Market Overview

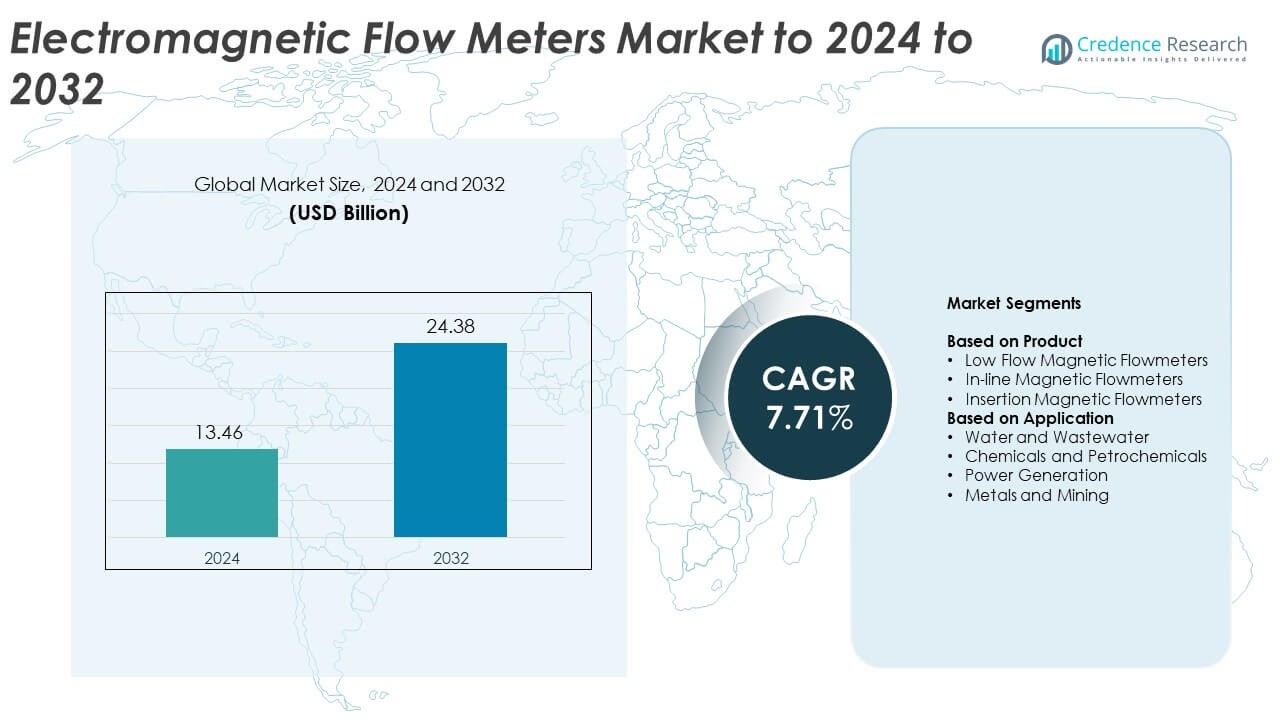

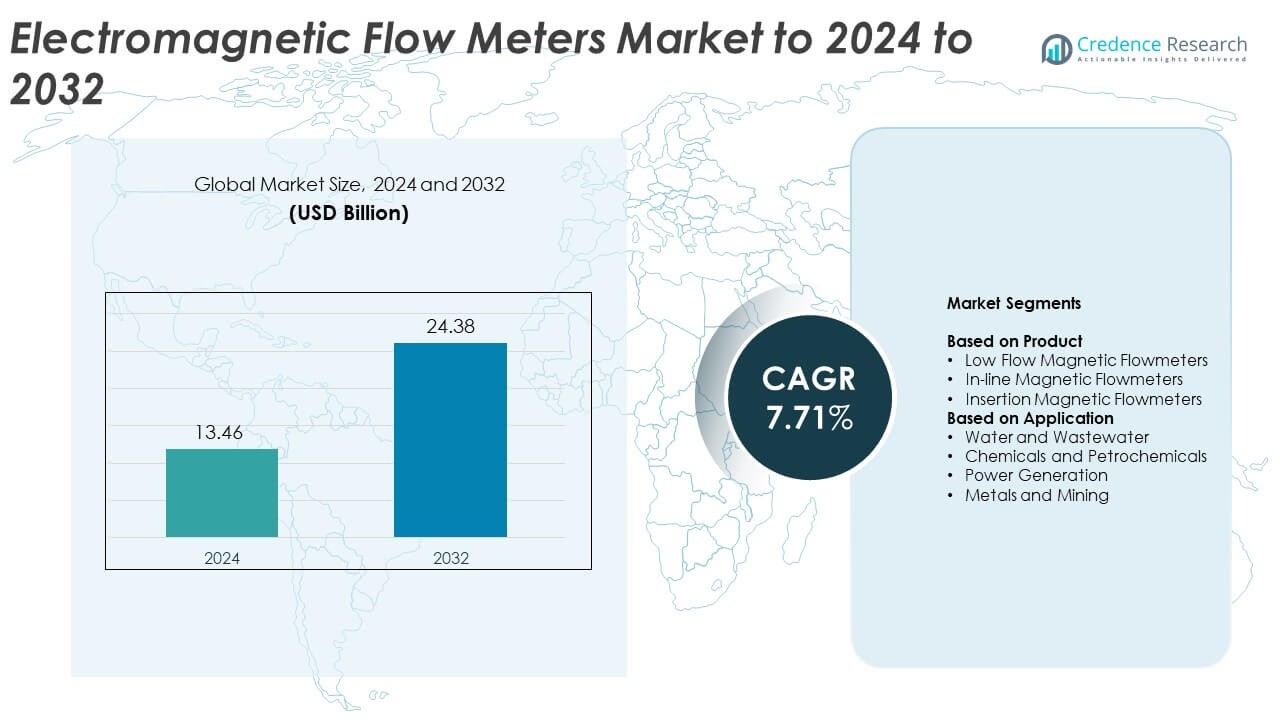

Electromagnetic Flow Meters Market size was valued at USD 13.46 billion in 2024 and is anticipated to reach USD 24.38 billion by 2032, growing at a CAGR of 7.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electromagnetic Flow Meters Market Size 2024 |

USD 13.46 Billion |

| Electromagnetic Flow Meters Market, CAGR |

7.71% |

| Electromagnetic Flow Meters Market Size 2032 |

USD 24.38 Billion |

The electromagnetic flow meters market includes top players such as Honeywell International Inc., Emerson Electric Corporation, KROHNE Messtechnik GmbH, Toshiba Corporation, Yokogawa Electric Corporation, Siemens AG, ABB Ltd, Endress+Hauser AG, OMEGA Engineering Inc. (Spectris PLC), and Azbil Corporation. These companies compete through high-accuracy designs, digital diagnostics, and strong service networks across industrial and municipal applications. Asia Pacific leads the global market with about 34% share in 2024 due to rapid industrial expansion and large water-infrastructure projects. North America follows with nearly 32% share, supported by smart metering upgrades, while Europe holds around 28% share driven by strong regulatory compliance and advanced automation adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The electromagnetic flow meters market reached USD 13.46 billion in 2024 and is projected to hit USD 24.38 billion by 2032 at a CAGR of 7.71%.

- Market growth is driven by rising demand for accurate flow measurement in water and wastewater treatment, which led the application segment with about 48% share in 2024.

- Smart metering, IoT-enabled diagnostics, and predictive monitoring are shaping key trends as industries shift toward digital and automated flow-control systems.

- Competition strengthens as leading manufacturers expand product innovation, focusing on higher accuracy, improved liner materials, and connectivity, while high installation costs remain a restraint for smaller utilities and plants.

- Asia Pacific led the market with nearly 34% share in 2024, followed by North America at about 32% and Europe at around 28%, supported by strong industrial automation and large municipal infrastructure upgrades across all regions.

Market Segmentation Analysis:

By Product

Low flow magnetic flowmeters led the product segment in 2024 with about 44% share. This lead came from rising demand for precise measurement in dosing systems, chemical batching, and food-grade liquid handling. These compact units support high accuracy at very low velocities, which helps industries reduce product loss and maintain process stability. In-line magnetic flowmeters continued to grow due to strong adoption in large pipelines and municipal networks, while insertion magnetic flowmeters gained traction for retrofit projects that need lower installation costs and reduced downtime.

- For instance, Emerson’s Rosemount Slurry Magnetic Flow Meter is a robust device designed for demanding applications in process plants. The meter is capable of measuring conductive slurries across a full velocity range of up to 12 m/s (39 ft/s) for certain models, with the preferred operational range for abrasive slurries being 0.9 to 3.1 m/s (3 to 10 ft/s) to ensure optimal accuracy while significantly minimizing wear and extending the liner’s lifespan.

By Application

Water and wastewater dominated the application segment in 2024 with nearly 48% share. Utilities rely on electromagnetic flowmeters for high-accuracy measurement, non-intrusive design, and maintenance-free operation across treatment plants and distribution lines. The segment grows further due to stricter metering regulations, leak-detection programs, and rising investments in smart infrastructure. Chemicals and petrochemicals recorded steady growth as plants adopt corrosion-resistant meters for aggressive fluids, while power generation and metals and mining increased uptake to support cooling water monitoring and slurry flow control.

- For instance, ABB’s AquaMaster 4 electromagnetic flowmeter is targeted at potable water and wastewater networks and offers battery operation for up to 10 years, enabling accurate flow monitoring in remote district-metered areas without external power.

Key Growth Drivers

Rising investment in water and wastewater infrastructure

Growing upgrades in municipal networks drive strong demand for electromagnetic flow meters. Utilities need accurate, drift-free measurement to support leak detection, billing accuracy, and treatment-plant optimization. Governments continue to expand spending on smart metering programs and network rehabilitation, which increases adoption across urban and industrial regions. The non-intrusive design and long service life of these meters help reduce maintenance costs and operational downtime, making them a preferred choice for large-scale distribution and treatment systems.

- For instance, Diehl Metering reports that its HYDRUS 2.0 ultrasonic smart water meters have reached about 8 million installed units worldwide, indicating large-scale utility programs to modernize water-network measurement and leak-detection capabilities.

Expansion of process automation in industrial plants

Industries across chemicals, power, and food processing are adding more automated flow-control systems to improve efficiency. Electromagnetic flow meters offer high precision with zero pressure drop, which supports stable batch control and quality assurance. Plants depend on these meters to handle conductive liquids, slurries, and corrosive media without mechanical wear. As factories continue adopting digital monitoring platforms and advanced process-control technologies, the need for reliable, maintenance-free flow measurement accelerates across multiple production lines.

- For instance, Honeywell’s VersaFlow TWM 1000 and TWM 9000 electromagnetic flow converters provide a 4–20 mA output with HART communication, along with pulse, frequency, and status outputs.

Shift toward energy-efficient and sustainable operations

Manufacturers and utilities are adopting flow-measurement devices that support energy savings and reduce environmental impact. Electromagnetic flow meters meet these needs through low power consumption, long calibration cycles, and minimal waste generation. Growing sustainability targets across industries encourage firms to replace older mechanical meters with modern magnetic designs. These meters help facilities optimize water use, reduce chemical dosing errors, and enhance compliance with environmental regulations, which strengthens market demand during the forecast period.

Key Trends & Opportunities

Integration of smart and IoT-enabled systems

Digital platforms continue to reshape flow-measurement practices across utilities and industries. New electromagnetic flow meters support wireless connectivity, cloud dashboards, and real-time diagnostics that simplify asset management. Smart features help operators detect anomalies early, reduce unplanned downtime, and streamline maintenance schedules. Growing adoption of digital water networks and predictive monitoring creates strong opportunities for manufacturers offering advanced connectivity and analytics-driven solutions built for large-scale infrastructure.

- For instance, Sensus (a Xylem brand) documents that its FlexNet AMI system underpins over 1,700 electric, water, and gas projects, supports more than 50 million endpoints, and carries over 795 million data messages per day, demonstrating large-scale IoT connectivity for metering and network analytics.

Rising adoption in harsh and abrasive fluid applications

Industries handling slurries, mining effluents, and chemical mixtures are increasing their use of electromagnetic flow meters. Modern designs with advanced liner materials and reinforced electrodes deliver long service life in abrasive and corrosive conditions. This boosts reliability in demanding processes such as mineral processing, cooling water loops, and effluent discharge monitoring. The trend opens opportunities for specialized product lines designed for high-wear environments where mechanical meters fail.

- For instance, KROHNE’s OPTIFLUX 5100 electromagnetic flowmeter is designed for slurries and corrosive liquids and is specified for operating temperatures up to 180 °C with robust liners, which aligns with demanding duties in chemical, mining, and mineral-slurry applications.

Growing demand for retrofit and replacement projects

Aging pipeline networks and outdated metering devices create strong growth potential for retrofit solutions. Insertion-type electromagnetic flow meters are gaining traction due to their lower installation effort and minimal downtime. Industries and utilities prefer these options when upgrading existing systems without major piping changes. The shift toward replacement-driven demand provides a steady market base across mature regions, especially in industrial clusters and municipal facilities.

Key Challenges

High initial installation and calibration costs

Electromagnetic flow meters require higher upfront spending than many traditional flow-measurement devices. Installation may involve pipe modifications, grounding requirements, and integration with control systems, which increases project costs for smaller facilities. Budget-constrained municipalities and small manufacturers may delay adoption due to these expenses. The need for proper calibration and setup also adds technical complexity, creating barriers for end users with limited engineering resources.

Performance limitations with non-conductive fluids

These meters rely on liquid conductivity to measure flow, which restricts use with oils, hydrocarbons, and other non-conductive media. Industries dealing with such fluids must depend on alternative technologies, reducing the total addressable market. This limitation also affects hybrid process lines where both conductive and non-conductive liquids are present. Manufacturers must invest in product diversification or complementary technologies to overcome lost opportunities in sectors where electromagnetic designs cannot operate effectively.

Regional Analysis

North America

North America held about 32% share of the electromagnetic flow meters market in 2024. The region benefits from strong investment in water treatment upgrades, smart metering programs, and industrial automation. Utilities adopt advanced flow monitoring to improve leak detection and meet tightening regulatory standards. Growth also comes from chemical, food processing, and power plants modernizing flow-control systems. Rising spending on digital water networks and pipeline rehabilitation supports steady adoption across the United States and Canada, while replacement of aging mechanical meters continues to drive long-term demand.

Europe

Europe accounted for nearly 28% share in 2024, supported by strict environmental regulations and rapid deployment of smart water infrastructure. Water utilities in Germany, the United Kingdom, France, and Italy continue adopting magnetic flow meters to enhance accuracy in distribution networks and wastewater treatment facilities. Industrial sectors such as chemicals, pharmaceuticals, and food processing also use these meters for compliance and efficiency improvement. Ongoing investments in digital monitoring platforms and sustainability-focused upgrades reinforce market growth across both Western and Eastern Europe.

Asia Pacific

Asia Pacific led the global market with about 34% share in 2024. Expanding water management programs in China, India, and Southeast Asia drive high adoption across municipal and industrial networks. Rapid industrialization increases demand for accurate flow measurement in chemicals, power generation, and food processing. Governments in the region continue investing in large-scale pipeline expansion and wastewater treatment, boosting long-term consumption. Growing manufacturing capacity for low-cost magnetic meters also strengthens regional supply and accelerates adoption in cost-sensitive industries.

Latin America

Latin America held around 4% share in 2024, driven by gradual upgrades in water supply systems and rising industrial activity. Countries such as Brazil, Mexico, and Chile are adopting electromagnetic flow meters to improve measurement accuracy in treatment plants and distribution networks. Mining operations across Peru and Chile use these meters for slurry handling and effluent monitoring. Although budget constraints slow large-scale deployment, increasing public investment in water infrastructure and improving industrial automation continue to support moderate growth across the region.

Middle East and Africa

The Middle East and Africa captured about 2% share in 2024, supported by water scarcity challenges and rising investments in desalination plants and wastewater treatment. Gulf countries adopt electromagnetic flow meters to enhance efficiency in large-scale water distribution and industrial cooling systems. Mining and metals processing in South Africa also contribute to demand. Infrastructure limitations and cost barriers restrain rapid expansion, yet ongoing pipeline modernization projects and industrial diversification initiatives continue to create emerging opportunities across the region.

Market Segmentations:

By Product

- Low Flow Magnetic Flowmeters

- In-line Magnetic Flowmeters

- Insertion Magnetic Flowmeters

By Application

- Water and Wastewater

- Chemicals and Petrochemicals

- Power Generation

- Metals and Mining

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The electromagnetic flow meters market is shaped by major players such as Honeywell International Inc., Emerson Electric Corporation, KROHNE Messtechnik GmbH, Toshiba Corporation, Yokogawa Electric Corporation, Siemens AG, ABB Ltd, Endress+Hauser AG, OMEGA Engineering Inc. (Spectris PLC), and Azbil Corporation. The competitive landscape reflects strong focus on accuracy, durability, and advanced digital features tailored to water management and industrial automation. Leading manufacturers invest heavily in smart diagnostics, IoT connectivity, and predictive maintenance tools that improve system reliability and reduce downtime. Many companies enhance competitiveness through expanded global manufacturing footprints, offering region-specific product variants with improved liner materials and enhanced corrosion resistance. Firms also strengthen market presence by deepening partnerships with utilities and industrial clients, providing integrated solutions that combine sensors, controllers, and software platforms. Growing demand for retrofit installations encourages suppliers to develop flexible, easy-to-install designs that support aging pipeline networks and complex industrial environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International Inc.

- Emerson Electric Corporation

- KROHNE Messtechnik GmbH

- Toshiba Corporation

- Yokogawa Electric Corporation

- Siemens AG

- ABB Ltd

- Endress+Hauser AG

- OMEGA Engineering Inc. (Spectris PLC)

- Azbil Corporation

Recent Developments

- In 2025, Endress+Hauser AG’s development team won an AMA Innovation Award for their ultrasonic flowmeter technology, Proline Prosonic Flow P 500, which, while ultrasonic, represents a significant advance in clamp-on flow measurement complementary to their electromagnetic flowmeter efforts.

- In 2025, KROHNE Messtechnik GmbH showcased the Enviromag Electromagnetic Flowmeter in April 2025 at Data Center World for precise measurement in water management and cooling systems, highlighting its robust design with no moving parts and minimal pressure drop.

- In 2024, ABB Ltd announced the launch of its next-generation electromagnetic flowmeters, featuring two advanced products—ProcessMaster and AquaMaster.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as water utilities expand smart metering networks.

- Industrial plants will increase adoption due to rising automation and digital control.

- Demand will rise for meters with advanced diagnostics and self-monitoring features.

- Mining and chemical sectors will boost usage for abrasive and corrosive fluid applications.

- Replacement of aging mechanical meters will remain a major growth driver.

- IoT-enabled electromagnetic meters will gain wider acceptance in large infrastructure projects.

- Manufacturers will focus on energy-efficient and low-maintenance product designs.

- Asia Pacific will strengthen its lead due to rapid industrial and municipal expansion.

- Adoption in wastewater reuse and recycling projects will accelerate.

- Growing emphasis on sustainability will push industries toward accurate and reliable flow measurement technologies.