Market Overview:

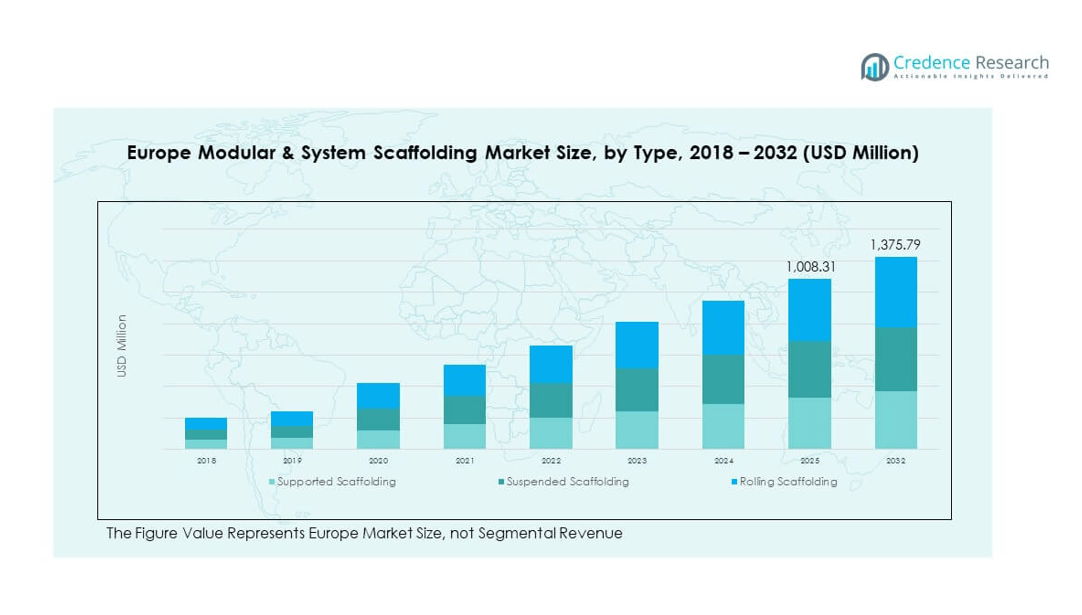

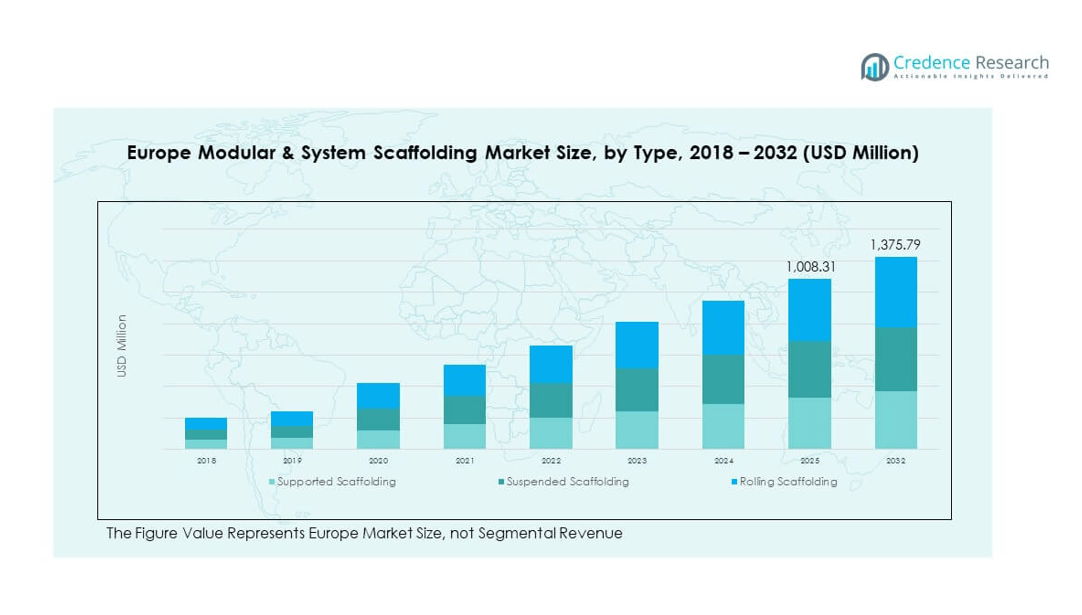

The Europe Modular & System Scaffolding Market size was valued at USD 681.32 million in 2018, increased to USD 933.27 million in 2024, and is anticipated to reach USD 1,375.79 million by 2032, at a CAGR of 4.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Modular & System Scaffolding Market Size 2024 |

USD 933.27 million |

| Europe Modular & System Scaffolding Market, CAGR |

4.50% |

| Europe Modular & System Scaffolding Market Size 2032 |

USD 1,375.79 million |

The growth of the Europe Modular & System Scaffolding Market is primarily driven by increased construction and infrastructure renovation activities across urban centers. Rising demand for safe and efficient scaffolding systems in commercial and industrial construction projects fuels the adoption of modular scaffolding. Government initiatives supporting urban renewal and housing development further boost demand. The flexibility, reusability, and enhanced safety features of modular and system scaffolding make them highly preferred over traditional scaffolding. Innovations in modular systems have also improved assembly efficiency and reduced labor costs, which strengthens market penetration.

Geographically, Western Europe leads the modular and system scaffolding market due to high infrastructure maturity, stringent safety regulations, and established construction practices in countries like Germany, the UK, and France. Northern and Central Europe are emerging as key markets, backed by public infrastructure upgrades and industrial project expansions. Southern Europe is witnessing gradual growth, driven by tourism-related restoration projects and smart city developments. Eastern Europe is expected to gain momentum with EU-backed infrastructure investments and increasing adoption of modern construction technologies. Overall, the market shows balanced expansion across both developed and developing regions in Europe.

Market Insights:

- The Europe Modular & System Scaffolding Market was valued at USD 933.27 million in 2024 and is expected to reach USD 1,375.79 million by 2032, growing at a CAGR of 4.50%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Growth is fueled by rising demand for infrastructure upgrades, high-rise developments, and stringent safety standards across commercial and industrial construction.

- Increasing adoption of reusable and pre-engineered scaffolding systems supports faster installation and cost efficiency.

- Market faces challenges from high initial investment costs and the need for skilled labor to manage modular systems effectively.

- Regulatory fragmentation across European nations complicates cross-border operations and increases compliance overhead.

- Western Europe leads the market share due to advanced construction practices and regulatory enforcement in Germany, France, and the UK.

- Eastern and Southern Europe are emerging growth hubs, supported by EU funding, public housing expansion, and heritage restoration projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Urban Infrastructure and High-Rise Construction Activities Across Europe

The Europe Modular & System Scaffolding Market benefits significantly from rising investments in urban infrastructure projects and high-rise construction. Governments and private developers are increasing spending on commercial towers, public buildings, and institutional complexes. These large-scale vertical projects require adaptable and secure scaffolding systems for safe work access at elevated heights. Modular systems offer flexibility and speed during erection and dismantling, which meets project deadlines and enhances cost-efficiency. Construction companies prefer these systems to reduce downtime and ensure worker safety. Residential complexes in densely populated urban zones further boost demand. The market responds to evolving architectural trends requiring versatile support structures.

Strict Regulatory Focus on Worker Safety and Compliance Standards

European construction regulations impose rigorous safety requirements that strongly favor the adoption of system scaffolding. Organizations must comply with EU-wide mandates concerning fall prevention, load-bearing capacity, and worker protection. The Europe Modular & System Scaffolding Market aligns well with these mandates by offering standardized, pre-engineered components with proven safety profiles. Contractors and developers face legal and financial risks for non-compliance, which increases reliance on certified scaffolding products. Public infrastructure contracts often specify modular systems to ensure regulatory adherence. It remains critical for scaffolding providers to meet EN 12810/12811 safety standards. This compliance-driven environment strengthens the market for modular systems.

- For instance, Layher’s Allround Scaffolding system is fully certified under EN 12810/12811 and supports load class 6 (up to 6.0 kN/m² over 6 m²) with reduced capacity beyond that area, as per its technical brochures.

Rise in Renovation and Retrofitting Projects Across Aging European Infrastructure

A significant portion of European infrastructure is aging, prompting a surge in retrofitting and restoration projects. Historic buildings, bridges, and transport systems across Western and Southern Europe require structural support for maintenance activities. The Europe Modular & System Scaffolding Market gains from this demand because its systems provide safe access to complex geometries and delicate structures. Lightweight components allow scaffolders to avoid damaging heritage facades. Cities with UNESCO heritage zones require high-precision scaffolding, which modular designs can deliver. Contractors increasingly use these systems for adaptive reuse projects. The market sees continued traction from both public and private rehabilitation initiatives.

- For instance, ULMA Construction provides specialized formwork and scaffolding solutions for restoration of historic buildings across Spain, including façade rehabilitation at public heritage sites.

Technological Integration and Demand for Time-Efficient Construction Methods

The integration of digital tools like Building Information Modeling (BIM) with scaffolding planning processes enhances precision and productivity. The Europe Modular & System Scaffolding Market sees growing interest from firms that prioritize construction speed and cost control. Modular systems enable streamlined logistics, repeatable assembly, and minimal labor training. Prefabrication and 3D planning reduce installation errors and accelerate project timelines. Digital twin simulations support efficient design and risk mitigation. Companies adopt lean construction principles supported by modular scaffolding. The adoption of smart jobsite monitoring tools strengthens the value proposition. These technological synergies drive long-term preference for system-based scaffolding.

Market Trends:

Adoption of Lightweight, High-Strength Materials in Scaffolding Components

Manufacturers are investing in the development of lightweight yet durable scaffolding materials such as aluminum alloys and advanced composites. The Europe Modular & System Scaffolding Market reflects this shift as clients seek reduced assembly time and safer handling. Lightweight systems reduce physical strain on workers, promote faster transport, and enhance project mobility. These materials maintain structural integrity while meeting demanding load requirements. This trend supports energy efficiency goals by lowering carbon footprints across supply chains. The market experiences increased preference for corrosion-resistant scaffolds suited for maritime and chemical industries. Material innovation becomes a critical product differentiator in bidding scenarios.

- For instance, Hünnebeck’s MODEX® scaffolding system supports leg loads up to 50 kN and heavy-duty shore loads up to 215 kN via force-locked connections. DU‑AL aluminum beams like the T225 and S150 offer load capacities of 6.8–29 kNm at weights between ~3.2 and 8.9 kg/m, demonstrating high strength-to-weight efficiency.

Increased Use of Scaffold Cladding and Environmental Control Systems

Environmental considerations are shaping the way scaffolding is implemented across European cities. The Europe Modular & System Scaffolding Market witnesses demand for integrated cladding systems that protect workers and nearby environments. Scaffold claddings reduce dust dispersion, noise pollution, and exposure to weather elements. These features are increasingly mandated in urban projects and sensitive areas like hospitals and schools. Sustainability-minded developers prefer enclosed scaffolding to align with green building certifications. Fire-retardant and UV-resistant coverings gain traction in hot and dry regions. Temporary insulation helps improve site safety and performance. Cladding upgrades enhance the functional value of modular scaffolding.

- For example, Altrad Group provides modular weather protection systems with PVC cladding to support containment during renovation and maintenance work.

Rental Service Expansion and Equipment-as-a-Service Models

Contractors across Europe are turning to rental solutions instead of outright purchases due to cost control and project-based needs. The Europe Modular & System Scaffolding Market adapts through rental-focused business models and flexible leasing agreements. Rental services provide access to updated systems without long-term investment burdens. Companies benefit from logistics, inspection, and maintenance support bundled into service packages. High equipment utilization rates drive profitability for rental providers. This model supports short-term and small-scale construction jobs across rural and suburban regions. Equipment-as-a-Service is gaining adoption for seasonal projects and pop-up installations. Scalability and convenience make rental the preferred trend.

Strategic Collaborations for Product Customization and Local Compliance

Leading players in the Europe Modular & System Scaffolding Market are forming joint ventures and partnerships to co-develop tailored scaffolding solutions. These alliances focus on addressing country-specific building codes and client requirements. Localized design ensures compatibility with terrain, climate, and regional safety norms. Partnerships with logistics providers improve delivery timelines across remote project sites. Suppliers and contractors collaborate through digital platforms to streamline procurement and reduce downtime. Multilingual technical support enhances customer experience across diverse regions. Strategic alliances drive innovation in modularity, safety locks, and extension accessories. These collaborations ensure competitive edge in saturated and regulated markets.

Market Challenges Analysis:

High Initial Capital Investment and Complexity in Skilled Labor Deployment

One of the core challenges in the Europe Modular & System Scaffolding Market stems from the high upfront investment required for advanced modular systems. Construction firms, particularly SMEs, face financial constraints when transitioning from traditional to modular systems. The cost includes not only the scaffolding components but also design software, training programs, and safety certification. Furthermore, the market experiences difficulty in finding and retaining skilled labor capable of assembling complex modular structures. While modular systems are engineered for efficiency, improper assembly can lead to safety hazards and project delays. This discourages smaller contractors from full-scale adoption.

Fragmented Regulatory Standards and Permitting Delays Across European Nations

The Europe Modular & System Scaffolding Market must navigate a fragmented regulatory landscape across the continent. Although EU-level directives provide a framework, individual nations enforce scaffolding standards and permits differently. This causes operational inefficiencies and delays, particularly for cross-border projects. Companies must invest in region-specific compliance documentation, slowing down deployment and increasing administrative overhead. These inconsistencies hinder scalability for rental providers and manufacturers alike. Compliance with multiple safety audits and certification schemes adds further cost pressure. Market participants struggle to maintain consistency in product specifications across countries, affecting logistics planning and procurement cycles.

Market Opportunities:

Growth of Smart Cities and Sustainable Infrastructure Programs in Urban Hubs

The push for smart city development and climate-resilient infrastructure creates strong opportunities for the Europe Modular & System Scaffolding Market. Governments in the region commit funding toward mass transit networks, energy-efficient buildings, and public infrastructure upgrades. These projects rely on modular scaffolding to manage complex geometries and tight urban spaces. The market benefits from increasing demand for scaffolds that integrate with digital monitoring and green certifications. Sustainable infrastructure targets encourage widespread adoption of reusable, low-emission scaffolding systems. These projects offer multi-year procurement contracts that ensure revenue stability for suppliers and service providers.

Expansion in Eastern Europe and Growth in Public Housing Projects

Emerging economies in Eastern Europe present untapped opportunities for scaffolding providers as urbanization and public housing programs accelerate. Cities in Poland, Romania, and the Balkans receive funding from EU cohesion policies to upgrade civil infrastructure. The Europe Modular & System Scaffolding Market expands through regional distributors and training programs to meet demand. Governments seek cost-effective, durable scaffolding for large-scale residential and transport projects. The shift from informal to regulated construction supports modular adoption. New entrants can gain market share by offering affordable, standardized scaffolding systems compliant with EU norms.

Market Segmentation Analysis:

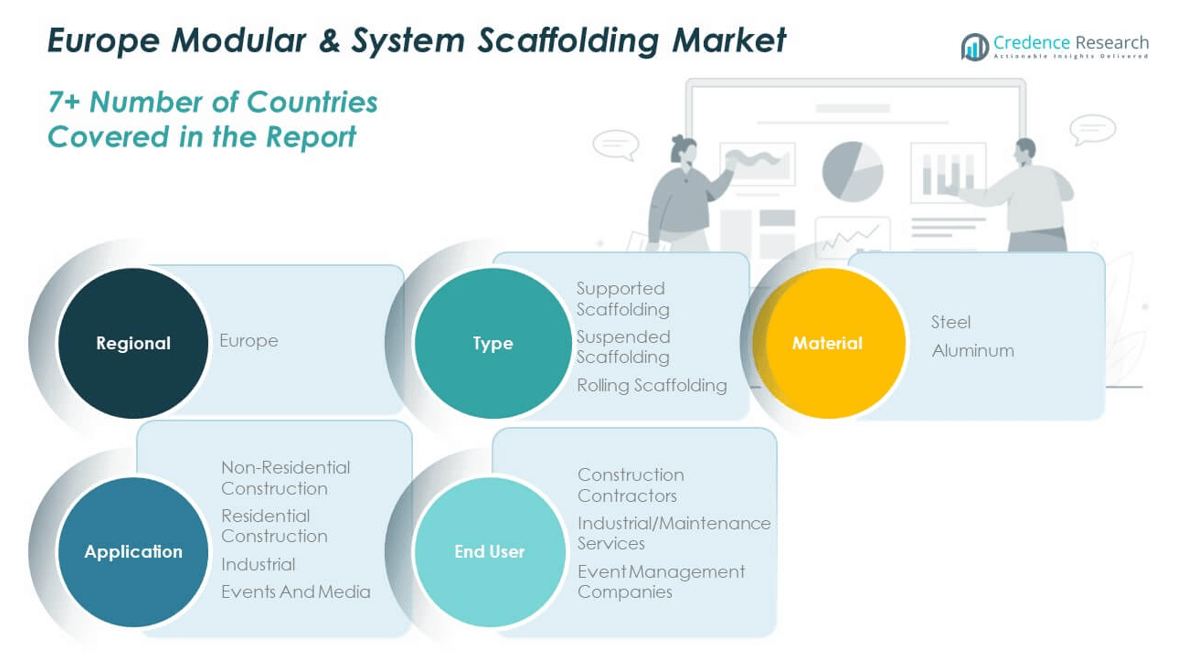

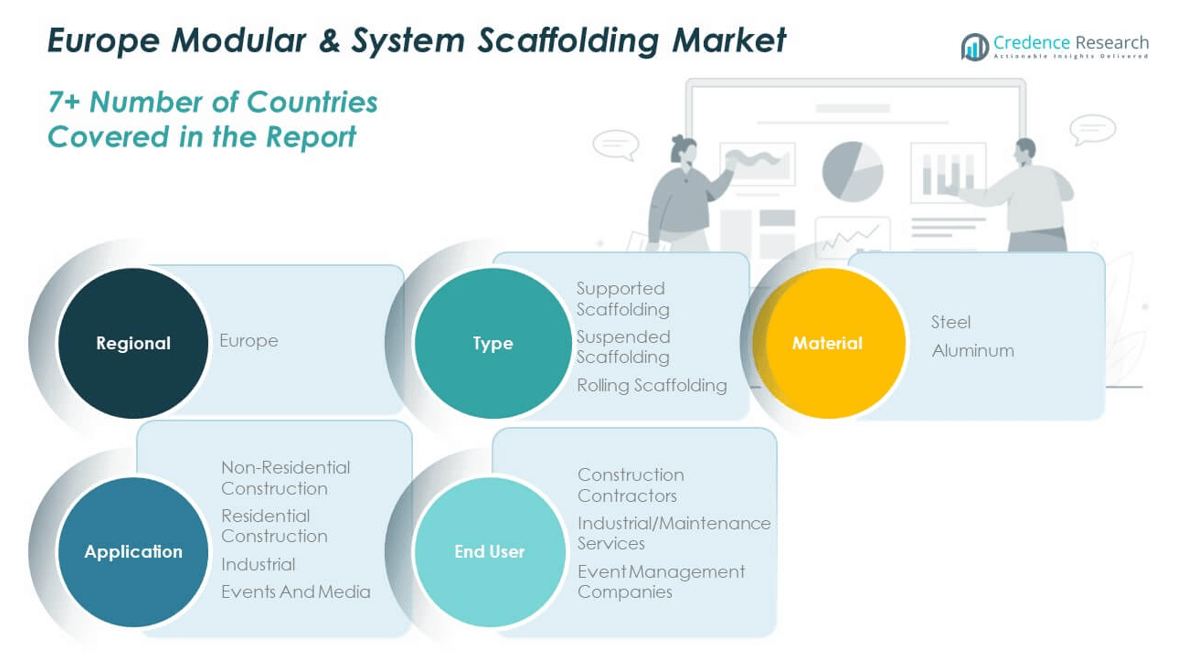

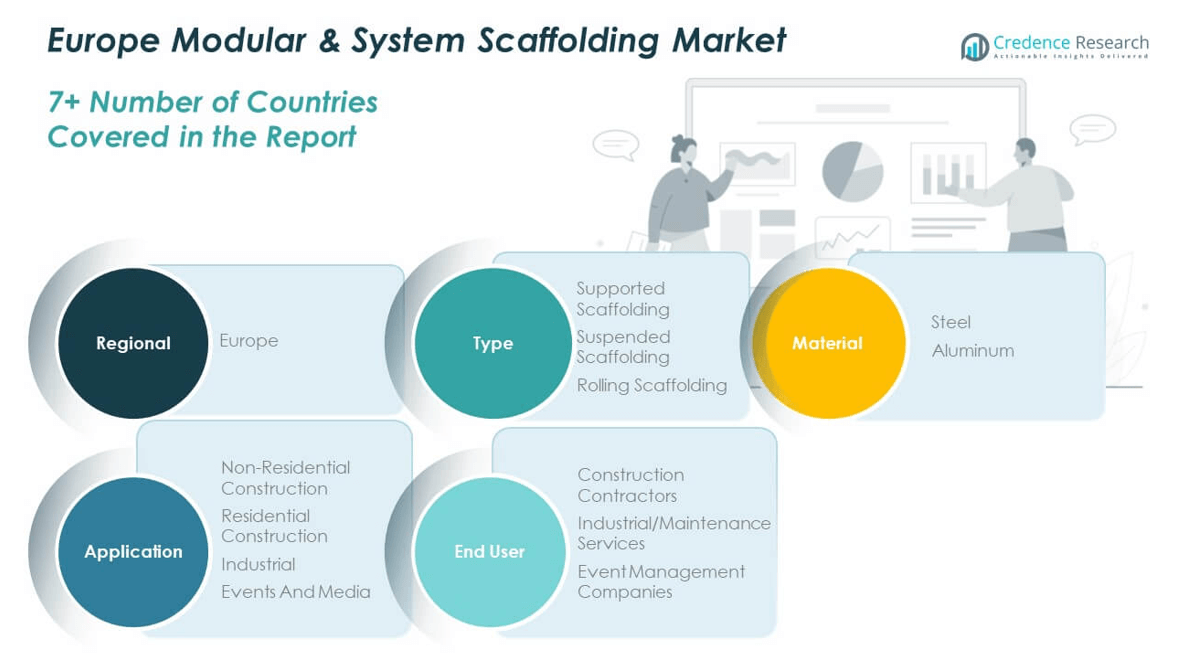

The Europe Modular & System Scaffolding Market is segmented by type, material, application, and end user, reflecting diverse usage across construction and industrial sectors.

By types, supported scaffolding holds the dominant share due to its structural stability and wide application in large-scale construction. Suspended scaffolding is preferred for maintenance work on high-rise buildings and bridges, while rolling scaffolding is gaining popularity in indoor projects where mobility and flexibility are essential.

By material, steel scaffolding leads the market, offering high durability, load-bearing capacity, and fire resistance. It is extensively used in heavy construction and industrial projects. Aluminum scaffolding is growing steadily due to its lightweight, corrosion resistance, and ease of transport, particularly in applications requiring frequent assembly and dismantling.

By application, non-residential construction is the largest segment, driven by commercial, institutional, and infrastructure projects. Residential construction and industrial segments also contribute significantly, fueled by urban housing and maintenance operations. Events and media applications use modular systems for temporary staging and structure setup.

- For instance, Layher’s Allround Scaffolding system forms the structural foundation for Layher Event Systems used in large music festivals like Electric Zoo, where over 86 tons of equipment supported approximately 150,000 attendees across a multi-day event.

By end users, construction contractors account for the largest market share, using scaffolding across all project phases. Industrial and maintenance service providers follow, requiring reliable systems for plant access and equipment servicing. Event management companies use modular scaffolding for staging, lighting towers, and temporary installations. The market continues to evolve with rising customization needs across these varied end-user groups.

- For instance, Bilfinger ISP Germany regularly uses Layher’s Allround system for modular scaffolding during chemical plant turnarounds, optimizing safety and downtime with digital planning and logistical expertise.

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

By Region:

- Western Europe

- Northern and Central Europe

- Eastern and Southern Europe

Regional Analysis:

Western Europe accounts for the largest share in the Europe Modular & System Scaffolding Market, holding 42% of the total market in 2024. Countries such as Germany, France, and the United Kingdom lead due to their advanced construction sectors, high renovation frequency, and strict adherence to safety regulations. These countries invest heavily in urban infrastructure, public transport, and green buildings, driving consistent demand for modular scaffolding. It continues to benefit from large-scale commercial and residential projects. Companies in this region prioritize compliant, reusable scaffolding systems that align with national standards. The presence of established players supports strong product availability and service infrastructure.

Northern and Central Europe contribute 28% to the Europe Modular & System Scaffolding Market in 2024. This region includes the Netherlands, Belgium, Austria, and Switzerland, where demand is fueled by institutional building projects, industrial facilities, and energy infrastructure. Government contracts often specify modular systems to ensure safety and operational efficiency. It shows positive growth due to public sector investments and sustainable development goals. The scaffolding industry in this region benefits from high awareness of productivity tools and modern building practices. Innovation in design, automation, and digital planning tools enhances the market presence across Northern European nations.

Eastern and Southern Europe together represent 30% of the Europe Modular & System Scaffolding Market. Eastern countries such as Poland, Romania, and Hungary are expanding urban infrastructure with EU funding, creating high demand for modern scaffolding solutions. Southern Europe, including Spain, Italy, and Greece, experiences growth through heritage restoration and tourism-driven construction. It sees increased adoption of modular scaffolding due to stricter safety enforcement and rising demand for fast, reusable systems. Suppliers focus on localized training and distribution to penetrate fragmented regional markets. These regions offer high growth potential for rental-based scaffolding models due to budget constraints and flexible project cycles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Layher Holding GmbH & Co. KG

- PERI Group

- GBM (Italy)

- Altrad Group

- XERVON

- Rohrer Group

- Safway Group (European Operations)

- Elplast Group

- MJ-Gerüst GmbH

- Pilosio S.p.A

Competitive Analysis:

The Europe Modular & System Scaffolding Market features a competitive landscape marked by the dominance of established global players and the steady rise of regional providers. Leading companies such as Layher, PERI Group, and ULMA Construction maintain strong market positions through extensive product lines, innovation, and regional customization. It remains highly competitive as smaller firms and rental service providers enter the market with flexible, cost-effective solutions tailored to specific country regulations. Companies invest in research and development to improve modularity, safety features, and compatibility with digital project management tools. Market leaders leverage robust logistics networks, technical consulting, and aftersales support to retain clients. Strategic partnerships and acquisitions are common tactics to expand geographic footprint and service capabilities. Competitive differentiation often hinges on compliance with EN standards, rapid deployment, and tailored scaffolding configurations. Companies that deliver both performance and regulatory assurance are best positioned to secure large-scale infrastructure and commercial contracts across Europe.

Recent Developments:

- In May 2025, the PERI Group announced the acquisition of Greenbids, an advanced AI company. The acquisition is structured to provide immediate access to transformative AI technology and a blue-chip client base, with expected benefits for Perion One’s platform performance. The integration is anticipated to be accretive to adjusted EBITDA and margins from the outset, with further acceleration of revenue and synergies expected from 2026 onward.

- In April 2025, Layher Holding GmbH & Co. KG commenced full operations at its newest production plant, known as Plant 3, in Güglingen-Eibensbach, Germany. The facility is a highly automated and energy-efficient production center dedicated to Allround Scaffolding, designed to ensure top product quality and delivery readiness for Layher’s modular system customers.

- In January 2025, Genenta, in partnership with AGC Biologics, enhanced their collaboration for cell therapy manufacturing relevant to the GBM (Italy) operations. The agreement included dedicated GMP suite capacity in Milan to support clinical trials, increase manufacturing output, and enable Genenta to treat more patients in upcoming oncology studies.

Market Concentration & Characteristics:

The Europe Modular & System Scaffolding Market demonstrates a moderate to high level of concentration, with major players controlling a substantial share in Western and Northern Europe. It features well-structured supply chains, rigorous compliance demands, and ongoing innovation in scaffold engineering. High barriers to entry exist due to regulatory complexity, the need for technical expertise, and capital-intensive product development. However, emerging markets in Eastern and Southern Europe present space for mid-sized players offering region-specific solutions. The market is defined by increasing adoption of prefabricated modular systems that enhance speed, safety, and reusability. Firms prioritize digital integration, rental scalability, and environmental sustainability to align with evolving customer preferences. Long-term client relationships, certification support, and on-site training remain central to customer retention. The market rewards companies that combine engineering excellence with operational agility to address diverse project sizes and compliance environments across Europe.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Modular & System Scaffolding Market will witness steady growth driven by continued infrastructure modernization across urban and industrial zones.

- Demand for modular scaffolding will increase due to stricter safety enforcement and growing compliance requirements.

- Adoption of digital construction technologies will enhance efficiency in scaffold planning, deployment, and management.

- Rental-based scaffolding services will expand rapidly, especially in cost-sensitive and short-duration projects.

- Lightweight and corrosion-resistant materials will gain traction for projects requiring high mobility and durability.

- Restoration of heritage buildings and retrofitting of aging infrastructure will support sustained demand in Southern and Western Europe.

- Green building initiatives and sustainable construction targets will create opportunities for recyclable and reusable scaffolding systems.

- Growth in Eastern European markets will attract new entrants focused on localized, budget-friendly solutions.

- Strategic collaborations between manufacturers and construction firms will lead to customized system innovations.

- Investment in skilled labor training and digital upskilling will remain essential to support modular scaffolding adoption.