Market Overview

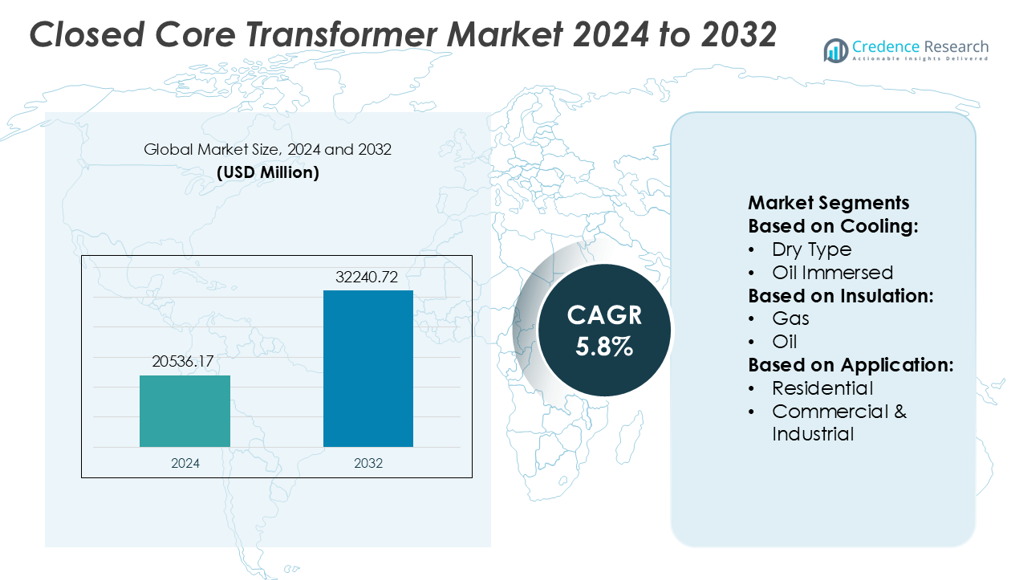

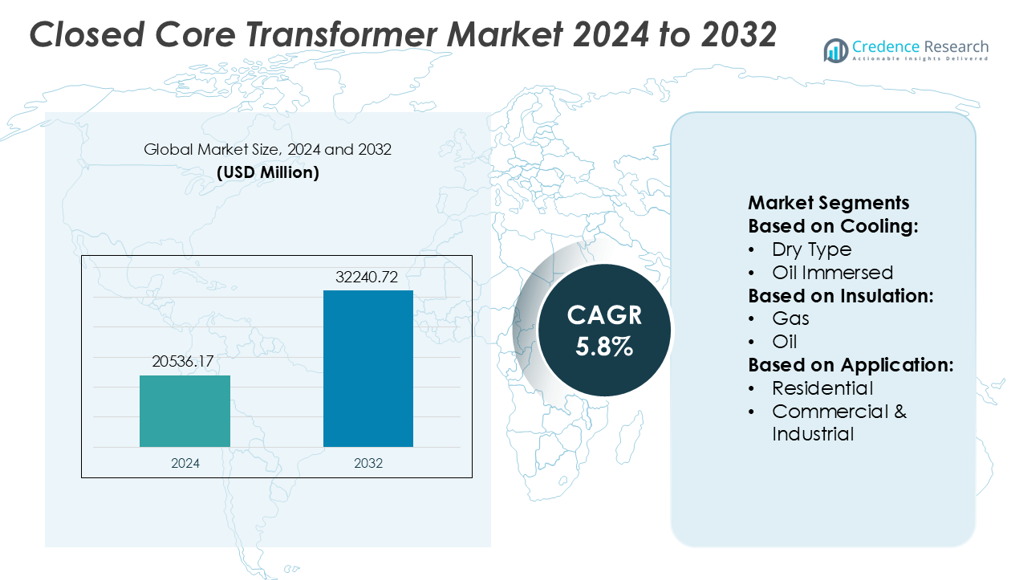

Closed Core Transformer Market size was valued USD 20536.17 million in 2024 and is anticipated to reach USD 32240.72 million by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Closed Core Transformer Market Size 2024 |

USD 20536.17 million |

| Closed Core Transformer Market, CAGR |

5.8% |

| Closed Core Transformer Market Size 2032 |

USD 32240.72 million |

The Closed Core Transformer Market includes several top players that compete through product efficiency, advanced insulation, and digital monitoring capabilities. Asia Pacific leads the global market with 35% share, supported by rapid industrial growth, utility expansion, and strong investment in renewable power grids. Manufacturers focus on low-loss magnetic cores, reliable cooling systems, and IoT-enabled features to improve operational safety and reduce downtime. Many suppliers strengthen their position through regional manufacturing, service networks, and customized voltage ratings for utility and industrial customers. Continuous replacement of aging grid assets and rising electrification across developing economies ensure steady long-term demand.

Market Insights

- Closed Core Transformer Market size was valued at USD 20536.17 million in 2024 and is projected to reach USD 32240.72 million by 2032, at a CAGR of 5.8% during the forecast period.

- Rising demand for grid modernization, renewable energy integration, and improved transmission efficiency drives new transformer installations in utilities, commercial networks, and industrial plants.

- Digital monitoring, IoT-enabled diagnostic systems, and low-loss magnetic cores represent major market trends as buyers prioritize operational safety, longer lifespan, and reduced maintenance.

- High product cost, supply chain delays in core materials, and installation challenges in remote areas remain key restraints, limiting faster rollout across small utilities and developing regions.

- Asia Pacific leads with 35% market share, followed by North America and Europe, while distribution transformers hold the largest segment share due to widespread adoption in substations and industrial facilities, supported by ongoing replacement of aging assets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Cooling

Oil immersed closed core transformers hold the dominant share with 68% of global installations, driven by high efficiency and longer service life in medium and high-voltage grids. Utilities prefer oil-based cooling because mineral and ester oils support better thermal conductivity and higher overload capacity compared to dry types. These transformers handle peak load fluctuations, making them suitable for substations, renewable power, and heavy industries. Dry type units continue to grow in indoor and fire-sensitive environments such as commercial complexes and metro stations, but oil immersed designs remain the primary choice for large-scale power distribution.

- For instance, CG Power & Industrial Solutions manufactures a wide range of oil-immersed power transformers up to the 765 kV class, which are designed to conform to strict international standards like IEC and IS regarding short-circuit withstand capabilities and temperature rise limits.

By Insulation

Oil-insulated designs lead this segment with 61% market share due to high dielectric strength and effective cooling properties. Their reliability in outdoor and harsh conditions supports deployment in transmission substations and renewable energy projects. Solid and gas insulation systems gain traction in compact and indoor installations, offering reduced maintenance needs and improved fire safety. Air and other specialty insulation types serve niche environments that require minimal environmental risk. However, the scalability, proven lifespan, and reduced power losses of oil-insulated transformers keep them ahead in utility and industrial networks.

- For instance, Hyosung Heavy Industries has been a key supplier of 765 kV extra-high-voltage transformers to substations within South Korea’s EHV grid, including facilities like Shin-Ansung.

By Application

Utility applications dominate the market with 52% share, supported by grid modernization programs, substation upgrades, and rapid renewable energy integration. Utilities deploy closed core transformers to improve voltage regulation and energy efficiency across long-distance transmission. Commercial and industrial facilities contribute to steady demand through manufacturing, data centers, and infrastructure expansion. Residential deployment remains smaller but rises with smart metering and distributed renewable systems. The utility sector’s continuous replacement of aging assets and expansion of high-capacity networks ensures sustained growth for closed core transformer installations.

Key Growth Drivers

Rising Grid Modernization and Electrification

Countries are investing in grid upgrades to improve reliability, reduce losses, and handle rising electricity consumption. Closed core transformers support efficient voltage stability and withstand heavy load cycles, making them essential for modern substations. Expansion of underground cabling, renewable energy integration, and smart grid automation further pushes installations. Utilities focus on replacing aging networks, especially in regions with transmission losses and unplanned outages. These upgrades strengthen infrastructure and boost long-term demand for high-performance closed core transformers.

- For instance, HPS provides medium-voltage distribution transformers with Basic Impulse Levels (BIL) up to 250 kV, while their low-voltage dry-type transformers are typically rated for temperature rises of 80°C or 115°C, depending on the specific application requirements.

Increasing Renewable Energy Deployment

Solar and wind projects need stable power evacuation, voltage balancing, and safe load management across variable output conditions. Closed core transformers deliver high efficiency and reduced core losses, which improves renewable power transmission to distribution networks. Government incentives, feed-in tariffs, and utility-scale clean energy parks expand new transformer installations. Offshore and onshore farms also require robust units with enhanced insulation and cooling capabilities. As renewable capacity accelerates, equipment demand grows across Europe, North America, and Asia-Pacific.

- For instance, Hitachi Energy delivered integral high-voltage equipment, including 320 kV DC converter transformers and the HVDC Light® system, which enables stable power evacuation from the large offshore turbines into the onshore grid.

Industrial Expansion and Electrification of Heavy Sectors

Manufacturing hubs, data centers, mining sites, and process industries require continuous power at stable voltages. Closed core transformers support high-capacity loads and handle thermal stress in harsh conditions. Growth in electric vehicle charging infrastructure, railways, and smart manufacturing also drives adoption. Energy-efficient designs reduce operational losses, helping industries cut power costs. With governments promoting industrial automation and electrified logistics, heavy users continue to upgrade capacity and add new closed core transformer units.

Key Trends & Opportunities

Rapid Growth of Eco-Friendly and Low-Loss Transformers

Energy-efficient transformers with reduced iron losses and improved insulation materials are gaining traction. Manufacturers are shifting toward amorphous metal cores, high-grade silicon steel, and eco-friendly oil alternatives. Many countries enforce energy-efficiency regulations to cut operational losses and reduce carbon footprints. Utilities respond by replacing older units with low-loss closed core transformers that meet environmental standards. R&D investments to improve dielectric strength and reduce noise levels create new product opportunities. This trend accelerates adoption across commercial buildings, industrial plants, and grid upgrades.

- For instance, GE documentation also confirms the use of natural ester fluid with a fire point above 360°C, which significantly improves thermal safety and insulation life in indoor and densely populated installations.

Expansion of Smart and Digitally-Enabled Transformers

Smart closed core transformers are becoming standard in digital substations and automated networks. Demand rises for transformers equipped with remote monitoring, self-diagnostics, and load analytics. Utilities prefer transformers that can predict insulation degradation, detect harmonics, and optimize voltage regulation. Cloud-connected devices enhance disaster response and maintenance planning. The trend encourages partnerships between transformer manufacturers and software providers to offer data-driven services beyond hardware sales. As countries move toward digital energy management, smart transformer deployment will grow rapidly.

- For instance, BHEL has manufactured and successfully tested 765 kV class transformers and autotransformers at its Bhopal facility. BHEL products are designed and built to meet national (IS – Indian Standards) and international (IEC – International Electrotechnical Commission) standards.

Opportunity in Emerging Markets

Developing regions such as Southeast Asia, Africa, and Latin America are investing in electrification, industrialization, and renewable projects. Rural electrification and new commercial infrastructure drive transformer installations. Governments are improving distribution networks and replacing aging equipment, creating large procurement opportunities. Industrial zones, railways, and metro systems also require reliable closed core transformers. Local manufacturing incentives and cross-border power trade expand growth prospects. These markets offer long-term revenue potential for global transformer suppliers.

Key Challenges

High Capital Costs and Long Procurement Cycles

Closed core transformers have high manufacturing, testing, and installation costs due to advanced insulation materials, precision engineering, and safety standards. Many utility tenders involve long approval cycles, slowing deployment. Budget constraints in developing regions delay modernization plans. Industrial users may choose lower-cost alternatives, affecting premium transformer sales. Rising raw material prices for steel, copper, and insulation materials further pressure margins. These cost barriers limit faster adoption despite strong long-term demand.

Supply Chain Constraints and Skilled Labor Shortage

Manufacturing relies on specialized raw materials, testing equipment, and skilled workforce for quality assurance. Disruptions in steel and copper supply affect production timelines and pricing. Shortage of technical labor affects design, winding, installation, and maintenance work. Many regions lack trained engineers for digital transformer monitoring and grid automation. Logistics challenges in remote project locations cause delivery delays. These supply-chain and workforce issues continue to hinder industry scalability.

Regional Analysis

North America

North America holds a strong position in the Closed Core Transformer Market with a market share near 27%. The United States leads due to long-standing grid infrastructure upgrades, smart substation deployment, and rising renewable power integration. Increased spending from utilities on energy-efficient transformers, digital monitoring, and grid stability boosts product demand. Canada adds further growth through industrial electrification and new power plant projects. Manufacturers focus on low-loss cores, IoT-enabled units, and advanced insulation suited for heavy-duty and extreme climate applications. Federal funding, carbon reduction targets, and aging grid replacement strategies continue to push long-term revenue expansion.

Europe

Europe holds around 24% market share, supported by a strong industrial base and rapid adoption of smart energy systems. Germany, France, the UK, and Italy dominate consumption, driven by stringent EU energy-efficiency regulations and aggressive decarbonization goals. Utilities replace outdated transformers with low-loss, high-reliability closed core units to reduce operational costs and power leakage. Growth also stems from grid connections for offshore wind farms, EV charging networks, and data centers. European manufacturers emphasize sustainable designs, recyclable steel cores, and remote diagnostic features. The shift toward digital grid automation and renewable balancing services reinforces continuous market advancement.

Asia Pacific

Asia Pacific holds the leading market share at 35%, driven by rapid urbanization, transmission upgrades, and renewable energy expansion. China and India record the highest installations because of heavy industrial power consumption, railway electrification, and large utility-scale solar and wind projects. Japan and South Korea support demand for premium-efficiency transformers with smart grid capabilities. Manufacturers benefit from government-backed grid modernization and cross-border power interconnection plans. Local production, cost-effective manufacturing, and large-scale capacity additions strengthen dominance. Increased foreign investment, factory automation, and adoption of IoT-enabled transformers sustain strong growth across utilities and industrial sectors.

Latin America

Latin America represents around 7% market share, driven by gradual power infrastructure expansion in Brazil, Mexico, Argentina, and Chile. Utilities seek higher-efficiency closed core transformers to reduce technical losses and modernize aging transmission systems. Renewable integration, especially solar in Chile and Brazil, accelerates substation and transformer installations. Growing industrial sectors in mining, oil & gas, and manufacturing further increase demand for reliable distribution networks. Limited domestic manufacturing capacity leads to higher imports, allowing global players to expand regional footprints. Public-private partnerships and foreign investments continue supporting long-term electrification and rural grid development.

Middle East & Africa

The Middle East & Africa hold nearly 7% market share, with rising investments in power generation, grid interconnection, and industrial electrification. Saudi Arabia, the UAE, Qatar, and South Africa lead deployment due to expansion of utilities, oil & gas facilities, and smart city infrastructure. Closed core transformers gain traction for desert climate conditions, high-load handling, and improved energy efficiency. Transmission upgrades support large-scale renewable projects in the UAE and Saudi Arabia. African nations increase procurement to reduce power outages and technical losses. International manufacturers benefit from EPC contracts, government energy diversification plans, and digital substation growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Cooling:

By Insulation:

By Application:

- Residential

- Commercial & Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Closed Core Transformer Market features CG Power & Industrial Solutions, Hyosung Heavy Industries, Hammond Power Solutions, Hitachi Energy, GE Vernova, Bharat Bijlee Limited, DAIHEN Corporation, Bharat Heavy Electricals Limited, Grupo Comtrafo, and Celme S.r.l. The Closed Core Transformer Market remains highly dynamic, with manufacturers focusing on energy-efficient designs, low-loss magnetic cores, and digital-ready products. Companies invest heavily in automation, advanced insulation materials, and IoT-enabled monitoring to reduce lifecycle costs and improve grid reliability. Procurement strategies emphasize high-grade silicon steel, precision lamination, and improved cooling systems to meet modern substation requirements. Many manufacturers strengthen their market position through technology upgrades, strategic partnerships, and regional production facilities that reduce logistics costs. Demand from utilities and industrial sectors pushes suppliers to offer customized voltage ratings, climate-resistant designs, and short lead times. Digital integration, including remote diagnostics and predictive maintenance, has become a major differentiator in competitive bidding for transmission and distribution projects. Continuous R&D spending, focus on regulatory compliance, and after-sales support networks contribute to long-term competitiveness in global markets.

Key Player Analysis

- CG Power & Industrial Solutions

- Hyosung Heavy Industries

- Hammond Power Solutions

- Hitachi Energy

- GE Vernova

- Bharat Bijlee Limited

- DAIHEN Corporation

- Bharat Heavy Electricals Limited

- Grupo Comtrafo

- Celme S.r.l.

Recent Developments

- In June 2025, Hitachi Energy India received an order for 30 units of 765 kV transformers to support India’s grid expansion, indicating active delivery of ultra-high-voltage transformers as part of the company’s commitment to advancing renewable integration and grid resilience.

- In June 2025, Mitsubishi Electric announced efforts to expand its HVDC transmission systems business, which includes scaling up production capacity for key transformer products, such as closed core power transformers, to meet global electrification demands and enhance reliable power transmission.

- In February 2023, Telawne Power Equipments unveiled its Internet of Things (IoT)-based smart transformers at the ELECRAMA 2023 event.Telawne announced the launch of these IoT-based smart transformers, which are designed to deliver better power quality.

Report Coverage

The research report offers an in-depth analysis based on Cooling, Insulation, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise due to continuous grid modernization and renewable power integration.

- Utilities will adopt more smart transformers with remote monitoring and predictive maintenance.

- Energy-efficient cores and low-loss materials will become standard for new installations.

- Growing electrification in developing regions will create new substation and distribution projects.

- Digital substations will drive adoption of IoT-enabled and SCADA-compatible transformer designs.

- Manufacturers will expand local assembly units to reduce logistics time and import dependence.

- Industrial sectors will invest in reliable closed core units to support automation and heavy loads.

- Replacement of aging grid assets will create steady procurement cycles in mature economies.

- Environment-focused policies will push suppliers toward recyclable materials and eco-friendly insulation.

- Global players will expand through partnerships, product customization, and service-based maintenance contracts.