Market Overview

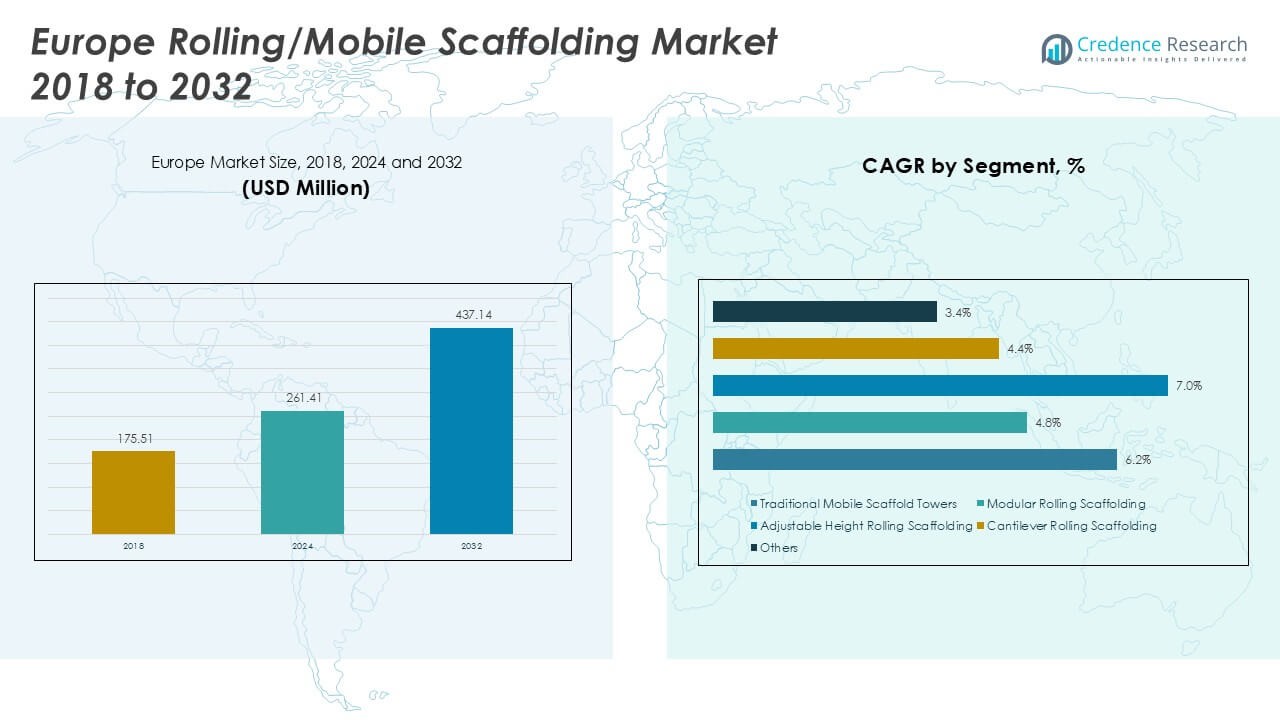

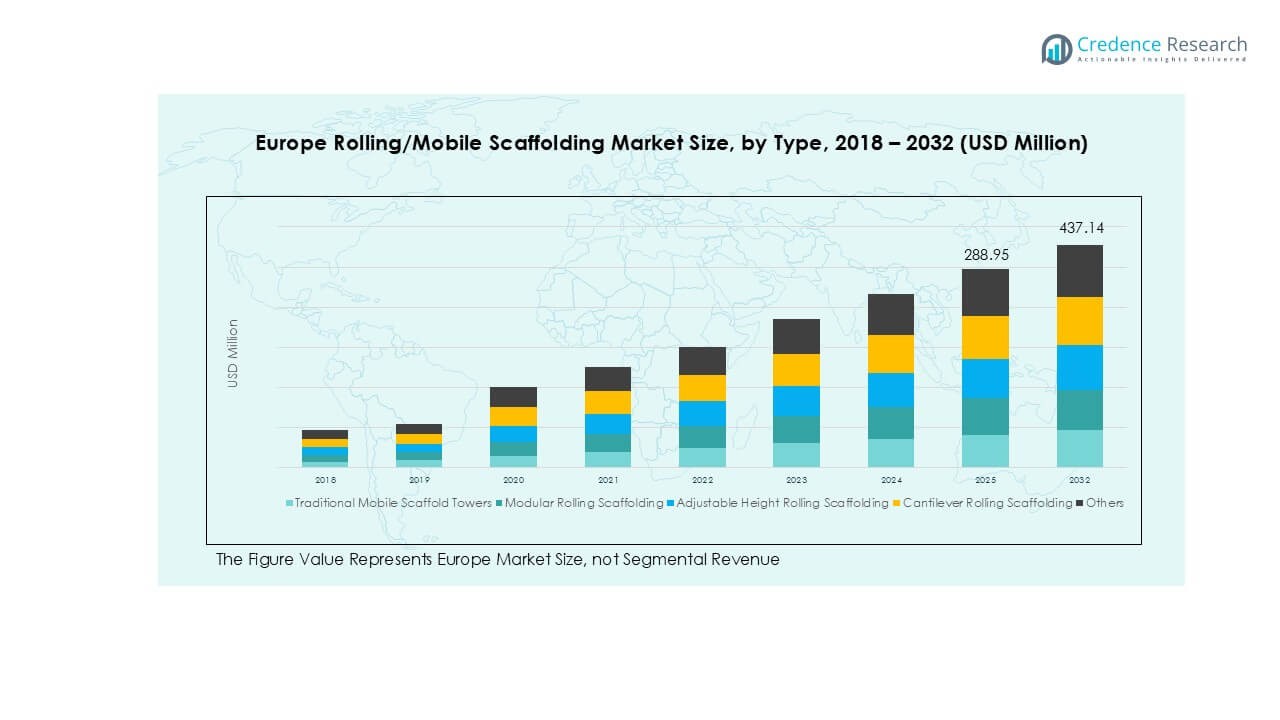

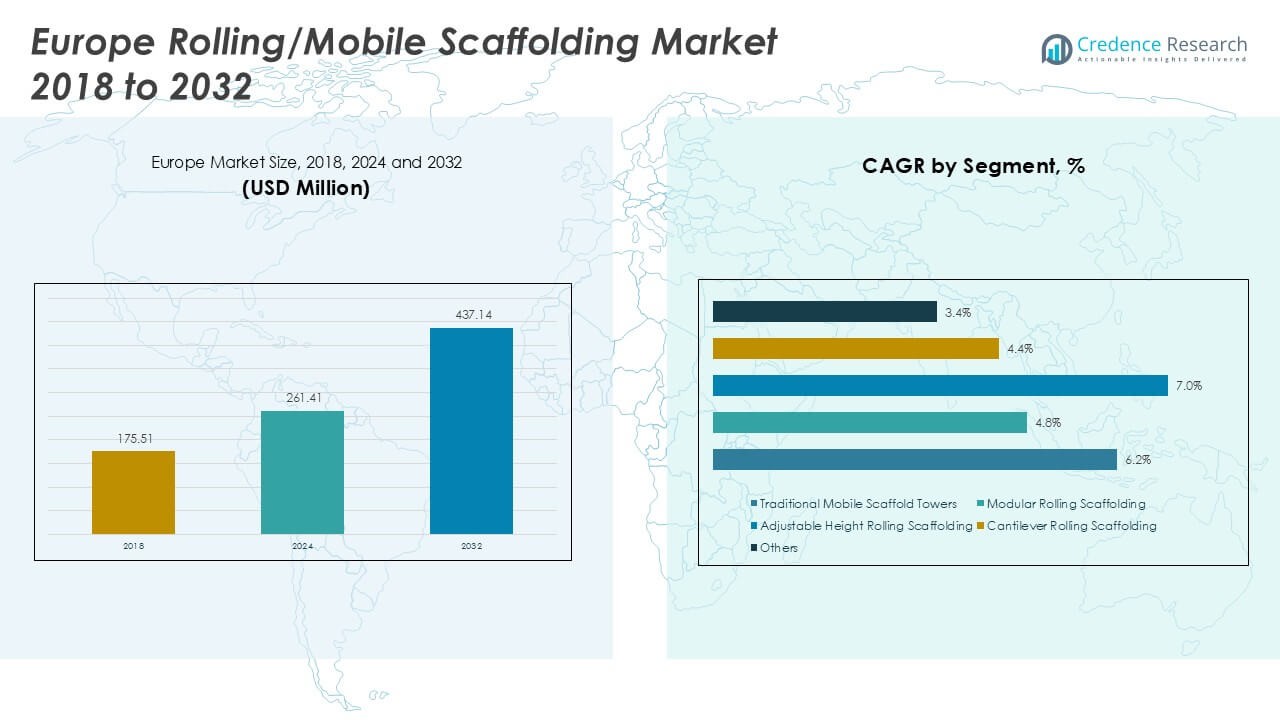

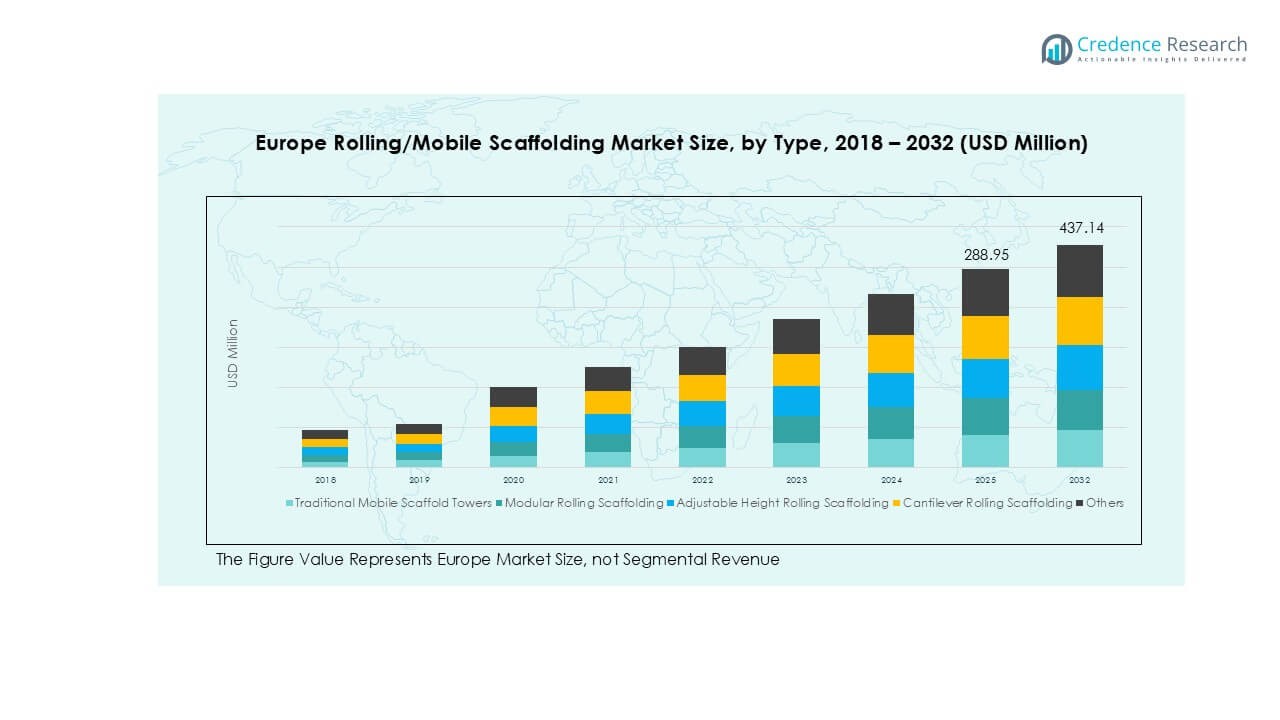

The Europe Rolling/Mobile Scaffolding market size was valued at USD 175.51 million in 2018 and grew to USD 261.41 million in 2024. It is anticipated to reach USD 437.14 million by 2032, expanding at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Rolling Mobile Scaffolding Market Size 2024 |

USD 261.41 Million |

| Europe Rolling Mobile Scaffolding Market, CAGR |

6.1% |

| Europe Rolling Mobile Scaffolding Market Size 2032 |

USD 437.14 Million |

The Europe Rolling/Mobile Scaffolding market is led by prominent players such as Euroscaffold Netherlands, Altrad Group, GBM Italy, ZARGES, Altrex, and Hünnebeck GmbH, each offering a broad range of scaffolding systems tailored to meet stringent European safety standards. These companies maintain a competitive edge through product innovation, regional expansion, and robust rental networks. Germany emerged as the leading regional market in 2024, accounting for 23% of the total European market share, driven by its advanced construction sector and strong industrial maintenance activities. The United Kingdom and France followed, with 19% and 17% market shares respectively, supported by infrastructure modernization, renovation projects, and strict workplace safety regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Rolling/Mobile Scaffolding market was valued at USD 261.41 million in 2024 and is projected to reach USD 437.14 million by 2032, growing at a CAGR of 6.1% during the forecast period.

- Market growth is driven by increasing urban infrastructure projects, rising demand for building maintenance and retrofitting, and strict enforcement of worker safety regulations across Europe.

- Key trends include the rising use of lightweight aluminuim scaffolding, growth in rental services, and integration of modular, ergonomic designs to improve safety and efficiency on-site.

- Leading companies such as Euroscaffold Netherlands, Altrad Group, and ZARGES dominate the market through innovation, regional expansions, and product diversification, while smaller players compete in niche segments.

- Regionally, Germany leads with a 23% share, followed by the UK (19%) and France (17%). Segment-wise, traditional mobile scaffold towers and aluminuim-based systems hold the highest shares due to their adaptability and ease of use.

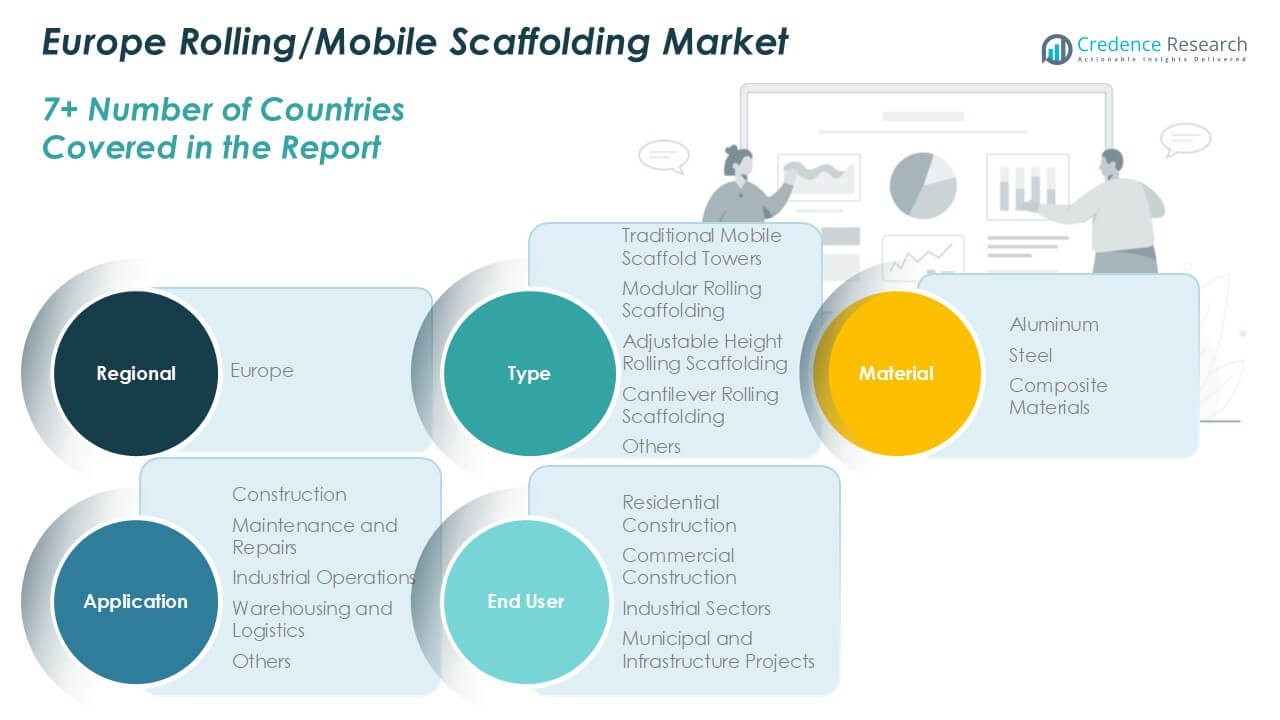

Market Segmentation Analysis:

By Type

In the Europe Rolling/Mobile Scaffolding market, Traditional Mobile Scaffold Towers emerged as the dominant sub-segment in 2024, accounting for over 35% of the market share. Their widespread use in residential and commercial construction, driven by ease of assembly, mobility, and cost-effectiveness, contributes to their leading position. Meanwhile, Modular Rolling Scaffolding is gaining traction due to its versatility in complex architectural projects and multi-level work platforms. The increasing demand for flexible and safety-enhanced scaffolding solutions across renovation and infrastructure upgrade projects in urban areas continues to fuel growth across all type-based segments.

- For instance, Altrex’s RS TOWER 52 module system supports working heights up to 14.2 meters for indoor use and 10.2 meters for outdoor setups, highlighting the popularity of modular towers in variable site conditions.

By Material:

Aluminium-based rolling scaffolding led the material segment, holding more than 48% of the market share in 2024. This dominance is attributed to aluminium’s lightweight, corrosion-resistant properties and ease of transportation, making it ideal for quick setup and frequent relocation. The growing adoption of sustainable and recyclable materials in construction further supports the segment’s expansion. Steel scaffolding, known for its strength and durability, remains crucial in heavy-duty industrial applications, while composite materials are slowly emerging as a niche solution, driven by innovation in hybrid scaffolding structures.

- For instance, ZARGES manufactures rolling towers with high-strength aluminium that reduce unit weight to as low as 65.5 kg for full scaffold configurations, allowing faster repositioning and setup in high-frequency work cycles.

By Application:

The Construction segment dominated the application landscape, capturing approximately 52% of the market share in 2024. Rolling scaffolding systems are extensively used in residential, commercial, and infrastructure projects for tasks such as painting, plastering, and exterior maintenance. The rising trend of renovation and energy-efficient retrofitting across Europe is driving consistent demand in this segment. Maintenance and Repairs followed closely, particularly in industrial and municipal facilities, where mobility and quick deployment are essential. Meanwhile, the Warehousing and Logistics sub-segment is expanding steadily due to growing automation needs and facility upgrades requiring temporary elevated access.

Key Growth Drivers

Rising Urban Infrastructure Development

The rapid pace of urbanization across Europe is fueling demand for modern construction and renovation projects, especially in residential and commercial sectors. Governments and private developers are heavily investing in urban renewal, energy-efficient buildings, and public infrastructure, which require safe, mobile, and flexible access systems. Rolling/mobile scaffolding provides ideal support for multi-level access, especially in confined or complex architectural environments, thereby gaining widespread adoption. This surge in urban construction activity continues to serve as a critical growth engine for scaffolding equipment manufacturers across the region.

- For instance, Hünnebeck GmbH supported over 200 commercial infrastructure projects across Germany, France, and Poland in 2023 using its mobile scaffolding systems, enabling consistent supply for vertical access solutions in urban cores.

Growing Emphasis on Worker Safety and Compliance

Stringent occupational safety regulations enforced by European agencies such as OSHA and EU-OSHA are propelling the use of secure access platforms like mobile scaffolding. Traditional access methods are being phased out in favor of systems that meet higher safety and ergonomic standards. Rolling scaffolding, with features like guardrails, lockable wheels, and height adjustability, ensures compliance with these guidelines while minimizing accident risks. This increased focus on worker protection and regulatory adherence is driving organizations to invest in advanced, safety-enhanced scaffolding solutions.

- For instance, the Altrad Group reported a 27% reduction in on-site incidents after deploying its UniTech scaffolding systems with integrated toe boards, fall arrest points, and double guardrail mechanisms across its European projects.

Increasing Demand for Refurbishment and Maintenance Projects

Europe’s mature real estate and industrial sectors are witnessing a spike in maintenance, repair, and refurbishment activities, particularly in aging buildings and historical structures. These projects require mobile and adjustable scaffolding that offers quick assembly and disassembly with minimal disruption. Rolling scaffolding solutions address this need effectively, enabling efficient access in operational facilities or restricted urban environments. The market benefits from this trend, as demand rises from both public and private sectors undertaking periodic upgrades and retrofitting initiatives.

Key Trends & Opportunities

Integration of Lightweight and Sustainable Materials

The use of lightweight materials such as aluminium and composite alloys is becoming increasingly common, driven by the need for easy-to-transport and energy-efficient solutions. These materials not only reduce labor fatigue but also lower the environmental impact, aligning with Europe’s strong sustainability goals. Manufacturers are innovating product lines with recyclable, corrosion-resistant materials that maintain structural integrity without adding bulk. This trend opens new opportunities for suppliers to align their offerings with green building standards and attract eco-conscious buyers.

- For instance, Mauderer Alutechnik offers mobile scaffolds made from 100% recyclable EN AW-6082 aluminium, contributing to a company-wide initiative that processed over 740 metric tons of recycled aluminium in 2023 alone.

Technological Advancements in Scaffold Design and Manufacturing

The industry is witnessing a shift toward digitalized and modular scaffolding systems. Advanced features such as tool-less assembly mechanisms, modular connectors, and CAD-driven customization are gaining popularity among end-users seeking efficiency and adaptability. The adoption of ergonomic design practices is also improving worker productivity and safety. Additionally, 3D modeling and simulation tools are enabling more accurate on-site scaffold planning. These innovations not only streamline operations but also offer differentiation for manufacturers in a highly competitive market.

- For instance, GBM Italy integrated 3D modeling software into its product design in 2022, leading to a 38% improvement in prototype-to-market turnaround times for new modular scaffolding systems.

Key Challenges

High Initial Costs and Price Sensitivity

Despite the long-term benefits, the high upfront cost of quality rolling scaffolding systems acts as a deterrent for small contractors and budget-sensitive projects. Many SMEs opt for traditional or rental equipment to avoid capital expenditure, which slows adoption rates for advanced scaffolding. Additionally, fluctuating raw material prices, particularly for aluminium and steel, affect production costs and price competitiveness. This challenge necessitates flexible pricing strategies and value-driven product differentiation for sustained market penetration.

Limited Awareness Among Smaller Enterprises

While large construction firms recognize the advantages of mobile scaffolding, awareness and adoption remain limited among small and medium-sized enterprises (SMEs), especially in Eastern and Southern Europe. These firms often rely on conventional scaffolding or ladders due to limited technical knowledge and training. The lack of targeted outreach, on-site demonstrations, and education around the benefits of rolling scaffolding impedes wider market adoption. Overcoming this barrier will require collaborative efforts between manufacturers, regulators, and training institutions.

Regional Analysis

United Kingdom

The United Kingdom held approximately 19% of the Europe Rolling/Mobile Scaffolding market in 2024, driven by a strong construction sector and ongoing urban regeneration projects across cities like London, Manchester, and Birmingham. The UK’s strict regulatory focus on worker safety and scaffold quality standards continues to favor mobile scaffolding adoption, especially among contractors involved in public infrastructure upgrades and residential retrofits. Additionally, the growing emphasis on sustainable construction practices has led to increased demand for lightweight aluminium scaffolding. Rising investments in the housing sector and maintenance of aging public buildings further support the growth of mobile scaffolding solutions.

France

France accounted for nearly 17% of the regional market in 2024, supported by robust public infrastructure development and an active refurbishment sector. The French government’s initiatives for energy-efficient building upgrades, such as retrofitting and facade renewals, are major contributors to market demand. Mobile scaffolding is increasingly used in urban restoration projects and cultural heritage site maintenance, where mobility and minimal structural interference are critical. The construction of eco-districts and large-scale transport projects like Grand Paris Express also sustains demand. Local manufacturers and rental companies continue to innovate scaffolding systems to comply with evolving safety norms and construction needs.

Germany

Germany led the Europe Rolling/Mobile Scaffolding market in 2024, capturing approximately 23% of the market share. The country’s well-established construction sector, combined with a high volume of industrial maintenance work, drives consistent demand for mobile scaffolding. German firms prioritize precision, safety, and durability, pushing demand for modular, high-load-bearing scaffolds. Strong investment in residential energy efficiency programs, industrial retrofits, and automotive manufacturing facilities further propels market growth. Germany’s leadership in automation and smart construction practices also encourages the integration of innovative scaffolding designs that align with modern building technologies and digital construction workflows.

Italy

Italy held about 12% of the European mobile scaffolding market in 2024, supported by a resurgence in building restoration and seismic retrofit projects. The country’s large inventory of aging infrastructure and historical architecture demands non-invasive, adaptable scaffolding systems, making rolling scaffolding a preferred choice. Public initiatives promoting sustainable urban development, along with renovation tax incentives, are boosting scaffolding demand, particularly in central and southern regions. Although the market remains price-sensitive, growing awareness around construction safety and improved scaffold designs is gradually driving adoption. The rental market continues to expand as contractors seek flexible and cost-effective solutions.

Spain

Spain contributed around 10% of the regional market share in 2024, largely driven by growth in residential construction and tourism-related renovations. Rolling scaffolding is widely used in maintenance of hotels, public buildings, and coastal infrastructure. Spain’s recovery from earlier economic slowdowns has reignited interest in energy-efficient housing and commercial properties, driving refurbishment projects that rely heavily on mobile access systems. While adoption remains fragmented across regions, major urban centers like Madrid and Barcelona show stronger uptake of advanced scaffolding due to stricter safety standards and urban renewal plans. Increased investments in transport infrastructure also support segment expansion.

Russia

Russia accounted for approximately 9% of the European Rolling/Mobile Scaffolding market in 2024. Despite economic fluctuations and geopolitical tensions, the country maintains a steady demand for scaffolding in its industrial and residential sectors. The growing number of energy infrastructure projects, especially in oil and gas, as well as urban development in cities like Moscow and St. Petersburg, are key market drivers. However, challenges related to import restrictions and currency volatility affect the availability and pricing of premium scaffolding solutions. Domestic production is expanding to meet demand, although safety regulations remain inconsistent compared to Western European standards.

Rest of Europe

The Rest of Europe, including countries such as Poland, Netherlands, Belgium, and the Nordic nations, collectively held about 10% of the regional market in 2024. These markets are witnessing steady growth fueled by infrastructure upgrades, smart city initiatives, and demand for compact scaffolding systems in urban environments. Poland and the Czech Republic, in particular, are investing heavily in residential housing and public facilities, while Scandinavian countries focus on green building and workplace safety. The rental model dominates in these regions, especially among SMEs seeking affordable, temporary access solutions. Market players are focusing on product innovation to meet varying compliance standards.

Market Segmentations:

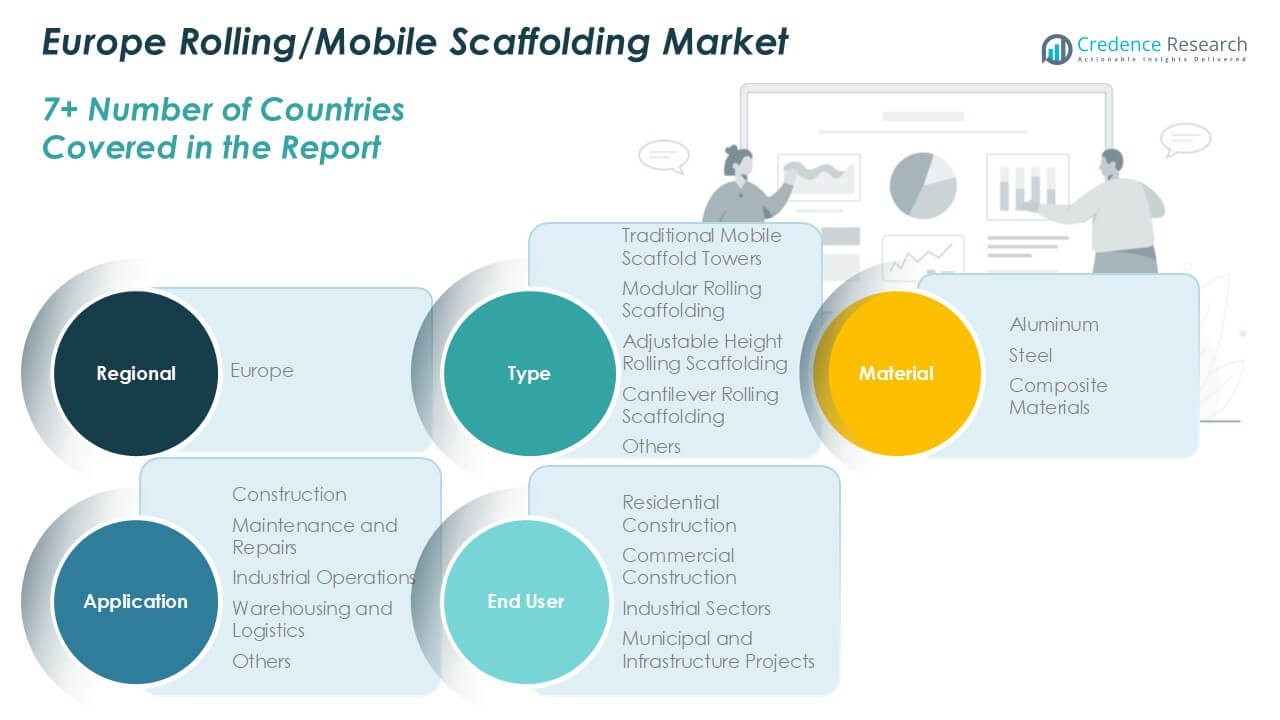

By Type:

- Traditional Mobile Scaffold Towers

- Modular Rolling Scaffolding

- Adjustable Height Rolling Scaffolding

- Cantilever Rolling Scaffolding

- Others

By Material:

- Aluminium

- Steel

- Composite Materials

By Application:

- Construction

- Maintenance and Repairs

- Industrial Operations

- Warehousing and Logistics

- Others

By End User:

- Residential Construction

- Commercial Construction

- Industrial Sectors

- Municipal and Infrastructure Projects

- Others

By Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Rolling/Mobile Scaffolding market features a moderately fragmented competitive landscape, with a mix of regional specialists and pan-European players. Key companies such as Euroscaffold Netherlands, Altrad Group, ZARGES, GBM Italy, and Hünnebeck GmbH maintain strong market positions through product innovation, extensive distribution networks, and strategic partnerships. These companies compete primarily on safety standards, material quality, modularity, and ease of assembly. Local players like Altrex and Munk Günzburger Steigtechnik focus on serving niche regional demands with tailored solutions and responsive customer support. Several players are expanding their rental services to cater to cost-sensitive clients and SMEs. Technological advancements, such as integration of lightweight materials and ergonomic designs, continue to shape competitive dynamics. Furthermore, ongoing efforts to align products with evolving EU safety regulations give a competitive edge to manufacturers that prioritize compliance. Mergers, acquisitions, and facility expansions remain key strategies for growth and market consolidation among leading players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Euroscaffold Netherlands

- GBM Italy

- Altrad Group

- Altrex

- ZARGES

- Hünnebeck GmbH

- TUBESCA

- Munk Günzburger Steigtechnik

- SARAYLI LTD.

- Mauderer Alutechnik

Recent Developments

- In May 2025, Layher continues its focus on lightweight aluminium scaffolding systems, particularly for the European and North American markets, with a strong emphasis on advanced, modular, and mobile solutions. While no specific new product launches are mentioned in the provided information for 2025, Layher’s ongoing research and development efforts are consistently highlighted for their contributions to quicker and safer assembly, especially concerning rolling and mobile scaffolding systems.

- In April 2025, PERI showcased further development and expansion of the PERI UP Scaffolding Kit, including the introduction of “PERI UP Public” components. These focus on quick installation and safety, specifically for public sector needs, with stairs and access points that meet strict safety standards and require minimal additional components. The modular logic allows more with fewer components, improving efficiency for rolling/mobile scaffolding use. The company also emphasized sustainability and introduced digital solutions (e.g., SYFIT, VEMAVENTURI) for management and safety on construction sites.

- In January 2025, BrandSafway showcased several innovations at the World of Concrete 2025, including enhancements to the QuikDeck® Suspended Access System, new multi-level platform options, and the launch of Flexi Deck, a lightweight, manually movable slab formwork system designed for faster early dismantling and improved site coverage.

Market Concentration & Characteristics

The Europe Rolling/Mobile Scaffolding Market exhibits moderate market concentration, with several established players dominating key national markets while regional manufacturers serve niche demands. It features a mix of global brands and specialized companies that focus on high-quality, safety-compliant scaffolding systems. Market characteristics include a strong emphasis on lightweight materials, modular construction, and ease of mobility to support rapid deployment across varied construction environments. Demand remains consistent in residential and commercial renovation projects, particularly in countries with aging infrastructure. Companies compete on safety standards, regulatory compliance, durability, and rental service offerings. Germany, the UK, and France account for the largest market shares, reflecting their active construction sectors and strict safety mandates. The rental model continues to grow, driven by cost-conscious contractors and small to mid-sized enterprises. Innovation in ergonomic design and digital planning tools supports competitive differentiation. The market responds steadily to EU directives, with safety and sustainability shaping product development and procurement preferences.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing demand for renovation and infrastructure upgrade projects across Europe.

- Adoption of lightweight and modular scaffolding systems will continue to rise due to ease of transport and installation.

- Rental-based scaffolding services will gain traction among SMEs and contractors seeking cost-efficient solutions.

- Stringent safety regulations across European countries will encourage wider use of compliant and secure mobile scaffolding systems.

- Urbanization and expansion of smart city initiatives will support demand for mobile scaffolding in tight and complex project environments.

- Use of aluminium and composite materials will increase due to their durability, sustainability, and corrosion resistance.

- Technological advancements such as quick-lock systems and ergonomic features will shape future product innovation.

- Growth in industrial maintenance activities will further boost the need for mobile scaffolding with flexible height and mobility features.

- Market competition will intensify as both global and regional players invest in product differentiation and service expansion.

- Eastern and Southern Europe will present new growth opportunities as awareness and adoption improve among smaller construction firms.