Market Overview:

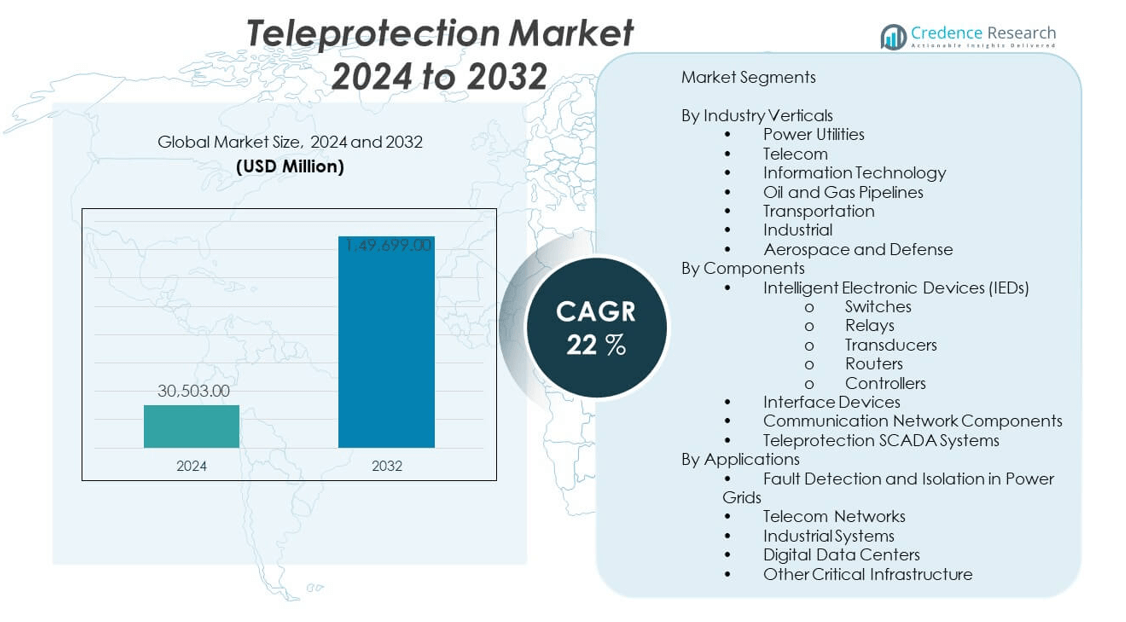

The Teleprotection Market is projected to grow from USD 30,503 million in 2024 to an estimated USD 149,699 million by 2032, with a compound annual growth rate (CAGR) of 22% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Teleprotection Market Size 2024 |

USD 30,503 million |

| Teleprotection Market, CAGR |

22% |

| Teleprotection Market Size 2032 |

USD 149,699 million |

This significant growth is driven by rising demand for advanced grid reliability, rapid digitization in power utilities, and integration of smart grid technologies globally. Increasing cyber threats and the growing need for secure communication between substations are further propelling investments in teleprotection systems. Rising adoption of renewable energy sources and smart grid infrastructure has amplified the need for reliable and instantaneous protection of critical electrical components. Teleprotection systems enable real-time fault isolation and system stability by ensuring faster communication between substations. The market also benefits from regulatory support, aging power infrastructure in developed economies, and the shift towards decentralized energy generation, which require more intelligent and responsive grid solutions.

North America currently leads the teleprotection market due to its advanced power infrastructure and early deployment of smart grid technologies. Europe follows closely, driven by modernization efforts and grid stability initiatives. The Asia-Pacific region is emerging as the fastest-growing market, led by rapid urbanization, growing electricity demand, and government-backed energy reforms in China, India, and Southeast Asia. Latin America and the Middle East are also witnessing increased adoption due to expanding transmission networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Teleprotection Market is projected to grow from USD 30,503 million in 2024 to USD 149,699 million by 2032, expanding at a CAGR of 22% due to rising demand for grid stability, secure communication systems, and smart grid integration.

- Increasing deployment of renewable energy, aging power grids, and stringent regulatory requirements are major drivers accelerating the adoption of teleprotection systems across the power transmission and distribution sector.

- High initial investment costs, complex system integration, and cybersecurity concerns pose key challenges that may hinder adoption in cost-sensitive and developing markets.

- North America dominates the market owing to early smart grid adoption, strong utility infrastructure, and investment in grid automation technologies.

- Europe remains a prominent market supported by modernization initiatives and policy-driven grid upgrades focused on reliability and operational efficiency.

- Asia-Pacific is experiencing rapid growth, driven by industrialization, rising electricity demand, and large-scale investments in transmission networks, especially in China and India.

- Emerging regions such as Latin America and the Middle East are gradually expanding their market share as they strengthen their grid infrastructures and adopt advanced teleprotection solutions.

Market Drivers:

Rising Need for Real-Time Fault Detection and Grid Stability Enhancement:

Power utilities are under pressure to deliver uninterrupted and stable electricity amid rising energy demand and aging infrastructure. Real-time fault isolation is critical to preventing cascading failures and large-scale blackouts. Teleprotection systems enable rapid communication between substations to detect and isolate faults in milliseconds. The increasing complexity of power grids, particularly in urban areas, requires faster and more accurate protective mechanisms. The teleprotection market benefits from this urgency, as utilities prioritize grid stability and operational continuity. It supports reliability goals by minimizing outage durations and improving restoration timelines.

- For instance, ABB’s latest digital teleprotection relays comply with IEC 61850 standards and achieve response times under 20 milliseconds, minimizing outage durations and supporting restoration timelines even in high-voltage transmission networks.

Smart Grid Investments Fuel Demand for Digital Protection Systems:

Governments and private stakeholders continue to invest heavily in smart grid infrastructure to modernize power distribution. Teleprotection systems are a foundational component of smart grids, allowing decentralized and automated grid responses. Digital substations, advanced metering infrastructure, and IoT-enabled control systems rely on seamless data transmission and fast protection logic. These developments increase the deployment of intelligent teleprotection solutions. The teleprotection market leverages these investments by offering scalable, standards-compliant systems. It supports enhanced coordination among devices, optimizing protection and control at multiple grid levels.

- For instance, Hitachi Energy offers digital substation teleprotection products including SEL-351R that incorporate IoT-enabled control, supporting remote monitoring and automated fault response, thereby optimizing decentralized grid response times by up to 15%.

Renewable Energy Integration Requires Faster Adaptive Protection:

The integration of renewable energy sources such as wind and solar introduces fluctuations in power generation and load behavior. These variations challenge traditional grid protection methods that depend on predictable supply and load conditions. Teleprotection solutions enable dynamic adaptation to these changing grid states by using synchronized phasor data and high-speed communication. They ensure accurate and rapid relay coordination across the distributed energy network. The teleprotection market addresses these new technical requirements, positioning itself as essential for grids that must handle intermittent generation and reverse power flows. It ensures system reliability without compromising renewable adoption.

IEC 61850 Compliance and Interoperability Accelerate Adoption:

Utilities are standardizing their protection and control systems around IEC 61850 to ensure vendor interoperability and future readiness. Teleprotection solutions that support this protocol enable faster deployment, easier maintenance, and integration with other automation technologies. The move toward unified data models and logical node structuring improves protection logic coordination. Equipment vendors now design products that align with these standards, improving compatibility across infrastructure. The teleprotection market aligns with these initiatives by delivering solutions that reduce integration costs and simplify system upgrades. It supports utilities in achieving regulatory compliance and technological uniformity.

Market Trends:

Migration from Legacy TDM to Packet-Based Communication Networks:

Utilities are replacing traditional TDM-based teleprotection communication with modern packet-switched networks like MPLS and IP. This shift allows for better bandwidth utilization, scalability, and network flexibility. Packet-based systems also support a broader range of applications beyond protection, including SCADA, video surveillance, and automation. Equipment manufacturers are responding by offering teleprotection devices with native Ethernet support and advanced routing features. The teleprotection market is adapting to this transformation by embedding security and synchronization protocols within IP frameworks. It benefits from the widespread telecom convergence and network modernization efforts.

Integration of Artificial Intelligence in Grid Protection Strategies:

AI and machine learning tools are being integrated into teleprotection schemes to enhance predictive maintenance and fault classification. These technologies analyze historical fault data, relay patterns, and grid topology to recommend adaptive protection settings. AI-based analytics optimize the location of protective relays and communication pathways for reduced fault response times. The teleprotection market is moving toward intelligent protection systems that offer self-diagnostic and self-healing capabilities. It enables utilities to proactively prevent failures and maintain grid resilience in complex operating environments.

- For instance, ABB leverages machine learning to analyze fault data trends and optimize relay location and settings, improving predictive maintenance schedules and reducing downtime by an estimated 20% in pilot implementations.

Growth of Hybrid Protection Architectures Combining Centralized and Edge Computing:

Traditional centralized control models are giving way to hybrid architectures that incorporate edge-based processing. Teleprotection devices are increasingly equipped with local intelligence to perform immediate decision-making at the substation level. This reduces latency and reliance on central systems, especially in remote or high-risk environments. The trend aligns with broader IT-OT convergence in power networks. The teleprotection market is witnessing demand for modular, edge-capable protection solutions that balance responsiveness with central oversight. It provides flexibility for utilities deploying protection strategies across varied terrains and infrastructures.

Rising Adoption of Optical Ground Wire (OPGW) and Fiber-Based Communication Links:

The deployment of OPGW and dedicated fiber optics for utility communication is increasing, enhancing the speed and reliability of protection signals. These links offer ultra-low latency and high bandwidth, essential for high-speed teleprotection schemes. Telecom-utility partnerships are also facilitating access to dark fiber infrastructure for protection use cases. The teleprotection market is leveraging these advancements by offering fiber-ready communication interfaces and protocols. It strengthens its position in utility communication planning by aligning with ongoing fiber rollouts.

Market Challenges Analysis:

High Capital Costs and Limited ROI Discourage Broad Deployment:

The implementation of advanced teleprotection systems involves substantial initial investment in hardware, communication infrastructure, and engineering design. Many utilities, especially in developing regions, hesitate to adopt these solutions due to budget constraints and long payback periods. Upgrading legacy protection systems to support high-speed digital communication demands significant infrastructure revamp. This economic barrier slows the pace of teleprotection adoption and limits its penetration in cost-sensitive markets. The teleprotection market experiences slower traction where capital expenditure is tightly regulated or subject to public approval.

Complexity of System Integration and Limited Skilled Workforce:

Teleprotection systems must integrate seamlessly with existing protection relays, SCADA systems, and network infrastructure. This requires precise configuration, protocol alignment, and real-time coordination across devices. Lack of standardized deployment frameworks and skilled professionals creates delays and operational inefficiencies. Utilities often struggle to maintain and troubleshoot complex teleprotection setups, especially in multi-vendor environments. The teleprotection market faces adoption resistance due to technical challenges in commissioning, interoperability, and ongoing maintenance support.

Market Opportunities:

Emerging Economies Accelerate Grid Modernization and Digitalization:

Developing countries are investing in grid expansion, automation, and resilience, creating fresh demand for advanced teleprotection systems. Governments in regions like Southeast Asia, Africa, and Latin America are allocating funds for T&D upgrades and renewable integration. The teleprotection market gains from these investments by offering future-proof and standards-compliant systems suited for evolving grid needs. It helps these economies leapfrog outdated technologies and adopt intelligent grid infrastructure.

Utilities Shift Toward Condition-Based Monitoring and Predictive Analytics:

Power utilities are moving beyond reactive protection toward predictive fault management. The integration of sensors, IoT devices, and AI platforms allows for real-time condition monitoring of lines and substations. The teleprotection market benefits by embedding predictive logic into its systems, enabling smarter fault prevention and operational efficiency. It positions itself as a key component of data-driven grid management.

Market Segmentation Analysis:

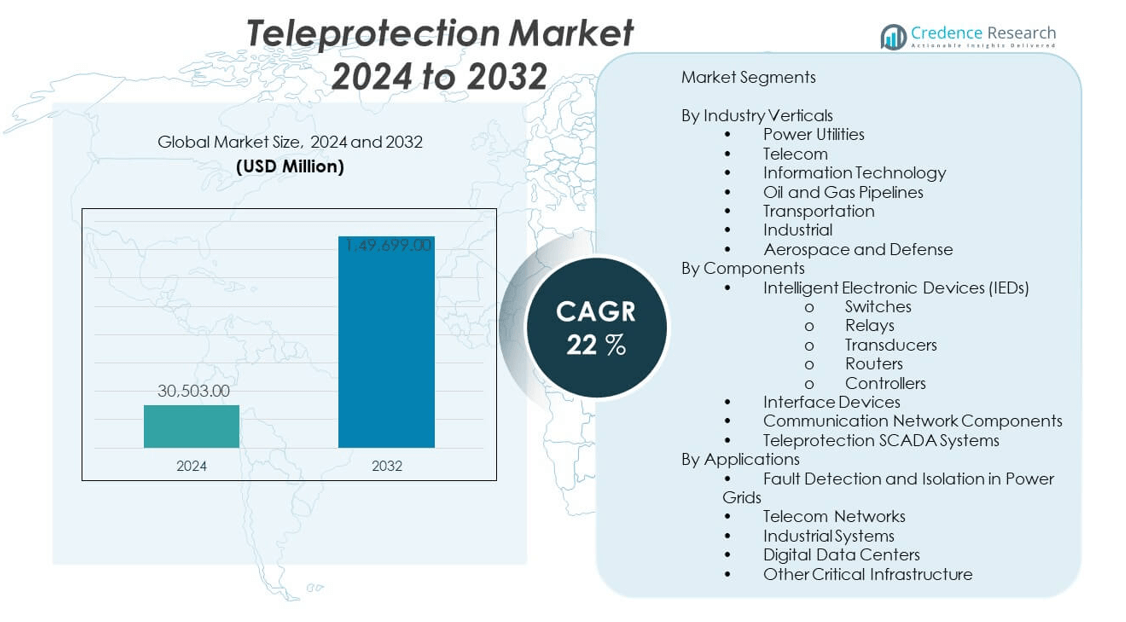

By Industry Verticals

The teleprotection market is led by power utilities, where real-time fault detection and grid reliability remain critical. Telecom and information technology sectors use teleprotection to secure high-speed communication networks. Adoption in oil and gas pipelines supports infrastructure integrity over long distances. The transportation sector implements teleprotection to prevent signaling failures, while industrial applications focus on minimizing production disruptions. Aerospace and defense require robust and secure protection systems to maintain operational readiness and safety across mission-critical networks.

- For instance, Siemens and ABB provide telecontrol software that supports IEC 61850-based standardized communication and supports multi-vendor interoperability for complex smart grids.

By Product Types

Core product segments include teleprotection units, essential for detecting and isolating faults, and telecontrol software and services, which enable centralized monitoring and control. The category of communication network technology is split between conventional systems, such as TDM, and advanced systems, including IP/MPLS and fiber-optic platforms that offer high-speed, low-latency communication for smart grid integration.

- For instance, Communication network technologies include fiber-optic platforms with latency under 5 ms, packet technology with embedded IEEE 1588 sync, and integrated cybersecurity suites meeting industrial cybersecurity standards.

By Components

Key components in the teleprotection market include intelligent electronic devices (IEDs) such as relays, switches, transducers, routers, and controllers, which perform real-time protection logic. Interface devices facilitate system integration, while communication network components—including outband, inband (such as power line communication), and Ethernet components—enable secure data transmission. Teleprotection SCADA systems provide comprehensive supervisory control across distributed infrastructures.

By Communication Technology

The market is segmented into traditional teleprotection and modern teleprotection, with the latter including digital teleprotection systems. Digital solutions dominate due to their high accuracy, low latency, and ease of integration with automation technologies, enabling utilities to meet evolving grid requirements.

By Applications

Teleprotection is primarily applied in fault detection and isolation in power grids, supporting system stability and outage prevention. It is also used in telecom networks to maintain uptime and service continuity. In industrial systems, it protects critical processes, while digital data centers rely on it to ensure uninterrupted operations. The market continues to expand into other critical infrastructure sectors requiring secure, real-time communication and control.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Industry Verticals

- Power Utilities

- Telecom

- Information Technology

- Oil and Gas Pipelines

- Transportation

- Industrial

- Aerospace and Defense

By Components

- Intelligent Electronic Devices (IEDs)

- Switches

- Relays

- Transducers

- Routers

- Controllers

- Interface Devices

- Communication Network Components

- Outband

- Inband (including Power Line Communication)

- Ethernet Components

- Teleprotection SCADA Systems

By Communication Technology

- Traditional Teleprotection

- Modern Teleprotection

- Digital Teleprotection Systems

By Applications

- Fault Detection and Isolation in Power Grids

- Telecom Networks

- Industrial Systems

- Digital Data Centers

- Other Critical Infrastructure

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leads with Advanced Grid Modernization and Highest Market Share

North America dominates the teleprotection market with a market share of approximately 36% in 2024, driven by early adoption of smart grid infrastructure and high investment in utility automation. The United States plays a central role due to its established electric grid, advanced communication networks, and strong regulatory support for grid protection upgrades. Regional utility companies actively deploy digital substations, IP/MPLS-based communication, and IEC 61850-compliant teleprotection systems to ensure high-speed fault isolation. Government initiatives to integrate renewables and improve grid resilience fuel further adoption of teleprotection systems. Canada complements this growth with large-scale energy projects, particularly in hydro and cross-border transmission. The teleprotection market in this region benefits from a strong ecosystem of vendors, research institutions, and technology integrators.

Europe Secures Second Position through Regulatory Support and Cross-Border Coordination

Europe holds the second-largest share in the teleprotection market, accounting for nearly 28% in 2024. The region’s focus on energy transition, grid decarbonization, and cross-border interconnections supports robust deployment of high-speed protection systems. Countries such as Germany, France, and the United Kingdom lead in implementing smart substations, fiber-optic communication links, and real-time fault response technologies. EU directives promoting grid reliability and renewable integration have increased utility spending on digital protection. Coordinated energy sharing between European nations necessitates synchronized teleprotection, driving demand for interoperable solutions. Strong partnerships between technology providers and transmission system operators contribute to sustained market traction. The presence of established manufacturers also facilitates faster deployment and innovation in protection technology.

Asia Pacific Emerges as the Fastest-Growing Region with Infrastructure Expansion

Asia Pacific is the fastest-growing region in the teleprotection market, projected to capture over 22% market share by 2032. Rapid industrialization, urbanization, and rising energy demand across China, India, and Southeast Asia are key growth drivers. Governments in the region are investing heavily in grid modernization and renewable integration, prompting the need for intelligent protection infrastructure. China leads in deploying teleprotection in ultra-high voltage transmission projects, while India expands its smart grid and substation automation programs. Regional utilities prioritize low-latency, scalable systems to handle increasing grid complexity. The availability of skilled engineering talent and favorable government policies accelerate technology adoption. The teleprotection market gains momentum here through foreign investments, public-private partnerships, and rising digitalization in utility operations.

Key Player Analysis:

- ABB Ltd.

- Siemens AG

- GE Energy (General Electric)

- Schneider Electric

- Hitachi Energy

- Nokia Corporation

- Schweitzer Engineering Laboratories (SEL)

- Alstom SA

- Mitsubishi Electric Corporation

- Cisco Systems, Inc.

Competitive Analysis:

The teleprotection market features a concentrated competitive landscape led by global power and automation giants. Key players include ABB, Siemens, GE Energy, Schneider Electric, and Hitachi Energy, each offering comprehensive teleprotection portfolios tailored for high-voltage and smart grid environments. Companies compete based on technological innovation, IEC 61850 compliance, and integration capabilities with modern substation automation systems. Strategic partnerships with telecom providers and utilities enhance their market position. Firms like Schweitzer Engineering Laboratories and Nokia focus on high-performance communication protocols and secure data transmission. The teleprotection market encourages continuous R&D investment to support evolving grid requirements and next-generation digital substations. It shows high entry barriers due to complex integration standards and the need for field-proven reliability.

Recent Developments:

- In March 2024, ABB Ltd. partnered with a major North American utility to deploy its new digital teleprotection relays integrated with IEC 61850 for ultra-fast fault clearance in critical substations.

- In January 2024, Hitachi Energy launched its next-generation hybrid teleprotection systems featuring AI-based predictive fault analysis, enhancing grid reliability across large-scale utility networks.

- In November 2023, Siemens expanded its SIPROTEC 5 product line to include modular teleprotection units designed for multi-protocol communication and advanced cyber-secure grid applications.

- In August 2023, Schneider Electric collaborated with a Southeast Asian government to modernize its transmission infrastructure using IP-based teleprotection and SCADA integration.

Market Concentration & Characteristics:

The teleprotection market exhibits moderate-to-high concentration, with a few multinational corporations dominating due to their established portfolios and technical expertise. It favors players with strong capabilities in protection relay technology, high-speed communication systems, and smart grid integration. The market demands certified products that comply with international standards and withstand harsh operational environments. It includes a mix of end-to-end solution providers and niche communication technology specialists. Buyers tend to prioritize vendors with proven performance in high-voltage environments and long-term service capabilities. The market evolves rapidly with digital trends, emphasizing latency reduction, interoperability, and edge intelligence in protection systems.

Report Coverage:

The research report offers an in-depth analysis based on Industry Vertical/Application and Technology. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for 5G and fiber-based teleprotection systems will significantly rise.

- Integration with AI and edge analytics will become industry standard.

- Hybrid protection solutions will gain traction across distributed grids.

- Utilities will increase investment in IEC 61850-compliant platforms.

- Developing regions will drive market expansion through smart grid rollouts.

- Digital substations will dominate future protection system deployments.

- Cloud-based remote monitoring of protection systems will see adoption.

- Cybersecurity features will become a critical differentiator for vendors.

- Partnerships between telecom and energy sectors will reshape solution delivery.

- Market consolidation will continue as global players acquire niche tech firms.