Market Overview

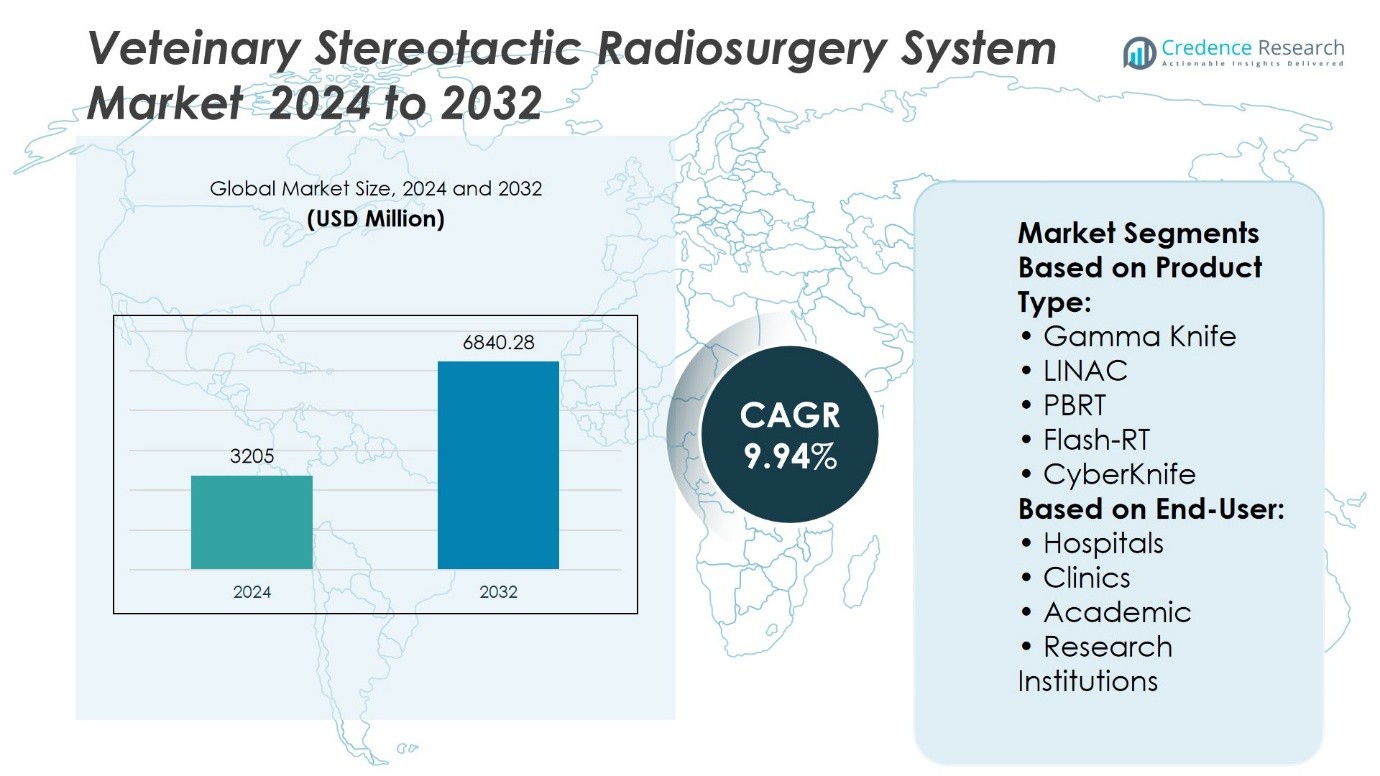

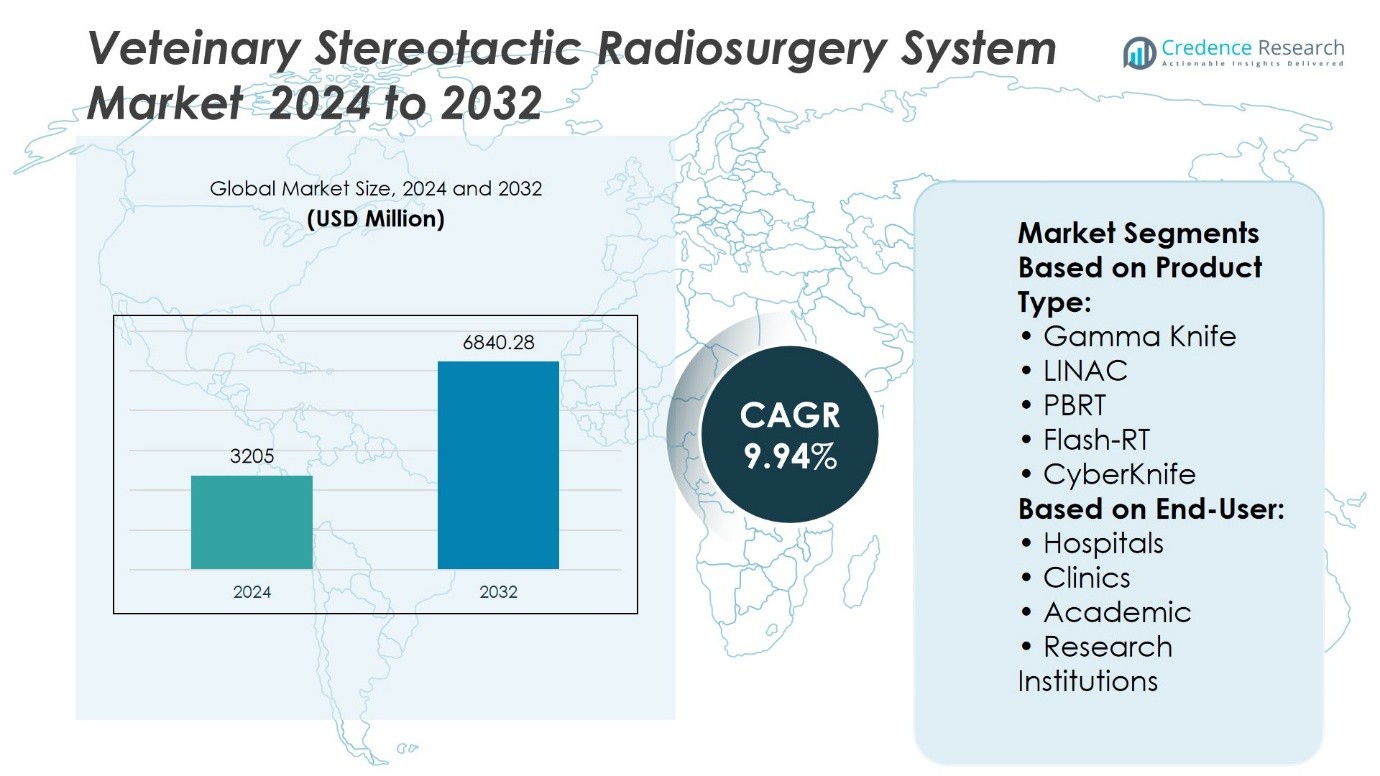

Veteinary Stereotactic Radiosurgery System Market size was valued at USD 3205 million in 2024 and is anticipated to reach USD 6840.28 million by 2032, at a CAGR of 9.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Veteinary Stereotactic Radiosurgery System Market Size 2024 |

USD 3205 Million |

| Veteinary Stereotactic Radiosurgery System Market, CAGR |

9.94% |

| Veteinary Stereotactic Radiosurgery System Market Size 2032 |

USD 6840.28 Million |

The Veterinary Stereotactic Radiosurgery System market is primarily driven by the rising prevalence of pet cancer cases, growing awareness of advanced veterinary oncology treatments, and increased spending on companion animal healthcare. The demand for precise, non-invasive procedures is fueling technology adoption across veterinary clinics and hospitals. Market trends indicate a shift toward image-guided radiotherapy and integration of artificial intelligence to improve treatment outcomes. Furthermore, collaborations between veterinary hospitals and device manufacturers are accelerating the availability of advanced radiosurgery systems, enhancing accessibility and treatment efficacy. The overall market reflects a steady transition toward technologically enhanced, patient-friendly oncology solutions in veterinary care.

North America holds the largest share of the Veterinary Stereotactic Radiosurgery System market due to advanced veterinary infrastructure, high pet healthcare expenditure, and rapid adoption of cutting-edge technologies. Europe follows closely with strong veterinary care systems and growing awareness of pet oncology treatments. Asia-Pacific is witnessing growing demand driven by rising pet ownership and expanding veterinary services. Key players in this market include Accuray Incorporated, Elekta AB, Varian Medical Systems Inc., PetCure Oncology, and RaySearch Laboratories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wooden toy market was valued at USD 3205 million in 2024 and is expected to reach USD 6840.28 million by 2032, growing at a CAGR of 9.94% during the forecast period.

- Rising consumer preference for eco-friendly and non-toxic toys is a key driver fueling market expansion.

- Growing demand for handcrafted and personalized wooden toys is shaping premium product segments.

- Major players like Melissa & Doug, PlanToys, and HABA are expanding global retail footprints and product innovation.

- Limited scalability and higher production time of artisanal toys restrain mass-market penetration.

- Europe leads the market with strong demand from Germany, France, and Nordic countries due to cultural preference for sustainable toys.

- Asia Pacific is emerging as a key manufacturing hub with countries like China and India increasing exports of wooden toys globally.

Market Drivers

Growing Incidence of Companion Animal Cancers Increases Demand for Precision Treatments

The rising incidence of tumors in companion animals has led to a significant push toward specialized treatment options. Tumors in pets, particularly brain and nasal cancers, require targeted therapies that preserve healthy tissue. The Veterinary Stereotactic Radiosurgery System Market responds to this need by offering high-precision, non-invasive solutions. It supports veterinarians in delivering accurate radiation doses without surgery, minimizing recovery time for animals. Pet owners are increasingly aware of and willing to invest in advanced cancer care. This shift is transforming expectations in veterinary oncology and driving adoption of stereotactic radiosurgery systems.

- For instance, PetCure Oncology, a prominent provider of stereotactic radiosurgery services in veterinary oncology, has treated over 6,000 pets using advanced SRS systems across its nine affiliated clinical locations in the United States.

Technological Advancements in Radiotherapy Equipment Expand Clinical Capabilities

New developments in imaging, robotics, and radiation beam modulation have strengthened the functionality of veterinary stereotactic systems. These systems now integrate real-time tumor tracking, high-resolution CT/MRI guidance, and sub-millimeter radiation accuracy. The Veterinary Stereotactic Radiosurgery System Market benefits from these innovations, enabling clinics to treat previously inoperable tumors. Improved treatment planning software and automated delivery enhance precision and reduce procedure time. These enhancements support broader clinical application across various tumor types. Clinics equipped with such systems are gaining a competitive edge in specialized oncology services.

- For instance, Accuray Incorporated has enhanced its CyberKnife® System with the InCise™ 2 Multileaf Collimator (MLC), enabling the delivery of highly conformal doses with robotic precision.

Increasing Veterinary Expenditure and Willingness to Adopt Human-Grade Care

Veterinary spending continues to rise globally, driven by a growing population of insured pets and a shift toward human-grade veterinary care. Pet owners are no longer limiting treatment to basic care but seek advanced solutions that mirror human healthcare standards. The Veterinary Stereotactic Radiosurgery System Market is gaining momentum from this behavioral change. It aligns with the demand for minimally invasive, high-precision therapies. Clinics offering advanced oncology solutions attract higher patient volumes and improve outcomes. The trend reinforces the role of stereotactic systems in modern veterinary practice.

Improved Access to Specialized Veterinary Oncology Centers

The expansion of veterinary referral centers and oncology-specific practices has increased accessibility to advanced radiation therapies. These centers invest in high-end stereotactic equipment to provide sophisticated treatment options for cancer cases. The Veterinary Stereotactic Radiosurgery System Market benefits from this expansion in infrastructure. It allows broader geographic distribution and reduces the burden of travel for pet owners seeking care. Veterinary specialists are more likely to recommend precision radiotherapy when systems are readily available. Growth in referral networks ensures sustained demand and integration of these systems into standard oncology protocols.

Market Trends

Integration of AI and Imaging Enhancements Improves Treatment Precision

Veterinary clinics are adopting artificial intelligence tools to enhance imaging accuracy and treatment planning. AI-powered software now assists in tumor contouring, reducing the risk of radiation exposure to healthy tissues. The Veterinary Stereotactic Radiosurgery System Market is evolving through such innovations, enabling clinics to deliver tailored therapy for each patient. Real-time imaging and automated dose calculations support more predictable outcomes. Clinics using AI-enhanced systems report fewer side effects and improved long-term recovery. These tools are becoming standard in advanced veterinary radiotherapy suites.

- For instance, according to the Veterinary Cancer Society, over 6 million dogs and 6 million cats are diagnosed with cancer each year in the U.S., with 1,200 to 1,500 of these receiving stereotactic radiosurgery treatments annually at specialty clinics

Portable and Scaled-Down System Designs Target Smaller Practices

Manufacturers are focusing on compact and modular stereotactic systems designed for veterinary clinics with limited space. These systems offer the same core functionalities as hospital-grade units but require less infrastructure. The Veterinary Stereotactic Radiosurgery System Market is responding to demand from mid-sized practices seeking to expand their oncology services. It allows broader access to advanced treatment without extensive remodeling or capital investments. Simplified user interfaces also reduce the training period for veterinary technicians. Compact systems are creating new opportunities in emerging and suburban regions.

- For instance, Mevion Medical Systems introduced the S250i Proton Therapy System with Hyperscan, which has been adapted for limited-space environments, requiring only 140 square meters of installation area compared to traditional systems that need over 400 square meters.

Increased Collaboration Between Human and Veterinary Oncology Fields

Technology transfer from human oncology continues to influence veterinary radiotherapy. Clinics now adapt linear accelerators and treatment planning models originally developed for human patients. The Veterinary Stereotactic Radiosurgery System Market reflects this convergence, with shared hardware platforms and software solutions. It promotes faster clinical validation and regulatory clearance. Joint research programs are also producing datasets specific to canine and feline tumors. This alignment ensures faster adoption and consistency in treatment quality.

Growing Emphasis on Minimally Invasive Oncology Protocols

Minimally invasive care is gaining favor in veterinary oncology due to shorter recovery periods and reduced procedural risks. Stereotactic radiosurgery supports this trend by delivering high-dose radiation in one or few sessions. The Veterinary Stereotactic Radiosurgery System Market is aligning with this shift by offering single-session protocols with reduced anesthesia requirements. It improves patient throughput and enhances comfort for both pets and owners. Clinics prefer protocols that minimize hospitalization and post-procedure monitoring. This trend is redefining standards in veterinary cancer care.

Market Challenges Analysis

High Equipment and Maintenance Costs Limit Widespread Adoption

The upfront investment required for stereotactic radiosurgery systems remains a major barrier for many veterinary clinics. Advanced systems demand specialized shielding, installation, and continuous calibration, all of which increase setup expenses. The Veterinary Stereotactic Radiosurgery System Market faces constraints in smaller and independent practices that cannot justify such capital outlays. It often restricts adoption to large referral centers or university hospitals. Maintenance contracts, software updates, and part replacements also impose recurring costs. These financial demands slow down market penetration despite rising clinical demand.

Shortage of Trained Veterinary Radiation Oncologists and Technicians

Operating a stereotactic system requires extensive training in radiation planning, physics, and veterinary oncology. The current pool of professionals with such expertise is limited, especially in developing regions. The Veterinary Stereotactic Radiosurgery System Market reflects this talent gap, which delays system utilization even after installation. It often leads to reliance on remote planning services or collaborations with human oncologists. This shortage impacts workflow efficiency and limits treatment availability. Expanding training programs and certification pathways is critical to support future market growth.

Market Opportunities

Expansion of Pet Insurance Coverage Encourages Advanced Oncology Care

The growth of pet insurance coverage is opening new opportunities for advanced veterinary procedures. Insured pet owners are more likely to pursue high-cost treatments, including precision radiosurgery for cancer management. The Veterinary Stereotactic Radiosurgery System Market stands to benefit from this shift, as financial constraints become less restrictive. It enables clinics to recommend optimal therapies without hesitation over affordability. Insurance providers are beginning to recognize the clinical effectiveness of stereotactic procedures. Broader coverage improves access to care and encourages investment in high-end radiotherapy infrastructure.

Rising Demand from Emerging Veterinary Referral Networks

The development of regional referral networks and specialty oncology centers is creating demand for advanced radiotherapy systems. These networks concentrate expertise and cases, making investment in stereotactic equipment more feasible. The Veterinary Stereotactic Radiosurgery System Market finds growth potential in these emerging hubs. It supports multi-disciplinary care models that integrate diagnostics, surgery, and radiotherapy under one roof. Veterinary groups with centralized operations are adopting such systems to strengthen service offerings. This trend is increasing the system’s reach beyond academic institutions into private practice settings.

Market Segmentation Analysis:

By Product Type:

The veterinary stereotactic radiosurgery market includes Gamma Knife, LINAC, PBRT/Flash-RT, and CyberKnife systems. LINAC (Linear Accelerator) systems lead the segment due to their adaptability and compatibility with advanced imaging. Clinics favor LINAC for its ability to treat diverse tumor types across species with high precision. CyberKnife follows, recognized for its robotic-assisted, frameless design that improves access to difficult anatomical areas. Its use in specialized veterinary oncology centers continues to expand. Gamma Knife is less widely adopted, mainly limited to neurological applications because of its rigid frame system. PBRT/Flash-RT represents the most advanced technology in the segment. It delivers radiation at ultra-high speeds, minimizing damage to healthy tissue, although it is currently limited to high-end research environments and pilot installations.

- For instance, Varian Medical Systems’ Clinac iX linear accelerator, used in veterinary oncology facilities, incorporates a 120-leaf Millennium multileaf collimator, each leaf measuring 5 millimeters in width at isocenter.

By End-User:

Hospitals and clinics account for the largest share of adoption in the veterinary stereotactic radiosurgery market. These facilities deploy radiosurgery platforms to deliver precise, minimally invasive cancer treatments that reduce anesthesia duration and recovery time. Specialty animal hospitals and multi-disciplinary veterinary centers are actively integrating radiotherapy into their oncology offerings. It has allowed them to handle complex treatment plans and expand their service capabilities. Academic and research institutions support the segment through clinical trials, training programs, and comparative oncology studies. These centers validate protocols, refine techniques, and facilitate innovation in radiosurgical applications, particularly in rare tumor models and experimental therapies.

- For instance, PetCure Oncology, which partners with veterinary hospitals across the United States, has treated 6,458 pets using stereotactic radiosurgery as of 2023. Their clinical model typically administers 3 treatment sessions per patient.

Segments:

Based on Product Type:

- Gamma Knife

- LINAC

- PBRT

- Flash-RT

- CyberKnife

Based on End-User:

- Hospitals

- Clinics

- Academic

- Research Institutions

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the highest market share in the global veterinary stereotactic radiosurgery system market, accounting for approximately 39%. The region is driven by the presence of advanced veterinary healthcare infrastructure and high pet healthcare expenditure. The United States, in particular, is a major contributor with a growing number of specialty veterinary hospitals equipped with precision radiosurgery tools such as LINAC and CyberKnife systems. The market is supported by strong research output from institutions like Colorado State University and UC Davis, where veterinary oncology centers are using LINAC-based radiosurgery for treating complex tumors in companion animals. High pet insurance penetration further enables clinics to adopt cost-intensive technologies without deterring patient volume. The region also benefits from companies like Accuray and Varian Medical Systems offering customized solutions for veterinary applications, expanding access across urban centers.

Europe

Europe follows with a market share of around 27%, with growing adoption across Germany, the United Kingdom, and France. Veterinary cancer care has gained prominence across referral centers and university-affiliated animal hospitals. Institutions like the Royal Veterinary College in the UK have adopted CyberKnife systems for animal radiotherapy, advancing treatment outcomes for intracranial and extracranial tumors. Public-private investments in veterinary research, particularly in Germany and the Netherlands, are promoting the adoption of advanced stereotactic platforms in animal care. Regulatory frameworks in the EU encourage ethical use of radiation-based therapies, which has positively influenced equipment standardization and procurement across specialty clinics. The growing number of veterinary oncologists and trained staff further supports the use of advanced systems in the region.

Asia Pacific

Asia Pacific holds a market share of about 19% and is emerging as a promising region due to increasing awareness of animal oncology and expanding pet healthcare expenditure in countries like Japan, Australia, and China. Japan has shown steady advancements with veterinary centers integrating LINAC-based radiosurgery units, often in collaboration with academic institutions like the University of Tokyo. Australia’s veterinary hospitals, especially in urban areas, are also exploring CyberKnife systems for localized treatment of hard-to-access tumors. China’s market is growing through both government-backed research and the rising number of private veterinary hospitals that seek to offer comprehensive cancer care. However, the high cost of equipment and limited trained personnel still constrain broader adoption across the region.

Latin America

Latin America contributes roughly 9% to the global market, with Brazil and Mexico leading regional developments. Veterinary hospitals in major cities like São Paulo and Mexico City are gradually introducing stereotactic radiosurgery, primarily using LINAC-based platforms. Some veterinary universities in Brazil have begun pilot projects evaluating radiosurgery effectiveness in treating canine brain tumors. However, market growth is somewhat restricted by the high capital investment required and inconsistent access to specialized veterinary radiologists. Training and technology partnerships with North American providers are helping to bridge some of these gaps.

Middle East and Africa

The Middle East and Africa collectively hold a smaller market share of about 6%. Growth in this region remains limited but is progressing in high-income areas such as the UAE and South Africa. A few specialty veterinary hospitals in Dubai and Johannesburg have started to explore stereotactic radiosurgery systems, often through collaborations with global equipment suppliers. Demand is mainly driven by pet owners seeking premium care for companion animals. Infrastructure limitations and limited clinical awareness continue to challenge widespread adoption, but gradual investments in veterinary infrastructure are creating room for future expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Veterinary Stereotactic Radiosurgery System Market include Mevion Medical Systems, Ion Beam Applications SA, Hitachi, PetCure Oncology, IntraOp Medical, C. R. Bard, Isoray, Elekta, Eckert & Ziegler, Varian Medical Systems, Accuray Incorporated, and BD. These companies are driving market competitiveness through advanced product development, strategic partnerships, and expansion into emerging regions. Varian and Elekta dominate with AI-integrated targeting systems and scalable treatment platforms, while Accuray and Mevion focus on compact, high-efficiency systems suitable for veterinary use. PetCure Oncology is expanding its clinical reach with a tele-radiosurgery model, offering specialized oncology solutions. Hitachi and Ion Beam Applications SA leverage their particle therapy expertise for precision-focused care. Other players like IntraOp Medical and Eckert & Ziegler are enhancing intraoperative and brachytherapy tools. This competitive landscape reflects a strong emphasis on innovation, clinical outcomes, and accessibility, positioning these firms to capture rising demand in veterinary oncology markets worldwide.

Recent Developments

- In February 2025, Varian partnered with Sun Nuclear to integrate the SunCHECK QA platform, reinforcing safety compliance across small-animal radiotherapy suites.

- In 2024, IBA remains an industry leader in particle beam technologies and has strengthened partnerships with Elekta to expand access to proton therapy (primarily in human medicine). The clinical potential for veterinary application is acknowledged as hospitals explore the benefits of compact and precise modalities for pets.

- In June 2024, Hitachi is developing next-generation radiotherapies, such as targeted alpha therapy (e.g., Actinium-225), for both human and veterinary applications. No direct veterinary SRS system release has been announced, but ongoing research is relevant for future animal oncology innovations.

Market Concentration & Characteristics

The Veterinary Stereotactic Radiosurgery System Market is gaining momentum due to the increasing incidence of animal cancers and growing adoption of advanced treatment options in veterinary medicine. It offers a non-invasive alternative to conventional surgery, allowing precise radiation delivery to tumors with minimal damage to surrounding healthy tissue. Technological advancements such as image-guided radiotherapy, robotic positioning, and real-time monitoring enhance the accuracy and efficiency of these systems. Rising awareness among pet owners about specialized cancer care has contributed to higher demand across veterinary oncology centers and specialty clinics. It benefits from strong investments by key manufacturers focused on miniaturizing systems, improving software interfaces, and expanding clinical research. Regulatory support and a shift toward quality pet healthcare also support the market’s progression. The Veterinary Stereotactic Radiosurgery System Market continues to evolve through collaborative efforts between veterinary hospitals and equipment manufacturers to deliver faster, safer, and more targeted treatments.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increasing adoption due to rising cases of pet cancers requiring advanced treatment.

- Veterinary clinics are expected to invest more in precision-based radiotherapy technologies.

- Software upgrades and AI integration will enhance treatment accuracy and planning.

- Growing awareness among pet owners will continue to drive demand for non-invasive cancer solutions.

- Manufacturers will focus on making systems more compact and affordable for mid-sized practices.

- Partnerships between veterinary hospitals and technology providers will improve access to advanced care.

- The market will benefit from ongoing research in radiation oncology for animals.

- Training programs for veterinarians will expand to support system usage and specialization.

- Reimbursement policies and insurance coverage for pet treatments may influence adoption.

- The demand for high-throughput, low-maintenance systems will shape future product development.