Market Overview

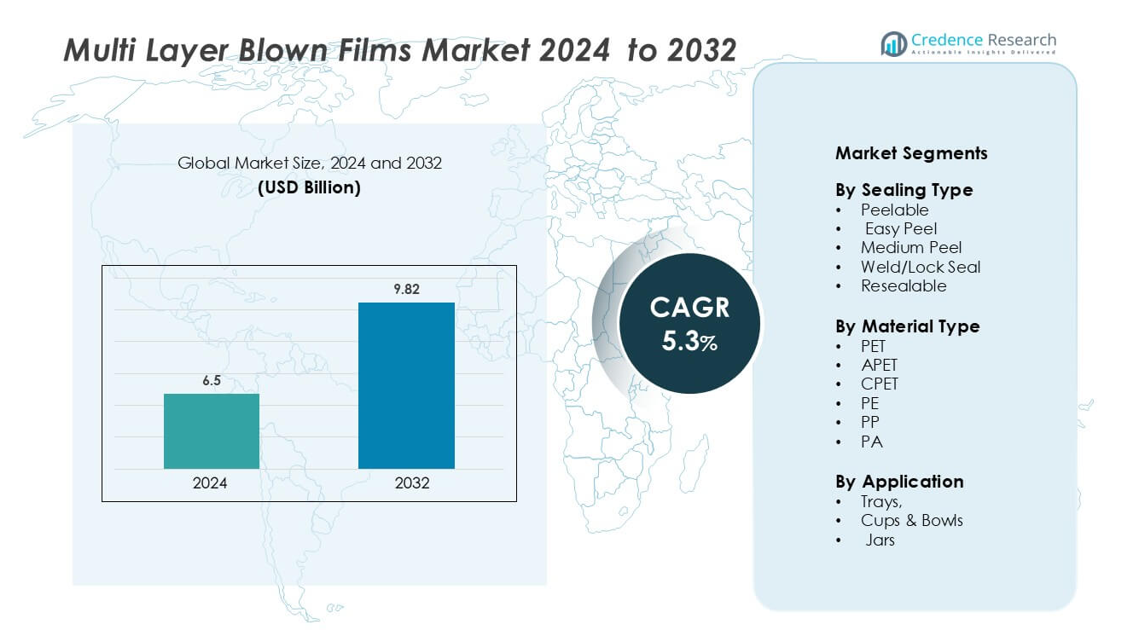

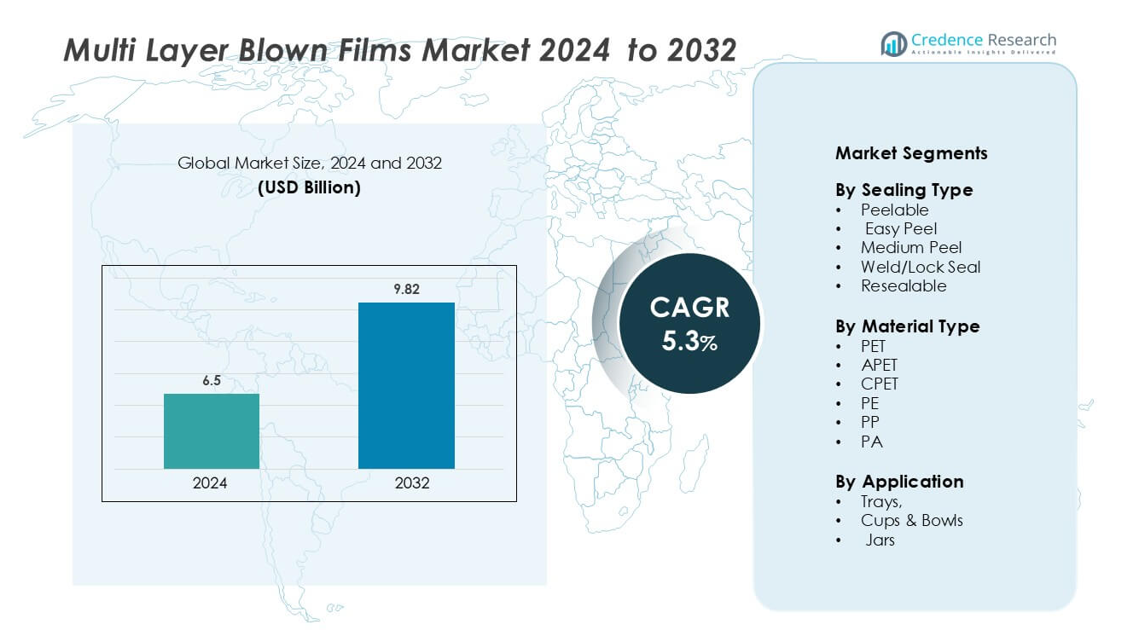

Multi-Layer Blown Films Market size was valued USD 6.5 billion in 2024 and is anticipated to reach USD 9.82 billion by 2032, at a CAGR of 5.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multi-Layer Blown Films Market Size 2024 |

USD 6.5 billion |

| Multi-Layer Blown Films Market, CAGR |

5.3% |

| Multi-Layer Blown Films Market Size 2032 |

USD 9.82 billion |

The multi-layer blown films market is dominated by leading companies such as Berry Global Inc. (U.S.), Uflex Ltd. (India), Flexopack S.A. (Greece), Coveris Holdings S.A. (Austria), Sealed Air Corporation (U.S.), Cosmo Films Ltd. (India), Mondi Group (UK), Toray Plastics (America), Inc. (U.S.), RPC bpi group (UK), and Amcor plc (UK). These players drive market growth through advanced co-extrusion technologies, sustainable product portfolios, and strong distribution networks. Strategic mergers, capacity expansions, and R&D investments strengthen their competitive edge. North America leads the global market with a 36% share, supported by strong packaging infrastructure and high demand from the food and healthcare sectors. Europe and Asia Pacific follow with significant contributions to overall growth.

Market Insights

- The multi-layer blown films market was valued at USD 6.5 billion in 2024 and is projected to grow at a CAGR of 5.3% through 2032.

- Rising demand for high-barrier and sustainable packaging in food, beverage, and healthcare sectors is driving market expansion.

- Technological advancements in co-extrusion and increasing use of recyclable mono-material films are shaping market trends.

- The market is highly competitive, with major players focusing on product innovation, capacity expansion, and strategic partnerships to strengthen their presence.

- North America leads with a 36% share, followed by Europe with 28% and Asia Pacific with 24%, while Weld/Lock Seal dominates the sealing type segment and PE leads material usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sealing Type

Weld/Lock Seal holds the dominant share in the multi layer blown films market due to its strong and durable sealing performance. This sealing type ensures airtight packaging, making it suitable for applications requiring high product protection and extended shelf life. It is widely used in food and pharmaceutical packaging where leak prevention is critical. The growing preference for tamper-proof packaging and improved barrier properties drives its adoption. Its ability to maintain seal integrity under varying temperature and pressure conditions further strengthens its market position.

- For instance, the dimensions given (0.4 mil for each skin layer and 1.2 mil for the core) are well within the typical range for co-extruded films. The total film thickness would be 2.0 mil, which is a common gauge for various packaging applications.

By Material Type

PE (Polyethylene) leads the market share among material types due to its excellent flexibility, heat sealability, and cost-effectiveness. PE offers strong barrier properties against moisture and contamination, making it suitable for a wide range of packaging applications. Its recyclability also aligns with growing sustainability goals in the packaging industry. High demand from food, beverage, and healthcare sectors fuels growth. In addition, ongoing innovations in multilayer film structures using PE enhance product protection, shelf life, and sealing performance.

- For instance, Dow’s INNATE™ Precision Packaging Resins enable downgauging of up to 25 % in film thickness while maintaining toughness in oriented PE films.

By Application

Trays account for the largest share in the application segment, supported by strong use in ready-to-eat and fresh food packaging. Multi-layer blown films provide superior sealing, strength, and barrier protection, maintaining product freshness during storage and transit. Trays offer a convenient format for retail display and consumer use, which boosts their adoption across food service and retail sectors. Rising consumption of packaged foods and increasing demand for secure, hygienic packaging solutions drive the segment’s dominance.

Key Growth Drivers

Rising Demand for High-Performance Packaging

The increasing demand for durable and protective packaging solutions is a major growth driver in the multi layer blown films market. Industries such as food and beverage, healthcare, and personal care rely on multilayer films for their superior barrier properties and extended shelf life. These films protect products against moisture, oxygen, and contaminants, ensuring quality during storage and transportation. The ability to combine multiple functional layers into a single film enhances strength, sealing, and clarity while reducing material usage. Growing consumer preference for convenient, safe, and hygienic packaging further accelerates adoption. Companies are investing in advanced extrusion technologies to meet performance and customization needs. This rising application base across multiple industries continues to strengthen market growth globally.

- For instance, the packaging industry considers an OTR of less than 15.5 cm³/m²·24h (or 1 cc/100 in²/24hr) as a high oxygen barrier, ideal for extending the shelf life of oxygen-sensitive goods.

Expanding Food and Beverage Industry

The rapid expansion of the food and beverage sector significantly boosts the demand for multi layer blown films. These films are widely used for trays, cups, pouches, and resealable packs that offer superior preservation and tamper resistance. Busy lifestyles and rising urbanization drive the demand for ready-to-eat and on-the-go food products, requiring strong and reliable packaging. Multilayer structures maintain product freshness and reduce food waste, making them essential for retailers and manufacturers. Regulatory focus on food safety standards also supports wider adoption of advanced packaging formats. Growing retail chains, cold storage distribution, and global export activities further expand packaging requirements, making the food and beverage segment a key driver of sustained market growth.

- For instance, Multiple reports confirm that the Omni Xtra+ film offers a weight reduction of over 25% compared to PVC films and that its mechanical properties allow for a thinner overall film without compromising strength or puncture resistance.

Shift Toward Sustainable and Recyclable Materials

The growing focus on environmental sustainability strongly influences the market’s expansion. Manufacturers are increasingly adopting recyclable and bio-based polymers in multilayer film production. These films help reduce plastic waste and carbon emissions, meeting stricter government regulations and corporate sustainability goals. Many brands are shifting to mono-material structures and thinner layers without compromising performance. This transition supports easier recycling and aligns with circular economy objectives. Major packaging converters are investing in green extrusion technologies and material innovation to strengthen their product portfolios. The rising demand for eco-friendly packaging from retailers and consumers further accelerates this shift, positioning sustainable multilayer blown films as a key growth driver for the coming years.

Key Trends & Opportunities

Advancements in Co-Extrusion Technology

Ongoing advancements in co-extrusion technology are shaping the future of multilayer blown films. Modern lines can integrate multiple functional layers in a single step, improving mechanical strength, clarity, and barrier performance. These advancements allow manufacturers to optimize film thickness, reduce raw material consumption, and enhance recyclability. High-speed extrusion systems and automated control improve production efficiency and product uniformity. This technological progress creates opportunities to develop customized packaging solutions for industries such as pharmaceuticals, fresh food, and industrial goods. With growing demand for precision-engineered films, equipment upgrades and digital process control are becoming key areas of investment.

- For instance, PLASCO Engineering Inc.’s JC-3CX1500 line supports a lay-flat width of 1,400 mm, film thickness range of 0.025 mm to 0.25 mm, and a maximum extrusion capacity of 320 kg/hr for 2/3/5-layer configurations.

Growing Use in Medical and Industrial Applications

The adoption of multilayer blown films is expanding beyond traditional packaging. In the medical sector, these films are used for sterile barrier systems, protective wraps, and flexible medical packaging. Their strong barrier properties and sealing performance meet strict regulatory and safety requirements. In industrial applications, they provide protection against moisture, UV exposure, and mechanical damage. The increasing demand for high-performance protective films in critical environments creates new revenue streams. This diversification across industries offers manufacturers opportunities to strengthen market presence and build long-term supply partnerships.

- For instance, Sigma Medical Films uses a seven-layer co-extrusion blown film machine to produce blister-grade film in widths from 400 mm to 1,250 mm, with thicknesses between 40 µm and 200 µm for medical device packaging.

Rise of Smart and Functional Packaging Solutions

Smart packaging trends are influencing the evolution of multilayer films. Manufacturers are integrating active and intelligent packaging features such as moisture indicators, antimicrobial layers, and temperature control properties. These innovations improve product monitoring, extend shelf life, and enhance safety. Smart features are particularly attractive for pharmaceuticals, perishable food, and logistics. The growing adoption of connected packaging solutions provides opportunities for differentiation and premium positioning in competitive markets. As demand for advanced packaging increases, companies integrating functionality with sustainability are likely to gain a competitive edge.

Key Challenges

High Production and Raw Material Costs

The production of multilayer blown films involves advanced machinery, energy-intensive processes, and high-quality polymers, leading to elevated costs. Price fluctuations in raw materials such as polyethylene and polypropylene create additional financial pressure on manufacturers. The cost of co-extrusion technology installation and maintenance is also significant, which can limit adoption by small and medium enterprises. Intense price competition among producers further reduces profit margins. To remain competitive, companies must focus on operational efficiency, waste reduction, and strategic sourcing. These cost-related constraints pose a major challenge to market expansion, especially in price-sensitive regions.

Complexity in Recycling and Waste Management

Despite growing sustainability efforts, recycling multilayer films remains challenging due to the combination of different polymers and additives. Traditional recycling systems struggle to separate these layers effectively, leading to contamination and increased processing costs. This limitation often results in landfilling or incineration, which raises environmental concerns and regulatory scrutiny. Governments and industry bodies are pushing for recyclable mono-material structures, requiring manufacturers to redesign product formulations and production lines. Transitioning to fully recyclable solutions demands significant investment and technical innovation. These recycling challenges can slow down market growth if not addressed through coordinated industry action and policy support.

Regional Analysis

North America

North America holds a 36% share of the global multi-layer blown films market, driven by strong demand from the food packaging and healthcare industries. The region’s mature packaging sector emphasizes product safety, sustainability, and advanced sealing technologies. High adoption of recyclable and high-barrier films supports compliance with strict environmental regulations. Major packaging manufacturers are investing in advanced co-extrusion lines to enhance product performance and reduce material usage. The United States leads regional growth with significant investments in sustainable packaging formats, while Canada shows rising adoption in ready-to-eat and medical packaging applications.

Europe

Europe accounts for a 28% market share, supported by strong regulatory frameworks promoting eco-friendly packaging. The region has seen rapid growth in recyclable and mono-material multilayer film solutions to meet circular economy goals. Food and beverage manufacturers lead adoption, driven by consumer demand for sustainable and tamper-resistant packaging. Countries like Germany, France, and Italy invest heavily in advanced extrusion equipment and digitalized production systems. Strict waste management laws and corporate sustainability commitments are encouraging companies to shift toward high-barrier and lightweight packaging solutions, strengthening Europe’s competitive position in the global market.

Asia Pacific

Asia Pacific represents a 24% market share, making it one of the fastest-growing regions in the multi layer blown films market. Rapid urbanization, a booming food processing sector, and rising disposable incomes drive packaging consumption. Countries like China, India, and Japan are key contributors to growth, supported by expanding manufacturing infrastructure and retail networks. Cost-effective raw materials and increasing investments in modern extrusion technology further support market expansion. Strong demand for flexible packaging in food, pharmaceuticals, and industrial sectors boosts production capacity, positioning Asia Pacific as a strategic hub for global manufacturers.

Latin America

Latin America holds a 7% share of the global market, with growth supported by rising packaged food demand and expanding retail channels. Countries like Brazil and Mexico are witnessing increased investments in food processing and healthcare packaging. The region’s gradual shift toward sustainable packaging solutions creates opportunities for multilayer blown film producers. Economic reforms and trade developments are encouraging foreign investment in local manufacturing facilities. However, slower technology adoption compared to developed markets remains a limiting factor. Continuous infrastructure improvements are expected to strengthen the region’s role in the global supply chain.

Middle East & Africa

The Middle East & Africa account for a 5% market share, supported by growing demand for food packaging, agricultural films, and industrial protection materials. Rapid population growth and expanding urban centers increase the need for cost-effective, durable packaging solutions. The UAE and Saudi Arabia lead regional adoption through investments in flexible packaging technologies and logistics expansion. Africa shows rising demand driven by food security programs and packaging modernization. Limited local production capacity remains a challenge, but increasing foreign partnerships and infrastructure upgrades are expected to enhance regional competitiveness in the coming years.

Market Segmentations

By Sealing Type

- Peelable

- Easy Peel

- Medium Peel

- Weld/Lock Seal

- Resealable

By Material Type

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The multi-layer blown films market is highly competitive, marked by continuous product innovation and strategic expansion by leading players such as Berry Global Inc., Uflex Ltd., Flexopack S.A., Coveris Holdings S.A., Sealed Air Corporation, Cosmo Films Ltd., Mondi Group, Toray Plastics (America), RPC bpi group, and Amcor plc. These companies focus on developing high-barrier, recyclable, and bio-based film solutions to meet evolving packaging demands in food, pharmaceutical, and industrial sectors. Partnerships and acquisitions remain key strategies to enhance regional reach and technology capabilities. Manufacturers are investing in advanced extrusion systems and multilayer co-extrusion lines to improve film strength, flexibility, and sustainability. The competition is also driven by growing demand for lightweight, cost-effective films that reduce material usage while maintaining superior protective properties. Continuous R&D investment in polymer chemistry and film processing technologies underpins market differentiation and long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Berry Global Inc. (U.S.)

- Uflex Ltd. (India)

- Flexopack S.A. (Greece)

- Coveris Holdings S.A. (Austria)

- Sealed Air Corporation (U.S.)

- Cosmo Films Ltd. (India)

- Mondi Group (UK)

- Toray Plastics (America), Inc. (U.S.)

- RPC bpi group (UK)

- Amcor plc (UK)

Recent Developments

- In April 2025, Mondi Group introduced a new recyclable anti-fog lidding film designed for fresh produce and ready-meal packaging applications. Developed as part of its “EcoSolutions” product line, the film offers high clarity, consistent anti-fog performance, and improved seal integrity on various tray materials. This launch aligns with growing consumer and regulatory demand for sustainable packaging and strengthens Mondi’s foothold in the European flexible packaging segment.

- In February 2025, Sealed Air Corporation launched its next-generation Cryovac® Multi-Layer Blown Films, optimized for ultra-high barrier protection and fog resistance in chilled meat and poultry packaging. Engineered to improve shelf visibility and reduce product spoilage, this innovation targets retail chains and food processors in North America and Latin America, bolstering Sealed Air’s competitive edge in value-added food packaging.

Report Coverage

The research report offers an in-depth analysis based on Sealing Type, Material Type, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable and recyclable multilayer films will rise steadily across industries.

- Co-extrusion technology advancements will enable higher barrier performance and production efficiency.

- Food and beverage packaging will remain the dominant application segment.

- Medical and industrial uses will expand due to growing need for protective and sterile packaging.

- Asia Pacific will experience strong growth driven by manufacturing expansion and retail demand.

- Regulations promoting circular economy will accelerate adoption of mono-material structures.

- Key players will focus on mergers, acquisitions, and capacity expansions to strengthen market presence.

- Digitalized production and automation will improve quality control and reduce waste.

- Smart packaging integration will enhance product safety and traceability.

- Investment in bio-based polymers will increase to meet evolving environmental standards.