Market Overview:

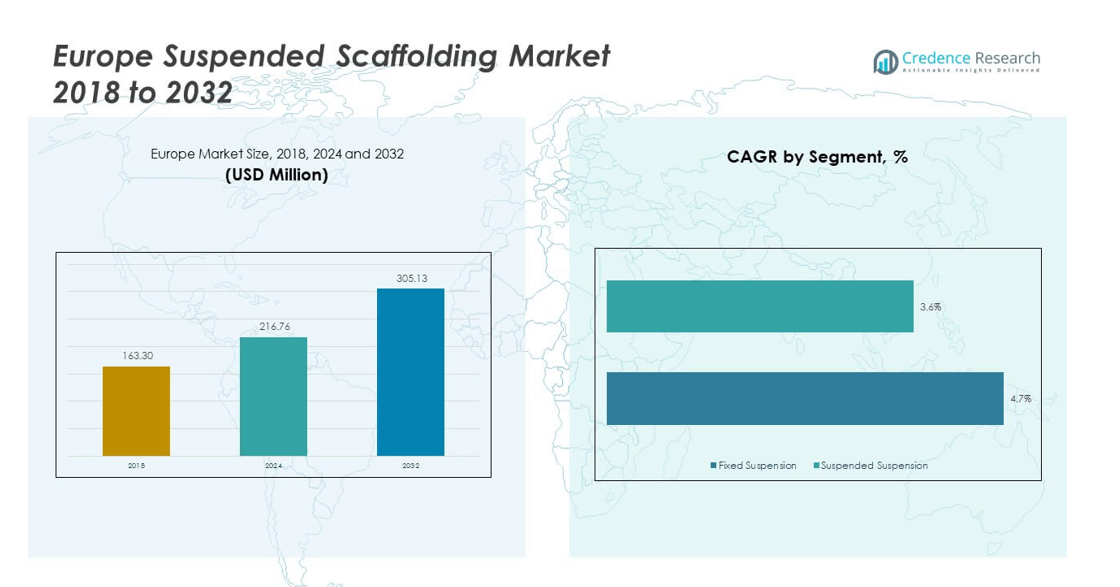

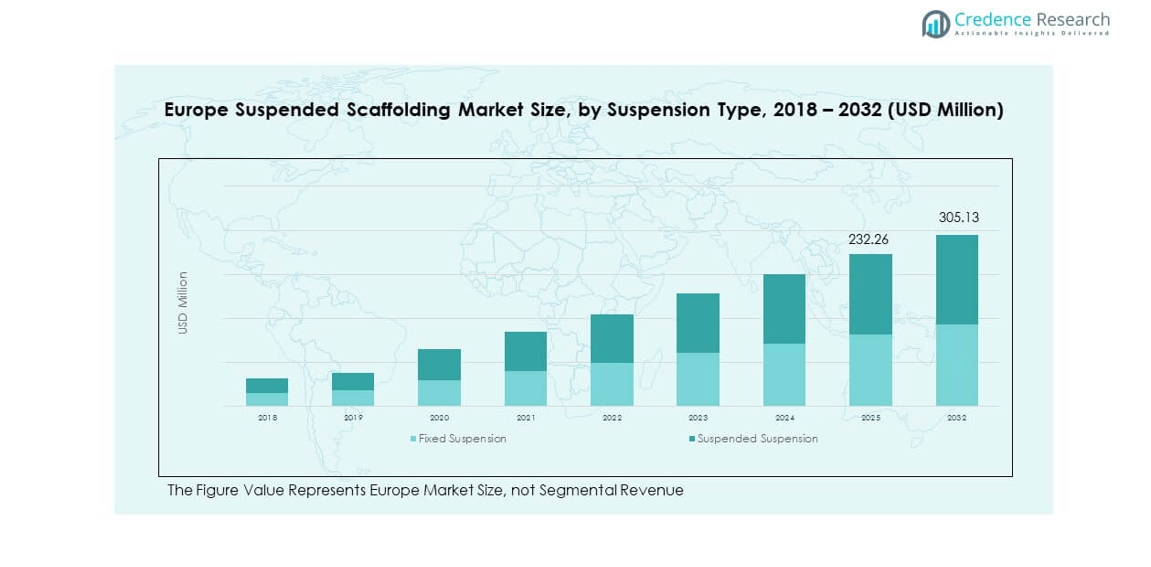

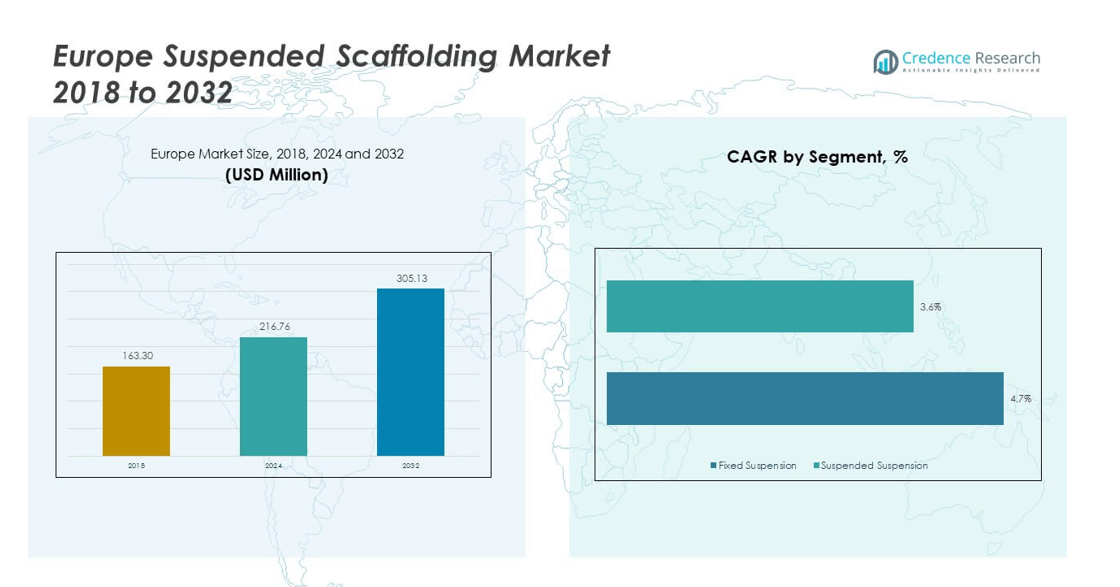

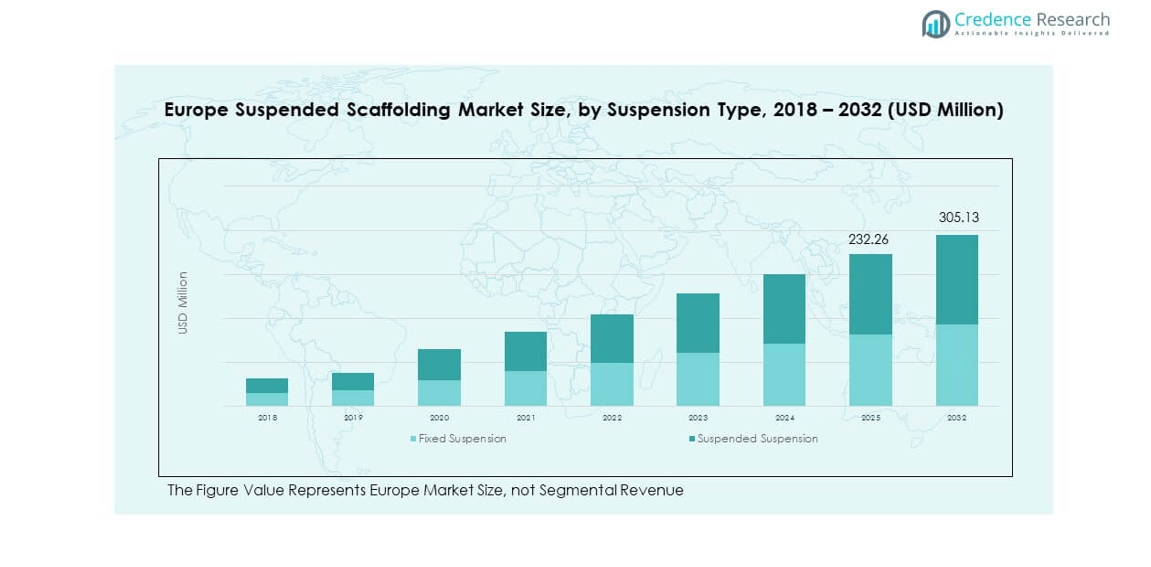

The Europe Suspended Scaffolding Market size was valued at USD 163.30 million in 2018 to USD 216.76 million in 2024 and is anticipated to reach USD 305.13 million by 2032, at a CAGR of 4.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Suspended Scaffolding Market Size 2024 |

USD 216.76 million |

| Europe Suspended Scaffolding Market, CAGR |

4.00% |

| Europe Suspended Scaffolding Market Size 2032 |

USD 305.13 million |

The Europe Suspended Scaffolding Market is primarily driven by rising construction activities across commercial and residential sectors, coupled with increasing investments in infrastructure modernization. The demand for safer and more efficient access systems in high-rise building maintenance, facade work, and restoration projects further fuels market growth. Additionally, strict regulatory frameworks emphasizing worker safety and the integration of advanced materials and automated scaffold control systems are pushing adoption. Growth in urban renovation projects and sustainability-focused retrofitting initiatives also contribute to the rising preference for suspended scaffolding solutions across the region.

In the regional context, Western Europe dominates the Europe Suspended Scaffolding Market, led by countries such as Germany, the United Kingdom, and France due to their well-established construction industries and high demand for maintenance and refurbishment of aging infrastructure. Northern and Southern Europe are witnessing steady growth with increased investments in urban development and tourism infrastructure. Meanwhile, Eastern Europe is emerging as a high-potential area, supported by EU infrastructure funding, growing industrialization, and rising awareness of construction safety practices. The market’s geographic expansion is influenced by construction trends, safety standards, and economic development levels across regions.

Market Insights:

- The Europe Suspended Scaffolding Market was valued at USD 216.76 million in 2024 and is projected to reach USD 305.13 million by 2032, growing at a CAGR of 4.00%.

- The Global Suspended Scaffolding Market size was valued at USD 882.70 million in 2018 to USD 1,240.25 million in 2024 and is anticipated to reach USD 1,921.79 million by 2032, at a CAGR of 5.24% during the forecast period.

- Growth in high-rise construction and façade refurbishment projects is driving demand for suspended scaffolding across urban centers.

- Strict safety regulations across Europe are accelerating the adoption of advanced, certified scaffolding systems with integrated safety features.

- Rising labor shortages in the construction industry are encouraging the use of mechanized suspended platforms to improve efficiency.

- High initial investment and maintenance costs of modern scaffolding systems remain a barrier for small to mid-sized contractors.

- Western Europe leads the market with 42% share, driven by mature construction markets and consistent renovation demand.

- Eastern Europe is emerging as a high-growth region, supported by EU infrastructure funding and rising urban development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Surge in Urban Infrastructure Development Across Major European Cities

Ongoing urbanization across Europe is driving a surge in infrastructure development projects, particularly in metropolitan regions. Governments and private stakeholders are heavily investing in commercial buildings, transportation networks, and mixed-use developments. The Europe Suspended Scaffolding Market benefits from these construction activities, as suspended platforms are essential for safe and efficient vertical access. High-rise construction projects in cities like London, Berlin, and Paris require adaptable scaffolding systems. The demand for modular and quick-to-install solutions is rising with stricter timelines. Market players are introducing advanced systems to support complex architecture. This driver will remain central to market momentum through the forecast period.

- For example, during construction at 2 Finsbury Avenue in London rising to approximately 170 m a cantilever‑suspended support structure was engineered to carry a Potain tower crane, mounted off the building’s core via a steel grillage.

Growth in Renovation and Restoration of Aging Building Stock

Europe holds a large base of old and historically significant buildings in need of regular upkeep and structural restoration. Governments offer financial incentives for heritage restoration, retrofitting, and façade improvements. The Europe Suspended Scaffolding Market is gaining traction in this segment due to its flexibility in difficult-to-reach and fragile building structures. Restoration contractors prefer lightweight, adjustable platforms that minimize damage risk. The market supports tailored configurations, ensuring safety and precision. Construction companies are actively integrating scaffolding into their restoration workflows. This application will continue to generate steady demand across the continent.

- For instance, during the restoration following the catastrophic 2019 fire at Notre‑Dame Cathedral, roughly 70,000 scaffold components, totaling an estimated 600 tons, were assembled around the damaged spire to stabilize and support the structure during reconstruction a pivotal element in the protective restoration process.

Stringent Safety Regulations Promoting Technologically Advanced Scaffolding

European Union regulations mandate strict compliance with worker safety norms in construction environments. These regulations are compelling contractors to adopt advanced suspended scaffolding systems with safety features. The Europe Suspended Scaffolding Market is influenced by compliance pressures, leading to the integration of fail-safe mechanisms, smart sensors, and anti-sway technology. System automation improves handling precision and minimizes risk of workplace injuries. Safety-focused designs are now a purchase criterion for both public and private sector tenders. The market responds by investing in product innovation. Regulatory stringency will continue to shape market evolution.

Rising Labor Shortages Boosting Demand for Mechanized Access Solutions

Europe faces a declining skilled labor force in the construction sector, increasing reliance on efficient mechanized systems. Suspended scaffolding reduces manual workload and enables faster, safer access to vertical surfaces. The Europe Suspended Scaffolding Market is growing in response to this need for labor-efficient solutions. Mechanized platforms offer height adjustability and reduced dependency on ground labor. Contractors adopt such systems to optimize timelines and labor costs. This shift in labor dynamics is prompting adoption of user-friendly scaffolding products. Market vendors are aligning offerings with these workforce realities. The driver remains pivotal for both new build and maintenance projects.

Market Trends:

Adoption of Lightweight Aluminum and Composite Scaffolding Materials

Manufacturers are shifting from traditional steel to lightweight materials such as aluminum and fiber-reinforced composites. These innovations reduce equipment weight, enhance portability, and lower installation times. The Europe Suspended Scaffolding Market is seeing an influx of such systems in both rental and purchase models. Lightweight structures improve safety during handling and transport, particularly in compact urban sites. The material trend aligns with sustainability goals through recyclability. Contractors benefit from quicker turnaround on projects. Vendors promote these products as cost-effective alternatives. This trend is expected to continue influencing product design.

- For example, PERI’s Alu UP Rosett Flex system features lightweight aluminum decking (~7.5 kg/m), enabling approximately 22% lower transport weight than comparable steel scaffolding, while maintaining Load Class 5 strength. Its modular grid design and tool-free connections support fast, flexible assembly in complex construction environments.

Increased Rental Adoption Among Small and Medium Contractors

Cost-conscious construction firms are moving toward renting rather than owning scaffolding equipment. This approach minimizes capital investment and maintenance burden. The Europe Suspended Scaffolding Market reflects this preference, with rental services expanding rapidly across regions. Specialized providers offer tailored rental packages, including setup and dismantling services. Contractors gain flexibility in matching scaffolding size to project scope. Rental access supports short-term renovation or façade cleaning projects. It also allows smaller firms to meet regulatory safety requirements without heavy upfront costs. This trend will shape business models in the market.

Integration of IoT and Automation in Scaffolding Systems

The adoption of smart technologies is transforming scaffolding into data-driven systems that support real-time monitoring. The Europe Suspended Scaffolding Market is embracing IoT-enabled platforms that monitor load capacity, positioning, and environmental conditions. These systems enhance worker safety and operational control. Automated winch systems allow remote lifting and lowering of platforms. Site supervisors use dashboards to track performance and prevent misuse. Smart integration helps meet EU safety compliance while boosting productivity. This trend is gradually becoming a standard in large-scale construction projects. It reflects a broader push toward digital transformation.

Growing Demand for Customizable Modular Scaffolding Platforms

Construction firms increasingly demand modular solutions that adapt to complex building geometries and variable working heights. The Europe Suspended Scaffolding Market is responding with customizable units that offer high configurability. These modular systems reduce assembly time and enable on-site adjustments. Demand is rising in sectors such as shipbuilding, stadium construction, and bridge maintenance. Suppliers offer interchangeable components and tool-free locking systems. Modular flexibility also allows easier transportation and storage. This trend supports lean construction practices and tight project deadlines. The market will continue to innovate in this direction.

- For example, Doka introduced its Ringlock modular scaffolding system, featuring galvanized steel components that assemble via hammer-only wedge-head connectors for efficient and bolt-free deployment. It supports high load capacities and adapts to irregular structures and tight site geometries, making it well suited for infrastructure, rebar, facade, and suspended scaffolding applications.

Market Challenges Analysis:

Complex Safety Compliance and Certification Requirements Across Countries

Navigating the fragmented safety regulations across European countries poses a challenge for suspended scaffolding providers. Different nations enforce varying certification standards and worker safety protocols. The Europe Suspended Scaffolding Market must address these regulatory discrepancies while ensuring product standardization. Manufacturers face delays in market entry due to prolonged approval timelines. It requires investment in compliance teams and localized certification processes. These complexities increase operational costs and extend go-to-market durations. Smaller firms struggle to scale across multiple countries under these conditions. Harmonizing standards remains difficult under current legal structures.

High Initial Investment and Maintenance Costs for Advanced Systems

Although modern suspended scaffolding systems offer safety and efficiency, they often come with high upfront costs. The Europe Suspended Scaffolding Market sees price sensitivity among smaller contractors and firms operating on limited budgets. Initial acquisition of motorized and sensor-enabled platforms demands substantial capital. Maintenance of these systems also adds recurring expenses. Some projects prefer basic, manually operated alternatives despite regulatory incentives. Financial constraints limit adoption across certain market segments. Cost-related challenges slow down modernization of scaffolding practices in low-margin construction zones. Market penetration remains uneven due to economic disparity.

Market Opportunities:

Expansion in Renewable Energy Infrastructure Projects and Offshore Installations

Rising investments in wind farms and solar energy projects across Europe are opening new application areas. Suspended scaffolding platforms serve installation and maintenance needs on offshore wind turbines and tall energy structures. The Europe Suspended Scaffolding Market can tap into this sector by offering corrosion-resistant and high-load-bearing systems. Vendors have opportunities to create energy-specific solutions that meet operational risks in marine environments. Growth in this niche can expand revenue sources for manufacturers. It also encourages collaborations with energy developers and EPC contractors across Europe.

Growing Demand for Scaffolding in Vertical Farming and Industrial Maintenance

Innovative use cases such as indoor vertical farming and complex industrial facility maintenance are creating fresh demand. The Europe Suspended Scaffolding Market can expand into these sectors by supplying compact, adjustable, and low-footprint systems. These applications require flexible platforms for access in constrained environments. Market players can differentiate by offering compact modular products tailored to these needs. This emerging demand represents a diversification opportunity beyond traditional construction markets. Vendors can leverage these segments for higher-margin contracts and specialized service offerings.

Market Segmentation Analysis:

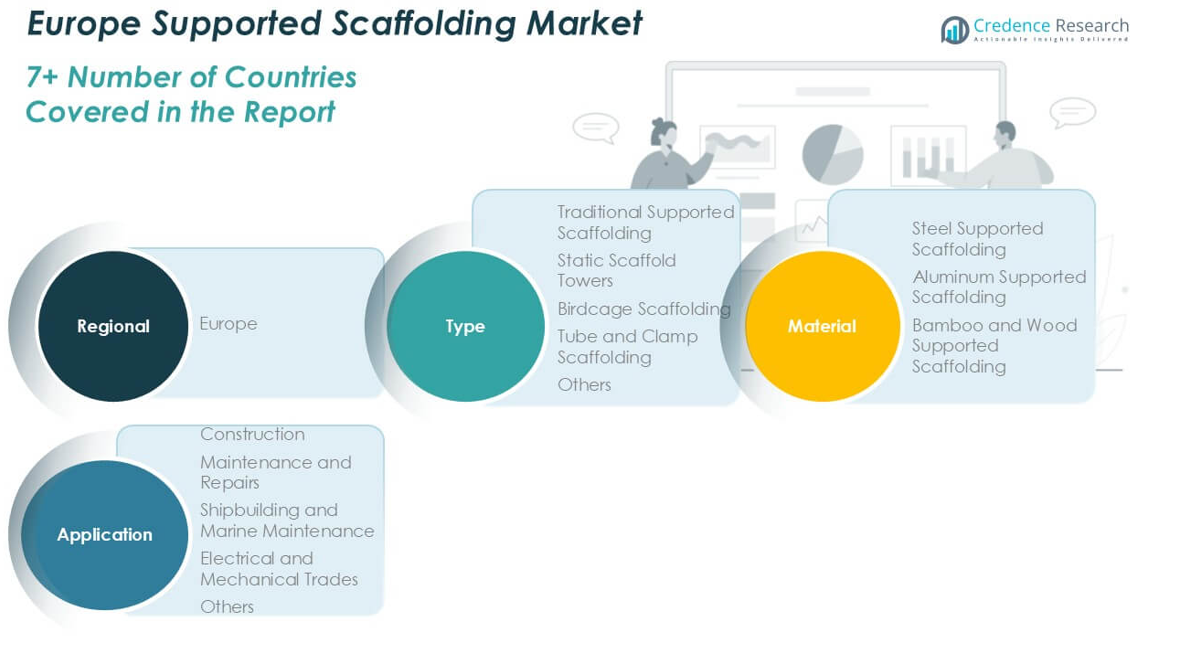

The Europe Suspended Scaffolding Market is segmented

By suspension type into fixed suspension and suspended suspension. Suspended suspension leads the segment due to its flexibility and widespread application in high-rise construction and restoration projects. Fixed suspension is used in stable and repetitive applications where structural integration is viable.

- For instance, BrandSafway’s QuikDeck® system supports live load capacities up to 75 psf (~366 kg/m²) depending on configuration and suspender spacing. Its modular, tool-free assembly makes it a preferred solution for bridge and industrial maintenance, providing quick setup and safe, stable access work on complex structures

By material, the market is divided into steel and aluminum. Steel scaffolding holds a significant share due to its durability and high load capacity. However, aluminum is gaining traction for its lightweight nature, ease of transport, and corrosion resistance, making it ideal for maintenance and renovation projects.

- For example, KOMPLET Suspended Scaffolding by Accesus uses aluminum modules to create platforms from 2m up to 15m long, with a maximum capacity of 1,180kg (approx. 2,600lbs). This system is lightweight and easy to transport.

By capacity, the market is categorized into light duty (up to 1,000 lbs), medium duty (1,000–2,000 lbs), and heavy duty (over 2,000 lbs). Medium duty scaffolding dominates due to its versatility across construction and industrial applications. Light duty platforms are preferred for inspections and low-impact maintenance, while heavy duty systems are deployed in large-scale industrial and infrastructure projects.

By end use, the market includes construction, maintenance, inspection, and others. Construction leads the segment owing to increased high-rise developments and commercial infrastructure upgrades. Maintenance activities drive steady demand across residential and public assets. Inspection-based applications require lightweight and easily maneuverable scaffolding, supporting the use of modular platforms. The “others” category includes niche applications like event setups and specialized industrial uses, contributing to market diversity. The segment distribution reflects the broad application scope of suspended scaffolding systems across evolving urban and industrial landscapes.

Segmentation:

By Suspension Type:

- Fixed Suspension

- Suspended Suspension

By Material:

By Capacity:

- Light Duty (Up to 1,000 lbs)

- Medium Duty (1,000–2,000 lbs)

- Heavy Duty (Over 2,000 lbs)

By End Use:

- Construction

- Maintenance

- Inspection

- Others

By Region:

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Russia

- Rest of Europe

Regional Analysis:

Western Europe holds the largest share of the Europe Suspended Scaffolding Market, accounting for 42% of the regional market. Countries like Germany, France, and the United Kingdom drive growth due to their advanced construction sectors and frequent refurbishment of aging infrastructure. High demand for safe, efficient scaffolding systems in commercial real estate and public infrastructure upgrades sustains this dominance. Government mandates on worker safety and energy-efficient retrofits further accelerate product adoption. The market benefits from strong supplier networks and early adoption of automation. It remains a hub for product innovation and large-scale application.

Northern and Southern Europe collectively represent around 34% of the Europe Suspended Scaffolding Market. In Northern Europe, countries such as Sweden and Denmark show rising demand due to high-rise construction, sustainable building practices, and urban development. Southern Europe, including Italy and Spain, is recovering from past economic slowdowns with increased investment in tourism infrastructure, restoration projects, and urban renewal. These regions rely on flexible and modular scaffolding platforms suited to diverse building structures. Regulatory alignment with EU safety norms supports market development. Construction firms in these regions increasingly prioritize efficiency and safety.

Eastern Europe accounts for 24% of the Europe Suspended Scaffolding Market and represents a high-growth region. Countries such as Poland, Romania, and the Czech Republic are experiencing industrial expansion, modernization of transport infrastructure, and growing urbanization. EU funding and foreign investment in infrastructure projects support demand for advanced scaffolding systems. The market is gradually shifting from traditional scaffolding to suspended platforms due to cost efficiency and reduced labor requirements. Awareness of safety standards is improving, creating opportunities for international players. It stands as a promising region for long-term market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Layher Ltd

- PERI Group

- GBM

- ADTO Industrial Group

- Altrad Group

- ULMA Group

- Aluminium Scaffold Towers Limited

- Euroscaffold Nederland

- MJ-Gerüst GmbH

- Waco Scaffolding and Equipment Company

Competitive Analysis:

The Europe Suspended Scaffolding Market features a competitive landscape with a mix of established global players and regional providers. Key companies include Altrex, FIXATOR, Tractel, Bee Access, and GEDA GmbH, each offering differentiated products tailored to various construction and industrial applications. Firms compete on parameters such as platform safety, material innovation, automation integration, and service contracts. Strategic partnerships with construction companies and rental service providers enhance market positioning. Manufacturers actively invest in R&D to meet evolving EU safety standards and environmental regulations. Pricing pressure persists due to the growing rental model and demand for cost-effective solutions. The market remains dynamic with frequent product upgrades and regional expansions.

Recent Developments:

- In March 2025, Layher Ltd genuinely launched a new era of scaffolding solutions at Bauma 2025, including innovations in safety, digitalization, modular spans, and sustainability—all supported by an official press article from Scaffmag. This includes the debut of their rebranded visual identity, CO₂-reduced decks, updates to the SoloTower and SIM2Field tools for smarter site planning, and several new scaffolding system components.

- In May 2025, the PERI Group’s affiliated company, Perion Network Ltd., officially acquired Greenbids, an advanced AI platform for digital campaign optimization, as covered in an official BusinessWire press release. The acquisition aims to enhance the company’s market position and digital capabilities globally, positioning PERI for further expansion and innovation.

Market Concentration & Characteristics:

The Europe Suspended Scaffolding Market demonstrates moderate concentration, with a few dominant players controlling significant market share. It is characterized by strong regulatory influence, technological advancement, and a growing preference for modular, lightweight systems. The market emphasizes safety compliance and equipment reliability. Rental models are gaining traction across small to medium contractors. Demand is largely project-driven and varies with public infrastructure cycles and urban development. Customization, quick installation, and low maintenance are essential buyer considerations. Competitive differentiation hinges on innovation and regional service capabilities.

Report Coverage:

The research report offers an in-depth analysis based on Suspension Type, Material, Capacity and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Europe Suspended Scaffolding Market is expected to witness steady growth driven by the continued expansion of commercial construction across major urban centers.

- Adoption of advanced safety technologies such as automated hoists and load monitoring systems will increase across high-rise and industrial projects.

- Rising demand for façade maintenance and retrofit initiatives will sustain long-term use of suspended scaffolding in both public and private sectors.

- Technological integration, including IoT and remote control features, will become a core differentiator among leading manufacturers.

- Growth in offshore infrastructure and renewable energy installations will create new use cases for corrosion-resistant suspended scaffolding systems.

- Market participants will expand rental services to support growing demand from cost-sensitive contractors and short-duration projects.

- Customizable modular platforms will gain traction due to their adaptability in complex architectural environments and time-sensitive applications.

- Regional expansion by international players into emerging Eastern European markets will intensify competitive dynamics.

- Stricter regulatory enforcement around worker safety and structural compliance will drive investments in certified scaffolding systems.

- Collaboration between OEMs and construction technology firms will foster innovation in product design and deployment efficiency.