Market Overview:

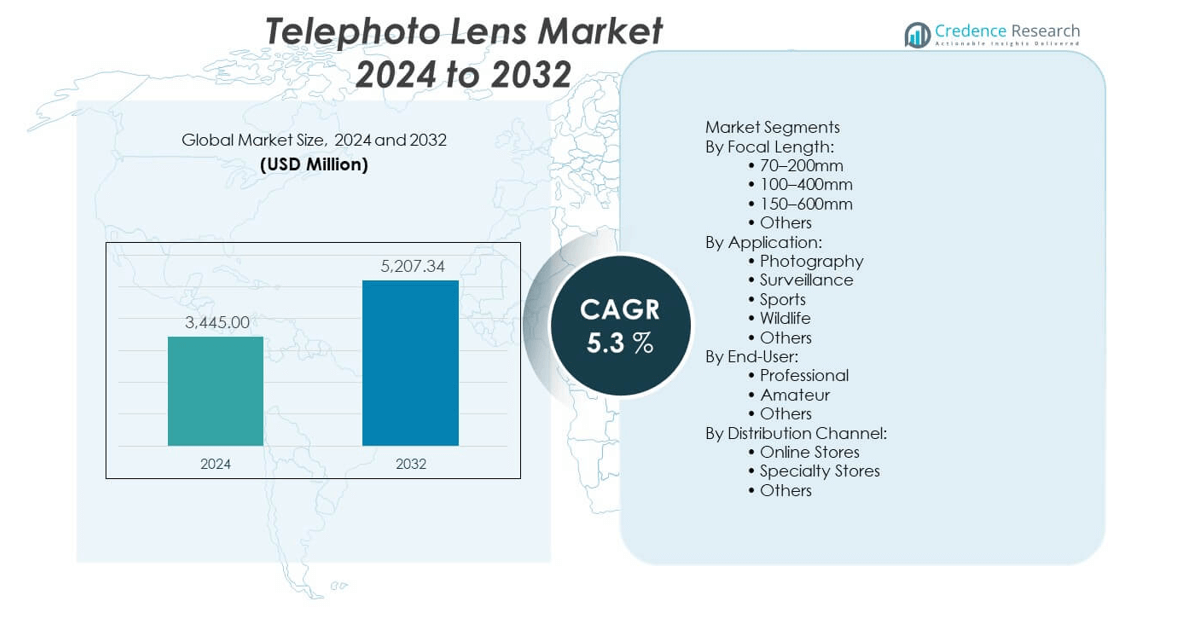

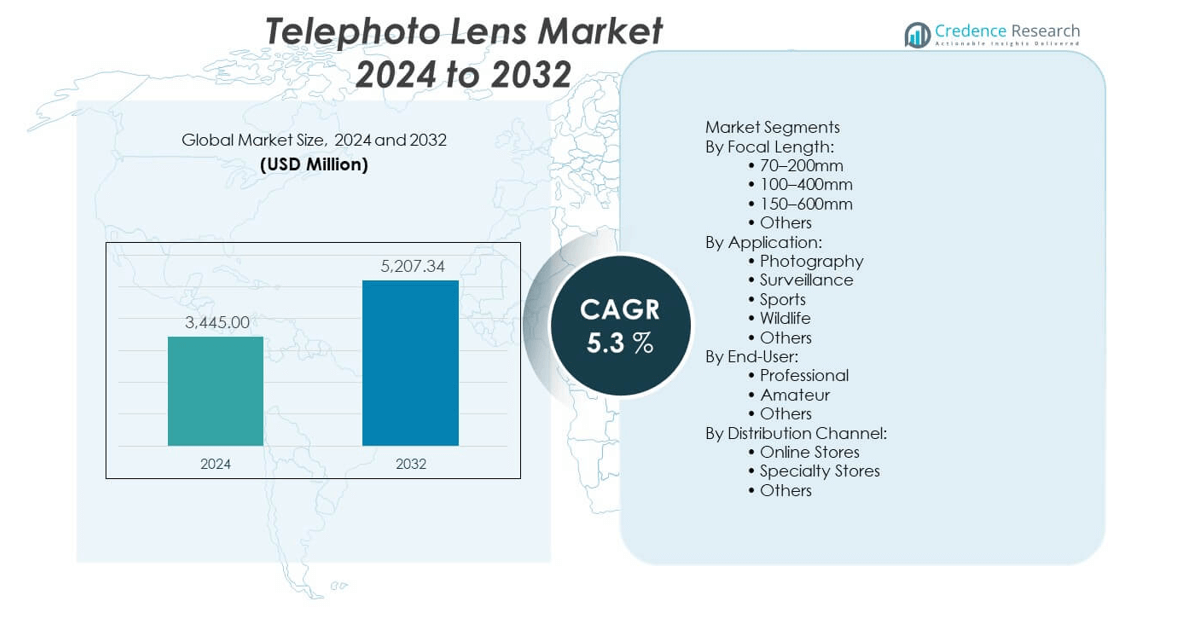

The Telephoto lens market is projected to grow from USD 3,445 million in 2024 to an estimated USD 5,207.34 million by 2032, with a compound annual growth rate (CAGR) of 5.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Telephoto lens market Size 2024 |

USD 3,445 million |

| Telephoto lens market, CAGR |

5.3% |

| Telephoto lens market Size 2032 |

USD 5,207.34 million |

The rising demand for professional-grade photography across wildlife, sports, and surveillance sectors continues to drive the telephoto lens market. Manufacturers benefit from increased demand for long-range precision optics in both consumer and industrial applications. Integration of advanced features such as image stabilization, lightweight materials, and compact form factors increases appeal across various user groups including travel photographers, defense units, and cinematographers.

In regional terms, North America dominates the market due to strong presence of professional photographers, sports coverage, and security surveillance needs. Asia-Pacific emerges as a fast-growing region, driven by expanding photography culture, rising disposable income, and growth of e-commerce channels in China, Japan, and India. Europe maintains a significant share, driven by luxury camera usage and filmmaking industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Telephoto lens market was valued at USD 3,445 million in 2024 and is projected to reach USD 5,207.34 million by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising demand for wildlife, sports, and surveillance photography continues to drive growth, supported by advancements in autofocus, stabilization, and compact lens technology.

- High manufacturing costs and limited cross-brand compatibility pose restraints, especially for budget-conscious and entry-level consumers.

- North America leads the market with a 34.2% share, driven by professional usage across media, defense, and wildlife sectors.

- Asia-Pacific emerges as the fastest-growing region with 29.6% share, fueled by increasing e-commerce access and growing interest in photography among younger demographics.

- Europe maintains a steady 22.5% share, supported by strong creative industries and demand for premium optics in film, tourism, and academia.

- Expanding online retail, photography education, and influencer ecosystems continue to increase amateur and semi-professional lens adoption globally.

Market Drivers:

Surging Popularity of Wildlife and Sports Photography Elevates Long-Range Optics Demand:

The Telephoto lens market gains strong momentum from the global rise in wildlife and sports photography. These segments require high magnification capabilities and fast autofocus, features that telephoto lenses are specifically designed to offer. Professionals and hobbyists seek gear that captures fast-moving subjects from significant distances with minimal distortion. The growth of adventure tourism and wildlife documentaries amplifies this trend. The expansion of social media platforms encourages content creators to invest in advanced optical gear, strengthening the market’s consumer base. Manufacturers are responding by offering lenses that balance speed, image clarity, and ergonomic design. Innovations such as silent motor autofocusing and optical image stabilization further increase lens utility in dynamic shooting environments. The popularity of high-speed sports events also boosts the market’s need for long-focal-length optics that deliver sharp action shots from stadium sidelines. This segment anchors a major portion of demand growth.

- For instance, Nikon’s NIKKOR Z 600mm f/4 TC VR S super telephoto lens features a silent autofocus motor and advanced optical design that enables sharp capture of fast-moving subjects even in challenging lighting, supporting shutter speeds as fast as 1/4000s for detailed sports photography. Similarly, Sony’s 200-600mm f/5.6-6.3 G lens offers high-speed autofocus and built-in Optical SteadyShot stabilization delivering precision when capturing split-second sports moments, supporting focal lengths up to 600mm ideal for various sports environments.

Expansion of Security Surveillance Systems Using Telephoto Lenses:

Governments and private enterprises continue to expand the deployment of long-range surveillance systems that utilize telephoto lenses for enhanced image capture capabilities. These lenses help security personnel monitor distant objects without compromising image clarity. It benefits large-scale infrastructure such as airports, border control zones, and critical public spaces. Increased investments in public safety, combined with the rise of smart city developments, fuel this growth. Telephoto lenses also integrate with AI-powered video analytics tools to detect threats with high precision. The demand for superior zoom functionality has led to the introduction of ruggedized telephoto models compatible with CCTV and thermal cameras. The market for these applications spans urban safety, industrial surveillance, and military border operations. Their usage ensures robust monitoring in low-visibility and long-range scenarios.

- For instance, Axis Communications’ Q60 Series IP cameras incorporate telephoto lenses with up to 32x optical zoom and built-in autofocus, delivering detailed long-range surveillance images up to 600 meters, and support AI analytics for object detection across airports and city infrastructure.

Technological Advancements Driving Compact, Lightweight Telephoto Designs:

Innovation in optical glass materials, coatings, and autofocusing systems enables the development of lighter, more compact telephoto lenses. This trend addresses the needs of traveling photographers and videographers who prioritize portability without compromising on focal range. It also enables amateur photographers to enter the telephoto segment without extensive equipment knowledge. Companies invest in precision-engineered lens elements and AI-powered focusing systems to make telephoto gear accessible to a broader user base. Compact telephoto zoom lenses with retractable or collapsible designs appeal to mirrorless and DSLR users alike. These advancements reduce bulk, improve handling, and allow seamless integration with newer camera systems. Manufacturers continue to reduce aberrations and improve image stabilization across long focal lengths. These innovations redefine usability for both professionals and enthusiasts.

Demand for High-Resolution Cinematography and Filmmaking Tools:

The Telephoto lens market benefits significantly from the growth of high-resolution content creation, particularly in the film, television, and streaming industries. Cinematographers require long lenses for dramatic close-up shots, compression effects, and background isolation. The demand for 4K, 6K, and 8K productions drives the adoption of telephoto optics that deliver edge-to-edge sharpness and dynamic bokeh. Film studios and streaming platforms rely on telephoto tools for action sequences, wildlife cinematography, and surveillance shots. Companies introduce cinema-specific telephoto lenses with precision manual focus rings, aperture control, and full-frame sensor compatibility. The expanding content creation industry, supported by platforms like Netflix and YouTube, accelerates professional gear procurement, including premium telephoto models. Industry preference for telecentric designs and PL-mount systems further broadens telephoto lens demand in digital filmmaking.

Market Trends:

Rising Use of Telephoto Lenses in Smartphone Camera Modules:

The Telephoto lens market observes a growing trend of integration with smartphone camera arrays. OEMs enhance mobile zoom performance by including periscope-style telephoto lenses. These compact optics support up to 10x optical zoom, offering users DSLR-like results in slim devices. Increasing consumer demand for professional-quality mobile photography influences flagship phone designs. Brands such as Apple, Samsung, and Huawei actively integrate multi-lens telephoto modules with advanced software. AI-driven stabilization, subject tracking, and low-light performance push the envelope in mobile lens utility. This trend creates a parallel mass-market segment that supplements traditional interchangeable lens sales. Telephoto technology helps smartphone makers gain competitive differentiation in an intensely crowded market.

- For instance, Samsung’s Galaxy S23 Ultra features a periscope telephoto lens offering up to 10x optical zoom with Super Resolution Zoom technology, achieving image stabilization through AI-enhanced software to reduce blur in telephoto shots even at full zoom. Apple’s iPhone 15 Pro incorporates a 5x telephoto zoom lens with sensor-shift stabilization combined with AI-powered autofocus tracking to capture sharp images of distant subjects in dynamic scenes.

Growing Availability of Budget-Friendly Telephoto Options for Enthusiasts:

Leading manufacturers now offer affordable telephoto lenses targeted at amateur photographers and hobbyists. These products balance functionality with accessible price points, offering medium-range focal lengths and decent aperture ratings. Manufacturers design these models for crop-sensor DSLRs and mirrorless systems, often bundling them in beginner camera kits. Plastic-bodied constructions, simplified focus systems, and optimized glass coatings keep costs low while ensuring usability. The rising popularity of entry-level photography vlogging and outdoor content boosts this trend. Consumers appreciate long-range capabilities for birdwatching, sports, and family events. The market expands with models in the 55–250mm and 70–300mm categories, helping new users enter the space without premium investment barriers.

- For instance, Canon’s EF-S 55-250mm f/4-5.6 IS STM lens delivers stable image quality with an optical image stabilizer that reduces camera shake by up to 3.5 stops, equipped with a stepping motor (STM) for near-silent autofocus, making it ideally suited for beginners shooting sports and wildlife at moderate distances.

Customization and Modular Lens Systems for Industrial Imaging:

The Telephoto lens market experiences diversification with the growth of industrial imaging, machine vision, and UAV-based inspection systems. Companies offer telephoto optics with modular mounts, adjustable iris, and custom focal lengths. These lenses support automated inspection, AI image recognition, and thermal sensing in logistics, manufacturing, and defense applications. OEMs require reliable, distortion-free zoom systems with rugged builds for use in harsh environments. Custom lens designs cater to robotic arms, drone platforms, and factory surveillance systems. The modularity allows system integrators to tailor performance based on application-specific requirements. This trend extends the market beyond traditional imaging, contributing to long-term volume stability.

Shift Toward Environmentally Friendly Materials in Lens Manufacturing:

Telephoto lens manufacturers are exploring eco-conscious production methods to reduce environmental impact. This includes using lead-free glass, recycled aluminum housings, and biodegradable packaging. Companies adopt cleaner chemical coatings for anti-reflection and abrasion resistance. The trend is driven by increasing ESG commitments across the optics industry. Brands that implement green practices appeal to environmentally aware consumers and institutions. Adoption of sustainable packaging and lifecycle management programs also influences B2B purchasing decisions, particularly from public sector and educational buyers. These initiatives help companies align with international sustainability standards, opening new procurement opportunities.

Market Challenges Analysis:

High Manufacturing Cost of Precision Telephoto Lenses Constrains Adoption:

Producing telephoto lenses involves complex optical design, premium materials, and precision engineering, which results in high costs. Achieving edge-to-edge clarity across long focal lengths requires multiple aspherical and ED glass elements, which are expensive to manufacture. Premium models often include advanced autofocus motors, weather-sealed bodies, and image stabilization modules, increasing production complexity. This limits affordability, especially for entry-level users and budget-conscious markets. High price points may deter casual consumers and photography beginners from purchasing dedicated telephoto gear. Rental models and second-hand purchases dominate certain price-sensitive regions. The market must balance innovation with cost management to broaden its consumer base.

Limited Compatibility Across Brands and Mount Systems Hinders Purchase Decisions:

Many telephoto lenses are designed for specific camera mounts, restricting cross-brand compatibility. Photographers using systems from Canon, Nikon, Sony, or Fujifilm may face challenges when switching brands, requiring entirely new lens investments. Third-party lenses help to bridge the gap, but compatibility issues such as autofocus accuracy or firmware updates may persist. Professional users often hesitate to invest in proprietary lenses without long-term system stability. This challenge affects resale value and influences bulk purchases in institutional settings. A lack of standardization increases customer friction, impacting purchase frequency and volume across global channels.

Market Opportunities:

Expansion of E-Commerce Platforms Boosts Lens Accessibility Across Tier-2 and Tier-3 Cities:

The rise of e-commerce platforms increases access to premium and mid-range telephoto lenses across smaller urban centers. Online retailers offer competitive pricing, EMIs, and bundled accessories, making it easier for consumers to purchase long-range optics without visiting specialty stores. Enhanced distribution networks allow brands to reach untapped customer bases, especially in emerging markets. This shift improves brand visibility and contributes to consistent demand across retail channels.

Growth of Photography Education and Influencer Ecosystem Spurs Entry-Level Demand:

Institutions, academies, and online creators promote photography education, inspiring new users to explore advanced gear. Telephoto lenses are positioned as essential tools for wildlife, portrait, and journalism students. Influencers showcasing lens performance on digital platforms drive aspirational purchases. This ecosystem supports first-time buyers entering the telephoto lens market.

Market Segmentation Analysis:

By Focal Length

The Telephoto lens market is segmented by focal length into 70–200mm, 100–400mm, 150–600mm, and others. The 70–200mm range leads demand due to its versatility in events, portraits, and travel photography. The 100–400mm and 150–600mm lenses serve professionals in wildlife and sports, offering extended reach and image stability. The “others” category includes specialty focal lengths for niche and industrial use.

- For instance, the Sigma 150-600mm f/5-6.3 DG DN OS Sports lens supports wide telephoto zoom with 25 optical elements, advanced optical stabilization, and fast autofocus, fulfilling professional needs in wildlife and sports photography across multiple camera mounts.

By Application

Key applications include photography, surveillance, sports, wildlife, and others. Photography remains the largest segment, supported by growing content creation and professional usage. Wildlife and sports drive high-performance lens adoption due to their demanding conditions. Surveillance applications rely on telephoto capabilities for long-range monitoring, especially in defense and urban safety infrastructure.

- For instance, Sony’s 400mm f/2.8 G Master lens is widely used in professional sports photography; it enables high-speed autofocus with less than 0.03-second focusing time and delivers crisp, high-resolution images with excellent contrast and minimal chromatic aberration, essential for fast-paced action captures.

By End-User

End users include professionals, amateurs, and others. Professional users prioritize optical quality, durability, and brand compatibility. Amateurs contribute significantly to volume growth, choosing mid-range and beginner-friendly models. The “others” category includes institutions, researchers, and filmmakers using telephoto optics for specialized tasks.

By Distribution Channel

The market is distributed through online stores, specialty stores, and others. Online stores dominate with accessibility, product variety, and value-based offerings. Specialty stores serve professional users seeking expert advice, trial opportunities, and after-sales service. The “others” segment includes direct sales and camera exhibitions, which support brand engagement and demonstrations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Focal Length:

- 70–200mm

- 100–400mm

- 150–600mm

- Others

By Application:

- Photography

- Surveillance

- Sports

- Wildlife

- Others

By End-User:

- Professional

- Amateur

- Others

By Distribution Channel:

- Online Stores

- Specialty Stores

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America – Leading with Professional Adoption

North America holds the largest share in the telephoto lens market, accounting for approximately 34.2% of global revenue. The region benefits from a strong base of professional photographers, content creators, and media production houses. The United States drives demand through commercial applications in sports broadcasting, wildlife photography, and surveillance. High disposable income and a mature camera accessories market support the adoption of premium telephoto lenses. The region also shows early adoption of mirrorless systems, encouraging lens upgrades. North America remains a key hub for innovation, with high usage across consumer and defense sectors.

Asia-Pacific – Fastest Growth Backed by Rising Consumer Base

Asia-Pacific commands around 29.6% of the telephoto lens market and represents the fastest-growing region. Demand is rising due to increasing interest in photography among younger populations and the expansion of e-commerce platforms across China, India, Japan, and South Korea. The presence of major lens manufacturers such as Canon, Nikon, and Sony in Japan enhances regional supply and innovation. Consumer electronics penetration and mobile photography trends also influence telephoto lens add-on markets. Economic growth and urbanization are increasing interest in nature, travel, and sports photography, driving volume sales across both amateur and professional segments.

Europe – Steady Demand from Enthusiasts and Creative Industries

Europe holds a market share of approximately 22.5% in the telephoto lens market, driven by a steady consumer base and strong adoption across creative and media industries. Countries such as Germany, the UK, and France lead in demand, supported by tourism, wildlife photography, and film production. European consumers show preference for precision-engineered optics and full-frame systems. The market benefits from institutional purchases for academic, broadcasting, and environmental documentation. Online retail growth, coupled with photography education programs, supports amateur participation. Europe’s stable demand profile makes it a key region for premium product positioning and long-term sales.

Key Player Analysis:

- Canon Inc.

- Nikon Corporation

- Sony Corporation

- Tamron Co., Ltd.

- Sigma Corporation

- Fujifilm Holdings Corporation

- Panasonic Corporation

- Olympus Corporation

- Leica Camera AG

- Zeiss Group

Competitive Analysis:

The Telephoto lens market features a highly competitive environment dominated by Japanese and German manufacturers. Canon, Nikon, and Sony maintain strong market positions through innovation, product range, and vertical integration. Sigma and Tamron offer cost-effective alternatives with solid performance. Leica and Zeiss target high-end niche segments with superior optics and premium design. The market rewards optical performance, lens speed, and system compatibility. Companies focus on catering to DSLR, mirrorless, and industrial camera systems while competing on build quality, weight optimization, and stabilization features. It remains moderately concentrated, with top players holding a major market share and consistent innovation defining competitive success.

Recent Developments:

- On 27 March 2025, Canon announced the RF-S14-30mm f/4-6.3 IS STM PZ, its first lens to feature a built-in power zoom that enables smooth zooming during video shooting.

Market Concentration & Characteristics:

The Telephoto lens market is moderately concentrated, with global leadership shared among a handful of companies such as Canon, Nikon, and Sony. It exhibits high entry barriers due to the capital-intensive nature of precision optics manufacturing. Product development cycles remain long, requiring advanced R&D and specialized materials. The market emphasizes product reliability, compatibility, and optical performance. It shows medium-to-high brand loyalty, especially among professional users. Product differentiation is largely driven by focal length range, aperture speed, image stabilization, and weight optimization.

Report Coverage:

The research report offers an in-depth analysis based on Segment 1, Segment 2 focal length, application, end-user, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for mirrorless telephoto lenses will continue rising.

- Compact, travel-friendly models will dominate consumer demand.

- E-commerce will drive lens penetration in emerging economies.

- Industrial use cases in UAVs and machine vision will expand.

- Integration of AI-assisted autofocus will redefine user experience.

- Premium telephoto gear will see steady adoption in film studios.

- Smartphone-compatible telephoto add-ons will gain popularity.

- Modular and custom optics will grow in industrial segments.

- Sustainability initiatives will influence lens material sourcing.

- OEM collaborations with camera brands will intensify.