, attracting and retaining skilled workers becomes a key challenge for businesses and contractors in the fit-out sector.

Market Opportunities:

Expansion in Regional and Suburban Areas

The Australia Office Fit Out Market presents opportunities in regional and suburban areas where businesses are expanding to reduce operating costs. As companies explore outside major cities, the demand for office fit-outs in these locations increases. These areas offer more affordable real estate options and are becoming attractive for businesses looking to tap into local talent pools. The market has an opportunity to cater to these growing demands with flexible, cost-effective fit-out solutions.

Demand for Sustainable and Green Fit-Outs

There is an expanding opportunity for businesses in the Australia Office Fit Out Market to focus on sustainable and green building solutions. With increased corporate responsibility towards the environment, companies are seeking office spaces that reduce environmental impact through energy-efficient designs and the use of eco-friendly materials. Companies that specialize in sustainable fit-outs can capitalize on this trend by offering green-certified solutions to meet the needs of environmentally-conscious clients.

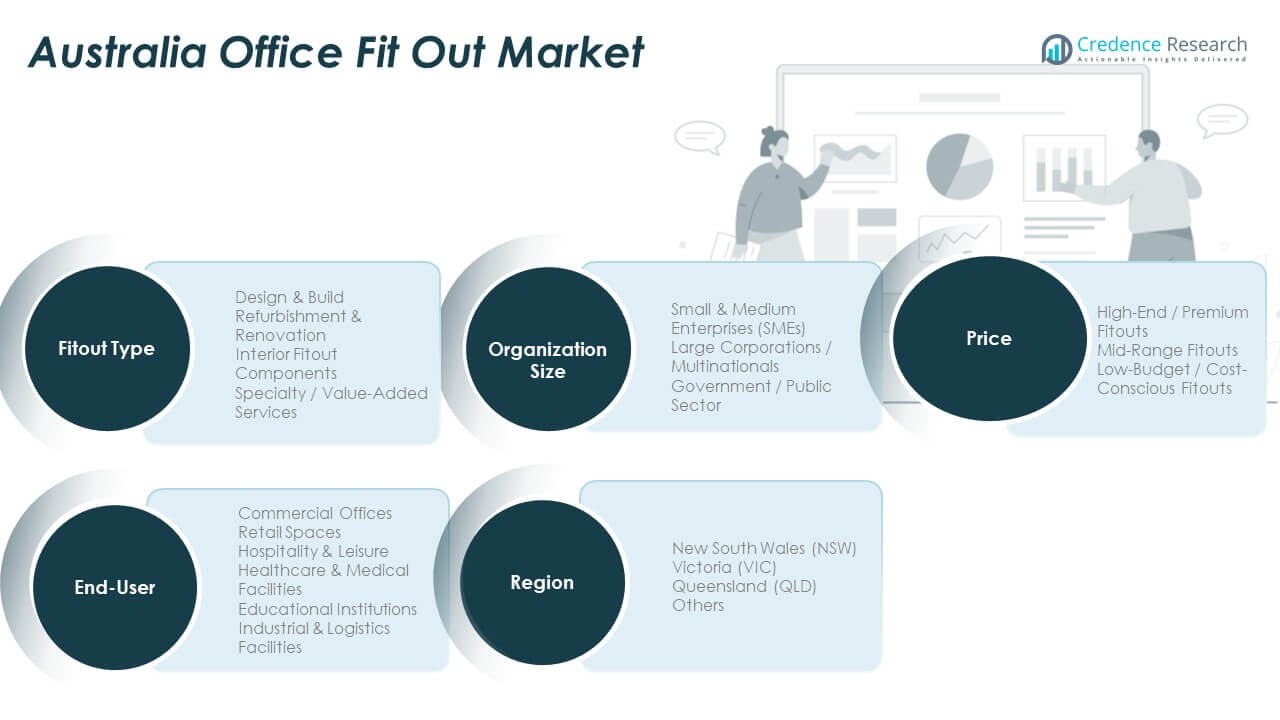

Market Segmentation Analysis

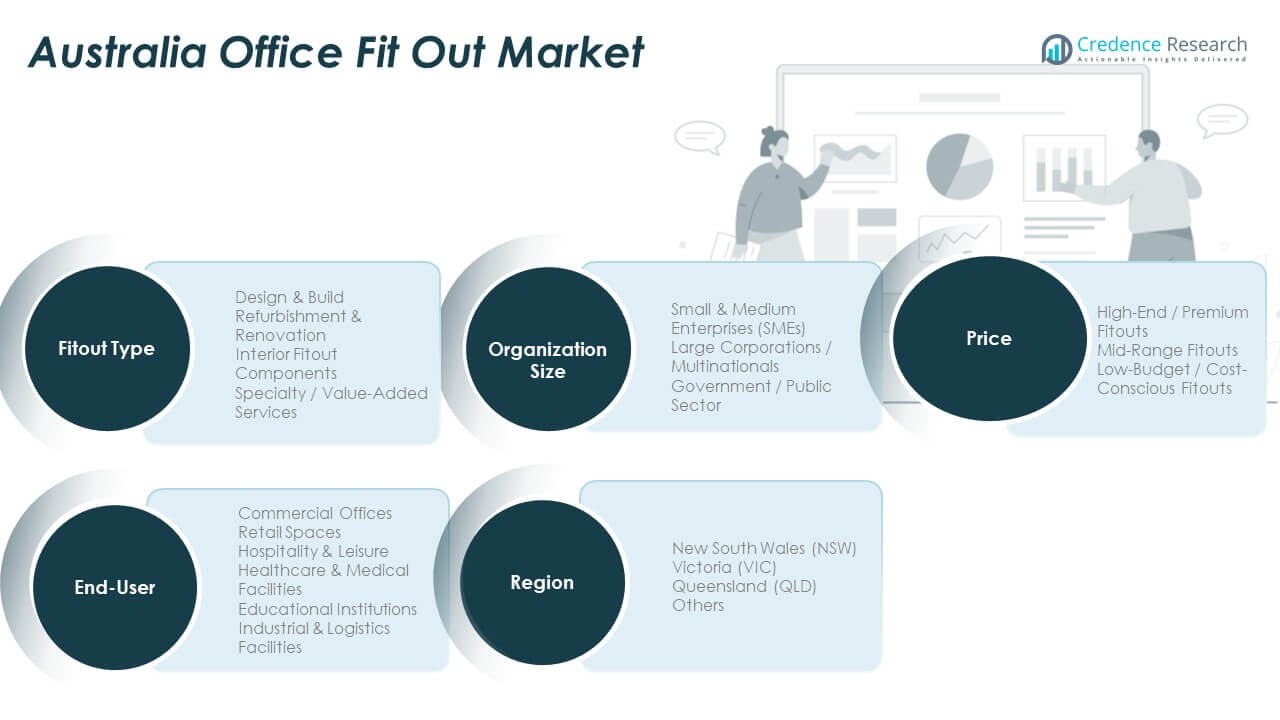

By Fitout Type:

The Design & Build segment in the Australia Office Fit Out Market is driven by the need for comprehensive solutions that integrate both design and construction. This segment offers end-to-end services, ensuring consistency and efficiency from concept to completion. Refurbishment & Renovation is another key segment, focusing on upgrading and modernizing existing office spaces. As businesses aim to optimize their work environments, this segment caters to companies seeking cost-effective solutions while enhancing the functionality and aesthetics of their offices. The Interior Fitout segment focuses on customizing the internal space of offices to meet specific client requirements, from flooring to furniture. Components cover specific elements like lighting, partitioning, and furnishings, which form essential parts of office layouts. Specialty / Value-Added Services cater to businesses that require specialized fit-outs, such as those in the healthcare or technology sectors, where functionality and compliance with regulations are critical.

- For instance: Hansen Yuncken delivered several industrial facilities, including the Williams-Sonoma Logistics Facility with 5-Star Green Star certification, deploying solar energy generation and energy monitoring, resulting in documented reductions in operational energy costs.

By Organization Size:

The demand in the Australia Office Fit Out Market varies across different organization sizes. Small & Medium Enterprises (SMEs) seek cost-effective and flexible solutions to match their growing workforce needs. Large Corporations / Multinationals require high-quality, sophisticated fit-outs that align with their global standards and brand image. These organizations typically demand large-scale projects with innovative and customizable designs. The Government / Public Sector also represents a significant segment, with a focus on compliance, sustainability, and durability in their office fit-out needs.

By Price:

In the Australia Office Fit Out Market, the High-End / Premium Fitouts segment caters to businesses seeking luxurious and high-tech office spaces. These fit-outs prioritize aesthetics, quality, and innovation. Mid-Range Fitouts are the most common, offering a balance between cost and quality. These fit-outs cater to businesses looking for functional spaces without excessive expenditure. The Low-Budget / Cost-Conscious Fitouts segment is essential for organizations seeking affordable solutions while maintaining efficiency and practicality in their office designs.

- For instance: WorkZone East, managed by Knight Frank, was the first commercial building in Western Australia to achieve carbon-neutral status and a 6 Star NABERS Energy Rating, as validated by NABERS records.

By End-User:

The Commercial Offices segment dominates the Australia Office Fit Out Market, driven by the growing demand for modern, efficient workspaces. Retail Spaces require unique fit-out designs tailored to consumer engagement and product display needs. The Hospitality & Leisure sector demands bespoke designs that create welcoming environments for clients and guests. Healthcare & Medical Facilities require specialized office fit-outs that meet stringent regulatory requirements, with attention to safety and functionality. Educational Institutions look for fit-outs that create conducive learning environments while accommodating evolving technological needs. Industrial & Logistics Facilities require robust, durable, and functional spaces to support heavy operations and logistics functions.

Segmentation

By Fitout Type:

- Design & Build

- Refurbishment & Renovation

- Interior Fitout

- Components

- Specialty / Value-Added Services

By Organization Size:

- Small & Medium Enterprises (SMEs)

- Large Corporations / Multinationals

- Government / Public Sector

By Price:

- High-End / Premium Fitouts

- Mid-Range Fitouts

- Low-Budget / Cost-Conscious Fitouts

By End-User:

- Commercial Offices

- Retail Spaces

- Hospitality & Leisure

- Healthcare & Medical Facilities

- Educational Institutions

- Industrial & Logistics Facilities

By Region:

- New South Wales (NSW)

- Victoria (VIC)

- Queensland (QLD)

- Others

Regional Analysis

New South Wales (NSW) Region Overview

The Australia Office Fit Out Market holds the strongest position in New South Wales, which accounts for approximately 35% of the total market share. Major corporations and the financial services sector based in Sydney drive demand for high‑quality office fit‑outs, including advanced design and sustainability features. The concentration of CBD office towers and ongoing refurbishment projects maintain a steady pipeline of fit‑out work. The region’s infrastructure investments and corporate relocations reinforce its dominance in the fit‑out market.

Victoria Region Trends and Share

Victoria holds around 27% of the market share in the Australia Office Fit Out Market. Melbourne’s diversified economy—from technology to education and health services—supports broad demand for office fit‑outs. The shift to hybrid work models prompts businesses in Victoria to redesign office spaces and support collaborative zones. The fit‑out sector there benefits from both new development and refurbishment of ageing office inventory.

Queensland and Other Regions Market Share

Queensland and the remaining states and territories make up the remaining 38% of the market share combined. Queensland shows growth potential thanks to increasing business activity in Brisbane and regional office hubs. Other states such as Western Australia and South Australia present smaller volumes but offer growth opportunities in regional expansions and lower‑cost fit‑out projects. Variation in market maturity and economic drivers among regions affect the pace of growth across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Elite Fitout

- Dentifit

- Innova Group

- Schiavello Construction

- McCormack

Competitive Analysis

The Australia Office Fit Out Market features a competitive landscape with a mix of large‑scale national players and specialised local contractors. Leading firms service major corporate clients, offering turnkey design‑and‑build solutions, refurbishment services and value‑added packages. Mid‑tier providers focus on SME segments, cost‑conscious fit‑outs and niche value‑added services. The market sees pressure on margins due to rising material costs, tight labour supply and increasing demand for sustainability certifications. Firms that offer integrated project delivery, smart‑workspace technologies and sustainable materials gain advantage. Differentiation also arises from service quality, design innovation and regional coverage across major cities and growth corridors. Given evolving work models and corporate sustainability mandates, companies that scale efficiently and maintain cost control stand better chances to secure high‑value contracts.

Recent Developments

- In November 2025, SHAPE Australia Corporation Limited announced the acquisition of Arden Group, a national retail‑fit‑out and facilities maintenance specialist. The deal comprised an upfront payment of AUD 25 million with an additional AUD 7 million in potential earn‑out payments. The acquisition enhances SHAPE’s capabilities in multi‑site retail fit‑outs and strengthens its service offering within the fit‑out and facilities management sectors.

Report Coverage

The research report offers an in-depth analysis based on Fitout Type, Organization Size, Price and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand from businesses adapting to hybrid work models, boosting the need for flexible office designs.

- Technological advancements will drive innovation, with smart office solutions such as IoT integration becoming standard in fit-outs.

- The focus on sustainability will intensify, with companies prioritizing green building certifications and energy-efficient designs.

- A rise in refurbishment projects will occur as companies seek to modernize existing office spaces to align with new work trends.

- The growing shift toward co-working spaces will influence demand, especially in urban centers and regional hubs.

- Mid-range and cost-conscious fit-outs will dominate due to increasing cost pressures, especially from small and medium-sized enterprises.

- The integration of wellness-focused designs will increase as organizations invest in employee well-being through health-promoting office environments.

- Regional diversification will create growth opportunities in suburban and regional markets as businesses expand outside major metropolitan areas.

- Increasing demand for specialized fit-outs in sectors such as healthcare, education, and industrial facilities will shape market growth.

- Strong competition among national and regional players will encourage service differentiation and innovation, fueling market dynamics.