Market Overview

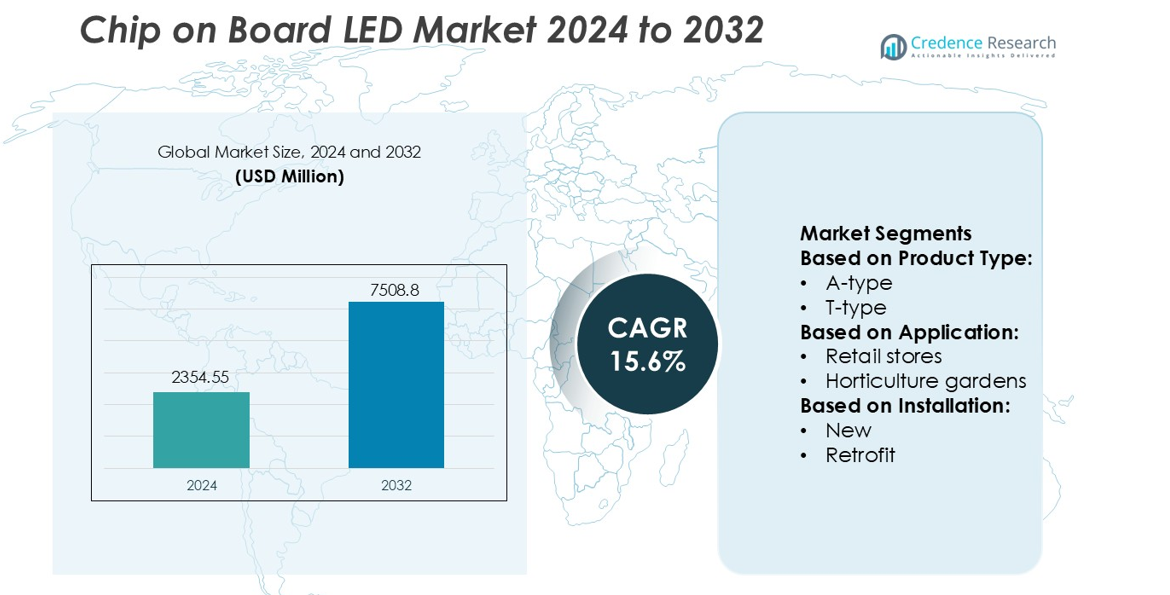

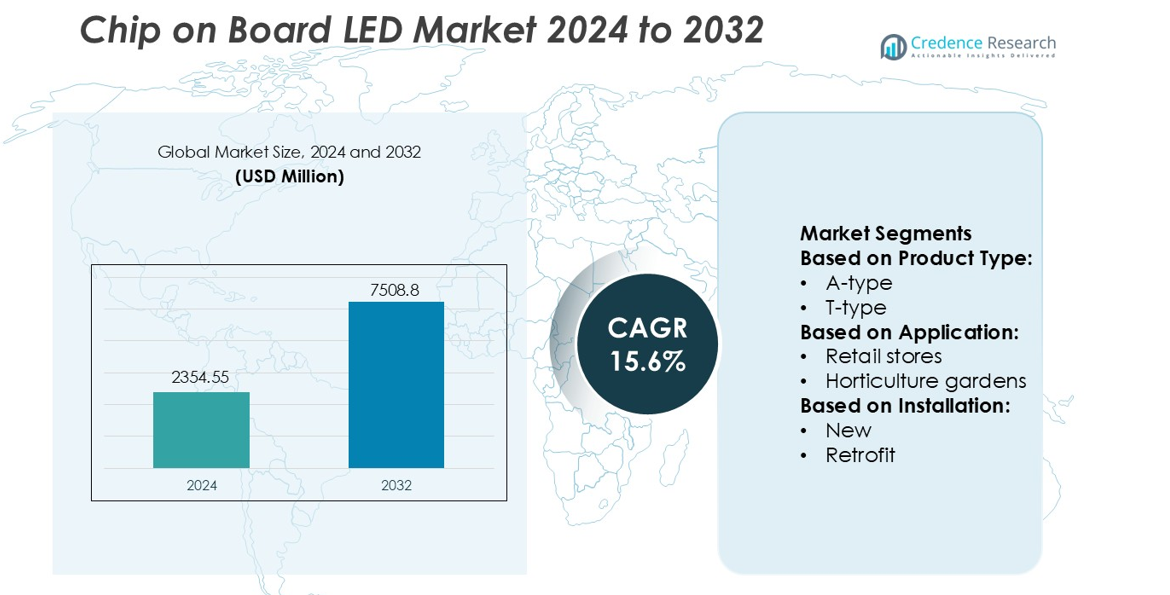

Chip on Board LED Market size was valued USD 2354.55 million in 2024 and is anticipated to reach USD 7508.8 million by 2032, at a CAGR of 15.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chip on Board LED Market Size 2024 |

USD 2354.55 million |

| Chip on Board LED Market, CAGR |

15.6% |

| Chip on Board LED Market Size 2032 |

USD 7508.8 million |

The Chip on Board (COB) LED market includes major participants such as Panasonic Corporation, Halonix Technologies Private Limited, Seoul Semiconductor Co., Ltd., Cree Lighting USA LLC, Nanoleaf, LSI Industries Inc., Dialight, Acuity Brands, Inc., Hubbell, and Savant Technologies LLC. These companies compete through advancements in high-lumen output, thermal efficiency, energy savings, and IoT-based lighting control. Product innovation focuses on smart lighting, architectural fixtures, outdoor installations, and compact automotive applications. Asia Pacific remains the dominant regional market, holding 38% share, supported by large-scale manufacturing, strong supply chains, and rapid adoption across commercial buildings, infrastructure, consumer electronics, and industrial facilities.

Market Insights

- The Chip on Board LED Market was valued at USD 2354.55 million in 2024 and is projected to reach USD 7508.8 million by 2032, growing at a CAGR of 15.6%.

- Demand grows due to longer operational life, high brightness, compact size, and the rising shift from traditional lighting to smart and energy-efficient solutions.

- Key players focus on high-lumen output, better heat control, wireless dimming, and IoT-based lighting, intensifying competitive innovation across commercial, outdoor, and automotive applications.

- High initial cost of COB modules and thermal management requirements act as restraints, especially for price-sensitive regions and small-scale buyers.

- Asia Pacific leads with 38% share, supported by strong manufacturing and electronics production, while luminaires represent the dominant segment due to large installations across commercial buildings, streets, malls, and smart infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Luminaires lead the Chip on Board (COB) LED market with the highest share due to strong adoption across commercial and residential spaces. Within luminaires, downlighting holds the dominant position because COB LEDs deliver high brightness, uniform illumination, and efficient thermal performance. Their compact structure supports slim fixture designs, which helps lighting brands target hotels, retail stores, offices, and public infrastructure projects. Demand rises further through smart lighting upgrades, decorative interior designs, and energy-efficiency mandates. Lamps such as A-type and T-type remain relevant in household replacements, but luminaires continue to outperform due to longer lifecycle, lower maintenance, and higher lumen output.

- For instance, Seoul Semiconductor’s “SunLike COB” series, such as part numbers within the SAWS1063A family (e.g., S4SM-1063xx9736-0B000G3S-00001), features a high color rendering index (CRI of 97 or higher) and a typical forward voltage of approximately 34.8 V when driven at the standard test current of around 0.29 A (290 mA).

By Application

Indoor lighting dominates the Chip on Board LED market and secures the largest share, driven by residential, commercial, office, and retail deployment. Downlights, panel lights, and track lights use COB LEDs to offer glare-free, uniform output and reduced heat generation. Commercial facilities prefer COB-based luminaires for product displays and focused beam control. Horticulture gardens also adopt COB LEDs because strong photosynthetic-active light enhances plant growth. Industrial units integrate them for warehouse and production hall illumination. Outdoor lighting, including streets, tunnels, and sports complexes, grows steadily, but indoor installations remain ahead due to renovation projects and rising smart home adoption.

- For instance, Dialight has deployed over a million industrial LED fixtures globally. Its Vigilant® High Bay luminaires, including models with up to 71,000 lumens at up to 155 lumens per watt, can achieve significant energy savings, with some applications reporting over 65% reduction in energy consumption compared to conventional lighting systems.

By Installation

New installations lead the Chip on Board LED market and hold the dominant share as construction of smart homes, commercial buildings, retail outlets, and industrial facilities increases. Developers select COB LEDs for long service life, easy integration with sensors, and high lumen efficiency. Hospitality and retail chains upgrade lighting to improve aesthetics, visibility, and energy savings. Retrofit projects also expand, especially in aging buildings and streetlight modernization programs. However, the pace of new construction and government guidelines for energy-efficient infrastructure allow new installations to stay ahead, supported by falling COB LED module costs and rapid fixture design innovation.

Key Growth Drivers

Rising Demand for High-Lumen Efficiency and Compact Lighting

Demand for compact, high-lumen lighting supports rapid COB LED adoption. Manufacturers focus on advanced chip-on-substrate designs, tight beam control, and improved heat transfer. COB modules provide strong color uniformity and brightness for retail, architectural, and industrial spaces. Energy efficiency rules and phase-outs of traditional lamps accelerate the shift. Automotive headlights, medical lighting, and commercial downlights prefer COB LEDs due to long lifespan and stable output. Growth continues as OEMs integrate COB modules with digital dimming and smart lighting controls.

- For instance, Hubbell’s Protecta X LED luminaire offers a system life exceeding 120,000 hours at 25 °C and claims 50% energy savings compared to fluorescent alternatives in field deployment.

Increasing Penetration of Smart and Connected Lighting Systems

Smart building projects fuel COB LED usage across offices, malls, and urban infrastructure. COB modules support IoT-enabled lighting with sensors, wireless controls, and automation. The segment benefits from rising adoption of human-centric lighting, daylight adaptation, and occupancy-based energy savings. Smart city plans emphasize LED streetlights with remote monitoring, fault alerts, and predictive maintenance. Manufacturers combine COB LEDs with Bluetooth Mesh, Zigbee, or Wi-Fi drivers to enhance functionality and lower operating costs. Rising retrofit activity also expands installations in old commercial properties.

- For instance, Aculux 5° Precision Spot delivers a high center beam candlepower (CBCP) of 32,000 from its 3-inch aperture. This high CBCP, combined with its ultra-narrow 5-degree beam, provides exceptional beam control for accent lighting in demanding environments, such as high-ceiling applications.

Growing Applications in Automotive and Industrial Lighting

Automotive OEMs adopt COB LEDs for low beam, high beam, and fog lamps due to strong lumen density and thermal stability. Compact modules enable sleek headlamp designs and enhanced road visibility. In factories and warehouses, COB high-bay fixtures improve illumination and lower maintenance. Industrial plants prefer COB-based floodlights for durability, vibration resistance, and long service life. Increasing EV production and autonomous vehicle development boost advanced lighting demand. Strong adoption across construction sites, airports, and sports arenas further accelerates market growth.

Key Trends & Opportunities

Rising Shift Toward Energy-Efficient and Sustainable Lighting

Global sustainability targets and energy-saving mandates drive LED replacement of halogen and HID lamps. COB systems reduce heat generation and power consumption, helping businesses cut electricity bills. Green building certifications favor LEDs due to lifespan and recyclable components. Lighting brands introduce eco-friendly substrates, lead-free designs, and modular fixtures. The trend creates opportunities for vendors offering low-carbon production, recyclable heat sinks, and smart-controlled energy tracking.

- For instance, LSI’s AirLink Blue system uses a Bluetooth mesh network has a maximum range of 150 feet between fixtures, ensuring reliable communication and scalability for large industrial applications.

Advancement in Thermal Management and Chip Packaging

Better heat dissipation enables higher lumen output and longer life. Manufacturers introduce ceramic substrates, copper-based PCBs, and vapor chamber cooling. Smaller chips with multi-emitter configurations enhance beam quality without increasing power draw. New phosphor coatings boost color accuracy for retail, studio, and healthcare applications. This trend encourages premium product launches and supports differentiated portfolios for lighting OEMs.

- For instance, Panasonic’s circular plastics project has successfully resulted in the ability to recycle 17,000 tons of plastic per year via cascade recycling (recycling into different products) and 8,000 tons of plastic per year via horizontal recycling.

Growing Adoption of Human-Centric and Architectural Lighting

Premium homes, hotels, museums, and malls use COB LEDs for warm dimming, tunable white, and smooth color rendering. The technology enhances visual comfort, interior mood, and display aesthetics. Smart LEDs controlled via apps or voice assist boost customer appeal. Designers favor COB modules for glare-free spotlights and recessed downlights. The trend drives strong sales in luxury residential and hospitality lighting.

Key Challenges

High Cost of Advanced COB Modules and Drivers

Premium substrates, precise binning, and advanced thermal solutions increase production costs. Many price-sensitive buyers still prefer mid-power SMD LEDs. Smart COB fixtures require specialized drivers and control hardware, adding expense. In emerging markets, limited budgets slow transition to COB-based commercial lighting. Manufacturers aim to reduce costs through automation, mass production, and localized supply chains, but pricing remains a roadblock in large-scale retrofits.

Heat Concentration and Performance Degradation Risks

COB LEDs place multiple chips on a tight surface, increasing heat density. Poor thermal design can cause lumen drop, color shift, and shorter lifespan. Low-quality heat sinks or improper fixture design amplify the issue. Industrial and outdoor installations face higher failure risk without proper cooling. Vendors invest in ceramic boards, high-conductivity metals, and advanced optics, yet effective heat management remains a major engineering challenge for long-term reliability.

Regional Analysis

North America

North America holds 28% of the global COB LED market, driven by large commercial adoption and rapid replacement of legacy lighting. The United States leads due to rising smart city deployments, modernization of stadiums, and architectural lighting demand. Incentives for energy efficiency and sustainability accelerate sales across residential and industrial spaces. Strong presence of major lighting manufacturers and LED packaging companies supports continuous innovation in lumen output, heat dissipation, and color consistency. Commercial buildings, retail stores, and public infrastructure create a steady procurement pipeline. Expansion of IoT-based lighting control systems further increases COB LED integration in smart buildings.

Europe

Europe accounts for 25% of the global market, supported by strict energy-efficiency regulations, green building trends, and carbon-reduction mandates. Germany, the U.K., Italy, and France remain leading adopters, especially in retail, hospitality, and street lighting. Renovation of old lighting systems and expansion of commercial infrastructure keep demand stable. Lighting OEMs and semiconductor packaging companies in the region focus on premium and architectural-grade COB modules. Industrial and outdoor applications benefit from longer lifecycle and low maintenance. Growing smart city programs, EV charging infrastructure, railway stations, and airports maintain consumption of high-power COB lighting systems across Europe.

Asia Pacific

Asia Pacific dominates with 38% share, driven by strong manufacturing ecosystems, large-scale urban development, and high LED penetration in electronics. China, Japan, South Korea, and Taiwan serve as global manufacturing hubs for COB chips, substrates, drivers, and modules. Rapid construction of commercial complexes, smart factories, and public transport networks boosts installations. Consumer electronics brands adopt COB LEDs for backlighting, digital displays, and automotive lighting. Low-cost production and a robust supply chain improve export competitiveness. Government support for energy-saving lighting across streets, malls, and households fuels strong volume growth across developing economies in the region.

Latin America

Latin America holds 5% share of the COB LED market, driven by increasing adoption in commercial, public, and industrial lighting. Brazil and Mexico lead procurement due to smart city initiatives and modernization of airports, malls, and factories. Residential retrofitting grows gradually as consumers shift from halogen and fluorescent options to long-life LED systems. Price sensitivity and budget constraints slow adoption in certain markets, but partnerships with global LED brands improve affordability. Rising construction of retail spaces, hotels, and public infrastructure supports demand for high-brightness COB modules designed for outdoor and decorative lighting applications.

Middle East & Africa

The Middle East & Africa region represents 4% market share, supported by infrastructure expansion, tourism growth, and commercial real estate projects. UAE, Saudi Arabia, and Qatar adopt COB LEDs for premium architectural lighting in malls, hotels, stadiums, and smart city precincts. The technology performs well in high-temperature environments due to superior thermal efficiency and longer operational life. African markets grow steadily, led by urban development in South Africa, Kenya, and Nigeria. Increasing investments in airports, highways, and industrial parks provide opportunities for durable and energy-efficient lighting solutions.

Market Segmentations:

By Product Type:

By Application:

- Retail stores

- Horticulture gardens

By Installation:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Chip on Board (COB) LED market features major players such as Panasonic Corporation, Halonix Technologies Private Limited, Seoul Semiconductor Co., Ltd., Cree Lighting USA LLC, Nanoleaf, LSI Industries Inc., Dialight, Acuity Brands, Inc., Hubbell, and SAVANT TECHNOLOGIES LLC. The Chip on Board (COB) LED market is defined by continuous innovation in high-efficiency lighting modules, thermal management, and integrated control systems. Manufacturers focus on improving lumen output, color consistency, and heat dissipation to support demanding commercial, industrial, and architectural installations. Many companies are expanding portfolios to include smart, sensor-based, and IoT-enabled lighting that allows automation, remote monitoring, and energy optimization. Pricing remains competitive due to strong manufacturing capacity in Asia and rising global production. Market players also invest in mini-COB and micro-COB technology for compact fixtures, automotive lighting, and consumer electronics. Strategic partnerships with infrastructure developers, retail chains, and public agencies strengthen distribution, while sustainability drives adoption of recyclable materials and low-power consumption designs. Government regulations on energy efficiency further intensify competition, pushing suppliers to achieve longer operational life and enhanced performance. As smart city and commercial renovation projects expand worldwide, competitive rivalry is expected to increase.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Cree LED launched the XLamp XP-L Photo Red S Line LEDs for horticulture it complements Cree LED’s COB portfolio strategy around application-optimized emitters used alongside COB modules in high-PAR luminaires.

- In October 2024, OSRAM, a leading provider of lighting technologies and solutions, announced the launch of a new LED lighting solution for outdoor and stadium applications. OSCONIQ® C 3030 provides exceptional intensity with thermal efficiency making it an attractive choice for several outdoor applications.

- In November 2024, CV28D LEDs with FusionBeam technology for signs/displays; although mid-power signage devices, this sat alongside Cree’s ongoing COB families for high-density lighting applications.

- In September 2024, FOHSE, a leading name in the horticulture science space, announced the launch of its PRO Series LED lighting technology. The new lighting technology is expected to revolutionize cannabis cultivation, and the product range features seven adjustable spectrum channels for all use cases

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Installation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption in smart homes, public infrastructure, and commercial spaces.

- Manufacturers will focus on improving heat management and lumen output for high-intensity applications.

- IoT-enabled lighting systems will gain strong traction across smart city projects.

- Mini-COB and micro-COB technologies will expand in automotive, displays, and compact fixtures.

- Demand for energy-efficient lighting will rise due to stricter global efficiency regulations.

- More companies will integrate wireless dimming, sensors, and automation into COB modules.

- Architectural and decorative lighting will adopt premium COB designs with better color rendering.

- Supply chain localization will increase as countries push domestic LED manufacturing.

- COB LEDs will replace traditional modules in stadiums, malls, airports, and industrial sites.

- Prices will continue to decline as production scales and packaging technology advances.