Market Overview:

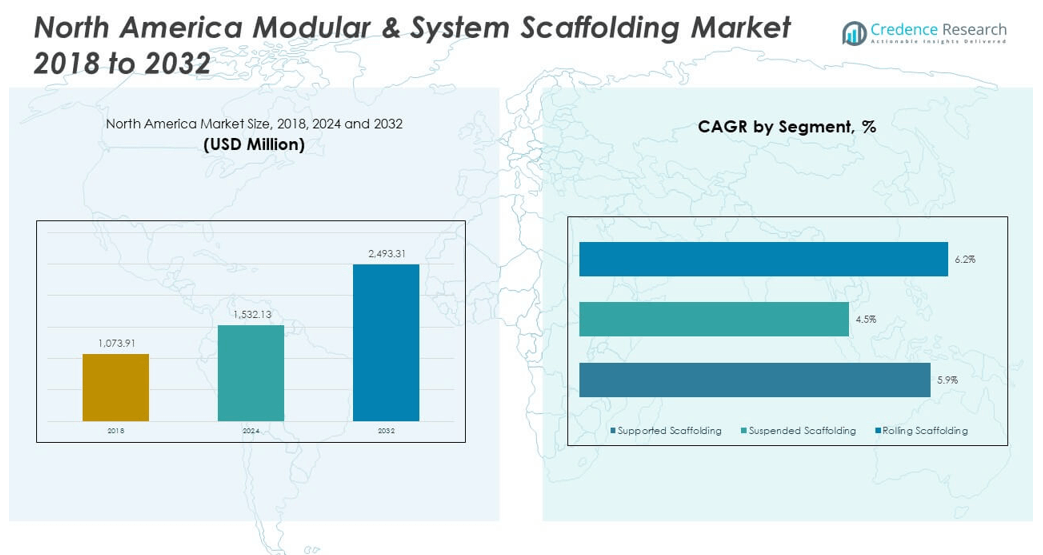

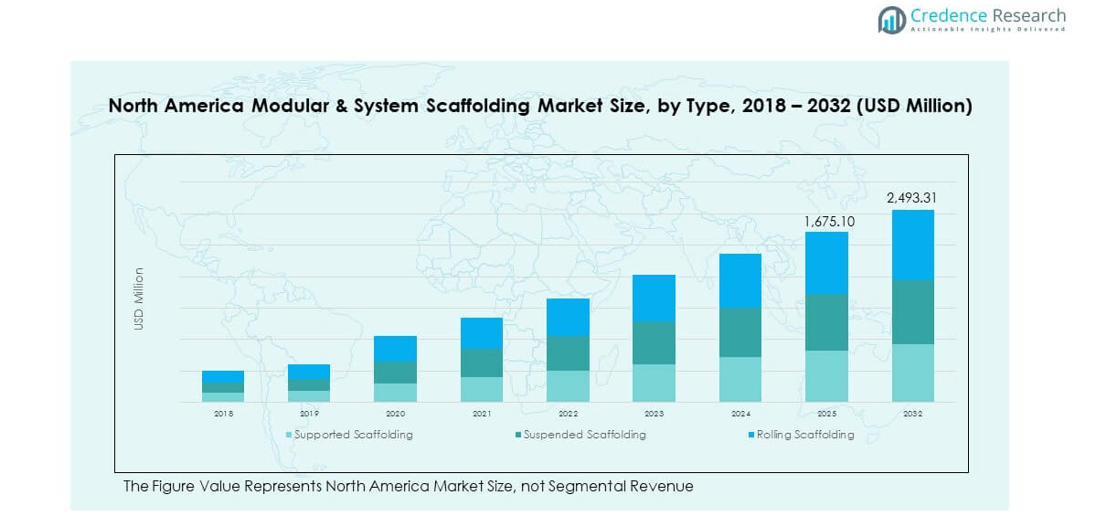

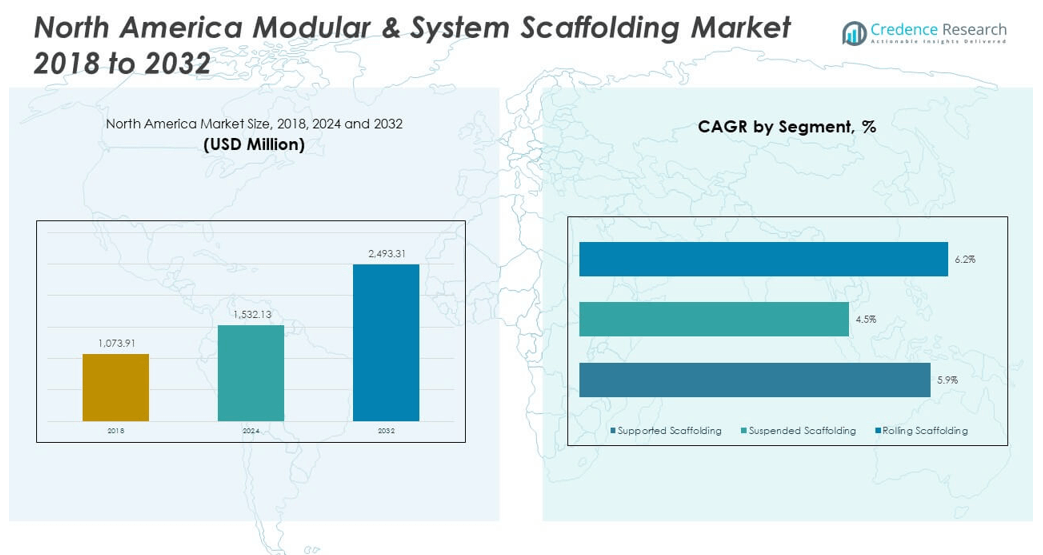

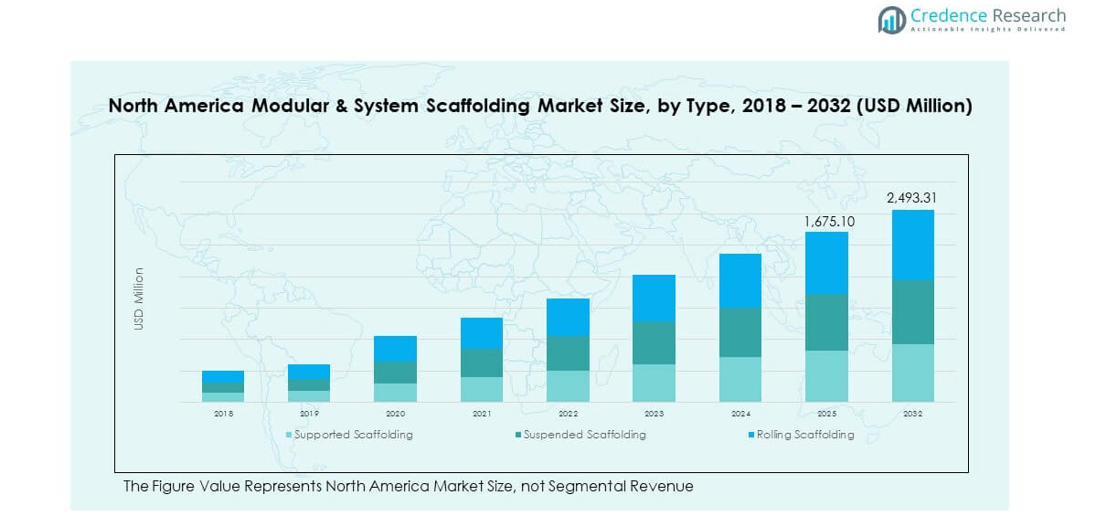

The North America Modular & System Scaffolding Market size was valued at USD 1,073.91 million in 2018 to USD 1,532.13 million in 2024 and is anticipated to reach USD 2,493.31 million by 2032, at a CAGR of 5.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Modular & System Scaffolding Market Size 2024 |

USD 1,532.13 million |

| Middle East Modular & System Scaffolding Market, CAGR |

5.80% |

| Middle East Modular & System Scaffolding Market Size 2032 |

USD 2,493.31 million |

The market in North America is primarily driven by the robust growth in construction and infrastructure development activities across the region. Significant investments in commercial and residential construction, along with an increasing focus on renovation and maintenance of aging infrastructure, have accelerated demand for modular and system scaffolding. The market is also benefiting from the rising adoption of safer, more efficient scaffolding systems that reduce labor costs and enhance operational productivity. Technological advancements, such as lightweight materials and customizable configurations, are further driving market penetration.

Regionally, the United States holds the dominant share of the North American modular and system scaffolding market, owing to its extensive construction industry and government-backed infrastructure upgrades. Canada is emerging as a high-growth market, supported by rising urban development and investments in public transportation and industrial projects. The demand is particularly strong in metropolitan areas where large-scale commercial and infrastructure projects require safe, versatile scaffolding systems. Additionally, regulatory emphasis on worker safety across the region continues to promote the use of advanced scaffolding solutions.

Market Insights:

- The North America Modular & System Scaffolding Market was valued at USD 1,532.13 million in 2024 and is projected to reach USD 2,493.31 million by 2032, growing at a CAGR of 5.80%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Rising investments in infrastructure modernization and commercial construction are fueling steady market growth.

- Increasing demand for safe, modular scaffolding systems is driven by strict compliance with regional safety regulations.

- Technological advancements in lightweight materials and automated installation solutions enhance operational efficiency.

- High initial setup costs and fluctuating raw material prices present key restraints to market expansion.

- The United States holds the largest regional share, driven by extensive construction activity and regulatory enforcement.

- Canada and Mexico are emerging markets due to rising urban development and growth in industrial projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Infrastructure Modernization and Expanding Urban Projects Stimulate Market Growth

Rapid urban expansion and large-scale infrastructure development across major North American cities continue to propel the demand for advanced scaffolding systems. Governments are investing heavily in upgrading transportation networks, bridges, and public facilities, which require reliable modular scaffolding solutions. The North America Modular & System Scaffolding Market benefits from stringent safety regulations that encourage the adoption of high-performance scaffolding. Construction companies prefer modular systems for their flexibility and quick assembly, which reduce project timelines. The growing trend of high-rise residential and commercial structures further boosts market growth. The emphasis on efficiency and worker safety enhances the adoption of technologically improved scaffolding designs. Investments in smart city initiatives also contribute to consistent market expansion.

- For instance, the U.S. Infrastructure Investment and Jobs Act allocates approximately $110 billion for roads and bridge rehabilitation. PERI’s UP Flex system—certified to load class LK 6 (permissible load up to 6.0 kN/m²)—features gravity‑locking ledger nodes and anti‑uplift decks.

Rise of Renovation and Maintenance Activities Across the Region

A significant portion of market growth stems from the rising need for maintenance of aging infrastructure. Urban areas face an increased requirement for scaffolding solutions to support repair and refurbishment of commercial buildings and industrial facilities. The North America Modular & System Scaffolding Market leverages these trends with modular platforms designed for complex environments. Construction firms are opting for scaffolding systems that can be reconfigured easily to handle varying project demands. Demand for scaffolding in energy and manufacturing industries is growing due to frequent plant overhauls and maintenance. Strong focus on extending the lifespan of existing structures encourages steady adoption of high-quality scaffolding. The rise in government-funded restoration projects underlines the market’s positive outlook.

- For example, BrandSafway offers comprehensive modular scaffolding rental and access services to industrial and energy clients, with a focus on planned maintenance and turnaround projects.

Technological Advancements and Innovative Design Solutions Drive Adoption

Manufacturers are continuously introducing lightweight, durable, and customizable scaffolding products. Advanced modular systems with enhanced load-bearing capacity and precision engineering gain strong traction in the construction sector. The North America Modular & System Scaffolding Market benefits from these innovations as firms seek cost-effective solutions that boost productivity. Modern design features allow faster assembly and disassembly, reducing labor costs significantly. The integration of safety-focused components, such as guardrails and anti-slip platforms, improves user confidence. Increased use of aluminum and high-strength alloys supports the market’s growth. Automation in scaffolding installation also reduces operational risks while improving project timelines.

Regulatory Standards and Focus on Worker Safety Promote Market Expansion

Stringent safety and quality standards are encouraging companies to invest in certified scaffolding solutions. Regulatory authorities emphasize compliance with Occupational Safety and Health Administration (OSHA) guidelines, driving demand for safer modular platforms. The North America Modular & System Scaffolding Market aligns with these mandates by providing tested and approved designs. Construction companies prioritize systems with robust safety features to mitigate workplace accidents. The push for risk reduction on high-rise projects supports the adoption of modular scaffolding with advanced locking mechanisms. Growing awareness of safety compliance in industrial and commercial sectors strengthens market penetration. The combination of regulatory oversight and corporate responsibility fosters a favorable environment for growth.

Market Trends:

Integration of Digital Technologies and Smart Scaffolding Solutions

The adoption of digital tools and smart technologies is reshaping scaffolding operations across the region. Construction firms use software-based planning tools for optimizing scaffolding layouts and project efficiency. The North America Modular & System Scaffolding Market experiences a rise in demand for systems integrated with sensors and IoT solutions. These innovations help monitor load, detect structural shifts, and ensure safe usage on complex projects. Automated systems also minimize manual errors during installation. Companies are increasingly using digital twin models to simulate scaffolding requirements before deployment. The trend toward automation strengthens the market’s ability to support advanced construction needs.

Shift Toward Lightweight and Environmentally Sustainable Materials

Eco-friendly construction practices drive the demand for recyclable and lightweight scaffolding components. Aluminum and composite materials are becoming popular due to their reduced environmental impact and high durability. The North America Modular & System Scaffolding Market benefits from these innovations that lower transport costs and improve assembly efficiency. The shift toward sustainability aligns with broader industry trends of reducing carbon footprints. Manufacturers focus on designing scaffolding that balances strength with reduced material usage. Green building certifications also encourage the use of sustainable scaffolding products. This trend creates opportunities for firms offering innovative and eco-conscious solutions.

- For example, Aluma Systems’ Aluma Beam® is a long-established, high-strength aluminum component known for its durability, lightweight design, and use across forming, shoring, and access systems. Official product literature emphasizes its strength-to-weight efficiency, but does not specify EN AW‑6082 T6 heat treatment nor quantify speed or weight gains relative to steel systems.

Growing Adoption of Rental Scaffolding Services

The rising preference for rental-based scaffolding solutions is transforming market dynamics. Construction firms choose rental services to reduce upfront capital expenses and maintenance costs. The North America Modular & System Scaffolding Market is seeing rental companies expand their fleets with advanced modular systems. Rental services offer flexible solutions tailored to short-term projects, which boosts adoption in urban construction. The growing number of specialized service providers improves availability and customer support. Companies also value rental solutions that ensure regular maintenance and compliance with safety standards. This trend supports the steady growth of service-based revenue models.

Increasing Customization and Project-Specific Scaffolding Solutions

Construction projects demand scaffolding systems that adapt to unique architectural designs. Manufacturers are responding by offering highly customizable modular systems tailored to client needs. The North America Modular & System Scaffolding Market benefits from demand for project-specific solutions that enhance efficiency. Companies design scaffolding to accommodate irregular building shapes and tight urban spaces. Enhanced engineering techniques enable the production of modular systems that fit complex industrial setups. Customers prefer solutions that reduce downtime and improve site workflow. This trend emphasizes the importance of design versatility and rapid configuration capabilities.

- For example, Bil-Jax provides sectional, utility, and system scaffolding widely adopted for industrial, commercial, and event applications, as shown in its product catalogs and case study of the TF2100 tent flooring system.

Market Challenges Analysis:

High Initial Costs and Fluctuating Raw Material Prices Affect Profitability

The high cost of advanced scaffolding systems poses a barrier for small and medium construction firms. Initial investment in modular scaffolding can be significant due to quality standards and advanced design features. The North America Modular & System Scaffolding Market faces added pressure from fluctuating prices of aluminum and steel. Rising raw material costs directly impact production expenses and pricing strategies. Companies must maintain competitive prices while ensuring safety and durability, which reduces profit margins. The cost of maintenance and inspection for premium scaffolding also adds to operational challenges. Firms offering rental services must manage wear and tear to maintain profitability. These factors collectively affect the market’s growth pace.

Labor Shortages and Compliance with Strict Safety Regulations Create Hurdles

The shortage of skilled workers in the construction sector impacts the efficient setup of modular scaffolding. Companies require trained personnel to handle assembly and safety checks, which adds to project costs. The North America Modular & System Scaffolding Market also faces challenges from strict safety compliance. Non-compliance with OSHA standards leads to penalties, project delays, and higher operational risks. Manufacturers need continuous testing and certification to ensure product reliability. Meeting diverse safety standards across states complicates distribution and logistics. These challenges limit the adoption of scaffolding solutions by smaller contractors with limited resources.

Market Opportunities:

Rising Demand from Renewable Energy and Industrial Construction Projects

The shift toward renewable energy infrastructure, including wind and solar farms, opens new growth avenues. Scaffolding systems play a vital role in the installation and maintenance of large energy structures. The North America Modular & System Scaffolding Market can leverage this demand with specialized designs for industrial setups. Companies investing in energy transition projects require scalable scaffolding for efficient assembly. The expansion of manufacturing and warehousing facilities also boosts demand. It benefits from high-volume industrial projects requiring robust platforms.

Growth Potential in Emerging Urban and Infrastructure Development Areas

Expanding urbanization and planned infrastructure projects in emerging cities present new opportunities. Construction firms require flexible scaffolding systems for mixed-use developments and smart city projects. The North America Modular & System Scaffolding Market can capitalize on growing government budgets allocated for transport and housing. Firms that offer rental models and custom modular solutions can strengthen their market position. The shift toward green building construction further increases opportunities for advanced scaffolding systems.

Market Segmentation Analysis:

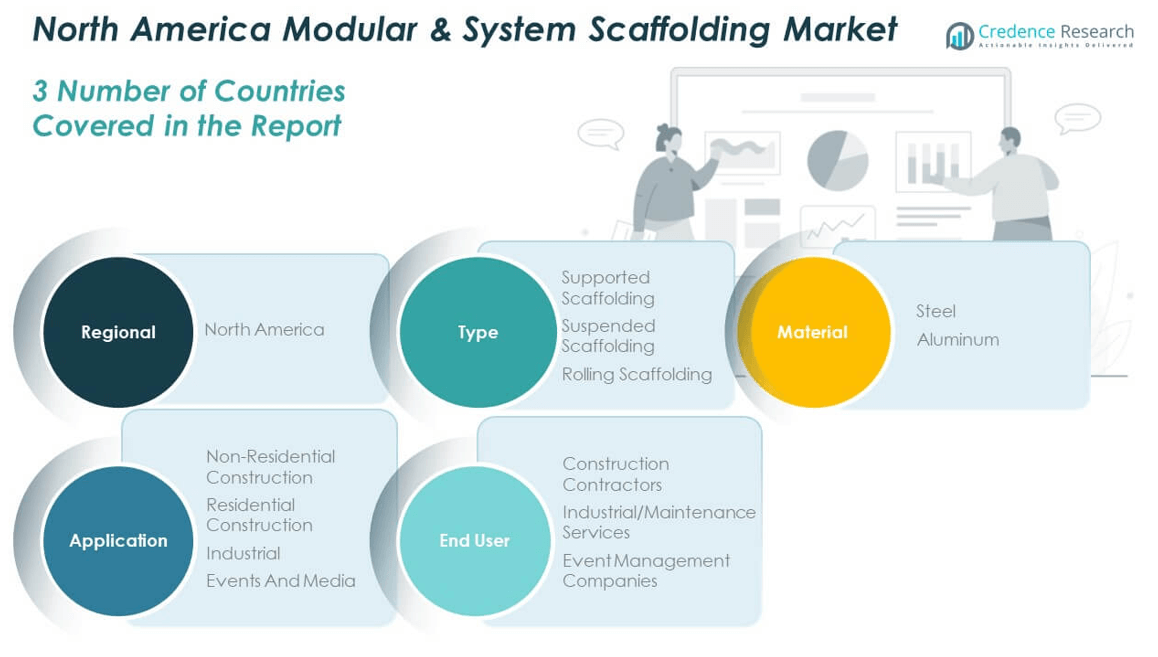

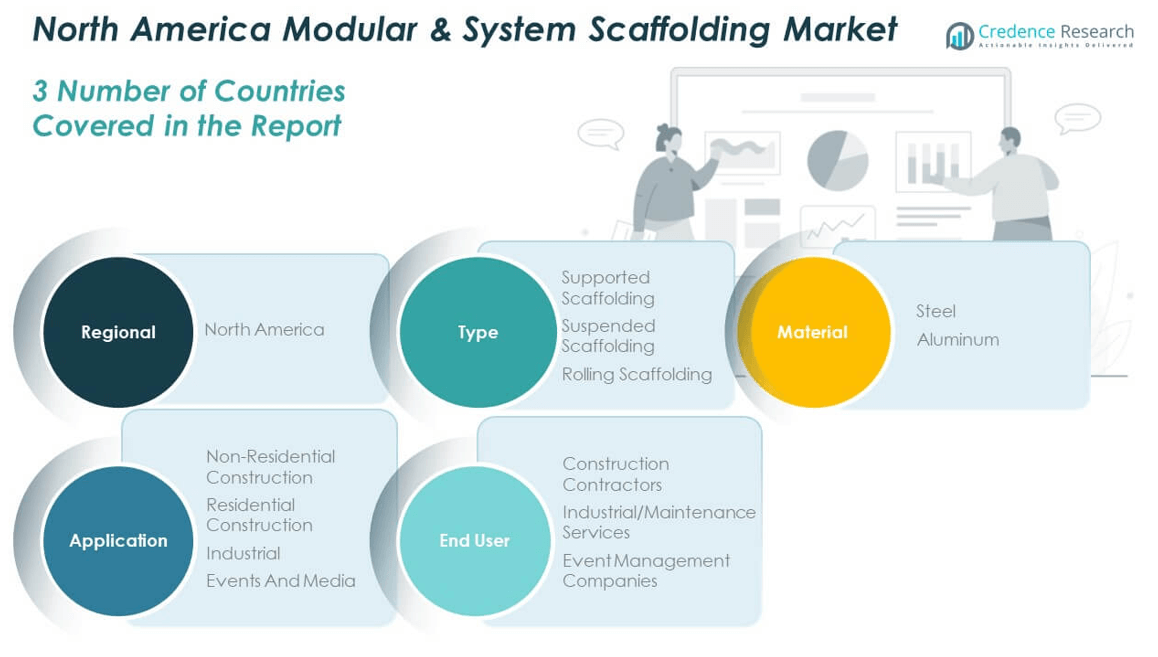

The North America Modular & System Scaffolding Market is segmented by type, material, application, and end user, each contributing to its dynamic structure.

By type segments, supported scaffolding holds the largest share due to its extensive use in large-scale construction and maintenance projects. Suspended scaffolding is gaining traction for high-rise building exteriors, while rolling scaffolding is preferred for indoor and mobile applications due to its flexibility and ease of relocation.

- For example, Sky Climber’s LNX tower hoists provide powered suspended platform access with regulated vertical travel speeds of up to 35 ft/min, integrated over‑speed brakes, and wireless controls as outlined in the manufacturer’s product specifications.

By material, steel dominates due to its strength and durability, especially in heavy-duty construction environments. Aluminum scaffolding is favored in projects requiring lightweight, corrosion-resistant structures that allow quick assembly.

- For example, BrandSafway publishes detailed engineering manuals such as Systems™ Scaffold (ORN203) and SafMax® Frame System guides, which provide component-level load ratings and best-practice guidance.

By application, non-residential construction leads demand, driven by commercial buildings, infrastructure development, and institutional projects. Residential construction follows with steady growth, supported by ongoing urbanization. Industrial applications are significant, particularly in maintenance and facility upgrades across energy and manufacturing sectors. Events and media applications use scaffolding for temporary structures, gaining popularity in urban venues and entertainment setups.

By end users, construction contractors account for the majority share, relying on scaffolding for diverse building requirements. The North America Modular & System Scaffolding Market also sees strong engagement from industrial and maintenance services, which depend on system scaffolds for operational efficiency and safety. Event management companies represent a niche but fast-growing segment, requiring adaptable systems for staging and venue installations. Each segment reflects the market’s adaptability to evolving construction methods and sector-specific demands.

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

By Region:

Regional Analysis:

The United States dominates the North America Modular & System Scaffolding Market, accounting for over 73% of the regional market share. Its leadership is driven by robust construction activity, particularly in commercial real estate, transportation infrastructure, and energy projects. Major cities such as New York, Los Angeles, and Houston are witnessing sustained investments in high-rise buildings and large-scale public works. The strong regulatory framework focused on safety compliance accelerates the adoption of advanced modular scaffolding systems. Companies in the U.S. also lead in product innovation and rental service networks. It continues to set the pace for market growth and technological integration across the region.

Canada holds approximately 20% of the North American market, with rising demand supported by increasing investments in public infrastructure and urban development. Key cities such as Toronto, Vancouver, and Montreal are experiencing rapid residential and commercial expansion. Government initiatives focused on infrastructure renewal and affordable housing projects drive scaffolding requirements. The North America Modular & System Scaffolding Market benefits from Canada’s preference for modular solutions in complex and multi-phase developments. The market is further supported by growth in the energy and mining sectors. It sees strong demand for reconfigurable systems that adapt to varied terrain and structure types.

Mexico accounts for the remaining 7% of the regional market and is steadily expanding its scaffolding demand through industrial and manufacturing projects. The country’s special economic zones and border-area construction activity support the use of system scaffolding in logistics hubs and assembly plants. While the market remains smaller in scale, increased foreign investment and trade-driven infrastructure initiatives enhance growth. Mexico’s adoption of safety standards aligned with international practices improves demand for compliant scaffolding systems. The North America Modular & System Scaffolding Market gains from Mexico’s participation in regional construction supply chains. It presents long-term opportunities as the construction industry becomes more mechanized and regulated.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BrandSafway

- Safway Atlantic

- Layher North America

- PERI Group

- ULMA Construction

- MJ-Gerüst

- Atlantic Pacific Equipment (AT-PAC)

- Altrad Group

- Waco Kwikform

- Sunshine Enterprise

Competitive Analysis:

The North America Modular & System Scaffolding Market features strong competition among global and regional players that prioritize innovation, safety, and project-specific customization. Leading manufacturers such as PERI Group, Layher Holding GmbH & Co KG, and BrandSafway have established a dominant presence through extensive product portfolios, robust service networks, and compliance with stringent safety regulations. These companies continue to invest in R&D to develop lighter, safer, and more efficient modular systems. Their focus on integrating digital technologies, such as Building Information Modeling (BIM) and IoT-based monitoring, enhances operational efficiency and customer satisfaction. It benefits from a mature rental services market, where players offer end-to-end scaffolding solutions, including planning, erection, and dismantling. Competitive dynamics are also shaped by regional and local providers offering cost-effective, tailored solutions that address specific site challenges. Strategic mergers, acquisitions, and geographic expansions are common as companies seek to strengthen market share and service reach.

Recent Developments:

- In January 2025, BrandSafway showcased several new solutions at the World of Concrete, notably the Flexi Deck slab formwork system—an innovative, lightweight product exclusive to Aluma Systems, part of the BrandSafway family. Flexi Deck allows for early dismantling of beams and planking and is designed for safe, efficient slab construction. Updates also include enhancements to the QuikDeck Suspended Access System and demonstrations of the SC1000 Voyager™ battery-powered hoist.

- In January 2025, PERI Group announced the launch of two new formwork solutions, SKYFLEX and LEVO, introduced at the World of Concrete 2025 in Las Vegas. These innovative systems demonstrate PERI’s commitment to advancing construction technology and providing safer, more efficient scaffolding solutions to the North American market.

- In April 2025, Layher North America relocated its operational footprint by opening a new scaffolding materials and support facility in Baltimore County. The new location enables Layher to expand its engineering, assembly, storage, and office capabilities in the region, supporting both new and existing clients in North America.

- In April 2025, Atlantic Pacific Equipment (AT-PAC) announced it had completed its integration into Umdasch Industrial Solutions. This follows its acquisition by Doka, a Umdasch Group company, in 2023. The move strengthens AT-PAC’s offering as an end-to-end scaffolding provider for industrial and construction clients across North America, now leveraging increased resources and logistics.

Market Concentration & Characteristics:

The North America Modular & System Scaffolding Market is moderately concentrated, with a few major players holding significant market share through established brand recognition, broad distribution networks, and advanced product offerings. It features a mix of global manufacturers and regional providers competing on quality, customization, and safety compliance. The market favors companies that deliver integrated solutions, including rental, design, and on-site support. Standardization of safety regulations across the U.S., Canada, and Mexico creates opportunities for uniform product offerings. It exhibits high entry barriers due to the need for certifications, capital-intensive production, and strong client relationships. Product differentiation and service reliability remain critical competitive factors.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise due to continued infrastructure modernization across urban and industrial zones.

- Adoption of digital scaffolding solutions will expand with greater use of BIM and project simulation tools.

- Growth in green construction practices will encourage development of sustainable, lightweight scaffolding materials.

- Rental-based scaffolding services will gain traction among contractors seeking flexible and cost-effective options.

- Regulatory pressure will drive investments in high-safety, OSHA-compliant scaffolding systems.

- Integration with IoT and smart monitoring devices will enhance on-site safety and efficiency.

- Energy and utility sector projects will offer new revenue streams for system scaffolding providers.

- Advancements in modular design will support customization for complex architectural projects.

- Labor shortages will encourage development of automated and easy-to-assemble scaffolding structures.

- Cross-border infrastructure projects will create opportunities for regional service expansion.