Market Overview:

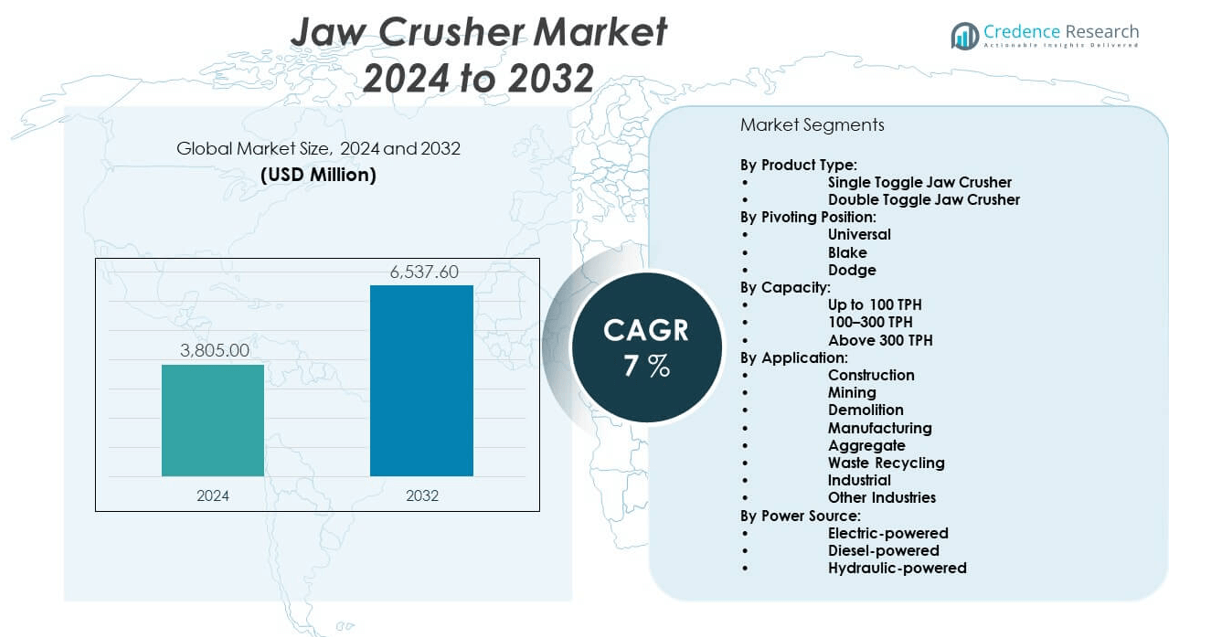

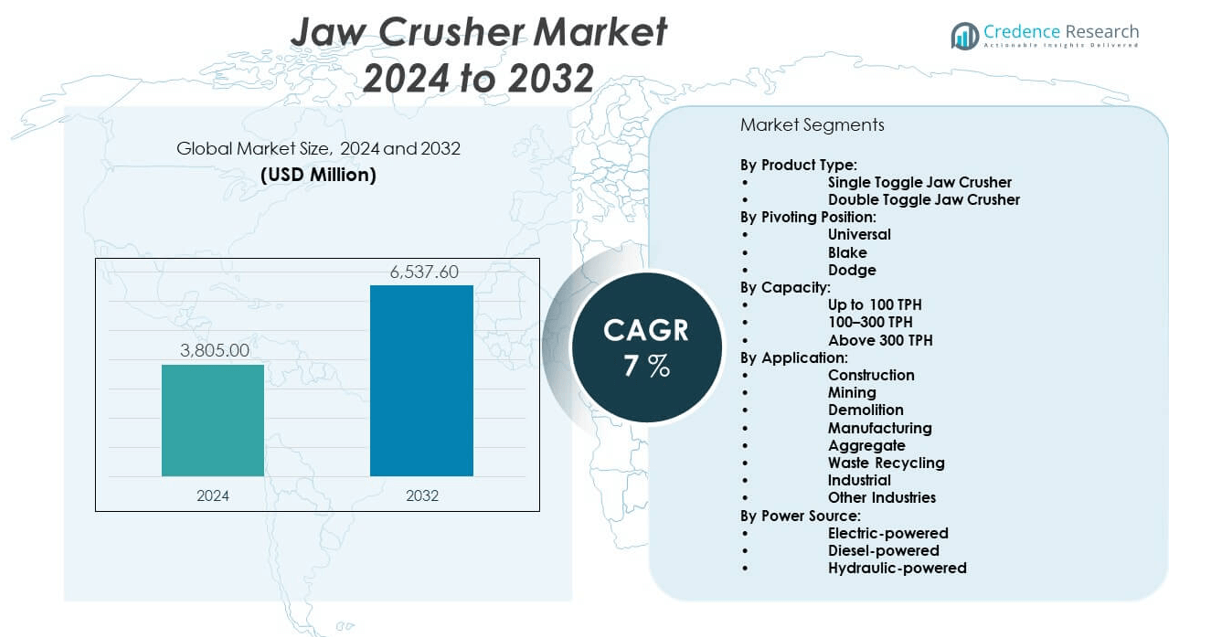

The Jaw crusher market is projected to grow from USD 3,805 million in 2024 to an estimated USD 6,537.6 million by 2032, with a compound annual growth rate (CAGR) of 7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Jaw Crusher Market Size 2024 |

USD 3,805 million |

| Jaw Crusher Market, CAGR |

7% |

| Jaw Crusher Market Size 2032 |

USD 6,537.6 million |

The jaw crusher market is expanding due to the rising demand for efficient and durable crushing equipment across mining, construction, and demolition industries. Increasing infrastructure development projects, particularly in emerging economies, drive the need for raw material processing. Manufacturers are innovating to offer high-capacity, energy-efficient, and low-maintenance crushers that meet stringent environmental regulations. Urbanization, industrialization, and the need for cost-effective aggregate production continue to propel market adoption globally.

Asia-Pacific dominates the jaw crusher market, led by countries like China and India, where rapid urban expansion and infrastructure investments create high demand. North America and Europe follow with consistent growth, backed by modernization of construction practices and steady mining operations. Latin America and Africa are emerging regions, driven by mining exploration, economic development, and government-supported infrastructure projects. These geographies benefit from abundant mineral reserves and increasing construction activities, positioning them as key growth areas for jaw crusher adoption.

Market Insights:

- The Jaw crusher market was valued at USD 3,805 million in 2024 and is projected to reach USD 6,537.6 million by 2032, growing at a CAGR of 7% during the forecast period.

- Rising infrastructure development, mining expansion, and demolition activities are major drivers boosting demand for jaw crushers globally.

- Growing preference for mobile and energy-efficient crushers supports product innovation and wider adoption across construction and quarrying sectors.

- High capital investment and maintenance costs remain key restraints, especially for small and medium-sized enterprises.

- Supply chain disruptions and a shortage of skilled labor affect timely equipment availability and servicing in several regions.

- Asia-Pacific dominates the market with a 3% share, led by China, India, and Southeast Asia due to strong infrastructure and mining growth.

- North America and Europe follow, driven by modernization of industrial equipment and rising emphasis on environmentally compliant crushing systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Infrastructure Growth and Industrial Expansion Amplify Equipment Demand:

The Jaw crusher market benefits from rising global investments in large-scale infrastructure and industrial development. Governments prioritize construction of highways, railways, and airports, which accelerates demand for aggregates. Mining and quarrying sectors require robust crushing equipment to process materials for cement and concrete. The increase in urban population leads to more construction activity, further driving equipment needs. Manufacturers respond with durable and high-output jaw crushers to meet industrial performance standards. It supports efficient material handling across construction and mining applications. Energy efficiency and automation in machines enhance their appeal in cost-sensitive sectors. The Jaw crusher market gains momentum as project volumes continue to grow.

- For instance, Metso Corporation’s Nordberg® C Series jaw crushers, widely used in the construction and mining sectors, offer feed openings up to 1200 mm and throughput capacities of up to 7,500 metric tons per hour (MTPH) in their MKIII 54-75 models, powered by an 800-hp motor. These crushers incorporate automation systems like VisioRock® for real-time feed-size monitoring, achieving up to 30% more capacity with significantly lower energy consumption while maintaining robustness for industrial demands

Growing Mineral Exploration and Mining Activities Drive Equipment Adoption:

The rise in global mineral exploration projects fuels demand for reliable rock-crushing systems. The Jaw crusher market leverages this growth by providing machinery suited for hard rock and ore crushing. Governments in developing regions grant more licenses to tap into untapped mineral reserves. Mining companies prefer jaw crushers for primary crushing due to their high crushing ratios and low operational costs. It ensures consistency in output, which is vital for downstream processing. The shift to deeper and more complex mining sites intensifies the need for advanced crushing solutions. Safety requirements and operational efficiency further increase equipment specifications. This environment sustains long-term demand for heavy-duty jaw crushers.

- For instance, Sandvik AB’s acquisition of the Schenck Process Group mining segment supports the integration of enhanced crushing solutions with engineered components that improve throughput and wear resistance essential for mineral processing, though specific numerical metrics for crushers were not disclosed recently, the firm is known for delivering crushers with capacities surpassing 1000 tons per hour aimed at complex ore bodies.

Rapid Urbanization and Commercial Construction Drive Product Utilization:

Urban development projects contribute significantly to the expansion of the Jaw crusher market. Cities continue to expand outward and upward, requiring demolition and reconstruction of aging infrastructure. This creates steady demand for equipment that supports efficient material recycling. Jaw crushers enable onsite crushing of concrete and stone debris, reducing transportation and disposal costs. It promotes sustainability and helps meet modern construction norms. Real estate and commercial sectors invest in high-rise buildings and shopping complexes, which increases aggregate requirements. Contractors prioritize portable and mobile jaw crushers for flexible deployment. The growing construction volume worldwide keeps jaw crushers relevant in project planning.

Regulatory Compliance and Environmental Considerations Influence Market Expansion:

The Jaw crusher market aligns with evolving regulatory frameworks targeting environmental protection. Governments impose strict emissions and noise control regulations on construction equipment. Manufacturers develop crushers that operate within permissible noise and dust levels. It integrates advanced filtration systems and energy-efficient motors to meet environmental standards. The shift toward sustainable development encourages adoption of low-emission and recyclable equipment. Construction firms seek compliance-ready machinery to avoid legal penalties and improve public image. The push for greener operations creates demand for smart, low-impact crushing systems. These regulatory forces shape product innovation and market penetration strategies across regions.

Market Trends:

Adoption of Mobile and Portable Jaw Crushers for Onsite Efficiency:

A notable trend in the Jaw crusher market is the shift toward mobile and portable crushing units. Contractors and construction firms prioritize mobility to reduce setup times and minimize transport costs. Compact jaw crushers offer ease of movement between job sites without sacrificing crushing power. It enhances productivity by allowing onsite processing of demolition waste and raw aggregates. The rising use of mobile crushers in remote and rugged terrains highlights their operational flexibility. Rental models for portable crushers are also gaining traction among SMEs. Manufacturers expand their product lines with trailer-mounted and skid-mounted variants. The mobility trend caters to dynamic project needs in evolving construction environments.

- For instance, Metso’s Lokotrack® LT120™ mobile jaw crusher offers a flexible solution designed for primary crushing with feed openings optimized for aggregate production, capable of handling large feed sizes and integrating easily into multi-stage processes, designed for quick setup and breakdown enabling two working days assembly on average, thus enhancing onsite operational efficiency

Integration of Automation and Digital Monitoring for Operational Control:

Automation plays a growing role in the evolution of the Jaw crusher market. Smart systems now enable remote monitoring of machine health, performance metrics, and maintenance schedules. It reduces downtime and improves safety by alerting operators to faults in real-time. Integration of digital control panels, IoT sensors, and AI-based diagnostics improves equipment efficiency. Data-driven decision-making helps operators optimize throughput and reduce wear and tear. Manufacturers invest in R&D to offer crushers with intelligent feedback systems. These solutions are especially valuable in large-scale mining and industrial operations. The push for automation strengthens as industries modernize their equipment ecosystems.

- For instance, Metso’s Remote IC app, launched in 2024, offers connected remote monitoring and control of Lokotrack crushers and screens, providing operators with real-time data on machine status, predictive maintenance alerts, and performance optimization tools from mobile devices, reducing unplanned downtime and optimizing operational continuity.

Use of Wear-Resistant Materials and Component Enhancements:

Another trend influencing the Jaw crusher market is the incorporation of advanced materials in component design. High manganese steel, abrasion-resistant alloys, and composite materials extend machine life. It reduces the frequency of replacements, lowering operational costs for end users. The focus is on longer-lasting jaw plates, side liners, and bearings to improve crushing durability. Enhancements in hydraulic systems and lubrication also contribute to performance. OEMs differentiate their offerings with material-grade customization based on application needs. These innovations improve reliability in harsh environments, including mining and demolition. Wear-resistant materials support the demand for rugged, low-maintenance crushing systems.

Strategic Collaborations and Aftermarket Service Expansion:

Strategic partnerships and extended service networks are shaping the Jaw crusher market landscape. Manufacturers collaborate with distributors to expand reach and enhance support capabilities. It improves customer satisfaction through localized service, parts availability, and training programs. Aftermarket services, including equipment refurbishment and predictive maintenance, generate recurring revenue. Global brands enter joint ventures to co-develop region-specific solutions and improve brand presence. Companies invest in digital platforms to streamline support, diagnostics, and spare part ordering. These strategies build long-term relationships and increase machine lifecycle value. The trend strengthens as customers demand not just equipment, but full-service reliability.

Market Challenges Analysis:

High Capital Investment and Maintenance Costs Limit Market Penetration:

The Jaw crusher market faces challenges related to the high initial cost of equipment and ongoing maintenance expenses. Small and medium-sized enterprises often lack the financial flexibility to invest in high-performance machines. It becomes harder to justify capital outlays in cost-sensitive or short-duration projects. Operational costs, including wear part replacement, energy consumption, and service downtime, impact profitability. Equipment failure due to improper use or lack of skilled labor further increases expenses. Financing options and leasing models are limited in some regions, restricting access to advanced crushers. Buyers may settle for less efficient alternatives due to budget constraints. This cost barrier hinders rapid market penetration among smaller players and new entrants.

Supply Chain Disruptions and Skilled Labor Shortages Hinder Operations:

Global supply chain disruptions present another challenge for the Jaw crusher market. Component shortages, transportation delays, and raw material price volatility affect production timelines. It results in extended lead times and cost overruns, impacting both manufacturers and end users. In parallel, the industry experiences a shortage of skilled technicians and operators. Training requirements for new, digitally enabled crushers are higher than traditional models. The lack of qualified service personnel delays maintenance and reduces equipment uptime. Regional disparities in workforce development and logistics infrastructure compound the issue. These factors introduce uncertainty in delivery, deployment, and support of jaw crushers in growing markets.

Market Opportunities:

Expansion in Emerging Economies and Infrastructure Development Initiatives:

The Jaw crusher market finds strong growth potential in emerging economies where urbanization and infrastructure spending remain high. Governments launch large-scale transportation and housing projects that require extensive aggregate production. It creates opportunities for localized manufacturing, rental fleets, and customized product lines. Strategic expansion into countries with rich mineral reserves also unlocks mining sector demand. Regional players can capitalize by offering cost-effective and energy-efficient equipment tailored to local needs. These markets present untapped potential for manufacturers seeking growth beyond saturated regions.

Recycling and Sustainable Construction Practices Create New Use Cases:

Recycling in construction and demolition generates fresh demand in the Jaw crusher market. Onsite crushing of old concrete and building materials reduces landfill use and transportation emissions. It supports sustainability goals and aligns with green building standards. Municipalities and contractors increasingly adopt jaw crushers to process recyclable debris. Product designs that emphasize noise reduction, dust suppression, and fuel efficiency appeal to eco-conscious buyers. This segment creates long-term opportunity for crushers that deliver both performance and environmental compliance.

Market Segmentation Analysis:

By Product Type

The Jaw crusher market is segmented into single toggle and double toggle crushers. Single toggle crushers dominate due to their simple design, lower maintenance, and widespread use in primary crushing operations. Double toggle crushers offer enhanced force and durability, making them suitable for heavy-duty applications in mining and quarrying.

- For example, single toggle models like Metso’s C Series crushers emphasize ease of maintenance with features such as hydraulic shell separation and top-size-in designs allowing feed sizes up to 41 inches, optimized for energy efficiency and throughput, while double toggle designs typically handle tougher crushing conditions requiring more robust components.

By Pivoting Position

This segment includes Blake, Dodge, and Universal types. Blake crushers lead the segment, favored for their high capacity and consistent output in large-scale operations. Universal crushers offer versatility in feed and discharge, while Dodge crushers, though less common, are used in specific controlled-size output applications.

By Capacity

Crushers with 100–300 TPH capacity hold the largest market share, meeting the requirements of mid-sized infrastructure and mining projects. Above 300 TPH units are used in high-volume aggregate and mineral processing. Equipment under 100 TPH is primarily used in small-scale operations and laboratory settings.

By Application/End-User Industry

The Jaw crusher market sees highest demand from mining and construction sectors due to ongoing infrastructure and extraction activities. Aggregate, demolition, and waste recycling industries follow closely. Emerging applications include manufacturing and processing industries such as chemicals, food, and pharmaceuticals.

By Power Source

Electric-powered crushers dominate, driven by operational efficiency and reduced emissions in fixed installations. Diesel-powered crushers are preferred for field mobility and off-grid use. Hydraulic-powered variants serve high-precision or high-pressure crushing needs in specific industrial environments.

Segmentation:

By Product Type:

- Single Toggle Jaw Crusher

- Double Toggle Jaw Crusher

By Pivoting Position:

By Capacity:

- Up to 100 TPH

- 100–300 TPH

- Above 300 TPH

By Application:

- Construction

- Mining

- Demolition

- Manufacturing

- Aggregate

- Waste Recycling

- Industrial

- Other Industries

By Power Source:

- Electric-powered

- Diesel-powered

- Hydraulic-powered

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific: Leading with Infrastructure and Mining Demand (42.3%)

Asia-Pacific holds the largest share in the jaw crusher market, accounting for approximately 42.3% of global revenue. The region’s dominance is driven by rapid urbanization, extensive infrastructure projects, and the presence of major mining operations in China, India, and Australia. Government investments in roads, railways, housing, and energy sectors fuel consistent demand for crushing equipment. China leads in both production and consumption, supported by its large-scale construction and mineral processing activities. India follows with growing quarrying and cement industries, while Southeast Asian countries expand their construction and mining footprints. It benefits from cost-effective manufacturing and a strong distribution base across key countries.

North America: Mature Market with Steady Industrial Demand (24.7%)

North America contributes around 24.7% to the global jaw crusher market, driven by robust construction, aggregate production, and industrial recycling sectors. The United States dominates the regional market with stable demand from road construction, commercial infrastructure, and mining. Equipment replacement cycles and technological upgrades support continued investment in advanced, energy-efficient crushers. Canada contributes through mineral exploration and infrastructure development in remote regions. The presence of established manufacturers and rental equipment providers strengthens market penetration. It reflects a mature but active market, focused on high-capacity, compliant, and automated crushing systems.

Europe and LAMEA: Diversified Growth with Industrial and Mining Expansion (Europe: 18.5%, LAMEA: 14.5%)

Europe holds a 18.5% share of the jaw crusher market, supported by ongoing renovation projects, waste recycling regulations, and investments in sustainable construction. Germany, the UK, and France lead demand through advanced infrastructure and manufacturing sectors. LAMEA (Latin America, Middle East, and Africa) accounts for 14.5%, driven by expanding mining exploration, especially in Brazil, Chile, South Africa, and parts of the Middle East. Increasing urbanization and infrastructure development in these regions create favorable conditions for crusher deployment. It benefits from rising foreign direct investments, raw material demand, and untapped resource potential, although supply chain limitations and political risk remain challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Metso Corporation

- Sandvik AB

- Thyssenkrupp AG

- Komatsu Ltd.

- Astec Industries, Inc.

- Terex Corporation

- Weir Group

- Wirtgen Group

- FLSmidth A/S

- McLanahan Corporation

Competitive Analysis:

The Jaw crusher market is highly competitive, with key players focusing on product innovation, global expansion, and strategic collaborations. Major companies such as Metso Corporation, Sandvik AB, Thyssenkrupp AG, and Komatsu Ltd. dominate due to their strong technical expertise and extensive distribution networks. These firms emphasize advanced automation, fuel efficiency, and modular designs to meet industry-specific demands. Mid-sized players target niche applications and regional markets with cost-effective solutions. The market sees a blend of established global manufacturers and emerging local players, creating pricing pressure and constant innovation. It drives competition through continuous R&D and aftersales service differentiation.

Recent Developments:

- In July 2025, Metso Corporation reinforced its position in the jaw crusher market by continuing to offer its flagship Nordberg® C Series primary jaw crushers, including the C106, C117, and C120 models. These crushers are designed with core principles of sustainability and environmental compliance, catering to the strong demand in construction, infrastructure, and mining sectors, particularly in India. Metso’s facility in Alwar, Rajasthan, manufactures these models to ensure local support and faster deliveries, meeting diverse operational needs with energy-efficient, dust and noise reduction technologies integrated into the equipment.

Market Concentration & Characteristics:

The Jaw crusher market is moderately concentrated, with a few global manufacturers holding significant share due to brand recognition, product range, and distribution scale. It features both capital-intensive multinational companies and agile regional players. High entry barriers exist due to technological complexity, regulatory compliance, and investment in production facilities. The market prioritizes durability, energy efficiency, and customization. Product differentiation often centers around automation, mobility, and environmental performance. It remains driven by project-based procurement, long product lifecycles, and strong aftermarket service requirements.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Pivoting Position, Capacity, Application/End-User Industry, Power Source, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growth will be driven by infrastructure development in emerging markets.

- Mining expansion will sustain long-term demand for heavy-duty jaw crushers.

- Mobile and portable variants will gain popularity in field-based applications.

- Automation and remote monitoring will become standard features in new models.

- Product innovations will focus on energy efficiency and environmental compliance.

- Asia-Pacific will continue to dominate global demand due to construction activity.

- Waste recycling and demolition sectors will generate new market opportunities.

- Equipment leasing and rental will rise among small and mid-sized contractors.

- Digital aftermarket services will differentiate key players and boost revenue.

- Regulatory frameworks will shape product design and localization strategies.