Market Overview:

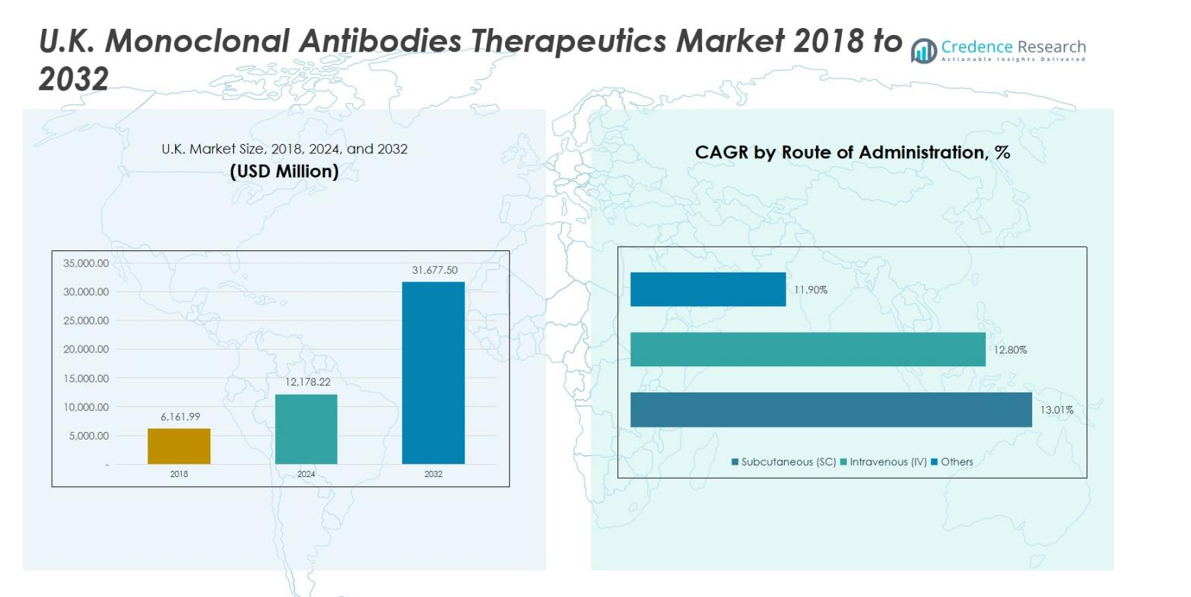

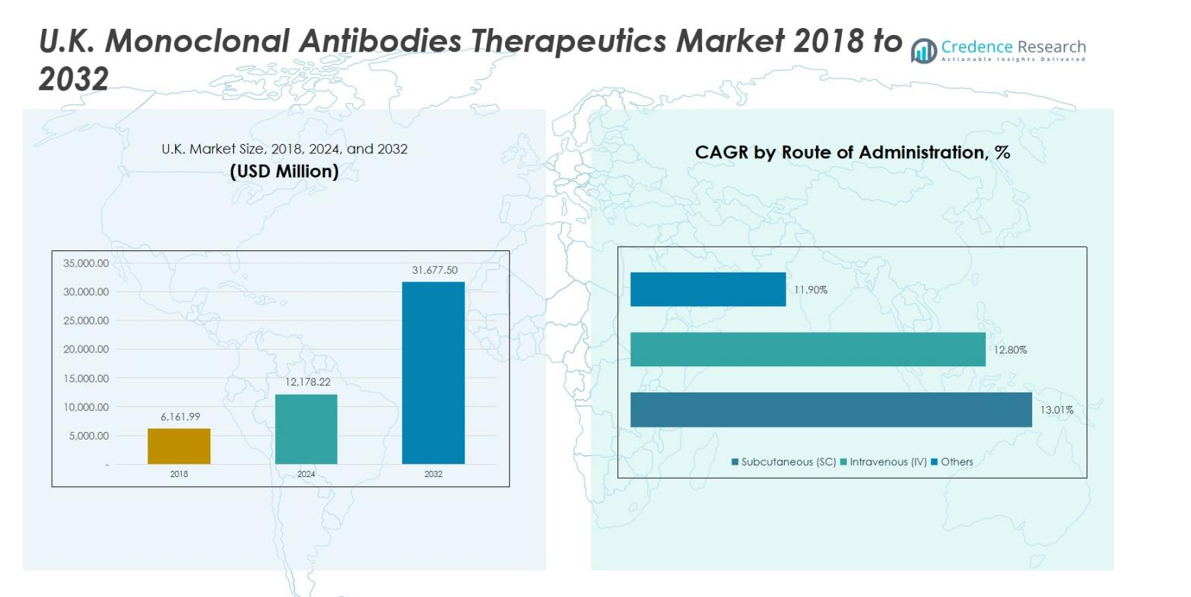

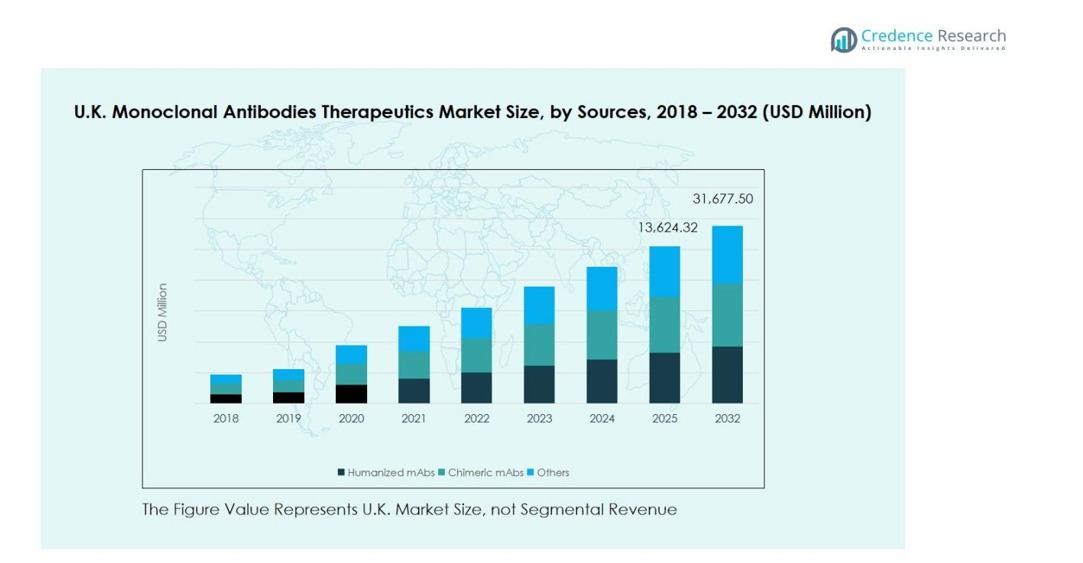

U.K. Monoclonal Antibodies Therapeutics Market size was valued at USD 6,161.99 million in 2018, growing to USD 12,178.22 million in 2024, and is anticipated to reach USD 31,677.50 million by 2032, at a CAGR of 12.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Monoclonal Antibodies Therapeutics MarketSize 2024 |

USD 12,178.22 million |

| U.K. Monoclonal Antibodies Therapeutics Market, CAGR |

12.9% |

| U.K. Monoclonal Antibodies Therapeutics Market Size 2032 |

USD 31,677.50 million |

The U.K. Monoclonal Antibodies Therapeutics Market is highly competitive, led by key players including F. Hoffmann-La Roche Ltd, Sanofi, AbbVie Inc., Bristol Myers Squibb Company, Apollo Therapeutics Limited, AstraZeneca, Amgen Inc., Eli Lilly and Company, Kymab Ltd, and Johnson & Johnson Services, Inc. These companies focus on expanding their portfolios through humanized and bispecific antibodies, subcutaneous formulations, and biosimilars to address oncology, autoimmune, and infectious disease segments. Strategic collaborations, mergers, and robust R&D pipelines enable faster product launches and broader market penetration. England emerges as the leading region, commanding 65% of total revenue, supported by advanced healthcare infrastructure, high patient volumes, and strong adoption of innovative therapies. The combination of established players and a supportive regulatory environment positions the U.K. market for sustained growth across multiple therapeutic areas and administration routes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.K. Monoclonal Antibodies Therapeutics Market was valued at USD 12,178.22 Million in 2024 and is projected to reach USD 31,677.50 Million by 2032, growing at a CAGR of 12.9%.

- Rising prevalence of cancer, autoimmune, and chronic inflammatory diseases is driving demand, with oncology accounting for nearly 50% of therapeutic area revenue and humanized mAbs holding 45% of the sources segment.

- The shift toward subcutaneous administration, ease of self-administration, and patient convenience are key trends, accelerating adoption in hospitals and specialty clinics.

- Competition is intense among leading players such as F. Hoffmann-La Roche Ltd, Sanofi, AbbVie Inc., and AstraZeneca, who are focusing on R&D, biosimilars, and innovative formulations to strengthen market presence.

- England leads the regional market with 65% share, followed by Scotland (15%), Wales (10%), and Northern Ireland (10%), supported by advanced healthcare infrastructure and strong regulatory frameworks.

Market Segmentation Analysis:

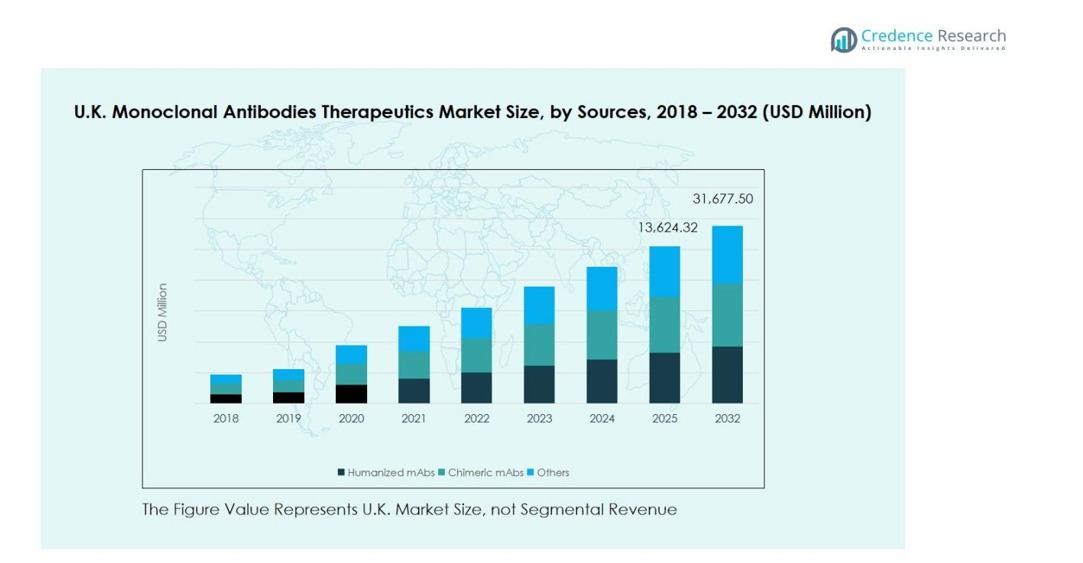

By Sources:

The humanized monoclonal antibodies (mAbs) segment dominates the U.K. market, accounting for approximately 45% of total revenue. Growth is driven by their higher specificity and lower immunogenicity compared to chimeric antibodies, making them preferable for chronic disease treatments. Increasing R&D investments and approvals of novel humanized mAbs for oncology and autoimmune disorders further fuel demand. Chimeric mAbs follow with a notable share, benefiting from established clinical use, while the ‘Others’ category remains marginal but shows potential from emerging antibody formats. Rising adoption in hospitals and specialty clinics reinforces segment growth.

- For instance, Chimeric mAbs follow with a notable share, benefiting from their established clinical use; infliximab (Remicade), a human-mouse chimeric antibody targeting TNF-α, is used for refractory Crohn’s disease and rheumatoid arthritis.

By Therapeutic Area:

Oncology leads the therapeutic area segment, contributing nearly 50% of the market share. The dominance is supported by the rising prevalence of cancers, advancements in targeted therapies, and strong pipeline activity from major biotech firms. Autoimmune and inflammatory diseases follow closely, driven by chronic patient populations and expanded treatment indications. Infectious diseases, cardiovascular & metabolic disorders, and neurological disorders collectively capture smaller shares but show steady growth due to increasing clinical trials and adoption of monoclonal therapies. The market’s expansion is underpinned by continuous innovation and regulatory approvals.

- For instance, the PHOENYCS GO phase 3 trial of dapirolizumab pegol by UCB and Biogen showed marked improvement in systemic lupus erythematosus (SLE) symptoms, while Argenx’s efgartigimod demonstrated efficacy in idiopathic inflammatory myopathies and Sjögren’s disease in phase 2 studies.

By Route of Administration:

Subcutaneous (SC) administration is the leading route, representing around 55% of the market share. Its preference stems from patient convenience, reduced hospital visits, and the feasibility of self-administration, particularly for chronic conditions. Intravenous (IV) delivery, though traditionally dominant, is experiencing slower growth due to longer administration times and higher healthcare costs. The ‘Others’ category, including emerging delivery methods, remains minimal but benefits from innovations in drug formulation and targeted delivery systems. Growing awareness and adoption in both hospital and specialty clinic settings continue to drive SC segment growth.

Key Growth Drivers

Rising Prevalence of Chronic and Cancer Diseases

The increasing incidence of cancer, autoimmune, and chronic inflammatory disorders in the U.K. is a primary driver for the monoclonal antibodies therapeutics market. Healthcare providers are adopting mAb therapies due to their targeted action, efficacy, and reduced side effects compared to conventional treatments. Oncology remains the leading therapeutic area, fueling demand for innovative antibody therapies. The growing patient population, coupled with early diagnosis and awareness programs, continues to expand the market, making monoclonal antibodies a preferred option in both hospital and specialty care settings.

- For instance, in autoimmune diseases, Rituximab (Rituxan), developed by Roche, targets CD20 on B cells. It is used for conditions like rheumatoid arthritis and certain autoimmune blood disorders, showing a significant reduction in disease symptoms and B cell populations.

Advancements in Monoclonal Antibody Technology

Continuous innovation in antibody engineering, including humanized and bispecific antibodies, is driving market growth. Improved efficacy, reduced immunogenicity, and enhanced delivery mechanisms are expanding clinical applications across multiple therapeutic areas. Companies are investing heavily in R&D to develop novel mAbs targeting previously untreatable conditions. Additionally, the introduction of subcutaneous formulations enhances patient compliance and broadens adoption in outpatient and homecare settings, further accelerating market expansion and providing a competitive edge to early adopters.

- For instance, the introduction of subcutaneous monoclonal antibody formulations, such as those developed by Regeneron Pharmaceuticals, has reduced administration time and enhanced patient compliance by enabling at-home treatments with shorter and more convenient dosing schedules.

Supportive Regulatory Environment and Approvals

Favorable regulatory frameworks and accelerated approval pathways in the U.K. are facilitating faster market entry for monoclonal antibodies. Regulatory agencies are increasingly granting priority review for therapies addressing unmet medical needs, particularly in oncology and rare diseases. This environment encourages investment in clinical trials and innovation while reducing time-to-market. Strong patent protection and clear guidelines for biosimilars also foster market confidence, attracting global pharmaceutical players and contributing to steady growth across multiple therapeutic areas and administration routes.

Key Trends & Opportunities

Expansion of Subcutaneous Administration

The shift from intravenous to subcutaneous administration is a notable market trend, driven by patient convenience, reduced hospital stays, and ease of self-administration. This trend aligns with the growing emphasis on outpatient care and home-based treatment, particularly for chronic conditions like autoimmune diseases. Pharmaceutical companies are increasingly developing SC formulations of established mAbs to enhance patient compliance and reduce healthcare costs. The trend is expected to accelerate adoption rates and create opportunities for novel delivery systems and patient-centric therapeutic solutions.

- For instance, Janssen’s development of a subcutaneous Stelara (ustekinumab) for Crohn’s disease, allowing patients to self-dose with a prefilled syringe and avoid regular clinic visits.

Emerging Biologics and Biosimilars

The development of biosimilars and next-generation biologics presents significant opportunities for market expansion. Cost-effective alternatives are enabling broader patient access, particularly in NHS-funded programs, while stimulating competition and innovation. Companies are investing in biosimilar development for high-demand mAbs, offering potential for rapid revenue growth. Additionally, emerging antibody formats, including bispecific and antibody-drug conjugates, open new therapeutic possibilities across oncology, autoimmune, and infectious diseases, creating long-term growth potential for both established and new market players.

- For instance, Celltrion has launched biosimilars such as infliximab (Remsima), rituximab, and trastuzumab. Their competitive pricing strategy and quality manufacturing have established them as key players worldwide.

Key Challenges

High Treatment Costs

Monoclonal antibody therapies remain expensive, limiting patient access and posing a challenge for widespread adoption. High production costs, complex manufacturing processes, and extended clinical development contribute to elevated pricing. Despite growing awareness and insurance coverage, affordability remains a barrier, particularly in outpatient and homecare settings. This challenge encourages the development of biosimilars and cost-efficient delivery methods, but managing cost without compromising efficacy continues to be a critical concern for manufacturers and healthcare providers alike.

Complex Regulatory and Manufacturing Requirements

Stringent regulatory requirements and sophisticated manufacturing processes create significant hurdles for market players. Monoclonal antibodies require rigorous quality control, specialized facilities, and adherence to evolving safety standards, which can delay product launches. Additionally, compliance with EU and U.K. guidelines for biologics and biosimilars adds complexity to market entry. Companies must invest heavily in R&D, validation, and continuous monitoring, making market penetration challenging for smaller players and slowing the adoption of innovative therapies despite strong clinical demand.

Regional Analysis

England

England dominates the U.K. monoclonal antibodies therapeutics market, holding a 65% share of total revenue. The region benefits from a dense concentration of advanced healthcare infrastructure, research institutions, and major pharmaceutical hubs. High patient volumes in oncology and autoimmune therapies drive strong adoption of mAb treatments. Strategic collaborations between hospitals and biotech companies accelerate clinical trials and product launches. Additionally, government funding and early access programs support widespread availability of monoclonal therapies. The presence of leading manufacturers and active regulatory support further reinforce England’s market leadership within the U.K.

Scotland

Scotland accounts for 15% of the U.K. market share in monoclonal antibodies therapeutics. Growth is supported by strong healthcare services, specialized hospitals, and increasing adoption of targeted therapies for chronic and rare diseases. Clinical research initiatives and academic partnerships enhance access to novel treatments. Oncology and autoimmune segments are primary contributors to revenue, driven by increasing incidence rates and early detection programs. Government-backed healthcare schemes ensure patient affordability and encourage uptake. Investments in biologics manufacturing and local distribution networks also contribute to Scotland’s steady expansion in the monoclonal antibodies market.

Wales

Wales holds a 10% share of the U.K. monoclonal antibodies therapeutics market, driven by increasing demand in oncology and autoimmune disorders. The region benefits from public healthcare programs that improve patient access to advanced biologic therapies. Adoption of subcutaneous and intravenous monoclonal antibody treatments is growing, particularly in hospital and specialty clinic settings. Local collaborations between pharmaceutical companies and healthcare providers facilitate clinical trials and accelerate new product launches. Government initiatives promoting early diagnosis and targeted therapies further stimulate market growth, positioning Wales as a key contributor to the overall U.K. monoclonal antibodies therapeutics market.

Northern Ireland

Northern Ireland contributes 10% to the overall U.K. monoclonal antibodies therapeutics market. Market growth is fueled by the rising prevalence of chronic and rare diseases, combined with the expansion of specialty clinics and hospital networks. Government-backed healthcare programs enhance patient access to innovative therapies, particularly in oncology and autoimmune treatment areas. Local partnerships between biotech firms and healthcare providers accelerate clinical research and adoption of monoclonal antibodies. Although smaller in size compared to England and Scotland, Northern Ireland demonstrates steady growth due to increasing awareness, improved healthcare infrastructure, and targeted initiatives to support biologics usage across the region.

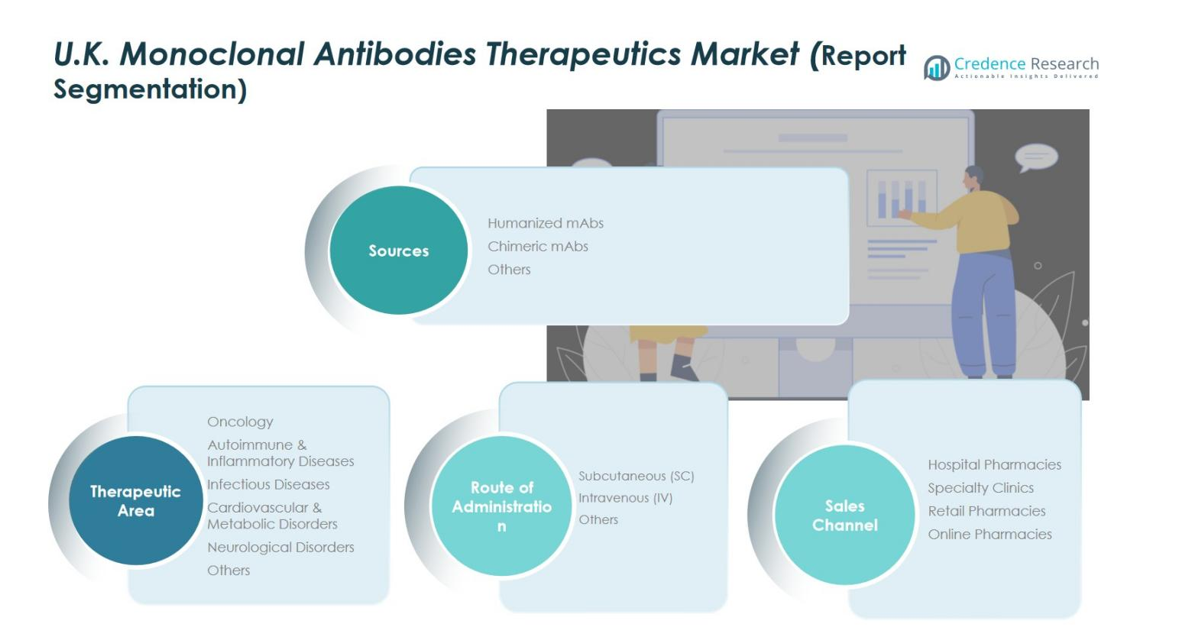

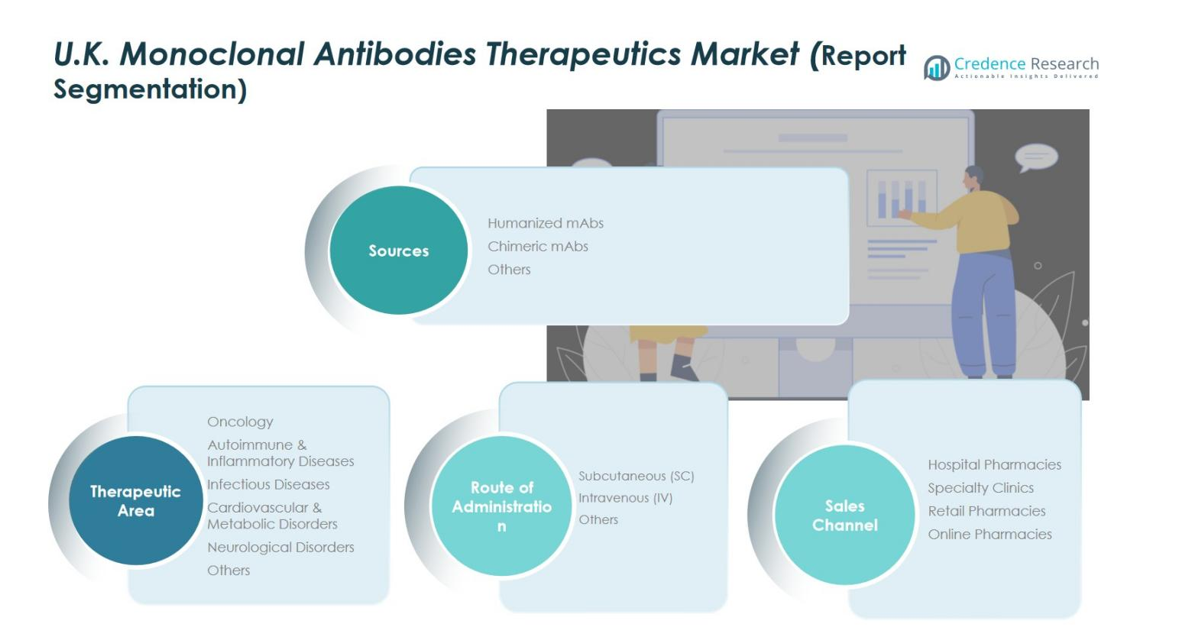

Market Segmentations:

By Sources

- Humanized mAbs

- Chimeric mAbs

- Others

By Therapeutic Area

- Oncology

- Autoimmune & Inflammatory Diseases

- Infectious Diseases

- Cardiovascular & Metabolic Disorders

- Neurological Disorders

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Others

By Sales Channel

- Hospital Pharmacies

- Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

- England

- Scotland

- Wales

- Northern Ireland

Competitive Landscape

The competitive landscape of the U.K. monoclonal antibodies therapeutics market is led by key players including F. Hoffmann-La Roche Ltd, Sanofi, AbbVie Inc., Bristol Myers Squibb Company, Apollo Therapeutics Limited, AstraZeneca, Amgen Inc., Eli Lilly and Company, Kymab Ltd, and Johnson & Johnson Services, Inc. Market competition is driven by continuous innovation, strategic collaborations, and expansion of product portfolios across oncology, autoimmune, and infectious disease segments. Companies are focusing on developing humanized and bispecific antibodies, improving subcutaneous formulations, and launching biosimilars to enhance market reach. Additionally, mergers, acquisitions, and partnerships are strengthening distribution networks and accelerating clinical research. Strong R&D pipelines, regulatory approvals, and patient-centric strategies further differentiate companies, intensifying competition. This dynamic environment encourages technological advancements and robust market growth while enabling players to capture significant shares in hospital, specialty, and retail pharmacy channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hoffmann-La Roche Ltd

- Sanofi

- AbbVie Inc.

- Bristol Myers Squibb Company

- Apollo Therapeutics Limited

- AstraZeneca

- Amgen Inc.

- Eli Lilly and Company

- Kymab Ltd

- Johnson & Johnson Services, Inc.

Recent Developments

- On April 17, 2025, GSK announced that the U.K. Medicines and Healthcare products Regulatory Agency (MHRA) approved Blenrep in combination therapies for relapsed/refractory multiple myeloma.

- In September 2025, AbbVie launched Elahere (mirvetuximab soravtansine-gynx) in the U.K. at the same list price as in the U.S., following its MHRA approval in July 2025. The antibody-drug conjugate targets ovarian cancer cells.

- In May 2025, Amgen’s TEPEZZA (teprotumumab) received MHRA approval as the first therapy specifically for moderate-to-severe Thyroid Eye Disease in adults, marking a major advancement in targeted treatment options

Report Coverage

The research report offers an in-depth analysis based on Sources, Therapeutic Area, Route of Administration, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily driven by increasing prevalence of cancer and autoimmune diseases.

- Adoption of humanized and bispecific monoclonal antibodies will expand across therapeutic areas.

- Subcutaneous administration will gain preference due to patient convenience and reduced hospital visits.

- Biosimilars will create opportunities for cost-effective therapies and broader patient access.

- Oncology will continue to dominate the therapeutic segment with high research and development activity.

- Technological innovations in antibody engineering will enable development of next-generation therapies.

- Strategic partnerships and collaborations among pharma and biotech companies will accelerate product launches.

- Growth in specialty clinics and hospital networks will support higher treatment adoption rates.

- Regulatory support for novel therapies and accelerated approvals will facilitate faster market entry.

- Continuous investment in clinical trials and research will drive long-term market expansion.