Market Overview:

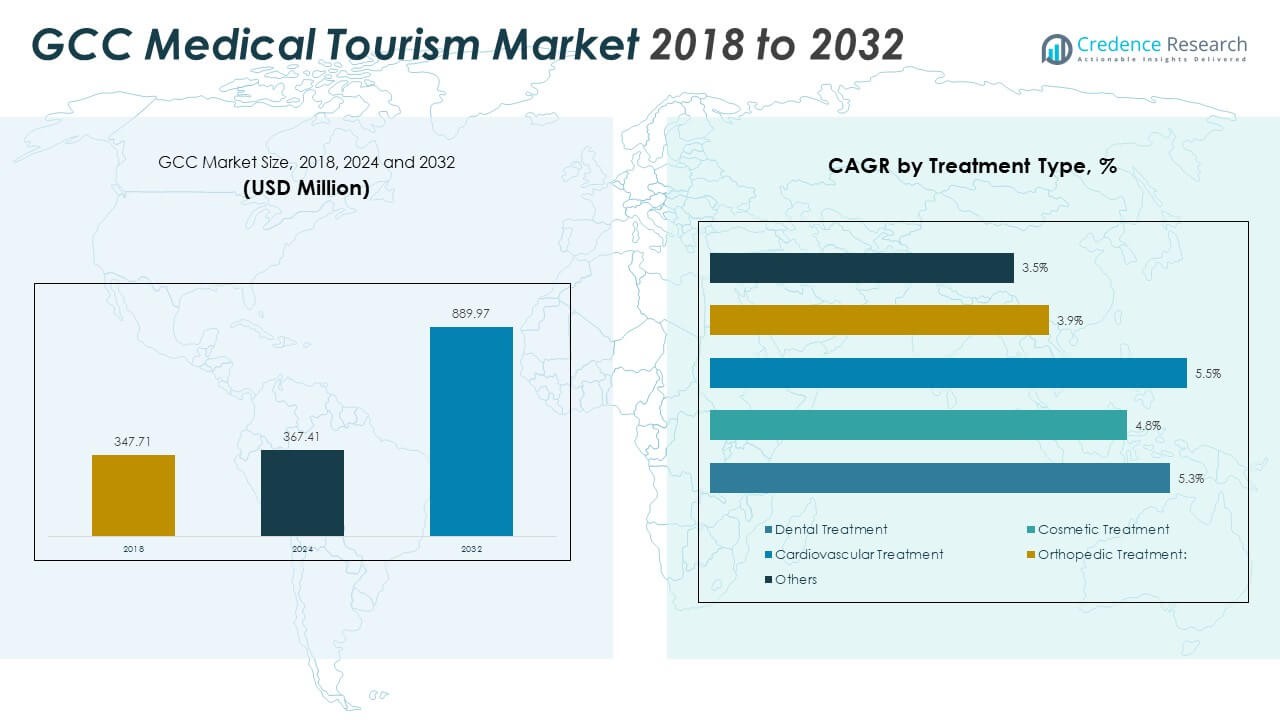

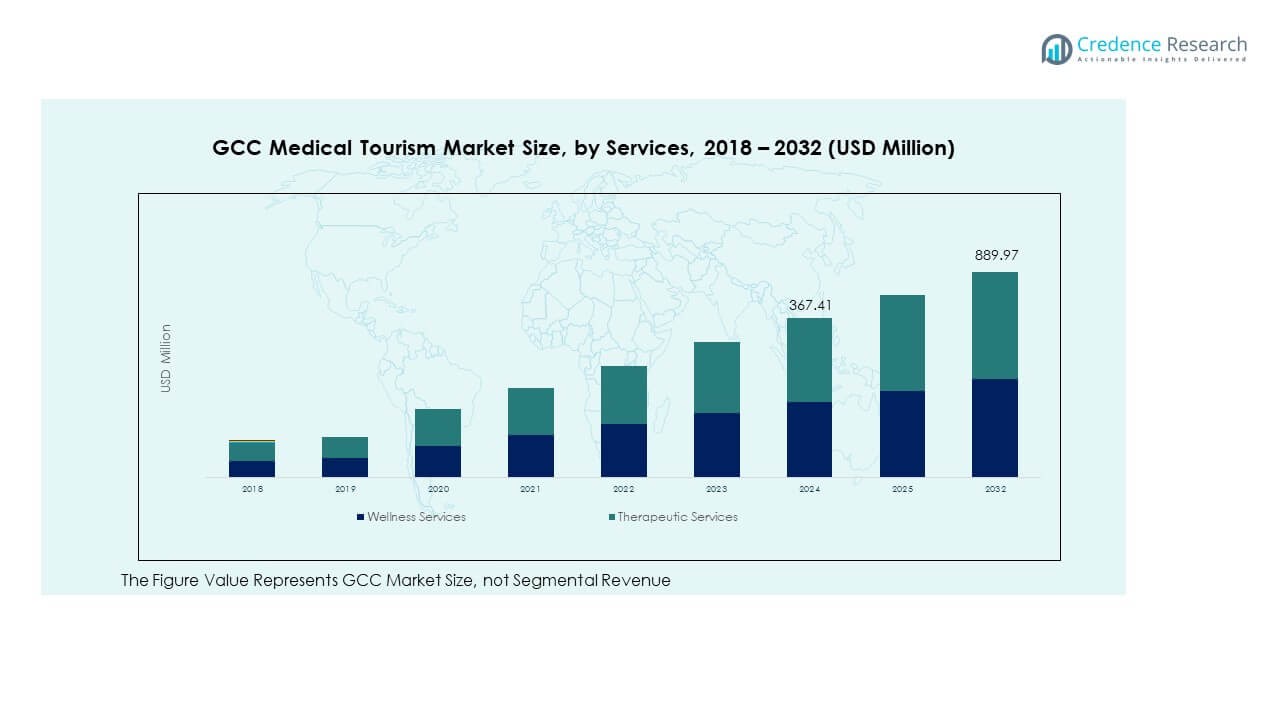

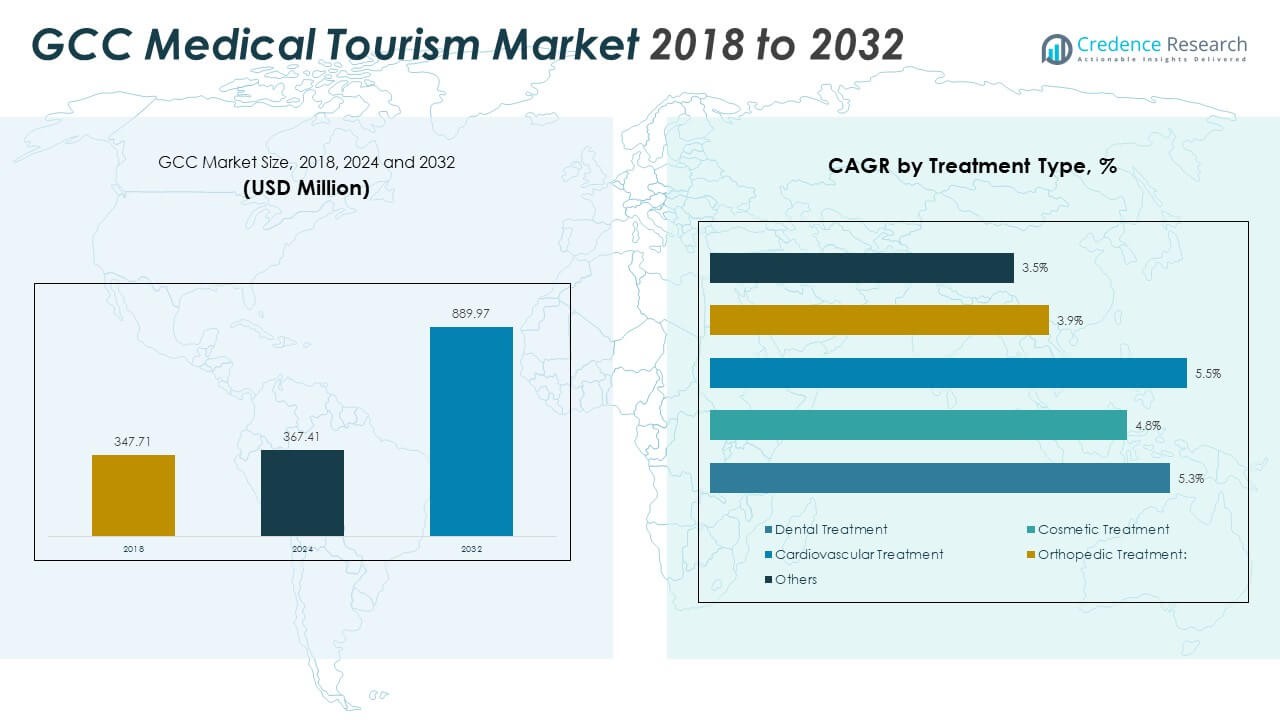

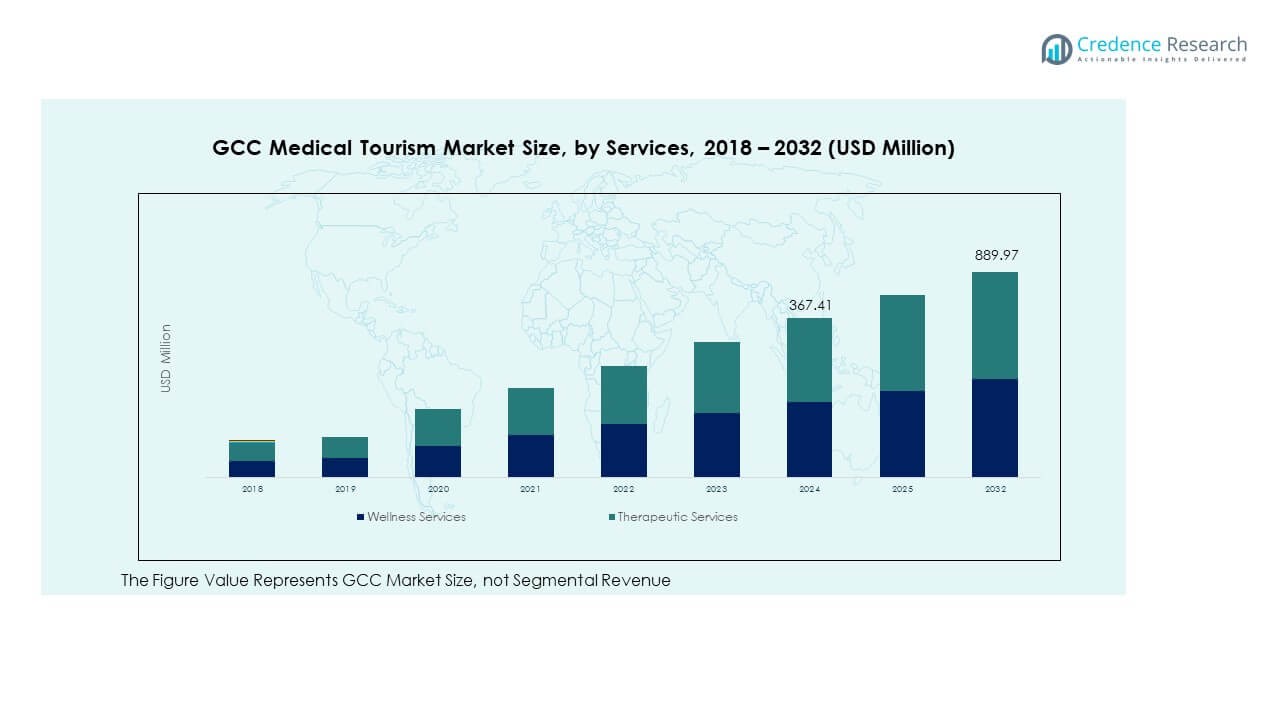

The GCC Medical Tourism Market size was valued at USD 347.71 million in 2018 to USD 367.41 million in 2024 and is anticipated to reach USD 889.97 million by 2032, at a CAGR of 10.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| GCC Medical Tourism Market Size 2024 |

USD 367.41 Million |

| GCC Medical Tourism Market, CAGR |

10.26% |

| GCC Medical Tourism Market Size 2032 |

USD 889.97 Million |

The GCC Medical Tourism Market is driven by strong healthcare infrastructure development, strategic government initiatives, and rising demand for specialized medical services. Advanced clinical facilities, international accreditation, and competitive pricing enhance patient confidence. Supportive visa frameworks and integrated tourism services improve accessibility for international travelers. Expanding wellness programs and rehabilitation care attract patients seeking both treatment and recovery experiences. Growing collaborations between hospitals and travel service providers strengthen service delivery. It benefits from digital health advancements and cross-border partnerships that improve patient flow and quality of care.

The UAE leads the GCC Medical Tourism Market with well-developed healthcare infrastructure, specialized medical hubs, and strong connectivity. Saudi Arabia is rapidly emerging with major investments in advanced care facilities and health transformation programs. Qatar and Bahrain focus on niche areas like rehabilitation and wellness, supported by government initiatives. Kuwait and Oman are enhancing infrastructure to increase medical tourism capacity. Leading destinations offer competitive services, while emerging markets expand through strategic partnerships and infrastructure upgrades.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The GCC Medical Tourism Market was valued at USD 347.71 million in 2018, reached USD 367.41 million in 2024, and is projected to hit USD 889.97 million by 2032, growing at a CAGR of 10.26%.

- The UAE leads with 46% share, driven by strong healthcare infrastructure, advanced treatments, and government support. Saudi Arabia follows with 29%, supported by health transformation programs, while Qatar, Bahrain, Kuwait, and Oman collectively account for 25% due to niche healthcare investments.

- Saudi Arabia represents the fastest-growing region, supported by major investments in specialized care, digital health expansion, and rising inbound patient flow.

- Therapeutic services account for 64% of the total service segment, reflecting strong demand for specialized medical treatments and rehabilitation.

- Wellness services represent 36% of the segment, highlighting growing patient interest in integrated wellness and preventive healthcare experiences.

Market Drivers

Strong Government Policies and National Tourism Strategies Enhancing Healthcare Infrastructure

Government support plays a major role in driving medical tourism across the GCC. Several countries have introduced healthcare investment programs and national tourism plans to improve service delivery. Dubai, Riyadh, and Doha have emerged as strong destinations with advanced hospital networks. Authorities focus on patient-centered care models and international accreditation standards. Infrastructure upgrades in specialized medical zones are attracting foreign patients. It benefits from strong cross-sector collaboration between tourism and healthcare regulators. Hospitals now offer comprehensive packages that combine treatment and leisure. This strategic alignment is fueling growth in the GCC Medical Tourism Market.

- For instance, Rashid Hospital in Dubai is internationally accredited by the Joint Commission International (JCI) and is listed in Newsweek’s 2025 “World’s Best Hospitals” ranking with an excellence score of 83.22%, reflecting its strong reputation for advanced medical and trauma care in the region.

Expansion of Specialized Medical Services and Advanced Clinical Facilities

Specialized care in fields like orthopedics, cardiology, fertility, and cosmetic surgery is gaining global attention. Regional hospitals are partnering with international medical institutions to boost expertise and reputation. Modern facilities provide cutting-edge equipment and trained specialists, ensuring superior clinical outcomes. It delivers reduced waiting times and tailored treatment plans for overseas patients. Medical institutions are emphasizing personalized recovery programs and rehabilitation services. Government-backed innovation in digital health tools strengthens patient experience. Medical zones are expanding in prime cities to meet global standards. This clear focus on specialization supports the GCC Medical Tourism Market.

- For instance, King Faisal Specialist Hospital & Research Centre (KFSHRC) in Riyadh reported a 98% survival rate from over 400 robotic cardiac surgeries performed since 2019. The hospital confirmed that these procedures significantly reduced patient recovery time compared to traditional methods, highlighting its advanced surgical capabilities.

Strong Connectivity and Simplified Visa Processes for International Patients

Ease of travel and visa facilitation is a major growth driver. Governments in the region are streamlining entry procedures for medical tourists through dedicated visa categories. Airports, airlines, and tourism boards are creating integrated programs to support patient inflows. It benefits from strong global air connectivity and reliable transport infrastructure. Travelers experience minimal administrative hurdles and faster onboarding at specialized healthcare centers. Dedicated patient support teams offer multilingual assistance. Governments also promote medical travel insurance frameworks. This seamless mobility infrastructure boosts trust and convenience in the GCC Medical Tourism Market.

Rising Awareness of Cost-Effective Treatment and Superior Patient Experience

The growing appeal of affordable, high-quality care positions the region competitively in global markets. Patients from Africa, Asia, and Europe view GCC countries as attractive alternatives to Western healthcare hubs. Medical treatments in these destinations cost less while maintaining international standards. It reflects strong investment in advanced diagnostics, robotic surgery, and aftercare services. Hospitals highlight their patient-first approach through concierge support and cultural sensitivity. Tourism and healthcare operators collaborate to offer bundled packages. Marketing campaigns target medical travelers through trusted global channels. This strategic positioning accelerates the GCC Medical Tourism Market.

Market Trends

Rising Integration of Wellness and Preventive Healthcare Tourism

Medical tourism in the region is increasingly merging with wellness and preventive care programs. Hospitals now collaborate with resorts and wellness centers to offer holistic health packages. Spa treatments, yoga programs, and rehabilitation therapies are combined with advanced medical care. It creates a unique value proposition for long-stay patients. Countries focus on post-treatment recovery tourism to boost patient retention. Wellness hubs in Dubai and Doha are leading this shift. Preventive healthcare attracts younger, health-conscious travelers. This integration is reshaping demand patterns in the GCC Medical Tourism Market.

- For instance, Dubai’s medical tourism sector attracted over 691,000 international health tourists in 2023, according to the Dubai Health Authority. Dubai Health Experience (DXH) plays a key role in promoting medical travel through its integrated network of accredited hospitals and clinics.

Adoption of Digital Platforms and AI Tools to Enhance Patient Journey

The region is investing heavily in digital health platforms to improve patient management. AI-powered systems support appointment scheduling, remote monitoring, and predictive diagnosis. Hospitals deploy teleconsultation tools to engage international patients before their travel. It enables patients to make faster and more informed healthcare decisions. Digital portals provide transparent cost structures and personalized treatment plans. AI also strengthens language translation services for diverse patient groups. Cross-border medical platforms connect travelers with top healthcare providers. This technological shift strengthens the GCC Medical Tourism Market.

- For instance, Cleveland Clinic Abu Dhabi confirmed screening over 2,000 patients for colorectal cancer using AI-assisted colonoscopy since January 2024. The hospital highlighted this milestone as part of its broader strategy to enhance diagnostic precision and patient outcomes.

Focus on Personalized and Cultural-Sensitive Healthcare Delivery

Hospitals across the region are enhancing patient experiences through personalized care protocols. Medical teams offer tailored treatment programs aligned with cultural and religious sensitivities. Dedicated patient coordinators assist with travel, lodging, and communication needs. It improves trust and boosts international patient satisfaction. Facilities also offer multi-language services and culturally appropriate meals. Special recovery zones are designed for comfort and privacy. This patient-focused strategy creates a competitive edge in attracting diverse travelers. Cultural inclusivity is becoming a defining trend in the GCC Medical Tourism Market.

Emergence of Cross-Border Healthcare Partnerships and Brand Collaborations

Cross-border partnerships between healthcare providers and tourism boards are expanding rapidly. Leading hospitals collaborate with international brands to increase visibility and reputation. These alliances enhance training, research, and technology transfer. It builds confidence among patients seeking globally recognized treatments. Strategic tie-ups also improve access to global insurance networks. Medical institutions leverage joint marketing campaigns to attract niche patient segments. Partnerships also boost medical infrastructure standards. These collaborations strengthen the GCC Medical Tourism Market’s global footprint.

Market Challenges Analysis

Intense Global Competition and Need for Continuous Service Differentiation

Competition from established medical tourism destinations such as Thailand, India, and Singapore remains intense. Many international patients compare costs, outcomes, and recovery experiences before making choices. GCC providers must continuously innovate to maintain their appeal. It faces pressure to offer unique service models and advanced medical technology. Price sensitivity among patients creates a challenge in balancing affordability with premium service. Specialized healthcare centers require ongoing investments in staff and infrastructure. Market differentiation strategies must address quality, convenience, and branding. This competitive environment tests the long-term positioning of the GCC Medical Tourism Market.

Regulatory Framework Gaps and Limited Insurance Integration

The absence of a fully harmonized medical tourism regulatory system creates operational friction. Some countries face gaps in patient data exchange, quality assurance, and post-treatment follow-up standards. Insurance integration remains fragmented, creating hurdles for seamless patient coverage. It weakens trust among international travelers seeking transparent healthcare processes. Lack of standardization in pricing and service packages complicates decision-making. Legal recourse frameworks are still evolving, which raises concerns about accountability. Visa policies vary across GCC states, affecting uniform patient access. These regulatory and financial challenges restrict the GCC Medical Tourism Market’s full potential.

Market Opportunities

Strategic Positioning as a Global Hub for Advanced and Specialized Treatments

GCC countries can leverage their strong infrastructure and geopolitical location to attract global patients. Specialized services in orthopedics, fertility, cardiac care, and oncology create new market potential. Strong investments in smart hospitals, AI diagnostics, and robotic surgery enhance credibility. It benefits from increasing demand for advanced procedures from neighboring regions. International branding campaigns can strengthen market reach. Strategic public-private partnerships can accelerate expansion. Focus on niche specialties gives the GCC Medical Tourism Market a strong competitive advantage.

Growing Potential for Regional Collaboration and Integrated Patient Ecosystems

GCC countries have an opportunity to build a unified medical tourism framework. Shared insurance models, joint marketing, and common accreditation systems can attract more travelers. Integrated medical and wellness hubs can extend patient stays. It creates strong economic and healthcare synergies within the region. Regional connectivity and unified visa processes improve patient mobility. Collaboration between governments and private operators supports sustainable growth. A strong ecosystem ensures consistent quality and patient trust across borders. This integrated model expands the GCC Medical Tourism Market’s global influence.

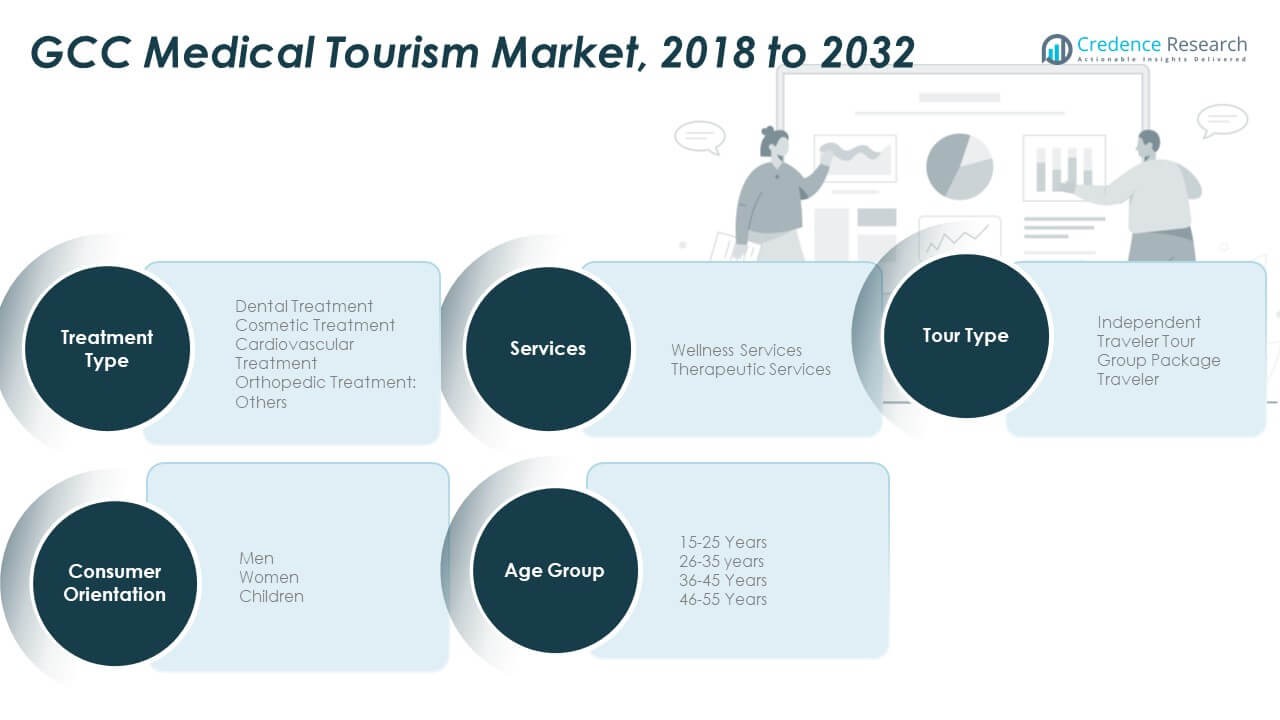

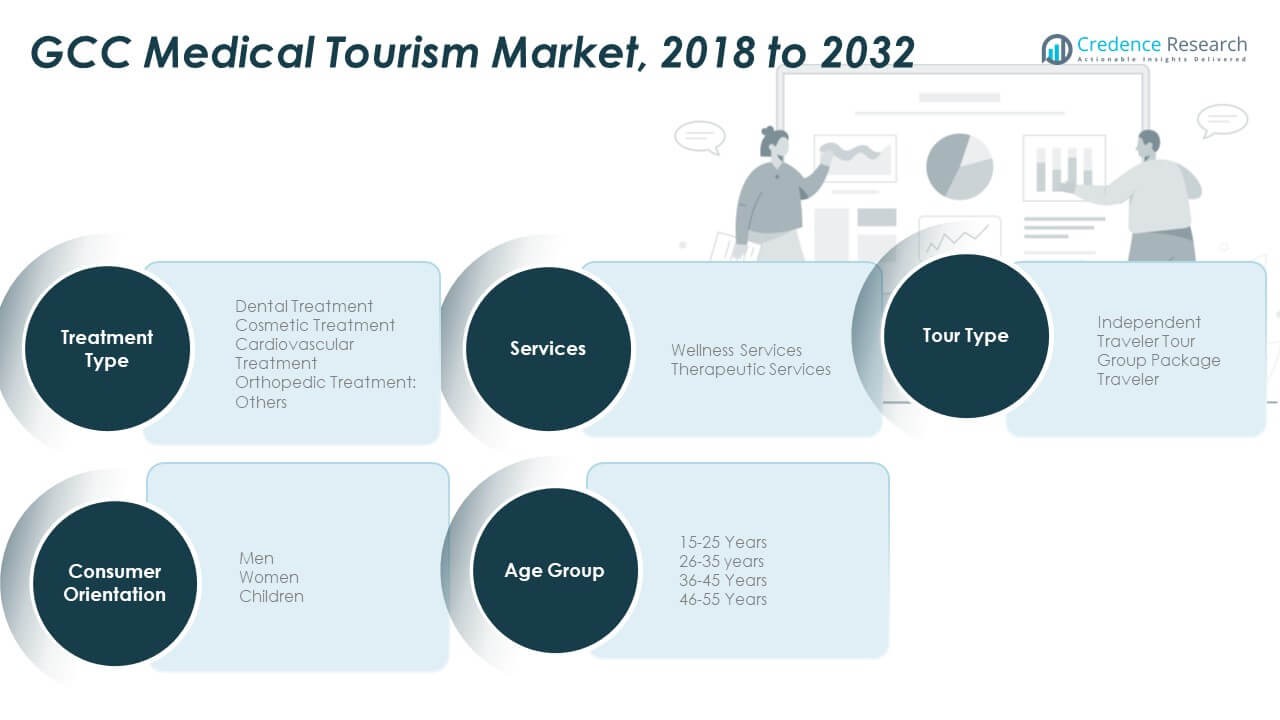

Market Segmentation Analysis

By Treatment Type

The GCC Medical Tourism Market sees strong demand across various treatment types. Dental and cosmetic treatments attract high patient volumes due to affordability, minimal recovery time, and access to skilled professionals. Cardiovascular and orthopedic procedures draw patients seeking advanced surgical techniques and specialized rehabilitation. Fertility and other treatments further diversify the portfolio, increasing appeal among medical travelers. It benefits from advanced hospitals, skilled surgeons, and international accreditation that strengthen trust and service quality.

By Services

Wellness and therapeutic services are key growth areas. Wellness programs focus on preventive care, lifestyle improvement, and recovery enhancement. Therapeutic services support post-surgical rehabilitation and chronic condition management. It caters to travelers seeking holistic health experiences that combine medical procedures with wellness tourism. Integration of spa, fitness, and nutritional programs boosts patient retention and encourages long-stay visits, strengthening the region’s healthcare tourism ecosystem.

- For instance, Saudi German Hospital Dubai achieved a Guinness World Records™ title on February 13, 2025, for conducting 879 vascular health screenings in 12 hours. This milestone highlights the hospital’s leadership in preventive healthcare and wellness initiatives in the region.

By Tour Types

Independent traveler tours dominate due to flexible scheduling, direct access to hospitals, and personalized treatment plans. Patients prefer managing their itinerary and selecting specialized facilities independently. Group package travel serves wellness and rehabilitation seekers who value structured programs. It offers bundled services, including flights, accommodation, and treatment packages, ensuring affordability and ease of coordination. This dual model supports both individual and group patient inflows effectively.

By Consumer Orientation

Men and women contribute significantly to market demand, with women leading in cosmetic and wellness segments. Men show growing interest in cardiovascular, dental, and orthopedic treatments. Pediatric medical travel is increasing steadily as families seek specialized care for children. It benefits from improved pediatric services and global patient trust. Providers are adapting services to cater to specific needs across these consumer groups.

- For instance, Al Zahra Hospital Dubai surpassed 400 robotic surgeries as of November 2024, marking a major milestone in minimally invasive treatment for both adult and pediatric patients and supporting trusted access to world-class surgical technology.

By Age Group

The 26–35 and 36–45 age segments lead demand, driven by elective surgeries and wellness treatments. Younger travelers between 15–25 years seek dental, cosmetic, and wellness programs. The 46–55 segment focuses on cardiovascular and orthopedic care. It reflects rising health awareness and the preference for specialized treatments abroad. Service providers tailor offerings to meet age-specific healthcare and recovery needs, supporting market expansion.

Segmentation

By Treatment Type

- Dental Treatment

- Cosmetic Treatment

- Cardiovascular Treatment

- Orthopedic Treatment

- Others

By Services

- Wellness Services

- Therapeutic Services

By Tour Types

- Independent Traveler Tour

- Group Package Traveler

By Consumer Orientation

By Age Group

- 15–25 Years

- 26–35 Years

- 36–45 Years

- 46–55 Years

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

United Arab Emirates

The United Arab Emirates leads the GCC Medical Tourism Market with a market share of 46%. Dubai and Abu Dhabi dominate patient inflows due to advanced hospital networks, international accreditation, and integrated tourism services. Government programs support large-scale investments in healthcare infrastructure and wellness facilities. Medical free zones and world-class hospitals attract patients from Europe, Asia, and Africa. The country’s strong connectivity, simplified medical visa policies, and multilingual healthcare workforce enhance its competitiveness. It benefits from its reputation for cosmetic, dental, orthopedic, and fertility treatments, positioning the UAE as a global medical tourism hub.

Saudi Arabia

Saudi Arabia holds a 29% market share, driven by rapid healthcare modernization and national transformation goals. Vision 2030 accelerates investment in specialized medical centers and digital health platforms. Riyadh and Jeddah are emerging as major destinations for cardiovascular and orthopedic treatments. Strong government funding and private sector participation are strengthening the ecosystem. The country’s cultural alignment with regional travelers supports medical tourism growth from neighboring nations. It focuses on expanding capacity in high-demand specialties to reduce outbound medical travel and boost domestic revenue retention.

Qatar, Bahrain, Kuwait, and Oman

Qatar, Bahrain, Kuwait, and Oman together account for a 25% market share. Qatar leads this group with investments in wellness and preventive healthcare services. Bahrain is expanding niche segments like rehabilitation and dental tourism. Kuwait and Oman are improving medical infrastructure to strengthen their appeal to international patients. Strategic location and stable regulatory frameworks make these destinations attractive for regional travelers. It gains momentum through collaborations with global healthcare providers and wellness resorts. Growth in these markets reflects a shift toward diversified medical tourism offerings across the subregion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fortis Healthcare

- Health Capital (Wellness Zone WLL)

- Thumbay Medical Tourism

- Fakhri Travel & Tourism Centre

- American Hospital Dubai

- VAID Health Care Services (VHS)

- On-time Healthcare

- Shifa International Hospitals

- Zulekha Healthcare

- Exeter Bone & Joint

- Lyfboat Technologies Pvt. Ltd

- Medsurge India

- Al AfiyaMedi Tour

- Farhan Travel & Tourism

- AL Hakkim Medical Services

- Arabian Gulf Medical Tourism Agency

Competitive Analysis

- The GCC Medical Tourism Market is characterized by intense competition between hospitals, medical facilitators, and travel service providers. Leading healthcare providers, including Fortis Healthcare, American Hospital Dubai, and Zulekha Healthcare, dominate with advanced infrastructure and specialized treatment services. Medical travel agencies such as Al AfiyaMedi Tour, Lyfboat Technologies, and Arabian Gulf Medical Tourism Agency strengthen the network by linking patients with trusted hospitals. It benefits from strong cross-border collaborations and brand partnerships that enhance credibility and patient reach. Key players focus on expanding service portfolios across dental, cosmetic, orthopedic, and cardiovascular specialties. Investments in digital health platforms, AI-driven patient engagement, and multilingual support systems increase operational efficiency. Travel and wellness service providers integrate accommodation, transport, and recovery packages, creating a seamless experience for international patients. Regional players differentiate themselves through high-quality standards, cultural alignment, and personalized services. Continuous innovation, international accreditation, and strategic expansion remain central to sustaining competitiveness in this fast-growing market.

- Recent Developments

- In October 2025, Thumbay Rehabilitation Hospital (part of Gulf Medical University’s College of Health Sciences) launched the region’s most advanced hyperbaric oxygen therapy and transcranial magnetic stimulation therapies, setting a new benchmark for rehabilitation care in the GCC medical tourism market.

- In April 2025, Healthtrip entered a strategic partnership with Satguru Travel Group to support seamless movement of African patients seeking specialized healthcare in the UAE, Saudi Arabia, India, and Germany. This partnership focuses on providing single-window healthcare logistics combining travel, insurance, and hospital access making high-quality treatment broadly accessible for patients across Africa.

- In February 2025, Thumbay Medical Tourism Conclave 2025 ended on a groundbreaking note, fostering global collaboration and innovation in medical tourism services. The event brought together industry leaders, resulting in strategic partnerships and transformative announcements aimed at enhancing accessibility and the international reach of healthcare solutions.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Services, Tour Types, Consumer Orientation and Age Group. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Medical tourism infrastructure will continue to expand, driven by large-scale investments in specialized hospitals and wellness centers.

- Digital transformation will enhance patient engagement through teleconsultation, remote monitoring, and multilingual service platforms.

- Wellness and preventive care tourism will grow as countries promote integrated recovery and lifestyle programs.

- Strategic government initiatives will strengthen visa frameworks and encourage cross-border patient mobility.

- International accreditation and quality certifications will help attract more medical travelers seeking trusted healthcare.

- Regional collaboration among GCC countries will support unified insurance models and joint marketing campaigns.

- High-demand treatment segments like dental, cosmetic, cardiovascular, and orthopedic care will lead service growth.

- Independent traveler tours will dominate, while structured group travel models will expand wellness tourism.

- AI-driven diagnostics, robotic surgeries, and digital medical records will increase treatment precision and patient trust.

- Brand partnerships and hospital expansions will intensify competition, strengthening the global positioning of the GCC medical tourism ecosystem.