Market Overview

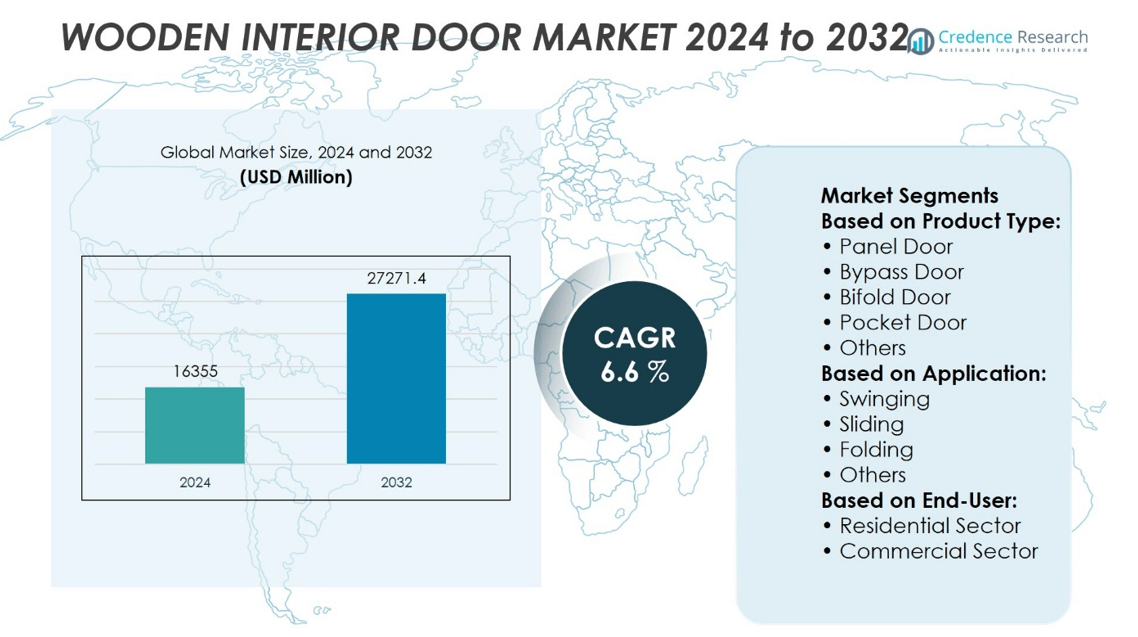

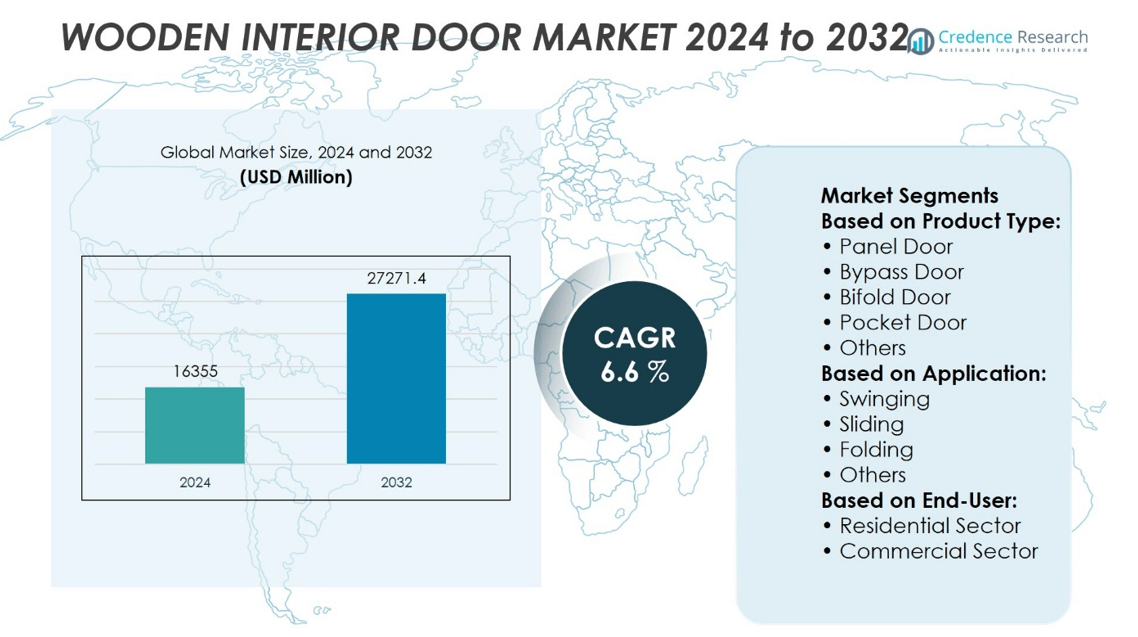

The wooden interior door market size was valued at USD 16355 million in 2024 and is anticipated to reach USD 27271.4 million by 2032, at a CAGR of 6.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wooden Interior Doors Market Size 2024 |

USD 16355 million |

| Wooden Interior Doors Market, CAGR |

6.6% |

| Wooden Interior Doors Market Size 2032 |

USD 27271.4 million |

The wooden interior door market is driven by increasing demand for residential and commercial construction, fueled by rapid urbanization and rising disposable incomes. Consumers’ growing preference for aesthetic, durable, and customizable interior solutions has further accelerated market expansion. Technological advancements in manufacturing processes and the availability of a wide range of wood types and designs enhance product appeal. Moreover, the shift towards sustainable and eco-friendly building materials supports the adoption of wooden doors. Trends such as smart home integration and minimalist interior designs are influencing product innovation and encouraging the development of space-saving and modern wooden door solutions.

The wooden interior door market exhibits strong growth across North America, Europe, and Asia Pacific, with Asia Pacific leading due to rapid urban development and infrastructure expansion in countries like China and India. North America and Europe benefit from renovation trends and premium interior design preferences. Key players in the market include Masonite International Corporation, JELD-WEN Holding Inc., Simpson Door Company, and TruStile Doors LLC, all of which focus on product innovation, sustainability, and expanding their global distribution networks.

Market Insights

- The wooden interior door market was valued at USD 16355 million in 2024 and is expected to grow at a CAGR of 6.6% through 2032.

- Market growth is fueled by rapid urbanization, expanding residential construction, and rising demand for modern interior aesthetics.

- A growing trend toward eco-friendly wooden doors made from FSC-certified and engineered wood is shaping product innovation.

- Smart home integration is influencing demand for custom-designed doors with digital locks and automation compatibility.

- Key players such as Masonite, JELD-WEN, Simpson Door Company, and ASSA ABLOY are investing in R&D and expanding product portfolios.

- Fluctuating raw material prices, deforestation concerns, and competition from alternative materials like steel and fiberglass act as key restraints.

- Asia Pacific dominates the market due to booming construction in China and India, while North America and Europe show steady demand driven by renovation activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Residential and Commercial Infrastructure Spurs Market Growth

The wooden interior door market benefits significantly from rapid urbanization and rising residential and commercial construction projects worldwide. Growing populations and expanding middle-class segments fuel housing demand in emerging economies, which increases the need for interior doors. Commercial buildings such as offices, hotels, and healthcare centers also contribute to the demand. Renovation of existing infrastructure in mature markets continues to play a key role. Property owners increasingly prioritize design aesthetics and functionality, both of which wooden doors deliver. The market shows consistent growth where real estate development remains strong and sustained.

- For instance, Masonite International Corporation reported delivering over 28 million doors globally in 2023, supported by its U.S. manufacturing facilities that produced more doors per day, reflecting its capacity to meet surging demand from both residential and commercial sectors.

Consumer Preference Shifts Toward Aesthetic and Customizable Interior Solutions

Consumers seek visually appealing interiors, and wooden doors offer natural warmth, texture, and elegance. The wooden interior door market aligns well with shifting tastes toward personalized and high-end interiors. Buyers now demand a wider variety of finishes, panel designs, and wood species to match modern interiors. Manufacturers meet this demand by offering tailored solutions and premium product lines. Rising disposable income in urban households enables more spending on home interiors. It drives innovation and quality improvements in door designs and finishes.

- For instance, TruStile’s Project Configurator enables customization across 66 distinct panel and sticking profile combinations, and selections span over 400 design styles.

Material Demand and Eco-Friendly Certifications Encourage Adoption

Sustainability remains a key driver influencing purchasing decisions in the wooden interior door market. Environmentally conscious buyers and stricter regulatory standards push manufacturers to use responsibly sourced wood and eco-certified materials. Companies invest in sustainable supply chains and low-VOC finishes to meet green building codes. Green certifications enhance brand value and appeal to a growing base of eco-aware consumers. It reinforces trust in wooden door products as viable, renewable options. The emphasis on sustainability strengthens market appeal and long-term adoption.

Technological Advancements and Product Innovations Boost Competitive Edge

Innovation in manufacturing technology improves product precision, durability, and customization capabilities. CNC machining, digital printing, and advanced finishing techniques support mass customization at lower costs. The wooden interior door market benefits from such efficiencies that also shorten delivery times. Integration of soundproofing and fire-resistant features enhances functional value. Manufacturers offering modern features within traditional designs attract a broader customer base. It enables companies to differentiate in a competitive landscape.

Market Trends

Growing Popularity of Minimalist and Contemporary Interior Designs Influences Product Styles

Minimalist and contemporary home designs drive demand for sleek, clean-lined wooden doors. Consumers favor neutral tones, flush panels, and subtle textures that align with modern aesthetics. The wooden interior door market reflects this trend through product ranges that emphasize simplicity and functionality. Designers and architects recommend understated door styles to complement open layouts and minimalist interiors. Matte finishes and concealed hardware have become common preferences. It encourages manufacturers to refine their product offerings to meet evolving style expectations.

Increased Use of Engineered Wood and Composite Materials for Enhanced Performance

Engineered wood doors gain traction for their durability, resistance to warping, and cost-effectiveness. These doors offer the appearance of solid wood while meeting performance and budget requirements. The wooden interior door market adopts these alternatives to balance sustainability and strength. Manufacturers invest in composite cores, laminates, and veneer technologies to improve longevity. It reduces dependence on scarce hardwoods while maintaining design quality. The trend supports resource optimization and aligns with evolving building standards.

Smart Home Integration Drives Interest in Technologically Enhanced Doors

Smart homes create demand for doors with integrated electronic locks, sensors, and automation-ready hardware. Buyers expect more than traditional design—they seek functionality that fits into connected living spaces. The wooden interior door market responds by offering products compatible with home automation systems. Innovations include concealed wiring channels and smart access controls. It creates opportunities for partnerships between door manufacturers and smart home tech providers. The trend signals a shift toward multifunctional, tech-ready interior solutions.

- For instance, Yale’s Assure Lock 2 Touch includes a built‑in fingerprint scanner capable of registering up to 20 unique fingerprints, with a recognition response time of under 0.5 seconds.

Customization and Bespoke Design Preferences Gain Momentum Across Market Segments

Homeowners and developers increasingly request tailored door designs to match interior themes and brand aesthetics. This trend spans luxury residential, hospitality, and commercial projects. The wooden interior door market adapts by expanding options for finishes, paneling, glazing, and dimensions. Customization enhances customer satisfaction and adds value to property interiors. It encourages flexible manufacturing models and investment in digital design tools. The shift supports long-term engagement between brands and design-conscious buyers.

- For instance, a Smart Home Survey of 1,006 U.S. households conducted in December 2024 found that smart locks were installed in 190 homes

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Instability Affect Production Costs

Volatile prices of timber and engineered wood materials pose significant cost management challenges for manufacturers. Global supply disruptions, climate-related events, and regional logging restrictions reduce availability and inflate input costs. The wooden interior door market faces pressure to maintain quality while controlling pricing. Small and mid-sized producers often lack the scale to absorb these fluctuations. It affects production planning and reduces margins across distribution channels. Inconsistent raw material supply can delay lead times and impact customer satisfaction.

Environmental Regulations and Sustainability Compliance Increase Operational Burden

Strict environmental policies on deforestation, emissions, and waste disposal impose compliance costs on manufacturers. Governments and certification bodies require documentation of responsible sourcing, sustainable production, and low-emission processes. The wooden interior door market must adapt to these regulations without compromising affordability or design flexibility. It requires continuous investment in cleaner technologies, audits, and certified supply chains. Smaller firms may struggle to meet these standards, limiting their market competitiveness. Compliance also impacts material choices and limits sourcing options in regulated regions.

Market Opportunities

Expansion in Emerging Economies Presents New Avenues for Market Penetration

Rapid urban development and rising housing demand in Asia-Pacific, Africa, and Latin America create strong opportunities for growth. Increasing middle-class populations and government-backed infrastructure projects drive residential and commercial construction. The wooden interior doors market stands to benefit from expanding real estate sectors in these regions. Local production units and strategic partnerships can help reduce costs and improve market access. It enables companies to tailor products to regional design preferences and pricing expectations. Early entry into these markets can secure long-term customer loyalty and brand visibility.

Rising Demand for Green Buildings Encourages Sustainable Product Innovation

Global interest in energy-efficient and eco-certified buildings encourages demand for sustainable door solutions. Builders and architects seek materials that meet green building standards without compromising aesthetics. The wooden interior doors market has room to grow by offering products made from certified wood, low-emission finishes, and recyclable components. It positions manufacturers to serve high-value projects that prioritize sustainability. Investment in eco-friendly design and transparent sourcing can enhance brand reputation and open access to premium segments. The shift toward responsible construction creates lasting demand for compliant interior products.

Market Segmentation Analysis:

By Product Type

The wooden interior door market is categorized into panel doors, bypass doors, bifold doors, pocket doors, and others. Panel doors hold the dominant share due to their timeless appeal, durability, and compatibility with various architectural styles. Pocket doors are seeing higher demand in urban residential projects where floor space is limited. Bypass and bifold doors are preferred for closets and utility areas, offering ease of installation and use. The “others” segment includes custom-crafted and decorative designs that cater to premium and design-centric buyers.

- For instance, JELD-WEN’s Craftsman II 1-panel interior wood door is manufactured with a standard thickness of 35 mm, rail height of 178 mm, and stile width of 114 mm, supporting both hollow core

By Application

This market is segmented by application into swinging, sliding, folding, and others. Swinging doors continue to lead the segment due to their wide acceptance in both traditional and modern interiors. It offers practical functionality and a broad selection of finishes and styles. Sliding doors are increasingly used in space-constrained layouts and contemporary designs. Folding doors serve dual-purpose areas such as patios or home offices and provide flexible partitioning. The “others” category includes unique movement mechanisms tailored to designer specifications or niche architectural needs.

- For instance, Kangton Industry hollow core swing doors are available in thickness options of 35 mm, 40 mm, and 45 mm, with standard door width .

By End-User

The end-use segmentation includes residential and commercial sectors. The residential segment drives the bulk of the demand, propelled by home improvement trends and the growing popularity of customized interiors. It reflects consumer interest in premium wood finishes and sustainable construction materials. The commercial segment, comprising offices, hotels, and institutional buildings, emphasizes durability and uniform design. Demand here is shaped by large-scale infrastructure development and brand-specific interior themes. Both segments are influenced by evolving building codes, environmental certifications, and a shift toward energy-efficient interior components.

Segments:

Based on Product Type:

- Panel Door

- Bypass Door

- Bifold Door

- Pocket Door

- Others

Based on Application:

- Swinging

- Sliding

- Folding

- Others

Based on End-User:

- Residential Sector

- Commercial Sector

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share of the wooden interior door market, accounting for approximately 34% of the global market in 2024. The region benefits from well-established residential construction, increasing renovation activities, and a strong preference for wooden aesthetics in interior design. The United States dominates the regional market due to consistent demand from both residential and commercial sectors. Growth in multi-family housing and upscale residential developments continues to drive product innovation and premium wood usage. Consumers increasingly favor environmentally certified and engineered wood products, aligning with sustainability goals and green building standards. Canada follows closely, supported by government-backed housing initiatives and a growing urban population. High consumer awareness regarding design trends and quality finishes further enhances the demand for customized and high-performance wooden interior doors across North America.

Europe

Europe accounts for approximately 28% of the global wooden interior door market. The region shows steady growth, supported by high-end residential refurbishment projects and strict environmental regulations favoring sustainable wood materials. Countries such as Germany, the UK, France, and Italy are leading contributors. Germany’s robust construction industry and energy-efficient building standards drive the demand for engineered wood doors. The UK and France are experiencing increased demand from the premium housing segment, with consumers favoring aesthetics and craftsmanship. Energy performance directives and emphasis on circular economy principles have pushed manufacturers toward innovation in recyclable and reusable wood-based door components. Moreover, advancements in fire-rated wooden doors and acoustic insulation are gaining traction in the commercial and institutional segments across Europe.

Asia Pacific

Asia Pacific captures around 24% of the global wooden interior door market and is expected to witness the fastest growth rate during the forecast period. China, India, Japan, and Southeast Asian nations are key contributors. China dominates the regional landscape, driven by rapid urbanization, large-scale residential projects, and government initiatives supporting real estate development. India follows with rising middle-class income and increasing investments in housing infrastructure. The market in Asia Pacific is highly competitive and price-sensitive, yet there is growing interest in value-added wooden doors with decorative finishes and engineered features. Japan, known for precision craftsmanship and minimalistic interior designs, continues to influence demand for customized wooden doors. Expanding urban populations and smart city projects across Southeast Asia further stimulate market growth.

Latin America

Latin America holds a market share of approximately 7% in the global wooden interior door industry. Brazil and Mexico are the largest contributors due to expanding housing markets and government-supported social housing programs. Consumers show preference for warm-toned wood finishes that complement traditional and modern interiors. Market growth remains moderate, influenced by economic fluctuations and uneven construction activity across the region. However, an emerging trend of eco-friendly building materials and locally sourced wood products is helping to improve adoption rates of wooden interior doors.

Middle East & Africa

The Middle East & Africa region accounts for roughly 7% of the global market share. In the Middle East, the demand is largely driven by the hospitality, commercial, and luxury residential sectors in countries like the UAE and Saudi Arabia. These markets favor high-end wooden doors with decorative detailing and custom finishes. In Africa, growth is more gradual, supported by urban development and expanding middle-income housing. Although wood alternatives are sometimes more cost-effective, government and private sector investments in modern infrastructure are contributing to steady demand for wooden interior doors. Increasing awareness of interior design trends and availability of imported products are supporting the market’s evolution in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TruStile Doors LLC

- Bayer Built Woodworks Inc.

- Karona Inc.

- Simpson Door Company

- Masonite International Corporation

- Appalachian Wood Products Inc.

- Sun Mountain Inc.

- Jeld-Wen Holding, Inc.

- Artisan Hardware

- Steves & Sons Inc.

Competitive Analysis

The wooden interior doors market includes Jeld-Wen Holding Inc., Masonite International Corporation, Puertas Sanrafael, Hörmann KG, and Woodgrain Millwork Inc. The wooden interior doors market is highly competitive, driven by design innovation, material efficiency, and the growing demand for customized and space-saving solutions. Companies compete by offering a diverse range of styles, including panel, flush, sliding, and pocket doors, to cater to varied architectural and interior design preferences. The shift toward sustainable manufacturing practices has also intensified competition, with manufacturers focusing on certified wood sources and low-emission finishes to align with environmental regulations. Technological advancements, such as the integration of smart locks and improved acoustic insulation, are further shaping competitive dynamics. Manufacturers are increasingly investing in automation and precision engineering to enhance production efficiency and reduce delivery timelines. Additionally, supply chain control and local distribution networks play a vital role in ensuring market responsiveness. The market also witnesses frequent updates in product lines to reflect emerging design trends, such as minimalist aesthetics and contemporary textures.

Recent Developments

- In May 2024, Owens Corning acquired Masonite International Corporation (“Masonite”), a leading global provider of interior and exterior doors and door systems. Masonite common shares have been acquired by Owens Corning for $133.00 per share, with an implied transaction value of approximately $3.9 billion.

- In March 2024, VT Industries celebrated the groundbreaking of their $16 million expansion of the Holstein, Iowa architectural wood door manufacturing plant. The expansion will add 175, 000 square-feet to the production footprint and is expected to be completed in spring 2025.

- In April 2024, Shakti Hormann launched full-scale production at its engineered wooden doors manufacturing facility in Jaipur. The plant, which invested of over ?175 crores, and is expected to significantly contribute to local employment with 150 direct and 300 indirect jobs.

- In November 2023, Pella Corporation announced the acquisition of aluminum window and door manufacturer Lawson Industries, Inc. The closing of this transaction improved Pella’s presence in Florida and enables the company to serve all customers and channels with a robust portfolio of materials, brands, and services.

Market Concentration & Characteristics

The wooden interior doors market demonstrates moderate concentration, with a mix of global manufacturers and strong regional players shaping its structure. It features a combination of mass-produced standard doors and high-end custom offerings, catering to diverse consumer needs in both residential and commercial sectors. The market includes well-established companies with extensive distribution networks and consistent product quality, which enhances customer loyalty and repeat business. It supports a wide range of styles, materials, and finishes, reflecting evolving design preferences and architectural trends. Demand remains steady due to ongoing construction activities and renovation projects, especially in urban and suburban areas. Competitive differentiation comes from customization capabilities, material sustainability, and design innovation. Companies invest in automation and advanced manufacturing techniques to improve efficiency and product consistency. Regional suppliers maintain their position by focusing on localized demand and offering flexible solutions to builders and contractors. It benefits from rising consumer interest in eco-friendly materials and interior aesthetics, driving preferences toward durable and visually appealing wood-based solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End- User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers focus on expanding product lines to meet diverse architectural styles.

- Demand rises for doors made from sustainably sourced and certified wood materials.

- Smart lock compatibility becomes a standard feature in premium product offerings.

- Urbanization drives steady demand in multi-family residential construction projects.

- Companies invest in digital tools to enhance design visualization and customer experience.

- Growth in renovation projects increases sales of replacement interior doors.

- Fire-rated and soundproof wooden doors gain popularity in commercial buildings.

- Automation and CNC technology improve production speed and design precision.

- Market players strengthen distribution through strategic retail and e-commerce channels.

- Consumer preference shifts toward natural finishes and minimalist door designs.