Market Overview:

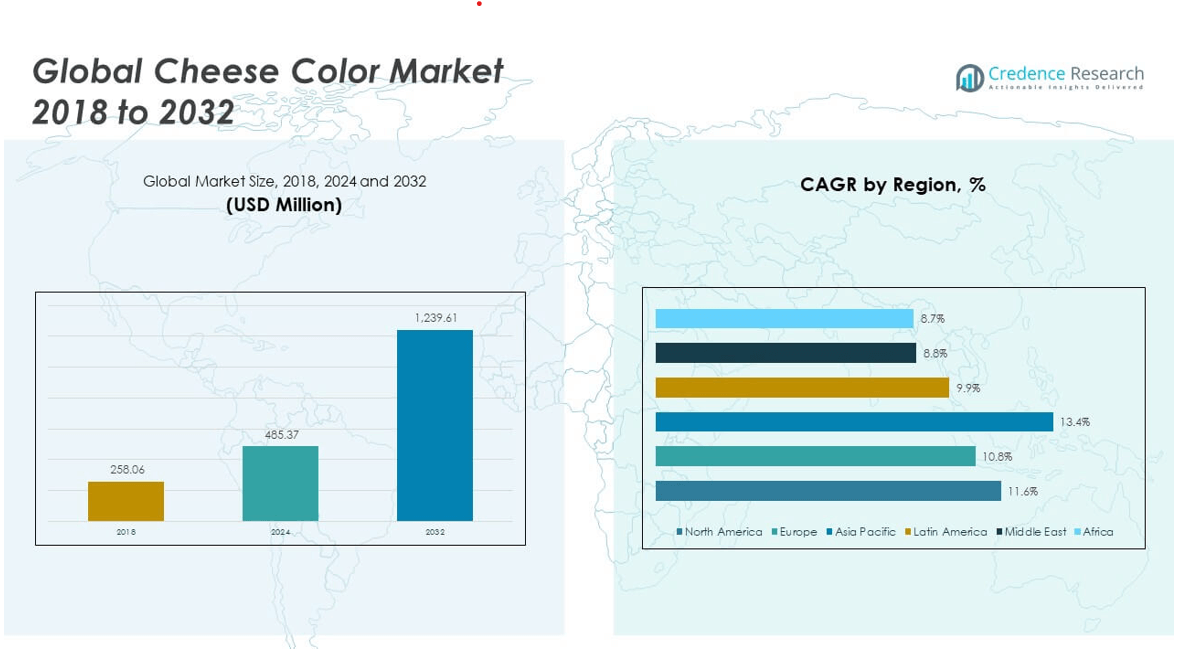

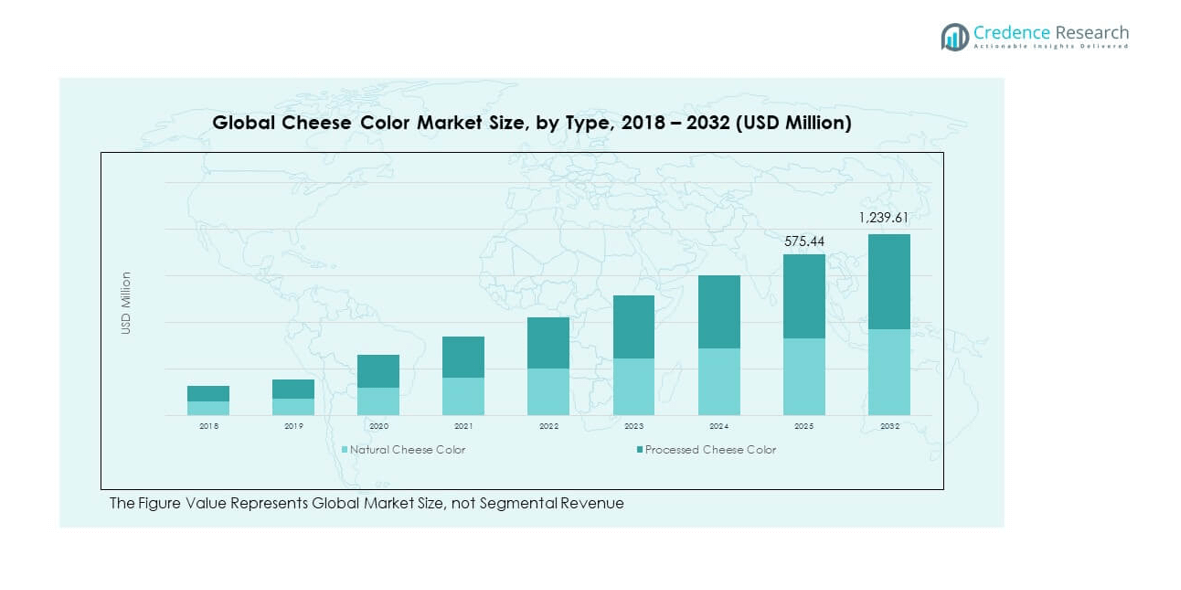

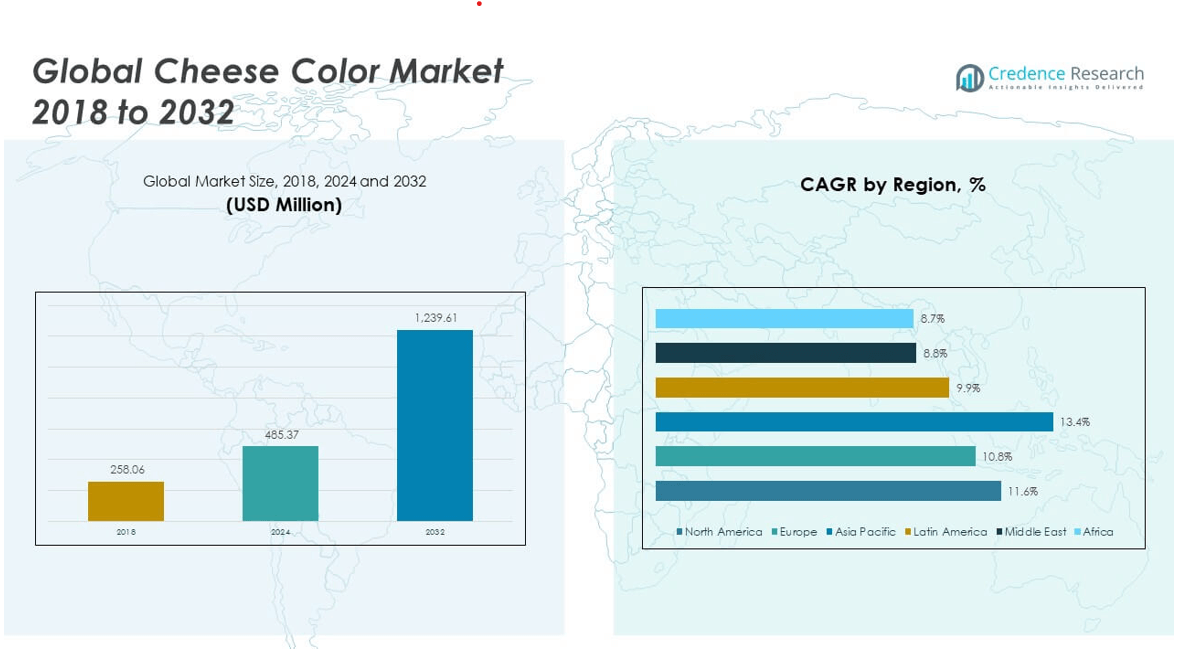

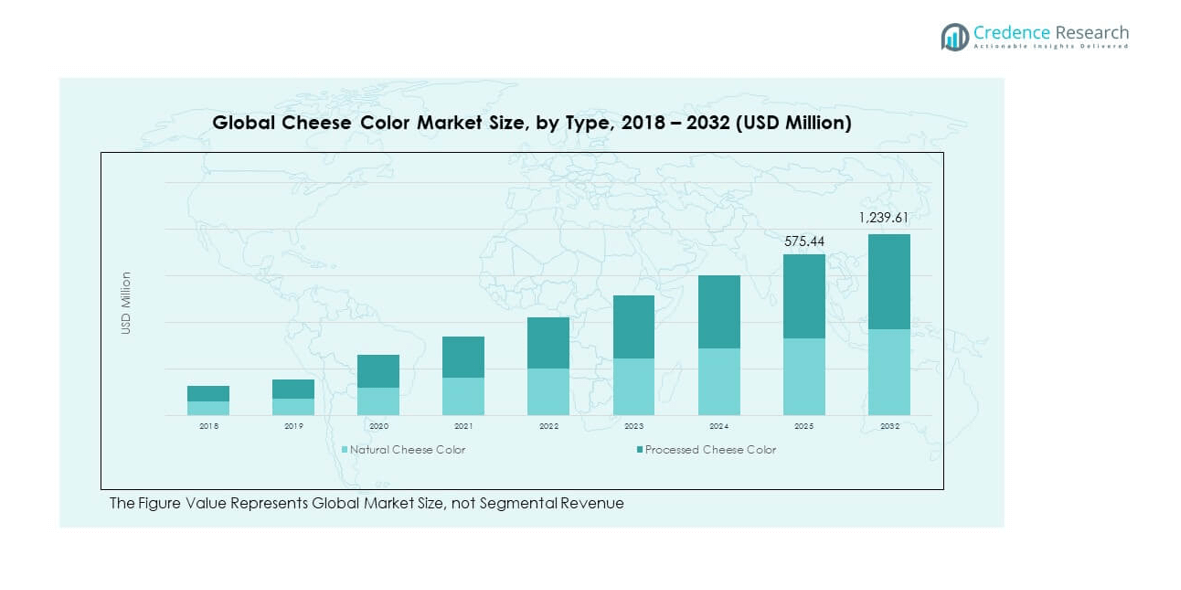

The Global Cheese Color Market size was valued at USD 258.06 million in 2018 to USD 485.37 million in 2024 and is anticipated to reach USD 1,239.61 million by 2032, at a CAGR of 11.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cheese Color Market Size 2024 |

USD 1,193.67 million |

| Cheese Color Market, CAGR |

11,59% |

| Cheese Color Market Size 2032 |

USD 1,239.61 million |

Efficient formulation innovations alongside increasing demand for vibrant, visually appealing dairy products have spurred significant market momentum. Manufacturers are actively enhancing product stability, natural ingredient transparency, and clean-label offerings to align with health-conscious consumer preferences. Regulatory shifts favoring natural colorants over synthetic alternatives further encourage industry-wide adoption. As a result, producers are investing in research to improve color performance and shelf-life under varied processing conditions, accelerating market growth across multiple cheese categories.

Europe and North America currently dominate the cheese color market, backed by well-established dairy industries, stringent food safety norms, and strong clean-label trends. Meanwhile, Asia-Pacific—especially countries like China and India—is emerging rapidly, driven by rising dairy consumption, urbanization, and growing interest in Western-style cheese products. Latin America and the Middle East & Africa are also witnessing gradual expansion as local cheese production and consumer awareness continue to rise.

Market Insights:

- The Global Cheese Color Market was valued at USD 485.37 million in 2024 and is expected to reach USD 1,239.61 million by 2032, growing at a CAGR of 11.59%.

- Rising demand for natural, clean-label food products is driving the adoption of plant-based cheese colorants across all major cheese-producing regions.

- Growth in processed and packaged cheese consumption, especially in fast food and ready-to-eat meals, supports market expansion.

- Regulatory challenges and approval delays for new colorant ingredients act as barriers in several regional markets.

- North America holds the largest market share due to high cheese consumption and advanced dairy processing infrastructure.

- Asia Pacific is the fastest-growing region, driven by urbanization, changing food habits, and expansion of local cheese production.

- Limited availability and price fluctuations of natural raw materials like annatto and turmeric can disrupt supply chains and increase production costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Consumer Preference for Visually Appealing Dairy Products Drives Cheese Color Adoption

The growing importance of visual appeal in food consumption significantly influences consumer purchasing behavior. Consumers associate vibrant cheese colors with freshness, quality, and taste, which drives demand for color-enhanced dairy products. Cheese producers are increasingly adopting natural colorants to deliver consistent visual appeal across product batches. This shift aligns with broader trends in premiumization and clean-label consumption. Visual uniformity also plays a crucial role in brand recognition and consumer trust. The Global Cheese Color Market benefits from this shift as companies respond with innovative, high-performing coloring solutions. It continues to expand with product differentiation as a central strategy for customer retention.

Rising Demand for Natural Colorants Boosts Market Expansion

Consumers are becoming increasingly aware of the ingredients in their food and prefer natural over synthetic additives. This preference has created a surge in demand for plant-based and organic cheese colors derived from annatto, beta-carotene, turmeric, and paprika. Regulatory agencies across regions are imposing tighter restrictions on artificial ingredients, reinforcing this shift. Manufacturers are reformulating their cheese products to eliminate synthetic dyes without compromising quality or color consistency. The clean-label movement pushes producers to invest in transparent labeling and simpler ingredient lists. The Global Cheese Color Market sees growth as natural colorants dominate new product development. It evolves to meet strict labeling standards and respond to informed consumer choices.

- For instance, Givaudan’s Certified Organic Annatto Cheese Color WS-14 is a water-soluble, plant-based coloring, ensuring vibrant yellow to orange shades in cheese while meeting strict non-GMO, organic, kosher, and halal certifications.

Innovation in Food Processing Technologies Enhances Color Application

Advancements in food processing equipment and formulation technologies are enabling more efficient integration of cheese colorants. New emulsification systems and microencapsulation methods improve color stability under diverse storage and temperature conditions. These innovations help maintain consistent hues throughout the product’s shelf life. Manufacturers can now customize shades based on regional preferences and cheese types. The Global Cheese Color Market benefits from this flexibility and precision. It attracts investment from producers seeking scalable, cost-effective coloring solutions that meet both aesthetic and regulatory demands. Continuous R&D contributes to competitive differentiation and accelerates global product launches.

Expanding Cheese Consumption Across Emerging Markets Encourages Growth

Emerging economies are witnessing increased cheese consumption due to urbanization, western dietary influences, and rising disposable income. Supermarkets and quick-service restaurants are introducing a broader variety of cheese-based offerings to meet shifting consumer preferences. This transition stimulates demand for cheese colorants that enhance product presentation and shelf visibility. Local dairy producers are upgrading manufacturing processes to incorporate food-grade coloring systems. The Global Cheese Color Market benefits from expanding distribution channels and growing demand for processed cheese products. It supports regional cheese brands in achieving global market readiness. Increasing investment in dairy processing in countries like India, Brazil, and China is fueling further adoption.

- For instance, in India, per capita milk solids consumption is forecast to reach 30kg by 2034, representing significant growth in dairy intake and cheese-based product demand.

Market Trends:

Surge in Vegan and Plant-Based Cheese Creates New Demand for Specialty Colorants

The rapid expansion of the plant-based food industry has given rise to a significant demand for vegan cheese alternatives. These products require distinct formulation strategies, including colorants that maintain appeal without using dairy-derived bases. Companies are developing new, plant-compatible coloring agents that mimic traditional cheese shades. These include algae-derived and fermented natural pigments. The Global Cheese Color Market experiences fresh momentum from this segment. It opens up R&D pipelines for adaptable, allergen-free color formulations. This trend highlights the merging of food innovation, sustainability, and dietary diversity, increasing market depth.

Integration of AI and Automation in Color Matching Technologies Enhances Efficiency

Automation and artificial intelligence tools are increasingly integrated into food production, including the color formulation process. These technologies help manufacturers achieve exact color uniformity across batches and reduce product waste. AI-driven color management systems can detect inconsistencies and adjust input formulations in real time. The Global Cheese Color Market leverages such tools to improve quality control and production efficiency. It strengthens its position by reducing error margins and meeting aesthetic benchmarks consistently. These innovations also support large-scale production environments where accuracy and speed are critical.

- For instance, Kraft Heinz uses NotCo’s AI platform “Giuseppe” in its joint venture to develop plant-based cheese alternatives by mimicking animal-based formulations. Unilever runs over 500 AI-driven R&D projects globally, using in silico experimentation to rapidly test and optimize recipe combinations for faster, consistent product development.

Clean Label Certification and Transparency Accelerate Ingredient Innovation

Consumers demand not only clean-label products but also third-party certification that verifies ingredient quality and sourcing. Retailers and food brands increasingly require transparent documentation from colorant suppliers. This pushes producers to invest in traceability technologies and certification processes such as USDA Organic, EU Organic, and Non-GMO Project Verified. The Global Cheese Color Market adapts by offering standardized and certifiable formulations. It evolves to address consumer scrutiny and retailer compliance requirements. Colorant innovation now centers on accountability, ethical sourcing, and environmental safety.

- For instance, GNT USA’s EXBERRY® portfolio includes 20 Non-GMO Project Verified color concentrates, making it one of the first plant-based color ranges to receive third-party certification in North America. These clean-label colorants are made from fruits, vegetables, and plants using physical processing methods, meeting strict standards set by the Non-GMO Project.

Regional Flavor and Color Preferences Influence Product Development Strategy

Cheese colors are no longer standardized globally; companies must now cater to region-specific preferences. For example, American consumers often prefer cheddar with a bright orange hue, while Europeans may lean toward natural white or pale-yellow cheeses. Latin American markets show increased preference for richly colored artisanal cheeses. The Global Cheese Color Market responds with customized solutions that match cultural taste and visual expectations. It supports localization strategies that allow multinational brands to align with regional identities. Market segmentation based on aesthetic preferences strengthens consumer engagement and brand loyalty.

Market Challenges Analysis:

Regulatory Barriers and Ingredient Approval Delays Impact Market Speed

Regulatory frameworks for food colorants vary significantly across regions, causing delays in product approvals and market entry. Complex approval processes often limit the use of novel or region-specific natural colorants, especially in the U.S., EU, and parts of Asia. These discrepancies slow down product innovation pipelines and increase the time-to-market for new formulations. The Global Cheese Color Market faces challenges when attempting to harmonize labeling and safety standards across international markets. It must navigate differing ingredient restrictions while maintaining consistency in global branding strategies. This regulatory friction creates additional compliance costs for manufacturers.

Fluctuations in Raw Material Availability and Pricing Create Supply Risks

Natural cheese colorants rely heavily on agricultural sources such as annatto seeds, turmeric, and beetroot, which are subject to weather patterns, political unrest, and market speculation. Price volatility in these commodities creates uncertainty in production planning. Unexpected shortages may force companies to adjust formulations or switch suppliers, affecting color consistency. The Global Cheese Color Market experiences production disruptions and margin pressures due to raw material instability. It relies on diversified sourcing strategies and improved supplier networks to mitigate risks. Seasonal variation and quality inconsistencies also complicate procurement and inventory management.

Market Opportunities:

Untapped Markets in Developing Regions Open Doors for Market Penetration

Many developing countries are seeing rapid growth in cheese production and consumption, but lack access to advanced coloring technologies. This opens up opportunities for cheese color manufacturers to enter underpenetrated markets with tailored solutions. Local producers are looking for cost-effective and compliant colorants to meet growing consumer demand. The Global Cheese Color Market can expand its presence by partnering with regional dairies, offering training, and ensuring regulatory compatibility. It builds strong local networks and adapts to regional market conditions. Increasing government support for local food manufacturing further reinforces long-term investment prospects.

Customized Color Blends for Artisanal and Gourmet Cheese Segments Offer Growth Potential

Artisanal cheese makers seek unique color profiles to differentiate their products in premium retail and foodservice channels. They often require small-batch, customizable colorants that complement exclusive branding. The Global Cheese Color Market can capture value in this niche by offering flexible, made-to-order solutions. It fosters product uniqueness, supports brand storytelling, and helps manufacturers appeal to upscale consumers. The market grows by enabling aesthetic innovation in specialized dairy categories. Rising consumer interest in regional and handcrafted cheeses strengthens demand for distinctive and natural visual appeal.

Market Segmentation Analysis:

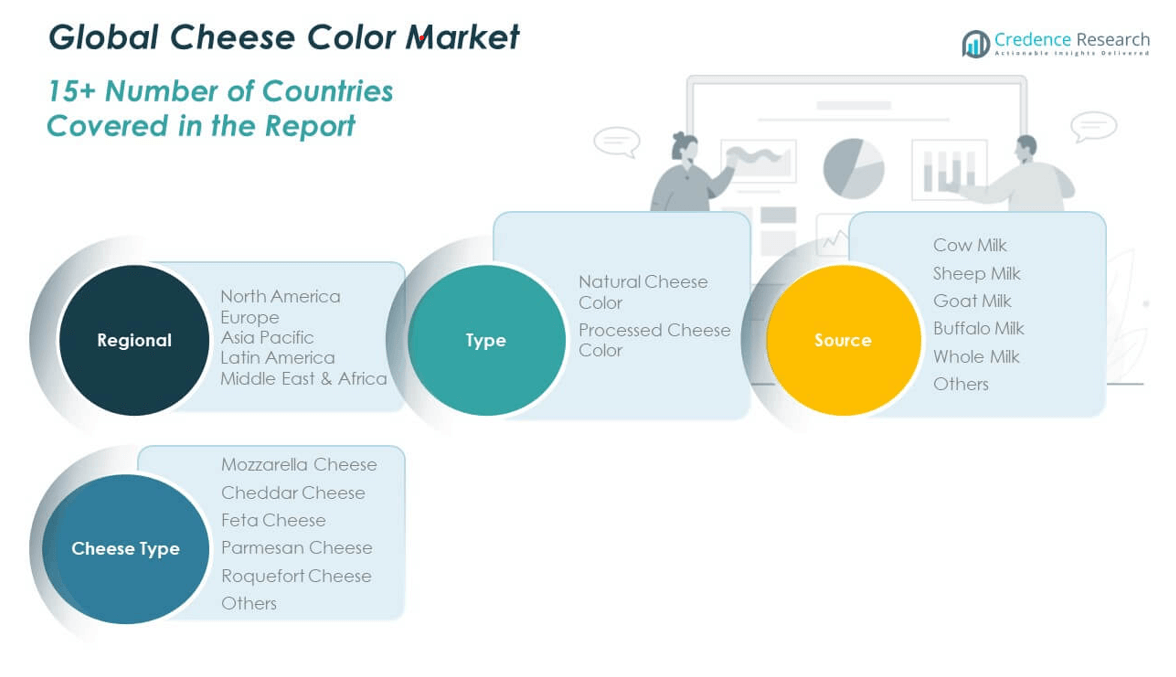

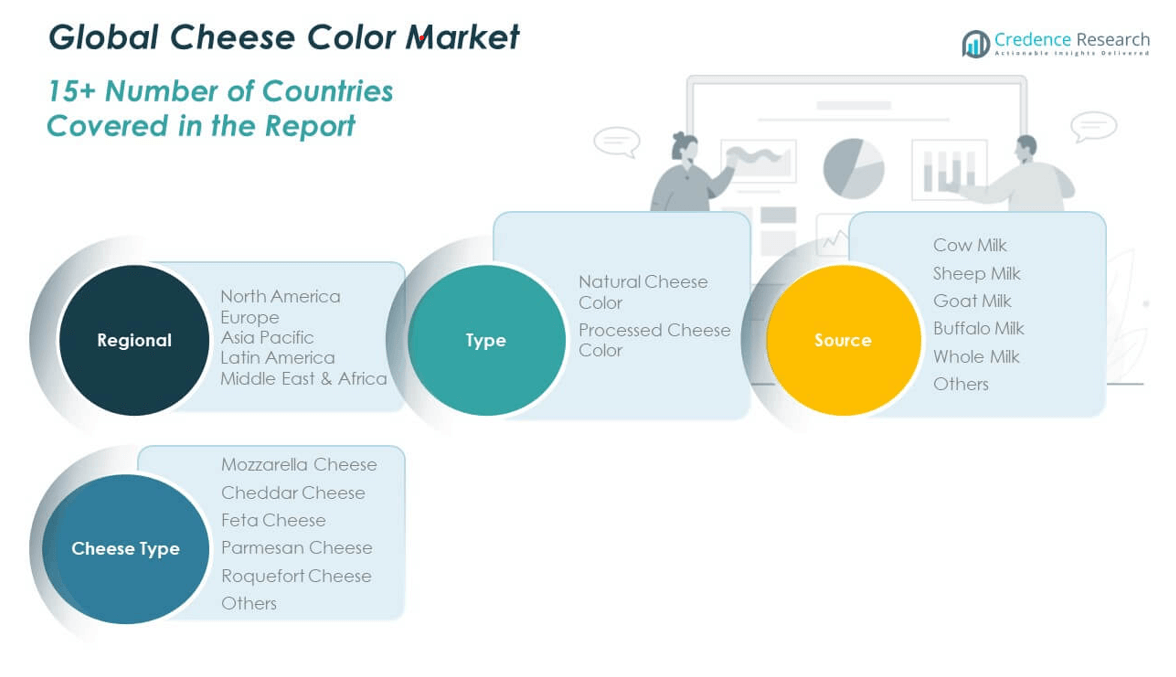

The Global Cheese Color Market is segmented by type, source, and cheese type, each playing a critical role in shaping market dynamics.

By type, natural cheese color leads the market due to increasing consumer demand for clean-label and plant-based ingredients. Processed cheese color maintains steady growth, supported by consistent demand in industrial and foodservice applications requiring uniform appearance.

- For instance, Kraft Heinz has eliminated synthetic colors in key U.S. products and is reformulating processed cheese lines using natural extracts like annatto and paprika to align with evolving consumer preferences.

By source, cow milk dominates the segment, driven by its widespread availability and global consumption. Goat and sheep milk are gaining traction in premium and specialty cheese segments, while buffalo milk supports regional consumption in South Asia and the Middle East. Whole milk-based cheese color products remain preferred for their rich texture and color consistency. Other sources, including blends and non-dairy alternatives, address evolving dietary preferences.

- For instance, Saputo Inc. processes approximately 11 billion liters of milk annually across its global operations, reinforcing its position as one of the world’s largest dairy processors. This scale supports high-volume cheese production where standardized color application is essential. Goat, sheep, and buffalo milk are commonly used in regional and specialty cheeses, though direct volume metrics for their growth in cheese color applications remain limited.

By cheese type, mozzarella and cheddar represent the largest share, fueled by their high usage in fast food and packaged goods. Feta, parmesan, and Roquefort cater to niche and gourmet categories with specialized color needs. It continues to adapt to diverse cheese types, offering tailored coloring solutions that meet both functional and visual expectations.

Segmentation:

By Type:

- Natural Cheese Color

- Processed Cheese Color

By Source:

- Cow Milk

- Sheep Milk

- Goat Milk

- Buffalo Milk

- Whole Milk

- Others

By Cheese Type:

- Mozzarella Cheese

- Cheddar Cheese

- Feta Cheese

- Parmesan Cheese

- Roquefort Cheese

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Cheese Color Market size was valued at USD 113.86 million in 2018 to USD 211.96 million in 2024 and is anticipated to reach USD 542.82 million by 2032, at a CAGR of 11.6% during the forecast period. North America holds the largest share in the Global Cheese Color Market, contributing 43.66% of the global revenue in 2024. It benefits from high per capita cheese consumption, well-established dairy processing infrastructure, and advanced food technology adoption. The U.S. drives most of the regional demand, with growing interest in premium cheese varieties and clean-label products. Leading food manufacturers in the region prioritize natural colorant usage due to consumer concerns about synthetic additives. Retailers and foodservice operators are demanding consistent color profiles, prompting innovation in cheese coloring techniques. It also benefits from the presence of global cheese producers and a strong regulatory framework supporting food safety and transparency.

Europe

The Europe Global Cheese Color Market size was valued at USD 73.61 million in 2018 to USD 133.48 million in 2024 and is anticipated to reach USD 321.07 million by 2032, at a CAGR of 10.8% during the forecast period. Europe accounts for 27.51% of the global market share in 2024, with strong demand from countries like Germany, France, the Netherlands, and Italy. The region emphasizes traditional cheese-making practices while adopting modern food-grade coloring technologies. Consumer awareness around natural food ingredients has led to a significant reduction in synthetic dye usage. European regulatory bodies enforce strict ingredient compliance, pushing manufacturers toward certified natural colorants. It gains momentum from the rising popularity of organic and specialty cheeses. Growth in food tourism and artisanal cheese production also contributes to a broader range of cheese styles and shades. Innovation in regional cheese variants supports diversified demand for coloring agents across multiple formats and retail categories.

Asia Pacific

The Asia Pacific Global Cheese Color Market size was valued at USD 47.80 million in 2018 to USD 97.74 million in 2024 and is anticipated to reach USD 283.88 million by 2032, at a CAGR of 13.4% during the forecast period. Asia Pacific represents 20.14% of the global market share in 2024 and is the fastest-growing regional segment. Growth is driven by rapid urbanization, rising dairy consumption, and the westernization of diets in markets like China, India, Japan, and Southeast Asia. The emergence of processed cheese as a staple in foodservice and retail is expanding the need for standardized coloring solutions. Local manufacturers are investing in food-grade technologies and importing advanced coloring systems. It shows rising demand for cost-effective natural colorants tailored to regional cheese types. Increasing disposable income and changing dietary habits are boosting premium cheese categories with higher aesthetic expectations.

Latin America

The Latin America Global Cheese Color Market size was valued at USD 12.19 million in 2018 to USD 22.64 million in 2024 and is anticipated to reach USD 51.18 million by 2032, at a CAGR of 9.9% during the forecast period. Latin America holds 4.66% of the global market share in 2024, with demand concentrated in Brazil, Mexico, and Argentina. The region is experiencing a steady increase in processed and packaged cheese consumption. Growing supermarket chains and the expansion of fast-food restaurants have influenced cheese production and presentation standards. The region favors strong and vibrant cheese colors that align with local visual preferences. It witnesses growing adoption of annatto-based and other plant-derived colorants, especially in semi-industrial operations. Awareness of food quality and clean labels is increasing, although synthetic colorants are still in use in price-sensitive segments. Collaboration between local producers and international colorant suppliers supports capacity building and product diversification.

Middle East

The Middle East Global Cheese Color Market size was valued at USD 6.25 million in 2018 to USD 10.59 million in 2024 and is anticipated to reach USD 22.09 million by 2032, at a CAGR of 8.8% during the forecast period. The Middle East contributes 2.18% of the global market share in 2024. Countries like Saudi Arabia, the UAE, and Egypt are leading market contributors, driven by growing dairy processing industries and rising cheese consumption. Local consumers increasingly demand visually attractive cheese formats in both traditional and western-style variants. It benefits from expanding retail chains and tourism-driven food service growth. Adoption of natural cheese colorants is at a nascent stage but shows upward momentum. Imported food standards and halal certification needs influence ingredient transparency. Cheese color manufacturers see potential in offering high-quality, compliant colorants suited for local preferences.

Africa

The Africa Global Cheese Color Market size was valued at USD 4.35 million in 2018 to USD 8.96 million in 2024 and is anticipated to reach USD 18.57 million by 2032, at a CAGR of 8.7% during the forecast period. Africa accounts for 1.85% of the global market share in 2024 and remains an emerging segment with long-term potential. South Africa leads regional demand, followed by Nigeria and Kenya, where urban middle-class growth is expanding processed food categories. It sees moderate uptake of cheese colorants, mostly in urban dairy operations and industrial cheese production. Affordability remains a key concern, limiting rapid adoption of premium natural colorants. Educational campaigns on food quality and safety are helping drive awareness. Infrastructure limitations and reliance on imports challenge supply chain reliability. Still, regional food manufacturers are showing interest in clean-label solutions and standardized product presentation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

zz

Key Player Analysis:

Competitive Analysis:

The Global Cheese Color Market features a competitive landscape led by a mix of multinational players and specialized ingredient manufacturers. Key companies such as DSM, Sensient Technologies, DDW (a Kerry Group company), Chr. Hansen, and Givaudan dominate with extensive product portfolios and strong distribution networks. It focuses heavily on natural color development, clean-label offerings, and region-specific customization. Strategic activities include product innovation, acquisitions, and regional expansion to strengthen market share. Competitors invest in R&D to improve color stability and compatibility with diverse cheese formulations. Partnerships with dairy producers and co-development projects support market penetration. Companies compete on quality, certification standards, cost efficiency, and customer support. Local players in emerging markets gain traction through price competitiveness and tailored offerings, contributing to dynamic regional competition. The Global Cheese Color Market maintains a high level of innovation driven by consumer demand and regulatory compliance across developed and developing economies.

Recent Developments:

- In April 2025, BASF SE introduced three new natural-based personal care ingredients—Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA—designed to cater to the sustainable and biodegradable trends shaping consumer demand for natural products. The launch, presented at the in-cosmetics.

- In March 2025, Arla Foods Ingredients also announced a major strategic partnership with Valley Queen, a leading South Dakota-based dairy processor. The agreement is intended to boost Arla’s capacity and footprint in the high-protein dairy market in the United States, supporting its global strategy to meet rising demand for protein-enriched dairy products.

- In February 2025, Sensient Technologies Corporation completed the acquisition of Biolie, a French manufacturer specializing in white biotechnology and natural ingredient extraction. This move, finalized on February 14, 2025, extends Sensient’s expertise and manufacturing capability in the area of active natural colors, supporting sustainable product innovation within their color portfolio.

Market Concentration & Characteristics

The Global Cheese Color Market exhibits moderate to high concentration, with a few key players holding significant market shares across developed regions. It shows strong product standardization but continues to evolve through customization and innovation in natural colorants. Market entry barriers remain moderate due to regulatory complexities and formulation requirements. The market favors suppliers with robust sourcing capabilities, technical support, and compliance infrastructure. Natural colorants dominate growth areas, reflecting health-conscious consumer preferences and tightening regulatory policies. The market structure supports long-term contracts with dairy producers, enhancing stability for leading players. Demand for clean-label, sustainable solutions reinforces the strategic importance of traceability and ingredient transparency. It reflects a blend of mature and fast-growing segments shaped by regional dairy practices and consumer trends.

Report Coverage:

The research report offers an in-depth analysis based on type, source, and cheese type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Natural colorants will continue to replace synthetic dyes, driven by clean-label consumer demand.

- Asia Pacific is expected to lead future growth due to rising cheese consumption and urbanization.

- Manufacturers will focus on customizing color solutions for regional cheese types and flavor profiles.

- Technological innovations in microencapsulation will improve color stability across diverse processing conditions.

- Plant-based and vegan cheese categories will create new demand for allergen-free color formulations.

- Regulatory alignment across regions will streamline product approvals and support global expansion.

- Strategic collaborations between colorant suppliers and dairy producers will enhance product development.

- Sustainability initiatives will drive the use of eco-friendly raw materials and transparent sourcing.

- Demand from quick-service restaurants and packaged food brands will stimulate product innovation.

- Advancements in AI-based color matching systems will improve production consistency and reduce waste.