Market Overview

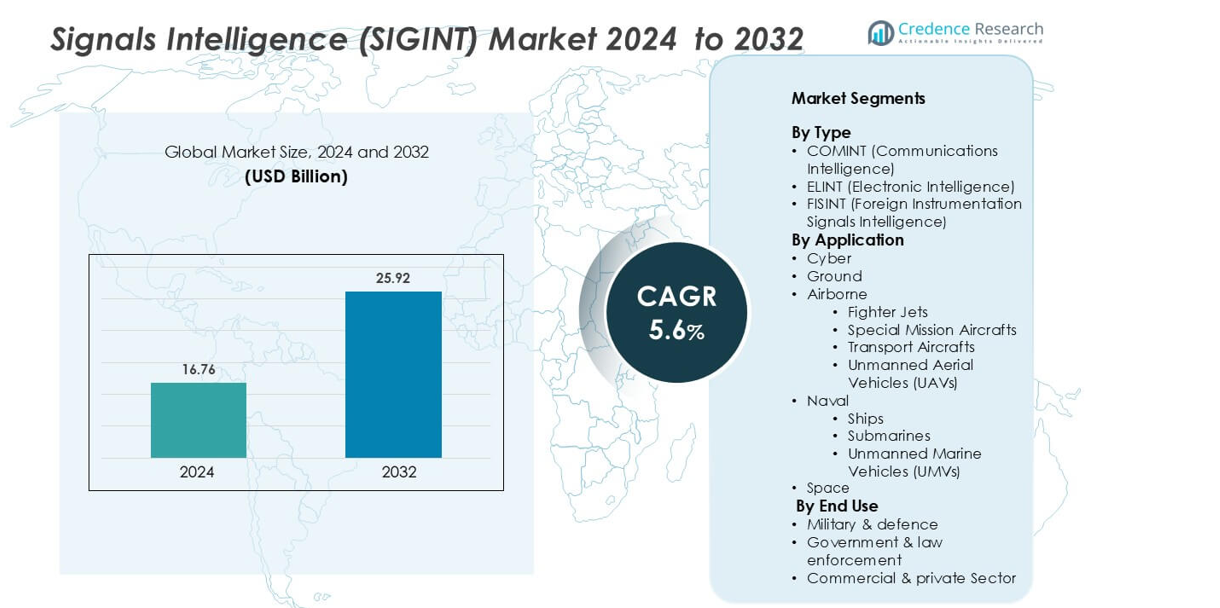

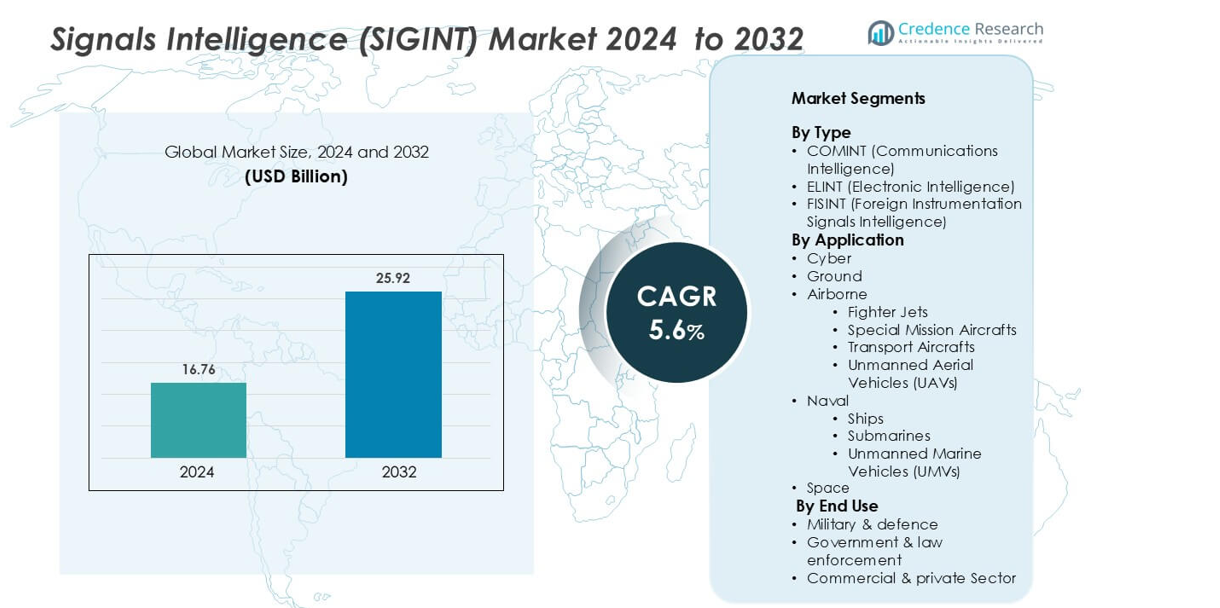

Signals Intelligence (SIGINT) Market size was valued USD 16.76 billion in 2024 and is anticipated to reach USD 25.92 billion by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Signals Intelligence (SIGINT) MarketSize 2024 |

USD 16.76 billion |

| Signals Intelligence (SIGINT) Market, CAGR |

5.6% |

| Signals Intelligence (SIGINT) Market Size 2032 |

USD 25.92 billion |

Signals Intelligence (SIGINT) market is shaped by advanced technological capabilities and strong defense collaborations. Major companies include Thales, Boeing, Northrop Grumman, Elbit Systems, Lockheed Martin, BAE Systems, General Dynamics, Airbus, L3Harris, and Raytheon. These players focus on developing sophisticated COMINT, ELINT, and FISINT platforms to support military modernization, electronic warfare, and strategic intelligence operations. North America leads the market with 38% share, driven by high defense spending, cutting-edge R&D, and strong government-industry partnerships. Europe follows with 26% and Asia Pacific with 22%, supported by expanding defense infrastructure and joint surveillance programs. Competitive strategies center on innovation, multi-domain integration, and expanding global defense contracts.

Market Insights

- The global Signals Intelligence (SIGINT) market is valued at USD 16.76 billion in 2024 and is projected to reach USD 25.92 billion by 2032, growing at a CAGR of 5.6% during the forecast period.

- Rising geopolitical tensions, growing border security needs, and increasing defense modernization programs are driving market expansion across multiple domains, including COMINT, ELINT, and FISINT.

- Airborne platforms hold the largest segment share due to their role in real-time surveillance and threat detection, supported by growing UAV and special mission aircraft deployments.

- North America leads with 38% market share, followed by Europe at 26% and Asia Pacific at 22%, while the Middle East & Africa and Latin America account for 8% and 6%, respectively.

- High system complexity, interoperability issues, and advanced encryption methods pose restraints, but strong competition among players like Thales, Boeing, Northrop Grumman, Lockheed Martin, and Raytheon sustains innovation and market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

COMINT (Communications Intelligence) holds the largest market share in the SIGINT market. Its dominance is driven by growing cross-border communication monitoring needs and counterterrorism operations. COMINT enables real-time interception and analysis of voice, text, and data signals, supporting strategic and tactical missions. Rising geopolitical tensions and the need for advanced surveillance strengthen its adoption by defense agencies. ELINT and FISINT are expanding steadily as electronic and telemetry data collection gain importance in modern warfare and space missions, but COMINT remains the primary intelligence tool for operational decision-making and strategic security planning.

- For instance, the AN/ALR-93 is a self-protection system that detects radiofrequency (RF) signals from enemy radar systems.

By Application

Airborne platforms dominate the application segment, led by fighter jets and special mission aircraft. This dominance comes from their critical role in real-time threat detection, secure communication interception, and electronic warfare missions. Advanced airborne SIGINT systems enable wide-area monitoring and quick response in conflict zones. Growing investments in modern aircraft fleets and UAV integration further drive this growth. Naval and space applications are expanding rapidly as nations enhance maritime surveillance and satellite intelligence programs, but airborne SIGINT remains the most deployed and strategically vital segment in global defense operations.

- For instance, the RC-135’s sensor suite can “detect, identify and geolocate signals throughout the electromagnetic spectrum,” and is capable of processing data from “potentially thousands of electronic emitters”.

By End Use

In end use, military and defense dominate the market, supported by rising investments in electronic warfare and intelligence modernization programs. Government and law enforcement agencies follow, using SIGINT for border security, counterterrorism, and organized crime monitoring, while commercial use remains limited but emerging.

Key Growth Drivers

Rising Geopolitical Tensions and Border Security Needs

Increasing geopolitical conflicts and rising cross-border threats are major forces driving SIGINT market growth. Governments are investing heavily in advanced surveillance and intelligence systems to secure borders, monitor adversarial activities, and detect potential threats in real time. Modern SIGINT solutions enable rapid interception and decryption of enemy communications, supporting pre-emptive defense strategies. The growing complexity of electronic warfare requires continuous intelligence gathering through COMINT, ELINT, and FISINT systems. Nations are prioritizing SIGINT deployment along sensitive borders, critical infrastructure, and conflict-prone regions to enhance situational awareness. As global instability rises, demand for strategic and tactical intelligence platforms is expected to accelerate significantly, positioning SIGINT as a core element of national defense modernization programs.

- For instance, BAE Systems publicly advertises that the TSP, with its nine mission modes, “can process multiple signals without having to change hardware”.

Rapid Modernization of Defense Communication Infrastructure

Defense forces worldwide are modernizing communication networks to handle high-bandwidth, multi-domain operations. This shift is driving the adoption of next-generation SIGINT solutions that can intercept, process, and analyze vast data volumes from multiple signal sources. Integration with artificial intelligence, machine learning, and cloud-based architectures enhances accuracy, speed, and decision-making capabilities. Advanced platforms are enabling joint operations across air, land, sea, and space domains. Modern defense strategies rely on continuous, secure, and real-time intelligence, making SIGINT a critical enabler of integrated command-and-control networks. Several nations are upgrading existing surveillance assets to counter emerging electronic warfare tactics, strengthening the market’s growth outlook.

- For instance, Lockheed Martin openly discusses its work on multi-domain operations, which relies heavily on integrating and analyzing sensor data from various platforms across different environments (land, sea, air, space, and cyber).

Rising Adoption of UAVs and Space-Based Intelligence Platforms

The increasing use of UAVs and satellite networks for intelligence gathering is significantly boosting SIGINT demand. UAVs offer flexibility, lower operational costs, and extended mission durations, making them ideal for surveillance and reconnaissance missions. Space-based SIGINT platforms provide broad coverage and persistent monitoring capabilities. These technologies enable defense agencies to track signals across remote or high-threat zones without deploying manned forces. The integration of UAV-based SIGINT payloads with advanced data analytics enhances precision and responsiveness. As more countries invest in unmanned and satellite surveillance systems, SIGINT platforms will continue to play a central role in multi-domain intelligence operations.

Key Trend & Opportunities

Integration of AI and Big Data in SIGINT Systems

The integration of AI, machine learning, and big data analytics is transforming SIGINT operations. Traditional intelligence systems face challenges in processing large volumes of complex signals. AI-powered platforms enhance pattern recognition, automate signal classification, and deliver actionable insights faster. These capabilities strengthen early threat detection, cyber defense, and electronic warfare strategies. Real-time data analytics also improves interoperability between defense forces, enhancing joint operational capabilities. Growing investment in AI-based defense intelligence solutions presents strong opportunities for SIGINT vendors to offer more advanced, scalable, and cost-efficient platforms to global defense agencies.

- For instance, Northrop Grumman uses AI to accelerate data analysis and support decision-making for warfighters. A specific example on their website describes how a team used AI to process satellite telemetry data faster than humans, reducing a 40-hour task to just five seconds.

Expansion of Space-Based and Maritime SIGINT Applications

The increasing focus on space and maritime domains is creating new opportunities for SIGINT deployment. Space-based platforms allow persistent surveillance, signal monitoring, and secure communications interception over wide geographic areas. Maritime SIGINT solutions strengthen naval situational awareness, supporting anti-piracy, anti-submarine, and fleet protection missions. Nations are investing in satellite constellations, unmanned surface vessels (USVs), and undersea sensor networks to expand intelligence reach. These developments present strong market opportunities for advanced, interoperable SIGINT systems that support joint operations across multiple domains. Vendors offering modular and scalable solutions stand to benefit the most from this expansion.

- For instance, Airbus and Thales were awarded a 10-year contract by the French defence procurement agency in 2021 to develop a tactical SIGINT system for the French armed forces.

Key Challenges

High System Complexity and Integration Barriers

SIGINT systems require advanced hardware, complex signal processing algorithms, and secure integration with multiple defense networks. This complexity creates major operational challenges, including interoperability issues and longer deployment timelines. Many legacy defense infrastructures cannot easily support next-generation SIGINT platforms without expensive modernization. Achieving seamless coordination between air, land, sea, and space assets remains a significant hurdle. The need for specialized skills, high maintenance costs, and data security requirements further increase system complexity. These factors can slow adoption, especially in countries with limited defense budgets or aging communication networks.

Rising Data Encryption and Signal Camouflage Techniques

Adversaries are increasingly using sophisticated encryption, frequency-hopping, and signal-masking techniques to evade interception. This makes real-time signal analysis more difficult, reducing the effectiveness of traditional SIGINT methods. Advanced cyberwarfare tactics and stealth communication protocols demand highly adaptive intelligence systems. Governments must invest heavily in R&D to keep pace with evolving threats. Upgrading decryption capabilities and integrating advanced analytics tools becomes essential. The growing complexity of modern signal environments presents a major challenge to intelligence agencies, requiring continuous innovation to maintain operational superiority.

Regional Analysis

North America

North America holds 38% of the global SIGINT market share, making it the largest regional contributor. The region’s dominance stems from robust defense budgets, advanced electronic warfare capabilities, and early technology adoption. The U.S. leads with significant investments in COMINT, ELINT, and space-based intelligence platforms to enhance operational readiness. High integration of SIGINT across airborne, naval, and space assets ensures real-time situational awareness. Canada’s growing emphasis on border surveillance and cyber intelligence further supports market expansion. Strong R&D infrastructure, defense alliances, and strategic modernization keep North America at the forefront of global SIGINT advancements.

Europe

Europe accounts for 26% of the global SIGINT market share, supported by rising defense modernization initiatives across major economies. The U.K., Germany, and France are leading investments in communication interception, electronic warfare, and satellite-based intelligence solutions. Increased collaboration through NATO strengthens joint surveillance and intelligence-sharing frameworks. Growing geopolitical tensions in Eastern Europe further accelerate demand for real-time signal interception capabilities. Modernization of naval fleets, fighter jets, and UAV deployments enhances operational strength. Europe’s strong defense industrial base and collaborative defense programs position the region as a key pillar in the global SIGINT ecosystem.

Asia Pacific

Asia Pacific represents 22% of the global SIGINT market share and is the fastest-growing region. Rising defense spending and rapid military modernization drive this growth. China, India, Japan, and South Korea are expanding investments in advanced surveillance technologies to strengthen strategic intelligence networks. Ongoing territorial disputes and heightened border tensions fuel demand for airborne and satellite SIGINT systems. Governments are integrating AI-based tools to improve real-time signal processing and threat detection. Expanding UAV fleets and defense collaborations make Asia Pacific a major future growth engine for SIGINT solutions, supported by robust security modernization programs.

Middle East & Africa

The Middle East & Africa hold 8% of the global SIGINT market share, reflecting steady growth in defense investments. Security concerns, regional conflicts, and counterterrorism operations are accelerating the adoption of COMINT and ELINT systems. Countries such as Israel, Saudi Arabia, and the UAE are modernizing surveillance networks to strengthen strategic defense. UAV-based intelligence platforms and fixed SIGINT stations enhance border monitoring capabilities. Africa is gradually expanding its defense infrastructure through regional collaborations. Although the market share is smaller than other regions, rising defense alliances and modernization projects are driving increased SIGINT deployment.

Latin America

Latin America holds 6% of the global SIGINT market share, supported by growing demand for intelligence and surveillance systems. Brazil, Mexico, and Colombia are increasing investments in fixed and portable SIGINT platforms to address border security and counter-narcotics challenges. Rising concerns over organized crime and maritime threats fuel the adoption of advanced interception technologies. Governments are strengthening international defense partnerships to enhance operational intelligence. Though defense budgets remain moderate, steady modernization programs are expected to boost airborne and naval SIGINT applications, positioning Latin America as an emerging growth region in the global SIGINT market.

Market Segmentations:

By Type

- COMINT (Communications Intelligence)

- ELINT (Electronic Intelligence)

- FISINT (Foreign Instrumentation Signals Intelligence)

By Application

-

- Fighter Jets

- Special Mission Aircrafts

- Transport Aircrafts

- Unmanned Aerial Vehicles (UAVs)

-

- Ships

- Submarines

- Unmanned Marine Vehicles (UMVs)

By End Use

- Military & defence

- Government & law enforcement

- Commercial & private Sector

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Signals Intelligence (SIGINT) market is defined by strong technological capabilities and extensive defense partnerships. Leading players include Thales, Boeing, Northrop Grumman, Elbit Systems, Lockheed Martin, BAE Systems, General Dynamics, Airbus, L3Harris, and Raytheon. These companies focus on advanced COMINT, ELINT, and FISINT platforms to support defense modernization programs globally. North America leads the market with 38% share, driven by the presence of major U.S. defense contractors and high defense spending. Europe follows with 26%, supported by strong industrial capabilities and joint defense initiatives. Asia Pacific holds 22%, fueled by rising military investments. Key strategies include product innovation, strategic collaborations, and multi-domain intelligence integration, ensuring competitive positioning across airborne, naval, space, and cyber SIGINT applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thales

- Boeing

- Northrop Grumman

- Elbit Systems

- Lockheed Martin

- BAE Systems

- General Dynamics

- Airbus

- L3Harris

- Raytheon

Recent Developments

- In January 2025, Iran launched Zagros, its first signals intelligence vessel. The unveiling enhanced its electronic surveillance and cyber intelligence capabilities. Alongside it, they also conducted massive militaristic exercises aimed at safeguarding Iranian nuclear facilities such as Natanz and Fordow. The domestically manufactured Zagros was expected to bolster Iran’s control over Indian and Pacific Ocean maritime regions.

- In November 2024 Spain’s Indra Systems presented a signals intelligence (SIGINT) system, which operated by detecting radar and communication signals for naval vessels like patrol ships and warships. The additional features include automatic integration with other more advanced sensor networks and monitoring the entire electromagnetic spectrum. Indra provides F100 frigates, LHD Juan Carlos I, and F110 frigate with advanced technologies, meaning they are already in use.

- In October 2024, General Dynamics Mission Systems added signals intelligence (SIGINT) capabilities to the Infantry Squad Vehicle (ISV) using its Tactical Electronic Warfare System-Infantry Brigade Combat Team (TEWS-I). This system helps detect, identify, and locate enemy signals while supporting electronic warfare (EW) and cyber operations.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven SIGINT systems will enhance real-time signal interception and analysis.

- Integration of SIGINT with multi-domain operations will improve defense coordination.

- Growth in UAV and satellite deployments will expand airborne and space-based intelligence.

- Modernization of defense networks will boost demand for advanced COMINT and ELINT solutions.

- Rising cybersecurity threats will accelerate investment in tactical SIGINT capabilities.

- Regional conflicts and border security concerns will strengthen defense surveillance programs.

- Miniaturization of SIGINT sensors will enable more portable and flexible deployment.

- Increased government collaborations will support joint intelligence and data-sharing frameworks.

- Technological innovation will drive faster, more secure signal processing systems.

- Expanding defense budgets in emerging markets will create new growth opportunities.