Market Overview

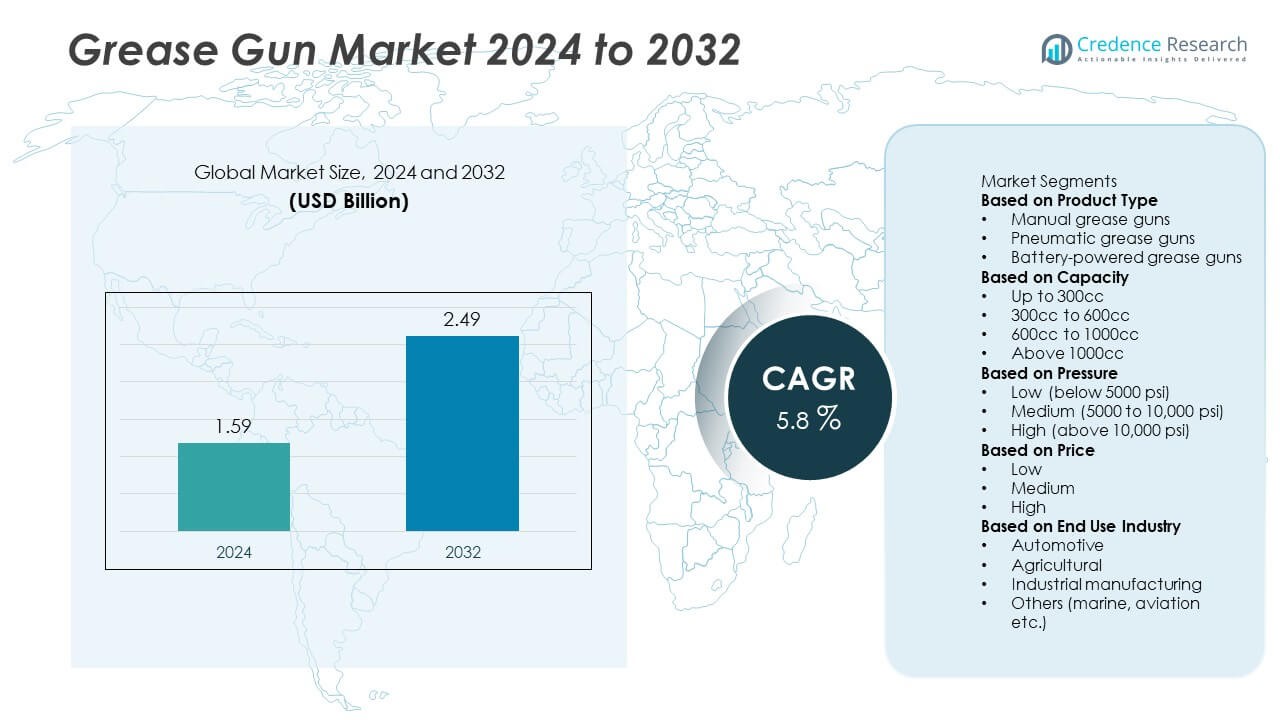

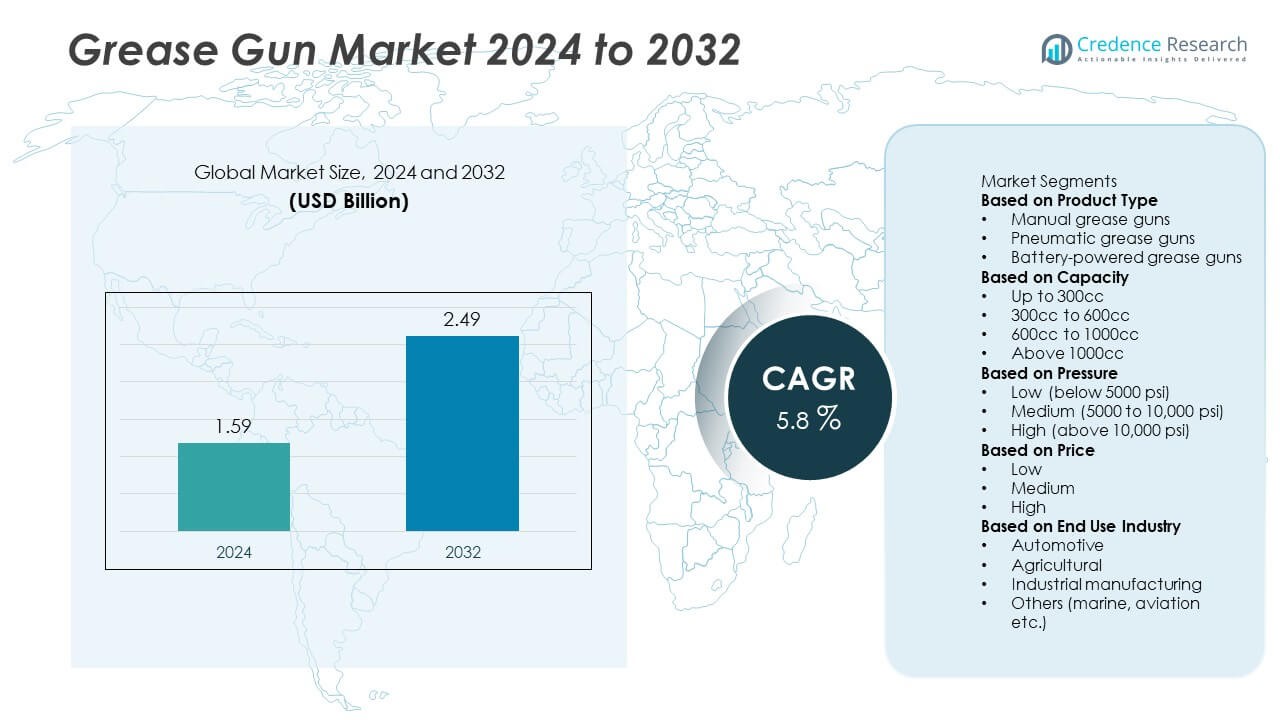

The Grease Gun Market was valued at USD 1.59 billion in 2024 and is projected to reach USD 2.49 billion by 2032, registering a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Grease Gun Market Size 2024 |

USD 1.59 Billion |

| Grease Gun Market, CAGR |

5.8% |

| Grease Gun Market Size 2032 |

USD 2.49 Billion |

The grease gun market is led by major companies including CRC Industries, Macnaught, Milwaukee Tool, Hiwin, SAE Products, Hopkins, Groz Tools, Anti-Seize Technology, Kinequip, and Chicago Pneumatic. These manufacturers emphasize performance, durability, and innovation through battery-powered and pneumatic product advancements. North America dominated the global market with a 38% share in 2024, driven by strong industrial maintenance practices and advanced lubrication systems. Europe followed with 29%, supported by strict equipment maintenance standards and widespread use in automotive and manufacturing sectors. Asia-Pacific accounted for 25%, emerging as the fastest-growing region due to industrial expansion and increased adoption of mid-capacity grease guns across heavy machinery applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The grease gun market was valued at USD 1.59 billion in 2024 and is projected to reach USD 2.49 billion by 2032, growing at a CAGR of 5.8%.

- Growth is driven by increasing demand for efficient lubrication tools in automotive, industrial, and construction applications, supported by rising preventive maintenance adoption.

- Battery-powered and smart grease guns are gaining traction due to portability, precision, and reduced manual effort across workshops and production facilities.

- Key players such as CRC Industries, Milwaukee Tool, Macnaught, and Groz Tools focus on innovation, digital integration, and expanding service networks to strengthen global presence.

- North America led with 38% market share in 2024, followed by Europe with 29% and Asia-Pacific with 25%, while manual grease guns held a dominant 52% share among product types, supported by affordability and widespread industrial usage.

Market Segmentation Analysis:

By Product Type

Manual grease guns dominated the market with a 52% share in 2024. Their affordability, ease of use, and suitability for small-scale maintenance tasks make them the preferred choice in automotive workshops and agricultural equipment servicing. Pneumatic and battery-powered types are gaining momentum due to faster lubrication and reduced operator fatigue. Increasing use of cordless grease guns in industrial maintenance, driven by efficiency and mobility, is expected to accelerate segment growth. Brands such as Milwaukee Tool and Lincoln Industrial focus on battery-powered innovations to improve pressure output and precision.

- For instance, Milwaukee Tool’s M18 cordless grease gun delivers up to 10,000 PSI operating pressure and dispenses up to 10 ounces per minute, powered by an 18V lithium-ion battery. With an extended capacity 5.0 Ah battery, the unit supports a runtime of up to 10 standard cartridges per charge, enhancing productivity in heavy-duty lubrication tasks across industrial facilities.

By Capacity

The 300cc to 600cc capacity segment held the largest share of 46% in 2024. This range offers optimal grease volume for moderate to heavy machinery maintenance, balancing portability and refill frequency. It is widely used across automotive, construction, and manufacturing applications. Smaller capacities up to 300cc serve compact tools, while above 1000cc are used for heavy-duty equipment. Rising adoption of mid-capacity models by OEMs for assembly line lubrication strengthens this segment. Growing industrial automation continues to drive consistent demand for mid-capacity grease guns globally.

- For instance, Macnaught’s K32 Flexigun series features a 400g grease capacity and delivers up to 10,000 PSI discharge pressure per cycle. The model includes a flexible high-pressure hose, and its pistol-grip design allows for one-handed operation. This makes it ideal for machinery lubrication in confined industrial environments.

By Pressure

Medium-pressure grease guns, operating between 5,000 and 10,000 psi, accounted for a 49% market share in 2024. These models provide sufficient force for effective lubrication in automotive, mining, and heavy machinery sectors. Their versatility across both manual and powered types drives widespread adoption. High-pressure units above 10,000 psi are gaining traction in specialized applications requiring deep penetration and precise lubrication. Increasing investment in industrial maintenance and the expansion of manufacturing facilities sustain growth across all pressure ranges.

Key Growth Drivers

Industrial Equipment Maintenance Expansion

The growing need for efficient lubrication in industrial machinery is a major driver of the grease gun market. Regular maintenance extends equipment life, prevents mechanical failures, and ensures smooth operations in manufacturing and construction. Increasing investments in industrial automation and heavy equipment upkeep are boosting demand for high-performance lubrication tools. This trend is supported by the rise of preventive maintenance programs across plants and workshops, where grease guns play a critical role in enhancing productivity and reducing operational downtime.

- For instance, Groz Tools manufactures heavy-duty manual grease guns rated for up to 10,000 PSI and air-operated grease guns that can develop up to 6,000 PSI. Their air-operated models, which can deliver a continuous flow of grease, and their manual models, which provide a precise discharge per stroke, are both used in industrial and factory maintenance for lubricating conveyor bearings, hydraulic fittings, and other machinery.

Rising Automotive Production and Aftermarket Services

Expanding global automotive manufacturing and growing vehicle maintenance demand are fueling market growth. Grease guns are essential for lubricating components such as joints, bearings, and suspension parts. Automotive workshops and service centers rely heavily on both manual and powered grease guns to ensure precision lubrication. The surge in electric vehicle production also contributes, as OEMs adopt advanced lubrication systems to improve assembly efficiency and mechanical reliability across diverse vehicle models.

- For instance, Chicago Pneumatic developed its CP9886 pneumatic riveter for automotive assembly and service operations. This blind riveter offers a pulling force of up to 12.6 kN (2,833 lbf) and can be used for rivets ranging from 3.2 mm to 5.0 mm. It has a compact and ergonomic design with a composite handle and operates with low vibration.

Technological Advancements in Lubrication Tools

Innovations in battery-powered and pneumatic grease guns are reshaping the market landscape. Enhanced portability, ergonomic designs, and precision control features have increased adoption across industrial and commercial sectors. Manufacturers such as Lincoln Industrial and Dewalt are focusing on smart lubrication systems with digital pressure indicators and automated grease flow control. These innovations reduce human error, optimize grease usage, and improve maintenance accuracy, driving replacement demand for older manual systems across high-volume industries.

Key Trends & Opportunities

Shift Toward Cordless and Smart Lubrication Systems

The market is witnessing a growing shift toward battery-powered and connected grease guns. Cordless models offer convenience and mobility in confined spaces, while smart variants provide real-time pressure monitoring. Integration of IoT-enabled systems for predictive maintenance is also gaining traction. Companies are developing rechargeable grease guns with longer runtimes and faster discharge rates to support industrial uptime and operator efficiency. These technological shifts open new opportunities in automotive and heavy equipment sectors.

- For instance, DeWalt introduced its DCGG571M1 cordless grease gun equipped with a 20V MAX* lithium-ion battery, capable of delivering up to 10,000 PSI operating pressure. The model provides a 42-inch flexible hose for extended reach and can dispense up to 16 grease cartridges per charge with a 4.0 Ah battery.

Expansion in Construction and Agricultural Sectors

Infrastructure development and mechanized farming are generating new opportunities for grease gun manufacturers. Heavy machinery, loaders, and tractors require consistent lubrication to prevent wear and mechanical stress. The rising number of public infrastructure projects and modernized agricultural practices, especially in Asia-Pacific and Latin America, fuels steady product demand. Manufacturers are targeting these sectors with durable, high-capacity grease guns suitable for field and workshop applications, strengthening their market presence.

- For instance, the Lincoln PowerLuber 1886 cordless grease gun is suitable for lubricating joints and bearings in demanding field environments. Designed for heavy agricultural and construction machinery, it features a high-torque motor developing up to 10,000 PSI pressure and uses 20-volt lithium-ion battery technology for cordless operation.

Key Challenges

Operational Safety and Overpressure Risks

Incorrect handling and excessive pressure during lubrication can damage machinery components, posing safety risks. Operators often face challenges in controlling grease flow, leading to equipment contamination or failure. Lack of standardized pressure control systems in manual and pneumatic grease guns remains a key limitation. Manufacturers are addressing this issue through safer nozzle designs and pressure regulation mechanisms, but user training and compliance remain major concerns affecting product reliability.

Fluctuating Raw Material and Battery Costs

The rising cost of steel, aluminum, and lithium-ion batteries affects product pricing and profitability. Manufacturers face pressure to maintain competitive pricing while ensuring durability and performance. Supply chain disruptions and battery shortages also impact production schedules, particularly for cordless grease guns. To mitigate this, companies are exploring local sourcing strategies and material innovations to reduce dependency on volatile raw material markets while maintaining high-quality standards.

Regional Analysis

North America

North America held the largest share of 38% in the grease gun market in 2024. The region benefits from extensive industrial infrastructure and a strong automotive maintenance network. The United States leads in adoption, supported by a large base of manufacturing and construction equipment. The presence of major manufacturers such as Lincoln Industrial and Dewalt further strengthens regional dominance. Increasing investment in smart maintenance tools and the growing use of battery-powered grease guns continue to drive market expansion across workshops and industrial facilities.

Europe

Europe accounted for 29% of the global grease gun market in 2024, driven by strict equipment maintenance standards and widespread adoption of automated lubrication tools. Countries such as Germany, the United Kingdom, and France lead the regional demand due to strong automotive and industrial sectors. The focus on energy-efficient operations and preventive maintenance supports steady product adoption. Manufacturers in the region are integrating ergonomic and eco-friendly designs to meet sustainability goals, enhancing competitiveness in professional workshops and heavy machinery servicing.

Asia-Pacific

Asia-Pacific captured 25% of the global market share in 2024 and is projected to grow fastest during the forecast period. Rapid industrialization, infrastructure expansion, and large-scale agricultural modernization are major growth drivers. China, India, and Japan dominate demand due to their growing manufacturing bases and construction activities. The increasing use of mid-capacity and battery-powered grease guns across factories and equipment service centers boosts regional adoption. Rising awareness about maintenance efficiency and equipment longevity continues to support long-term growth.

Latin America

Latin America held an 5% share of the grease gun market in 2024, driven by expanding construction and agricultural industries. Countries such as Brazil and Mexico are leading adopters, supported by modernization of industrial facilities and machinery maintenance needs. The demand for affordable manual and pneumatic grease guns is high among small and medium enterprises. Ongoing infrastructure development projects and increased investments in mining equipment maintenance contribute to stable market performance.

Middle East & Africa

The Middle East & Africa accounted for 3% of the global grease gun market in 2024. The growth is fueled by rising industrialization, oil and gas exploration, and expanding construction activities in GCC countries. The demand for durable, high-pressure grease guns is increasing in heavy machinery and transport maintenance. South Africa and the UAE serve as key markets due to their strong industrial service base. Government-backed infrastructure development and regional manufacturing expansion are expected to enhance future market potential.

Market Segmentations:

By Product Type

- Manual grease guns

- Pneumatic grease guns

- Battery-powered grease guns

By Capacity

- Up to 300cc

- 300cc to 600cc

- 600cc to 1000cc

- Above 1000cc

By Pressure

- Low (below 5000 psi)

- Medium (5000 to 10,000 psi)

- High (above 10,000 psi)

By Price

By End Use Industry

- Automotive

- Agricultural

- Industrial manufacturing

- Others (marine, aviation etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the grease gun market features key players such as CRC Industries, Macnaught, Milwaukee Tool, Hiwin, SAE Products, Hopkins, Groz Tools, Anti-Seize Technology, Kinequip, and Chicago Pneumatic. These companies focus on expanding their product portfolios with innovations in battery-powered, pneumatic, and precision-controlled manual grease guns. Manufacturers are investing in ergonomic designs, lightweight materials, and digital pressure monitoring to improve efficiency and user safety. Strategic collaborations with industrial equipment manufacturers enhance brand presence across automotive, construction, and heavy machinery sectors. North American and European players emphasize advanced lubrication technology and durability, while Asia-Pacific participants are targeting cost-effective and high-capacity models. Ongoing product differentiation and sustainability-focused designs are key strategies to strengthen market competitiveness and meet evolving industrial maintenance demands globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Macnaught introduced an advanced air-powered grease gun designed for improved flow efficiency and reduced manual effort in industrial lubrication applications.

- In September 2025, Makita U.S.A. recalled about 62,927 units of its cordless grease guns (models XPG01S1, XPG01SR1, XPG01Z) and related hoses. The recall was due to a hose rupture risk causing laceration injuries.

- In April 2025, CRC Industries expanded its food-grade line by launching three new NSF H1-certified lubricants and greases, including a bio-based grease and a sugar dissolver that integrates a 2-way actuator to reduce straw detachment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Capacity, Pressure, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for battery-powered grease guns will continue to rise in industrial applications.

- Smart and IoT-enabled lubrication tools will gain wider adoption across factories.

- Manufacturers will focus on ergonomic and lightweight designs for operator comfort.

- Growth in automotive and heavy equipment maintenance will sustain steady market expansion.

- Integration of digital pressure monitoring systems will enhance precision and safety.

- Asia-Pacific will emerge as the fastest-growing region due to industrial development.

- Companies will invest in eco-friendly materials and energy-efficient product designs.

- Strategic collaborations with OEMs will improve product reach and reliability.

- Online sales channels will expand as users prefer direct access to branded tools.

- Continuous innovation in high-pressure and cordless grease guns will strengthen global competitiveness.