Market Overview:

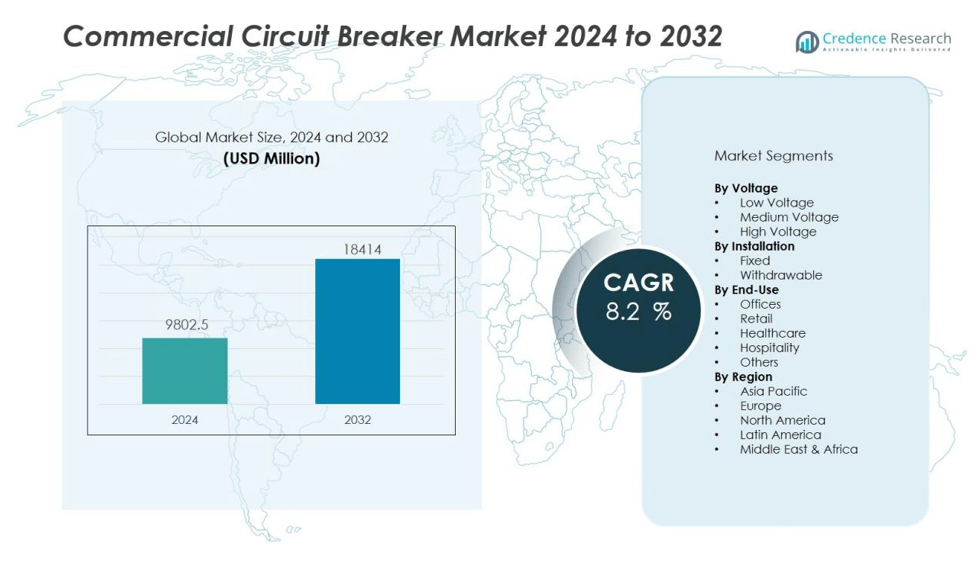

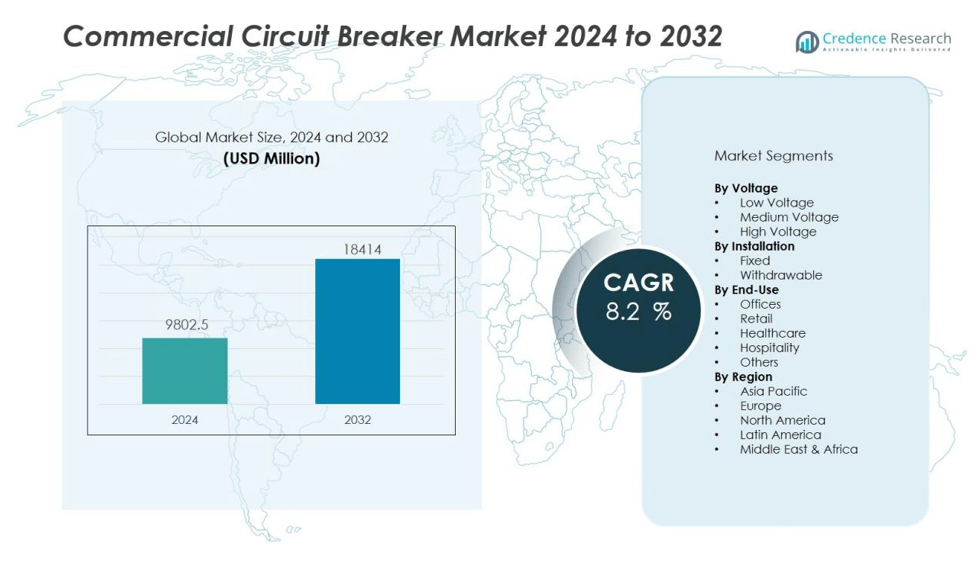

The Commercial circuit breaker market size was valued at USD 9802.5 million in 2024 and is anticipated to reach USD 18414 million by 2032, at a CAGR of 8.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Circuit Breaker Market Size 2024 |

USD 9802.5 million |

| Commercial Circuit Breaker Market, CAGR |

8.2% |

| Commercial Circuit Breaker Market Size 2032 |

USD 18414 million |

Key market drivers include growing investments in commercial real estate, rapid electrification, and the replacement of outdated protection systems with energy-efficient, reliable alternatives. Rising awareness of operational safety, coupled with the integration of IoT-enabled monitoring and predictive maintenance features, is encouraging businesses to adopt advanced circuit breakers. The push for compliance with evolving energy efficiency and electrical safety standards also fuels market expansion, as commercial facilities prioritize uninterrupted power supply and equipment protection.

Regionally, North America holds a significant share, supported by a well-established commercial sector, regulatory mandates, and high adoption of smart grid technologies. Asia-Pacific is expected to record the fastest growth, driven by large-scale infrastructure projects in China, India, and Southeast Asia. Europe follows closely, supported by modernization initiatives and sustainability-driven electrical system upgrades.

Market Insights:

- The Commercial circuit breaker market was valued at USD 9,802.5 million in 2024 and is projected to reach USD 18,414 million by 2032, growing at a CAGR of 8.2% during 2024–2032.

- Increasing investments in commercial real estate, rapid electrification, and replacement of outdated systems with energy-efficient alternatives are key growth drivers.

- Rising focus on operational safety and integration of IoT-enabled monitoring and predictive maintenance is accelerating adoption in commercial facilities.

- High initial costs and complex installation requirements, especially for retrofitting older infrastructure, remain significant adoption barriers.

- North America holds 32% market share, led by the U.S., due to advanced infrastructure, regulatory mandates, and strong smart grid adoption.

- Asia-Pacific leads with 38% market share, driven by infrastructure expansion, urbanization, and government-led energy efficiency programs in China, India, and Southeast Asia.

- Europe holds 22% market share, supported by sustainability-focused upgrades, modernization initiatives, and growing adoption of eco-friendly circuit protection solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Reliable Power Distribution in Commercial Infrastructure:

The Commercial circuit breaker market is benefiting from the growing need for reliable and efficient power distribution systems in modern commercial infrastructure. Expanding office complexes, retail outlets, hospitals, and educational institutions require stable electrical networks to ensure uninterrupted operations. Circuit breakers play a critical role in protecting sensitive equipment from overloads and short circuits, making them indispensable in high-usage environments. The rising complexity of electrical systems in commercial facilities further drives the demand for advanced and customizable breaker solutions.

Stringent Electrical Safety Regulations and Compliance Requirements:

Governments and regulatory bodies are enforcing strict electrical safety standards across commercial establishments to minimize fire hazards and equipment damage. Compliance with these regulations necessitates the adoption of certified, high-performance circuit breakers. It is prompting facility owners and managers to replace outdated systems with modern solutions that meet updated safety codes. This trend is particularly evident in developed regions where inspection and maintenance protocols are strictly monitored.

- For instance, Siemens’ SIRIUS 3RV2 circuit breaker, introduced in collaboration with BASF, now uses biomass-balanced plastic components, resulting in a reduction of approximately 270tons of CO₂ emissions per year, while fully meeting the latest electrical safety and performance requirements.

Integration of Smart and IoT-Enabled Circuit Protection Solutions:

Technological advancements are transforming the commercial circuit breaker market through the integration of smart monitoring and IoT-based features. These solutions enable real-time fault detection, predictive maintenance, and remote control, enhancing operational efficiency. Businesses are adopting such systems to reduce downtime, optimize energy use, and improve safety. The ability to collect and analyze usage data also supports better decision-making in electrical management.

- For instance, Garcia integrated smart IoT circuit breaker across more than 700 production line devices, enabling centralized control and reducing maintenance response time to just minutes during equipment alerts.

Growth in Commercial Real Estate and Infrastructure Development:

Rapid urbanization and expansion of commercial real estate are significantly boosting demand for advanced circuit protection. New construction projects in sectors such as hospitality, healthcare, and corporate offices require robust electrical safety systems. It is encouraging manufacturers to develop scalable, energy-efficient breakers suitable for diverse building layouts. Emerging economies are witnessing accelerated adoption due to rising investment in modern infrastructure.

Market Trends:

Adoption of Smart Circuit Breakers with Advanced Monitoring Capabilities:

The Commercial circuit breaker market is witnessing a steady shift toward smart breakers equipped with advanced monitoring, diagnostic, and control functionalities. These solutions integrate IoT and cloud-based platforms to enable real-time tracking of electrical loads, fault detection, and predictive maintenance. Businesses are increasingly investing in such systems to enhance operational safety, reduce downtime, and optimize energy consumption. Smart circuit breakers also support remote control and automated fault isolation, making them suitable for modern commercial facilities with complex electrical networks. Manufacturers are focusing on developing products that combine high performance with compact design to meet space constraints in commercial buildings. The growing emphasis on energy efficiency and cost reduction further accelerates the adoption of these advanced solutions.

- For instance, Schneider Electric’s Smart Systems cover breakers from 20A–6,000A and enable preventive maintenance alerts, tracking contact wear and live breaker status, helping to reduce unplanned downtime for facilities with thousands of monitored points.

Emphasis on Sustainable and Energy-Efficient Circuit Protection Solutions:

The market is experiencing a rising demand for circuit breakers designed with eco-friendly materials and energy-saving features. Growing environmental concerns and stricter energy regulations are encouraging the adoption of solutions that minimize power losses while maintaining high protection standards. It is prompting manufacturers to invest in R&D for low-maintenance, long-life breakers that align with green building certifications. Commercial facility managers are prioritizing equipment that supports sustainability targets without compromising safety or reliability. Hybrid and modular circuit breaker designs are gaining traction for their flexibility and ease of upgrades. The integration of renewable energy sources into commercial grids is also driving demand for breakers capable of handling variable power inputs and advanced load management.

- For instance, MasterPact MTZ breakers equipped with the MicroLogic X trip unit support real-time measurement of 40 electrical parameters and integration of up to eight PV strings, enabling precise management of variable renewable inputs.

Market Challenges Analysis:

High Initial Costs and Complex Installation Requirements:

The Commercial circuit breaker market faces challenges from the high upfront costs associated with advanced circuit protection systems. Smart and IoT-enabled breakers require significant investment, which can deter small and medium-sized commercial enterprises. Installation in existing buildings often involves complex retrofitting, leading to extended downtime and higher labor expenses. It is particularly challenging for older infrastructure with outdated wiring or limited space for new equipment. These factors can slow adoption rates despite the long-term benefits of modern circuit breakers.

Technical Limitations and Maintenance Constraints:

While advanced circuit breakers offer improved functionality, they can be sensitive to environmental conditions and require specialized maintenance. Commercial facilities in regions with unstable power supply may face frequent tripping, leading to operational disruptions. It is essential to have skilled technicians for maintenance and repairs, but the shortage of trained professionals in some markets hampers effective servicing. Compatibility issues between new breakers and legacy systems can also create integration hurdles. These technical constraints can limit widespread adoption in cost-sensitive or infrastructure-challenged regions.

Market Opportunities:

Expansion of Smart Commercial Infrastructure and Digital Energy Management:

The Commercial circuit breaker market has strong opportunities in the growing adoption of smart building technologies and digital energy management systems. Increasing investments in commercial infrastructure are creating demand for breakers with remote monitoring, predictive maintenance, and energy optimization capabilities. It is well-positioned to benefit from the integration of IoT and AI in electrical protection, enabling facilities to improve safety while reducing operational costs. The rise of connected commercial spaces, from retail outlets to large corporate complexes, will further accelerate the shift toward intelligent circuit protection solutions.

Integration with Renewable Energy and Sustainable Building Initiatives:

The transition toward renewable energy and sustainable building practices presents a significant growth avenue. Commercial facilities are increasingly incorporating solar, wind, and hybrid power systems, creating demand for circuit breakers capable of managing variable loads and grid interactions. It offers opportunities for manufacturers to design products that meet green building certifications and energy efficiency standards. The push for low-maintenance, long-life, and eco-friendly electrical protection devices will encourage innovation. Emerging markets with rapid infrastructure growth and strong renewable energy adoption are expected to drive substantial future demand.

Market Segmentation Analysis:

By Voltage:

The Commercial circuit breaker market is segmented into low voltage, medium voltage, and high voltage categories. Low voltage breakers dominate usage in retail outlets, offices, and small-scale commercial facilities due to cost efficiency and ease of installation. Medium voltage breakers are preferred in larger complexes, hospitals, and manufacturing-linked commercial units for handling higher loads. High voltage breakers serve specialized commercial applications, such as data centers and large infrastructure projects, where uninterrupted power is critical.

- For instance, ABB’s UniGear ZS1 medium-voltage air-insulated switchgear delivers a short-time withstand current of 50 kA at 17.5 kV.

By Installation:

The market includes fixed and withdrawable installations. Fixed breakers are widely used in applications requiring compact layouts and minimal maintenance. Withdrawable types are favored in facilities where operational flexibility and ease of replacement are priorities, supporting reduced downtime during servicing. It is influenced by infrastructure type, safety requirements, and maintenance policies.

- For instance, ABB’s latest SACE Tmax XT fixed circuit breakers achieve a breaking capacity of up to 25kA and feature compact DIN-rail mounting, saving critical panel space while ensuring reliable operation.

By End-Use:

End-use segments include offices, retail, healthcare, hospitality, and others. Offices lead due to high power demand for IT systems and climate control equipment. Retail spaces require reliable protection for lighting, refrigeration, and POS systems. Healthcare facilities prioritize advanced breakers with real-time fault detection to safeguard critical medical equipment. Hospitality and mixed-use commercial spaces also represent significant growth potential.

Segmentations:

By Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

By Installation:

By End-Use:

- Offices

- Retail

- Healthcare

- Hospitality

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America :

North America holds 32% market share in the Commercial circuit breaker market, supported by a mature commercial sector and stringent electrical safety regulations. The region benefits from widespread adoption of smart grid technologies and high demand for energy-efficient electrical protection solutions. The U.S. leads the market due to large-scale commercial infrastructure, rapid modernization of electrical systems, and strict compliance requirements. It is further strengthened by ongoing retrofitting projects in retail, healthcare, and corporate facilities. The presence of leading manufacturers and strong investment in R&D contribute to steady innovation in product offerings.

Asia-Pacific:

Asia-Pacific accounts for 38% market share, driven by extensive infrastructure development and rapid urbanization in China, India, and Southeast Asia. The region is experiencing strong demand for advanced circuit breakers in commercial projects such as office complexes, shopping malls, and hospitality facilities. It benefits from government initiatives promoting energy-efficient and safe electrical systems. It is also supported by growing adoption of smart building technologies across urban centers. Manufacturers are expanding production facilities in the region to meet rising domestic demand and competitive export potential.

Europe:

Europe holds 22% market share, supported by ongoing modernization of commercial infrastructure and strict environmental regulations. Countries such as Germany, the UK, and France are prioritizing energy-efficient circuit protection solutions in line with sustainability targets. The market is influenced by renovation projects that replace outdated systems with advanced, eco-friendly alternatives. It is also benefiting from increased adoption of digital monitoring and automation in electrical systems. European manufacturers are focusing on innovation to align with green building certifications and evolving safety codes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- Eaton

- CG Power and Industrial Solutions Limited

- Siemens AG

- General Electric

- Larsen & Toubro Limited

- Schneider Electric

- Kirloskar Electric Company

- Camsco Electric

- Mitsubishi Electric Corporation

Competitive Analysis:

The Commercial circuit breaker market is characterized by the presence of global leaders and established regional players competing through technology, quality, and service differentiation. Key companies include ABB, Eaton, CG Power and Industrial Solutions Limited, Siemens AG, General Electric, Larsen & Toubro Limited, Schneider Electric, and Kirloskar Electric Company. It is driven by innovation in smart, energy-efficient, and IoT-enabled breaker solutions to meet evolving safety and performance standards in commercial infrastructure. Leading players maintain strong distribution networks, brand recognition, and long-term partnerships with contractors and facility managers. Competitive strategies focus on expanding product portfolios, enhancing digital capabilities, and complying with stringent regulatory requirements. Market participants are also investing in R&D to develop compact, modular, and sustainable designs suited for modern commercial facilities. The competitive landscape reflects a balance between price competitiveness and the ability to deliver high-performance solutions tailored to diverse end-use applications.

Recent Developments:

- In April 2025: ABB announced it will open a new $40 million factory in Albuquerque, New Mexico, for advanced electric motor production related to power grid hardening and upgrades.

- In September 2024, GE residential electrical products such as load centers and circuit breakers began transitioning to the ABB brand starting this month.

- In February 2025, Mitsubishi Electric signed an agreement with HD Renewable Energy to establish a joint venture focusing on renewable energy aggregation business, including solar power and battery storage systems.

Market Concentration & Characteristics:

The Commercial circuit breaker market exhibits moderate to high concentration, with a mix of global leaders and regional manufacturers competing on technology, quality, and service capabilities. It is characterized by continuous innovation in smart, energy-efficient, and IoT-enabled solutions to meet evolving safety and performance standards. Leading companies maintain strong distribution networks, brand recognition, and long-term client relationships in commercial infrastructure sectors. The market shows high entry barriers due to regulatory compliance requirements, advanced manufacturing capabilities, and established customer loyalty. Product differentiation is driven by durability, integration capabilities, and customization for diverse commercial applications.

Report Coverage:

The research report offers an in-depth analysis based on Voltage, Installation, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Demand for smart and IoT-enabled circuit breakers will increase as commercial facilities prioritize real-time monitoring and predictive maintenance.

- Integration of renewable energy systems in commercial buildings will drive the need for advanced circuit breakers capable of managing variable loads.

- Adoption of energy-efficient and eco-friendly breakers will rise in response to stricter sustainability regulations.

- Retrofitting of older commercial buildings will create opportunities for compact, high-performance breaker solutions.

- Manufacturers will focus on modular and hybrid designs to enhance flexibility in diverse electrical setups.

- Growth in commercial real estate across emerging economies will expand market penetration for advanced electrical protection systems.

- Digitalization of electrical networks will strengthen the demand for breakers with analytics and remote control features.

- Competitive strategies will increasingly revolve around product innovation, safety compliance, and value-added services.

- Regulatory frameworks will continue to influence product design, manufacturing, and adoption patterns across regions.

- Collaborations between breaker manufacturers and smart building solution providers will shape the next phase of market evolution.