Market Overview

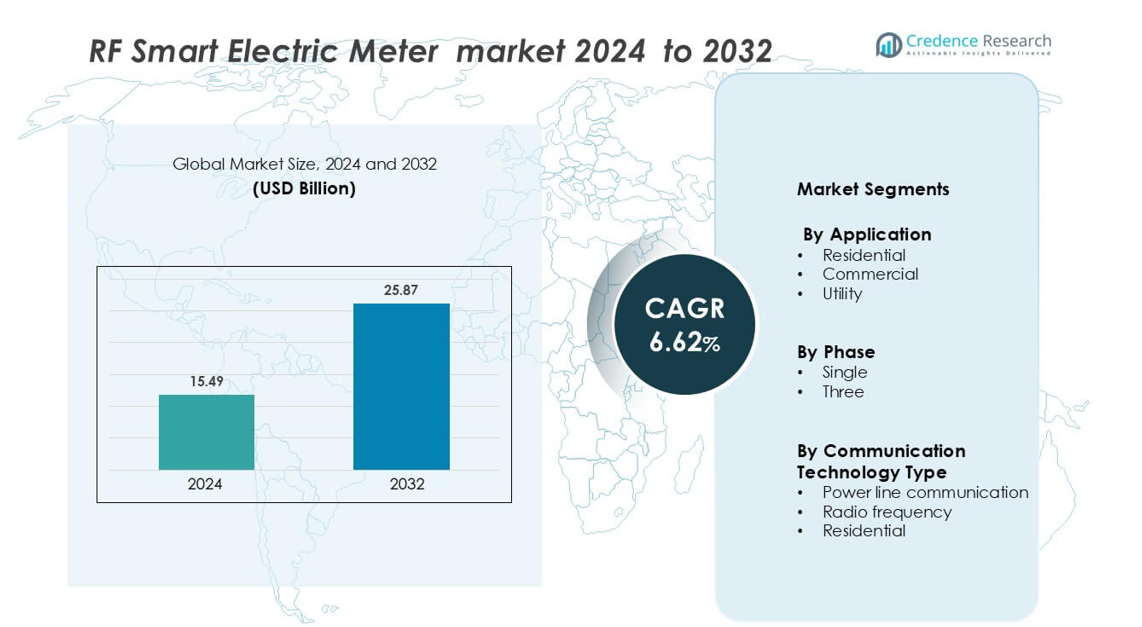

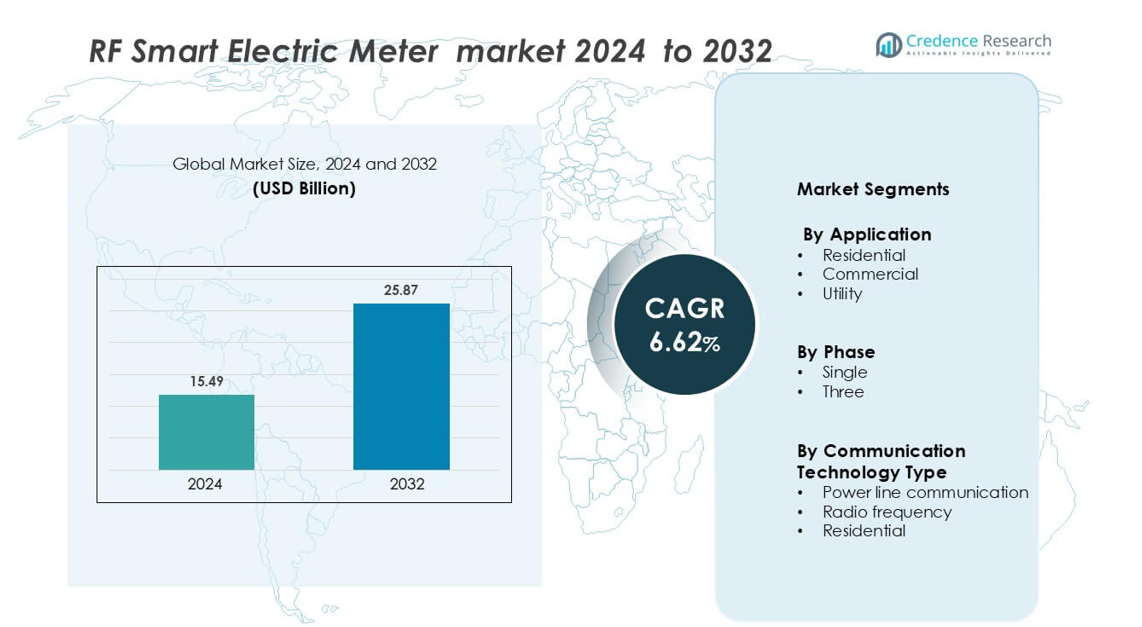

RF Smart Electric Meter Market size was valued USD 15.49 billion in 2024 and is anticipated to reach USD 25.87 billion by 2032, at a CAGR of 6.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| RF Smart Electric Meter Market Size 2024 |

USD 15.49 billion |

| RF Smart Electric Meter Market, CAGR |

6.62% |

| RF Smart Electric Meter Market Size 2032 |

USD 25.87 billion |

The RF smart electric meter market is shaped by strong competition among leading global players focusing on advanced communication solutions and grid modernization. Key companies include Cisco Systems, Inc., Apator SA, Itron Inc., Honeywell International Inc., Circutor, General Electric, CyanConnode, Aclara Technologies LLC, Iskraemeco Group, and Advanced Electronics Company (AEC). These companies emphasize strategic collaborations with utilities, large-scale deployments, and innovation in RF-based metering technology to enhance performance and reliability. North America leads the global market with a 32% share, supported by robust infrastructure, strong regulatory support, and rapid adoption of smart grid programs. This leadership is reinforced by advanced utility networks and high penetration in residential and commercial applications.

Market Insights

- The RF smart electric meter market is valued at USD 15.49 billion in 2024 and is projected to grow at a CAGR of 6.62% during the forecast period.

- Rising smart grid deployment and increasing energy efficiency initiatives are driving large-scale adoption across residential and commercial segments.

- Integration with IoT platforms, advanced analytics, and renewable energy sources is shaping market trends and expanding application areas.

- The market is moderately consolidated, with key players such as Cisco Systems, Apator SA, Itron Inc., Honeywell International Inc., and General Electric leading through product innovation and strategic partnerships.

- North America holds 32% market share, followed by Europe with 27% and Asia Pacific with 25%. Residential application leads the segment share, supported by government-backed digitization programs and rapid urbanization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

Residential dominates the RF smart electric meter market with the largest market share. The growth is driven by increasing adoption of smart home solutions and demand for real-time energy usage tracking. Utilities deploy residential RF meters to enable remote monitoring, faster outage detection, and efficient billing systems. Government-led energy efficiency programs and rising consumer awareness about energy conservation further support adoption. Commercial and utility segments follow, supported by integration with advanced grid infrastructure and demand management programs to optimize energy distribution and reduce operational costs.

- For instance, Itron is a global leader in the Industrial Internet of Things (IIoT), with a large and established network. Itron Inc. has deployed several million, OpenWay Riva or Gen5 Riva distributed intelligence (DI)-enabled meters across U.S. utilities, such as with Xcel Energy and Liberty Utilities, to support two-way communication and real-time diagnostics.

By Phase

Single-phase RF smart electric meters hold the dominant market share, primarily due to their extensive use in residential and small commercial buildings. These meters are easy to install, cost-effective, and provide accurate energy measurement with reliable communication. Three-phase meters are gaining traction in industrial and large commercial applications for load management and demand response integration. Growth in distributed energy resources and modernization of power grids is encouraging utilities to expand single-phase deployments, ensuring improved energy efficiency and grid stability.

- For instance, Landis+Gyr AG has a history of successful large-scale deployments utilizing both RF mesh and PLC technologies, with an installed base of over 300 million devices worldwide, which help to improve data accuracy and lower transmission delays.

By Communication Technology Type

Radio frequency technology leads this segment with the largest market share, supported by its reliable data transmission and lower infrastructure cost compared to other technologies. RF-enabled meters allow real-time monitoring, two-way communication, and efficient outage management. Power line communication remains relevant in grid modernization projects but faces integration challenges in dense urban areas. RF communication’s scalability and compatibility with existing utility networks make it the preferred choice for large-scale smart meter rollouts, particularly in residential and commercial energy management applications.

Key Growth Drivers

Rising Smart Grid Deployment

The increasing deployment of smart grids is a major driver of the RF smart electric meter market. Utilities are modernizing energy infrastructure to improve grid reliability, reduce losses, and enable real-time monitoring. RF smart meters enable two-way communication, helping utilities manage demand and detect faults quickly. Governments and energy regulators support this transformation through digitalization programs and grid resilience initiatives. The demand is strong in urban areas, where grid modernization supports renewable integration, peak load balancing, and energy security. These deployments also enhance operational efficiency, reduce manual meter reading, and provide better consumer insights, fueling large-scale adoption across regions.

- For instance, an energy industry analysis from May 2025, which reviewed Itron’s technology and 2024 revenues, reported that the company had delivered c300M communicating endpoints across various energy and water networks.

Increasing Energy Efficiency Initiatives

The growing focus on energy conservation and regulatory targets is driving demand for RF smart electric meters. These meters provide accurate consumption data, enabling utilities and consumers to optimize energy use and reduce waste. Governments are mandating smart metering programs to meet emission targets and support efficient energy distribution. RF technology allows fast data transfer and remote monitoring, which improves billing accuracy and supports flexible tariff models. This enhances energy planning and consumer engagement, while also supporting the expansion of distributed energy resources. Energy-saving programs in both residential and commercial sectors further accelerate the adoption of these meters.

- For instance, in July 2022, CyanConnode announced that over 1 million smart meters in India were communicating on its Radio Frequency (RF) network.

Rapid Urbanization and Infrastructure Growth

Expanding urban infrastructure is creating strong demand for RF smart meters. Rapid population growth in cities drives higher energy consumption, making efficient grid management critical. RF smart meters support automated data collection, outage detection, and seamless integration with advanced metering infrastructure (AMI). This helps utilities address rising energy demand while improving service reliability. Infrastructure projects, including smart city initiatives, are adopting RF smart meters to support digital energy ecosystems. The scalability and cost-effectiveness of RF technology make it ideal for large deployments, enabling utilities to strengthen grid visibility and support sustainable urban growth.

Key Trends & Opportunities

Integration with IoT and Advanced Analytics

The integration of RF smart meters with IoT and data analytics platforms is transforming grid operations. IoT-based smart meters enable continuous data exchange, supporting predictive maintenance and real-time energy optimization. Advanced analytics help utilities forecast demand patterns and manage energy flows more efficiently. This trend also supports the rise of home automation systems and energy management solutions. As utilities invest in digital transformation, RF technology provides a scalable foundation for connected infrastructure, creating new opportunities for technology providers and energy service companies to offer value-added solutions.

- For instance, Cisco’s solutions include RF mesh technology. Their Wireless Personal Area Network (WPAN) modules for their Connected Grid Routers deliver 900 MHz RF mesh connectivity for smart metering and other utility applications.

Growing Demand for Renewable Energy Integration

RF smart meters are becoming a key enabler of renewable energy adoption. Their real-time monitoring and two-way communication capabilities support integration of distributed energy resources like solar and wind. Utilities can balance variable power generation, manage peak loads, and ensure stable grid operations. This creates opportunities for advanced demand response programs and dynamic pricing models. As more nations set renewable energy targets, RF smart meters are playing a crucial role in modernizing grids, improving power quality, and supporting sustainable energy transition strategies.

- For instance, GE has documented more localized, smaller-scale projects. For example, in 2012, it announced a smart meter solution for Philippine utility MERALCO.

Expansion of Smart City Projects

The increasing number of smart city developments globally is creating strong opportunities for RF smart electric meter adoption. These meters support connected infrastructure by enabling energy-efficient buildings, automated street lighting, and smart transportation systems. RF communication’s scalability and low maintenance requirements make it ideal for city-wide deployments. As municipalities focus on reducing operational costs and improving energy resilience, RF smart meters are becoming a core component of urban digital infrastructure strategies, opening new revenue streams for technology vendors and service providers.

Key Challenges

Interference and Network Reliability Issues

One of the major challenges in deploying RF smart meters is interference from other wireless devices and network congestion in dense urban areas. RF signals can be disrupted by physical obstacles and competing frequencies, leading to communication errors and delays. This affects data transmission accuracy and system reliability. Utilities must invest in robust network planning, advanced frequency management, and redundancy mechanisms to minimize downtime. These challenges can increase deployment costs and complicate large-scale rollouts, especially in complex grid environments.

Cybersecurity and Data Privacy Concerns

As RF smart meters rely on wireless communication, they face increased exposure to cybersecurity threats. Unauthorized access, data breaches, or tampering can disrupt energy distribution and compromise customer information. Ensuring end-to-end encryption, secure authentication, and compliance with data protection regulations is essential. Utilities and vendors must invest in advanced security frameworks to protect RF networks and maintain consumer trust. Rising regulatory scrutiny around data handling adds complexity, creating additional costs and technical challenges for stakeholders in the smart metering ecosystem.

Regional Analysis

North America

North America holds the largest market share of 32% in the RF smart electric meter market, driven by strong investments in grid modernization and supportive regulatory frameworks. Utilities in the U.S. and Canada are accelerating RF meter deployments to enable real-time monitoring, outage detection, and advanced demand response. High penetration in residential and commercial segments aligns with federal energy efficiency goals and emission reduction targets. Strategic smart grid funding programs and the presence of major solution providers strengthen the region’s leadership position, ensuring sustained dominance in market share and technology adoption.

Europe

Europe accounts for a 27% market share, supported by ambitious energy transition goals and extensive smart grid initiatives. EU member states actively promote RF smart meter installations through strict energy efficiency regulations and subsidy programs. Germany, the U.K., France, and Italy are leading deployments with large-scale national rollouts. Integration of RF communication with renewable generation and demand-side management strengthens grid resilience. Advanced infrastructure, strong regulatory oversight, and high consumer engagement position Europe as a major contributor to the global RF smart electric meter market.

Asia Pacific

Asia Pacific holds a 25% market share and is the fastest-growing region in the RF smart electric meter market. Rapid urbanization, rising electricity demand, and widespread smart city projects are driving adoption across China, Japan, India, and South Korea. Governments are investing heavily in grid modernization to enhance reliability and integrate distributed renewable energy resources. High-density residential deployments and expanding commercial applications fuel rapid market growth. Strong policy support and private sector investments are boosting the region’s share, positioning Asia Pacific as a key growth engine.

Latin America

Latin America captures a 9% market share, with Brazil, Mexico, and Chile leading RF smart meter deployments. Utilities focus on minimizing transmission losses, improving billing accuracy, and increasing grid transparency. RF technology’s flexibility and low installation cost make it suitable for varying grid conditions across urban and rural areas. Regulatory reforms and rising energy consumption are encouraging utilities to expand smart metering infrastructure. These factors support steady market expansion, helping the region strengthen its position in the global RF smart electric meter landscape.

Middle East & Africa

The Middle East & Africa region holds a 7% market share, reflecting steady but growing adoption of RF smart electric meters. Countries like the UAE, Saudi Arabia, and South Africa are advancing grid modernization to enhance operational efficiency and reduce manual interventions. RF communication supports integration with renewable projects and digital transformation strategies. Government-backed initiatives and increasing investments in smart infrastructure are driving deployment. Rising demand for reliable power supply and energy diversification further boost the region’s share in the global RF smart electric meter market.

Market Segmentations:

By Application

- Residential

- Commercial

- Utility

By Phase

By Communication Technology Type

- Power line communication

- Radio frequency

- Residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The RF smart electric meter market is highly competitive, with several established players driving innovation and market expansion. Key companies include Cisco Systems, Inc., Apator SA, Itron Inc., Honeywell International Inc., Circutor, General Electric, CyanConnode, Aclara Technologies LLC, Iskraemeco Group, and Advanced Electronics Company (AEC). These players focus on advanced communication technologies, interoperability, and smart grid integration to strengthen their market presence. Strategic initiatives such as product innovation, large-scale deployments, and partnerships with utility providers are shaping the competitive landscape. North America leads the global market with a 32% share, supported by strong grid modernization programs. Europe and Asia Pacific follow with 27% and 25% market shares, respectively, driven by smart city projects, renewable energy integration, and government-backed digitization initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco Systems, Inc.

- Apator SA

- Itron Inc.

- Honeywell International Inc.

- Circutor

- General Electric

- CyanConnode

- Aclara Technologies LLC

- Iskraemeco Group

- Advanced Electronics Company (AEC)

Recent Developments

- In June 2023, Kamstrup was awarded a significant contract with BKW Energie AG, an energy and infrastructure firm based in Bern, following a competitive tender process. The contract encompasses the provision of 404,000 OMNIPOWER electricity meters along with a head-end system.

- In August 2022, Adani Group announced an investment of roughly USD 60 million to roll out smart electric meters in Mumbai, India. The plan was to install around 700,000 smart meters in 2023, providing customers with real-time updates on their power usage.

Report Coverage

The research report offers an in-depth analysis based on Application, Phase, Communication Technology Type and Geography. It details leading market players providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Deployment of RF smart meters will accelerate with rising global smart grid investments.

- Integration with IoT and AI will enhance real-time monitoring and energy optimization.

- Utilities will adopt advanced RF technologies to improve grid resilience and efficiency.

- Expansion of renewable energy integration will boost demand for two-way communication meters.

- Government-led energy efficiency programs will drive large-scale meter rollouts.

- Cost reduction in RF modules will support higher adoption in developing markets.

- Advanced analytics will enable better demand forecasting and dynamic pricing.

- Smart city projects will create new opportunities for RF metering infrastructure.

- Cybersecurity and data protection solutions will become a major investment focus.

- Regional market consolidation will strengthen through strategic partnerships and mergers.