Market Overview

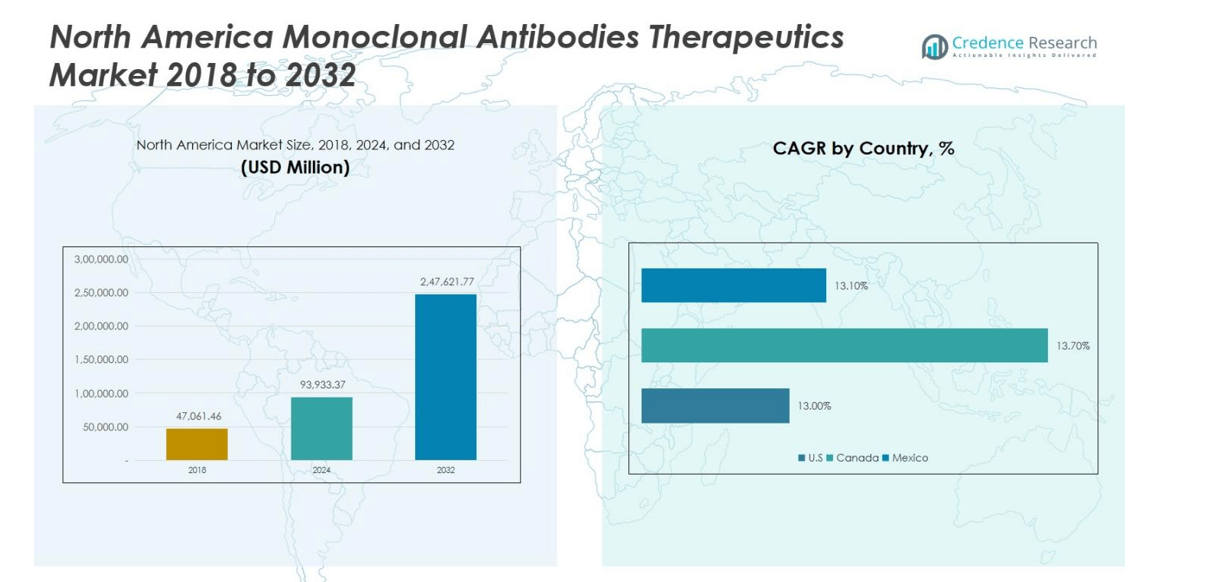

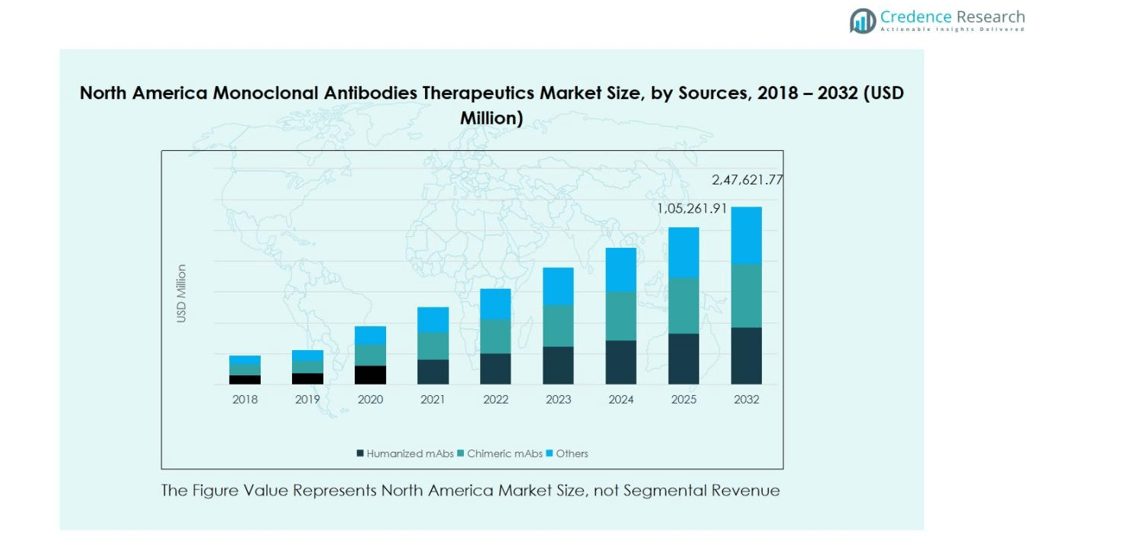

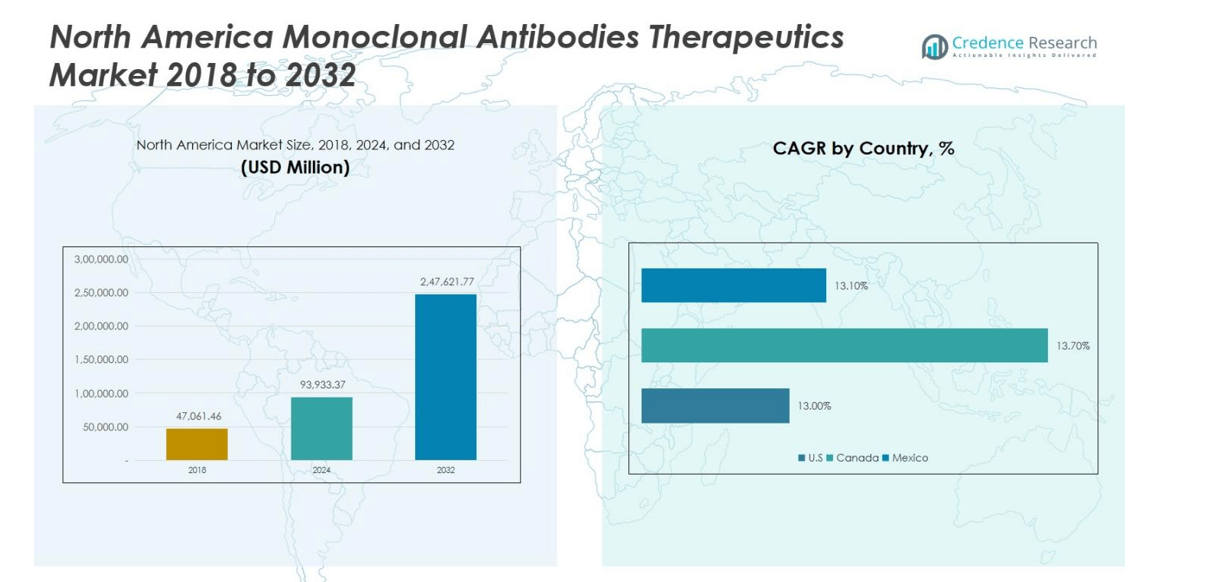

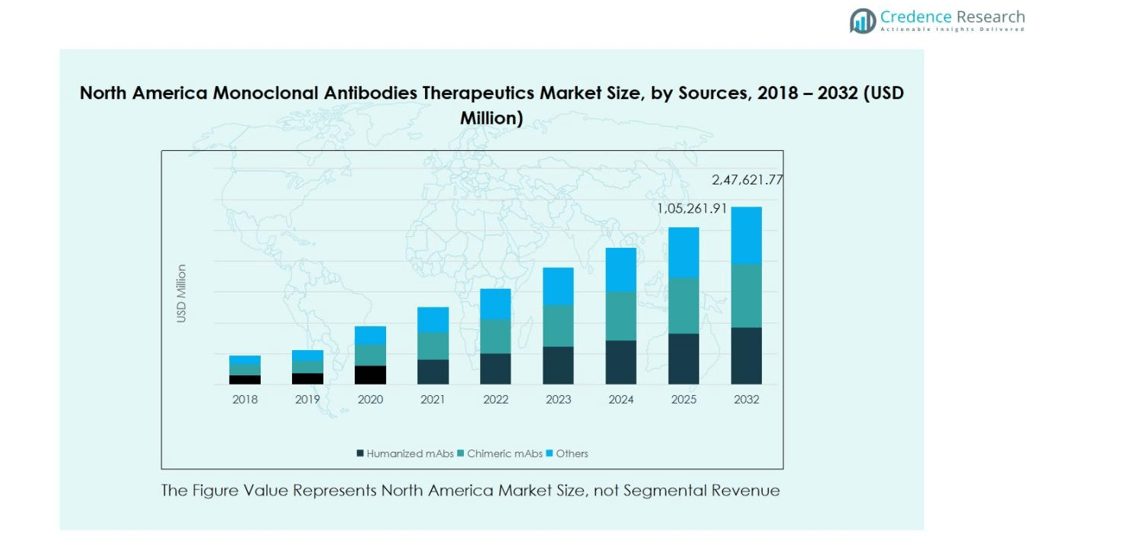

North America Monoclonal Antibodies Therapeutics Market size was valued at USD 47,061.46 million in 2018, reached USD 93,933.37 million in 2024, and is anticipated to reach USD 247,621.77 million by 2032, growing at a CAGR of 12.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Monoclonal Antibodies Therapeutics Market Size 2024 |

USD 93,933.37 million |

| North America Monoclonal Antibodies Therapeutics Market, CAGR |

12.6% |

| North America Monoclonal Antibodies Therapeutics Market Size 2032 |

USD 247,621.77 million |

The North America Monoclonal Antibodies Therapeutics Market is dominated by leading players such as F. Hoffmann-La Roche Ltd, Sanofi, AbbVie Inc., Bristol Myers Squibb Company, Novartis AG, AstraZeneca, Amgen Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies maintain strong market positions through extensive product portfolios, strategic collaborations, and continuous innovation in therapeutic development. The United States leads the regional market with a 74% share, driven by advanced healthcare infrastructure, high research funding, and a strong presence of biopharmaceutical firms. Canada and Mexico follow, contributing significantly to regional growth through expanding clinical trials and increased biologics adoption.

Market Insights

- North America Monoclonal Antibodies Therapeutics Market size was valued at USD 93,933.37 million in 2024 and is projected to reach USD 247,621.77 million by 2032, growing at a CAGR of 12.6%. Humanized monoclonal antibodies (mAbs) held the largest source segment share of 62%, while oncology led the therapeutic area with 48%, and intravenous administration dominated with 71% share.

- The market growth is primarily driven by the rising prevalence of chronic and autoimmune diseases, increasing cancer incidence, and growing demand for targeted therapies with higher efficacy and reduced side effects.

- A major trend shaping the market is the expansion of subcutaneous (SC) delivery systems, offering patient-friendly administration and supporting home-based treatment models. Integration of AI and data analytics in drug development is also accelerating precision medicine adoption.

- The market is highly competitive, led by F. Hoffmann-La Roche Ltd, Sanofi, AbbVie Inc., and other key players, focusing on innovation, strategic collaborations, and pipeline expansion.

- High manufacturing costs, complex production processes, and stringent regulatory requirements remain key restraints, while the United States leads the regional market with 74% share, followed by Canada at 16% and Mexico at 10%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source:

In the North America Monoclonal Antibodies Therapeutics Market, humanized monoclonal antibodies (mAbs) dominate the source segment, capturing 62% of the total market share in 2024. Their high biocompatibility, reduced immunogenicity, and enhanced efficacy in treating complex diseases such as cancer and autoimmune disorders have positioned them as the preferred choice among healthcare providers. The segment’s growth is further propelled by the increasing adoption of advanced antibody engineering technologies and the growing number of FDA approvals for humanized mAb therapies targeting oncology and chronic inflammatory conditions.

- For instance, in 2024, Roche’s PiaSky® (crovalimab-akkz), a humanized IgG1 monoclonal antibody, received full FDA approval for treating paroxysmal nocturnal hemoglobinuria (PNH) with engineered features to improve recycling and reduce immune reactions.

By Therapeutic Area:

The oncology segment leads the North America Monoclonal Antibodies Therapeutics Market, accounting for 48% of the total market share in 2024. The dominance of this segment is driven by the rising prevalence of various cancers, the availability of targeted therapies, and increased R&D investments by pharmaceutical companies. Additionally, the growing number of clinical trials focused on tumor-specific antigens and the integration of monoclonal antibodies with immunotherapy approaches continue to expand their therapeutic applications, reinforcing oncology’s leading position across the region.

- For instance, Roche received FDA approval in 2024 for Tecentriq Hybreza, the first subcutaneous PD-(L)1 inhibitor providing faster cancer immunotherapy administration for lung, liver, skin, and soft tissue cancers.

By Route of Administration:

The intravenous (IV) route of administration remains the dominant mode in the North America Monoclonal Antibodies Therapeutics Market, holding about 71% of the total market share in 2024. This preference is attributed to its rapid bioavailability, controlled dosage administration, and suitability for complex or high-dose antibody formulations. Hospitals and specialty clinics primarily administer IV therapies for cancer, autoimmune, and infectious diseases, ensuring precise delivery and efficacy. However, the subcutaneous (SC) route is gaining traction due to its patient-friendly nature and growing shift toward home-based treatment models.

Key Growth Drivers

Rising Prevalence of Chronic and Autoimmune Diseases

The growing incidence of chronic and autoimmune disorders such as rheumatoid arthritis, multiple sclerosis, and various cancers is a major driver of the North America Monoclonal Antibodies Therapeutics Market. An aging population and changing lifestyle patterns have led to a surge in disease cases, increasing demand for effective targeted therapies. Monoclonal antibodies offer superior specificity and fewer side effects compared to traditional treatments, making them the preferred therapeutic option. This rising disease burden continues to fuel demand and encourage research into novel antibody-based treatments.

- For instancer, Genentech’s Atezolizumab (Tecentriq) received FDA approval in 2021 as adjuvant treatment for non-small cell lung cancer, where it improved disease-free survival compared to placebo in patients with PD-L1-positive tumors, reducing the risk of disease recurrence or death by 36% in pivotal trials.

Advancements in Antibody Engineering and Biologic Research

Technological progress in antibody engineering, hybridoma, and recombinant DNA methods has significantly improved the safety and efficacy of monoclonal antibodies. These advancements have led to the creation of fully human and humanized antibodies with enhanced stability and extended half-lives. North America’s strong biopharmaceutical research infrastructure, supported by academic partnerships and government funding, further accelerates innovation. Continuous improvements in biologic design and manufacturing processes are broadening therapeutic applications, contributing to the market’s sustained growth and competitive edge in global antibody development.

- For instance, hybridoma technology, introduced in 1975 by Köhler and Milstein, remains foundational for producing highly specific monoclonal antibodies by fusing B cells with myeloma cells to create immortal hybridoma lines capable of continuous antibody production.

Growing FDA Approvals and Strategic Collaborations

The increasing number of FDA approvals for monoclonal antibody therapies across oncology, infectious diseases, and autoimmune disorders strengthens market expansion. Regulatory incentives such as orphan drug status and breakthrough therapy designations encourage rapid commercialization. Moreover, strategic collaborations between major pharmaceutical and biotech companies are enhancing R&D capabilities and expanding clinical pipelines. These partnerships enable cost efficiency, technological innovation, and broader treatment accessibility, positioning North America as a leader in antibody-based therapeutics and driving steady market advancement.

Key Trends and Opportunities

Expansion of Subcutaneous Delivery Systems

A major trend shaping the market is the growing shift toward subcutaneous (SC) delivery systems. Patients and healthcare providers increasingly favor SC administration for its convenience, shorter infusion times, and compatibility with home-based treatments. Pharmaceutical firms are developing advanced SC formulations that maintain efficacy while improving patient comfort and compliance. This transition from intravenous to subcutaneous delivery not only enhances patient experience but also reduces hospital dependency and overall treatment costs, reinforcing the adoption of antibody therapies across North America.

- For instance, Alphamab Oncology developed a proprietary platform for high-concentration subcutaneous formulations, successfully producing KN035, the world’s first subcutaneously injectable PD-(L)1 inhibitor that enhances patient compliance by allowing smaller injection volumes while preserving drug stability.

Integration of AI and Data Analytics in Drug Development

The integration of artificial intelligence (AI) and data analytics presents significant opportunities in monoclonal antibody discovery and optimization. AI-driven models enable faster identification of antigen targets, molecular design, and prediction of therapeutic efficacy. Leading pharmaceutical companies are leveraging machine learning algorithms to streamline clinical trial design and enhance precision medicine approaches. This technology-driven evolution reduces R&D costs and accelerates time-to-market, opening avenues for developing next-generation antibody therapies tailored to patient-specific needs and rare disease conditions.

For instance, MAbSilico has developed an in silico pipeline that designs humanized antibody sequences optimized for affinity and developability within days, significantly de-risking and speeding up the discovery process.

Key Challenges

High Manufacturing Costs and Complex Production Processes

The manufacturing of monoclonal antibodies involves sophisticated bioprocessing, stringent regulatory oversight, and expensive raw materials, leading to high production costs. These expenses often translate into elevated therapy prices, limiting affordability and accessibility. Additionally, maintaining consistency and scalability during production remains a technical challenge for many biopharmaceutical firms. To address this, companies are investing in single-use bioreactors, continuous bioprocessing, and automation technologies, though cost pressures continue to constrain market growth, especially in smaller healthcare settings.

Stringent Regulatory Requirements and Approval Delays

The North American regulatory landscape for monoclonal antibodies is highly demanding, requiring extensive preclinical testing, long clinical trial phases, and comprehensive post-market surveillance. These rigorous processes often delay product approvals and increase development costs, creating hurdles for smaller biotech firms. The evolving guidelines for biosimilars add further complexity, necessitating additional validation and documentation. While regulatory bodies such as the FDA are working to expedite reviews for critical therapies, the lengthy approval timelines remain a key challenge affecting market entry and innovation speed.

Regional Analysis

United States

The United States holds the largest share of the North America Monoclonal Antibodies Therapeutics Market, accounting for 74% of the regional revenue in 2024. The dominance of the U.S. market is supported by advanced healthcare infrastructure, high R&D investments, and the strong presence of leading biopharmaceutical companies such as Amgen, AbbVie, and Bristol Myers Squibb. Robust FDA approval processes and continuous innovation in antibody engineering technologies have accelerated the development of novel therapeutic antibodies. Increasing prevalence of cancer, autoimmune diseases, and favorable reimbursement policies continue to strengthen the market’s growth trajectory across the country.

Canada

Canada represents 16% of the North America Monoclonal Antibodies Therapeutics Market in 2024, driven by rising healthcare expenditure and growing adoption of biologic therapies. The country’s focus on improving patient access to innovative biologics and biosimilars has encouraged strong demand in oncology and autoimmune disease segments. Collaborative research initiatives between academic institutions and biopharmaceutical companies are expanding clinical development pipelines. Moreover, supportive regulatory frameworks from Health Canada and public funding for advanced therapeutics contribute to the country’s growing share, making Canada a key emerging hub for monoclonal antibody research and commercialization.

Mexico

Mexico accounts for 10% of the North America Monoclonal Antibodies Therapeutics Market in 2024, with increasing government initiatives to enhance healthcare accessibility and expand biologics availability. The country’s market growth is fueled by rising incidences of chronic diseases and the gradual integration of advanced biologic therapies in public and private healthcare sectors. Expanding partnerships with global pharmaceutical companies and improved infrastructure for clinical trials are fostering greater adoption of monoclonal antibody-based treatments. Although regulatory challenges and cost constraints persist, Mexico’s improving healthcare landscape positions it as a growing contributor to the regional market.

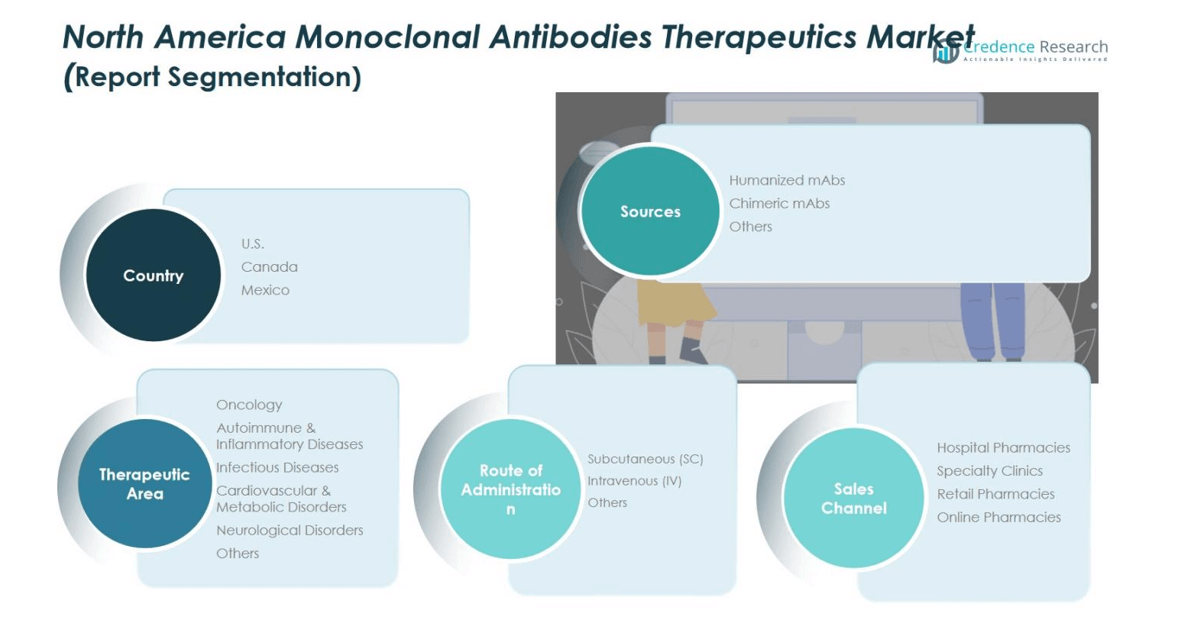

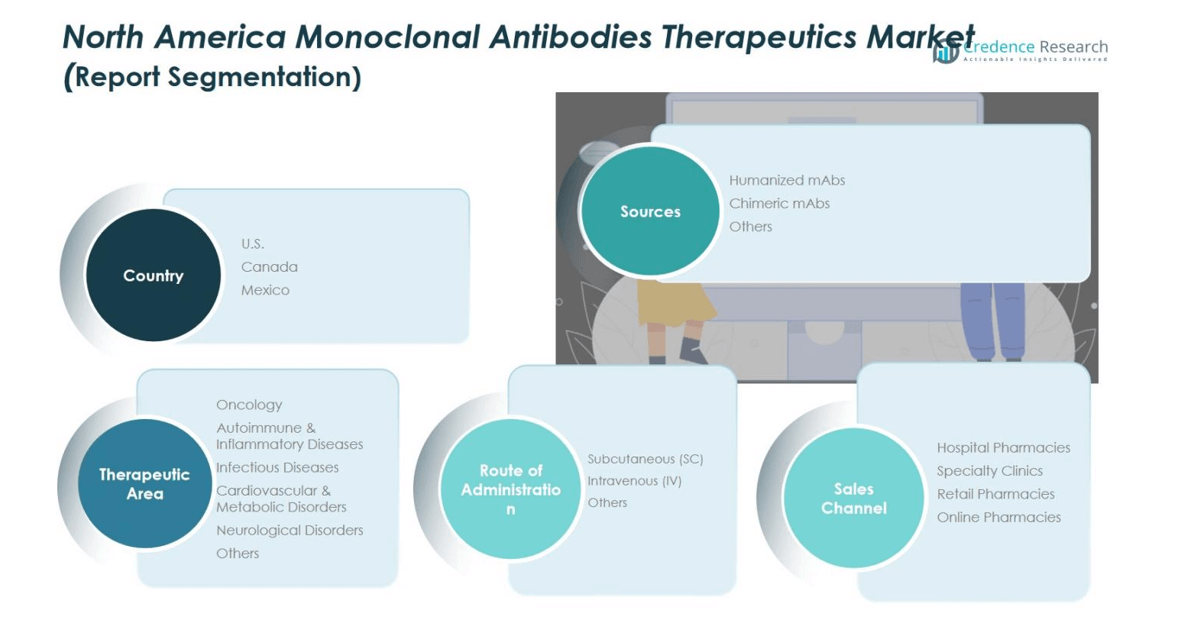

Market Segmentations:

By Sources

- Humanized mAbs

- Chimeric mAbs

- Others

By Therapeutic Area

- Oncology

- Autoimmune & Inflammatory Diseases

- Infectious Diseases

- Cardiovascular & Metabolic Disorders

- Neurological Disorders

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Others

By Sales Channel

- Hospital Pharmacies

- Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

Competitive Landscape

The competitive landscape of the North America Monoclonal Antibodies Therapeutics Market is defined by the strong presence of major players such as F. Hoffmann-La Roche Ltd, Sanofi, AbbVie Inc., Bristol Myers Squibb Company, Novartis AG, AstraZeneca, Amgen Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, and Johnson & Johnson Services, Inc. These companies dominate the regional market through extensive product portfolios, robust R&D investments, and continuous innovation in antibody development. Strategic collaborations, mergers, and acquisitions are central to strengthening their market position and expanding therapeutic pipelines. The focus remains on developing next-generation antibodies with enhanced efficacy, lower immunogenicity, and improved delivery systems. In addition, many key players are leveraging advanced technologies such as AI-driven drug discovery and hybridoma engineering to accelerate production and reduce development costs. With increasing FDA approvals and expansion of biosimilar portfolios, competition continues to intensify, driving innovation and accessibility across the regional therapeutic landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hoffmann-La Roche Ltd

- Sanofi

- AbbVie Inc.

- Bristol Myers Squibb Company

- Novartis AG

- AstraZeneca

- Amgen Inc.

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Johnson & Johnson Services, Inc.

- Other Key Players

Recent Developments

- In January 8, 2024, Johnson & Johnson entered into a definitive agreement to acquire Ambrx Biopharma, a clinical-stage biopharmaceutical company with a proprietary synthetic biology platform for next-generation antibody drug conjugates, in an all-cash deal valued at approximately $2.0 billion.

- In February 28, 2024, AbbVie and OSE Immunotherapeutics announced a global license and collaboration agreement to develop OSE-230, a monoclonal antibody in pre-clinical stages targeting chronic and severe inflammation.

- In October 17, 2025, Rani Therapeutics signed a major licensing agreement with Chugai Pharmaceutical to develop and commercialize an oral version of Chugai’s experimental antibody for a rare disease, with the deal potentially expanding to five additional drugs, totaling up to $1.09 billion.

- In 2024, AbbVie announced the acquisition of Aliada Therapeutics, a company specializing in developing ALIA-1758, an anti-pyroglutamate amyloid beta monoclonal antibody aimed at treating Alzheimer’s disease.

Report Coverage

The research report offers an in-depth analysis based on Sources, Therapeutic Area, Route of Administration, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with increasing adoption of targeted monoclonal antibody therapies across oncology and autoimmune diseases.

- Advancements in antibody engineering and biomanufacturing technologies will enhance therapeutic precision and reduce production complexity.

- The growing approval of biosimilar monoclonal antibodies will increase treatment accessibility and affordability across the region.

- Strategic partnerships between pharmaceutical companies and research institutions will accelerate innovation and clinical trial development.

- Rising investment in personalized medicine will drive demand for monoclonal antibodies tailored to individual patient profiles.

- Subcutaneous delivery formulations will gain momentum due to their convenience and patient compliance advantages.

- Expansion of AI-driven drug discovery platforms will improve efficiency in antibody design and reduce development timelines.

- Healthcare digitization and real-world data analytics will strengthen post-market surveillance and treatment optimization.

- Increasing government support for biologics research will encourage domestic production and reduce dependency on imports.

- Continued emphasis on oncology and chronic disease management will sustain market growth and therapeutic diversification.