Market Overview:

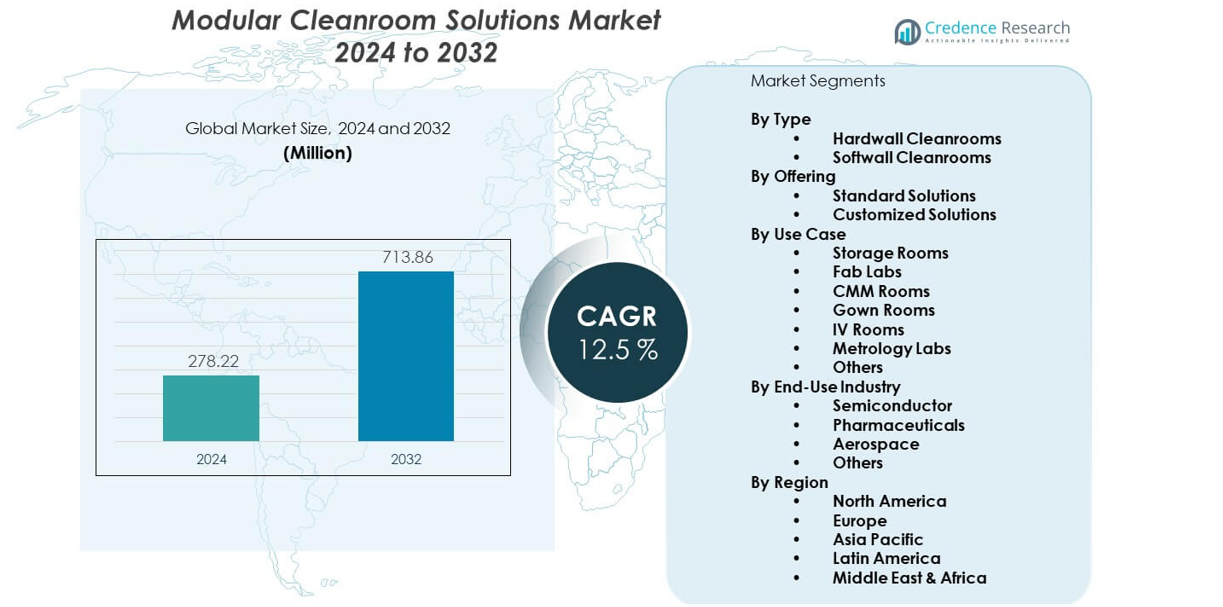

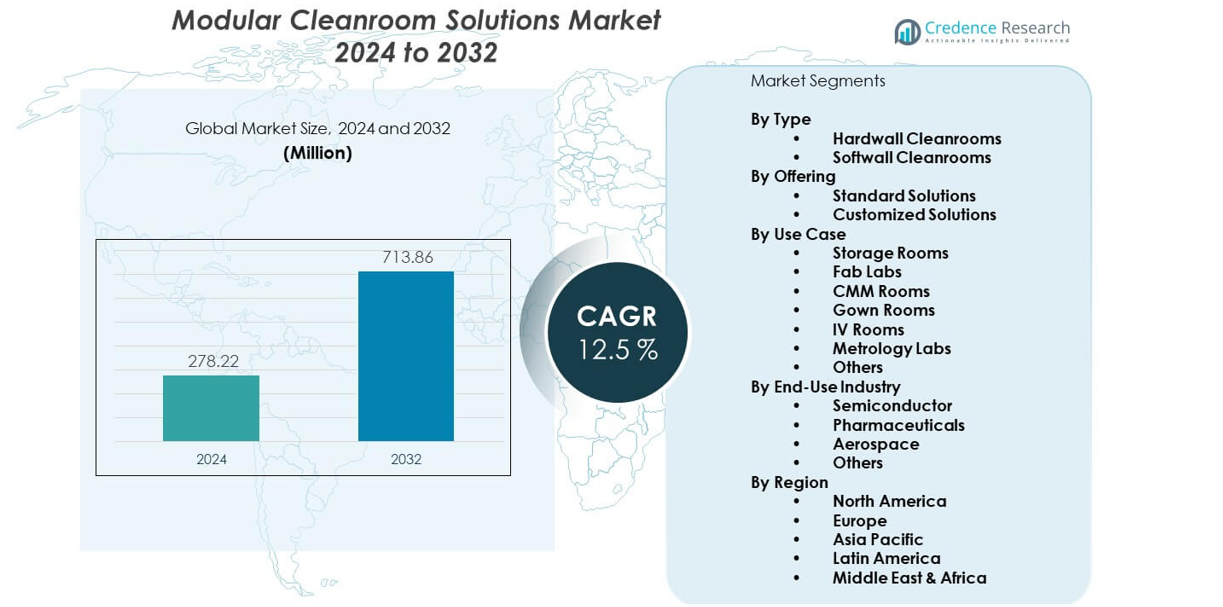

The Modular cleanroom solutions market is projected to grow from USD 278.22 million in 2024 to an estimated USD 713.86 million by 2032, with a compound annual growth rate (CAGR) of 12.5% from 2024 to 2032. Demand rises due to strict industry standards. Growth stays strong across high-value sectors.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Modular Cleanroom Solutions Market Size 2024 |

USD 278.22 million |

| Modular Cleanroom Solutions Market, CAGR |

12.5% |

| Modular Cleanroom Solutions Market Size 2032 |

USD 713.86 million |

Market growth comes from rising needs in pharma, biotech, and semiconductor units. Firms prefer modular structures due to faster setup and lower shutdown time. Adoption grows as advanced production shifts toward controlled environments. Companies use flexible modules to expand capacity quickly. Demand increases where regulated workflows require rapid updates.

North America leads due to strong pharma and electronics investment. Europe follows with strict quality norms and high technology use. Asia Pacific emerges fast as manufacturing shifts toward China, India, and Southeast Asian hubs. These regions expand due to large industrial growth and rising regulatory focus. Demand rises where clean processes scale rapidly.

Market Insights:

- The Modular cleanroom solutions market is valued at USD 278.22 million in 2024 and is projected to reach USD 713.86 million by 2032, growing at a 12.5% CAGR driven by rising demand in semiconductor, pharma, and biotech manufacturing.

- North America holds 38%, Europe holds 30%, and Asia Pacific holds 25%, supported by strong regulatory frameworks, advanced manufacturing bases, and sustained investment in clean production facilities.

- Asia Pacific is the fastest-growing region with a 25% share, driven by rapid expansion in electronics, pharmaceutical manufacturing, and large-scale industrial development.

- Hardwall Cleanrooms account for the largest share, supported by high adoption in semiconductor and pharmaceutical operations requiring rigid structures and stable contamination control.

- Customized Solutions hold a higher share than standard offerings, driven by industry needs for tailored airflow, precision layouts, and compliance-ready cleanroom configurations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Demand for Fast-Deployable Cleanroom Infrastructure Across Regulated Industries

The Modular cleanroom solutions market gains strong momentum from rising adoption in pharma, biotech, and semiconductor production. Many companies prefer modular systems due to shorter installation time compared to conventional structures. The shift toward high-precision workflows strengthens interest in quick setup units. Modular layouts support capacity changes without long shutdown periods. Firms rely on pre-engineered modules to meet safety and compliance needs. Rapid production scale-ups in biologics and medical devices reinforce spending. New investments in chip fabrication clean zones support higher demand. It creates strong traction for flexible cleanroom upgrades across industrial facilities.

- For instance, AES Clean Technology reports installing turnkey modular cleanrooms that achieve ISO 7 performance with HEPA filters rated at 99.99% efficiency at 0.3 microns, allowing rapid deployment for sterile drug manufacturing.

Growing Emphasis on Quality Compliance and Industry-Specific Regulatory Standards

Regulatory authorities enforce strict environmental controls, pushing firms to adopt scalable cleanroom systems. Production units rely on modular rooms to maintain ISO, GMP, and FDA requirements. Companies choose controlled modules to reduce contamination risks. Demand expands where regulated workflows need repeatable air quality performance. Complex drug and diagnostic manufacturing use modular rooms to meet rising compliance checks. The trend strengthens due to rising audits across critical industries. Many businesses upgrade old cleanrooms to meet updated guidelines. It supports rising adoption across regions with expanding regulated sectors.

- For instance, Terra Universal provides modular cleanrooms validated to ISO 5 with laminar flow of 90 feet per minute, a standard commonly required for aseptic processing and device assembly.

Rising Need for Flexible and Adaptable Production Environments Across Industries

Industries value modular cleanrooms due to flexible expansion features. Facilities can adjust layouts faster when product lines shift. Many manufacturers rely on this structure to align with fluctuating production cycles. Modularity helps firms add new equipment without heavy reconstruction. The growing shift toward personalized medicines and custom electronics boosts flexible room demand. Units support rapid reconfiguration for R&D and pilot batches. Firms seek layouts that support safe material flow and contamination control. The Modular cleanroom solutions market benefits from rising preference for adaptable room formats.

Increasing Investments in High-Precision Manufacturing and Technology-Driven Processes

High-tech industries rely on superior particle control and stable airflow conditions. Modular cleanrooms support advanced applications in optics, aerospace, and battery production. Many companies adopt these units to reduce operational downtime during facility expansion. Digital manufacturing accelerates the need for controlled spaces. New automation in production raises cleanroom reliability demands. Industries also focus on aligning cleanroom zones with robotics and sensor networks. Growth in high-value electronic assembly reinforces cleanroom upgrades. It drives continuous investment in modular units built for sensitive environments.

Market Trends:

Shift Toward Hybrid Cleanroom Structures with Integrated Smart Monitoring Technologies

The Modular cleanroom solutions market sees strong adoption of hybrid units using smart sensors. Many facilities integrate IoT-based monitoring to track particles and airflow in real time. Firms rely on automated alerts to maintain consistent environmental control. Digital dashboards support predictive maintenance in sensitive zones. Many companies deploy hybrid walls combining steel, glass, and composite panels for better performance. Smart airflow modules enhance overall room stability. More facilities integrate energy-optimized lighting and filtration systems. The trend supports higher efficiency across critical cleanroom applications.

- For instance, Clean Rooms International offers smart FFU systems equipped with ECM motors that cut energy use by up to 50% while maintaining certified ISO-class airflow rates.

High Preference for Pre-Validated and Turnkey Modular Cleanroom Systems

Many buyers prefer turnkey modular systems to reduce installation complications. Pre-validated units help firms meet quality standards with limited downtime. Companies depend on vendors to deliver fully equipped cleanrooms with HVAC, filtration, and controls. The rising use of turnkey models speeds up project timelines. It supports industries with rapid production targets. Vendors focus on pre-certified modules to reduce testing stages. Buyers value predictable deployment and reduced risk. The trend expands across sectors with high throughput manufacturing needs.

- For instance, PortaFab’s modular cleanrooms are factory-engineered with pre-wired wall panels and integrated air handling modules that can achieve ISO 8 certification upon installation, helping clients reduce on-site validation time significantly.

Growing Popularity of Portable and Compact Cleanroom Modules for Small-Scale Operations

Portable cleanrooms gain traction among labs, diagnostic centers, and specialty manufacturing units. Compact modules help businesses maintain clean zones without major construction. Many users deploy portable rooms for temporary or seasonal projects. Firms rely on small modular units for sampling, packaging, and sensitive testing. The trend increases where companies need short-term contamination control. Portable formats also support small budgets. New materials help reduce weight while maintaining structural stability. It expands access to cleanroom capabilities for small enterprises.

Adoption of Sustainable Cleanroom Materials and Eco-Focused Construction Models

Industries invest in sustainable cleanroom designs to reduce energy costs. Many companies choose low-emission materials to meet internal sustainability goals. Efficient HVAC modules support lower power consumption. Firms adopt recyclable panels to cut project waste. Green construction models align with environmental certifications. More vendors introduce low-maintenance materials with long lifecycle performance. Buyers value cleanrooms that reduce operational overhead. The trend strengthens where sustainability targets grow across regulated sectors.

Market Challenges Analysis:

High Initial Costs and Complex Integration Needs Across Critical Manufacturing Sites

The Modular cleanroom solutions market faces high upfront costs that limit adoption among small companies. Many firms struggle with budget allocation for advanced HVAC and filtration systems. Integration with existing buildings often increases engineering complexity. Buyers need specialized contractors for installation and validation. Procurement delays also create scheduling challenges. Some regions lack skilled professionals for modular cleanroom setup. It creates slower adoption where technical expertise is limited. Many companies evaluate long-term savings before approving expansion plans.

Limited Awareness and Uneven Adoption Across Developing Industrial Regions

Many firms in emerging economies remain unaware of modular cleanroom benefits. Decision-makers often choose traditional construction due to familiarity. Limited supplier networks create operational barriers. Companies face difficulty sourcing certified materials or skilled installers. Long approval cycles also impact project timelines. Some industries lack strict contamination standards, delaying cleanroom adoption. Buyers hesitate when regulatory environments evolve slowly. It restricts wider penetration across developing markets.

Market Opportunities:

Rising Scope for Cleanroom Expansion in High-Growth Biotech, Semiconductor, and Precision Engineering Sectors

The Modular cleanroom solutions market gains opportunities from rapid expansion in advanced manufacturing. Biotech and semiconductor firms plan new sites that require scalable cleanroom layouts. Many companies prefer modular systems for faster deployment. Demand rises where high-precision processes grow across Asia Pacific and North America. Firms seek cleanrooms that align with automated production lines. Vendors can introduce advanced modules tailored to specialized workflows. New investments in precision assembly expand the addressable market. It creates strong potential for long-term revenue growth.

Growing Vendor Focus on Smart, Energy-Efficient, and Highly Customizable Modular Cleanrooms

Vendors can expand portfolios with energy-optimized modules for modern manufacturing sites. Many buyers prefer rooms with adjustable layouts and digital environmental control. Firms also seek cleanrooms with low-maintenance surfaces and improved airflow systems. The trend supports development of customizable modules for diverse industries. Vendors can reduce installation timelines using standardized components. It enables quicker delivery across remote or high-demand regions. Digital integration creates added value for buyers. Market players can invest in innovations that improve reliability and reduce operational costs.

Market Segmentation Analysis:

By Type

The Modular cleanroom solutions market sees strong adoption across Hardwall and Softwall Cleanrooms, with each type meeting different operational needs. Hardwall units support stable airflow, rigid panel strength, and long-term contamination control for high-spec industries. Many semiconductor and pharmaceutical plants prefer this structure for sensitive workflows. Softwall formats appeal to labs and small production units that need flexible layouts and quick installation. These units help organizations create controlled environments without major construction. Firms choose between the two based on lifecycle, mobility, and contamination requirements. It supports steady adoption across varied industrial settings.

- For instance, Terra Universal’s softwall cleanrooms can achieve ISO 5–8 classifications using ceiling-mounted FFUs delivering 650–800 CFM each, providing certified cleanliness with minimal structural work.

By Offering

Standard Solutions gain traction where users seek pre-engineered, ready-to-install cleanroom structures. These units reduce installation time and support predictable performance for regulated workflows. Many firms deploy standard modules for routine processes and repetitive production tasks. Customized Solutions serve operations that require tailored airflow, specific materials, and unique zone configurations. These systems support advanced manufacturing processes in semiconductor and biotech facilities. Buyers choose customized formats to align cleanroom layouts with complex equipment and workflow needs. It strengthens adoption across industries with strict quality expectations and evolving production demands.

- For instance, OCTANORM’s modular systems allow custom wall configurations using aluminum profiles and panel infills tested for structural stability under cleanroom pressures, supporting specialized semiconductor and aerospace requirements.

By Use Case

The market covers diverse use cases including Storage Rooms, Fab Labs, CMM Rooms, Gown Rooms, IV Rooms, Metrology Labs, and other specialized zones. Storage Rooms use modular cleanrooms to protect sensitive materials from contamination. Fab Labs rely on controlled environments for prototype development and precision tasks. CMM Rooms maintain stable conditions for accurate measurement operations. Gown Rooms support controlled entry procedures for regulated facilities. IV Rooms require sterile conditions for safe compounding. Metrology Labs depend on consistent airflow for repeatable inspection accuracy. Each use case supports broader adoption where clean processes remain essential. It enables scalable deployment across multi-zone facilities.

By End-Use Industry

End-use segmentation spans Semiconductor, Pharmaceuticals, Aerospace, and other industrial sectors. Semiconductor manufacturing adopts modular cleanrooms for particle-sensitive chip production steps. Pharmaceutical facilities depend on clean zones for sterile preparation, packaging, and quality control. Aerospace operations use these rooms for assembly, inspection, and material testing. Other industries adopt modular formats for R&D, diagnostics, and precision manufacturing. Each industry uses modular layouts to improve workflow control and reduce contamination risk. Demand rises where firms need scalable, compliant environments with predictable performance. It supports long-term market growth across global production hubs.

Segmentation:

By Type

- Hardwall Cleanrooms

- Softwall Cleanrooms

By Offering

- Standard Solutions

- Customized Solutions

By Use Case

- Storage Rooms

- Fab Labs

- CMM Rooms

- Gown Rooms

- IV Rooms

- Metrology Labs

- Others

By End-Use Industry

- Semiconductor

- Pharmaceuticals

- Aerospace

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds nearly 38% share of the global modular cleanroom solutions market, supported by strong adoption across pharmaceutical, biotech, and semiconductor projects. The region benefits from a mature regulatory environment that prioritizes contamination control and quality assurance. Many companies invest in modular units to shorten project timelines and expand controlled manufacturing spaces. Demand stays strong across the U.S., where high-value electronics and life science production continue to grow. Firms rely on modular systems to upgrade older facilities without extended downtime. The modular cleanroom solutions market gains traction here due to steady capital investment and strict compliance needs. It supports rapid deployment for facilities seeking scalable cleanroom capacity.

Europe

Europe accounts for nearly 30% share, driven by strict regulatory frameworks and consistent demand across healthcare and aerospace. Many facilities upgrade to modular structures to meet evolving GMP, ISO, and quality management standards. The region sees strong interest in both standard and customized modules due to varied production needs. Germany, France, and the U.K. lead adoption where high-precision manufacturing dominates. Companies value modular layouts for faster validation and predictable environmental performance. The modular cleanroom solutions market benefits from regional focus on technology-driven production environments. It supports cleanroom adoption for both new construction and retrofit projects.

Asia Pacific

Asia Pacific holds nearly 25% share and remains the fastest-growing regional segment. Growth accelerates due to rapid expansion of semiconductor, pharmaceutical, and electronics manufacturing. China, South Korea, Japan, and India drive strong investment in new cleanroom infrastructure. Many firms in the region choose modular formats to scale production quickly and meet rising export requirements. Adoption rises where industrial zones expand and regulatory expectations strengthen. The modular cleanroom solutions market sees rising traction as companies shift to flexible facilities that reduce installation delays. It supports sustained market growth across emerging and established manufacturing hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abtech Inc.

- AES Clean Technology

- ACH Engineering Inc.

- ACMAS Technologies Pvt. Ltd.

- Allied Cleanrooms

- Clean Room Depot Inc.

- Clean Rooms International Inc.

- Gerbig Cleanrooms

- OCTANORM North America Inc.

- PortaFab Corp.

- Terra Universal Inc.

- Camfil AB

- Arbonia AG

- MECART Cleanrooms

- Modular Cleanrooms Inc.

- Taikisha Ltd.

Competitive Analysis:

The Modular cleanroom solutions market features active competition driven by innovation, rapid build capability, and compliance-focused designs. Major players expand portfolios with pre-engineered modules, hybrid wall systems, and enhanced HVAC integration. Firms compete on installation speed, customization quality, and lifecycle performance. Many providers invest in digital monitoring tools to strengthen cleanroom reliability. Large companies target high-spec industries that demand strict contamination control. Smaller vendors focus on cost-effective solutions for labs and R&D units. Partnerships with semiconductor and pharmaceutical manufacturers support wider adoption. It maintains competitive intensity as companies pursue new contracts across global production hubs.

Report Coverage:

The research report offers an in-depth analysis based on By Type, By Offering, By Use Case, and By End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption across semiconductor and biotech facilities will strengthen long-term demand.

- Increased focus on contamination control will push firms toward modular upgrades.

- Growth in robotics and precision assembly will boost cleanroom customization needs.

- Energy-efficient HVAC units will influence new cleanroom design standards.

- Modular retrofits will expand across aging manufacturing infrastructure.

- Demand for turnkey cleanrooms will increase as firms seek faster deployment.

- Digital environmental monitoring will become a core integration feature.

- Hybrid wall systems will gain traction in high-performance production zones.

- Emerging markets will accelerate adoption due to expanding industrial clusters.

- Vendors will compete through advanced materials, flexible layouts, and validation support.