Market Overview

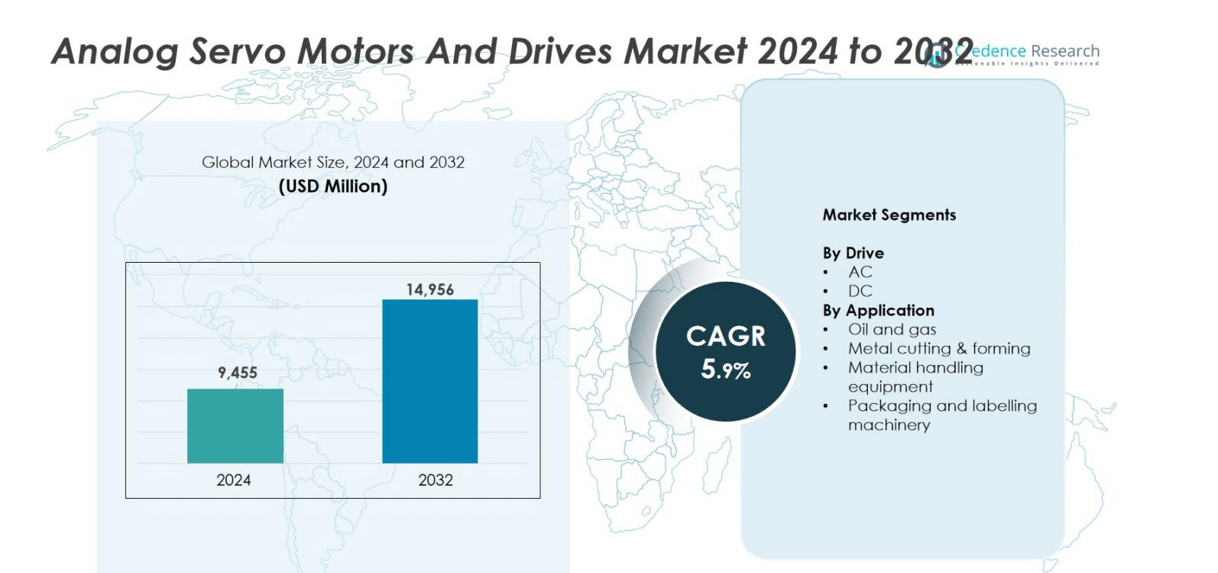

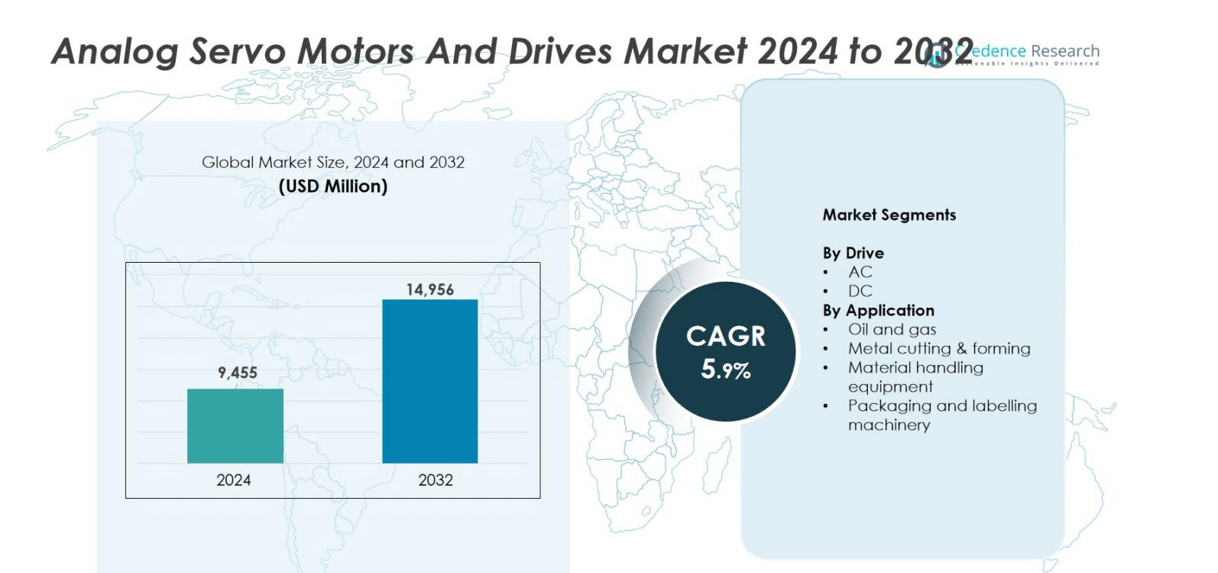

The Analog Servo Motors and Drives Market size was valued at USD 9,455 million in 2024 and is anticipated to reach USD 14,956 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Analog Servo Motors and Drives Market Size 2024 |

USD 9,455 million |

| Analog Servo Motors and Drives Market, CAGR |

5.9% |

| Analog Servo Motors and Drives Market Size 2032 |

USD 14,956 million |

The Analog Servo Motors and Drives market features strong competition among key players such as Mitsubishi Electric, Bosch Rexroth, Hitachi, ABB, Nidec, Delta Electronics, Analog Devices, KEB Automation, Danfoss, and Applied Motion Products. These companies focus on expanding their product portfolios through advanced motion control solutions and integration of energy-efficient servo technologies. Continuous innovation in automation and robotics applications strengthens their global presence. Asia-Pacific leads the market with a 37% share, driven by rapid industrialization, large-scale manufacturing, and significant investments in smart factory initiatives across China, Japan, and South Korea, solidifying its position as the global growth hub.

Market Insights

- The Analog Servo Motors and Drives Market was valued at USD 8.4 billion in 2024 and is projected to reach USD 14.9 billion by 2032, registering a CAGR of 7.2% from 2025 to 2032.

- The market growth is driven by increasing automation in manufacturing and the rising demand for precise motion control in robotics and CNC machinery.

- A key trend includes the integration of smart feedback sensors and energy-efficient designs to enhance performance and reduce downtime across industrial applications.

- Major players such as ABB, Bosch Rexroth, Mitsubishi Electric, and Nidec compete through innovations, strategic partnerships, and digital control advancements to expand their global reach.

- Asia Pacific dominates the market with a 41% share, supported by strong industrial automation in China and Japan, while the AC drive segment leads the market due to its superior efficiency and versatility in high-performance applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drive

The analog servo motors and drives market is segmented into AC and DC drives. The AC drive segment dominates the market with a 67% share, driven by its superior speed control, energy efficiency, and adaptability across automation systems. Industries prefer AC drives for their precise motion control and low maintenance needs in continuous operations. The increasing adoption of advanced AC servo systems in manufacturing and robotics further supports segment growth, as they offer enhanced torque performance and efficient synchronization in multi-axis applications.

- For instance, Mitsubishi Electric’s MR-J5 series AC servo drives demonstrate superior speed control and energy-saving features, widely adopted in automotive manufacturing lines for precise motion and reduced downtime.

By Application

Among applications, metal cutting and forming holds the largest market share at 34%, supported by the growing demand for high-precision motion control in CNC machining and fabrication units. Servo drives provide accurate torque response and consistent speed regulation essential for industrial automation. The adoption of servo technology in this segment is also driven by the increasing shift toward smart manufacturing and digitalized production environments, which enhance operational efficiency and reduce material wastage.

- For instance, Delta Electronics’ Electric Servo Press incorporates built-in sensors and closed-loop force control that reduces response delays to 0.2 ms, ensuring consistent quality and efficiency in metal forming.

Key Growth Drivers

Expanding Industrial Automation and Smart Manufacturing

The growing emphasis on automation across industries is a major driver of the analog servo motors and drives market. Manufacturing facilities increasingly rely on servo systems to improve production precision, operational speed, and energy efficiency. Analog servo drives provide reliable control for repetitive tasks in assembly lines, packaging, and material handling applications. Their cost-effectiveness and ease of integration make them suitable for small and medium enterprises adopting Industry 4.0 standards. Automotive and electronics manufacturers are upgrading conventional equipment with servo systems to enhance process consistency and throughput. As industrial automation accelerates globally, demand for high-performance servo technologies continues to rise.

- For instance, Siemens introduced the SINAMICS S210 servo drive system, capable of delivering up to 7 kW output with precision torque control for high-speed assembly lines.

Rising Adoption in Robotics and Precision Machinery

Analog servo motors and drives are integral to robotics, where precise torque and motion control are essential. The increasing deployment of industrial and collaborative robots in sectors such as automotive, medical devices, and consumer goods is boosting market growth. Servo systems enable smooth, accurate, and synchronized motion, critical for robotic arms and precision machinery. Manufacturers prefer analog drives for their low latency, stability, and simplicity in repetitive control applications. With expanding investments in robotic assembly and inspection systems, the demand for compact, efficient, and durable servo drives is increasing. The global focus on robotics-driven productivity improvements is expected to sustain this trend through the forecast period.

- For instance, Yaskawa Electric Corporation’s Sigma-X series brushless rotary servo motor SGMXA-04AWA6CA1 features a rated torque of 1.27 Nm and a peak torque of 4.46 Nm, with a maximum motor speed of 6000 rpm.

Growth in Packaging, Labelling, and Process Industries

The packaging and labeling sectors increasingly use analog servo drives to achieve consistent speed control and reduced downtime. Servo systems provide rapid acceleration and deceleration, enhancing machine performance in fast-paced production environments. In food, beverage, and pharmaceutical industries, servo-controlled motion ensures precision in filling, cutting, and sealing operations, maintaining quality and safety standards. The rising demand for flexible packaging machinery and automated labeling solutions is driving adoption further. Additionally, analog servo motors deliver reliable operation under harsh industrial conditions, making them a preferred choice for continuous-use applications. This growing integration into packaging and process industries significantly contributes to the overall market expansion.

Key Trends & Opportunities

Integration of Energy-Efficient and Compact Servo Systems

Manufacturers are developing energy-efficient analog servo drives with compact designs to meet the rising need for sustainable automation. Advances in semiconductor components and heat management allow these systems to deliver higher power density while reducing energy consumption. Compact analog servo systems are particularly suitable for space-constrained equipment in robotics, medical devices, and compact production lines. The trend toward miniaturization and sustainability aligns with government initiatives promoting energy-efficient industrial machinery. As companies aim to reduce carbon footprints, adoption of eco-friendly servo technologies offers long-term opportunities for growth and innovation in this market.

- For instance, Siemens SINAMICS V90 servo drive (alongside the SIMOTICS S-1FL6 motor) covers a power range from 0.05 kW to 7.0 kW and leverages high dynamic performance with rated torques in the range of 1.27 Nm to 33.40 Nm.

Increasing Modernization of Legacy Production Equipment

Many manufacturers are upgrading legacy machinery with analog servo systems to enhance control accuracy and productivity without full digital transformation. This modernization trend helps companies extend equipment life, minimize maintenance costs, and improve reliability. Analog servo drives serve as an ideal retrofit solution due to their simplicity and proven stability in industrial environments. The opportunity lies in regions where small and medium manufacturers seek affordable automation upgrades. With the ongoing transition from manual to semi-automated systems, retrofitted servo solutions are expected to play a key role in bridging technological gaps in emerging economies.

- For instance, when retrofitting older punch-press equipment, Nidec SYS reported that the changeover to servo motors resulted in 2–3 % less power consumption in updated machines.

Key Challenges

Growing Shift Toward Digital Servo Systems

The market faces challenges due to the rising preference for digital servo systems offering advanced features like remote monitoring and adaptive control. While analog systems are cost-effective and simple, digital alternatives provide higher flexibility and connectivity, appealing to smart factories. This technological shift may limit analog servo market expansion, especially in high-end industrial applications. Manufacturers must focus on improving analog system performance, reliability, and integration capability to retain competitiveness. Balancing cost advantages with evolving digital demands remains a key challenge for traditional analog servo drive producers.

High Maintenance and Compatibility Constraints

Analog servo motors and drives, though reliable, often face maintenance and compatibility issues when integrated with newer automation platforms. These systems require precise tuning and regular calibration, increasing operational complexity. Moreover, analog drives may struggle to interface with modern programmable logic controllers (PLCs) and industrial networks designed for digital communication. This lack of interoperability can slow adoption in technologically advanced industries. Manufacturers addressing these compatibility gaps through hybrid or adaptive interface designs will likely overcome this challenge and sustain their market presence amid growing modernization pressures.

Regional Analysis

North America

North America holds a 34% market share in the analog servo motors and drives market, supported by advanced industrial automation and strong adoption of robotics across manufacturing and healthcare sectors. The U.S. leads regional growth due to high investments in motion control technologies and process optimization. Expanding applications in packaging, labeling, and material handling systems further drive demand. The presence of key players such as ABB and Mitsubishi Electric enhances innovation and system integration. Continuous modernization of legacy industrial setups strengthens the region’s position as a global hub for servo-driven automation solutions.

Europe

Europe accounts for a 29% market share, driven by its strong automotive and machinery manufacturing base. Countries like Germany, Italy, and France are major contributors, emphasizing energy-efficient and precision motion systems. The European Union’s focus on sustainable production and Industry 4.0 adoption boosts servo technology integration in smart factories. OEMs prefer analog drives for their cost-effectiveness and reliable performance in repetitive motion tasks. With increased demand in robotics and process automation, European manufacturers continue to invest in enhancing productivity and operational efficiency using servo-based systems.

Asia-Pacific

Asia-Pacific leads the market with a 37% share, fueled by rapid industrialization, robotics adoption, and factory automation in China, Japan, South Korea, and India. Strong demand from electronics, automotive, and packaging industries accelerates servo drive usage. The region’s competitive manufacturing environment encourages investments in efficient, low-cost motion control solutions. Government initiatives supporting automation and smart manufacturing in China’s “Made in China 2025” and Japan’s industrial strategies further boost adoption. The presence of major manufacturers such as Delta Electronics and Nidec enhances regional technological innovation and market expansion.

Latin America

Latin America captures a 7% market share, supported by gradual industrial automation across Brazil, Mexico, and Argentina. The region is witnessing rising adoption of servo drives in packaging, food processing, and material handling industries. Efforts to enhance production efficiency and reduce maintenance costs drive servo system installations. Growing investments in automotive and electronics manufacturing are also contributing factors. However, limited technological infrastructure and higher equipment costs restrain faster growth. As industries modernize, opportunities for analog servo drives are expected to expand steadily across medium-scale industrial setups.

Middle East & Africa

The Middle East & Africa region holds a 5% market share, primarily driven by demand from oil and gas, energy, and infrastructure projects. GCC countries such as the UAE and Saudi Arabia are investing in automation to improve operational reliability in industrial plants. The adoption of servo drives in drilling and refining operations supports productivity and safety improvements. South Africa’s growing manufacturing and packaging sectors also contribute to regional growth. While the market remains in the early adoption phase, increasing infrastructure investments and industrial diversification are expected to fuel future expansion.

Market Segmentations

By Drive

By Application

- Oil and gas

- Metal cutting & forming

- Material handling equipment

- Packaging and labelling machinery

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Analog Servo Motors and Drives Market features a competitive landscape driven by technology integration, precision control, and industrial automation trends. Key players such as ABB, Bosch Rexroth, Mitsubishi Electric, Nidec, Delta Electronics, Danfoss, KEB Automation, Hitachi, Applied Motion Products, and Analog Devices focus on innovation to enhance motion efficiency and reliability. These companies emphasize high-performance servo solutions tailored for manufacturing, robotics, and packaging sectors. ABB and Mitsubishi Electric lead with advanced servo systems that ensure seamless synchronization in automation processes, while Bosch Rexroth and Nidec strengthen their portfolios through energy-efficient drive technologies. Delta Electronics and Danfoss invest heavily in compact and scalable solutions for flexible production environments. Meanwhile, Analog Devices supports precision motion control through sensor-integrated circuits that improve feedback accuracy. Strategic alliances, product upgrades, and digital integration remain central to sustaining market leadership and addressing the growing demand for responsive and efficient servo systems worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Electric

- Bosch Rexroth

- Hitachi

- ABB

- Nidec

- Delta Electronics

- Analog Devices

- KEB Automation

- Danfoss

- Applied Motion Products

Recent Developments

- In June 2024, Mclennan started to offer the MDX+ series servo drives the Applied Motion Products Inc. has launched. These are compact units that provide a brushless motor, drive stage, absolute encoder, and motion controller in a single package. The drives operate in the 100-550 W power range, and 24-60 V DC supply. MDX+ also incorporates efficient heat management and features pulse train, RS-485, EtherCAT and CANopen as well as dynamic braking, E-stop, and STO as optional control methods.

- In April 2024, Applied Motion Products launched the MDX+ Series of low-voltage integrated servo systems that combine a servo motor, drive, and encoder into a single compact unit to improve motion control efficiency.

- In March 2024, Siemens AG announced the acquisition of ebm-papst’s industrial drive technology division to strengthen its automation and analog servo drive portfolio.

- In February 2024, SANYO DENKI widened the scope of SANMOTION G servo system with its new lineup of servo motors from 1.8 to 5 kW, and servo amplifiers with a capacity of 75, 100, and 150 A. These components are intended for application in robotics, machine tools, semiconductor and food industry equipment, and medical devices

Report Coverage

The research report offers an in-depth analysis based on Drive, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady expansion due to increased industrial automation across multiple sectors.

- Rising adoption of robotics and motion control systems will sustain demand for servo technologies.

- Energy-efficient and compact analog servo systems will gain traction in cost-sensitive markets.

- Manufacturers will focus on retrofitting legacy equipment with affordable analog drive solutions.

- Asia-Pacific will remain the growth hub, driven by strong manufacturing and robotics adoption.

- Integration of analog drives with hybrid and semi-digital platforms will enhance market competitiveness.

- Demand from packaging, labeling, and material handling applications will continue to strengthen.

- Ongoing technological upgrades will improve analog drive precision and long-term reliability.

- The medical and healthcare sectors will increasingly adopt servo systems for robotic applications.

- Strategic collaborations among global and regional players will support product innovation and expansion.