Market Overview

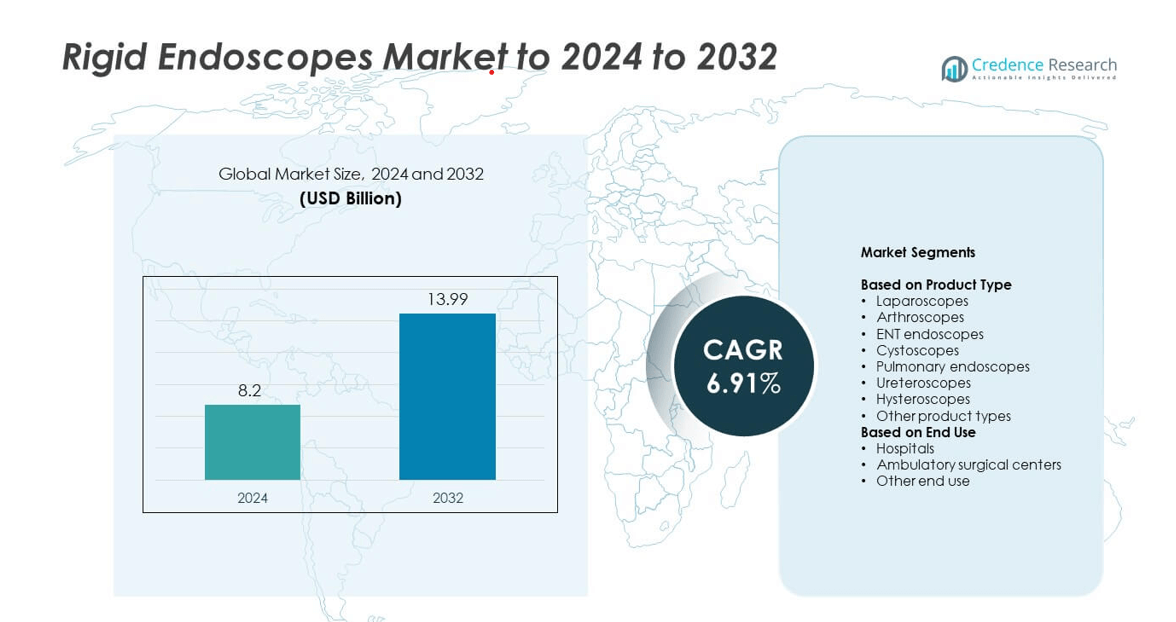

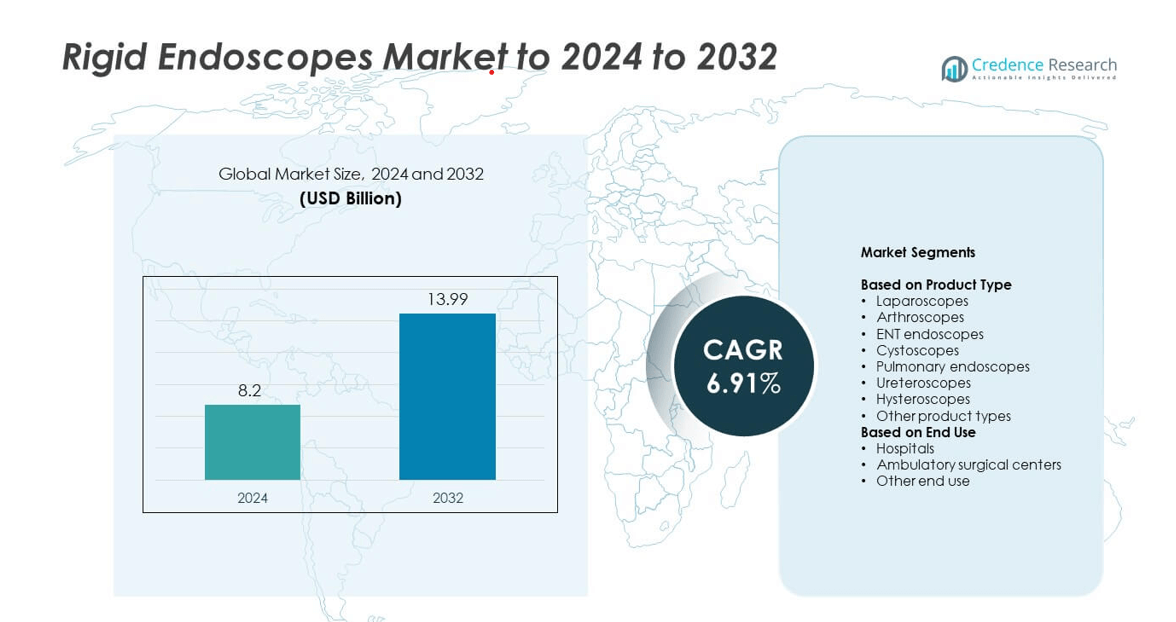

The rigid endoscopes market size was valued at USD 8.2 billion in 2024 and is anticipated to reach USD 13.99 billion by 2032, at a CAGR of 6.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rigid Endoscopes Market Size 2024 |

USD 8.2 billion |

| Rigid Endoscopes Market, CAGR |

6.91% |

| Rigid Endoscopes Market Size 2032 |

USD 13.99 billion |

The rigid endoscopes market is driven by major players such as Olympus Corporation, Karl Storz, Stryker, Medtronic, and Boston Scientific, which lead through strong innovation and global distribution networks. These companies focus on advanced optical technologies, 3D visualization, and robotic integration to enhance surgical accuracy and efficiency. Continuous R&D efforts support product upgrades and wider clinical applications across various surgical specialties. North America led the global market in 2024 with a 37% share, supported by advanced healthcare infrastructure, high procedural volumes, and early adoption of minimally invasive and robotic-assisted surgical technologies.

Market Insights

- The rigid endoscopes market was valued at USD 8.2 billion in 2024 and is projected to reach USD 13.99 billion by 2032, growing at a CAGR of 6.91%.

- Growth is driven by the rising adoption of minimally invasive surgeries, advanced imaging technologies, and expanding healthcare infrastructure worldwide.

- Key trends include the integration of robotics and AI in endoscopic systems, along with the growing use of reusable and sterilization-friendly instruments.

- The market is highly competitive, with players focusing on R&D, ergonomic designs, and global expansion to strengthen their market presence.

- Regionally, North America held a 37% share in 2024, followed by Europe with 29% and Asia-Pacific with 25%, while laparoscopes remained the dominant product segment with 34% of the market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Laparoscopes dominated the rigid endoscopes market in 2024, accounting for 34% of the total share. Their wide adoption in minimally invasive surgeries such as gallbladder removal, hernia repair, and bariatric procedures drives segment growth. Advancements in high-definition imaging and 3D visualization further enhance surgical accuracy, boosting demand. Arthroscopes and ENT endoscopes also show steady adoption due to growing orthopedic and sinus surgeries. Increasing patient preference for faster recovery and reduced hospital stays continues to strengthen laparoscope usage across global healthcare systems.

- For instance, the KARL STORZ IMAGE1 S 4U system features 3840×2160 (4K) resolution and a 3× digital zoom, while the weight of its compatible camera heads can vary.

By End Use

Hospitals held the largest share of 61% in 2024, driven by advanced infrastructure and access to skilled surgeons. The high volume of complex diagnostic and therapeutic endoscopic procedures supports hospital dominance. Increased funding for upgrading surgical units and integrating robotic-assisted systems further enhances adoption. Ambulatory surgical centers are gaining traction due to faster patient turnover and cost-effective operations. The growing trend of outpatient surgeries and enhanced recovery programs is expected to accelerate the demand for rigid endoscopes in both hospitals and specialty centers.

- For instance, Intuitive reported an installed base of 10,763 da Vinci systems and 427 quarterly placements.

Key Growth Drivers

Rising Adoption of Minimally Invasive Surgeries

The demand for rigid endoscopes is increasing due to the global shift toward minimally invasive surgical procedures. These surgeries reduce patient trauma, recovery time, and hospital costs while improving outcomes. Hospitals are rapidly upgrading operating rooms with advanced endoscopic equipment to meet patient demand. Surgeons favor rigid endoscopes for their superior image clarity and precision. The rising incidence of chronic diseases requiring surgical intervention, such as gastrointestinal and orthopedic disorders, continues to boost adoption across both developed and emerging healthcare markets.

- For instance, Medtronic’s LigaSure technology has been used in more than 35 million procedures.

Technological Advancements in Imaging and Optics

Continuous innovation in optical fibers, 3D visualization, and high-definition imaging is a major factor driving market growth. Modern rigid endoscopes now offer enhanced brightness, depth perception, and accuracy, improving surgical outcomes. The integration of digital sensors and AI-based image enhancement helps surgeons perform complex procedures with greater precision. Manufacturers are investing in compact and ergonomic designs, improving usability and sterilization. These developments not only enhance clinical efficiency but also extend product lifespans, further strengthening market expansion across surgical specialties.

- For instance, FUJIFILM surgical camera heads specify 4K UHD at 3840×2160 and 60 fps.

Growing Demand in Ambulatory Surgical Centers

Ambulatory surgical centers are rapidly adopting rigid endoscopes to perform outpatient surgeries efficiently. The demand is driven by lower treatment costs, faster recovery, and reduced hospital stays. Surgeons prefer rigid endoscopes in these settings for their reliability and consistent image quality. Increasing healthcare investments and insurance coverage for minimally invasive procedures further support this trend. The shift toward decentralized healthcare delivery models encourages equipment manufacturers to develop portable and cost-effective endoscopic systems, expanding their reach across smaller surgical facilities globally.

Key Trends & Opportunities

Integration of Robotics and AI in Endoscopic Systems

The combination of robotics and artificial intelligence with rigid endoscopy is transforming surgical precision. AI algorithms enable real-time image analysis, assisting surgeons in detecting abnormalities and reducing human error. Robotic-assisted endoscopy enhances dexterity and control during complex operations. Major healthcare providers are integrating these systems into surgical suites to improve outcomes and efficiency. This technological convergence presents significant opportunities for manufacturers to offer next-generation, intelligent endoscopy solutions, driving premium product adoption in advanced surgical centers worldwide.

- For instance, Asensus reported over 2,700 Senhance procedures year-to-date by September 30, 2023. By that same date, the company had initiated five new Senhance Surgical programs.

Rising Focus on Sterilization and Reusable Devices

A growing emphasis on infection control and sustainability is fueling the demand for reusable rigid endoscopes. Healthcare providers are seeking sterilization-friendly and durable models to reduce operating costs and medical waste. Advances in autoclaving materials and modular component design are extending product life. Regulatory bodies promoting eco-friendly practices are also encouraging the transition from disposable to reusable devices. This shift supports long-term efficiency and cost reduction while addressing environmental concerns within hospital and surgical center operations.

- For instance, Olympus warrants Goldtip rigid laparoscopes for 5 years against autoclave damage.

Expansion into Emerging Healthcare Markets

Emerging economies in Asia-Pacific and Latin America offer vast growth potential due to rising healthcare expenditure and improving surgical infrastructure. Government investments in public health facilities and growing awareness of minimally invasive procedures are accelerating adoption. Local manufacturers are collaborating with global brands to introduce affordable, high-performance endoscopes. Training programs for surgeons and ongoing hospital modernization efforts further support market penetration. These developments create lucrative opportunities for expanding the rigid endoscopes market across underserved regions.

Key Challenges

High Equipment and Maintenance Costs

Rigid endoscopes involve significant capital investments and high maintenance expenses, limiting adoption among smaller healthcare facilities. The cost of advanced imaging systems, sterilization units, and replacement parts further increases operational budgets. Developing regions often struggle with funding constraints, delaying infrastructure upgrades. Additionally, frequent calibration and repair requirements affect workflow efficiency. These factors collectively pose a challenge to widespread adoption, particularly in resource-limited medical environments seeking cost-effective surgical solutions.

Shortage of Skilled Endoscopic Professionals

A lack of trained surgeons and technicians capable of operating advanced rigid endoscopes hinders market expansion. Complex procedures require specialized skills in handling and maintaining delicate optical instruments. In many emerging regions, training facilities remain limited, and professional development programs are underfunded. This shortage affects surgical outcomes and slows the integration of new technologies. Addressing this challenge requires continuous medical education, investment in simulation-based training, and manufacturer-led skill enhancement initiatives.

Regional Analysis

North America

North America dominated the rigid endoscopes market with a 37% share in 2024. The region’s growth is driven by advanced healthcare infrastructure, high adoption of minimally invasive surgeries, and strong presence of key manufacturers. Increasing demand for laparoscopic and arthroscopic procedures in the United States and Canada supports steady expansion. Favorable reimbursement policies and continuous product innovation enhance procedural efficiency and clinical outcomes. The region also benefits from early adoption of 3D and robotic-assisted endoscopic systems, which improve surgical precision and patient recovery times across major hospitals and specialized centers.

Europe

Europe accounted for a 29% share of the rigid endoscopes market in 2024. Strong healthcare systems in Germany, France, and the United Kingdom contribute to significant adoption of advanced endoscopic solutions. The region’s emphasis on quality care and surgical accuracy drives steady demand. Favorable regulatory frameworks and government investments in modernizing healthcare facilities strengthen market penetration. The growing elderly population, coupled with rising cases of gastrointestinal and orthopedic conditions, increases surgical volumes. Manufacturers in Europe are also focusing on cost-effective, sterilization-friendly designs to support sustainability initiatives within hospitals and ambulatory centers.

Asia-Pacific

Asia-Pacific captured a 25% share of the rigid endoscopes market in 2024, showing the fastest growth rate globally. Expanding healthcare infrastructure, rising medical tourism, and increasing adoption of minimally invasive procedures are key contributors. Countries like China, Japan, and India are investing heavily in hospital modernization and surgical training. The region’s large patient population and growing awareness of early disease diagnosis are fueling demand. Local manufacturers are forming partnerships with international brands to deliver affordable, high-quality endoscopic systems. Government initiatives to enhance healthcare access further support strong market expansion across Asia-Pacific.

Latin America

Latin America held a 6% share of the rigid endoscopes market in 2024. The market is gradually expanding with growing investments in healthcare modernization and increased awareness of endoscopic procedures. Brazil and Mexico are leading in surgical adoption due to improving medical infrastructure and the availability of trained professionals. The shift toward minimally invasive surgeries in private hospitals and specialty clinics drives steady growth. However, high equipment costs and uneven healthcare access remain challenges. Despite these limitations, public health initiatives and regional partnerships continue to enhance market penetration across the region.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the rigid endoscopes market in 2024. Growth is supported by rising healthcare investments, particularly in Saudi Arabia, the UAE, and South Africa. Expanding hospital networks and increased demand for advanced diagnostic and surgical technologies are boosting adoption. Government-led programs under national health strategies encourage modernization of surgical facilities. While high import costs and limited skilled professionals pose challenges, growing awareness of early disease management and adoption of minimally invasive procedures continue to drive gradual market development across the region.

Market Segmentations:

By Product Type

- Laparoscopes

- Arthroscopes

- ENT endoscopes

- Cystoscopes

- Pulmonary endoscopes

- Ureteroscopes

- Hysteroscopes

- Other product types

By End Use

- Hospitals

- Ambulatory surgical centers

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The rigid endoscopes market is led by prominent players such as Olympus Corporation, Karl Storz, Stryker, Medtronic, Boston Scientific, Arthrex, Fujifilm, B. Braun, Smith & Nephew, Richard Wolf, ConMed, PENTAX Medical, Henke-Sass Wolf, XION GmbH, Schölly Fiberoptic, Ambu A/S, and Cook Medical. These companies focus on expanding product portfolios through innovation in optics, 3D visualization, and integration of digital and robotic technologies. Strong distribution networks and partnerships with healthcare institutions enhance their global presence. Many manufacturers are investing in cost-efficient, sterilization-friendly, and reusable devices to meet sustainability goals. Strategic mergers, acquisitions, and R&D initiatives aim to strengthen surgical precision and improve patient outcomes. Growing demand for advanced imaging and minimally invasive tools is driving these firms to develop compact and ergonomic designs. Continuous technological upgrades, surgeon training programs, and region-specific product strategies further solidify their competitive positioning in both developed and emerging healthcare markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Olympus Corporation

- Karl Storz

- Stryker

- Medtronic plc

- Boston Scientific

- Arthrex

- Fujifilm

- B. Braun

- Smith & Nephew

- Richard Wolf

- ConMed

- PENTAX Medical

- Henke-Sass, Wolf

- XION GmbH

- Schölly Fiberoptic

- Ambu A/S

- Cook Medical

Recent Developments

- In 2025, Fujifilm Holdings Corporation Unveiled the groundbreaking ELUXEO 8000 Therapeutic Endoscopy Solution in India

- In 2024, Olympus Corporation opened its first flexible endoscope sterilization facility, Sapphire, in Melbourne, as part of a new service offering to improve risk management for endoscopy services.

- In 2024, Medtronic plc Introduced the ColonPRO AI software for its GI Genius intelligent endoscopy system in, a move aimed at improving patient care.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The rigid endoscopes market will continue to grow steadily due to rising surgical volumes.

- Adoption of minimally invasive and robotic-assisted surgeries will expand across healthcare facilities.

- Advancements in optics, 3D imaging, and AI-based visualization will enhance surgical precision.

- Hospitals will maintain dominance, while ambulatory surgical centers gain significant traction.

- Asia-Pacific will emerge as the fastest-growing region due to improving healthcare infrastructure.

- Demand for reusable and sterilization-friendly endoscopes will rise to support sustainability goals.

- Training programs for surgeons and technicians will expand to address skill shortages.

- Manufacturers will focus on ergonomic designs and digital integration for workflow efficiency.

- Strategic partnerships and mergers will increase to strengthen product portfolios and market presence.

- Government healthcare investments will support broader accessibility of advanced endoscopic technologies worldwide.