Market Overview

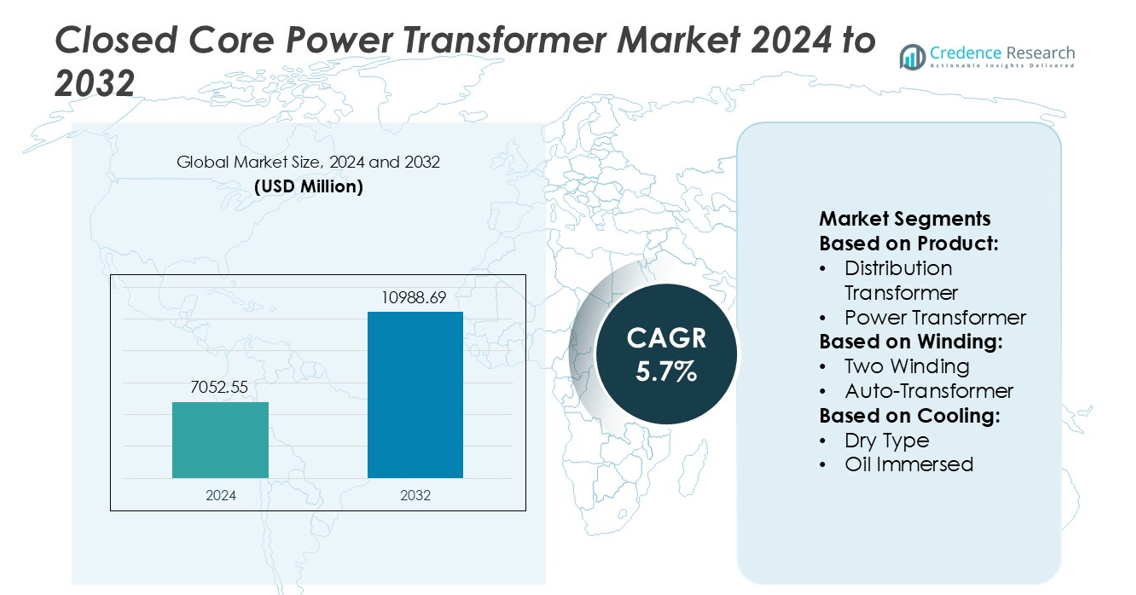

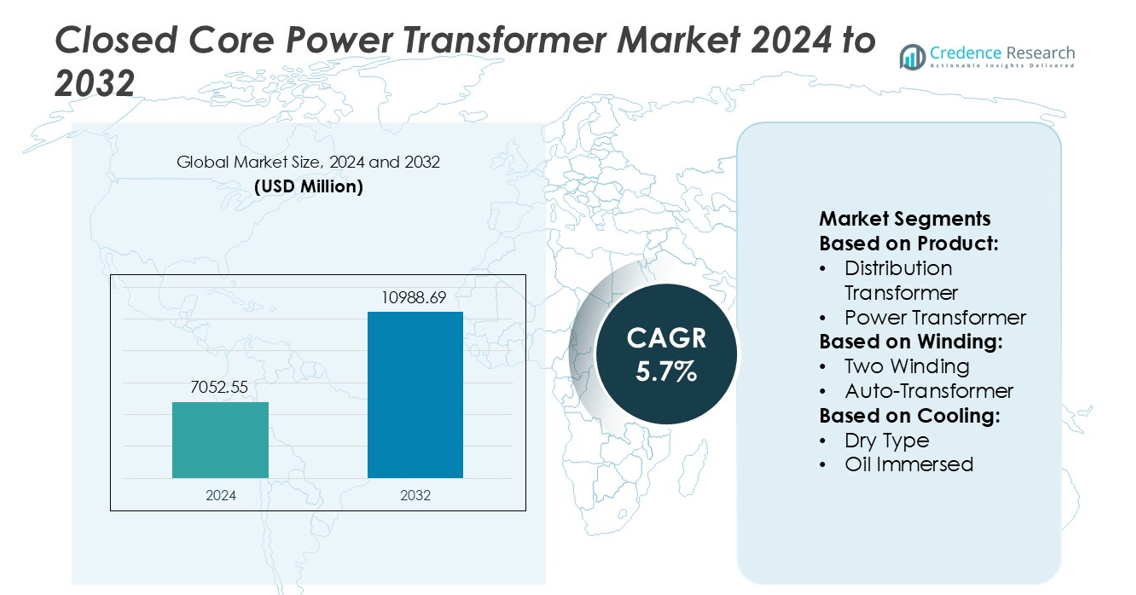

Closed Core Power Transformer Market size was valued USD 7052.55 million in 2024 and is anticipated to reach USD 10988.69 million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Closed Core Power Transformer Market Size 2024 |

USD 7052.55 million |

| Closed Core Power Transformer Market, CAGR |

5.7% |

| Closed Core Power Transformer Market Size 2032 |

USD 10988.69 million |

The Closed Core Power Transformer Market focus on high-efficiency cores, advanced insulation, and smart monitoring features to meet rising grid modernization needs. Global manufacturers such as Siemens Energy, Schneider Electric, Mitsubishi Electric, Toshiba, General Electric, Elsewedy Electric, Hyosung, Voltamp, Kirloskar Electric, and Ormazabal compete through technology upgrades, automation, and region-specific product customization. Many companies invest in IoT-enabled transformers and energy-efficient designs to reduce losses and support predictive maintenance. Asia Pacific remains the leading region with 35% market share, driven by rapid industrialization, renewable power expansion, and large investments in transmission and distribution infrastructure.

Market Insights

- Closed Core Power Transformer Market size reached USD 7052.55 million in 2024 and is projected to hit USD 10988.69 million by 2032 at a CAGR of 5.7%.

- Demand rises due to steady grid modernization, renewable integration, and industrial electrification, with utilities upgrading old assets to reduce losses and improve voltage stability.

- Major players enhance competitiveness with smart monitoring, IoT-based diagnostics, high-efficiency cores, and regional product customization to secure long-term utility contracts.

- Cost barriers and raw material price fluctuations remain key restraints, particularly for smaller manufacturers and budget-constrained utilities in developing regions.

- Asia Pacific leads with 35% share, while North America holds 26%, supported by aging grid replacement, and the Distribution Transformer segment accounts for the largest share due to widespread utility and industrial usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Distribution transformers hold the dominant position in the Closed Core Power Transformer Market, accounting for the largest revenue share. Their demand stays high due to widespread use in commercial, residential, and industrial power distribution networks. The segment benefits from grid modernization programs, renewable power integration, and replacement of aging utility infrastructure. Power transformers also show steady growth as utilities expand transmission capacity to support rising electricity loads and cross-border power trade. The “Others” category, including specialty and rectifier transformers, grows in niche sectors such as railways and heavy industries, but remains smaller compared with mainstream distribution units.

- For instance, Ormazabal’s closed-core distribution transformers in the iE3 series are designed for low-loss operation and support primary voltages up to 36,000 volts while maintaining acoustic noise levels below 50 decibels according to internal performance tests.

By Winding

Two-winding transformers lead the winding segment with the highest market share. Their dominance is driven by reliable voltage regulation, better fault isolation, and strong adoption across medium- and high-voltage applications. Utilities and industrial users prefer two-winding designs due to simplified control and strong insulation performance, especially in urban substations and manufacturing facilities. Auto-transformers, while more compact and cost-efficient, serve a smaller share due to limited suitability in systems needing high electrical isolation. However, rising demand for compact grid equipment and renewable power synchronization is supporting gradual growth in auto-transformer adoption.

- For instance, Siemens Energy’s GEAFOL two-winding dry-type transformers operate at voltages typically up to 36,000 volts (36 kV) and are designed with high inherent mechanical strength to withstand high short-circuit forces, a key feature highlighted in the company’s technical brochures.

By Cooling

Oil-immersed transformers represent the dominant cooling segment with the largest market share. These units offer superior heat dissipation, longer operational life, and high overload handling, making them the top choice for high-capacity transmission and distribution networks. Utilities favor oil-immersed designs for outdoor substations and heavy-load applications. Dry-type transformers, though growing in popularity, hold a smaller share due to lower capacity limits. Their adoption increases in commercial buildings, hospitals, and indoor substations where fire safety, low maintenance, and reduced environmental risk drive installation.

Key Growth Drivers

Rising Demand for Stable Power Distribution

The Closed Core Power Transformer Market benefits from rising demand for stable and efficient electricity transmission. Growth in commercial buildings, industrial facilities, and renewable power projects increases the need for transformers that reduce load losses and improve voltage regulation. Utilities prefer closed core designs due to their low flux leakage and better magnetic performance, supporting grid stability during peak demand. Expansion of smart grids and substation upgrades also creates fresh installation needs. The push for continuous and loss-free distribution supports long-term market expansion across developed and emerging regions.

- For instance, Kirloskar Electric’s closed-core distribution transformers are manufactured with cold-rolled grain-oriented silicon steel and operate at insulation levels typically up to 33,000 volts (33 kV).

Rapid Urbanization and Industrialization

Fast urbanization and industrial development fuel the installation of new power infrastructure in developing economies. Manufacturing hubs, metro rail networks, data centers, and process industries rely on transformers to maintain consistent energy supply. Closed core transformers provide higher reliability compared to open core units, making them suitable for high-use environments. Government investments in rural electrification, smart city projects, and solar and wind integration accelerate deployment. Power utilities adopt modern transformer designs to manage increased household consumption and industrial loads, strengthening demand for closed core products.

- For instance, Elsewedy Electric’s closed-core power transformers are engineered for primary voltages up to 500,000 volts and are tested to withstand lightning impulse levels of 1,425,000 volts, as documented in the company’s certified product datasheets.

Upgradation of Aging Power Infrastructure

Aging grid networks require replacement of outdated transformers that cause losses and power instability. Many countries are modernizing substations to support digital monitoring and lower maintenance needs. Closed core transformers with improved insulation, energy-efficient cores, and high overload capacity are selected for refurbishment projects. Electrification of railway systems and long-distance transmission upgrades create recurring replacement cycles. Regulatory emphasis on reducing power losses and meeting safety standards further encourages utilities and OEMs to switch to advanced closed core designs.

Key Trends & Opportunities

Adoption of Energy-Efficient and Low-Loss Designs

Energy-efficient transformers are gaining traction due to global emission reduction goals and rising electricity prices. Manufacturers develop low-loss cores, advanced grain-oriented laminations, and better cooling technologies to reduce operational cost. Utility companies focus on Total Cost of Ownership (TCO) rather than initial purchase price, boosting installation of premium closed core units. Countries with strict energy-efficiency norms offer incentives for replacing old transformers with high-efficiency models, creating a large retrofit opportunity.

- For instance, Mitsubishi Electric’s EX-α series oil-immersed distribution transformers using an amorphous-iron core were installed in a pilot program at the Nagoya Works’ E1 Building, contributing to a 55% reduction in the building’s overall power consumption and associated CO2 emissions, as documented in an in-house installation case study.

Integration of IoT-Enabled Smart Transformers

Digital monitoring and IoT-based sensors support predictive maintenance, fault detection, and real-time load tracking. Smart closed core transformers help utilities reduce downtime and extend product lifecycle. Rising adoption of digital substations, remote monitoring platforms, and cloud-based asset management solutions creates a new demand segment. Manufacturers collaborate with automation and software companies to develop intelligent transformer systems, opening revenue streams beyond hardware sales.

- For instance, Hyosung’s smart transformer units integrate UHF partial-discharge sensors, oil-temperature hotspot sensors, and DGA modules, and are deployed in their extra-high-voltage transformers rated up to 765 kV and 1,500 MVA.

Renewable Power Grid Expansion

Wind and solar farms need efficient transformers to connect intermittent generation to the main grid. Closed core transformers ensure lower leakage reactance, making them suitable for distributed and utility-scale renewable installations. Governments and private players continue investing in renewable parks and hybrid grids, especially in Asia Pacific, Europe, and North America. This transition offers strong long-term opportunities for transformer manufacturers and component suppliers.

Key Challenges

High Initial Installation and Manufacturing Costs

Closed core transformers require high-quality magnetic steel, precision assembly, and advanced insulation, making them costlier than basic designs. Utilities with limited budgets may delay upgrades or opt for cheaper alternatives, particularly in low-income regions. Procurement of premium raw materials and skilled labor increases production expense, affecting price competitiveness. These cost barriers restrict rapid adoption and slow market penetration in small commercial and rural installations.

Supply Chain Disruptions and Material Shortages

The market relies on core steel, copper winding, and transformer oil, all of which face periodic shortages and price volatility. Disruptions in global logistics or metal supply increase project delays and affect manufacturing timelines. Geopolitical issues, trade restrictions, and fluctuating commodity prices further raise uncertainty. Smaller manufacturers experience difficulty maintaining stable inventory, impacting their ability to fulfill large orders and compete with global brands.

Regional Analysis

North America

North America holds 26% market share in the Closed Core Power Transformer Market, supported by strong electricity demand, modernization of aging grid networks, and fast adoption of smart substations. The United States leads installations due to large-scale industrial manufacturing, data center expansion, and renewable integration projects. Utilities invest in high-efficiency closed core units to reduce technical losses and meet regulatory emission targets. Canada continues upgrading rural electrification lines and transmission corridors, driving fresh procurement. Growth also benefits from the replacement of outdated oil-immersed systems and rising investments in power infrastructure resilience to withstand extreme weather events.

Europe

Europe accounts for 24% market share, driven by renewable energy targets, cross-border transmission upgrades, and strict energy efficiency regulations. Germany, the United Kingdom, France, and the Nordic countries implement smart grid deployments that require high-performance closed core designs. Infrastructure refurbishment programs replace obsolete transformers, supporting steady demand. The region’s strong focus on carbon reduction and smart monitoring boosts adoption of digital-ready units. Manufacturers also benefit from refurbishment cycles in rail electrification and offshore wind transmission. Continuous investments in voltage stabilization and substation automation sustain Europe’s role as an attractive market for transformer suppliers.

Asia Pacific

Asia Pacific dominates the market with 35% share, supported by rapid urbanization, industrial expansion, and large-scale renewable installations. China and India invest heavily in electricity transmission lines, rural electrification, and grid modernization, driving high sales volumes. Southeast Asian countries accelerate transformer procurement for smart city programs and real estate growth. Closed core transformers gain preference due to improved reliability and lower power losses in high-load environments. Government-funded solar parks, wind farms, and industrial corridors expand long-term opportunities. Growing digital infrastructure and data center development further enhance demand for efficient transformer designs.

Latin America

Latin America holds 8% share, primarily led by Brazil, Mexico, Chile, and Argentina. The region adopts closed core transformers to improve grid stability and cut technical losses in long-distance transmission systems. Renewable energy expansion—especially wind projects in Brazil and solar installations in Mexico—creates steady deployment. Utilities replace aging equipment to reduce outage frequency, while commercial and industrial zones generate additional demand. Budget constraints and slower infrastructure spending limit rapid adoption, but foreign investments in mining, manufacturing, and urban electrification continue supporting moderate market growth across the region.

Middle East & Africa

The Middle East & Africa region accounts for 7% market share, driven by transmission upgrades, industrial investments, and expanding urban electrification. Gulf countries such as Saudi Arabia and the UAE deploy closed core transformers for smart grid programs, desalination plants, and commercial infrastructure. In Africa, growing power deficits increase investments in new substations, rural electrification, and solar mini-grids. Although procurement depends on government funding and international financiers, adoption continues to improve. Manufacturing zones, oil and gas facilities, and infrastructure megaprojects sustain demand, while long-term diversification plans boost utility-scale installations.

Market Segmentations:

By Product:

- Distribution Transformer

- Power Transformer

By Winding:

- Two Winding

- Auto-Transformer

By Cooling:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Closed Core Power Transformer Market players such as Ormazabal, Siemens Energy, Kirloskar Electric, Elsewedy Electric, Mitsubishi Electric, Voltamp, Toshiba, Hyosung, Schneider Electric, and General Electric. The Closed Core Power Transformer Market features a competitive environment driven by continuous product innovation, energy-efficient designs, and digital monitoring technologies. Manufacturers focus on developing low-loss magnetic cores, improved insulation, and IoT-enabled transformers that support predictive maintenance and voltage stability. Companies invest in automation, advanced testing systems, and smart cooling methods to increase reliability and reduce lifecycle costs. Partnerships with utilities, EPC contractors, and renewable power developers help secure long-term supply contracts and expand global presence. Growing demand from transmission upgrades, smart grid modernization, and data center expansion encourages suppliers to offer tailored voltage ratings and faster delivery cycles. Many players also strengthen after-sales service, refurbishment programs, and spare part support to maintain customer loyalty and capture recurring revenue opportunities, keeping the market competitive and innovation-driven.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ormazabal

- Siemens Energy

- Kirloskar Electric

- Elsewedy Electric

- Mitsubishi Electric

- Voltamp

- Toshiba

- Hyosung

- Schneider Electric

- General Electric

Recent Developments

- In October 2025, Toshiba JSW announced its digital transformation initiative for power generation with the introduction of EtaPRO, an advanced IoT monitoring platform that improves transformer efficiency and reliability, including for closed core power transformer systems.

- In October 2025, Voltamp Transformers secured a ₹149 crore order from Gujarat Energy Transmission Corporation Limited (GETCO) for the design, manufacture, testing, and supply of power transformers, including closed core units.

- In September 2025, Hyosung Heavy Industries announced a major expansion of its HVDC transformer manufacturing capacity in Changwon, South Korea.

- In June 2025, Mitsubishi Electric announced efforts to expand its HVDC transmission systems business, which includes scaling up production capacity for key transformer products, such as closed core power transformers, to meet global electrification demands and enhance reliable power transmission

Report Coverage

The research report offers an in-depth analysis based on Product, Winding, Cooling and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as utilities modernize transmission and distribution networks.

- Smart grid expansion will boost adoption of IoT-enabled transformer systems.

- Renewable energy integration will create steady installation needs for new substations.

- Energy-efficient and low-loss transformer designs will gain stronger preference.

- Replacement of aging grid assets will drive recurring procurement across regions.

- Manufacturers will increase automation in production to reduce delivery time.

- Digital monitoring and predictive maintenance will become standard features.

- Developing economies will invest in rural and industrial electrification projects.

- Data center growth will support demand for reliable closed core transformers.

- After-sales services, refurbishment, and long-term maintenance contracts will expand.